TIDMBEZ

RNS Number : 5797N

Beazley PLC

10 May 2018

Press

Release

Beazley plc trading statement for the three months ended 31

March 2018

London, 10 May 2018

Overview

-- Gross premiums written increased by 10% to $631m (2017: $573m)

-- Premium rates on renewal business increased by 3%

-- Year to date investment return of zero

Andrew Horton, Chief Executive Officer, said:

"Beazley made a strong start to 2018 with premium growth of 10%

on average across the portfolio. We have also seen rate increases

across many lines of business as the market recalibrates its

pricing in the wake of the high catastrophe activity seen in late

2017.

While our investment return is lower than we would have hoped at

this stage, US interest rates are now materially higher which will

benefit the business going forward."

31 March 31 March % increase

2018 2017

Gross premiums written

($m) 631 573 10

--------- --------- -----------

Investments and cash ($m) 4,845 4,551 6

--------- --------- -----------

Year to date investment

return - 0.9%

--------- --------- -----------

Rate increase/(decrease) 3% (1%)

--------- --------- -----------

Premiums

Gross premiums written for the three months ended 31 March 2018

increased by 10% year on year to $631m.

Our property team have benefitted from the improved underwriting

conditions seen in the wake of the high catastrophe frequency

experienced at the end of 2017. As such, premiums have increased

29% year on year to $108m.

Our reinsurance division also benefited from improved

underwriting conditions with rates increasing 7% across the

portfolio, driving an increase in premium of 7% to $90m.

Specialty lines, our largest division, saw premium increase to

$295m, a 6% increase. This was driven by a 17% increase in business

written within the US.

Our political, accident and contingency division has achieved

good growth across a number of areas which has enabled it to

increase premiums by 14% year on year despite rate pressures in

some areas, in particular terrorism.

Our performance to the end of March 2018 by business division

is:

Gross premiums written Gross premiums written % increase Q1 2018 Rate change

31 March 2018 31 March 2017

$m $m % %

--------------------------------- ----------------------- ----------------------- ----------- --------------------

Marine 71 69 3% 2%

Political, accident &

contingency 67 59 14% (3%)

Property 108 84 29% 8%

Reinsurance 90 84 7% 7%

Specialty lines 295 277 6% -

--------------------------------- ----------------------- ----------------------- ----------- --------------------

OVERALL 631 573 10% 3%

--------------------------------- ----------------------- ----------------------- ----------- --------------------

Business update

At the AGM it was announced that after 28 years at Beazley Neil

Maidment would be retiring. As such, Neil will step down from the

board as of 31 December 2018. Adrian Cox, who has been head of

specialty lines since 2008, will succeed Neil as chief underwriting

officer.

Also at the AGM, David Roberts formally became the chairman of

the Beazley plc board.

Claims update

There have been no major catastrophe events in 2018 and our

previous guidance, of a full year combined ratio in the low

nineties with below average reserve releases following the natural

catastrophes of 2017, is unchanged.

Investments

As at the end of March our portfolio allocation was as

follows:

31 March 2018 31 March 2017

Assets Allocation Assets Allocation

$m % $m %

Cash and cash

equivalents 548 11.3 472 10.3

Sovereign, quasi-sovereign

and supranational 1,282 26.5 1,042 22.9

Corporate debt

* Investment grade

2,117 43.7 2,266 49.8

58 1.2 88 1.9

* High yield

123 2.5 94 2.1

Senior secured

loans - - 5 0.1

Asset backed

securities 17 0.3 3 0.1

Derivative asset

------- ----------- ------- -----------

Core portfolio 4,145 85.5 3,970 87.2

------- ----------- ------- -----------

Equity linked

funds 151 3.1 118 2.6

Hedge funds 381 7.9 320 7.0

Illiquid credit

assets 168 3.5 143 3.2

------- ----------- ------- -----------

Overall portfolio 4,845 100.0 4,551 100.0

------- ----------- ------- -----------

As at 31 March 2018 we have made a net investment loss of $1.1m,

or 0% (31 March 2017: $42.5m gain, 0.9%). Rising US bond yields,

widening credit spreads on corporate debt and volatile equity

markets combined to create a difficult environment for our

investments in this period, resulting in a small loss overall.

However, fixed income yields have risen significantly in recent

months and this is a positive sign for future investment

returns.

The weighted average duration of our fixed income portfolio was

1.4 years at 31 March 2018 (31 March 2017: 1.9 years).

ENDS

For further information, please contact:

Beazley plc

Christine Oldridge

+44 (0) 207 6747758

Note to editors:

Beazley plc (BEZ.L), is the parent company of specialist

insurance businesses with operations in Europe, United States,

Canada, Latin America and Asia. Beazley manages seven Lloyd's

syndicates and, in 2017, underwrote gross premiums worldwide of

$2,343.8 million. All Lloyd's syndicates are rated A by A.M.

Best.

Beazley's underwriters in the United States focus on writing a

range of specialist insurance products. In the admitted market,

coverage is provided by Beazley Insurance Company, Inc., an A.M.

Best A rated carrier licensed in all 50 states. In the surplus

lines market, coverage is provided by the Beazley syndicates at

Lloyd's.

Beazley is a market leader in many of its chosen lines, which

include professional indemnity, property, marine, reinsurance,

accident and life, and political risks and contingency

business.

For more information please go to: www.beazley.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTALMRTMBMMBTP

(END) Dow Jones Newswires

May 10, 2018 02:00 ET (06:00 GMT)

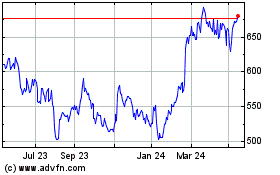

Beazley (LSE:BEZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

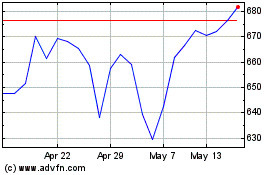

Beazley (LSE:BEZ)

Historical Stock Chart

From Apr 2023 to Apr 2024