BellSouth Issue of Debt

November 08 2004 - 10:10AM

UK Regulatory

RNS Number:9843E

Bellsouth Corp

08 November 2004

For more information contact:

LeAnn Hansen Boucher, BellSouth

404-249-2839

BellSouth Announces Plans to Issue $2 Billion in Debentures

ATLANTA - November 8, 2004 - BellSouth Corporation (NYSE: BLS) announced today

it is offering $2 billion aggregate principal amount of three-year floating

rate, and eight and 30- year fixed rate senior notes to be issued pursuant to

the company's shelf registration statement filed with the Securities and

Exchange Commission. Proceeds from the sale of the notes will complete the

long-term debt that BellSouth expects to raise to refinance its portion of the

purchase price for Cingular's acquisition of AT&T Wireless. JP Morgan, Lehman

Brothers, Morgan Stanley and Goldman Sachs will be acting as Bookrunners.

About BellSouth Corporation

BellSouth Corporation is a Fortune 100 communications company headquartered in

Atlanta, Georgia and a parent company of Cingular Wireless, the nation's largest

wireless voice and data provider.

Backed by award winning customer service, BellSouth offers the most

comprehensive and innovative package of voice and data services available in the

market. Through BellSouth Answers(R), residential and small business customers

can bundle their local and long distance service with dial up and high speed DSL

Internet access, satellite television and Cingular(R) Wireless service. For

businesses, BellSouth provides secure, reliable local and long distance voice

and data networking solutions. BellSouth also offers online and directory

advertising through BellSouth(R) RealPages.com(R) and The Real Yellow Pages(R).

In addition to historical information, this document may contain forward-looking

statements regarding events and financial trends. Factors that could affect

future results and could cause actual results to differ materially from those

expressed or implied in the forward-looking statements include: (i) a change in

economic conditions in domestic or international markets where we operate or

have material investments which would affect demand for our services; (ii) the

intensity of competitive activity and its resulting impact on pricing strategies

and new product offerings; (iii) higher than anticipated cash requirements for

investments, new business initiatives and acquisitions; (iv) unfavorable

regulatory actions; (v) currency devaluations and continued economic weakness in

certain international markets in which we operate or have material investments;

and (vi) those factors contained in the Company's periodic reports filed with

the SEC. The forward-looking information in this document is given as of this

date only, and, BellSouth assumes no duty to update this information.

More information about BellSouth can be found at http://www.bellsouth.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IODUUGBUGUPCGAR

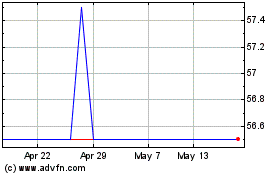

British Smaller Companie... (LSE:BSC)

Historical Stock Chart

From Jun 2024 to Jul 2024

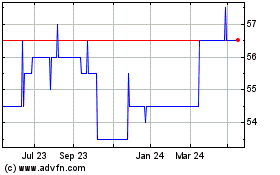

British Smaller Companie... (LSE:BSC)

Historical Stock Chart

From Jul 2023 to Jul 2024