Custodian REIT plc : Unaudited Net Asset Value as at 31 March 2019 (804877)

April 30 2019 - 2:01AM

UK Regulatory

Dow Jones received a payment from EQS/DGAP to publish this press

release.

Custodian REIT plc (CREI)

Custodian REIT plc : Unaudited Net Asset Value as at 31 March 2019

30-Apr-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

30 April 2019

Custodian REIT plc

("Custodian REIT" or "the Company")

Unaudited Net Asset Value as at 31 March 2019

Custodian REIT (LSE: CREI), the UK commercial real estate investment

company, today reports its unaudited net asset value ("NAV") as at 31 March

2019 and highlights for the period from 1 January 2019 to 31 March 2019

("the Period").

Financial highlights

· NAV total return per share1 for the year ended 31 March 2019 ("FY19") of

5.9% (year ended 31 March 2018 ("FY18"): 9.6%), comprising 6.1% income

(FY18: 6.2%) and a 0.2% capital decrease (FY18: 3.4% capital increase)

· NAV per share of 107.1p (31 December 2018: 108.1p)

· NAV of GBP426.6m (31 December 2018: also GBP42 6.6m)

· FY19 EPRA earnings per share2 7.3p (FY18: 6.9p)

· Target dividend per share3 for the year ending 31 March 2020 increased

1.5% to 6.65p (FY19: 6.55p)

· Net gearing4 of 24.1% loan-to-value (31 December 2018: 24.7%)

· GBP4.1m of new equity raised during the Period at an average premium of

8.0% to dividend adjusted NAV per share

· Market capitalisation of GBP442.8m (31 December 2018: GBP460.1m)

Portfolio highlights

· Portfolio value of GBP572.7m (31 December 2018: GBP576.2m)

· GBP1.4m valuation increase from successful asset management initiatives

· GBP5.0m overall valuation decrease (0.9% of portfolio)

· EPRA occupancy5 95.9% (31 December 2018: 96.5%)

1 NAV per share movement including dividends paid and approved for the

period.

2 Profit after tax excluding net gains on investment property and one-off

costs divided by weighted average number of shares in issue.

3 Dividends paid and approved relating to the year.

4 Gross borrowings less unrestricted cash divided by portfolio valuation.

5 Estimated rental value ("ERV") of let property divided by total portfolio

ERV.

Net asset value

The unaudited NAV of the Company at 31 March 2019 was GBP426.6m, reflecting

approximately 107.1p per share, a decrease of 1.0p (0.9%) since 31 December

2018:

Pence per share GBPm

NAV at 31 December 2018 108.1 426.6

Issue of equity (net of costs) 0.1 4.1

Valuation movements relating to:

- Asset management activity 0.3 1.4

- Other valuation movements (1.6) (6.4)

Net valuation movement (1.3) (5.0)

Income earned for the Period 2.5 10.3

Expenses and net finance costs for the (0.7) (2.9)

Period

Dividends paid6 (1.6) (6.5)

NAV at 31 March 2019 107.1 426.6

6 Dividends of 1.6375p per share were paid on shares in issue throughout the

Period.

The NAV attributable to the ordinary shares of the Company is calculated

under International Financial Reporting Standards and incorporates the

independent portfolio valuation as at 31 March 2019 and income for the

Period but does not include any provision for the approved dividend of

1.6375p per share for the Period to be paid on 31 May 2019.

Commenting on the Company's performance during the Period, Richard

Shepherd-Cross, Managing Director of Custodian Capital Limited (the

Company's discretionary investment manager) said:

"In common with many participants in the UK property market the Company was

circumspect in relation to investment during the Period, following on from

much reduced activity through 2018. In part this has been due to market

pricing exceeding our expectations of value and in part due to limited

opportunities in our target sectors.

"The net valuation movement of GBP5.0m represents a 0.9% decrease in the value

of the portfolio during the Period. This valuation decrease was driven by

high street retail valuations falling by GBP5.2m, primarily due to the

reduction in ERVs at 17 of the Company's 33 high street retail assets, based

on recent transactional evidence. Sentiment in the UK property market has

moved quite quickly since September 2018, most notably against retail, and

perhaps a correction was a necessary and an important part of a functioning

market. Some of this negative movement may be recovered following the

conclusion of lease re-negotiations which are underway or under

consideration, although we cannot rule out further falls in confidence in

the property market from general economic or political turbulence. We

believe our strategy of focusing on sustainable income will support future

dividends through any market volatility and deliver capital growth for

shareholders over the long-term."

Asset management

A continued focus on active asset management including rent reviews, new

lettings, lease extensions and the retention of tenants beyond their

contractual break clauses resulted in a GBP1.4m valuation increase in the

Period, primarily due to:

· Agreeing a new 10 year reversionary lease with Revlon International

Corporation for an industrial unit in Stone, with annual rent increasing

by 24% to GBP398k and valuation increasing by GBP0.7m;

· Agreeing a new 10 year lease with Age Scotland at Causewayside House,

Edinburgh where the tenant expanded its letting to take the whole first

floor office suite, increasing the annual rent by 44% to GBP157k and the

valuation by GBP0.4m;

· Documenting a 10 year reversionary lease with Synertec at Leacroft Road,

Warrington, extending the lease expiry from July 2022 to July 2032 and

increasing the valuation by GBP0.2m; and

· Agreeing a new lease for additional external seating with Chokdee

Limited (t/a Giggling Squid) at a restaurant in Bath, with annual rent

increasing by 12% to GBP135k and valuation increasing by GBP0.1m.

Further initiatives on other properties currently under review are expected

to complete during the current quarter. These positive asset management

outcomes have been tempered by the company voluntary arrangement ("CVA") of

Paperchase decreasing annual rent at the Company's Shrewsbury property by

45% from GBP150k to GBP83k, resulting in a GBP0.4m valuation decrease.

The portfolio's weighted average unexpired lease term to first break or

expiry ("WAULT") decreased from 5.8 years at 31 December 2018 to 5.6 years

at the Period end, reflecting principally the natural elapse of a quarter of

a year due to the passage of time.

Property market

Commenting on the commercial property market outside London, Richard

Shepherd-Cross said:

"Investment activity across the UK, as reported by JLL's UK capital market

research, is down 15% in Q1 2019, equivalent to nearly GBP2bn, as investors

reflect on the political and economic uncertainties. However, it is

understood that there is a significant weight of capital still targeting UK

commercial property. Investors appear to want to see prices fall before they

commit but, with vendors not motivated to sell, this caution is contributing

to low investment volumes.

"There are a number of events that might change the prevailing market: The

first would be a conclusion on Brexit, with an 'acceptable' outcome

potentially boosting investor confidence.

"The second might be continued political uncertainty unbalancing the

equilibrium of the economy leading to a repeat of the redemption crisis

experienced by open-ended property funds in the wake of the EU referendum in

the summer of 2016. While there have been net outflows from these funds over

recent months, the flow has not become a flood. Fund managers are bolstering

their cash reserves with selective asset sales, but not at sufficiently

reduced prices to tempt investors back in meaningful volumes.

"A third issue could be a further deterioration in the retail trade and

retail investment values, leading to a general contagion across other

sectors. It is acknowledged that the UK has too many shops and retailers are

actively reducing the size of their store portfolios while acknowledging

that physical stores remain a very important part of their sales proposition

and a key interface with the customer. This reduction in store portfolios is

not all about on-line retailing, although on-line is clearly having a real

impact. As shopping habits evolve retailers need to be flexible enough to

meet those changing requirements and landlords may need to accept that

retailers will need greater flexibility.

"Retail is an unfolding story but the short-term impact on retail property

investment is being felt keenly by investors. The long-term picture for

retail is likely to be polarised. Prime and good secondary locations will

remain popular with retailers and investors alike, although rents may need

to adjust downwards. Poor secondary retail locations may need to be

re-purposed into residential, leisure or other uses.

"Despite many negative predictions for the UK economy in the face of Brexit

or even as a result of Brexit indecision, to date the economy has defied the

sceptics. GDP continues to grow and unemployment is at a 44 year low. Both

of these indicators are positive for commercial property.

"Across all regions of the UK the industrial and logistics sector is

delivering new buildings to the market. For 'big box' (100,000 sq ft plus)

we have witnessed an increase in speculative development as developers try

to exploit demand and the relative lack of supply. Up to 50% of all big box

was speculatively developed last year and it was e-commerce, food and 'other

retailers' who dominated the new lettings.

"After five years of focus on big box logistics the market has identified

the lack of supply of smaller buildings and for the first time in recent

years we have started to see development focused on this sector. One area of

the letting market that has not fully matured is urban logistics. Meeting

the challenge of on-line sales fulfillment is going to see demand for

in-town or suburban logistics buildings. At present such buildings do not

exist or are in short supply as rental levels are not high enough to bring

forward new development, but the potential for rental growth in this

sub-sector is very real. The Company's portfolio is well positioned to

exploit this rental growth, with 19% of its assets in the

industrial/logistics sub-sector which continues to be a target for selective

acquisitions.

"The good news is not restricted to industrial/logistics. Regional office

markets have also performed well, demonstrating rental growth. Again it is

lack of supply combined with strength in regional economies that has driven

this growth and the pipeline of new development continues to look

restricted. New office lettings across all regional markets were 10% above

the five year average during 2018."

Portfolio analysis

At 31 March 2019 the Company's property portfolio comprised 155 assets (31

December 2018: 155 assets) with a net initial yield7 ("NIY") of 6.6% (31

December 2018: 6.6%). The portfolio is split between the main commercial

property sectors, in line with the Company's objective to maintain a

suitably balanced investment portfolio. Slight swings in sector weightings

reflect market pricing at any given time and the desire to maintain an

opportunistic approach to acquisitions. Sector weightings are shown below:

7 Passing rent divided by property valuation plus purchaser's costs.

Valuation Period Weighting by Weighting by

valuation income8 31 income8 31

movement Mar 2019 Dec 2018

31 Mar 2019

GBPm

GBPm

Sector

Industrial 224.3 1.9 38% 37%

Retail 123.4 (1.4) 22% 22%

warehouse

Other9 95.7 (0.3) 17% 17%

High street 68.6 (5.2) 12% 13%

retail

Office 60.7 - 11% 11%

Total 572.7 (5.0) 100% 100%

8 Current passing rent plus ERV of vacant properties.

9 Includes car showrooms, petrol filling stations, children's day nurseries,

restaurants, gymnasiums, hotels and healthcare units.

Diversification across sectors helps to remove volatility from the

portfolio, as demonstrated in the Period with the Industrial sector of the

portfolio seeing a GBP1.9m valuation increase.

Despite a GBP1.4m valuation decrease in the valuation of retail warehouse

assets during the Period, we believe low rents per sq ft, 'big box' formats,

free parking and a complimentary relationship with on-line through continued

growth in 'click-and-collect' mean valuations and rents are likely to remain

more robust than the High Street.

The Company also operates a geographically diversified portfolio across the

UK, seeking to ensure that no one area represents the majority of the

portfolio. The geographic analysis of the Company's portfolio at 31 March

2019 was as follows:

Valuation Period Weighting Weighting

valuation by income10 by income10

movement 31 Mar 31 Dec 2018

2019

31 Mar 2019

GBPm

GBPm

Location

West Midlands 132.8 (0.4) 22% 22%

North-West 91.2 (1.1) 18% 17%

South-East 77.0 (2.0) 12% 13%

South-West 71.3 (1.1) 11% 11%

East Midlands 70.6 (0.6) 13% 13%

North-East 51.3 1.3 10% 10%

Scotland 44.8 (0.1) 8% 8%

Eastern 27.3 (0.9) 5% 5%

Wales 6.4 (0.1) 1% 1%

Total 572.7 (5.0) 100% 100%

10 Current passing rent plus ERV of vacant properties.

For details of all properties in the portfolio please see

www.custodianreit.com/property-portfolio [1].

Activity and pipeline

Commenting on pipeline, Richard Shepherd-Cross said:

"We are considering a pipeline of opportunities and believe there may be

potential to make contra-cyclical acquisitions where we believe that

short-term market weakness can unlock long-term value for the Company."

Financing

Equity

The Company issued 3.6m new ordinary shares of 1p each ("the New Shares")

during the Period raising GBP4.1m. The New Shares were issued at a premium of

8.0% to the unaudited NAV per share at 31 December 2018, adjusted to exclude

the dividend paid on 28 February 2019.

Debt

At the Period end the Company had:

· A GBP45m revolving credit facility ("RCF") with Lloyds Bank plc with

interest of 2.45% above three-month LIBOR of which GBP10m expires on 30 June

2019 and GBP35m expires on 13 November 2020;

· A GBP20m term loan with Scottish Widows plc with interest fixed at 3.935%

and is repayable on 13 August 2025;

· A GBP45m term loan with Scottish Widows plc with interest fixed at 2.987%

and is repayable on 5 June 2028; and

· A GBP50m term loan with Aviva Investors Real Estate Finance comprising:

i) A GBP35m tranche repayable on 6 April 2032 with fixed annual interest of

3.02%; and

ii) A GBP15m tranche repayable on 3 November 2032 with fixed annual interest

of 3.26%.

On 14 January 2019, the Company increased the RCF facility from GBP35m to GBP45m

until 30 June 2019 to provide the Company with additional capacity for

property acquisitions.

Dividends

An interim dividend of 1.6375p per share for the quarter ended 31 December

2018 was paid on 28 February 2019. The Board has approved an interim

dividend relating to the Period of 1.6375p per share payable on 31 May 2019

to shareholders on the register on 26 April 2019.

In the absence of unforeseen circumstances, the Board intends to pay

quarterly dividends to achieve a target dividend11 per share for the year

ending 31 March 2020 of 6.65p (FY19: 6.55p). The Board's objective is to

grow the dividend on a sustainable basis, at a rate which is fully covered

by projected net rental income and does not inhibit the flexibility of the

Company's investment strategy.

11 This is a target only and not a profit forecast. There can be no

assurance that the target can or will be met and it should not be taken as

an indication of the Company's expected or actual future results.

Accordingly, shareholders or potential investors in the Company should not

place any reliance on this target in deciding whether or not to invest in

the Company or assume that the Company will make any distributions at all

and should decide for themselves whether or not the target dividend yield is

reasonable or achievable.

- Ends -

Further information:

Further information regarding the Company can be found at the Company's

website www.custodianreit.com [2] or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240 8740

Imlach / Ian Mattioli MBE

www.custodiancapital.com [3]

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numis.com/funds

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which listed on the

main market of the London Stock Exchange on 26 March 2014. Its portfolio

comprises properties predominantly let to institutional grade tenants on

long leases throughout the UK and is principally characterised by properties

with individual values of less than GBP10m at acquisition.

The Company offers investors the opportunity to access a diversified

portfolio of UK commercial real estate through a closed-ended fund. By

targeting sub GBP10m lot-size, regional properties, the Company intends to

provide investors with an attractive level of income with the potential for

capital growth.

Custodian Capital Limited is the discretionary investment manager of the

Company.

For more information visit www.custodianreit.com [2] and

www.custodiancapital.com [3].

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 8424

EQS News ID: 804877

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=be531edfb7113375e33d32944df93de5&application_id=804877&site_id=vwd_london&application_name=news

2: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=44eae66ce326b2005a19503bbab5faed&application_id=804877&site_id=vwd_london&application_name=news

3: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=c24dec6d0ea6c746569ddd52de0eca8d&application_id=804877&site_id=vwd_london&application_name=news

(END) Dow Jones Newswires

April 30, 2019 02:01 ET (06:01 GMT)

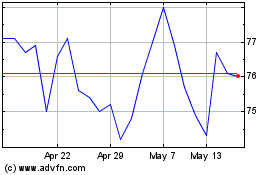

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

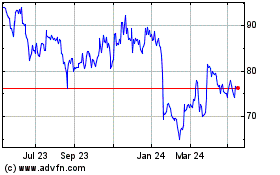

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024