Issue of Equity & EGM Notice

April 17 2007 - 12:14PM

UK Regulatory

RNS Number:0221V

Cashbox PLC

17 April 2007

Cashbox plc

Proposed Issue of Equity, Notice of EGM and Further re Directorate

The Board is pleased to announce a proposal to issue 21,762,618 new ordinary

shares of 1 penny each ("New Ordinary Shares") at 15p per share to raise

approximately #3.26 million as part of proposals for Cashbox plc ("the Company")

to obtain new banking facilities, to repay existing loans and raise additional

working capital (the "Proposals"). The Company is seeking shareholder approval

to grant the Directors the requisite authority to issue the New Ordinary Shares

and to renew the authorities granted to the Directors under the Companies Act

1985 ("the Act") to issue new shares in the Company.

The Company will today post a circular to shareholders to explain the reasons

for the issue of the New Ordinary Shares and to seek shareholders' approval of

the resolutions to be proposed at an Extraordinary General Meeting ("EGM") on 11

May 2007 ("Resolutions"), notice of which is set out in the circular to

shareholders.

Background to and reasons for the Proposals

As a direct result of the difficulties experienced with the current lease

provider, General Capital Venture Finance Limited ("GCVF"), and as stated in the

Company's interim results for the six months to 31 December 2006 published on 30

March 2007, the Board decided to seek alternative financing for the business.

The Company has secured loans of #2.8 million as an interim measure, while

discussions are taking place with Bank of Scotland to provide new lending

facilities. These discussions are at an advanced stage, credit approval has been

received, and the Company is working towards completion in the near future. The

Company has also secured commitments for additional equity investment of

#585,000 from certain directors and other investors.

The Company has repaid #130,000 (plus accrued interest) of these loans and is

proposing to settle the balance of #2,670,000 (plus accrued interest (although

one group of lenders, being clients of UK investment bank Fairfax I.S. plc, has

waived its entitlement to accrued interest)) and raise #585,000 of additional

working capital through the issue of 21,762,618 New Ordinary Shares at 15p per

share to the outstanding lenders and other investors, conditional on approval of

the Resolutions at the EGM and admission of the New Ordinary Shares to AIM. Part

of the new equity is required to satisfy a pre-condition of the proposed new

lending facilities that the Company raises at least #2 million in new equity

capital. The new facility is expected to comprise #8 million of debt finance,

#500,000 of vehicle finance and a #750,000 overdraft facility.

The Company currently has 1,264 ATMs in operation with its customers and

continues to see strong demand for more ATMs to be installed both with existing

customers and potential new customers. The Bank of Scotland facilities, together

with additional capital that will be made available to the Company on completion

of the fundraising, will enable the Company to resolve matters with GCVF and

will enable a faster roll-out of ATMs to meet such demand than would otherwise

be the case and enable the Company to aggressively pursue new sites.

As part of the equity issue, the following Directors are investing in the

business and will be issued New Ordinary Shares at the same price of 15p per

share as follows (conditional on approval of the Resolutions at the EGM and

admission to AIM of the New Ordinary Shares):

New Total shareholding Approx. % of enlarged

Ordinary after the issued share capital

Shares equity issue after the equity issue

Anthony Sharp (via

Annenberg Investment

Management S.A.) 1,666,666 24,004,666 28.84

Ciaran Morton 200,000 200,000 0.24

Robin Saunders 676,334 676,334 0.81

John Maples 135,184 135,184 0.16

David Auger 133,333 133,333 0.16

Admission to AIM

The Company will make application for the New Ordinary Shares to be admitted to

trading on AIM and admission is expected to take place on 14 May 2007. The New

Ordinary Shares will rank pari passu with the existing ordinary shares of 1

penny each in the capital of the Company, including the rights to all dividends

and other distributions declared, paid or made after the date of issue.

Extraordinary General Meeting

At the Extraordinary General Meeting on 11 May 2007 shareholders will be asked

to consider and if thought fit to pass the following resolutions:

1. an ordinary resolution to give the directors authority under section 80 of

the Act to allot the 21,762,618 New Ordinary Shares and to allot new

ordinary shares of 1 penny each up to an aggregate nominal amount of

#415,858, such authority to expire at the conclusion of the next AGM of the

Company; and

2. a special resolution to authorise the Directors to allot the New Ordinary

Shares, to allot new ordinary shares of 1 penny each up to an aggregate

nominal amount of #124,757 and to allot ordinary shares of 1 penny each

pursuant to a rights issue, as if Section 89 (1) of the Act did not apply,

such authority expiring at the conclusion of the next AGM of the Company.

As an explanation of Resolution 2, Section 95 of the Act concerns the

dis-application of statutory preemption rights pursuant to Section 89 of the

Act. Section 89 of the Act provides that, if the directors wish to issue new

securities for cash, they must be first be offered to current holders of shares

in proportion to the number of shares they each hold at that time. By Section 95

of the Act, shareholders can resolve by special resolution, as proposed above,

to dis-apply Section 89 of the Act for a specified nominal amount of shares.

Recommendation

The Directors consider that the passing of the Resolutions is in the best

interests of the Company and its shareholders as a whole. Accordingly, the Board

unanimously recommends shareholders to vote in favour of the Resolutions to be

proposed at the EGM as they intend to do in respect of their own beneficial

holdings of, in aggregate, 25,494,000 Ordinary Shares, representing

approximately 41.5 per cent. of the Company's existing issued share capital.

The independent Directors consider, having consulted with Seymour Pierce Limited

as nominated adviser, that the Proposals are fair and reasonable insofar as

shareholders are concerned.

Further copies of the circular to shareholders and notice of EGM will be

available from the offices of Seymour Pierce Limited, Bucklersbury House, 3

Queen Victoria Street, London EC4N 8EL.

Further re Directorate

Further to the announcement on 30 March 2007 regarding the appointment of

William Hughes, Mr Hughes was also a director of Medicsight Inc. and Tactica

Fund plc within the last five years. William Hughes was also a director of Megap

Limited when a receiver (Scottish Companies) was appointed on 4 September 1987

and net liabilities were estimated at being less than #500,000. William Hughes

was also a director of Caledonian Golf and Leisure Limited until 1 December 1997

which later, on 25 September 1998, had a receiver (Scottish Companies)

appointed.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEEAKLXFFDXEFE

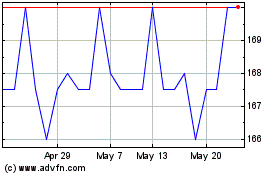

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jul 2023 to Jul 2024