TIDMAXL

RNS Number : 5449U

Arrow Exploration Corp.

29 March 2023

NOT FOR RELEASE, DISTRIBUTION, PUBLICATION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO OR FROM THE UNITED

STATES, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

Arrow Exploration Corp.

("Arrow" or the "Company")

Arrow Announces 2022 Year-end reserves

Before Tax NPV-10 values increased 97% for 1P and 51% for 2P

RESERVES,

1P and 2P reserve replacement ratio was 165% AND 164%

respectively

CALGARY, March 29, 2023 - Arrow Exploration Corp. (AIM: AXL;

TSXV: AXL) is pleased to announce the results of its 2022 year-end

reserves evaluation by Boury Global Energy Consultants Ltd.

("BouryGEC").

All reserves volume figures stated below are on a Working

Interest Gross Reserve basis. Currency amounts are in United States

dollars (unless otherwise indicated) and comparisons refer to

December 31, 2021.

Highlights

- Proved ("1P") reserves:

o Increased by 11% to 3.37 million barrels of oil equivalent

("MMboe "), driven principally through uplift at Tapir (Rio Cravo),

Colombia;

o Net present value before tax, discounted at 10% ("NPV-10") is

$57.9 million ($17.15/boe) for 1P reserves.

- Proved plus Probable ("2P") reserves:

o Increased by 4% to 7.69 MMboe;

o NPV-10 is $127.3 million ($16.56/boe) for 2P reserves.

- Proved plus Probable plus Possible ("3P") reserves:

o Increased by 1% to 11.68 MMboe;

o NPV-10 is $205.8 million ($17.57/boe) for 3P reserves.

- Before tax NPV-10 values have increased 97% for 1P and 51% for

2P, over year-end 2021, due to reserves growth and an increase in

the oil price forecast used by BouryGEC at year-end 2022; 2022

Proved Developed Producing ("PDP") reserves increased 27% to 1.31

MMboe supported by the improved performance of the new drilling in

the Rio Cravo Field; PDP reserves represent 39% of 1P reserves,

reflecting an attractive ratio of base production to low-risk

drilling targets; and

- Before tax NPV-10 per share of US$0.14/share, US$0.39/share,

and US$0.63/share for 1P, 2P, and 3P reserve categories,

respectively;

- BouryGEC post tax NPVs impacted by changes in Colombian tax

regime in the year but pre other corporate tax shelters (further

detail below).

CEO Commentary

Marshall Abbott, CEO of Arrow, commented: "Arrow delivered an

increase in volumes and pre-tax values across 1P, 2P and 3P

reserves in 2022. We are pleased with the results of the BouryGEC

reserves evaluation, which reinforces the significant value of our

Colombian and Canadian assets.

The BouryGEC 2022 report of course does not account for the

current drilling campaign at Rio Cravo Este, where, given the

encouraging results to date, we might expect further

reclassifications and increase in reserves. Additionally, with the

imminent drilling of the Carrizales Norte wells, we would expect to

continue growing reserves in the near future.

2022 Year-End Reserves Summary

Management has presented below a summary of Arrow's reserves as

at December 31, 2022, on a working interest gross reserves basis,

which have been taken from and reconcile directly to the reserves

report prepared by BouryGEC, an independent qualified reserves

evaluator. The figures in the following tables have been prepared

in accordance with the standards contained in the most recent

publication of the Canadian Oil and Gas Evaluation Handbook (the

"COGEH") and the reserve definitions contained in National

Instrument 51-101 - Standards of Disclosure for Oil and Gas

Activities ("NI 51-101"). In addition to the summary information

disclosed in this announcement, more detailed information will be

included in Arrow's annual reserves evaluation for the year ended

December 31, 2022 to be filed on SEDAR (www.sedar.com) and posted

on Arrow's website ( www.arrowexploration.ca ).

After tax values have been calculated without taking into

account the tax shelter created by capital spending on projects

that do not have reserve values associated with them, such as the

Tapir 3D seismic project, drilling at Carazales Norte and annual

G&A. Spending on these projects will provide tax shelter and

result in a reduction of tax for future.

Brent Crude Oil Price and AECO Gas Price Forecasts in BouryGEC

Reserves Evaluation

Year-End Forecast: 2023 2024 2025 2026 2027 2028 2029

Brent (US$/bbl) - Dec.

31, 2022 $85.00 $82.80 $80.50 $82.00 $84.20 $85.88 $87.60

------- ------- ------- ------- ------- ------- -------

AECO-C Spot (C$/MMbtu) C$4.83 C$4.50 C$4.31 C$4.42 C$4.53 C$4.64 C$4.61

------- ------- ------- ------- ------- ------- -------

Year-End Working Interest Gross Reserves - Breakdown by Category

and Country (Mboe)

2022 2021 Change % Change

Proved developed

producing 1,319 1037 282 27%

------- ------- ------- ---------

- Colombia assets

(core) 664 287

------- ------- ------- ---------

- Colombia assets

(non-core) 178 117

------- ------- ------- ---------

- Canada assets 475 633

------- ------- ------- ---------

Proved developed

non-producing 26 362 (336) (93%)

------- ------- ------- ---------

- Colombia assets

(core) 0 63

------- ------- ------- ---------

- Colombia assets

(non-core) 26 42

------- ------- ------- ---------

- Canada assets 0 258

------- ------- ------- ---------

Proved undeveloped 2,032 1,649 383 23%

------- ------- ------- ---------

- Colombia assets

(core) 453 88

------- ------- ------- ---------

- Colombia assets

(non-core) 1,579 1,561

------- ------- ------- ---------

- Canada assets 0 0

------- ------- ------- ---------

Total Proved 3,376 3,048 329 11%

------- ------- ------- ---------

Probable 4,314 4,373 (59) (1%)

------- ------- ------- ---------

- Colombia assets

(core) 1,003 1,232

------- ------- ------- ---------

- Colombia assets

(non-core) 2,765 2,446

------- ------- ------- ---------

- Canada assets 546 694

------- ------- ------- ---------

Total Proved plus

Probable 7,691 7,421 270 4%

------- ------- ------- ---------

Possible 3,989 4,119 (130) (3%)

------- ------- ------- ---------

- Colombia assets

(core) 2,224 1,933

------- ------- ------- ---------

- Colombia assets

(non-core) 1,513 1,828

------- ------- ------- ---------

- Canada assets 252 359

------- ------- ------- ---------

Total Proved plus

Probable & Possible 11,679 11,540 140 1%

------- ------- ------- ---------

Possible reserves are those additional reserves that are less

certain to be recovered than probable reserves. There is a 10%

probability that the quantities actually recovered will equal or

exceed the sum of proved plus probable plus possible reserves.

(1) "Core" assets include Arrow's share of reserves in the Tapir

Block, the Santa Isabel Block (Oso Pardo), and Mateguafa. Arrow's

50% interest in the Tapir Block is contingent on the assignment by

Ecopetrol SA of such interest to Arrow.

(2) "Non-core" assets include the Ombu Block (which includes the Capella Field)

(3) "Canada" assets include Fir and Pepper

Year-End Net Present Value at 10% - Before Tax ($ Thousands)

Category 2022 2021 % Change

Proved

-------- -------- ---------

Developed Producing 32,092 11,406 181%

-------- -------- ---------

Non-Producing 357 2,112 (83%)

-------- -------- ---------

Undeveloped 25,458 15,889 60%

-------- -------- ---------

Total Proved 57,906 29,407 97%

-------- -------- ---------

Probable 69,440 54,738 27%

-------- -------- ---------

Total Proved plus Probable 127,346 84,146 51%

-------- -------- ---------

Possible 78,471 49,842 57%

-------- -------- ---------

Total Proved plus Probable &

Possible 205,817 133,987 54%

-------- -------- ---------

Possible reserves are those additional reserves that are less

certain to be recovered than probable reserves. There is a 10%

probability that the quantities actually recovered will equal or

exceed the sum of proved plus probable plus possible reserves.

Year-End Net Present Value at 10% - After Tax ($ Thousands)

Category 2022 2021 % Change

Proved

------- ------- ---------

Developed Producing 19,509 11,170 75%

------- ------- ---------

Non-Producing 269 2,112 (87%)

------- ------- ---------

Undeveloped 9,092 11,705 (22%)

------- ------- ---------

Total Proved 28,871 24,987 16%

------- ------- ---------

Probable 28,618 33,886 (16%)

------- ------- ---------

Total Proved plus Probable 57,489 58,873 (2%)

------- ------- ---------

Possible 32,033 29,959 7%

------- ------- ---------

Total Proved plus Probable &

Possible 89,522 88,832 1%

------- ------- ---------

Possible reserves are those additional reserves that are less

certain to be recovered than probable reserves. There is a 10%

probability that the quantities actually recovered will equal or

exceed the sum of proved plus probable plus possible reserves.

Year-End Net Present Value at 10% - After Tax ($ millions) -

Sensitivity Cases

In the context of the Brent crude oil and AECO gas prices

prevailing at the time of the publication of this press release,

when compared generally to the Brent crude oil and AECO gas price

forecasts used in the BouryGEC Reserves Evaluation for the year

ended December 31, 2022, Arrow is also providing readers with the

following sensitivity analysis as to the net present value of its

reserves.

Type of Sensitivity Total Proved Total Proved Total Proved

(US$MM) plus Probable plus Probable

(US$MM) & Possible

(US$MM)

BouryGEC Forecast Price

Case 28.9 57.5 89.5

------------- --------------- ---------------

WTI Premium of US$10/bbl 36.5 72.7 111.2

------------- --------------- ---------------

AECO Premium of C$0.30/MMBtu 29.2 58.2 90.3

------------- --------------- ---------------

Readers are cautioned that there is no certainty that the

forecast price of crude oil or natural gas will increase as

calculated by changes to the Dec. 31, 2022 BouryGEC price deck used

in the Reserves Evaluation report.

Forecast Revenues and Costs - Undiscounted ($ millions)

Category Revenue (3) Royalties Operating DC Abandonment BT Future Income Taxes AT Future

Cost (2) & Net Revenue Net Revenue

Reclamation (1) (1)

Total Proved 159.5 15.3 34.2 32.4 4.3 73.3 34.7 38.6

------------ ---------- ------------- ----- ------------ ------------ ------------- ------------

Total Proved

plus

Probable 354.0 33.3 62.9 67.4 6.9 183.6 93.2 90.4

------------ ---------- ------------- ----- ------------ ------------ ------------- ------------

Total Proved

plus

Probable &

Possible 591.2 63.2 105.7 82.1 8.2 332.0 174.3 157.7

------------ ---------- ------------- ----- ------------ ------------ ------------- ------------

Possible reserves are those additional reserves that are less

certain to be recovered than probable reserves. There is a 10%

probability that the quantities actually recovered will equal or

exceed the sum of proved plus probable plus possible reserves.

(1) BT = Before Taxes and AT = After Taxes

(2) Operating Cost less processing and other income

(3) Revenue includes Petrolco Income

2021 Year-End Working Interest Gross Reserves Reconciliation

(Mboe)

Total Proved Total Proved Total Proved

plus Probable plus Probable

& Possible

31-Dec-21 3,049 7,421 11,541

------------- --------------- ---------------

Technical Revisions 745 395 503

------------- --------------- ---------------

Economic Factors 58 352 112

------------- --------------- ---------------

Production (476) (476) (476)

------------- --------------- ---------------

31-Dec-22 3,376 7,692 11,680

------------- --------------- ---------------

Possible reserves are those additional reserves that are less

certain to be recovered than probable reserves. There is a 10%

probability that the quantities actually recovered will equal or

exceed the sum of proved plus probable plus possible reserves.

Qualified Person's Statement

The technical information contained in this announcement has

been reviewed and approved by Grant Carnie, senior non-executive

director of Arrow Exploration Corp. Mr. Carnie is a member of the

Canadian Society of Petroleum Engineers, holds a B.Sc. in Geology

from the University of Alberta and has over 35 years' experience in

the oil and gas industry.

The recovery and reserve estimates provided in this news release

are estimates only, and there is no guarantee that the estimated

reserves will be recovered. Actual reserves may eventually prove to

be greater than, or less than, the estimates provided herein. In

certain of the tables set forth above, the columns may not add due

to rounding.

Cautionary Statement

This press release contains various references to the

abbreviation "BOE" which means barrels of oil equivalent. Where

amounts are expressed on a BOE basis, natural gas volumes have been

converted to oil equivalence at six thousand cubic feet (Mcf) per

barrel (bbl). The term BOE may be misleading, particularly if used

in isolation. A BOE conversion ratio of six thousand cubic feet per

barrel is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead.

This Announcement contains inside information for the purposes

of the UK version of the market abuse regulation (EU No. 596/2014)

as it forms part of United Kingdom domestic law by virtue of the

European Union (Withdrawal) Act 2018 ("UK MAR").

For further Information, contact:

Arrow Exploration

Marshall Abbott, CEO +1 403 651 5995

Joe McFarlane, CFO +1 403 818 1033

Brookline Public Relations, Inc.

Shauna MacDonald +1 403 538 5645

Canaccord Genuity (Nominated Advisor

and Joint Broker)

Henry Fitzgerald-O'Connor

James Asensio

Gordon Hamilton +44 (0)20 7523 8000

Auctus Advisors (Joint Broker)

Jonathan Wright + 44 (0)7711 627449

Rupert Holdsworth Hunt

Camarco (Financial PR)

Georgia Edmonds +44 (0)20 3781 8331

Rebecca Waterworth

Billy Clegg

About Arrow Exploration Corp.

Arrow Exploration Corp. (operating in Colombia via a branch of

its 100% owned subsidiary Carrao Energy S.A.) is a publicly traded

company with a portfolio of premier Colombian oil assets that are

under-exploited, under-explored and offer high potential growth.

The Company's business plan is to expand oil production from some

of Colombia's most active basins, including the Llanos, Middle

Magdalena Valley (MMV) and Putumayo Basin. The asset base is

predominantly operated with high working interests, and the

Brent-linked light oil pricing exposure combines with low royalties

to yield attractive potential operating margins. Arrow's 50%

interest in the Tapir Block is contingent on the assignment by

Ecopetrol SA of such interest to Arrow. Arrow's seasoned team is

led by a hands-on executive team supported by an experienced board.

Arrow is listed on the AIM market of the London Stock Exchange and

on TSX Venture Exchange under the symbol "AXL".

Reserves Categories

Reserves are estimated remaining quantities of oil and natural

gas and related substances anticipated to be recoverable from known

accumulations, from a given date forward, based on analysis of

drilling, geological, geophysical and engineering data; the use of

established technology; and specified economic conditions which are

generally accepted as being reasonable and shall be disclosed.

"Proved Developed Producing Reserves" are those reserves that

are expected to be recovered from completion intervals open at the

time of the estimate. These reserves may be currently producing or,

if shut-in, they must have previously been on production, and the

date of resumption of production must be known with reasonable

certainty.

"Proved Developed Non-Producing Reserves" are those reserves

that either have not been on production or have previously been on

production but are shut-in and the date of resumption of production

is unknown.

"Proved Undeveloped Reserves" are those reserves expected to be

recovered from known accumulations where a significant expenditure

(e.g., when compared to the cost of drilling a well) is required to

render them capable of production. They must fully meet the

requirements of the reserves category (proved, probable, possible)

to which they are assigned.

"Proved" reserves are those reserves that can be estimated with

a high degree of certainty to be recoverable.

"Probable" reserves are those additional reserves that are less

certain to be recovered than Proved reserves but more certain to be

recovered than Possible reserves.

"Possible" reserves are those additional reserves that are less

likely to be recoverable than Probable reserves.

Forward-looking Statements

This news release contains certain statements or disclosures

relating to Arrow that are based on the expectations of its

management as well as assumptions made by and information currently

available to Arrow which may constitute forward-looking statements

or information ("forward-looking statements") under applicable

securities laws. All such statements and disclosures, other than

those of historical fact, which address activities, events,

outcomes, results or developments that Arrow anticipates or expects

may, could or will occur in the future (in whole or in part) should

be considered forward-looking statements. In some cases,

forward-looking statements can be identified by the use of the

words "continue", "expect", "opportunity", "plan", "potential" and

"will" and similar expressions. The forward-looking statements

contained in this news release reflect several material factors and

expectations and assumptions of Arrow, including without

limitation, Arrow's evaluation of the impacts of COVID-19, the

potential of Arrow's Colombian and/or Canadian assets (or any of

them individually), the prices of oil and/or natural gas, and

Arrow's business plan to expand oil and gas production and achieve

attractive potential operating margins. Arrow believes the

expectations and assumptions reflected in the forward-looking

statements are reasonable at this time but no assurance can be

given that these factors, expectations and assumptions will prove

to be correct.

The forward-looking statements included in this news release are

not guarantees of future performance and should not be unduly

relied upon. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. The forward-looking

statements contained in this news release are made as of the date

hereof and the Company undertakes no obligations to update publicly

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

"Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release"

Glossary

Bbl/d: Barrels per day

$/Bbl: Dollars per barrel

Mcf/d: Thousand cubic feet of gas per day

$/Mcf: Dollars per thousand cubic feet of gas

Boe/d: Barrels of oil equivalent per day

$/Boe: Dollars per barrel of oil equivalent

PDP: Proved Developed Producing

1P: Proved Reserves

2P: Proved plus Probable Reserves

3P: Proved plus Probable plus Possible Reserves

MMbtu: Millions btu

MMboe: Millions of barrels of oil equivalent

Mbtu: Thousands btu

Mboe: Thousands of barrels of oil equivalent

Working Interest Gross Reserves: The reserves attributable to

the Company's license working interest pre-taxes and royalties

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAADPADEDEAA

(END) Dow Jones Newswires

March 29, 2023 02:00 ET (06:00 GMT)

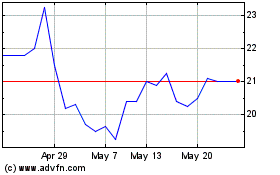

Arrow Exploration (LSE:AXL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Arrow Exploration (LSE:AXL)

Historical Stock Chart

From Jul 2023 to Jul 2024