TIDMAD4

RNS Number : 7329D

adept4 plc

28 June 2019

Adept4 plc

("Adept4", the "Group" or the "Company")

Interim Results for the six months ended 31 March 2019

Adept4 plc (AIM: AD4), the AIM quoted provider of IT as a

Service, today announces its unaudited interim results for the six

months ended 31 March 2019.

Summary

-- Revenue for the period of GBP4.2 million (H1 2018: GBP5.4 million);

-- Trading Group EBITDA(1) of GBP15,000 (H1 2018: GBP0.5 million);

-- Loss for the period of GBP1.1 million (H1 2018: GBP0.8 million);

-- Net debt(2) at 31 March 2019 of GBP3.4 million;

-- Significant reduction in costs at end of period following

decision to focus more on existing customer base with less emphasis

on new business generation;

-- Return to modest levels of monthly Trading Group EBITDA profitability;

-- Strategic review nearing conclusion.

Simon Duckworth, Non-Executive Chairman of Adept4,

commented:

"Having returned the business to modest levels of monthly

Trading Group EBITDA profitability with a reduced cash burn after

plc and debt service costs, the Board has more recently been able

to focus on taking positive steps to return the business to growth.

Good progress has been made in this regard and we look forward to

updating shareholders on our future plans in due course."

For further information please contact:

Adept4 plc

Simon Duckworth, Non-Executive Chairman 01925 398255

N+1 Singer (Nominated Adviser and Broker)

Jen Boorer

Shaun Dobson 0207 496 3000

MXC Capital Markets LLP

Charlotte Stranner 0207 965 8149

This announcement contains inside information.

(1) earnings before net finance costs, tax, depreciation,

amortisation, plc costs, separately identifiable items and

share-based

payments

(2) Net debt at 31 March 2019 comprises cash balances of

GBP0.8m, less the amortised cost of BGF loan notes of GBP4.2m.

CHAIRMAN'S STATEMENT

Strategic overview

In February 2019 we reported on the Group's financial results

for the year ended 30 September 2018 ("FY18"). Within those results

we noted that FY18 had been extremely challenging for the business,

with the investment made in the new sales team not yet delivering

the results we had hoped for and with progress further hindered by

the general level of caution which is evident in our economy.

We further reported that the continued delays in new sales in

the current financial year ("FY19") meant that the Group was

experiencing ongoing monthly Trading Group EBITDA and cash losses.

As a consequence, we announced that we had taken the decision to

focus on our existing customer base with less emphasis on new

business acquisition, which would lead to reduced revenue and gross

profit, but which requires a significantly lower operating cost

base, with the intention of returning the Group to profitability

and cash generation. This action was designed to protect the cash

reserves of the Group whilst the Board considered the strategic

options open to the Company. As at February 2019, further cost

savings had been identified which were in the process of being

implemented. I can now provide an update on these initiatives.

The cost reduction programme was completed at the end of March

2019 and has reduced overheads by circa GBP75,000 per month. Since

the changes were implemented, we have seen a pleasing increase in

the levels of new business won within our existing customer base,

demonstrating the strength of those relationships and the

opportunities therein. The recent performance of the business has,

however, been impacted by the cancellation of a contract by a major

customer, as announced on 8 April 2019. The Company disputes the

contract termination is valid and is currently seeking legal

redress from the customer. The combined effect of these changes

means that the Group has returned to modest levels of monthly

Trading Group EBITDA profit generation and the cash burn (after plc

costs and debt service costs) has reduced.

In seeking to recover value for shareholders the Board has been

considering the strategic options open to the Company and working

with its professional advisers, its debt provider and its major

shareholders to find the best way forward for all stakeholders.

This review is now nearing its conclusion and the Board will

announce the outcome of this as soon as practicable.

Trading and results

Revenue in the six months to 31 March 2019 ("H119") was GBP4.2

million, compared to GBP5.4 million in the six months to 31 March

2018 ("H118"). This reduction reflected both the delays experienced

in generating new sales and the conclusion of several

transformation projects which generated significant professional

services and product revenues in H118, together with a number of

planned and expected customer contract reductions.

In terms of our recurring revenues, as previously reported, some

of our larger customers undertook digital transformation projects

in FY18, to move them away from on-premise solutions to a more

dynamic and flexible cloud-based "Pay as you Use" IT solution.

After their initial investment in one-off costs, in FY19 these

customers started to enjoy the benefits of the monthly savings such

solutions provide. H119 also saw certain customers' fixed term IT

support contracts come to a natural end at the conclusion of the

related projects. As a result, recurring revenues in H119 were

GBP3.0 million (H118: GBP3.6 million), representing over 70% of

total revenue.

Product sales in the period were GBP0.8 million (H118: GBP1.1

million) with professional services revenue of GBP0.4 million

(H118: GBP0.7 million).

The resultant total gross profit was GBP2.1 million (H118:

GBP3.1 million). The reduction in gross profit margins from 57% in

H118 to 51% in H119 is predominantly due to the migration of

certain services from our infrastructure to that of a third party

(such as Microsoft), in line with our asset-light strategy. Whilst

initially resulting in some margin reduction, this strategy reduces

risk and cost of ownership for us and allows us to provide

customers with best-of-breed solutions with the ability to sell a

wider range of services to the customer. This transition also means

that we need fewer staff to support the in-house solutions, which

has enabled us to reduce our overhead base without affecting

customer service levels.

In the six months to March 2019, administrative expenses before

plc costs reduced to GBP2.1 million, a fall of GBP0.5 million

compared to H118. This resulted in a Trading Group EBITDA for the

period of GBP15,000 (H118: GBP0.5 million). As detailed above, the

Group's forward operating cost base has been reduced by circa

GBP75,000 per month as a result of the restructure which concluded

in March 2019. The restructure resulted in one-off costs in the

half-year of GBP0.1 million, shown in the income statement as

separately identifiable costs.

After accounting for plc costs and non-cash items such as

amortisation, depreciation and share-based payments charges, the

operating loss for the period was GBP0.9 million (H118: loss of

GBP0.5 million). After cash interest costs of GBP0.2 million and a

notional non-cash interest charge of GBP0.1 million in respect of

the loan from BGF, together with a deferred tax credit of GBP0.1

million, the loss after tax for H119 was GBP1.1 million (H118:

GBP0.8 million).

Cash used in operating activities in the period was GBP0.3

million (H118: GBP0.5 million). This figure includes the net impact

of the GBP0.6 million which was received from the vendors of Adept4

Managed IT Limited (being the cash element of Group's successful

GBP1.6 million warranty claim settlement in 2018), and the payment

of creditors in respect of legal fees relating to the warranty

claim, together with part payment of the GBP0.4 million settlement

of the Microsoft historic licencing review reported in December

2018 and provided for as a liability in the FY18 financial

statements. After interest payments of GBP0.2 million and a GBP0.1

million final payment in relation to the disposal of Pinnacle CDT

Limited, the cash balance at 31 March 2019 was GBP0.8 million (30

September 2018: GBP1.4 million).

Net debt at 31 March 2019 was GBP3.4 million (30 September 2018:

GBP2.7 million). This comprises the cash balance of GBP0.8 million

less the amortised cost of loan notes held by BGF of GBP4.2

million.

Outlook

Having returned the business to a position of modest monthly

Trading Group EBITDA profitability with a reduced cash burn after

plc and debt service costs, the Board has more recently been able

to focus on taking positive steps to return the business to growth.

Good progress has been made in this regard and we look forward to

updating shareholders on our future plans in due course.

Simon Duckworth

Non-Executive Chairman

28 June 2019

CONSOLIDATED INCOME STATEMENT

for the six-month period ended 31 March 2019

6 months 6 months Year to

to 31 March to 31 March 30 September

2019 2018 2018

Note GBP'000 GBP'000 GBP'000

----------------------------------- ----- ------------- ------------- --------------

Continuing operations

Revenue 3 4,181 5,392 10,185

Cost of sales (2,040) (2,323) (4,480)

----------------------------------- ----- ------------- ------------- --------------

Gross profit 3 2,141 3,069 5,705

----------------------------------- ----- ------------- ------------- --------------

Administrative expenses (2,318) (2,883) (5,598)

Amortisation of intangible assets 7 (454) (470) (907)

Depreciation (58) (39) (136)

Separately identifiable costs 4 (143) (137) (2,390)

Share-based payments (81) (60) (48)

----------------------------------- ----- ------------- ------------- --------------

Operating loss (913) (520) (3,374)

----------------------------------- ----- ------------- ------------- --------------

Interest receivable 2 1 7

Interest payable (303) (330) (609)

----------------------------------- ----- ------------- ------------- --------------

Net finance expense (301) (329) (602)

----------------------------------- ----- ------------- ------------- --------------

Loss before taxation (1,214) (849) (3,976)

----------------------------------- ----- ------------- ------------- --------------

Taxation 5 84 84 169

----------------------------------- ----- ------------- ------------- --------------

Loss and total comprehensive loss for

the period attributable to owners of

the parent (1,130) (765) (3,807)

------------------------------------------ ------------- ------------- --------------

Loss per share

Basic and fully diluted 6 (0.50)p (0.34)p (1.68)p

----------------------------------- ----- ------------- ------------- --------------

Non-statutory measure : Trading

Group EBITDA(1)

Operating loss (913) (520) (3,374)

Plc costs 192 267 482

Amortisation of intangible assets 7 454 470 907

Depreciation 58 39 136

Separately identifiable costs 4 143 137 2,390

Share-based payments 81 60 48

----------------------------------- ----- ------------- ------------- --------------

Trading Group EBITDA(1) 15 453 589

----------------------------------- ----- ------------- ------------- --------------

(1) earnings before net finance costs, tax, depreciation,

amortisation, plc costs, separately identifiable items and

share-based

payments

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 March 2019

At 30

At 31 At 31 March September

March

2019 2018 2018

Note GBP'000 GBP'000 GBP'000

--------------------------------- ----- --------- ------------ ----------

Non-current assets

Intangible assets 7 7,849 11,369 8,282

Property, plant and equipment 103 214 146

Total non-current assets 7,952 11,583 8,428

--------------------------------- ----- --------- ------------ ----------

Current assets

Inventories 86 102 26

Trade and other receivables 8 2,443 2,822 2,900

Cash and cash equivalents 841 2,037 1,427

--------------------------------- ----- ------------ ----------

Total current assets 3,370 4,961 4,353

--------------------------------- ----- --------- ------------ ----------

Total assets 11,322 16,544 12,781

--------------------------------- ----- --------- ------------ ----------

Liabilities

Short-term borrowings 9 (32) (1,035) (32)

Trade and other payables (1,421) (1,137) (1,102)

Other taxes and social security

costs (373) (554) (377)

Accruals and deferred income (1,208) (1,426) (1,937)

--------------------------------- ----- --------- ------------ ----------

Total current liabilities (3,034) (4,152) (3,448)

--------------------------------- ----- --------- ------------ ----------

Non-current liabilities

Long-term borrowings 9 (4,205) (4,038) (4,117)

Deferred tax liability 10 (1,164) (1,332) (1,248)

--------------------------------- ----- --------- ------------ ----------

(5,369) (5,370) (5,365)

--------------------------------- ----- --------- ------------ ----------

Total liabilities (8,403) (9,522) (8,813)

--------------------------------- ----- --------- ------------ ----------

Net assets 2,919 7,022 3,968

--------------------------------- ----- --------- ------------ ----------

Equity

Share capital 2,271 2,271 2,271

Share premium account 11,337 11,337 11,337

Capital redemption reserve 6,489 6,489 6,489

Merger reserve 1,997 1,997 1,997

Other reserve 1,730 1,661 1,649

Retained earnings (20,905) (16,733) (19,775)

--------------------------------- ----- --------- ------------ ----------

Total equity 2,919 7,022 3,968

--------------------------------- ----- --------- ------------ ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six-month period ended 31 March 2019

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- --------

At 1 October

2017 2,271 11,337 6,489 1,997 1,601 (15,968) 7,727

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- --------

Loss and total

comprehensive

loss for the

period - - - - - (765) (765)

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- --------

Transactions

with owners

Share-based

payments - - - - 60 - 60

Total

transactions

with owners - - - - 60 - 60

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- --------

Total

movements - - - - 60 (765) (705)

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- --------

Equity at 31

March

2018 2,271 11,337 6,489 1,997 1,661 (16,733) 7,022

--------------- --------------------------- --------------------------- --------------------------- --------------------------- --------------------------- --------- --------

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- ------------ --------- --------- ---------- ---------

At 1 April 2018 2,271 11,337 6,489 1,997 1,661 (16,733) 7,022

Loss and total

comprehensive

loss for the

period - - - - - (3,042) (3,042)

------------------- --------- --------- ------------ --------- --------- ---------- ---------

Transactions with

owners

Share-based

payments - - - - (12) - (12)

Total transactions

with owners - - - - (12) - (12)

------------------- --------- --------- ------------ --------- --------- ---------- ---------

Total movements - - - - (12) (3,042) (3,054)

------------------- --------- --------- ------------ --------- --------- ---------- ---------

Equity at 30

September

2018 2,271 11,337 6,489 1,997 1,649 (19,775) 3,968

------------------- --------- --------- ------------ --------- --------- ---------- ---------

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- ------------ --------- --------- ---------- -----------

At 1 October 2018 2,271 11,337 6,489 1,997 1,649 (19,775) 3,968

Loss and total

comprehensive

loss for the

period - - - - - (1,130) (1,130)

------------------ --------- --------- ------------ --------- --------- ---------- -----------

Transactions with

owners

Share-based

payments - - - - 81 - 81

Total

transactions

with owners - - - - 81 - 81

------------------ --------- --------- ------------ --------- --------- ---------- -----------

Total movements - - - - 81 (1,130) (1,049)

------------------ --------- --------- ------------ --------- --------- ---------- -----------

Equity at 31

March

2019 2,271 11,337 6,489 1,997 1,730 (20,905) 2,919

------------------ --------- --------- ------------ --------- --------- ---------- -----------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the six-month period ended 31 March 2019

6 months 6 months Year to

to 31 to 31 30 September

March March 2018

2019 2018

GBP'000 GBP'000 GBP'000

------------------------------------------- --------- --------- --------------

Cash flows from operating activities

Loss before taxation (1,214) (849) (3,976)

Adjustments for:

Depreciation 58 39 136

Amortisation 454 470 907

Share-based payments 81 60 48

Net finance expense 301 329 602

Settlement of Warranty Claim - - (1,578)

Impairment of goodwill - - 2,644

Decrease/(increase) in trade and other

receivables 457 (473) 73

(Increase)/Decrease in inventories (60) (35) 40

(Decrease)/increase in trade payables,

accruals and deferred income (334) (55) 195

------------------------------------------- --------- --------- --------------

Net cash used in operating activities (257) (514) (909)

------------------------------------------- --------- --------- --------------

Cash flows from investing activities

Purchase of property, plant and equipment (15) (75) (70)

Payment of deferred consideration - - (8)

Interest received 2 1 7

------------------------------------------- --------- --------- --------------

Net cash used in investing activities (13) (74) (71)

------------------------------------------- --------- --------- --------------

Cash flows from financing activities

Finance lease income received - 56 56

Payment of finance lease liabilities (12) (18) (44)

Interest paid (204) (218) (410)

Net cash used in financing activities (216) (180) (398)

------------------------------------------- --------- --------- --------------

Cash flows from discontinued operations

Settlement of dispute regarding Pinnacle

CDT Limited (100) (100) (100)

------------------------------------------- --------- --------- --------------

Net cash used in discontinued operations (100) (100) (100)

------------------------------------------- --------- --------- --------------

Net decrease in cash (586) (868) (1,478)

Cash at bank and in hand at beginning

of period 1,427 2,905 2,905

------------------------------------------- --------- --------- --------------

Cash at bank and in hand at end of

period 841 2,037 1,427

------------------------------------------- --------- --------- --------------

Comprising:

Cash at bank and in hand 841 2,037 1,427

------------------------------------------- --------- --------- --------------

NOTES TO THE FINANCIAL INFORMATION

for the six-month period ended 31 March 2019

1. General Information

Adept4 plc is a company incorporated in the United Kingdom under

the Companies Act 2006. The principal activity of the group is the

provision of IT as a Service ("ITaaS") to small and medium sized

businesses in the United Kingdom. The interim financial statements

are presented in pounds sterling because that is the currency of

the primary economic environment in which each of the Group's

subsidiaries operates.

The address of its registered office is 5 Fleet Place, London,

EC4M 7RD and its principal places of business are Leeds and

Warrington. The company is quoted on AIM, the market of that name

operated by the London Stock Exchange, under ticker symbol

AD4.L

These interim financial statements contain inside

information.

2. Basis of preparation

The annual financial statements of the Group are prepared in

accordance with applicable International Financial Reporting

Standards (IFRSs) as adopted by the EU and in accordance with the

Companies Act 2006. The interim financial information in this

report has been prepared using accounting standards consistent with

IFRS as adopted by the European Union. IFRS is subject to amendment

and interpretation by the International Accounting Standards Board

(IASB) and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS that the Directors expect to be adopted by the

European Union and applicable at 30 September 2019.

Financial information contained in this document does not

constitute statutory accounts within the meaning of section of 434

of the Companies Act 2006 ("the Act"). The statutory accounts for

the year ended 30 September 2018 have been filed with the Registrar

of Companies. The report of the auditors on those statutory

accounts was unqualified, did not draw attention to any matters by

way of emphasis and did not contain a statement under section

498(2) or (3) of the Act. The financial information for the six

months ended 31 March 2019 and 31 March 2018 is unaudited.

The accounting standards applied by the Group in these interim

financial statements are the same as those applied by the Group in

the consolidated financial statements for the year ended 30

September 2018 with the exception of two new accounting standards

introduced in the six-month period to 31 March 2019, as

follows:

-- IFRS 15 Revenue from Contracts with Customers (effective 1 January 2018);

-- IFRS 9 Financial Instruments (effective 1 January 2018); and

Using the modified retrospective method, we assessed the impact

of IFRS 9 and IFRS 15 and confirm that no material changes were

required to the Group's financial results.

Under IFRS 15 there is a broader definition of what is

capitalisable as cost to obtain a contract. We have matched the

amortisation of capitalised costs to obtain a contract to the

revenue recognised but have used the practical expedient of IFRS 15

not to capitalise costs that relate to revenue that is recognised

in the income statement within twelve months.

As a practical expedient and as allowed under the standard, we

have applied the five-step approach under IFRS 15 to portfolios of

contracts which have similar characteristics and these have not

materially impacted the Group's financial results for the interim

period to 31 March 2019.

The adoption of IFRS 9 does not have a material impact on the

results of the Group.

After reviewing budgets, forecasts and cash projections for the

next twelve months and beyond, the Directors believe that the Group

has adequate resources to continue operations for the foreseeable

future and for this reason they have adopted a going concern basis

in preparing the interim financial statements. The interim

financial statements were approved by the Board of Directors on 27

June 2019.

3. Segment Reporting

The Chief Operating Decision Maker ("CODM") has been identified

as the director of the Company and its subsidiaries, who review the

Group's internal reporting in order to assess performance and to

allocate resources.

The CODM assesses profit performance principally through

adjusted profit measures consistent with those disclosed in the

Annual Report and Accounts. The Board believes that the Group

comprises a single reporting segment, being the provision of IT

managed services to customers. Whilst the CODM reviews the revenue

streams and related gross profits of three categories separately

(Recurring Services, Product and Professional Services), the

operating costs and operating asset base used to derive these

revenue streams are the same for all three categories and are

presented as such in the Group's internal reporting. Accordingly,

the segmental analysis below is therefore shown at a revenue and

gross profit level in line with the CODM's internal assessment

based on the following reportable operating segments:

-- Recurring Services This segment comprises the provision of

continuing IT services which have

an ongoing billing and support element.

-- Product This segment comprises the resale of solutions

(hardware and software)

from leading technology vendors.

-- Professional Services This segment comprises the provision of

highly skilled resource to consult,

design, install, configure and integrate IT technologies.

All revenues are derived from customers within the UK and no

customer accounts for more than 10% of external revenues.

Inter-segment transactions are accounted for using an arm's length

commercial basis.

The operating segments for the six months to 31 March 2018 have

been restated to reflect the definitions used in the Annual Report

and Accounts for the year ended 30 September 2018, in particular

the Professional Services operating segment, which now includes all

separable Professional Services revenues associated with Product

and Recurring Services revenues, which have been unbundled to

measure the contribution of our skilled technical resources. This

analysis is consistent with that used internally by the CODM and,

in the opinion of the Board, better reflects the nature of the

revenue.

3.1 Analysis of revenue 6 months 6 months Year to

to to

31 March 31 March 30 September

2019 2018 2018

GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- -------------

By operating segment

Recurring services 3,022 3,551 7,100

Product 793 1,124 1,987

Professional services 366 717 1,098

------------------------------- --------- --------- -------------

Total revenue 4,181 5,392 10,185

------------------------------- --------- --------- -------------

3.2 Analysis of gross profit 6 months 6 months Year to

to to

31 March 31 March 30 September

2019 2018 2018

GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- -------------

By operating segment

Recurring services 1,667 2,128 4,231

Product 167 256 439

Professional services 307 685 1,035

---------

Total gross profit 2,141 3,069 5,705

------------------------------- --------- --------- -------------

4. Separately identifiable costs and income

During the period, the Group incurred the following separately

identifiable costs and income which are material by their size or

incidence:

6 months 6 months Year to

to to 30 September

31 March 31 March 2018

2019 2018 GBP'000

GBP'000 GBP'000

----------------------------------- ---------- ---------- --------------

Settlement of warranty claim - - 1,578

Costs in relation to the warranty

claim and other M&A activities - - (481)

Settlement of historic Microsoft

licence review - - (376)

Impairment of goodwill - - (2,644)

Costs in relation to disposal of

Pinnacle CDT Limited - (90) (196)

Integration and restructure costs (143) (47) (271)

----------------------------------- ---------- ---------- --------------

Separately identifiable costs (143) (137) (2,390)

----------------------------------- ---------- ---------- --------------

5. Taxation

6 months to 6 months Year to

to

31 March 31 March 30 September

2019 2018 2018

GBP'000 GBP'000 GBP'000

------------------------------------ ------------ --------- -------------

Current tax

UK corporation tax for the period - - -

on continuing operations

Deferred tax credit

Deferred tax credit on intangible

assets from continuing operations 84 84 169

Total taxation credit for the

period 84 84 169

------------------------------------ ------------ --------- -------------

6. Loss per share

6 months 6 months Year to

to to

6. Loss per share

31 March 31 March 30 September

2019 2018 2018

p/share p/share p/share

-------------------------------------- ------------ ------------ -------------

Basic and fully diluted - continuing

operations (0.50) (0.34) (1.68)

-------------------------------------- ------------ ------------ -------------

GBP000 GBP000 GBP000

-------------------------------------- ------------ ------------ -------------

Loss on continuing operations (1,130) (765) (3,807)

-------------------------------------- ------------ ------------ -------------

Weighted average number of shares

in issue:

Basic and fully diluted 227,065,100 227,065,100 227,065,100

-------------------------------------- ------------ ------------ -------------

The weighted average number of ordinary shares for the purpose

of calculating the basic and diluted measures is the same. This is

because the outstanding share incentives would have the effect of

reducing the loss per ordinary share and therefore would be

anti-dilutive under the terms of IAS 33.

7. Intangible assets IT, billing

and

website Customer

Goodwill systems Brand lists Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------------- --------------- -------- --------- --------

Cost

113

At 1 October 2017 4,447 - 1,157 7,580 13,297

Additions - 35 - - 35

At 31 March 2018 4,447 148 1,157 7,580 13,332

Disposals - (6) - - (6)

----------------------- -------------- --------------- -------- --------- --------

At 30 September 2018 4,447 142 1,157 7,580 13,326

Additions - 21 - - 21

At 31 March 2019 4,447 163 1,157 7,580 13,347

----------------------- -------------- --------------- -------- --------- --------

Amortisation

At 1 October 2017 (200) (7) (150) (1,136) (1,493)

Charge for the period - (10) (60) (400) (470)

At 31 March 2018 (200) (17) (210) (1,536) (1,963)

Impairment charge (2,644) - - - (2,644)

Charge for the period - (10) (55) (372) (437)

At 30 September 2018 (2,844) (27) (265) (1,908) (5,044)

Charge for the period - (15) (57) (382) (454)

At 31 March 2019 (2,844) (42) (322) (2,290) (5,498)

----------------------- -------------- --------------- -------- --------- --------

Net Book Value

At 31 March 2018 4,247 131 947 6,044 11,369

At 30 September 2018 1,603 115 892 5,672 8,282

At 31 March 2019 1,603 121 835 5,290 7,849

----------------------- -------------- --------------- -------- --------- --------

8. Trade and other receivables At 30 September

At 31 At 31 2018

March 2019 March

2018

GBP000 GBP000 GBP000

-------------------------------- ------------- ------- ----------------

Trade receivables 1,489 1,615 1,343

Warranty settlement - - 600

Other debtors - 47 36

Prepayments and accrued income 954 1,160 921

--------------------------------- ------------- ------- ----------------

Trade and other receivables 2,443 2,822 2,900

--------------------------------- ------------- ------- ----------------

9. Borrowings At 31 March At 31 At 30

2019 March September

2018 2018

GBP000 GBP000 GBP000

------------------------------------------- ------------ -------- -----------

Short-term borrowings

Finance lease 32 43 32

Deferred consideration for Adept4 Managed - 992 -

IT Limited

Total short-term borrowings 32 1,035 32

------------------------------------------- ------------ -------- -----------

Long-term borrowings

Finance lease 34 61 46

BGF loan notes repayable to BGF between

2021 and 2023 5,000 5,000 5,000

Warrant adjustment relating to BGF

loan notes (829) (1,023) (929)

------------------------------------------- ------------ -------- -----------

Total long-term borrowings 4,205 4,038 4,117

------------------------------------------- ------------ -------- -----------

10. Deferred tax At At At 30 September

31 March 31 March 2018

2019 2018

GBP000 GBP000 GBP000

---------------------------------- ---------- ---------- ----------------

Provision brought forward 1,248 1,416 1,416

Credits to income statement - on

intangibles (84) (84) (168)

Provision carried forward 1,164 1,332 1,248

----------------------------------- ---------- ---------- ----------------

11. Post Balance Sheet Events

On 8 April 2019, the Company announced that it had received

notice of termination of a customer contract which in the year to

30 September 2018, delivered GBP0.7 million of recurring revenue.

The Company disputes the contract termination is valid and is

therefore currently seeking legal redress from the customer.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FRMRTMBMTBIL

(END) Dow Jones Newswires

June 28, 2019 02:00 ET (06:00 GMT)

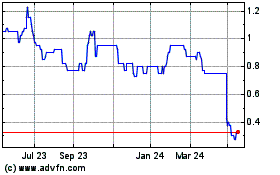

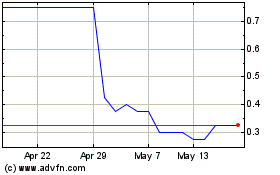

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Jul 2023 to Jul 2024