Custodian REIT PLC Purchase of Land with Pre-let Development (1560P)

June 04 2015 - 2:00AM

UK Regulatory

TIDMCREI

RNS Number : 1560P

Custodian REIT PLC

04 June 2015

4 June 2015

Custodian REIT plc

("Custodian REIT" or "the Company")

Purchase of Land with Pre-let Development

Custodian REIT (LSE: CREI), the UK property investment company,

is pleased to announce the completion of a forward funding

agreement for a pre-let development, together with the purchase of

the development land.

The Company has acquired 1.88 acres of land at the Tournament

Fields development, two miles south west of Warwick at junction 15

of the M40. The location allows easy access to the motorway

network, mainline rail services (via Warwick Parkway station) and

is close to Birmingham International Airport. Other occupiers on

the business park include Eagle Burgmann, Geberit, Pure Offices and

West Midlands Ambulance Service.

The development comprises a 27,400 sq ft single storey

industrial/warehouse unit, with construction being phased over an

expected five month build period. Development funding will be drawn

down via monthly certified payments.

The unit, to be developed by Clowes Developments, has been

pre-let to Semcon Product Information UK Limited on a 10.5 year

lease with no break option. On completion of the development for a

total consideration of GBP2.635 million, the total passing rent

will be GBP180,000, reflecting a net initial yield of 6.64%.

The agreed land purchase price of GBP0.85 million was funded

from the Company's existing facilities, with net borrowings

following the acquisition of 11.1% loan to value.

Commenting on the acquisition, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's external fund

manager), said: "The current shortfall in supply of quality

industrial units has led to increased demand for development

funding of this kind throughout the UK. This opportunity was of

particular interest due to a well located unit and strong tenant on

a long term lease. We anticipate further investment in pre-let

development projects while the requirement for good quality units

in areas of high demand continues."

- Ends -

For further information:

Further information regarding the Company can be found at the

Company's website www.custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240

Imlach / Ian Mattioli 8740

www.custodiancapital.com

Numis Securities Limited

Nathan Brown / Hugh Jonathan Tel: +44 (0)20 7260

1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757

4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust ("REIT")

listed on the London Stock Exchange. Its portfolio consists of

properties let to institutional grade tenants on long leases

throughout the UK.

It invests in a diversified portfolio of UK commercial

properties to achieve its investment objective of providing

shareholders with an attractive level of income together with the

potential for capital growth through a closed-ended fund.

The target portfolio is characterised by small lot sizes with

individual property values of less than GBP7.5 million at

acquisition.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQEAKKDEFLSEFF

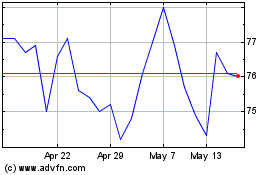

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

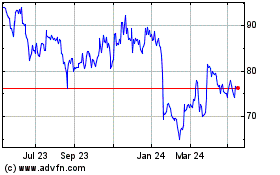

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024