TIDMBSE

AIM and Media Release

25 January 2022

BASE RESOURCES LIMITED

Quarterly Activities Report - December 2021

African mineral sands producer, Base Resources Limited (ASX & AIM: BSE) (Base

Resources or the Company) is pleased to provide a quarterly operational,

development and corporate update.

Key Points

* Kwale Operations maintained operational consistency through the quarter, in

line with FY22 guidance.

* Ongoing strong demand supported further price increases for all products in

the quarter.

* Bumamani DFS commenced and on track for completion in the June quarter.

* Tanzanian exploration commenced with 224 shallow auger holes completed.

* Discussions with the Government of Madagascar on Toliara Project fiscal

terms continued.

KWALE OPERATIONS

Operational performance

Mining operations continued to plan on the South Dune orebody with mined

tonnage decreasing slightly due to planned maintenance shutdowns and lower

mining rates. The heavy mineral (HM) grade of ore mined in the quarter was

higher at 3.82% (last quarter: 3.26%) as mining progressed towards the centre

of the South Dune orebody.

Wet concentrator plant (WCP) production of heavy mineral concentrate (HMC) was

higher at 153kt (last quarter: 134kt) as a consequence of the higher ore

grade. HMC stocks increased to 23kt (last quarter: 17kt). Sand tails

continued to be deposited into the mined-out Central Dune area and capped with

a 2m thick co-disposed slimes/sand layer to aid water retention and subsequent

rehabilitation and alternate land use. Rehabilitation of the Central Dune

slopes and plateau continued to plan and agricultural trials on the co-disposed

water retention layer proved successful. Rehabilitation of the mined-out

sections of the South Dune proceeded as scheduled.

SUMMARY Q4 20 Q1 21 Q2 21 Q3 21 Q4 21

Mining (million tonnes)

Ore mined 4.6 4.7 4.7 4.4 4.3

HM % 3.43 3.58 3.65 3.26 3.82

VHM % 2.62 2.80 2.78 2.50 2.94

Production (thousand tonnes)

Ilmenite 78.5 84.2 88.7 72.9 84.0

Rutile 18.2 19.5 20.1 17.8 18.4

Zircon 6.7 7.4 7.1 6.1 6.4

SUMMARY Q4 20 Q1 21 Q2 21 Q3 21 Q4 21

US$ per tonne

Sales revenue $464 $478 $497 $668 $459

Operating costs $161 $142 $148 $174 $161

Cost of goods sold $207 $169 $202 $264 $156

Revenue: Cost ratio 2.2 2.8 2.5 2.5 2.9

Sales (thousand tonnes)

Ilmenite 53.8 97.2 94.0 34.1 130.0

Rutile 12.0 26.1 24.6 13.8 11.6

Zircon 6.4 6.6 7.7 5.6 6.2

Mineral separation plant (MSP) feed tonnage of 146kt was higher than the prior

quarter (last quarter: 137kt), due to increased HMC feed availability.

Production of ilmenite was significantly higher in the quarter due to increased

MSP recoveries of 102% (last quarter: 100%) and an elevated proportion of

ilmenite in the mineral assemblage. Underlying MSP product recoveries for

rutile and zircon were steady and their production was in line with

expectations.

Bulk loading operations at Kwale Operations Likoni export facility continued to

run smoothly, dispatching a combined 138kt of bulk ilmenite and rutile during

the quarter (last quarter: 54kt). Containerised shipments of rutile and zircon

through the Mombasa Port proceeded to plan.

Total cash operating costs of US$18.1 million increased compared to the prior

quarter (last quarter at US$16.9 million) due to higher mining and maintenance

costs. However, the increased production volumes resulted in lower unit

operating costs of US$161 per tonne produced (rutile, ilmenite, zircon and

low-grade zircon) (last quarter: US$174 per tonne).

Cost of goods sold decreased to US$156 per tonne sold (operating costs,

adjusted for stockpile movements, and royalties) due to the sales mix (last

quarter: US$264 per tonne), as did average unit revenue of US$459 per tonne

(prior quarter: US$668 per tonne). Due to these factors, the revenue to cost

of goods sold ratio for the quarter increased to 2.9 (last quarter: 2.5).

At the end of the quarter, 100% of Kwale Operations employees had received at

least one dose of COVID-19 vaccine, with 76% fully vaccinated. Boosters are

scheduled to commence early in 2022.

FY22 production guidance

Kwale Operations production guidance for the 2022 financial year (FY22) remains

at:

* Rutile - 73,000 to 83,000 tonnes.

* Ilmenite - 310,000 to 340,000 tonnes.

* Zircon - 24,000 to 28,000 tonnes.1

[Note (1): Refer to Base Resources' announcement on 19 October 2021 "Quarterly

Activities Report - September 2021" for the assumptions upon which the FY22

production guidance is based.]

MARKETING

Despite uncertainties in China relating to power cuts, environmental controls

and COVID management policies, the TiO2 pigment industry and the main

zircon-user sectors (including ceramics) in China remained strong through the

December quarter. End user sectors for the Company's products in all other

markets continued to strengthen through the quarter. Further price increases

for TiO2 pigment have been announced globally for early 2022.

Demand for imported ilmenite as a feedstock for Chinese TiO2 pigment producers,

particularly from the Company's customers, remained strong in the quarter,

enabling further ilmenite price gains. Increased ilmenite supply from some

African sources, Vietnamese exports and Chinese domestic production through

2021 continued to lag behind demand resulting in an expectation that ilmenite

prices will maintain December levels through the March quarter. Bulk freight

costs to China eased through the quarter but remain volatile and are expected

to affect ilmenite price gains for the foreseeable future.

Demand for high grade TiO2 feedstocks (which includes rutile) again increased

significantly through the quarter as western TiO2 pigment producers sought to

maximise output volumes and the welding consumable and titanium metal sectors

strengthened further. The tight market for high grade feedstocks has been

exacerbated by uncertainties over supply from major high grade feedstock

producers. Rutile prices increased through the quarter and substantial price

increases have been secured for the March quarter. A major rutile shipment

scheduled for December 2021 was postponed to January 2022 due to delays with

the customer's chartered vessel, impacting reported sales for the December

quarter.

Zircon demand continues to be strong in all end use sectors and regions, which,

when combined with limited supply and minimal inventories, has resulted in a

tightening zircon market and upward price pressure. Zircon prices for the

Company's December quarter contracts increased by approximately US$600/t from

prices in September quarter contracts. Due to ongoing uncertainties in China

and the seasonally weaker winter period, average zircon pricing agreed for the

Company's March quarter contracts have seen only a marginal increase over

December quarter contract prices.

SUSTAINABILITY

Safety

There were no lost time injuries during the quarter, or in the past year, at

Kwale Operations or the Toliara Project, resulting in a lost time injury

frequency rate (LTIFR) for Base Resources of zero. Compared to the Western

Australian All Mines 2019/2020 LTIFR of 2.1, this is an exceptional performance

reflective of the ongoing focus and importance placed on safety by management.

Base Resources group employees and contractors have now worked 26.9 million

hours lost time injury (LTI) free, with the last LTI recorded in early 2014.

With two medical treatment injuries recorded in the last 12 months, Base

Resources' total recordable injury frequency rate is 0.50 per million hours

worked.

Community and environment - Kwale Operations

The Company has continued to assist the Kwale community through the COVID-19

pandemic, including by collaborating with county and national health

authorities to encourage the uptake of vaccines.

Agricultural livelihood programs in Kwale continued through the PAVI farmers'

cooperative, with the arrival of rain in the quarter allowing additional

planting to take place. Poultry and beekeeping programs continue to expand and

provide farmers and community groups with substantial incomes. Selection of

tertiary scholarship recipients was completed during the quarter with 220

awards made.

Implementation of identified projects by the Msambweni, Lunga and Likoni

Community Development Agreement Committees commenced in the quarter with

considerable progress made on several infrastructure projects.

Rehabilitation activities on the mined-out sections of the South Dune continued

in the quarter with community groups supplying indigenous legumes, grass seed

and manure. On the Central Dune, 14 hectares began being prepared for

additional agricultural trials. Refer to the PDF version of this announcement

available from Base Resources' website: https://baseresources.com.au/investors

/announcements/ for an image showing the progressive land rehabilitation

activities on the South Dune.

A successful visit by representatives of key government departments and

agencies, together with representatives of Kwale County, saw the endorsement of

the Company's post-mining land use concepts that will now move into the

pre-feasibility study phase.

Community and environment - Toliara Project

All community training programs, and social infrastructure construction,

remained on hold with the Government of Madagascar's suspension of the Toliara

Project's on-the-ground activities. However, the Company continued to partner

with local governments and community health groups in the Toliara region to

provide additional support to vulnerable communities affected by COVID-19,

including programs to address food insecurity and hygiene.

Modern slavery statement

During the quarter, Base Resources published its FY21 modern slavery statement

reporting on the Company's actions to identify, assess and address the risks of

modern slavery in the Company's operations and supply chains during the

period2.

[Note (2): For further information, refer to Base Resources' announcement on 3

December 2021 "Modern Slavery Statement".]

BUSINESS DEVELOPMENT

Toliara Project development - Madagascar

In November 2019, the Government of Madagascar required the Company to suspend

on-the-ground activity on the Toliara Project while discussions on fiscal terms

applying to the project were progressed. Activity remains suspended as Base

Resources continues to engage with the Government in relation to the country's

Large Mining Investment Law (LGIM) regime, fiscal terms applicable to the

Toliara Project and lifting of the on-the-ground suspension.

In September 2021, the Company completed an enhanced Definitive Feasibility

Study (DFS2) for the Toliara Project to incorporate an update to the estimated

Ranobe Ore Reserves and an increase in project scale.3 The outcomes of DFS2,

compared to the earlier 2019 DFS, included substantially improved forecast

financial returns for the Toliara Project, including a post-tax/pre-debt (real)

NPV10 of US$1.0 billion and an average revenue to cost of sales ratio of 3.5,

over an initial 38-year mine life.4 The DFS2 schedule assumes construction

will commence at the start of 2023, at a capital cost of US$520 million, which

would see production starting in early 2025. However, timing of the Final

Investment Decision (FID) to proceed with construction of the Toliara Project

remains subject to lifting of the suspension of on-the-ground activities and

agreeing acceptable fiscal terms with the Government of Madagascar. Once these

two key milestones are achieved, there will be approximately 11 months' work to

complete prior to reaching FID, including finalisation of funding, completion

of land acquisition, conclusion of major construction contracts and entering

into offtake agreements with customers. Resumption of reasonable international

travel will also be required to complete a significant portion of this pre-FID

work. The Company maintains readiness to accelerate progress when conditions

support.

Total expenditure on the Toliara Project for the quarter was US$1.2 million

(last quarter: US$2.1 million).

[Note (3): For further information, refer to Base Resources' announcement on 27

September 2021 "DFS2 enhances scale and economics of the Toliara Project" (DFS2

Announcement).]

[Note (4): Refer to the DFS2 Announcement for the material assumptions and

underlying methodologies for deriving these financial outcomes. The DFS2

Announcement also discloses key pre and post FID risks in respect of the

Toliara Project. Base Resources confirms that all the material assumptions

underpinning the production information and forecast financial information in

the DFS2 Announcement continue to apply and have not materially changed.]

Kwale mine life extension

The Company is progressing a definitive feasibility study (DFS) on higher grade

subsets of the Bumamani and Kwale North Dune deposits to extend Kwale

Operations mine life to July 2024. Following a pit optimisation study

completed in the quarter, a further Kwale North Dune pit area, referred to as

the P200 pit area (in addition to the original P199 pit area), has been

included in the DFS, which could further extend Kwale Operations mine life to

early Q4 2024. To secure the required mining tenure, an application for a

variation to extend the Kwale Special Mining Lease 23 (SML 23) to cover these

areas has been lodged. The DFS is expected to be completed in the second

quarter of 2022.

Extensional exploration - Kenya & Tanzania

No further work was conducted on the Vanga Prospecting License (PL/2015/0042)

in the quarter and completion of the remaining drill program (4,200 metres) in

the North-East Sector (Kwale East) of PL 2018/0119 remains on hold pending

community access being secured.

Prospecting licence applications lodged for an area in the Kuranze region of

Kwale county, about 70 km west of Kwale Operations (applications 2019 0260,

2510 and 2512), together with an area south of Lamu (applications 2019 0263,

0265, 0266), remain in process towards granting. An additional prospecting

licence application has been lodged for the area surrounded by the Kuranze

applications in Kenya, however application numbers and boundaries have not yet

been issued. A Government of Kenya moratorium on the issuance of prospecting

licences in November 2019 has affected the progress of all licence

applications. The Company continues to work with the Government, and other

mining sector stakeholders, to see the moratorium lifted to enable the

recommencement of the issuance of mineral rights.

The Company progressed on-ground exploration in Tanzania with a shallow auger

drilling program completing 224 holes to assess geochemical anomalies and

identify air core drilling targets. Sample assaying is in progress at the

Kwale Operations mine laboratory with infill auger drilling and test pits

planned in the March quarter to better understand the more prospective areas.

Subject to the outcomes of assays, as well as drill rig availability, deeper

drilling will then be progressed.

Expenditure on exploration activities in Kenya during the quarter was US$0.2

million (last quarter: US$0.3 million) and in Tanzania was US$0.2 million (last

quarter: US$0.1 million).

CORPORATE

FY22 interim financial results

The Company is targeting release of its FY22 interim consolidated financial

statements on 28 February 2022. Confirmation of timing and shareholder and

investor call details will be advised closer to the planned release.

Kwale royalty rate

As previously announced,5 in parallel with the extension of SML 23 to

incorporate the estimated Kwale South Dune Ore Reserves previously falling

outside the SML 23 boundary, Base Titanium Limited, Base Resources' wholly

owned Kenyan subsidiary, agreed to royalty rate increases that applied

retrospectively. During the quarter, Base Titanium Limited made royalty

payments to the Government of Kenya totalling US$18.8 million comprising the

necessary catch-up payments to the June 2021 quarter and payment of the

September quarter royalty at the agreed increased rate. Base Titanium Limited

also paid corporate tax instalments of US$7.7 million to the Government of

Kenya for the first half of FY22.

As at 31 December 2021, the Company had net cash of US$37.1 million consisting

of:

* Cash and cash equivalents of US$37.1 million.

* No debt.

As at 31 December 2021, the Company had the following securities on issue:

* 1,178,011,850 fully paid ordinary shares.

* 76,570,331 performance rights pursuant to the terms of the Base Resources

Long Term Incentive Plan, comprising:

+ 8,149,202 vested performance rights, which remain subject to exercise6.

+ 68,421,129 unvested performance rights subject to performance testing

in accordance with their terms of issue.

[Note (5): For further information, including the agreed increased royalty

rates and the periods during which they apply, refer to Base Resources'

announcement on 30 September 2021 "Kwale mining lease extension secured and

royalty discussion finalised".]

[Note (6): Vested performance rights have a nil cash exercise price. Unless

exercised beforehand, these rights expire five years after vesting.]

Forward looking statements

Certain statements in or in connection with this announcement contain or

comprise forward looking statements. Such statements may include, but are not

limited to, statements with regard to future production and grades, capital

cost, capacity, sales projections and financial performance and may be (but are

not necessarily) identified by the use of phrases such as "will", "expect",

"anticipate", "believe" and "envisage". By their nature, forward looking

statements involve risk and uncertainty because they relate to events and

depend on circumstances that will occur in the future and may be outside Base

Resources' control. Accordingly, results could differ materially from those

set out in the forward-looking statements as a result of, among other factors,

changes in economic and market conditions, success of business and operating

initiatives, changes in the regulatory environment and other government

actions, fluctuations in product prices and exchange rates and business and

operational risk management. Subject to any continuing obligations under

applicable law or relevant stock exchange listing rules, Base Resources

undertakes no obligation to update publicly or release any revisions to these

forward-looking statements to reflect events or circumstances after today's

date or to reflect the occurrence of unanticipated events.S.

For further information contact:

James Fuller, Manager Communications and Investor UK Media Relations

Relations

Base Resources Tavistock Communications

Tel: +61 (8) 9413 7426 Jos Simson and Gareth Tredway

Mobile: +61 (0) 488 093 763 Tel: +44 (0) 207 920 3150

Email: jfuller@baseresources.com.au

About Base Resources

Base Resources is an Australian based, African focused, mineral sands producer

and developer with a track record of project delivery and operational

performance. The company operates the established Kwale Operations in Kenya

and is developing the Toliara Project in Madagascar. Base Resources is an ASX

and AIM listed company. Further details about Base Resources are available at

www.baseresources.com.au

PRINCIPAL & REGISTERED OFFICE

Level 3, 46 Colin Street

West Perth, Western Australia, 6005

Email: info@baseresources.com.au

Phone: +61 (0)8 9413 7400

Fax: +61 (0)8 9322 8912

NOMINATED ADVISOR

RFC Ambrian Limited

Stephen Allen

Phone: +61 (0)8 9480 2500

JOINT BROKER

Berenberg

Matthew Armitt / Detlir Elezi

Phone: +44 20 3207 7800

JOINT BROKER

Canaccord Genuity

Raj Khatri / James Asensio / Patrick Dolaghan

Phone: +44 20 7523 8000

END

(END) Dow Jones Newswires

January 25, 2022 02:00 ET (07:00 GMT)

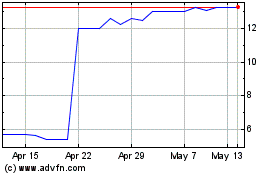

Base Resources (LSE:BSE)

Historical Stock Chart

From Jun 2024 to Jul 2024

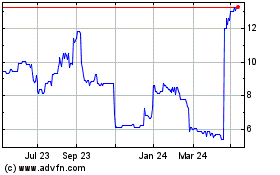

Base Resources (LSE:BSE)

Historical Stock Chart

From Jul 2023 to Jul 2024