RNS Number:3989P

Andrews Sykes Group PLC

28 July 2005

Andrews Sykes Group PLC ('The Company')

28 July 2005

Tender Offer

The Company announces it has today issued a circular to shareholders setting out

details of a proposed tender offer of up to approximately #25 million. What

follows is an unedited extract of Part I of this circular entitled 'Letter

from the Senior Independent Non-Executive Director'.

Definitions used in this announcement have the same meanings given in the

circular sent to Shareholders dated 28 July 2005 setting out the formal terms

and conditions of the Tender Offer.

Part I

LETTER FROM THE SENIOR INDEPENDENT NON-EXECUTIVE DIRECTOR

Andrews Sykes Group plc

(Registered in England No 175912)

Directors: Registered Office:

Jacques Gaston Murray (Chairman) Premier House

Robert John Stevens (Chief Executive Director) Darlington Street

Anthony Alexander Bourne (Finance Director) Wolverhampton

Francis Michael Benjamin Gailer (Senior Independent Non Executive Director) WV1 4JJ

Jean-Christophe Francois Georges Pillois (Non-Executive Director)

Richard John Pollard (Non-Executive Director)

Emmanuel David Oliver Adrien Sebag (Non-Executive Director)

Date: 28 July 2005

To Shareholders and, for information only, to the holders of options granted

under the Share Option Scheme.

Dear Shareholder

Tender Offer for up to 14,015,360 Ordinary Shares at 177.5p per Ordinary Share

and Capital Reduction

Introduction

As referred to in the announcement of the sale of the accommodation hire

subsidiary on 9 May 2005, your Board has been examining ways of returning value

to Shareholders. Your Board is pleased to announce that it now proposes, subject

to the Company receiving the approval of the Capital Reduction by the

Shareholders and confirmation of the same by the High Court, to return to

Shareholders by way of a Tender Offer up to approximately #25 million. Subject

to the consent of Shareholders and the terms of the Tender Offer, your Board

intends that each Shareholder be given the opportunity to sell to Brewin

Dolphin, Ordinary Shares held by him/her on the Record Date at a price of 177.5p

per Ordinary Share. These Ordinary Shares will then be sold by way of an

on-market transaction by Brewin Dolphin to the Company, for cancellation at the

Tender Price.

The Tender Offer requires the consent of Shareholders in the first instance. The

Company does not have sufficient distributable reserves to effect the Tender

Offer and therefore it is conditional on the Capital Reduction being implemented

so that the Company's balance sheet is reconstructed to allow the Tender Offer

to be completed. The Capital Reduction requires not only the approval of

Shareholders but also confirmation of the High Court.

The Board believes that a tender offer is an appropriate means of returning

funds to Shareholders as (subject to the provisions relating to certain Overseas

Shareholders set out in Part III of this document) it gives all Shareholders the

choice of whether or not to participate in the return of capital. Shareholders

may opt to tender none or all of their Basic Entitlement and, to the extent

their shareholding is in excess of 150 Ordinary Shares up to their Maximum

Entitlement, in return for cash, or they may choose to retain their Ordinary

Shares and thereby increase their percentage of the Company's issued share

capital in the event that the Tender Offer is completed successfully.

The purpose of this letter is to seek your approval to grant authority to

implement the Capital Reduction and the Tender Offer at the EGM convened to take

place on 24 August 2005, notice of which is set out at the end of this document.

Background to and reasons for the Tender Offer

The results of the Company for the 53 weeks ended 31 December 2004, set out in

the Report and Accounts of the Company sent to shareholders on 5 May 2005, show

that, as at that date, the Group had cash of #9.3 million (2003: #11.3m) and

total indebtedness of #12.2 million (2003: #16.0m). Interest cover

(pre-exceptional items) for 2004 was 27 times and total debt servicing costs

(interest plus repayments of principal) were covered 4.0 times by operating cash

flow.

Trading in the first half of 2005 has been difficult across the Group's UK

operations and both sales and profits are expected to be significantly down on

the comparable period of 2004. Further information on trading is set out in the

section headed ''Current Trading and Prospects'' below. Nevertheless, the Group

has continued to generate cash and, as referred to above, has successfully

disposed of its accommodation hire subsidiary during the first half of 2005 for

approximately #10 million. As a result, at 2nd July 2005 the Group had cash of

#12.3 million, after the payment of the 2004 final dividend of #8.1 million. Net

cash after borrowings amounted to #1.3 million.

For some time now the economy has been relatively stable in the UK with moderate

levels of interest rates which we expect to continue for the foreseeable future.

One consequence of this, is that cash generative, profitable companies such as

Andrews Sykes, are able to secure term bank funding at attractive rates in order

to return capital to shareholders and, thereby, enhance total shareholder

return.

The Tender Offer, if fully taken-up, will result in pro-forma total indebtedness

at 2 July 2005 increasing to #30 million. New loan facilities have been agreed

for, in aggregate, #30 million with Royal Bank of Scotland, repayable over a

period of 5 years. These new facilities replace the existing loan facilities of

#11 million. Your Directors have prepared and reviewed cash flow projections for

the Group on the basis that the Tender Offer is fully taken up by shareholders

and concluded that the Group still retains adequate levels of interest and debt

servicing cover given the above comments on the Group's consistent cash

generation.

If the Tender Offer is fully taken up, earnings per share for the period ended

31 December 2004 would increase from 8.5p to 8.8p. However diluted earnings per

share adjusted to eliminate the amortisation of goodwill and exceptional items

would increase from 14.2p to 16.2p. The Directors consider the adjusted diluted

earnings per share to be a more meaningful measure of earnings per share as it

is more closely aligned to future cash generation of the Group.

Your Directors have considered various ways of returning cash to Shareholders

and concluded that the Tender Offer provides the greatest flexibility in that

Shareholders may choose to tender all, some, or none of his/her Ordinary Shares

subject to their Basic and Maximum Entitlements.

Capital Reduction - Explanation and Background

As explained, it is a condition of the Tender Offer that the Capital Reduction

is effected. This requires not only the approval of Shareholders but also

confirmation by the High Court. The Capital Reduction is required to create

sufficient distributable reserves so that the Company can purchase those

Ordinary Shares which are tendered to Brewin Dolphin pursuant to the Tender

Offer. In addition, the Capital Reduction is considered prudent to protect the

ability of the Company to pay dividends in the future.

Under the Act, the Company can, with the approval of the Shareholders given by

way of a special resolution and with the confirmation of the High Court, reduce

or cancel its share premium account, capital redemption reserve and 95 per cent.

of its issued share capital. Such a reduction or cancellation creates a reserve

which can, subject to the protection of creditors, be credited to the Company's

profit and loss account.

The share premium account of the Company, together with the capital redemption

reserve which amount to #10,677,577 and #7,309,003 respectively are to be

cancelled pursuant to the Capital Reduction. In addition, 19 pence of each

issued Ordinary Share of 20 pence is to be cancelled and the nominal value

reduced to 1p. In addition, the unissued share capital is to be sub-divided so

that each Ordinary Share of 20 pence nominal value is to be sub-divided into 20

Ordinary Shares of 1p each.

As soon as practicable after the EGM, and subject to the Resolution having been

approved by Shareholders, the Company will petition the High Court for an order

to confirm the Capital Reduction. The High Court is likely to require that the

Company take appropriate steps for the protection of creditors of the Company.

These steps are likely to include certain creditors consenting to the Capital

Reduction and the balance being protected by the use of blocked bank accounts

and/or bank guarantees. However, provided the creditors are protected, it is

likely that the Company will be permitted to implement the Tender Offer.

The Capital Reduction, as such, will not involve any distribution or repayment

of capital or share premium by the Company other than pursuant to the Tender

Offer, and will not reduce the underlying net assets of the Company. Its

principal effect will be to increase distributable reserves so that the Company

will be able to fulfil any obligations to acquire shares pursuant to the Tender

Offer. The Capital Reduction does not affect the Shareholders' voting or

dividend rights or rights on any return of capital to Shareholders.

You will find set out at the end of this document a notice of EGM including a

resolution to approve the Capital Reduction and the Tender Offer. If the Capital

Reduction is approved by the requisite majority, the Company shall apply to the

High Court for confirmation of the Capital Reduction following the EGM. If the

High Court makes the order sought, the Company will proceed as quickly as

reasonably possible to implement the Capital Reduction by registering the court

order with the Registrar of Companies. It is expected that following the EGM the

Capital Reduction, including receipt of confirmation from the High Court, will

take between six and eight weeks to complete.

As a consequence of the Capital Reduction it is necessary for the Company to

amend its borrowing restrictions contained in the articles of association of the

Company. The current articles of association of the Company permit the Company

to borrow up to the lesser of #50,000,000 and three times the adjusted capital

and reserves of the Company. The Directors propose to amend the restriction so

that the limit is the greater of these two figures. The required amendment is

contained in the Notice of EGM.

The Directors are also seeking the authorisation of Shareholders to allot Shares

generally and up to a number of Shares representing approximately 5 per cent. of

the Company's issued share capital without pre-emption rights applying and the

required approvals required under sections 80 and 95 of the Act are contained in

the Notice of EGM. Notwithstanding the similar resolutions approved at the

annual general meeting of the Company held on 8 June 2005 this part of the

Resolution is intended to reflect the adjusted share capital post-completion of

the Capital Reduction and will supersede the resolutions passed at the annual

general meeting.

Tender Offer

The Tender Offer is conditional on the passing of the Resolution and, in view of

the Capital Reduction, Court confirmation as well. The Tender Offer is only

available to Qualifying Shareholders on the Register at the close of business on

13 September 2005 and in respect of Ordinary Shares held by them on that date.

The Tender Offer is conditional on the matters set out in paragraph 2 of Part II

of this document and the Tender Offer may be terminated on or before the Closing

Date in the circumstances set out in paragraph 4 of Part II of this document.

The terms of the Tender Offer are set out in the letter from Brewin Dolphin

contained in Part II of this document and in the Tender Form and are summarised

as follows:

*the Tender Offer will require in respect of the Capital Reduction:

(a) approval by Shareholders at the EGM; and

(b) confirmation by the High Court;

*all Qualifying Shareholders are being given the opportunity to participate in

the Tender Offer;

*Brewin Dolphin will purchase as principal up to 14,015,360 Ordinary Shares for

a total aggregate consideration of up to #25 million;

*Ordinary Shares will be purchased by way of an on-market transaction from

Qualifying Shareholders by Brewin Dolphin at the Tender Price of 177.5p per

Ordinary Share following which an equal number of Ordinary Shares will be sold

by way of an on-market transaction by Brewin Dolphin to the Company, for

cancellation, at the Tender Price;

*Qualifying Shareholders who wish to participate in the Tender Offer must return

a completed Tender Form to be received by the Receiving Agent by no later than

5.00 pm on 13 September 2005;

*Qualifying Shareholders do not have to tender any Ordinary Shares if they do

not wish to do so;

*subject to the Tender Offer becoming unconditional, tenders from Qualifying

Shareholders will be accepted to the extent a Qualifying Shareholder validly

tenders his/her Basic Entitlement and, to the extent their shareholding is in

excess of 150 Shares, up to his/her Maximum Entitlement as at the Record Date;

*Brewin Dolphin will not charge Qualifying Shareholders commission or dealing

charges on any Ordinary Shares purchased pursuant to the Tender Offer;

*the Tender Offer opens on 28 July 2005 and closes at 5.00 pm on 13 September

2005 unless extended in accordance with paragraph 6 of Part II of this document;

*Tender Forms will become irrevocable at the time of receipt by the Receiving

Agent; and

*all transactions will be carried out on the London Stock Exchange.

It is proposed that Ordinary Shares will be purchased under the Tender Offer at

a price of 177.5p per Ordinary Share which was the price of an Ordinary Share at

the close of business on 22 July 2005, the latest practicable date prior to the

publication of this document.

Taxation

A summary of the taxation consequences of the Tender Offer for UK resident

Qualifying Shareholders is set out in paragraph 7 of Part II of this document.

The information is intended only as a general guide to the current law and

practice in the UK.

UK tax resident Qualifying Shareholders are advised to consult their own

professional advisers regarding their own tax position without delay. All

Overseas Shareholders who are Qualifying Shareholders should consult their own

tax advisers as to the possible tax consequences to them of participating in the

Tender Offer.

Overseas Shareholders

The attention of all Overseas Shareholders is drawn to the section entitled

''Information for Overseas Shareholders'' set out in paragraph C of Part III of

this document and the relevant provisions of the Tender Form.

It is the responsibility of all Overseas Shareholders to satisfy themselves as

to the observance of any legal requirements in their jurisdiction, including,

without limitation, any relevant requirements in relation to the ability of such

Overseas Shareholders to complete and return a Tender Form and Form of Proxy.

Current Trading and Prospects

As referred to above, trading from continuing activities has been difficult

across the UK operations of the Group during the first half of 2005, due to a

competitive market and low demand caused by the unfavourable weather conditions

of a mild, dry winter.

The interim results in full are due to be announced at the end of September and

will show a decline in sales of around 12 per cent. to approximately #24.4

million and a decline in recurring EBIT of approximately #2.0 million from #5.6

million to #3.6 million over the same period in 2004 (after adjusting for #0.5

million non recurring items in the prior year).

This period of comparatively poor trading appears to have ended in May. The

operating results for June 2005 are slightly ahead of 2004 (after adjusting for

non recurring items in the prior year) and trading in the month of July, to the

date of this document, shows a substantial improvement over the same period in

the prior year. Overall, these early signs of recovery lead the Directors to

believe that the prospects for the second half are much improved over the first

half results if the warm weather continues.

Dividend Policy

The Board intends to review its dividend policy next at the time of the

announcement of the preliminary results for the financial period ending 31

December 2005 at which point it will communicate its decision to Shareholders.

Any decision on dividend will be based on: the ongoing operating performance of

the Group; its financing obligations following the Tender Offer; and any other

investment opportunities available to the Group from retained funds.

City Code

The Tender Offer gives rise to certain considerations under the City Code. Brief

details of the Panel, the City Code and the protections they afford to

Shareholders are described in paragraph E of Part III.

Extraordinary General Meeting

The implementation of the Tender Offer, which, for this purpose, includes the

Capital Reduction, is subject to the approval of Shareholders at the

Extraordinary General Meeting.

At the EGM the approval of Shareholders will be sought to approve the Capital

Reduction, authorise the on-market purchase by the Company from Brewin Dolphin

of up to 14,015,360 Ordinary Shares representing 24.2 per cent. of the Company's

Ordinary Share capital in issue as at 27 July 2005 (the latest practicable date

prior to the posting of this document) at the Tender Price, to approve a change

to the fixed borrowing limit of the Company as contained in its articles of

association and to grant the Directors power to allot Shares without pre-emption

applying.

As the resolutions relating to the Capital Reduction and the Tender Offer are

inter-conditional, there will only be one resolution put to Shareholders which

is a special resolution and requires the approval of 75 per cent. of the

Shareholders voting at the EGM, or on a poll, 75 per cent. of the votes cast.

Action to be taken

(a) Extraordinary General Meeting

You will find set out at the end of this document a notice convening the EGM to

be held at 10 Bruton Street, London W1J 6PX convened for 10.30 am on 24 August

2005 at which the Resolution will be proposed to approve the Capital Reduction

(including associated matters) and, subject to and conditional upon the Capital

Reduction being approved by Shareholders and confirmed by the Court, to grant

authority to the Company in accordance with the provisions of the Act to

purchase its own Ordinary Shares.

A reply-paid Form of Proxy is enclosed. Whether or not you wish to tender any of

your Ordinary Shares and regardless of whether or not you intend to be present

at the Extraordinary General Meeting you are requested to complete the Form of

Proxy in accordance with the instructions printed on it and to return it to the

Company's registrars, Lloyds TSB Registrars, The Causeway, Worthing, West

Sussex, BN99 6DA as soon as possible and, in any event, so that it is received

no later than 10.30 am on 22 August 2005. The completion and return of a Form of

Proxy will not preclude you from attending the EGM and voting in person if you

wish to do so.

(b) To complete the Tender Form

Qualifying Shareholders who wish to tender their Ordinary Shares in respect of

their Basic Entitlement and, if applicable, up to their Maximum Entitlement

should complete the Tender Form in accordance with the instructions printed on

it and in Part II of this document and return it either by post in the

accompanying reply-paid envelope (for use in the UK only) or by hand (during

normal business hours only) to Lloyds TSB Registrars, 3rd Floor, Princess House,

1 Suffolk Lane, London EC4R 0AX as soon as possible, but in any event so as to

arrive no later than 5.00 pm on 13 September 2005.

Qualifying Shareholders who hold their Ordinary Shares in certificated form

should also return with the Tender Form their share certificate(s) in respect of

the Ordinary Shares tendered.

Qualifying Shareholders who hold their Ordinary Shares in uncertificated form

should also transfer the relevant Ordinary Shares to an escrow balance as

described in Part II of this document and in the Tender Form.

Qualifying Shareholders who do not wish to sell any Ordinary Shares under the

Tender Offer need take no action in relation to the Tender Form. However, it is

important that Shareholders, whether or not they intend to participate in the

Tender Offer, return the completed Form of Proxy.

COMPLETED TENDER FORMS MUST BE RECEIVED BY NO LATER THAN 5.00 PM ON 13 SEPTEMBER

2005.

Further details as to the procedures for tendering and settlement are set out in

Parts II and III of this document and on the Tender Form.

Directors' Intentions

Mr J. G. Murray, Chairman, has irrevocably undertaken to procure that the

shareholders in the Company, over which he exercises control, vote in favour of

the Resolution and tender for their Maximum Entitlement in respect of in

aggregate 47,992,980 Ordinary Shares under the Tender Offer. All other Directors

who are interested in Ordinary Shares have irrevocably undertaken to vote in

favour of the Resolution and tender for their Maximum Entitlement in respect of

in aggregate 616,666 Ordinary Shares under the Tender Offer. Certain members of

Mr J. G. Murray's family have given irrevocable undertakings to vote in favour

of the Resolution and tender for their Maximum Entitlement in respect of in

aggregate 2,152,797 Ordinary Shares under the Tender Offer.

Further Information

Your attention is also drawn to the additional information set out in Parts II,

III and IV of this document and the Tender Form.

Recommendation

As described in the section headed ''Tender Offer'' above, the Directors believe

that the Tender Offer and the immediate purchase by the Company from Brewin

Dolphin of the tendered Ordinary Shares for cancellation, offers Shareholders an

excellent opportunity to realise all or part of their investment in the Company

(depending on the size of their holdings).

The Directors believe that the proposed Tender Offer and purchase by the Company

of its Ordinary Shares from Brewin Dolphin is in the best interests of the

Company and Shareholders as a whole. Accordingly the Board unanimously

recommends Shareholders to vote in favour of the Resolution, as the Directors

have undertaken to do so in respect of their own beneficial and non-beneficial

Ordinary Shares totalling in aggregate 50,224,858 Ordinary Shares (representing

approximately 86.6 per cent. of the issued share capital of the Company).

The Board is making no recommendation to Qualifying Shareholders in relation to

participation in the Tender Offer itself. Whether or not Qualifying Shareholders

decide to tender their Ordinary Shares will depend, amongst other things, on

their view of the Company's prospects and their own individual circumstances,

including their tax position. Qualifying Shareholders are recommended to consult

a duly authorised independent financial adviser and make their own decision.

Yours faithfully

Francis Michael Benjamin Gailer

Senior Independent Non-Executive Director

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2005

Opening of Tender Offer 28 July

Latest time and date for receipt of Forms of Proxy for the Extraordinary General Meeting 10.30 am on 22

August

Extraordinary General Meeting 10.30 am on 24

August

Latest time and date for receipt of Tender Forms 5 pm on 13

September

Record Date for Tender Offer 13 September

Expected date for the court hearing of the petition to confirm the Capital Reduction 14 September

Expected date on which Capital Reduction becomes effective 15 September

Expected date of announcement of take-up level under the Tender Offer and related details 15 September

Expected date of payment of Tender Offer consideration in respect of sold certificated Ordinary Shares 26 September

and payments made through CREST for Tender Offer consideration in respect of sold uncertificated

Ordinary Shares

Expected date of despatch of balance share certificates in respect of any unsold certificated Ordinary 26 September

Shares and CREST accounts to be credited in respect of any unsold uncertificated Ordinary Shares

Enquiries:

Brewin Dolphin Securities

Andrew Kitchingman 0113 2410130

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

TENUBRWRVORBUAR

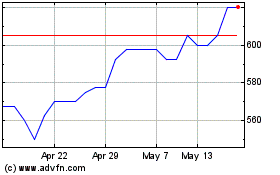

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Jul 2023 to Jul 2024