TIDMHMB

RNS Number : 8654U

Hambledon Mining PLC

06 December 2013

06 December 2013

Hambledon Mining plc

("Hambledon" or the "Company")

Strategic Review of Mining Operations

Hambledon Mining plc (AIM: HMB), the gold mining and development

company, today announces the results of its recent strategic review

and details of its long-term mine development plan.

Following completion of the strategic review and in light of the

operational improvements in the mining operations, the board of

directors of Hambledon (the "Board") believes that the Company's

prospects will be significantly improved by adopting a new

Sekisovskoye mine development plan which is designed to better

exploit existing infrastructure and the large resource base.

Key highlights

-- Significant increase in management's estimate of underground

resources from 1.8 million ounces

("Moz") to approximately 6 Moz of gold with average grade of

5.34 grammes per tonne ("g/t"),

using a 3 g/t cut-off grade. This revised estimate results from

an extensive underground drilling

programme of over 53,000 metres

o A full independent Competent Person's Report ("CPR") is

currently being prepared by

Venmyn Deloitte with publication expected in early 2014

o The existing processing plant, surface and underground

infrastructure together with an

underground operating transport decline combine to support a

robust economic case for

the expansion of underground mining operations

-- 22 year Life of Mine ("LOM") with robust economics and

projected to generate in the region of US$1

billion in free cash flow, according to management estimates

-- Expected gold production of 27,500 ounces ("oz") for the year

ended 31 December 2013 which is

forecast by management to increase to more than 100,000 oz per

year by 2017, a compound annual

growth rate of 35 per cent

-- Management's total LOM production cost forecast to be around

$560/oz of which the cash cost is

anticipated to be around $500/oz - underpins the economic

viability of the mine, even if gold prices

were to fall significantly

-- Estimated total remaining mine development capital

expenditure of approximately US$130 million,

with the bulk of spend forecast to occur over the next three

years. The majority of this capex is

forecast to be met through internally generated cash flow, with

the balance to be funded through a

combination of debt and, if appropriate, equity.

Aidar Assaubayev, CEO of Hambledon Mining, commented:

"Following a process that began a year ago, the Board and senior

management of Hambledon have developed a long-term plan with the

goal of becoming Central Asia's leading gold miner in terms of both

production and reserves."

Detailed summary of the strategic review and new mine

development plan

Update on Resource Estimate and CPR timing

Following an extensive underground diamond drilling program,

totalling over 53,000 metres, management has increased its internal

resource estimate from 1.8 Moz to approximately 6 Moz of gold with

an average gold grade of 5.34 g/t, using a 3 g/t cut-off grade. It

is expected that an independent CPR, scheduled for release in early

2014, will convert a significant portion of this internal resource

estimate into a JORC compliant resource category.

In total of 258 holes were drilled, comprising of:

-- 53,804 metres of underground exploration drilling from the +250mrl

-- Over 28,000 metres of underground exploration drilling is in

progress from the 0mrl level to -400mrl

The maximum depth of the zone tested was 870 metres and drilling

was generally conducted at intervals of 20 to 40 metres.

Capital Expenditure Budget

The Board has approved a capital expenditure budget of

approximately US$130 million for the underground mine development

over the life of mine. The key areas of capital spend are:

- Construction of two shafts to a depth of 1,000 metres

- Main ore-handling and ancillary equipment

- Commercial discovery bonus, contingency reserve, and increased working capital requirement

The peak of capital expenditures is scheduled to occur in

2014-2015, with shaft construction to be completed by 2016 and the

mine reaching its full design capacity by 2017. During the period

of shaft construction, underground mining will continue with the

existing transport decline used to deliver ore to surface.

Production Forecast

Production is forecast by management to increase from 22,470 oz

in 2012 to over 100,000 oz per annum by 2017, after completion of

the two shafts. Management is forecasting production for the year

ended 31 December 2013 to be approximately 27,500 oz.

The presence of existing surface and underground infrastructure,

a modern processing plant, operating transport decline, and a gold

grade of approximately 5.34 g/t, significantly enhances the project

economics.

Investor Presentation

An investor presentation which provides supplemental information

regarding our capital expenditure budget and our long-term mine

development plan, may be found on our website

http://www.hambledon-mining.com/ under the heading "Hambledon

Mining: Growing Central Asia Gold Producer" link.

Review by Qualified Person

Oleg Leonidovich Gorozhanin, senior consultant, has reviewed and

approved the technical information contained within this

announcement in his capacity as a qualified person under the AIM

Rules. Mr. Gorozhanin holds a Ph.D. in geological and mineralogical

sciences, is a member of the Association of Geological

Organizations, is a member of the Russian Academy of Science

(Geological and Mineralogical Division) and has over 40 years of

relevant mining industry experience.

Enquiries

Hambledon Mining Plc +44 (0) 207 932

Bogdan Poustovoi, CFA 2455

Strand Hanson (Nomad and Joint Broker)

Andrew Emmott

James Spinney +44 (0) 207 409

Ritchie Balmer 3494

+44 (0) 203 540

1720

Peat & Co. (Joint Broker) +44 (0) 203 540

John Beaumont, COO and Head of Research 1723

+44 (0) 207 138

Blythe Weigh Communications (Financial PR) 3204

Tim Blythe +44 (0) 7816 924626

Halimah Hussain +44 (0) 7725 978141

Camilla Horsfall +44 (0) 7817 841793

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGMMGZLKLGFZM

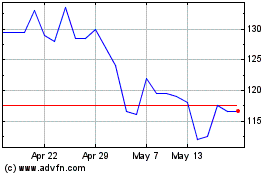

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Altyngold (LSE:ALTN)

Historical Stock Chart

From Jul 2023 to Jul 2024