TIDMBMK

RNS Number : 0014I

Benchmark Holdings PLC

30 November 2022

30 November 2022

Benchmark Holdings plc

("Benchmark", the "Company" or the "Group")

Full Year Results for the Financial Year ended 30 September

2022

A year of sustained growth and strategic delivery

Benchmark, the aquaculture biotechnology company, announces its

full year audited results for the year ended 30 September 2022 (the

"period").

Financial highlights - strong FY2022 results delivered ahead of

original market expectations

-- Revenue increase of 27% (+21% CER)

o Advanced Nutrition - excellent performance as the Company

continued to capitalise on renewed commercial focus and recovery in

the shrimp markets post pandemic; revenues increased by 14% (+7%

CER)

o Genetics - strong performance benefitting from high demand for

the Company's salmon eggs delivered from Benchmark's new incubation

centre in Iceland; revenue growth +24% (+21% CER)

o Health - first full year of sales from new sea lice solution

Ectosan (R) Vet and CleanTreat (R) resulting in revenue growth of

157% (+157% CER)

-- Adjusted EBITDA +60% (+54% CER) driven by growth in the three

business areas and continued financial discipline

-- Adjusted EBITDA margin of 20% (FY21: 16%). Adjusted EBITDA

margin excluding fair value uplift from biological assets increased

to 19% (FY21: 13%)

-- Loss for the period increased to GBP30.5m as a result of

increased depreciation associated with CleanTreat(R) units and

higher net finance expenses

-- Disciplined investment in growth areas with tangible capex totalling GBP10.8m

-- Refinancing of NOK 850m bond and post period end refinancing of USD $15m RCF

-- Cash and cash equivalents of GBP36.4m and available liquidity of GBP45.8m

-- At 28 November, cash and cash equivalents of GBP35m and available liquidity of GBP51m

GBPm FY 2022 FY 2021 % AER % CER**

-------------------------------------- -------- -------- ------- --------

Revenue 158.3 125.1 27% 21%

-------------------------------------- -------- -------- ------- --------

Adjusted

-------------------------------------- -------- -------- ------- --------

Adjusted EBITDA(1) 31.2 19.4 60% 54%

-------------------------------------- -------- -------- ------- --------

Adjusted EBITDA excluding fair value

uplift from biological assets 29.6 16.1 83% 76%

-------------------------------------- -------- -------- ------- --------

Adjusted operating profit 9.1 10.8 (15%) (23%)

-------------------------------------- -------- -------- ------- --------

Statutory

-------------------------------------- -------- -------- ------- --------

Operating loss (7.9) (5.4) (46%) (61%)

-------------------------------------- -------- -------- ------- --------

Loss before tax (23.2) (9.2) (152%) (167%)

-------------------------------------- -------- -------- ------- --------

Loss for the period (30.5) (11.6) (163%) (168%)

-------------------------------------- -------- -------- ------- --------

Basic loss per share (p) (4.60) (1.93) (138%)

-------------------------------------- -------- -------- ------- --------

Net debt(3) (73.7) (80.9) 9%

-------------------------------------- -------- -------- ------- --------

Net debt excluding lease liabilities (47.5) (56.9) 17%

-------------------------------------- -------- -------- ------- --------

** Constant exchange rate (CER) figures derived by retranslating

current year figures using previous year's foreign exchange

rates

(1) Adjusted EBITDA is EBITDA (earnings before interest, tax,

depreciation and amortisation and impairment), before exceptional

items including acquisition related expenditure.

(2) Adjusted Operating Profit is operating loss before

exceptional items including acquisition related items and

amortisation of intangible assets excluding development costs

(3) Net debt is cash and cash equivalents less loans and

borrowings

Business Area Performance - GBPm FY 2022 FY 2021 % AER % CER**

Revenue

-------- -------- ------ --------

Genetics 58.0 46.8 24% 21%

-------- -------- ------ --------

Advanced Nutrition 80.3 70.5 14% 7%

-------- -------- ------ --------

Animal Health 20.1 7.8 157% 157%

-------- -------- ------ --------

Adjusted EBITDA(1)

-------- -------- ------ --------

Genetics 16.0 11.5 39% 39%

-------- -------- ------ --------

* Net of fair value movements in biological assets 14.4 8.2 75% 76%

-------- -------- ------ --------

Advanced Nutrition 19.0 13.8 38% 29%

-------- -------- ------ --------

Animal Health 0.1 (2.7) 104% 102%

-------- -------- ------ --------

** Constant exchange rate (CER) figures derived by retranslating

current year figures using previous year's foreign exchange

rates

(1) Adjusted EBITDA is EBITDA (earnings before interest, tax,

depreciation and amortisation and impairment), before exceptional

items including acquisition related expenditure.

Operational highlights

Advanced Nutrition - excellent performance

-- Excellent performance driven by commercial focus, continued

innovation and cost discipline, supported by positive market

conditions

-- New products and product upgrades brought to market including

Artemia separation tool 'Sep-Art Automag' which delivers

sustainability benefits

-- Closure of trial facilities in Thailand as part of strategy to optimise operations

Genetics - continued growth

-- Continued growth in core salmon egg business with record sales in FY2022

-- New incubation centre in Iceland delivering increased quality

and capacity which was instrumental in satisfying peak demand in

the year

-- Commercialisation of SPR shrimp progressing, leveraging

Advanced Nutrition's market position in shrimp

Health - further commercialisation progress

-- Roll-out of Ectosan(R) Vet and CleanTreat(R) progressing with

increasing customer adoption. Solution delivered consistent

efficacy above 99%, with enhanced animal welfare and protection of

the environment

-- Marketing Authorisation for Ectosan(R) Vet and CleanTreat(R)

in Norway extended to one reuse of water

-- Marketing Authorisation obtained in the Faroe Islands

-- Ectosan(R) Vet patent grant approved giving 20 year protection

Group - ESG commitment, continued integration and delivery

against strategic priorities

-- ESG - on track to achieve our Net Zero targets with

implementation of carbon reduction plan; issue of first Green bond

validates strong ESG credentials

-- Continued Group integration by combining the commercial

efforts across our salmon products, making the business more

customer-centric and increasing efficiency

-- Excellent employee engagement results aligned to the Group's

goal of making Benchmark "A Great Place to Work"

-- Looking forward we remain focused on our four strategic pillars:

o Maintain and grow our leadership position in established

markets

o Expand our business through the launch of new products and

entry into new markets

o Continue to embed the new One Benchmark culture and to

integrate the Group to realise synergies

o Pursue add-on acquisitions within core areas, adhering to

strict criteria and making optimal use of our capital structure

Current trading and outlook - good momentum and tracking in-line

with management expectations

-- Good start to the year and positive momentum in the business

-- The diversified nature of the business and management's

proactive commercial approach creates resilience and mitigates the

potential impact from ongoing cost inflation and macroeconomic

pressures

-- Management expects that the recently announced change in tax

regime for aquaculture producers in Norway will have a marginal

direct effect on the Group's business

-- Well progressed towards dual listing on Euronext Growth Oslo

as announced this morning; intention to uplist to the Oslo Børs in

H1 calendar year 2023

-- Longer term, management believe the Group is uniquely

positioned in an industry that is structurally growing driven by

megatrends

Trond Williksen, CEO, commented:

" In FY2022 Benchmark delivered another year of growth and

strategic progress, underpinned by four quarters of consistently

improved financial results. This demonstrates the success of our

restructuring and culture change, the quality and potential of our

business and the talent and commitment of our people, as well as

the underlying strength of our markets.

"Our strategic and commercial focus have contributed to strong

results. Going into the new financial year, there is good momentum

in line with our expectations and positive dynamics in our industry

creating significant opportunities to deliver value for all our

stakeholders."

Details of analyst / investor call today

There will be a call at 9.00am UK time today for analysts and

investors. To attend the call, please register via Investor Meet

Company:

https://www.investormeetcompany.com/benchmark-holdings-plc-analyst-meeting-q4-results/register-investor

.

You can address registration questions to MHP Communications on

+44 (0)20 3128 8004, or by email on benchmark@mhpgroup.com .

Enquiries

Benchmark Holdings plc Tel: 0114 240 9939

Trond Williksen, CEO

Septima Maguire, CFO

Ivonne Cantu, Investor Relations

Numis (Broker and NOMAD) Tel: 020 7260 1000

James Black, Freddie Barnfield, Duncan Monteith

MHP Tel: 020 3128 8004

Katie Hunt, Reg Hoare, Veronica Farah benchmark@mhpgroup.com

About Benchmark

Benchmark's mission is to enable aquaculture producers to

improve their sustainability and profitability. We bring together

biology and technology, to develop innovative products which

improve yield, quality and animal health and welfare for our

customers. We do this by improving the genetic make-up, health and

nutrition of their stock - from broodstock and hatchery through to

nursery and grow out. Benchmark has a broad portfolio of products

and solutions, including salmon eggs, live feed (Artemia), diets

and probiotics and sea lice treatments. Find out more at

www.benchmarkplc.com

Chairman's Statement

A year of delivery

I am proud to report a second year of strong performance for

Benchmark, continuing a path that started in 2019 with a

substantial reorganisation of the business and the appointment of a

new management team.

In 2022 our focus was on delivering profitable growth in each of

our established core areas, on fully commercialising our recently

launched products, and on maintaining disciplined cash management

and investment. Together, this translated into a very strong

performance with significant top line growth and improved

underlying profitability. We remain committed to continuing on this

path of consistent delivery to reach sustainable profitability and

cash generation, and ultimately attractive shareholder returns.

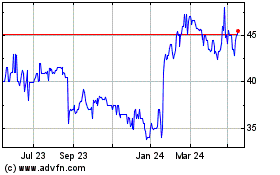

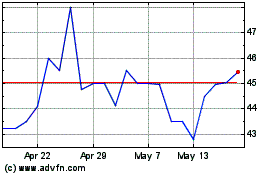

Macroeconomic and geopolitical conditions in the year materially

affected markets around the world and impacted the performance of

our shares. Smaller growth companies were particularly affected by

fund outflows and a change in investor sentiment. This is

particularly disappointing given the significant progress that the

Company made during the year. However, I am confident that we are

building fundamental value for our shareholders, which will

crystallise in the coming years.

Performance

The Group delivered excellent growth in the year with a 27%

increase in revenue and an 83% increase in Adjusted EBITDA

excluding fair value movements from biological assets. Importantly,

each of our three business areas delivered higher revenues and

Adjusted EBITDA, with growth in established areas and progress in

the commercialisation of new solutions, including Ectosan(R) Vet

and CleanTreat(R) and SPR shrimp genetics. We now have a solid,

diversified, well-balanced Group across geographies and species

which provides multiple opportunities for growth as well as

resilience to volatility in specific markets.

Adjusted EBITDA is the key profitability measure we use to track

underlying performance. In FY22 the Group delivered Adjusted EBITDA

of GBP31.2m (FY21: GBP19.4m) and an Adjusted EBITDA margin of 20%

(FY21: 16%) as a result of top line growth, increased asset

utilisation and good cost control.

There was an increase in depreciation related to our

CleanTreat(R) operations and higher net finance costs reflecting

foreign exchange volatility as well as costs associated with the

refinancing of our pre-existing NOK bond. This led to a net loss

for the year of GBP30.5m (FY21: GBP11.6m loss).

Financing

An area of focus for the Board in FY22 was to maintain a solid

financial position to support the Company's trading momentum and

growth strategy. To this end, in November 2021 the Company raised

GBP20.7m through a placing of shares with existing and new

shareholders which provided additional headroom. Later in the year,

in September 2022, in challenging macroeconomic and market

conditions, the Company successfully refinanced its NOK 850 million

bond which was due to mature in June 2023. The refinancing was

achieved through the issue of a NOK 750 million unsecured green

bond maturing in 2025 which validates our strong ESG credentials,

and places us in a solid financial position, particularly in light

of the ongoing challenging environment in the financial

markets.

Sustainability

Benchmark's mission is to drive sustainability in aquaculture.

In alignment with our mission, sustainability is front and centre

in our strategy and our operations. Our products are designed to

deliver improved yield and animal welfare, improving resource

efficiency and reducing environmental impact. In addition, we

manage our own operations responsibly with an ambitious commitment

to energy transition. In 2022, we made substantial progress towards

our Net Zero goals by developing a comprehensive emissions

reduction programme for our Thailand facility centred around the

installation of solar panels which commenced in 2022. In addition,

during the year we conducted a climate risk assessment across the

Group for the first time representing an important step towards

TCFD (Task Force on Climate-related Financial Disclosures)

compliance in 2023.

Board

On 29 November 2021, the Board appointed Atle Eide as

Non-Executive Director. Given Atle's previous role as a director of

Kverva AS, a significant shareholder in the Company, he is not

deemed an independent director. Atle has extensive experience in

the seafood industry including in his former roles as Chairman of

Salmar ASA and CEO of Mowi ASA, and as an investor, bringing value

to the Board.

Regular Board evaluation is an important element in maintaining

high standards of corporate governance and Board effectiveness. In

2022, the Board conducted an internal evaluation exercise. The

results, which were reviewed at the September 2022 Board meeting,

confirmed that the Board continues to perform effectively and with

a high degree of Director engagement.

Board meetings were held at various Group locations during the

year, enabling the Directors to interact broadly with our people,

promoting engagement and an understanding of local cultures.

Euronext Growth Listing

During the year, we communicated our intention to pursue a

listing in Oslo as the world's largest seafood-focused market. Our

decision followed extensive consultation with shareholders,

concluding that the Company would benefit from a listing in Oslo to

expand its access to a global base of specialist seafood investors

and analysts and to improve liquidity in our shares.

The Company's plan to launch a dual-listing on Euronext Growth

Oslo before the end of the calendar year is well progressed. The

dual-listing represents a first step towards a listing on the Oslo

Stock Exchange (Oslo Børs), the world's leading listed venue for

seafood and aquaculture companies. The Board intends to uplist the

Company to the Oslo Børs from Euronext Growth Oslo in the first

half of the calendar year 2023. In tandem, we intend to consult

with shareholders on whether to maintain the admission of the

Company's shares to trading on AIM. The intended dual listing on

Euronext Growth Oslo and the uplisting to the Oslo Børs are both

subject to market conditions.

In connection with its proposed admission to Euronext Growth

Oslo, Benchmark has today announced the terms of a potential

private placement and retail offering in Norway, representing in

aggregate 5% of the Company's enlarged issued share capital.

Looking ahead

While macroeconomic conditions remain challenging as we enter

2023 with high levels of cost inflation and interest rates

affecting consumer spend, Benchmark has started the year positively

and is prepared to meet the challenges of an inflationary

environment through a combination of price increases and

operational efficiencies to mitigate inflationary pressure.

Moreover, the Company enters 2023 with good momentum, and with a

clear strategy that will help deliver continued growth and progress

towards sustainable profitability and cash generation.

Longer term, Benchmark is well placed to deliver growth and

attractive shareholder returns. The Company is well invested, with

multiple, visible growth opportunities underpinned by existing

infrastructure. This, together with Benchmark's leading market

positions and the megatrends driving the aquaculture industry, give

us confidence in the future.

Our strong performance this year could not have been achieved

without the efforts of the 800+ people who make up this great

company. Their hard work, integrity and expertise have shone

through, and on behalf of the Board, I want to thank them for

everything they have done, and continue to do, for Benchmark. I

also want to thank and acknowledge our shareholders and other

stakeholders for their continued support.

Peter George

Chairman

Chief Executive Officer's Review

Sustained growth and strategic delivery

Benchmark delivered excellent growth in revenue and Adjusted

EBITDA in FY22, building on its track record of continuous

quarterly improvement since the restructuring was completed in

FY20. Revenues grew by 27% to GBP158.3m in the year, and Adjusted

EBITDA excluding fair value movements from biological assets grew

by 83% to GBP29.6m. On a constant exchange rate basis, Group

revenue and Adjusted EBITDA excluding fair value movements, were up

21% and 76%, respectively. Since the end of FY20, we have increased

revenues by 50% and Adjusted EBITDA by 115%.

Despite the strong revenue growth and the progress in our

underlying profitability, the Group reported a loss before tax of

GBP23.2m, (2021: loss of GBP9.2m). This is due to a GBP11.5m

increase in depreciation principally related to the leased vessels

used in the CleanTreat(R) operations and an increase in finance

costs due to higher interest rate charges and non-cash movements

associated with the accounting for the refinancing of our

pre-existing NOK bond. Total loss for the year was GBP30.5m (FY21:

GBP11.6m).

Trading and operational performance was strong in our three

business areas and all reported a significant increase in revenues

and Adjusted EBITDA. Advanced Nutrition continued its growth trend

with revenues up by 14%; Genetics increased revenues by 24%,

benefitting from strong demand for our salmon eggs, which we were

able to fulfil through our recent investment in a new bio-secure

incubation centre in Iceland; and Health reported 157% growth in

revenues, benefitting from the launch of its sea lice solution,

Ectosan(R) Vet and CleanTreat(R). While the commercialisation of

Ectosan(R) Vet and CleanTreat(R) is still in the initial phase, we

now have three well-performing and growing business areas with a

visible path to Group profitability and cash generation.

We maintained our ongoing financial discipline on costs,

investment and cash. Operating costs and R&D were GBP51.4m, a

14% increase from the prior year due to higher activity levels and

cost inflation. Our ongoing cost control, together with higher

asset utilisation resulted in an Adjusted EBITDA margin (excluding

fair value movement from biological assets) of 19% (FY21: 13%).

Capex during the year totalled GBP10.8m (FY21: GBP18.0m) reflecting

our new investment discipline and completion of investments to

support our main growth vectors. Our main investment was the

construction of a new incubation centre for salmon eggs in Iceland

which allows us to meet seasonal periods of peak demand. This was

particularly welcome this year when our customers experienced a

shortage of supply in our market.

By business area, Genetics reported revenues of GBP58m, 24%

above last year driven primarily by higher salmon egg sales.

Adjusted EBITDA before fair value movement in biological assets of

GBP14.4m was 75% above last year (FY21: GBP8.2m). Strategically, we

continued to build on our stronghold in salmon, covering all

production paradigms and producing regions. In addition, our focus

was on the launch of our SPR shrimp genetics in Asia and the

Americas, an important growth vector for the Group in the coming

years. Innovation is a key driver of our success in Genetics and

during the year we strengthened our team with the appointment of

Dr. Ross Houston as Director of Innovation for our Genetics

business and Chair of our Group Innovation Board.

Advanced Nutrition reported revenues of GBP80.3m, 14% ahead of

FY21 driven by increased sales in all product areas - Artemia,

Health and Diets. Adjusted EBITDA of GBP19.0m was 38% up on the

prior year (FY21: GBP13.8m). We continued to capitalise on our

enhanced commercial focus and structure and on our efforts to

improve our operations to drive efficiency and margins. This

included the closure of our trial facility in Thailand moving to

more effective solutions in partnership with external

providers.

In Health we reported revenues of GBP20.1m, (FY21: GBP7.8m) as a

result of increased Ectosan(R) Vet and CleanTreat(R) sales

following the commercial launch at the end of last year. Adjusted

EBITDA was GBP0.1m (FY21: loss GBP2.7m). The roll-out of Ectosan(R)

Vet and CleanTreat(R) is one of the Group's key strategic

priorities and we made further progress during the year, increasing

adoption of the new solution in the market. In addition, we reached

important milestones towards optimising our solution. Treatment

times were reduced, a marketing extension for a second re-use of

treatment water was obtained and we continue to work with our

customers on new configurations for our CleanTreat(R) systems

adapted to our customer's infrastructure.

Strategic delivery

Benchmark's strategy is directed at becoming the leading

aquaculture biotechnology company driving sustainability and

delivering attractive shareholder returns. Our strategy represents

a roadmap to achieve this and has three main elements:

-- maximising the opportunity in our established business

through a proactive commercial effort and continuous operational

improvement, benefitting from structural growth in the industry

-- extending our platform through additions to our product

offering and geographic expansion within our core areas

-- pursuing add-on opportunities within our core areas and

applying disciplined return parameters

At the beginning of 2022, we set out five strategic Group

priorities in areas that will drive growth and profitability for

the Group. These were the roll-out of Ectosan(R) Vet and

CleanTreat(R), the commercialisation of our shrimp genetics,

regaining leadership in Artemia within our Advanced Nutrition

business and delivering ESG and People agendas that are aligned to

our mission and that support our new performance-driven culture.

This clear strategic focus enables us to direct resources and

monitor progress. Overall, progress in all areas was positive in

2022.

As mentioned above we made important strategic progress in the

roll-out of our Ectosan(R) Vet and CleanTreat(R) solution.

Our SPR shrimp in Genetics was commercially launched in the year

with growing sales albeit from a small initial base. Our leading

position in the shrimp market through our Advanced Nutrition

business creates an important synergy facilitating market

entry.

In Advanced Nutrition, our priority for FY22 was to regain a

leadership position in the global Artemia market following a period

of oversupply which resulted in lower prices in the market

affecting our premium positioning. Through a renewed commercial

effort brought about by a management change in the business, we

have successfully recovered our position and gained momentum for

the future.

Looking forward to 2023, our Group priorities represent a

continuation of our current effort including the roll-out of

Ectosan(R) Vet and CleanTreat(R) and maintaining our leadership

position in Advanced Nutrition across our three product areas. In

Genetics, our focus will be on becoming the supplier of choice for

salmon eggs across all markets while continuing our work to

commercialise our shrimp genetics.

'One Benchmark' culture

One of our key focus areas over the last two years has been to

create a stronger, more aligned group to drive commercial

performance and realise synergies and efficiencies. The primary

engine of this culture change is a strategic priority framework

working alongside a performance management framework with our

values to guide our behaviour.

This unified culture has allowed us to drive further integration

by combining functions and establishing cross-group initiatives

which are delivering results. An example of this is the combination

of the marketing and commercial functions around species allowing

us to become more customer-centric.

Looking forward

We have had a good start to the year and there is good momentum

in the business. Cost inflation and other macroeconomic pressures

will continue to be a feature across the world in 2023 and we are

not immune. However, we have a well diversified, balanced business

which creates resilience to challenges in individual markets as

well as opportunities. In addition, we will continue to proactively

mitigate potential pressure on our business and our margins through

pricing, supplier management and operational improvements. The

recently announced change in the tax regime for aquaculture

producers in Norway is expected to have a marginal direct effect on

our business.

Looking further into the future, Benchmark is uniquely

positioned in an industry that is structurally growing and driven

by multiple megatrends. This creates significant opportunity for

growth and increasing returns for shareholders in the near and

medium term and for many years to come.

Trond Williksen

Chief Executive Officer

Financial Review

Strong and positive performance in the year

FY22 has been a year where our focus on commercial execution has

paid off. With all three business areas now commercially focused,

we have delivered growth across the board and have been able to

consistently deliver progress on our strategic objectives. We have

been able to leverage off the investments made in FY21 to meet

demand in the market within our Genetics business area. We have

continued to generate sales growth above market growth , albeit

aided by forex tailwinds from a strong US dollar in Advanced

Nutrition, and have had a full year of Ectosan(R)Vet and

CleanTreat(R) sales moving Health from being a development business

area to a commercial one.

Overview of reported financial results

During 2022, the Group's focus was on continuing to deliver a

strong commercial result and advancing its strategic

priorities.

Advanced Nutrition continued a track record of strong commercial

focus in 2022. Genetics also experienced strong sales in the year

and with a full year of Ectosan(R) Vet and CleanTreat(R) sales in

Health this resulted in an increase in Group revenue of 27% to

GBP158.3m in the year (2021: GBP125.1m). This increase in sales

meant that Gross Profit increased to GBP83.1m (2021: GBP65.6m).

Gross Margin was flat at 52% (2021: 52%). Using the same foreign

exchange rates experienced in 2021 (constant currency(5) ) revenue

increased by 21%.

As Reported (GBPm unless otherwise % CER

stated) 2022 2021 % AER **

Revenue 158.3 125.1 27% 21%

====== ====== ====== ======

Operating loss (7.9) (5.4) (46%) (61%)

====== ====== ====== ======

Loss before tax (23.2) (9.2) (152%) (167%)

====== ====== ====== ======

Loss for the period (30.5) (11.6) (163%) (168%)

====== ====== ====== ======

Basic loss per share (p) (4.60) (1.93) (138%) -

====== ====== ====== ======

** Constant exchange rate (CER) figures derived by retranslating

current year figures using previous year's foreign exchange

rates

Adjusted Measures (GBPm unless otherwise % CER

stated) 2022 2021 % AER **

Gross profit 83.1 65.6 27% 22%

====== ====== ===== =====

Gross profit % 52% 52% - -

====== ====== ===== =====

Adjusted EBITDA(1) 31.2 19.4 60% 54%

====== ====== ===== =====

Adjusted EBITDA(1) margin % 20% 16% - -

====== ====== ===== =====

Adjusted Operating Profit(2) 9.1 10.8 (15%) (23%)

====== ====== ===== =====

Net debt(3) (73.7) (80.9) 9% -

====== ====== ===== =====

** Constant exchange rate (CER) figures derived by retranslating

current year figures using previous year's foreign exchange

rates

(1) Adjusted EBITDA is EBITDA (earnings before interest, tax,

depreciation and amortisation and impairment), before exceptional

items including acquisition related expenditure.

(2) Adjusted Operating Profit is operating loss before

exceptional items including acquisition related items and

amortisation of intangible assets excluding development costs

(3) Net debt is cash and cash equivalents less loans and

borrowings

Business area performance

We continued to manage costs across the Group very closely.

Operating costs increased by 17% to GBP44.7m (2021: GBP38.2m) due

to the investment in new growth areas, mainly the ramp-up of

activities for the launch of Ectosan(R)Vet and CleanTreat(R) and

increased activity post the pandemic. Expensed R&D decreased by

5% to GBP6.7m (2021: GBP7.0m).

Adjusted EBITDA increased by 60% to GBP31.2m (2021: GBP19.4m)

driven by increased sales in Advanced Nutrition, a strong finish to

the year in Genetics and a full year of commercial activities in

Health for Ectosan(R)Vet and CleanTreat(R) as well as ongoing cost

control.

Adjusted measures

We continue to use adjusted results as our primary measures of

financial performance. We believe that these adjusted measures

enable a better evaluation of our underlying performance. This is

how the Board monitors the progress of the Group.

We use growth at constant exchange rate metrics when considering

our performance, whereby currency balances are retranslated at the

same exchange rate in use for the prior year to illustrate growth

on a currency like for like basis.

In line with many of our peers in the sector, we highlight

expensed R&D on the face of the income statement separate from

operating expenses. Furthermore, we report earnings before

interest, tax, depreciation and amortisation ("EBITDA") and EBITDA

before including exceptional and acquisition- related items

("Adjusted EBITDA"). The activities of the Group's equity accounted

investees are closely aligned with the Group's principal

activities, as these arrangements were set up to exploit

opportunities from the Intellectual Property ("IP") held within the

Group. As a result, to ensure that adjusted performance measures

are more meaningful, the Group's share of the results of these

entities is included within Adjusted EBITDA. We also report this

adjusted measure after depreciation and amortisation of capitalised

development costs ("Adjusted Operating Profit") as the Board

considers this reflects the result after taking account of the

utilisation of the recently expanded production capacity. In

addition, in line with the Salmon industry, we also report AEBITDA

excluding fair value uplift under IAS 41. Available liquidity,

being cash and undrawn facilities, is an important metric for

management of the business as it gives a measure of the available

liquid funds and is also a key financial covenant in the Group's

main debt facilities.

Genetics

Genetics delivered good growth in revenue driven by sales of

salmon eggs where volumes increased by 20% to 291 million eggs.

Revenues of GBP58.0m were up 24% (2021: GBP46.8m), +21% in constant

currency.

Demand for eggs in Norway increased by 23% during the year,

which we were able to supply due to the increased capacity in our

new incubation house in Iceland. We also saw increased demand from

all other territories in the year. This resulted an increase in

revenue from salmon eggs of 24% to GBP38.3m (2021: GBP30.9m).

In non-product based revenue streams, Genetics Services

continued to deliver in the year reflecting the strength and depth

of expertise of our Genetics team and our IP in the business,

contributing GBP1.3m (2021: GBP1.3m). Revenues from harvested fish

were aided by increased salmon prices producing harvest income in

the year of GBP8.5m (2021: GBP6.2m). Royalties earned from use of

our genetic IP fell in the year, with sales down to GBP0.8m (2021:

GBP1.0m) as the expected unwind of contracts continues for the next

year. Revenues from other products totalled GBP9.1m (2021:

GBP7.4m).

Gross profit increased by 24% in 2022 to GBP32.0m (2021:

GBP25.9m) and gross margin remained unchanged at 55%. Increased

gross profit from the core salmon business was offset by losses in

the newly launched SPR shrimp and tilapia, and the non-cash fair

value increase in biological assets fell by 52% in 2022 to GBP1.6m

(2021: GBP3.3m).

Shrimp and tilapia, both of which are areas of investment,

delivered combined Adjusted EBITDA losses in the period of GBP3.1m

(2021: GBP1.4m). The shrimp loss of GBP1.7m (2021: GBP0.9m)

followed the ceasing of capitalising costs after the commercial

launch of SPR shrimp in the year. We capitalised costs of GBP1.0m

in 2022 related to development of the shrimp nucleus before it

launched commercially. The loss in Tilapia was driven by the

capacity expansion being delayed due to COVID and a one-off GBP0.4m

loss related to a provision for committed running costs, over and

above the lease obligations, on a production site which is no

longer used.

R&D spend was lower and operating costs were higher than

2021 by GBP0.6m and GBP2.2m respectively as the business grew.

R&D reduced due to good cost optimisation in this area. R&D

activities in this business area are focused on developing the

traits of growth, disease resistance and sea lice resistance by

selecting the best performing animals from each generation

supported by cutting edge genetic technologies. The search for

markers for new traits that can be included in the breeding

programme continues.

The share of profits/losses from the equity accounted investees

relates primarily to the joint venture with Salmar Genetics AS

which delivered a share of loss of GBP0.5m (2021: loss of GBP0.6m).

In both 2022 and 2021, the joint venture suffered a biological

event which drove the losses.

Genetics has continued to establish its facility in Chile and

with overall AEBITDA losses of GBP3.4m and GBP0.6m invested in

capex in this new facility in 2022 (2021: GBP2.6m and 1.3m). The

facility has potential production capacity of 50 million eggs and

is currently utilising capacity of around 30 million eggs. During

the year we sold 4 million eggs.

All these factors contributed to increased AEBITDA of GBP16.0m

(2021: GBP11.5m) and AEBITDA margin of 28% (2021: 25%). AEBITDA

excluding fair value increased by 75% to GBP14.4m, an AEBITDA

margin of 25% (2021: 17%).

Advanced Nutrition

Throughout 2022, Advanced Nutrition delivered a strong

performance driven by continued commercial focus. As a result,

revenues in Advanced Nutrition increased by 14% in the year (7% at

CER). This is notable as some key markets continued to be impacted

by COVID-19 and the business faced significant logistical

challenges as a result of the pandemic. The strong commercial focus

has allowed us to continue to strengthen our position and take

increased market share.

In 2022, 73% of our revenues derived from shrimp with the

balance 27% of derived from the Mediterranean sea bass and sea

bream sector.

By product area, we drove growth in all product areas. Artemia

grew revenues by 7% (at CER) to GBP37.1m, followed by diets up 7%

(at CER) to GBP35.1m. Health which covers our probiotic and

environmental pond management portfolio grew revenues by 6% (at

CER) to GBP8.1m.

The increase in sales of GBP9.8m resulted in an increase in

gross profit of GBP6.6m and drove the gross margin up from 51% to

53%. This increase in margin was offset in part by an increase in

operating costs as we grew the business, but there continued to be

good cost control throughout this year. This led to Advanced

Nutrition reporting AEBITDA of GBP19.0m (2021: GBP13.8m) and an

increase in AEBITDA margin from 20% to 24%.

Within this business area, an important barrier to entry is the

access to GSL Artemia where we, through our relationship with the

Great Salt Lakes Cooperative have access to 44% of the annual

harvest of Artemia from the Great Salt Lakes. Whilst the harvest

can vary from year to year and we saw very high harvest levels in

19/20, the last two harvests were lower; the 20/21 harvest was

1,168 metric tonnes and the 21/22 harvest was 1,104 metric tonnes

which are considered normal harvest levels.

Health

Health reported revenue of GBP20.1m (2021: GBP7.8m) reflecting

the first full year of sales of Ectosan(R)Vet and CleanTreat(R) of

GBP14.8m of which GBP2.5m relates to revenue for vessel-related

costs and a marginal increase in sales of our existing sea lice

treatment, Salmosan(R) Vet of GBP5.4m (2021: GBP5.1m).

Gross profit increased by GBP4.9m to GBP8.6m, a margin of 43%,

with the launch of Ectosan(R)Vet and CleanTreat(R) combined with

increased margins from Salmosan(R) Vet.

During the year, the focus of this business area was to launch

Ectosan(R)Vet and CleanTreat(R) in Norway. The first vessel

launched in August 2021, with the second vessel launching in

December 2021. These activities drove an increase in operating

costs to GBP8.1m (2021: GBP6.2m) Adjusted EBITDA for the business

area was GBP0.1m (2021: GBP2.7m).

Cost Inflation

As noted earlier, cost control remains of significant importance

in Benchmark and in the current cost environment becomes even more

so. During the year, we focussed on a number of areas to mitigate

cost inflation. In Nutrition, the Operations team focused on

ensuring lean production and with better volumes, getting better

cost per units through to support margin. The procurement team were

consistently challenged to maintain or get better pricing for raw

materials. From an energy perspective, we have access to lower cost

energy in both Norway and Iceland where we have Genetics production

facilities and we have also commenced the plan to put solar panels

on our facility in Thailand. Whilst we are not immune from

inflation, we as a business seek to use multiple ways to mitigate

this as we move forward.

Exceptional items

Items that are material because of their nature whose

significance is sufficient to warrant separate disclosure and

identification within the consolidated financial statements are

referred to as exceptional items. The separate reporting of

exceptional items helps to provide an understanding of the Group's

underlying performance.

Exceptional expenses were fully offset by exceptional credits in

the year. Exceptional expenses related to legal and professional

costs in relation to the proposed dual listing on the Oslo exchange

of GBP0.8m, and restructuring costs of GBP0.4m including those

relating to a legal dispute within a divested business, and costs

relating to the closure of the Thai research centre in Advanced

Nutrition. These costs were offset by a credit of GBP1.2m relating

to additional contingent consideration received in the period

following the disposal of Aquaculture UK on 7 February 2020 and

Improve International on 23 June 2020.

Depreciation, amortisation and impairments

Depreciation and impairment of tangible assets was GBP19.9m

(2021: GBP8.4m), with depreciation charge of GBP19.9m (2021:

GBP8.5m) and impairment reversal of GBPnil (2021: GBP0.1m). The

depreciation charge in the year increased due to the launch of

CleanTreat(R) where the vessels are right-of-use assets held under

lease agreements. In total, depreciation and impairment charges on

leased assets under IFRS 16 was GBP11.3m (2021: GBP3.3m).

Amortisation and impairments of intangible assets totalled

GBP19.2m (2021: GBP16.3m). The amortisation charge includes GBP2.2m

(2021: GBP0.3m) relating to capitalised development following

commercialisation of Ectosan(R)Vet and CleanTreat(R) and SPR

shrimp.

Research and development

Expenses Total expensed and capitalised

As % As % As %

of of of As %

GBPm 2022 sales 2021 sales 2022 sales 2021 of sales

---- ------ ---- ------ ------ -------- ----- -----------

Expensed R&D by business

area

==== ====== ==== ====== ====== ======== ===== ===========

Genetics 4.3 7% 4.9 10% 5.3 9% 6.8 15%

==== ====== ==== ====== ====== ======== ===== ===========

Advanced Nutrition 2.0 2% 1.9 3% 2.1 3% 2.2 3%

==== ====== ==== ====== ====== ======== ===== ===========

Health 0.4 2% 0.2 3% 1.0 5% 2.9 36%

==== ====== ==== ====== ====== ======== ===== ===========

Total research and development 6.7 4% 7.0 6% 8.4 5% 11.8 9%

==== ====== ==== ====== ====== ======== ===== ===========

Expensed R&D activities decreased in the year by GBP0.3m

with Genetics having good cost optimisation in this area while

continuing to focus on improvements in the breeding nucleus. Health

spending remained low due to their significantly reduced R&D

programmes. Genetics' research is focused around continually

developing new disease and parasitic resistant traits as well as

growth traits which we can breed into our products. Advanced

Nutrition's focus is on expanding our product portfolio and driving

growth through product improvements.

Other operating costs

As % As %

of of

GBPm 2022 sales 2021 sales

Operating Expenses by Business Area

==== ====== ==== ======

Genetics 11.1 19% 8.9 19%

==== ====== ==== ======

Advanced Nutrition 21.5 27% 19.9 28%

==== ====== ==== ======

Health 8.1 41% 6.2 79%

==== ====== ==== ======

Corporate (net) 4.0 3.2

==== ====== ==== ======

Total operating expenses 44.7 28% 38.2 31%

==== ====== ==== ======

Other operating costs increased from GBP38.2m in 2021 to

GBP44.7m in 2022. The increase in costs include increased costs in

Health as we had a full year of commercial launch of Ectosan(R)Vet

and CleanTreat(R) and higher costs as we commercially launched

Chile and SPR shrimp and continued to grow in Nutrition.

Net finance costs

Analysis

GBPm 2022 2021

----- -----

Net Finance expenses

===== =====

Interest Income (0.3) (0.1)

===== =====

Foreign Exchange losses/(gains) (2.8) (2.8)

===== =====

Interest on bond and bank debt 6.2 6.0

===== =====

Amortisation of deferred financing fees 1.9 1.0

===== =====

Penalty for early settlement of the bond 1.6 -

===== =====

Movements of cash flow hedges 7.0 (1.4)

===== =====

Finance lease interest 1.7 1.1

===== =====

Total net finance expenses 15.3 3.8

===== =====

The Group incurred net finance costs of GBP15.3m during the year

(2021: GBP3.8m). Included within this was interest charged on the

Group's interest-bearing debt facilities of GBP9.7m (2021: GBP6.9m)

of which GBP1.6m related to the early redemption penalty for the

settlement of the NOK bond and with a further GBP1.9m of this being

amortisation of the deferred finance costs (2021: GBP1.0m). Net

foreign exchange gains of GBP2.8m (2021: net gain of GBP2.8m) arose

due to the movement in exchange rates on intercompany loans and

external debt. Movements on the cash flow hedges associated with

the Groups NOK bond debt resulted in charges of GBP7.0m (2021: gain

of GBP1.4m).

Statutory loss before tax

The loss before tax for the year at GBP23.2m is higher than the

prior year (2021: loss of GBP9.2m). This was a result of the

positive trading result offset by the increased depreciation on

right-of-use assets and amortisation of intangibles following the

launch of Ectosan(R) Vet/CleanTreat(R) and SPR shrimp, as well as

higher net finance costs as discussed above.

Taxation

There was a tax charge on the loss for the year of GBP7.3m

(2021: GBP2.4m), mainly due to overseas tax charges in Genetics and

Advanced Nutrition in territories where no loss relief is

available, partially offset by deferred tax credits on intangible

assets mainly arising on consolidation from acquisitions.

Other Comprehensive Income

In addition to the loss for the year of GBP30.5m, a significant

item to be reclassified to the income statement related to foreign

exchange translation differences. The gain on this account was

GBP47.2m. This gain was driven by a strong USD impacting two main

items, firstly the retranslation of the foreign currency

denominated subsidiary balance sheets in GBP at the year end of

GBP36.3m and the foreign exchange of GBP10.9m associated with items

which are designated as net investment hedges or internal loans

which are deemed to be equity and as such the exchange associated

with these goes directly to other comprehensive Income.

Reported loss for the year

The loss for the year was GBP30.5m (2021: loss of GBP11.6m).

Earnings per share

Basic loss and diluted loss per share were both 4.60p (2021:

loss per share 1.93p). The movement year on year is due to the

movement in the result as well as the increase in the weighted

average number of shares in issue of 28m.

Dividends

No dividends have been paid or proposed in either 2022 or 2021

and the Board is not recommending a final dividend in respect of

the year ended 30 September 2022.

Biological assets

A feature of the Group's net assets is its investment in

biological assets, which under IAS 41 are stated at fair value. At

30 September 2022, the carrying value of biological assets was

GBP46.7m (2021: GBP38.4m). This increase is due principally to the

increase in the biomass of broodstock as we continue to expand

production at Salten and Chile and increased eggs available for

sale in FY23. The fair value uplift on biological assets included

in cost of goods for the year was GBP1.6m (2021: GBP3.3m).

Intangibles

Additions to intangibles were GBP1.9m (2021: GBP5.0m) with the

main area of investment being capitalised development costs which

in the year decreased by GBP3.1m to GBP1.7m (2021: GBP4.8m).

R&D costs related to products that are close to commercial

launch have to be capitalised when they meet the requirements set

out under IAS 38. In this financial year, the main development

projects capitalised were as follows:

-- Ectosan(R)Vet/CleanTreat(R) (GBP0.6m)

-- SPR shrimp (GBP1.0m)

-- Patents for genetics (GBP0.2m)

-- Live food alternative diets (GBP0.1m)

Capital expenditure

During 2021, we invested in a number of growth initiatives and

in 2022 there remained some spend to complete them. The Group

incurred tangible fixed asset additions of GBP10.8m (2021:

GBP18.0m) broken down as follows:

-- Health: GBP2.6m

-- Genetics: GBP5.6m

-- Nutrition: GBP2.6m

Within Health, there was an investment in a third CleanTreat(R)

unit and finalising the mobilisation of the second vessel on which

the second CleanTreat(R) units are situated. During the year, this

third CleanTreat(R) unit was reclassified to inventory as it is

intended to be used in the new business model whereby the units are

sold to customers rather than owned by us. Capex associated with

our Genetics business was GBP5.6m where we finished the new

incubation house for our Icelandic facility (GBP2.3m) and commenced

building new tanks at Salten to support ramping up to the 150

million egg capacity at that facility which will continue in FY23

(GBP1.2m) and we continue to invest in our other growth initiatives

SPR Shrimp and Tilapia in the US. In Nutrition we continued to

invest in the two manufacturing facilities to support continued

growth.

Cash flow, liquidity and net debt

Movement in net debt GBPm

Net debt at 30 September 2021 (80.9)

======

Cash generated from operations excluding working capital and

taxes paid 30.3

======

Movement in working capital (12.0)

------------------------------------------------------------- ======

Capital expenditure (12.7)

======

Other investing activities (0.2)

======

Foreign exchange on cash and debt 10.5

======

Interest and tax (17.0)

======

Proceeds from previous year disposals of subsidiaries 1.5

======

New leases (IFRS 16) (11.5)

======

Shares issued 20.2

======

Other non-cash movements (1.9)

======

Net debt at 30 September 2022 (73.7)

======

Cash flow

With improved trading in all business areas, we saw strong cash

generated from operations of GBP30.3m (2021: GBP22m). This also

drove higher working capital levels and taxes, leading to net cash

flows generated from operating activities of GBP10.8m (2021:

GBP5.8m). Capital expenditure, both intangible and tangible, showed

a significant decrease of GBP10.0m to GBP12.7m (2021: GBP22.7m) as

we worked to moderate our capex and finished off the investment in

some of the growth initiatives, primarily the incubation house in

Iceland.

Working capital

Working capital has grown in the period driven by a number of

factors. As the dollar strengthened, we can see the impact on the

balance sheet as noted above in the other comprehensive income

section and this increased the working capital balances at 30

September 2022, but working capital did grow during FY2022.

We noted earlier the increase in biological assets within the

genetics areas. Other Inventories grew in Nutrition as we had more

GSL Artemia in inventory than previous years to ensure it was

available in all locations.

In Health, we had transferred the CleanTreat(R) equipment into

Inventory resulting in Health inventory increasing by GBP3.4m.

Trade Debtors and creditors, of course, increased as a result of

increased sales but trade debtors only increased slightly as a % of

sales from 19% to 20% in the year. Similarly, trade payables were

only slightly higher than last year.

A significant amount of cash is tied up with the working capital

of the group and focus continued to be on releasing that investment

in the years to come.

Refinancing and borrowing facilities

The Group had a NOK 850m senior secured floating rate listed

bond which was due to mature in June 2023 with a coupon of 5.25%

above three months Norwegian Interbank Offered Rate ("NIBOR"). The

Group also has a USD 15m revolving credit facility ("RCF") which

was due to mature in December 2022 and had GBP4m drawn at 30

September 2022. The interest rate on the facility is between 3% and

3.5% above LIBOR depending on leverage.

The Company successfully completed a new senior unsecured green

bond issue of NOK 750 million, with an expected maturity date of 27

September 2025. The bond has a coupon of three months NIBOR* + 6.5%

p.a. with quarterly interest payments.

There are other borrowing facilities held within Benchmark

Genetics Salten AS which were put in place to fund the building of

the Salten salmon eggs facility totalling NOK 227.5m (GBP18.8m)

(2021: NOK 246m (GBP20.9m)), which are ringfenced without recourse

to the other parts of the Group. Interest on these other debt

facilities ranges between 2.65% and 5% above Norwegian base rates.

In addition, a working capital facility of NOK 20.0m (renewal

annual in March) and an overdraft of NOK 17.5m (maturity December

2022) were in place for use solely by Benchmark Genetics Salten AS.

These facilities are undrawn (2021: undrawn).

Subsequent Events

Subsequent to the year end, on 21 November 2022, the company

successfully refinanced the RCF facility with a new facility of

GBP20m. The interest rate on the new RCF was between 2.5% and 3.25%

with a maturity of June 2025. In addition, the term loan facility

outstanding balance and the overdraft facility provided by Nordea

were refinanced into one facility on 1 November 2022 totalling

NOK179.5m with a maturity date of January 2028. The margin on the

new facility is 2.5%.

Cash and total debt

GBPm

Net debt 2022 2021

------ ------

Cash 36.4 39.5

====== ======

NOK 750m bond (2021: NOK 850m) (61.1) (75.5)

====== ======

Other borrowings (22.8) (20.9)

====== ======

Lease liabilities (26.2) (24.0)

====== ======

Net debt (73.7) (80.9)

====== ======

The RCF facility combined with the year-end cash balance of

GBP36.4m (2021: GBP39.5m) means the Group had total liquidity of

GBP45.8m (2021: GBP50.6m). This, while utilising tight cost and

cash control, is expected by the Directors to provide the Group

with sufficient liquidity to fund the investment and working

capital to crystalise the growth opportunities which are part of

the strategic priorities of the Group and provide adequate

headroom.

Equity raise

In November 2021, GBP20m net proceeds were raised through a

placing to provide the Company with additional headroom to maintain

this momentum and to continue to fund its ongoing growth

initiatives.

Oslo listing

During FY2021, the Board commenced a review of our capital

structure in the context of the approaching maturity of the main

facilities as noted above and with regard to funding in the short

term for investment opportunities to accelerate business area

growth. As a result the company continues to progress towards a

listing on Euronext Growth Oslo by the end of calendar year 2022.

As previously announced the Company intends to uplist to the Oslo

Børs, the leading seafood and aquaculture market globally, in H1 of

calendar year 2023. The timing of both the listing on Euronext

Growth Oslo and intended uplist to the Oslo Børs is subject to

market conditions.

Covenants

Banking covenants for the NOK bond and RCF exist in relation to

liquidity and an 'equity ratio'. Liquidity, defined as 'freely

available and unrestricted cash and cash equivalents, including any

undrawn amounts under the RCF', must always exceed the minimum

liquidity value, set at GBP10m. Available liquidity at 30 September

2022 is GBP45.8m (2021: GBP50.6m). The equity ratio, defined as

'the ratio of Book Equity to Total Assets' must always exceed 40%.

The equity ratio at 30 September 2022 was 61% (2021: 58%). In

addition, an equity to asset ratio covenant exists for the

Benchmark Genetics Salten AS debt with a target threshold of 40%,

this equity to asset ratio was 51.3% at 30 September 2022 (2021:

46.2%).

Going concern

As at 30 September 2022 the Group had net assets of GBP323.3m

(2021: GBP279.6m), including cash of GBP36.4m (2021: GBP39.5m) as

set out in the Consolidated Balance Sheet. The Group made a loss

for the year of GBP30.5m (2021: GBP11.6m). As at 30 September 2022

the Company had net assets of GBP346.6m (2021: GBP336.2m),

including cash of GBP3.2m (2021: GBP9.0m) as set out on the Company

Balance Sheet. The Company made a loss for the year of GBP16.5m

(2021: GBP3.9m).

As noted in the Strategic Report, we have seen a year of strong

performance following an extended period impacted by COVID-19, with

improvements throughout the year in all of our three business

areas. The Directors have reviewed forecasts and cash flow

projections for a period of at least 12 months including downside

sensitivity assumptions in relation to trading performance across

the Group to assess the impact on the Group's trading and cash flow

forecasts and on the forecast compliance with the covenants

included within the Group's financing arrangements.

In the downside analysis performed, the Directors considered

severe but plausible scenarios on the Group's trading and cash flow

forecasts, firstly in relation to continued roll out of the

Ectosan(R)Vet and CleanTreat offering. Sensitivities considered

included modelling slower ramp up of the commercialisation of

Ectosan(R) Vet and CleanTreat(R) through delayed roll-out of the

revised operating model for the service, together with reductions

in expected biomass treated and reduced treatment prices. Key

downside sensitivities modelled in other areas included assumptions

on slower commercialisation of SPR shrimp, slower salmon egg sales

growth both in Chile and to land-based farms in Genetics, along

with sensitivities on sales price increases and potential supply

constraints on CIS artemia in Advanced Nutrition. Mitigating

measures within the control of management have been identified

should they be required in response to these sensitivities,

including reductions in areas of discretionary spend, deferral of

capital projects and temporary hold on R&D for non-imminent

products.

The year ended with the successful refinancing of its NOK 850

million bond which was due to mature in June 2023 with the issue of

a NOK 750 million unsecured green bond maturing in 2025. This was

achieved against a backdrop of challenging macroeconomic and market

conditions and places the Group in a much stronger position in

light of the ongoing market environment. Additionally, following

the year end, the USD15m RCF was refinanced by a new GBP20m RCF on

21 November 2022 with a June 2025 maturity. Furthermore, our NOK

216m loan facility (which had NOK 165.6m outstanding at the year

end) which was set to mature in October 2023 was combined with our

NOK 17.5m overdraft facility into a new loan facility of NOK 179.5m

on 1 November 2022, with a new maturity date in a further 5 years

no later than 15 January 2028. Following all of these refinancing

transactions, the Directors are satisfied there are sufficient

facilities in place during the assessment period.

The global economic environment has recently experienced

turbulence largely as a result of the conflict in Eastern Europe

with supply issues in a number of industries impacted and inflation

at high levels. Against this backdrop, the Group shows resilience

against these pressures in its forecasts, with financial

instruments in place to fix interest rates and with opportunities

available to mitigate globally high inflation rates, such that even

under all of the above scenario analysis, the Group has sufficient

liquidity and resources throughout the period under review whilst

still maintaining adequate headroom against the borrowing

covenants. The Directors therefore remain confident that the Group

has adequate resources to continue to meet its liabilities as and

when they fall due within the period of 12 months from the date of

approval of these financial statements. Based on their assessment,

the Directors believe it remains appropriate to prepare the

financial statements on a going concern basis.

Consolidated Income Statement

for the year ended 30 September 2022

Notes 2022 2021

GBP000 GBP000

================================================ ===== ================== ==================

Revenue 158,277 125,062

Cost of sales (75,149) (59,477)

================================================ ===== ================== ==================

Gross profit 83,128 65,585

Research and development costs (6,691) (7,010)

Other operating costs (44,661) (38,221)

Share of loss of equity-accounted investees,

net of tax (595) (905)

================================================ ===== ================== ==================

Adjusted EBITDA(2) 31,181 19,449

Exceptional - restructuring/acquisition-related

items 4 16 (184)

================================================ ===== ================== ==================

EBITDA(1) 31,197 19,265

Depreciation and impairment (19,897) (8,359)

Amortisation and impairment (19,161) (16,283)

================================================ ===== ================== ==================

Operating loss (7,861) (5,377)

Finance cost 3 (20,057) (7,987)

Finance income 3 4,741 4,185

================================================ ===== ================== ==================

Loss before taxation (23,177) (9,179)

Tax on loss (7,274) (2,397)

================================================ ===== ================== ==================

Loss for the year (30,451) (11,576)

================================================ ===== ================== ==================

(Loss)/profit for the year attributable

to:

- Owners of the parent (32,087) (12,891)

- Non-controlling interest 1,636 1,315

================================================ ===== ================== ==================

(30,451) (11,576)

================================================ ===== ================== ==================

Earnings per share

Basic loss per share (pence) 5 (4.60) (1.93)

Diluted loss per share (pence) 5 (4.60) (1.93)

================================================ ===== ================== ==================

1 EBITDA - earnings before interest, tax, depreciation, amortisation and impairment.

2 Adjusted EBITDA - EBITDA before exceptional and acquisition-related items.

Consolidated Statement of Comprehensive Income

for the year ended 30 September 2022

2022 2021

GBP000 GBP000

====================================================== ================== ==================

Loss for the year (30,451) (11,576)

Other comprehensive income

Items that are or may be reclassified subsequently to

profit or loss

Foreign exchange translation differences 47,606 (9,929)

Cash flow hedges - changes in fair value 2,627 3,054

Cash flow hedges - reclassified to profit or loss 2,546 709

====================================================== ================== ==================

Total comprehensive income for the year 22,328 (17,742)

====================================================== ================== ==================

Total comprehensive income for the year attributable

to:

- Owners of the parent 20,326 (19,329)

- Non-controlling interest 2,002 1,587

====================================================== ================== ==================

22,328 (17,742)

====================================================== ================== ==================

Consolidated Balance Sheet

as at 30 September 2022

Notes 2022 2021

GBP000 GBP000

============================================ ===== ================== ==================

Assets

Property, plant and equipment 6 81,900 78,780

Right-of-use assets 7 27,034 25,531

Intangible assets 8 245,264 229,040

Equity-accounted investees 3,113 3,354

Other investments 15 15

Biological and agricultural assets 10 20,878 21,244

============================================ ===== ================== ==================

Non-current assets 378,204 357,964

============================================ ===== ================== ==================

Inventories 29,813 20,947

Biological and agricultural assets 10 25,780 17,121

Trade and other receivables 11 56,377 46,498

Cash and cash equivalents 36,399 39,460

============================================ ===== ================== ==================

Current assets 148,369 124,026

============================================ ===== ================== ==================

Total assets 526,573 481,990

============================================ ===== ================== ==================

Liabilities

Trade and other payables 12 (44,324) (46,668)

Loans and borrowings 13 (17,091) (10,654)

Corporation tax liability (10,211) (5,634)

Provisions (1,631) (563)

============================================ ===== ================== ==================

Current liabilities (73,257) (63,519)

============================================ ===== ================== ==================

Loans and borrowings 13 (93,045) (109,737)

Other payables 12 (8,996) (911)

Deferred tax (27,990) (28,224)

============================================ ===== ================== ==================

Non-current liabilities (130,031) (138,872)

============================================ ===== ================== ==================

Total liabilities (203,288) (202,391)

============================================ ===== ================== ==================

Net assets 323,285 279,599

============================================ ===== ================== ==================

Issued capital and reserves attributable

to owners of the parent

Share capital 704 670

Additional paid-in capital 420,824 400,682

Capital redemption reserve 5 5

Retained earnings (185,136) (154,231)

Hedging reserve (703) (5,876)

Foreign exchange reserve 77,705 30,465

============================================ ===== ================== ==================

Equity attributable to owners of the parent 313,399 271,715

Non-controlling interest 9,886 7,884

============================================ ===== ================== ==================

Total equity and reserves 323,285 279,599

============================================ ===== ================== ==================

The financial statements were approved and authorised for issue

by the Board of Directors on 30 November 2022 and were signed on

its behalf by:

Septima Maguire

Chief Financial Officer

Company number: 04115910

Consolidated Statement of Changes in Equity

for the year ended 30 September 2022

Total

Additional attributable

paid-in to equity

Share share Other Hedging Retained holders Non-controlling Total

capital capital* reserves reserve earnings of parent interest equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

====================== ======== ========== ========= ======== ========= ============= =============== ========

As at 1 October 2020 668 399,601 40,683 (9,651) (142,170) 289,131 6,309 295,440

====================== ======== ========== ========= ======== ========= ============= =============== ========

Comprehensive income

for the year

(Loss)/profit for the

year - - - - (12,891) (12,891) 1,315 (11,576)

Other comprehensive

income - - (10,213) 3,775 - (6,438) 272 (6,166)

====================== ======== ========== ========= ======== ========= ============= =============== ========

Total comprehensive

income for the year - - (10,213) 3,775 (12,891) (19,329) 1,587 (17,742)

====================== ======== ========== ========= ======== ========= ============= =============== ========

Contributions by and

distributions to

owners

Share issue 2 1,081 - - - 1,083 - 1,083

Share-based payment - - - - 830 830 - 830

====================== ======== ========== ========= ======== ========= ============= =============== ========

Total contributions

by and distributions

to owners 2 1,081 - - 830 1,913 - 1,913

====================== ======== ========== ========= ======== ========= ============= =============== ========

Changes in ownership

====================== ======== ========== ========= ======== ========= ============= =============== ========

Acquisition of NCI - - - - - - (12) (12)

====================== ======== ========== ========= ======== ========= ============= =============== ========

Total changes in

ownership

interests - - - - - - (12) (12)

====================== ======== ========== ========= ======== ========= ============= =============== ========

Total transactions

with

owners of the Company 2 1,081 - - 830 1,913 (12) 1,901

====================== ======== ========== ========= ======== ========= ============= =============== ========

As at 30 September

2021 670 400,682 30,470 (5,876) (154,231) 271,715 7,884 279,599

----------------------

Comprehensive income

for the year

(Loss)/profit for the

year - - - - (32,087) (32,087) 1,636 (30,451)

Other comprehensive

income - - 47,240 5,173 - 52,413 366 52,779

---------------------- ======== ========== ========= ======== ========= ============= =============== ========

Total comprehensive

income for the year - - 47,240 5,173 (32,087) 20,326 2,002 22,328

====================== ======== ========== ========= ======== ========= ============= =============== ========

Contributions by and

distributions to

owners

Share issue 34 20,704 - - - 20,738 - 20,738

Share issue costs

recognised

through entity - (562) - - - (562) - (562)

Share-based payment - - - - 1,182 1,182 - 1,182

====================== ======== ========== ========= ======== ========= ============= =============== ========

Total contributions

by and distributions

to owners 34 20,142 - - 1,182 21,358 - 21,358

====================== ======== ========== ========= ======== ========= ============= =============== ========

Changes in ownership

====================== ======== ========== ========= ======== ========= ============= =============== ========

Total changes in - - - - - - - -

ownership

interests

====================== ======== ========== ========= ======== ========= ============= =============== ========

Total transactions

with

owners of the Company 34 20,142 - - 1,182 21,358 - 21,358

====================== ======== ========== ========= ======== ========= ============= =============== ========

As at 30 September

2022 704 420,824 77,710 (703) (185,136) 313,399 9,886 323,285

====================== ======== ========== ========= ======== ========= ============= =============== ========

Consolidated Statement of Cash Flows

for the year ended 30 September 2022

Notes 2022 2021

GBP000 GBP000

=================================================== ===== ================= =================

Cash flows from operating activities

Loss for the year (30,451) (11,576)

Adjustments for:

Depreciation and impairment of property, plant

and equipment 8,602 5,017

Depreciation and impairment of right-of-use assets 11,295 3,342

Amortisation and impairment of intangible fixed

assets 19,161 16,283

(Profit)/loss on sale of property, plant and

equipment (43) 46

Finance income 3 (319) (1,442)

Finance costs 3 18,437 7,987

Increase in fair value of contingent consideration

receivable (1,203) -

Share of loss of equity-accounted investees,

net of tax 595 905

Foreign exchange losses/(gains) (3,985) (1,800)

Share-based payment expense 1,182 830

Other adjustments for non-cash items (276) -

Tax expense 7,274 2,397

Increase in trade and other receivables (8,511) (8,178)

Increase in inventories (5,406) (3,554)

Increase in biological and agricultural assets (6,099) (5,427)

Increase in trade and other payables 6,946 5,547

Increase in provisions 1,058 -

=================================================== ===== ================= =================

18,257 10,377

Income taxes paid (7,447) (4,587)

=================================================== ===== ================= =================

Net cash flows generated from operating activities 10,810 5,790

=================================================== ===== ================= =================

Investing activities

Purchases of investments (378) (578)

Receipts from disposal of investments 1,544 9

Purchases of property, plant and equipment (10,808) (17,683)

Purchases of intangibles (205) (225)

Capitalised research and development costs (1,708) (4,813)

Proceeds from sale of fixed assets 220 112

Interest received 119 88

=================================================== ===== ================= =================

Net cash flows used in investing activities (11,216) (23,090)

=================================================== ===== ================= =================

Financing activities

Proceeds of share issues 20,737 750

Share-issue costs recognised through equity (562) -

Acquisition of NCI - (12)

Proceeds from bank or other borrowings (net of

borrowing fees) 67,939 -

Repayment of bank or other borrowings (74,874) (3,106)

Interest and finance charges paid (9,629) (7,699)

Repayments of lease liabilities (10,533) (4,602)

=================================================== ===== ================= =================

Net cash flows used in from financing activities (6,922) (14,669)

=================================================== ===== ================= =================

Net decrease in cash and cash equivalents (7,328) (31,969)

Cash and cash equivalents at beginning of year 39,460 71,605

Effect of movements in exchange rate 4,267 (176)