RNS Number:0563U

Cashbox PLC

30 March 2007

Cashbox Public Limited Company

("Cashbox" or "the Company")

Interim Results for the six months ended 31st December 2006

Cashbox (AIM:CBOX), the independent Automated Teller Machine ("ATM") deployer

and operator, announces its interim results for the six months ended 31 December

2006 (H1 06/07).

Anthony Sharp, Executive Chairman said:

"Our sales force has continued its momentum but lack of timely funds from our

lease provider delayed our ability to roll out ATMs as quickly as we would have

liked, however the foundations remain in place to drive this business forward".

--------------------------------------------------------------------------------

as restated

H1 06/07 H2 05/06 H1 05/06

ended Dec 06 ended Jun 06 ended Dec 05

unaudited unaudited unaudited

# 000 # 000 # 000

Machines installed at period end 1,245 1,058 848

Turnover 2,243 1,730 1,429

Gross Margin % 26% 25% 34%

EBITDA* (1,311) (1,313) (735)

Loss on ordinary activities* (1,625) (1,531) (927)

Earnings per share* (2.6)p (3.0)p (2.7)p

Net debt 312 315 8

--------------------------------------------------------------------------------

* before exceptional items of #1,175,000 in H2 05/06 relating to listing and

share option costs.

Highlights

* Merchant contract wins increases potential ATM sites to over 80,000

* Installed estate increased to 1,245 despite difficulties with lease

provider

* Turnover up 30% from preceding six months and 57% from the same period last

year

* Gross margin up slightly from H2 05/06 but lower than the comparable period

H1 05/06 which benefited from higher service income

* Net debt at period end #0.3m, unchanged from H2 05/06

* New #2.8m loan facilities signed in 2007

CHAIRMAN'S STATEMENT

While the steps that the Board had put in place, as reported in the Annual

Report, put us in an excellent position to grow the business, the period to 31

December 2006 and the last couple of months have proved frustrating as our lease

provider, General Capital Venture Finance Ltd ("GCVF"), did not provide funds on

a timely basis. As a consequence our ability to roll out our ATMs across

Merchant Sites at the rate we would have liked was fundamentally prejudiced, and

our ability to reach a critical mass impeded. This has delayed our stated

ambition of achieving profitability. Clearly this is disappointing, however

arrangements for alternative ATM financing are being made and the foundations

remain in place to drive this business forward once we have access to necessary

capital.

In February 2007 we arranged a series of short term loans totaling #0.8m from

directors and some existing shareholders as the arrangements with GCVF

deteriorated. This is testament to the continuing support of a number of key

individuals. The Board also resolved to seek alternative asset financing to

facilitate the growth of the business and is in the final stages of negotiating

an #8.0m asset financing arrangement together with a #0.75m overdraft facility.

While this progresses, the Company has arranged a #2.0m loan facility in March

to enable the rollout of ATMs to continue.

At an operational level the existing estate of ATMs has performed well. During

this difficult time we have been able, through careful cash management, to

install a further 187 machines and the sales force have worked hard and

continued to sign a number of key agreements with major customers. The number of

sites owned or managed by Cashbox's customers (including those with an

associated membership network) has increased to in excess of 80,000.

Operationally we therefore believe the business is well placed to execute the

business plan once the asset financing arrangements are finalised.

Financial Review

Turnover for the first half of the year was #2.2m, up 30% from the second half

of last year and 57% over the first half of last year, the comparable period,

with growth due to higher transaction income as more ATMs are installed.

Gross margin for the period was 26%, up slightly from the second half of 05/06,

but down from the first half 05/06 which benefited from service income derived

from relocating a number of a customer's ATMs.

Administration costs were up significantly from the comparable period last year,

mainly salary costs including share-based payments, as the business continues to

put in place the infrastructure to grow, but only 15% up on the preceding six

months as the growth has been slowed while the financing of new ATM

installations is resolved.

Interest costs are lower following the restructuring of the debt prior to the

flotation of the Company in March 2006 and the interest for the six months ended

31 December 2006 relates principally to the lease facility.

Consequently the loss on ordinary activities for the period was #1.6m compared

to #0.9m for the comparable period with higher gross profit being more than

offset by the higher administration costs.

Careful cash management and negotiation of payment terms resulted in a net cash

inflow from operating activities of #0.9m, with cash collection from debtors and

increased creditors. This was utilised servicing the lease facilities and

purchasing fixed assets with an overall increase in cash for the period of

#0.6m.

Net debt was unchanged at #0.3m at the period end with the net cash inflow from

operating activities covering the continued investment in ATMs.

Board update

As we announced on 21 March 2007, Carl Thomas, previously CEO, was dismissed

without notice after a disciplinary process. Carl Thomas has notified the

Company he is appealing this decision. I have assumed executive responsibilities

while the company is without a Chief Executive and while holding an executive

position I have stepped down from the Audit Committee.

David Auger has also joined the Board to take over as Chief Financial Officer,

effective 2nd April 2007, from Darren Woolsgrove who will be working in a more

operational role assisting me. We are delighted to have been able to appoint

someone of David's calibre as CFO. The expertise he brings with him from high

profile organisations such as PricewaterhouseCoopers and ICI will be of great

benefit to Cashbox as we continue to grow. Darren has indicated a desire to

ultimately seek a new challenge after the Company's successful IPO and is seeing

through his commitments made at that time last year. He will be stepping down as

a Director once a CEO is in place.

Hanco Litigation update

The litigation between inter alia, Cashbox ATM Systems Limited (the Company's

Subsidiary), Carl Thomas (previously Cashbox CEO), and other former employees of

the Company and Hanco ATM Systems Limited ("Hanco") is continuing. At a hearing

on 21st February 2007, and as announced on 23rd February 2007, the court made an

order for the Company's Subsidiary and Carl Thomas to pay 60% of Hanco's costs

of the summary judgment application together with an interim payment on account

of those costs of #150,000. The Company's Subsidiary and Carl Thomas have

applied for permission to appeal the summary judgment decision and a stay of the

interim payment on account of costs has been granted pending determination of

the application for permission to appeal.

The Company and the Company's Subsidiary have obtained a joint and several

indemnity from both Carl Thomas and Anthony Sharp against any liability of the

Company or the Company's Subsidiary arising from or in connection with this

litigation to pay any sum for damages awarded in respect thereof by a court of

competent jurisdiction (including all sums payable to the legal advisers of

Hanco) or for any agreed settlement in respect thereof.

Hanco's application for an interim payment in relation to quantum was adjourned

to a further hearing.

The position of the Company's Subsidiary remains that Hanco would not be

entitled to anything other than nominal recovery because Hanco would not have

secured Phase II of the Threshers contract in any event; and Phase II of the

Threshers contract was not profitable for the Company's subsidiary.

Financing

As a direct result of the difficulties experienced with the current lease

provider GCVF, the Board decided to seek alternative financing for the business.

The Company has secured a #2.0m loan through the clients of UK investment bank,

Fairfax I.S. plc, while discussions are taking place with a major, reputable

prime lender to provide asset financing. These discussions are at an advanced

stage, credit approval has been received, and we are working towards completion

in the near future.

The Board is considering seeking additional equity financing to maintain an

appropriate level of financial gearing and, if necessary, will hold an

Extraordinary General Meeting to seek shareholder approval for this.

Discussions are taking place with GCVF for the termination of their lease

facility and release of their debenture security. It is the Company's view that

GCVF are in breach of the terms of the facility and that the significant

contractual penalties GCVF is currently relying on are not payable. The ongoing

without prejudice negotiations have been protracted and the outcome is

uncertain. The Board is of the view that the termination of this facility is in

the long term interests of the business and expects matters to be resolved in

the near future.

Outlook

Whilst the last few months have been a difficult and frustrating period for the

Company and our staff, we are confident that good progress will be made in

growing the business over the next few months and that we will be reporting

significant progress with our full year results to be announced in the autumn.

Anthony Sharp

Executive Chairman

30 March 2007

For further information:

Cashbox plc

Anthony Sharp, Executive Chairman Tel: +44 (0) 870 126 2274

asharp@cashboxplc.co.uk www.cashboxplc.co.uk

Seymour Pierce Limited

Jeremy Porter, Corporate Finance Tel: +44 (0) 20 7107 8000

www.seymourpierce.com

Media enquiries:

Threadneedle Communications

Josh Royston / Graham Herring Tel: +44 (0) 20 7936 9606

www.threadneedlepr.co.uk

CASHBOX PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE SIX MONTHS ENDED 31 DECEMBER 2006

as

unaudited unaudited restated

Notes 6m ended 6m ended Year ended

31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Turnover 2,243 1,429 3,159

Cost of sales (1,655) (947) (2,245)

--------- --------- ---------

Gross profit 588 482 914

--------- --------- ---------

Administrative

expenses (2,146) (1,265) (3,131)

Exceptional items:

Share based remuneration (options) - - (574)

charge

Listing costs - - (605)

--------- --------- ---------

Total exceptional costs - - (1,179)

--------- --------- ---------

Total

administrative

expenses (2,146) (1,265) (4,310)

--------- --------- ---------

Operating loss (1,558) (783) (3,396)

Interest receivable and

similar income 11 6 13

Interest payable and

similar charges 2 (78) (150) (254)

--------- --------- ---------

Loss on ordinary

activities before and

after taxation (1,625) (927) (3,637)

--------- --------- ---------

Loss per ordinary share (pence) 3

Basic (2.6)p (2.7)p (8.4)p

Diluted (2.6)p (2.7)p (8.4)p

Loss on ordinary

activities excluding

exceptional costs and

before and after taxation (1,625) (927) (2,458)

All amounts relate to continuing activities

CASHBOX PLC

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE SIX MONTHS ENDED 31 DECEMBER 2006

unaudited unaudited as restated

Notes 6m ended 6m ended Year ended

31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Loss for the period (1,625) (927) (3,637)

--------- ---------

Prior period adjustments 1 (75)

- share based payments

---------

Total gains and losses recognised

since last financial statements (1,700)

---------

CASHBOX PLC

CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2006

unaudited unaudited

Notes 31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Fixed assets

Tangible assets 1,167 234 674

Current assets

Stocks 27 48 22

Debtors 822 634 1,492

Cash at bank and in hand 1,161 625 536

--------- --------- ---------

2,010 1,307 2,050

Creditors: amounts

falling due within

one year 4 (4,865) (3,807) (2,225)

--------- --------- ---------

Net current

liabilities (1,688) (2,500) (175)

--------- --------- ---------

Total assets less

current liabilities (521) (2,266) 499

Creditors: amounts

falling due after

more than one year 4 - - (679)

--------- --------- ---------

Net liabilities (1,688) (2,266) (180)

--------- --------- ---------

Capital and reserves

Called up share capital 614 380 614

Share premium account 3,880 - 3,880

Merger reserve 2,180 2,180 2,180

Warrants reserve 37 - 37

Profit and loss account (8,399) (4,826) (6,891)

--------- --------- ---------

Shareholders' deficit 5 (1,688) (2,266) (180)

--------- --------- ---------

CASHBOX PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 31 DECEMBER 2006

unaudited unaudited

Notes 6m ended 6m ended Year ended

31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Net cash inflow /(outflow) from

operating activities 6 852 (742) (4,327)

---------- ---------- ----------

Returns on investments and

servicing of finance

Interest received 11 6 13

Interest paid (41) (117) (254)

---------- ---------- ----------

Net cash outflow from

returns on investment and

servicing of finance (30) (111) (241)

---------- ---------- ----------

Capital expenditure and financial

investment

Purchase of tangible fixed assets (623) (154) (44)

---------- ---------- ----------

Net cash outflow from

capital expenditure

and financial investment (623) (154) (44)

---------- ---------- ----------

Cash inflow / (outflow)

before use of liquid

resources and financing 3 (1,007) (4,612)

---------- ---------- ----------

Financing

Issue of ordinary shares for cash - 1,596 5,339

(net of issue costs)

Loans taken and repaid - (15) (457)

Cash advances from Lease 500 - -

Provider

Capital element of finance leases (74) - -

repaid

Sale and leaseback of tangible - - 215

fixed assets ---------- ---------- ----------

Net cash inflow from financing 426 1,581 5,097

---------- ---------- ----------

Increase / (decrease) in cash 625 574 485

---------- ---------- ----------

CASHBOX PLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2006

1. Accounting policies and basis of presentation of financial information

These financial statements have been prepared under the historical cost

convention and in accordance with applicable United Kingdom Accounting Standards

on a going concern basis and should be read in conjunction with the Group's

Annual Accounts for the year ended 30 June 2006. The results for the six months

ended 31 December 2006 and the comparative figures for the six months ended 31

December 2005 are unaudited.

The interim report for the six months ended 31 December 2006 was approved by the

Board on 29 March 2007.

This interim financial information does not constitute the Company's statutory

accounts within the meaning of section 240 of the Companies Act 1985. The

financial information for the year ended 30 June 2006 has been extracted from

the statutory accounts which have been filed with the Registrar of Companies.

The auditors' report in those accounts was unqualified but included an emphasis

of matter regarding Going Concern. The auditors' report did not contain a

statement under s237 (2) or (3) Companies Act 1985.

Change of accounting policy

The Company has applied the requirements of Financial Reporting Standard No 20

Share-based payment, which it has adopted for the first time with effect from 1

July 2006 as its application is obligatory for accounting periods commencing on

or after 1 January 2006.

The Group issues equity-settled share-based payments including share options and

warrants to certain Directors and employees. Equity-settled share-based payments

are measured at fair value at the date of grant using an appropriate option

pricing model. The fair value determined at the date of grant is expensed to the

profit and loss account on a straight line basis over the vesting period. At the

balance sheet date the cumulative change in respect of each award is adjusted to

reflect the actual levels of options vesting or expected to vest. The effect of

this is to increase costs for the six months ended 31 December 2006 by #117,000.

The prior period comparatives have been restated resulting in an increase in

costs for both the six months and year ended 30 June 2006 of #75,000 being

#71,000 of ordinary and #4,000 exceptional costs. There was no impact on opening

reserves at 1 July 2005 as no equity-settled share-based payments were made

prior to March 2006.

2. Interest payable and similar charges

unaudited unaudited

6m ended 6m ended Year ended

31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Bank loans and

overdrafts - 126 203

Supplier interest - 23 46

Other loans 5 1 5

Finance lease

interest and

other charges 73 - -

--------- --------- ---------

78 150 254

--------- --------- ---------

3. Loss per Share

Basic and diluted loss per share has been calculated on the basis of losses

after taxation of #1,625,000 (2005: #927,000) and 61,409,143 1p ordinary shares

(2005: 34,068,000 equivalent 1p ordinary shares) being the weighted average

number of shares in issue during the six month period. The exercise of share

options would have the effect of reducing the loss per ordinary share and is

therefore not dilutive under the terms of Financial Reporting Standard 22.

4. Creditors falling due within and after one year

unaudited unaudited

31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Within one year

Director loans - 600 -

Trade creditors 924 1,435 592

Taxation and social security 307 97 45

Amounts due under finance leases 973 - 172

Advances from lease provider 500 - -

Other creditors 473 462 469

Accruals and deferred income 1,688 1,213 947

--------- --------- ---------

4,865 3,807 2,225

--------- --------- ---------

After one year

Amounts due under finance leases - - 679

--------- --------- ---------

- - 679

--------- --------- ---------

The finance lease is provided by GCVF and is for a period of five years from the

date of execution, 30 June 2006, and as per a facility letter dated 23 March

2006 for a total facility of #6.1m. On 13 November and 18 December 2006, two

cash advances were received but no accompanying documentation has been provided

or executed and accordingly these balances are treated as Cash Advances rather

than finance leases.

Following GCVF's failure to provide funds on a timely basis, and in accordance

with the facility letter of 23 March 2006, it is expected that the finance

leases and cash advances will be repaid within the next 12 months and

accordingly balances previously due after one year have been reclassified.

5. Reconciliation of movements in shareholders' funds

unaudited unaudited as restated

6m ended 6m ended Year ended

31-12-06 31-12-05 30-06-06

#'000 #'000 #'000

Loss for the period (1,625) (927) (3,637)

Share based payments - credit to

reserves 117 - 645

---------- ---------- ----------

Profit and loss account (1,508) (927) (2,992)

Issue of shares - - 234

Premium on shares issued - - 3,880

Capital (merger) reserve - 1,706 1,706

Warrants reserve - - 37

---------- ---------- ----------

Net (decrease) / increase in

shareholders' funds (1,508) 779 2,865

---------- ---------- ----------

Shareholders' deficit at beginning

of the period as previously stated (180) (3,045) (3,045)

Prior period adjustments:

Share based remuneration charge 75 - -

Share based payments - credit to

reserves (75) - -

---------- ---------- ---------

Shareholders' deficit at beginning

of the period as restated (180) (3,045) (3,045)

---------- ---------- ---------

Shareholders' (deficit)/funds at

end of period (1,688) (2,266) (180)

--------- --------- ---------

6. Reconciliation of operating loss to net cash outflow from operating

activities

unaudited unaudited as restated

6m ended 6m ended Year ended

31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Operating loss (1,558) (783) (3,396)

Share based remuneration

charge 117 - 645

Depreciation 130 48 98

(Increase) /Decrease /

in stock (5) 163 189

Decrease /

(Increase) in debtors 834 (325) (1,294)

Increase /

(Decrease) in creditors 1,334 155 (569)

---------- ---------- ----------

Net cash outflow

from operating

activities 852 (742) (4,327)

---------- ---------- ----------

7. Analysis of changes in net debt

unaudited unaudited unaudited unaudited unaudited unaudited

Cash in Bank Total cash Debt due Debt due Total net

hand and overdraft and within one after one debt

at bank overdraft year year

#'000 #'000 #'000 #'000 #'000 #'000

At 30 June

2006 536 - 536 (172) (679) (315)

Cash flows 625 - 625 625

Cash advances

from lease

provider (500) - (500)

Funds due from

lease provider (192) (192)

Finance lease

repayments 74 - 74

Non cash items (4) (4)

Reclassificati

ons - - - (679) 679 -

-------- -------- -------- -------- -------- --------

At 31 December

2006 1,161 - 1,161 (1,473) - (312)

-------- -------- -------- -------- -------- --------

The funds due from lease provider relate to amounts invoiced to the lease

provider as part of the sale and leaseback of ATMs. A corresponding amount is

included in Debtors.

8. Dividend

The Directors are not able to declare a dividend.

9. Subsequent events

On 8 February 2007 the Company arranged a series of short term loans from

directors and a number of existing shareholders totalling #0.8m repayable on 28

days notice with interest payable at base rate plus 0.5%.

On 26 March 2007 the company signed a #2.0m 15% loan note repayable in three

years time with interest payable quarterly in arrears with Finsbury Nominees

Limited, a client of Fairfax I.S. plc, a UK investment bank.

10. Contingencies

The Company's Subsidiary has entered into a finance leasing agreement with GCVF.

The liabilities of the Company's Subsidiary pursuant to such agreement are

secured by fixed and floating charges and guarantees given by the Company and

Company's Subsidiary. Under the terms of the agreement, penalty clauses up to a

maximum of the outstanding charges discounted at 3% are payable on early

termination.

10. Contingencies (continued)

In December 2003 Hanco ATM Systems Limited ("Hanco") made significant claims

against Carl Thomas and Cashbox ATM Systems Limited ("Subsidiary") including an

allegation that Carl Thomas diverted a business opportunity from Hanco to

Cashbox, namely a contract for the installation of ATMs with the Thresher Group.

Both the Company's Subsidiary and Carl Thomas vigorously denied these claims.

The Company and the Company's Subsidiary have obtained a joint and several

indemnity from both Carl Thomas and Anthony Sharp against any liability of the

Company or the Company's Subsidiary arising from or in connection with this

litigation to pay any sum for damages awarded in respect thereof by a court of

competent jurisdiction (including all sums payable to the legal advisers of

Hanco) or for any agreed settlement in respect thereof.

11. Non-GAAP terms

EBITDA is earnings before interest, tax, depreciation, amortization, exceptional

items and minority interests and equals operating income before exceptional

items plus depreciation and amortization. EBITDA, which we consider to be a

meaningful measure of operating performance, particularly the ability to

generate cash, does not have a standard meaning under UK GAAP and may not be

comparable with similar measures used by others.

unaudited unaudited as restated

6m ended 6m ended Year ended

31-12-06 31-12-05 30-6-06

#'000 #'000 #'000

Operating loss (1,558) (783) (3,396)

Add back:

Exceptional items - - 1,179

Share based payments charge 117 - 71

Depreciation 130 48 98

--------- --------- ---------

EBITDA (1,311) (735) (2,048)

--------- --------- ---------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GIGDXCGXGGRG

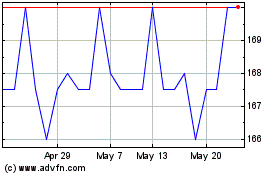

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jul 2023 to Jul 2024