RNS No 7281h

ANDREWS SYKES GROUP PLC

1st OCTOBER 1998

ANDREWS SYKES GROUP PLC

INTERIM RESULTS FOR THE SIX MONTHS

ENDED 27TH JUNE 1998

Hire, sale and servicing of portable heating, air conditioning,

drying, ventilating and pumping equipment and general plant hire

CHAIRMAN'S STATEMENT

I am very pleased to report on the results of our company for the

last 6 months as follows:

#000

* Turnover increased by 23.4% to 33,817

* Profit before taxation increased by 17.7% to 5,938

* Earnings per share increased by 16.1% to 4.90p

* Operating cash flow increased by 20.8% to 5,642

* Net assets increased by 97.0% to 22,282

* Interim dividend increased by 20% per share to 1.20p

Turnover increased by 11.7% in the continuing businesses to #30.6

million. Acquisitions completed during the first half of 1998

contributed turnover of #3.2 million, the majority relating to Cox

Plant which was acquired on 3rd June.

The enlarged group now has an annualised turnover in excess of

#100 million with an increased proportion of hire revenue.

The increase in profit before taxation reflects an improvement in

the operating profits before exceptionals in the continuing

businesses of 7.6%, together with the net effect of exceptional

items and has led to an increase in earnings per share of 16.1% to

4.9 pence per share.

Operating cash flows continue to be strong within the continuing

businesses and, furthermore, Cox will add significantly, allowing

fast repayment of existing debt.

I am pleased to announce an increase of 20% in the interim ordinary

dividend to 1.2 pence per share which will be paid on 27th November 1998

to shareholders on the register on 17th October 1998.

J-G Murray, Chairman 1st October 1998

Andrews Sykes Group plc

Group Profit and Loss Account

For the six months ended 27 June 1998

6 months 12 months

ended ended

6 months ended 27 June 98 29 June 97 27 Dec 97

--------------------------

Cont- Acquis- Total Total Total

inuing itions

#'000 #'000 #'000 #'000 #'000

--------------------------------------------------------------------------

Turnover 30,594 3,223 33,817 27,396 59,915

Cost of Sales (16,625) (2,249) (18,874) (14,851) (31,126)

--------------------------------------------------------------------------

Gross profit 13,969 974 14,943 12,545 28,789

Net operating

expenses (including

exceptional items set

out in note 2) (7,401) (1,330) (8,731) (7,435) (16,988)

--------------------------------------------------------------------------

Group operating

profit 6,568 (356) 6,212 5,110 11,801

--------------------------------------------------------------------------

Operating profit

before exceptionals

and amortisation of

goodwill 5,498 168 5,666 5,110 11,801

Exceptional items 1,070 (485) 585 - -

Amortisation of

goodwill - (39) (39) - -

--------------------------------------------------------------------------

Group operating

profit 6,568 (356) 6,212 5,110 11,801

==========================================================================

Share of operating

profit of associates 76 - -

Net interest payable

(group) (350) (63) (98)

--------------------------------------------------------------------------

Profit on ordinary

activities before tax 5,938 5,047 11,703

Tax on profit on

ordinary activities (1,871) (1,651) (3,752)

--------------------------------------------------------------------------

Profit on ordinary

activities after

taxation being profit

for the financial

period 4,067 3,396 7,951

Dividends:

Ordinary shares (987) (737) (2,311)

Convertible

preference shares (239) (321) (546)

--------------------------------------------------------------------------

Retained profit for

the period 2,841 2,338 5,094

==========================================================================

Earnings per ordinary

share 4.90 4.22 10.02

Fully diluted earnings

per ordinary share 4.54 3.88 8.98

Exceptional items (0.33) - -

Amortisation of goodwill 0.04 - -

--------------------------------------------------------------------------

Adjusted fully

diluted earnings per 4.25 3.88 8.98

ordinary share

==========================================================================

Dividends per share:

Preference 3.50 3.50 7.00

Ordinary 1.20 1.00 3.00

There were no discontinued operations during the period.

The comparative figures for earnings and dividends per share have been

restated to take account of the sub-division of the #1 ordinary shares

into five 20p ordinary shares which was effective from 4 June 1998.

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 27 June 1998

27 June 29 June 27 Dec

1998 1997 1997

#'000 #'000 #'000

--------------------------------------------------------------------

Fixed assets

Intangible assets 7,988 - -

Tangible assets 51,086 11,559 13,369

Investments 371 164 237

--------------------------------------------------------------------

59,445 11,723 13,606

--------------------------------------------------------------------

Current assets

Stocks 9,074 5,956 7,059

Debtors 25,973 10,714 13,887

Cash at bank and in hand 3,941 3,633 4,328

--------------------------------------------------------------------

38,988 20,303 25,274

Creditors falling due within one year

Loans and overdrafts (7,382) (1,000) (2,643)

Other creditors and provisions (22,123) (13,367) (16,948)

Deferred consideration (7,200) - (700)

Corporation tax (3,903) (2,137) (4,383)

--------------------------------------------------------------------

Net current (liabilities)/ assets (1,620) 3,799 600

====================================================================

Total assets less current liabilities 57,825 15,522 14,206

Creditors falling due after more than

one year

Loans (32,128) (1,750) (1,260)

Other creditors and provisions (1,160) (1,415) (1,132)

Deferred consideration (600) - (600)

Corporation tax (1,655) (1,027) -

--------------------------------------------------------------------

Net assets 22,282 11,330 11,214

====================================================================

Capital and reserves

Called up share capital 19,847 19,145 18,857

Share premium account 8,028 86 782

Revaluation reserve 353 370 361

Other reserves

(16,424) (13,186) (16,424)

Profit and loss account 10,468 4,915 7,628

--------------------------------------------------------------------

22,272 11,330 11,204

--------------------------------------------------------------------

Shareholders' funds

Equity 18,863 6,740 7,795

Non equity 3,409 4,590 3,409

--------------------------------------------------------------------

22,272 11,330 11,204

Minority interests (equity) 10 - 10

--------------------------------------------------------------------

22,282 11,330 11,214

====================================================================

Andrews Sykes Group plc

Consolidated cash flow statement

For the six months ended 27 June 1998

6 months 6 months 12 months

ended ended ended

27 June 98 29 June 97 27 Dec 97

Total Total Total

#'000 #'000 #'000

--------------------------------------------------------------------

Net cash inflow from operating

activities 5,642 4,672 12,533

--------------------------------------------------------------------

Returns on investments and

servicing of finance

Loan facility fees (680) - -

Net interest paid (188) (44) (75)

Preference dividends paid (239) (321) (560)

Interest element of finance

lease payments (21) (15) (41)

--------------------------------------------------------------------

Net cash outflow for returns on

investments and servicing of

finance (1,128) (380) (676)

--------------------------------------------------------------------

Cash outflow for taxation (681) (421) (2,212)

--------------------------------------------------------------------

Capital expenditure

Purchase of tangible fixed

assets (2,625) (2,426) (6,274)

Sale of tangible fixed assets 399 423 1,024

--------------------------------------------------------------------

Net cash outflow for capital

expenditure (2,226) (2,003) (5,250)

--------------------------------------------------------------------

Acquisitions

Purchase of subsidiary

undertakings (44,236) - (869)

Net cash acquired with

subsidiary undertakings 359 - 97

Payment of deferred consideration

on previous acquisitions (46) (1,348) (1,405)

Purchase of interests in

associates (58) - (73)

--------------------------------------------------------------------

Net cash outflow for

acquisitions (43,981) (1,348) (2,250)

--------------------------------------------------------------------

Equity dividends paid (1,547) (947) (1,710)

--------------------------------------------------------------------

Cash (outflow)/inflow before the

use of liquid resources and

financing (43,921) (427) 435

--------------------------------------------------------------------

Management of liquid resources

Movement in bank deposits (88) (795) (1,838)

Financing

Issue of ordinary share capital

net of issue costs 8,236 4 412

New loan draw downs and

factoring advances 37,857 - 94

Loan repayments (2,472) (500) (1,000)

Capital element of finance lease

repayments (87) (184) (298)

Purchase of own shares - (91) (92)

--------------------------------------------------------------------

Net cash inflow/(outflow) from

financing 43,534 (771) (884)

--------------------------------------------------------------------

Decrease in cash in the period (475) (1,993) (2,287)

--------------------------------------------------------------------

Andrews Sykes Group plc

Notes to the accounts

For the six months ended 27 June 1998

1. The results for the 12 months ended 27 December 1997 have

been extracted from the audited financial statements that

have been filed with the Registrar of Companies and contain

an unqualified audit report. The interim figures have not

been audited or reviewed.

The new Financial Reporting Standards, FRS10: Goodwill and

Intangible Assets and FRS11: Impairment of Fixed Assets and

Goodwill, which are first applicable in 1998 have been

adopted in this interim financial statement. In adopting

FRS10, the accounting policy has been changed as described

below. In all other respects the interim financial statement

has been prepared on a basis consistent with the financial

statements for the 12 months ended 27 December 1997.

Goodwill on acquisitions made in the 6 months ended 27 June

1998 has been capitalised and is being authorised over its

estimated useful economic life. Goodwill written off

directly to reserves in previous years has not been

reinstated.

2. Exceptional items

6 12

months months

ended ended

6 months ended 27 June 98 29 June 97 27 Dec 97

---------------------------

Cont- Acquis- Total Total Total

inuing itions

#'000 #'000 #'000 #'000 #'000

--------------------------------------------------------------------

Redundancy and

reorganisation

provisions - (485) (485) - -

Release of

prior year

provisions 1,370 - 1,370 - -

Abortive

acquisition

costs (300) - (300) - -

--------------------------------------------------------------------

1,070 (485) 585 - -

--------------------------------------------------------------------

At an Extraordinary General Meeting held on 3 June 1998 the

shareholders voted to replace cash bonuses for three

directors linked to the company's share price with equivalent

share options. Accordingly, provisions relating to the cash

bonuses built up in previous periods have been released.

3. Reconciliation of operating profit to net cash inflow from

operating activities

6 months 6 months 12 months

ended ended ended

27 June 98 29 June 97 27 Dec 97

Total Total Total

#'000 #'000 #'000

-----------------------------------------------------------------

Operating profit 6,212 5,110 11,801

Amortisation of goodwill 39 - -

Depreciation 2,958 1,764 3,603

Profit on sale of fixed assets (79) (69) (150)

Increase in stocks (1,489) (1,123) (2,029)

(Increase)/decrease in debtors (1,509) 408 (1,234)

(Decrease)/increase in

creditors and provisions (490) (1,418) 542

-----------------------------------------------------------------

Net cash inflow from

operating activities 5,642 4,672 12,533

-----------------------------------------------------------------

4. Reconciliation of net cash flow to movement in net

(debt)/funds

6 months 6 months 12 months

ended ended ended

27 June 98 29 June 97 27 Dec 97

Total Total Total

#'000 #'000 #'000

----------------------------------------------------------------

Decrease in cash in the period (475) (1,993) (2,287)

Cash (inflow) / outflow

from movement in debt and

lease financing (35,298) 684 1,204

Cash outflow from movement

in liquid resources 88 795 1,838

----------------------------------------------------------------

Change in net debt

resulting from cash flows (35,685) (514) 755

Finance lease, hire purchase

and other financing arrangements

acquired with subsidiaries (42) - (285)

Loan notes issued - - (1,600)

Translation differences - 11 (43)

Movement in period (35,727) (503) (1,173)

Opening net funds 7 1,180 1,180

----------------------------------------------------------------

Closing net (debt)/funds (35,720) 677 7

----------------------------------------------------------------

5. The earnings per ordinary share has been calculated by

dividing the profit after taxation and preference dividends

of #3,828,000 (6 months ended 29 June 1997: #3,075,000 ) by

the average number of ordinary shares in issue during the

period of 78,113,835 (6 months ended 29 June 1997:

72,515,495).

The fully diluted earnings per ordinary share has been

calculated on an adjusted profit of #4,231,000 (6 months

ended 29 June 1997: #3,433,000) and an adjusted number of

shares in issue of 93,247,021 (6 months ended 29 June 1997:

88,423,595) assuming that new ordinary shares had been issued

on 28 December 1997 in respect of all share options

outstanding at 27 June 1998 and the proceeds invested in

21/2% Consolidated Stock and that all convertible preference

shares had been converted into ordinary shares at 27 December 1997.

6. Consolidated statement of total recognised gains and losses

6 months 6 months 12 months

ended ended ended

27 June 98 29 June 97 27 Dec 97

Total Total Total

#'000 #'000 #'000

------------------------------------------------------------------

Profit for the financial period 4,067 3,396 7,951

Currency translation

differences on foreign

currency net investments (9) (13) (51)

------------------------------------------------------------------

Total gains and losses in

the period 4,058 3,383 7,900

------------------------------------------------------------------

7. Reconciliation of movements in group shareholders' funds

6 months 6 months 12 months

ended ended ended

27 June 98 29 June 97 27 Dec 97

Total Total Total

#'000 #'000 #'000

-------------------------------------------------------------------

Profit for the financial period 4,067 3,396 7,951

Dividends (1,226) (1,058) (2,857)

Other recognised gains and losses (9) (13) (51)

Goodwill taken to reserves on the

purchase of subsidiary undertakings - (96) (3,347)

Proceeds from ordinary

shares issued 8,236 4 412

Consideration on the

purchase of own shares - (91) (92)

-------------------------------------------------------------------

Net increase in

shareholders' funds 11,068 2,142 2,016

Shareholders' funds at the

beginning of the period 11,204 9,188 9,188

-------------------------------------------------------------------

Shareholders' funds at the

end of the period 22,272 11,330 11,204

-------------------------------------------------------------------

8. Acquisitions

On 31 March 1998 the group acquired the entire share capital

of Watnall Refrigeration Limited for #0.4 million in cash.

Watnall, based in Nottingham, installed and serviced

commercial air-conditioning and hired portable air-

conditioning and heating units. These activities have been

integrated within Andrews Sykes' existing installation and

hire businesses.

On 3 June 1998 the group acquired the trade and assets of Cox

Plant Hire for approximately #49.6 million. Cox hires

general plant and temporary accommodation from 34 locations

throughout the UK and operates as a stand alone subsidiary

within the Andrews Sykes group.

On 15 June 1998 the group acquired the trade and assets of

the Aberdeen depot of Burnthills Plant Limited for #0.3

million and the freehold of the depot for #0.25 million.

Burnthills hired both general plant and tools and portable

heating and dehumidification equipment. The trade has been

split between these two activities, which are now operated

from the depot by Cox Plant Limited and Andrews Sykes Hire

Limited respectively. In the 11 months ended 28 February

1998 Burnthills Aberdeen had a turnover of #0.4 million and

profits before tax of #62,000.

9. Copies of the Interim Report and Financial Statements will be

circulated to Shareholders shortly and will be available from

the Registered office of the Company. Premier House,

Darlington Street, Wolverhampton, WV1 4JJ.

For further information please contact:

Eric Hook (Chief Executive) Tel: 0171 329 0096

Andrews Sykes Group Plc Tel: 01902 328700 - From Friday 2nd October

onwards

John Goold /Emily Bruning

Shandwick Consultants Ltd Tel: 0171 329 0096

END

IR AFLFLAEIIVAT

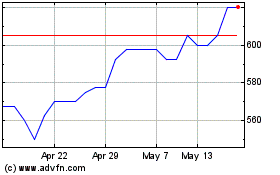

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jul 2023 to Jul 2024