TIDMATM

RNS Number : 4458H

AfriTin Mining Ltd

06 April 2022

6 April 2022

AfriTin Mining Limited

("AfriTin" or the "Company")

AfriTin Mining Five Year Growth Strategy

AfriTin Mining Limited (AIM: ATM), an African tech-metals mining

company with a portfolio of mining and exploration assets in

Namibia, is pleased to announce the release of its five-year growth

strategy. The Company aims to enlarge its footprint in Namibia by

expanding existing operations and adding mining locations both in

country and across Africa. In addition, revenue streams for

multiple technology metals concentrates will be developed,

expanding the current tin production to include lithium, tantalum

and tungsten.

Link to full pdf version with images:

https://afritinmining.com/afritin-mining-five-year-growth-strategy/

Investor Conference Call

AfriTin Mining will be hosting a live investor presentation via

the Investor Meet Company platform on Thursday, 7 April, at 11:00am

CAT/10:00am BST. The presentation is open to all existing and

potential shareholders. Questions can be submitted pre-event via

the Investor Meet Company dashboard up until 11:00am CAT/10:00am

BST the day of the meeting, or at any time during the

presentation.

Investors can sign up to Investor Meet Company for free and add

the AfriTin Mining Meet via:

https://www.investormeetcompany.com/afritin-mining-limited/register-investor

Highlights:

-- Uis Mine (Mining Licence ML 134):

o Current mining operation at Uis Mine is producing 850 tpa of

tin concentrate;

o Continued e xpansion of current operation aims to increase tin

concentrate production up to 2,800 tpa; in addition, lithium

concentrate production of 60,000 tpa and tantalum concentrate

production of 45 tpa will commence ;

o Phase 2 feasibility studies for larger-scale 10 Mtpa ROM

operation underway;

o Exploration drilling campaign in progress, with the aim of

expanding the existing JORC (2012) tin mineral resource from 71.54

Mt to a figure of 200 Mt of resource containing tin, lithium and

tantalum;

-- B1/C1 (Mining Licence ML 129): 15km from Uis

o Exploration programme in progress to confirm historical tin

and tantalum resource, and investigate recent spodumene (lithium)

discovery (announced 2 March 2022); and

-- Brandberg West (Exploration Licence EPL 5445): 107km from Uis

o Aggressive exploration programme underway at the site of the

historic tin and tungsten mining operation, aiming to confirm the

historical drilling database with a view to fast-tracking

production.

Anthony Viljoen (CEO) commented:

"I am pleased to publish our ambitions and pathway to becoming a

multi-tech metal producer over the next five years. AfriTin has

proven it is already part of a small and unique group of global tin

producers. What enhances our ambitions and the achievable future

strategy is the underexplored lithium potential combined with

multiple historic open pit tin mines close to our Uis mine. We look

forward to bringing these exciting deposits into production and

leveraging the knowledge gained from successfully building a new

mine at Uis."

Uis Mine (Mining Licence ML 134)

The Uis Mine is the site of a historic tin mine operated by

Iscor between 1958 and 1991. AfriTin re-established production of

tin concentrate in 2019. The operation is currently producing over

490 tpa of tin metal from 800 tpa of tin concentrate. The Company

announced a maiden JORC (2012) compliant mineral resource over the

V1/V2 pegmatite in 2019. Twenty-six exploration holes were drilled,

which validated the 141 historical holes over the V1/V2 orebody,

the latter comprising only two of the sixteen historically mined

pegmatites at Uis. The V1/V2 ore body contained a maiden JORC

(2012) compliant resource of 71.54 million tonnes of resource,

containing 96k tonnes of tin metal (Sn) in combined measured,

indicated and inferred categories, as well as 450k tonnes of

lithium oxide (Li(2) O) metal (1.1 Mt LCE), and 6,000 tonnes of

tantalum metal (Ta), both in the inferred category (announced 6

September 2019).

An exploration drilling programme is currently underway with the

aim of expanding the mineral resource for tin over the fourteen

additional, historically mined pegmatites, all of which occur

within a 5 km radius of the current processing plant. The Company

has set a mineral resource target of 200 Mt to be delineated within

the next 5 years.

The substantial mineral resource potential allows the Company to

consider economies of scale. AfriTin has defined an operational

strategy that will expand the throughput and product outcomes of

the Uis Mine, from two parallel work streams:

-- The completion of a Feasibility Study and the construction of

a larger Phase 2 10 Mtpa ROM operation which simultaneously

exploits multiple pegmatites; and

-- Modular expansion of the current Phase 1 mining operation to

enhance cash flow at defined project delivery points and continue

de-risking the Phase 2 Project

The expansion of the current mining operation will leverage the

existing water and power infrastructure - 72% of purchased grid

electricity is sourced from renewable energy sources, and this is

adequate to increase tin concentrate production by between 2 and 4

times. Expansion will also enable a lithium concentrate production

of up to 60,000 tpa (6,000 tpa contained LCE), together with a

tantalum concentrate production of 45 tpa. Financial modelling by

the Company indicates that this growth will potentially increase

revenues from approximately US$20 million pa for the current

operation, to more than US$100 million pa. Financial modelling by

the Company also indicates a potential NPV in excess of

US$500million and an IRR of 130% for the post-Phase 1 expansion,

assuming a 70-year life-of-mine at a discount rate of 8.3%,

including sunk capital to date.

Defined project deliverables include:

-- Crushing Circuit Expansion: Processing plant throughput

expansion to increase tin concentrate production to 1,500 tpa (up

76% from current values). This project is currently under

construction with commissioning expected in Q4 2022;

-- Ore Sorting: This facility will increase tin concentrate

production by increasing the current feed grade by a factor of 2 -

4x. The Company aims to achieve this by using x-ray transmission

(XRT) ore sorting as a dry pre-concentration method. An XRT ore

sorting test plant is planned for implementation during 2022 with

full-scale production expected in 2023; and

-- By-Product Circuit: Additional processing plant circuits to

produce both lithium concentrate (petalite mineral) and tantalum

concentrate. Test plants for lithium and tantalum are planned for

implementation during 2022.

Feasibility studies for a larger scale Phase 2 mining and

processing facility are also underway. This operation is envisioned

as a 10 Mtpa ROM operation producing approximately 16,000 tpa of

tin concentrate, 480,000 tpa of lithium concentrate (48,000 tpa

contained LCE), and 320 tpa of tantalum concentrate. It is expected

that Phase 2 will require upscaled electricity and water

infrastructure by tapping into existing electrical grid power and

utilizing desalinated water infrastructure close to the current

operation.

The Company has commenced the formative stages of a feasibility

study, with an initial Preliminary Economic Assessment using live

feed data from the current operations, and due in Q2 2022.

B1/C1 (Mining Licence ML 129)

The positive identification of spodumene, a primary lithium

mineral within the B1 and C1 pegmatites (announced 2 March 2022),

together with known tin and tantalum mineralisation, highlights the

prospectivity of the ML129 mining license. The Company intends to

progress the initial exploration programme here, with the aim of

confirming and expanding the historical drill hole database, and

potentially establishing a JORC (2012) compliant mineral resource

estimate.

Brandberg West (Exploration Licence EPL 5445)

Brandberg West is a historic open pit tin and tungsten mine,

operated by Gold Fields Limited between 1946 and the 1980's.

Located 107 km from the Uis Mine, Brandberg West is a polymetallic

deposit, with primary tin and tungsten mineralisation and secondary

copper mineralisation. The deposit features mineralised quartz vein

sets hosted in metasediments, and is expected to be well suited for

pre-concentration through modern mechanised ore sorting, prior to

concentration via gravity separation methods.

The Company intends initiating an exploration drilling programme

as a follow-on from the Company's recent exploration mapping and

sampling programme, with the aim of establishing a JORC (2012)

compliant mineral resource estimate. In addition, the company plans

to undertake a metallurgical test work programme to investigate

potential ore processing methods.

Financing

AfriTin currently generates US$800k a month in operating cash

flow from its Uis Mine and is fully financed to complete the

commissioning of its Phase 1 expansion and testwork programme for

the 2022 calendar year. Project expansion is being financed by a

project finance facility through its banking partner Standard Bank

Namibia. Thereafter, the Company intends funding its strategic

development activities at Uis Mine, at B1/C1 and at Brandberg West,

mainly from incremental Phase 1 cash flows and through appropriate

financing options on a project by project basis.

ESG

AfriTin is committed to the sustainable development of its

operations and the growth of its business. The leadership team

places great emphasis on creating value for the wider community,

our shareholders, investors, and other stakeholders. They have

established an environmental, social and governance (ESG) system

which has been implemented at all levels of the Company, and aligns

with international standards. Their ESG efforts also accord with

the strategy of building a new technology metals province in

Namibia, as well as elsewhere in Africa, and which will produce the

materials essential to global aspirations of reducing carbon

emissions. The Company plans to present its ESG Strategy in H2

2022.

Glossary of abbreviations

EBITDA Earnings Before Interest, Taxes, Depreciation and Amortization

FY AfriTin Mining Financial Year (March - Feb)

km kilometres

LCE Lithium Carbonate Equivalent

Li Symbol for Lithium

Li(2) O Lithium oxide

Li -> Li(2) O Metal to metal-oxide conversion factor of 2.153

Li(2) O -> Li(2) CO(3) Metal-oxide to lithium carbonate equivalent conversion factor of 2.473

Tpa Tonnes per annum

Mtpa Million Tonnes per annum

Q Quater

Sn Tin

SW South-west

Ta Tantalum

W Tungsten

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 207 220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Callum Stewart +44 (0) 20 7710 7600

Tavistock Financial PR (United

Kingdom) +44 (0) 207 920 3150

Jos Simson

Oliver Lamb

Nick Elwes

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is a London-listed tech-metals mining

company with a vision to create a portfolio of globally

significant, conflict-free, producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Tin Mine in Namibia to 16,000 tpa of tin concentrate ,

480,000 tpa lithium concentrate and 320 tpa of tantalum concentrate

in a Phase 2 expansion, having reached Phase 1 commercial

production in 2020. The Company strives to capitalise on the solid

supply/demand fundamentals of tin and lithium by developing a

critical mass of resource inventory, achieving production in the

near term and further scaling production by consolidating assets in

Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUMCCUPPUCQ

(END) Dow Jones Newswires

April 06, 2022 02:01 ET (06:01 GMT)

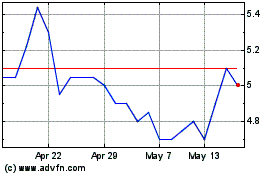

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jun 2024 to Jul 2024

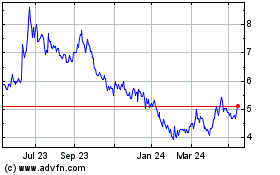

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jul 2023 to Jul 2024