RNS Number:7575R

Andrews Sykes Group PLC

29 September 2000

The following amendments have been made to the 'Interim Results' announcement

released at 07:05 today under RNS No 7485R.

Parts of the text of the announcement were duplicated. The duplications have

been removed.

In Note 5, the entry for 'Amortisation of goodwill as set out in note 4' for the

53 weeks to 1 January 2000 should read 434 and not 4.

All other details remain unchanged. The full corrected text is shown below.

ANDREWS SYKES GROUP PLC

INTERIM RESULTS FOR THE 26 WEEKS TO 1 JULY 2000

Chairman's Statement

I am able to report a satisfactory start to trading results for the year

2000. The salient points of the accounts for the six months ended 1

July 2000 are as follows:

#000

Group operating profit before exceptional 6,574

items and goodwill amortisation increased

by #763,000 to

EBITDA remained virtually unchanged at 11,943

Group operating profit decreased by 3,357

#421,000 to

Profit before tax remained virtually 2,166

unchanged at

Net cash inflow from operating activities

increased by #3,495,000 to 11,607

Gearing reduced from 98.6% to 77.1%

Financial review

Our plans to focus on our core UK based hire business has shown early

progress with effective controls being implemented across the Group.

The decision has been taken to close both the small operations in Poland

and Singapore where we considered both the return on capital employed

and growth potential for the Group to be unsatisfactory. The closure

costs were not significant and have been fully absorbed in the reported

figures.

We continued to develop and implement sales focused strategies as

outlined in the 1999 report and accounts. Despite all management's

efforts the effect of the continuing downward pressure on general plant

hire prices during the period impaired the Group's ability both to

increase turnover and grow profits to the desired extent. Consequently

a further detailed financial review of Cox Plant Limited has been

carried out in accordance with FRS 11 which has led management to

reassess the carrying value for goodwill on the balance sheet. It was

the view of the Board that the value of goodwill was overstated by #3

million and therefore this has been written off in the half year accounts.

The above write off is a non cash item and therefore has had no effect

on the Group's ability to generate cash. I am pleased to be able to

report that the net cash inflow from operating activities has increased

by #3.5 million compared with the same period last year to #11.6

million. The Group's operating profit before exceptional items and

goodwill amortisation also showed a 13% improvement compared to the

previous year.

Whilst the air conditioning hire and unit sales show an improvement

compared to the first half of 1999 they are still below the level

achieved in the same period in 1998 due to a relatively poor summer. In

particular the air conditioning business suffered from poor weather

related trading conditions in May and June after a promising period in

April.

Prospects

The poor summer continues to depress air conditioning hire into the

third quarter and as a result the outlook for the second half remains

cautious with efforts being directed at non-seasonal activity to

underpin the new strategies for the medium to long term.

Share buy back programme

During the period under review the company has purchased 1,575,000

shares for a total consideration of #876,000.

The Board continues to believe that shareholder value will be optimised

by a judicious purchase of our own shares, coupled with investment in

organic growth. In consequence the policy outlined previously will

continue.

J G Murray

Chairman

29 September 2000

For further information please contact:

Robert Stevens (Chief Executive) Telephone 01902 328 700

Andrews Sykes Group plc

Andrews Sykes Group plc

Group Profit and Loss Account

For the 26 weeks ended 1 July 2000

26 weeks to 26 weeks to 53 weeks to

1 July 2000 26 June 1999 1 January 2000

Total Total Total

#'000 #'000 #'000

Turnover 43,864 44,238 94,673

Cost of Sales (25,434) (26,393) (56,179)

Gross profit 18,430 17,845 38,494

Net operating expenses (15,073) (14,067) (26,819)

(previous periods include exceptional

items set out in note 3)

Group operating profit 3,357 3,778 11,675

EBITDA* 11,943 11,946 27,238

Depreciation and asset disposals (5,369) (6,135) (12,494)

Operating profit before exceptional items 6,574 5,811 14,744

and amortisation of goodwill

Exceptional items 0 (1,816) (2,635)

Amortisation of goodwill as set out in (3,217) (217) (434)

note 4

Group operating profit 3,357 3,778 11,675

Share of operating (loss)/profit of 0 (7) 0

associates

Income from other participating interests 0 0 135

Loss on the termination of overseas 0 0 (955)

operations

Net interest payable (1,191) (1,582) (2,857)

Profit on ordinary activities before tax 2,166 2,189 7,998

Tax on profit on ordinary activities (1,753) (737) (2,674)

Profit on ordinary activities after 413 1,452 5,324

taxation being profit for the financial

period

Dividends: Ordinary shares 0 (1,328) (1,326)

Convertible preference 0 (186) (220)

shares

Retained profit / (loss) for the period 413 (62) 3,778

Basic earnings per ordinary share 0.45 1.53 5.97

Fully diluted earnings per ordinary share 0.45 1.47 5.73

Exceptional items 0.00 2.11 2.96

Amortisation of goodwill 3.49 0.25 0.47

Adjusted fully diluted earnings per 3.94 3.83 9.16

ordinary share

Dividends per share: Preference 0.00 3.50 3.50

Ordinary 0.00 1.44 1.44

There were no significant acquisitions or discontinued operations during

the period.

*Earnings Before Interest, Taxation, Depreciation and Amortisation

excluding exceptional items and goodwill amortisation.

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 1 July 2000

1 July 26 June 1 January

2000 1999 2000

#'000 #'000 #'000

Fixed assets

Intangible assets 4,201 7,635 7,418

Tangible assets 32,252 39,057 35,164

Investments 773 578 622

37,226 47,270 43,204

Current assets

Stocks 6,950 8,165 7,829

Debtors 22,960 24,374 24,920

Cash at bank and in hand 6,848 5,543 3,764

36,758 38,082 36,513

Creditors falling due within one year

Loans and overdrafts (6,700) (7,500) (7,673)

Other creditors and provisions (11,742) (19,192) (14,963)

Deferred consideration 0 (600) 0

Corporation and overseas tax (2,382) (2,728) (1,518)

Net current assets 15,934 8,062 12,359

Total assets less current liabilities 53,160 55,332 55,563

Creditors falling due after more than one year

Loans (22,300) (29,453) (24,750)

Other creditors and provisions (1,446) (1,203) (1,555)

Corporation tax (515) (80) 0

Net assets 28,899 24,596 29,258

Capital and reserves

Called up share capital 18,129 19,737 18,443

Share premium account 10,399 8,168 10,394

Revaluation reserve 770 776 773

Other reserves 601 284 280

Profit and loss account (1,010) (4,379) (642)

28,889 24,586 29,248

Shareholders' funds

Equity 28,889 21,402 29,248

Non equity 0 3,184 0

28,889 24,586 29,248

Minority Interests (equity) 10 10 10

28,899 24,596 29,258

Analysis of net debt

Cash at bank and in hand 6,848 5,543 3,764

Deferred consideration 0 (600) 0

Total loans, overdrafts and finance lease (29,126) (37,179) (32,612)

obligations

Net debt (22,278) (32,236) (28,848)

Net debt as a percentage of a 77.1% 131.1% 98.6%

shareholders' funds

Andrews Sykes Group plc

Consolidated cash flow statement

For the 26 weeks ended 1 July 2000

26 weeks to 26 weeks to 53 weeks to

1 July 2000 26 June 1999 1 January 2000

#'000 #'000 #'000

Net cash inflow from operating activities 11,607 8,112 19,469

Returns on investments and servicing of

finance

Net interest paid (1,108) (1,975) (3,213)

Preference dividends paid 0 (223) (257)

Interest element of finance lease (4) (15) (9)

payments

Net cash outflow for returns on (1,112) (2,213) (3,479)

investments and servicing

of finance

Cash outflow for taxation (442) (1,095) (4,408)

Capital expenditure

Purchase of tangible fixed assets (3,413) (1,853) (4,677)

Purchase of shares held in ESOP (151) (70) (458)

Sale of tangible fixed assets 884 871 1,175

Net cash outflow for capital expenditure (2,680) (1,052) (3,960)

Acquisitions

Payment of deferred consideration on 0 (6,500) (6,500)

previous acquisitions

Net cash outflow for acquisitions 0 (6,500) (6,500)

Equity dividends paid 0 (1,987) (3,297)

Cash inflow/(outflow) before the use of

liquid resources and financing 7,373 (4,735) (2,175)

Management of liquid resources

Movement in bank deposits 189 (313) 575

Financing

Issue of ordinary share capital net of 6 0 932

issue costs

New loan draw downs and factoring 0 3,900 4,400

advances

Loan repayments (3,423) (3,673) (9,303)

Net capital element of finance lease (63) (91) (140)

payments

Purchase of own shares (876) (17) (16)

Net cash (outflow) / inflow from (4,356) 119 (4,127)

financing

Increase/(decrease) in cash in the period 3,206 (4,929) (5,727)

Andrews Sykes Group plc

Notes to the accounts

For the 26 weeks ended 1 July 2000

1. The interim report for the 26 weeks ended 1 July 2000 was approved by

the board on 29 September 2000. The financial information contained in

this interim report does not constitute statutory accounts for the Group

for the relevant periods. The interim report is unaudited but has been

reviewed by the auditors. The results for the 53 weeks ended 1 January

2000 have been extracted from the audited financial statements that have

been filed with the Registrar of Companies. The report of the auditors was

unqualified and did not contain a statement under section 237(2) or (3) of

the Companies Act 1985.

2. Segmental analysis

The Group's turnover may be analysed between the following

principal products and activities:

26 weeks to 26 weeks to 53 weeks to

1 July 2000 26 June 1999 1 January 2000

Total Total Total

#'000 #'000 #'000

Product group:

Pumps 9,896 12,085 22,375

Heating and ventilation 5,266 4,700 9,130

Air-conditioning 9,153 7,952 21,578

General plant 14,799 14,640 31,306

Other 4,750 4,861 10,284

Total 43,864 44,238 94,673

Activity:

Hire 29,956 28,076 59,766

Sales 7,877 10,792 19,825

Installation 6,031 5,370 15,082

Total 43,864 44,238 94,673

The geographical analysis of the Group's

turnover was as follows:

26 weeks to 26 weeks to 53 weeks to

1 July 2000 26 June 1999 1 January 2000

Total Total Total

#'000 #'000 #'000

United Kingdom 41,590 39,826 86,907

Rest of Europe 851 1,206 2,678

Middle East and Africa 1,283 1,938 3,490

The Americas 0 436 639

Rest of the World 140 832 959

43,864 44,238 94,673

The results can be further analysed by class of business:

Turnover Profit Exceptionals Group Net

before & goodwill operating assets

exceptionals profit

& goodwill

#'000 #'000 #'000 #'000 #'000

26 weeks ended

1 July 2000:

Pumps, heating, 29,065 5,700 (7) 5,693 20,619

ventilation, air-

conditioning & other

General plant 14,799 874 (3,210) (2,336) 8,280

43,864 6,574 (3,217) 3,357 28,899

26 weeks ended

26 June 1999:

Pumps, heating, 29,598 4,368 (1,823) 2,545 12,721

ventilation, air-

conditioning & other

General plant 14,640 1,443 (210) 1,233 11,875

44,238 5,811 (2,033) 3,778 24,596

53 weeks ended

1 January 2000:

Pumps, heating, 63,367 12,018 (3,604) 8,414 17,472

ventilation, air-

conditioning & other

General plant 31,306 2,861 (420) 2,441 11,786

94,673 14,879 (4,024) 10,855 29,258

3. Exceptional items 26 weeks to 26 weeks to 53 weeks to

1 July 26 June 1 January

2000 1999 2000

Total Total Total

#'000 #'000 #'000

Sterling contractual 0 (1,432) (1,440)

settlement costs

Redundancy and 0 (217) (1,014)

reorganisation

Abortive costs 0 (167) (181)

0 (1,816) (2,635)

Loss on the termination of 0 0 (955)

overseas operations

0 (1,816) (3,590)

Under agreements entered into in 1989, Sterling Fluid Products Limited ("SFP")

manufactured Sykes Pumps for the group. The agreements, which contained a

minimum annual purchase obligation, were terminated in 1995 and SFP claimed

#4.9 million in settlement plus additional interest and costs. The dispute

was settled out of court last year with a total payment to SFP of #3 million

and has re-established the exclusive rights which had been granted to SFP by

Andrews Sykes' previous management to use the Sykes Pumps name in the USA,

Iran, Iraq, and the sole right to market Sykes Pumps in those territories.

The settlement gave rise to the above exceptional charge last year after

provisions made in prior years and is inclusive of costs.

4. Amortisation of goodwill 26 weeks 26 weeks 53 weeks to

to 1 July to 26 June 1 January

2000 1999 2000

Total Total Total

#'000 #'000 #'000

Ordinary goodwill (217) (217) (434)

amortisation charge

Charge arising from (3,000) 0 0

impairment review

(3,217) (217) (434)

During the period and in accordance with FRS 11 the directors have performed

an impairment review of the carrying value of goodwill attributable to Cox

Plant Limited at 1 July 2000. The above #3 million charge arises from this

review.

Amortisation of goodwill is not an allowable item when computing the Company's

taxable profits. Therefore this has resulted in a high effective tax rate for

the 26 weeks to 1 July 2000.

5. Reconciliation of operating profit to net cash inflow from operating

activities

26 weeks to 26 weeks to 53 weeks to

1 July 26 June 1 January

2000 1999 2000

Total Total Total

#'000 #'000 #'000

Operating profit 3,357 3,778 11,675

Amortisation of goodwill as set 3,217 217 434

out in note 4

Depreciation 5,797 6,156 12,660

Profit on sale of fixed (428) (21) (166)

assets

Decrease in stocks 879 1,227 1,563

Decrease/(increase) in 1,993 (952) (1,625)

debtors

Decrease in creditors and (3,208) (2,293) (5,072)

provisions

Net cash inflow from 11,607 8,112 19,469

operating activities

6. Earnings per share

The basic figures have been calculated by reference to the weighted average

number of 20p ordinary shares in issue during the period of 91,449,890 (26

weeks ended 26 June 1999: 82,766,023) after adjusting for the bonus element of

the open offer. The earnings are the Group's profit after taxation and

preference dividends.

The calculation of the diluted earnings per ordinary share is based on diluted

earnings of #413,000 (26 weeks ended 26 June 1999: #1,266,000) and on

92,231,636 (26 weeks ended 26 June 1999: 86,118,661) ordinary shares

calculated as follows:

26 weeks to 1 July 2000 26 weeks to 26 June 1999

Earnings No. of Earnings No. of

#'000 shares #'000 shares

Basic earnings/weighted

average number 413 91,449,890 1,266 82,766,023

of shares

Weighted average number of 1,245,000 5,311,518

shares under option

Number of shares that (463,254) (1,958,880)

would have been issued have

been issued at fair value

Dividend saving/weighted 0 0 0 0

average number of ordinary

shares arising on the

conversion of the preference

shares

Diluted earnings/weighted 413 92,231,636 1,266 86,118,661

average number of shares

Diluted earnings per ordinary share 0.45p 1.47p

No account has been taken on the conversion of the preference shares in the

six months ended 26 June 1999 as the conversion was not dilutive.

The adjusted earnings per share excluding goodwill amortisation and

exceptional items is based upon the weighted average number of ordinary shares

as set out in the table above. The earnings can be reconciled to the diluted

earnings as follows:

26 weeks to 26 weeks to

1 July 2000 26 June 1999

Total Total

#'000 #'000

Diluted earnings 413 1,266

Goodwill amortisation 3,217 217

Net exceptional charge 0 1,816

Adjusted diluted earnings 3,630 3,299

Adjusted diluted earnings per ordinary share 3.94p 3.83p

(pence)

7.Consolidated statement of total recognised gains and losses

26 weeks to 26 weeks to 53 weeks to

1 July 2000 26 June 1999 1 January 2000

Total Total Total

#'000 #'000 #'000

Profit for the financial period 413 1,452 5,324

Currency translation differences on 98 14 (97)

foreign currency net investments

Total gains and losses in the period 511 1,466 5,227

8. Reconciliation of movements in group shareholders' funds

26 weeks to 26 weeks to 53 weeks to

1 July 2000 26 June 1999 1 January 2000

Total Total Total

#'000 #'000 #'000

Profit for the financial period 413 1,452 5,324

Dividends 0 (1,514) (1,546)

Other recognised gains and losses 98 14 (97)

Proceeds from ordinary shares issued 6 0 932

Consideration for the purchase (876) (17) (16)

of own shares

Net (decrease)/increase in (359) (65) 4,597

shareholders' funds

Shareholders' funds at the 29,248 24,651 24,651

beginning of the period

Shareholders' funds at the 28,889 24,586 29,248

end of the period

9. A copy of this statement will be posted to all shareholders and is

available from the Company's registered office at Premier House,

Darlington Street, Wolverhampton, WV1 4JJ.

KPMG Audit Plc

2 Cornwall Street

Birmingham

B3 2DL

INDEPENDENT REVIEW BY KPMG AUDIT PLC TO ANDREWS SYKES GROUP PLC

Introduction

We have been instructed by the company to review the interim financial

information and we have read the other information contained in the

interim report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial

information.

Directors' responsibilities

The interim report, including the financial information contained

therein, is the responsibility of, and has been approved by, the

directors. The Listing Rules of the Financial Services Authority

require that the accounting policies and presentation applied to the

interim figures should be consistent with those applied in preparing the

preceding annual accounts except where they are to be changed in the

next annual accounts in which case any changes, and the reasons for

them, are to be disclosed.

Review work performed

We conducted our review in accordance with guidance contained in

Bulletin 1999/4: Review of interim financial information issued by the

Auditing Practices Board. A review consists principally of making

enquiries of group management and applying analytical procedures to the

financial information and underlying financial data and, based thereon,

assessing whether the accounting policies and presentation have been

consistently applied unless otherwise disclosed. A review is

substantially less in scope than an audit performed in accordance with

Auditing Standards and therefore provides a lower level of assurance

than an audit. Accordingly we do not express an audit opinion on the

financial information.

Review conclusion

On the basis of our review we are not aware of any material

modifications that should be made to the financial information as

presented for the 26 weeks ended 1 July 2000.

KPMG Audit Plc 29 September 2000

Chartered Accountants

Registered Auditor

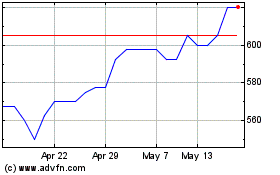

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jul 2023 to Jul 2024