TIDMAGTA

RNS Number : 7161P

Agriterra Ltd

29 October 2012

Agriterra Ltd / Ticker: AGTA / Index: AIM / Sector:

Agriculture

29 October 2012

Agriterra Ltd ('Agriterra' or 'the Company')

Operations Update, Unaudited financial results for the year

ended 31 May 2012 and Notice of Final Results

Agriterra Ltd, the AIM listed pan African agricultural company,

is pleased to announce that the Company's results for the year

ended 31 May 2012 will be released on 12 November 2012.

Agriterra continues to build its African focussed agricultural

and food production businesses in Mozambique and Sierra Leone, and

now has three revenue streams from beef, grain and cocoa. Revenues

are generated from Mozbife Limitada ('Mozbife') which conducts

cattle ranching, feedlot and abattoir operations, Desenvolvimento E

Comercialização Agricola Limitada ('DECA') and Compagri Limitada

('Compagri'), which operate maize farming and processing

businesses, and Tropical Farms Limited ('TFL'), which manages the

Group's cocoa sales, trading and farming activities.

During the year, the Group has invested heavily in expansion of

activities in line with its long term growth strategy. Mozbife's

current herd exceeds 4,800 cattle with 16,000 hectares of land

providing room for expansion. The herd is targeted to reach 6,000

by the end of 2012. The 48 billion litre dam at the Mavonde Stud

Ranch has been completed which has the capacity to irrigate 4,000

hectares and increases the head per hectare ration from 1.5 to 6.

The Group now has an 18 pen feedlot at Vanduzi with rolling

capacity of up to 3,000 head every 90 days, and over 700 hectares

planted for feed. The abattoir, with a 4,000 head per month

processing rate, has been completed and butchers shops are being

established to increase margin and complete the field to fork

model. DECA continues to operate at Chimoio and Tete with storage

capacity of 50,000 tonnes and processing of 60,000 tonnes per

annum. DECA and Compagri sold 21,717 tonnes of maize meal during

the year (2011: 28,822 tonnes), with lower volumes due to a very

strong harvest in 2011, which subsequently reduced demand for the

mealie meal product made by DECA and Compagri. However initial

contributions from the beef and cocoa operations resulted in

turnover for the Group increasing marginally to US$13.8 million

(2011: US$13.6 million). TFL's operations have expanded rapidly,

and there are now three main hubs and 41 satellite stores servicing

a direct buying register of 3,500 farmers. The company traded

approximately 1,250 tonnes of cocoa and 75 tonnes of coffee during

the year ended 31 May 2012. A 15 acre collateral management

facility is being developed in Freetown and plantations are being

secured. The on-ground team has been expanded significantly to

cater from the anticipated rise in revenues, which already exceed

US$3 million.

As a result of the progress and developments which reflect the

Company's investment strategy, the Company's will report an

approximate 55% increase in net asset value to US$38.5 million

(2011: US$24.8 million). During the period, investment in the

capital and operating infrastructure has been significant and the

Board believes it now has the foundation in place from which to

raise profitability and further enhance shareholder value. In

particular, after three years of developing its Mozambique ranching

operations, and the rapid implementation of an infrastructure for

TFL to enable higher volumes for trading and plantation

development, the Board believes that Agriterra is approaching the

point where it will soon be profitable on a sustainable basis. With

this in mind, the Company is reporting a pre-tax loss of

approximately US$6.9 million (2011: US$2.1 million) and turnover of

US$13.8 million (2011: US$13.5 million.). Importantly, and

reflecting the progress being made, trading for the first quarter

of the current financial year has been significantly higher than

the previous corresponding period.

With regards to cash, the Company recently announced that it had

signed an agreement to sell its legacy interest in the South Omo

Block to Marathon Oil Corp ('Marathon Oil'). Under the terms of the

agreement, the Company's 20% legacy interest in the South Omo Block

will be sold to Marathon Oil for a cash consideration of US$40

million on completion and a further US$10 million on Marathon Oil's

participation in a "Commercial Discovery". Additionally, the

Company is due payment of GBPGBP11.3 million, being partial

recompense for work already undertaken and the substantial

investment made by the Company on the Block Ba oil concession area

in South Sudan, during its previous incarnation as White Nile

Limited.

With such significant inflows of cash, the Company will be in a

strong position to accelerate its development programme, achieve

critical mass, invest in new projects and jurisdictions in order to

achieve its objective of becoming a significant pan-African

agricultural company.

Andrew Groves, Agriterra Chief Executive Officer said, "We

continue to make excellent progress building a long term

sustainable agricultural and food production business, and now have

three revenue streams from beef, grain and cocoa sales. Our

investment programme and expansion objectives will increase and

diversify these revenue streams significantly and improve margins

as we target profitability on a corporate level in the

mid-term.

"We also anticipate two significant cash injections in the near

future, firstly on completion of our agreement with Marathon Oil

which will provide the group with an additional US$40 million

before tax, followed by a compensation payment of GBP11.3 million

in relation to work completed at the Block Ba oil concession. The

dramatic cash injections will provide Agriterra with a very healthy

cash position which already underpins the valuation of the Company,

but will also enable the execution of our rapid growth

initiatives."

For further information please visit www.agriterra-ltd.com or

contact:

Andrew Groves Agriterra Ltd Tel: +44 (0) 20 7408

9200

Jonathan Wright Seymour Pierce Ltd Tel: +44 (0) 20 7107

8000

David Foreman Seymour Pierce Ltd Tel: +44 (0) 20 7107

8000

Andy Cuthill MC Peat & Co LLP Tel: +44 (0) 20 7104

2332

Susie Geliher St Brides Media & Finance Tel: +44 (0) 20 7236

Ltd 1177

The financial information for the year ended 31 May 2012 set out

below is unaudited and does not constitute the Company's statutory

accounts for the year ended 31 May 2012.

UNAUDITED CONSOLIDATED INCOME STATEMENT

For the year ended 31 May 2012

Year Year

ended ended

31 May 31 May

2012 2011

Continuing Operations Note $'000 $'000

----- ---------- ----------

Revenue 1 13,826 13,588

Cost of sales (11,913) (10,372)

Gross profit 1,913 3,216

Increase in value of biological

assets 400 214

Operating expenses (8,851) (6,109)

Other (expenses) / income (262) 349

Operating loss (6,800) (2,330)

Finance income 48 159

Finance costs (164) -

Loss before taxation (6,916) (2,171)

Income tax expense (26) (168)

Loss after tax (6,942) (2,339)

Discontinued operations

Profit / (loss) for the year 721 (89)

Loss for the year attributable

to owners of the parent (6,221) (2,428)

========== ==========

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 May 2012

2012 2011

Note $'000 $'000

------ ---------- ----------

ASSETS

Non-current assets

Intangible assets 963 271

Property, plant and equipment 26,243 13,264

Investments 9 -

Biological assets 1,642 631

Total non-current assets 28,857 14,166

---------- ----------

Current assets

Biological assets 1,018 157

Inventories 6,701 2,976

Trade and other receivables 3,628 2,039

Cash and cash equivalents 3,553 8,172

Total current assets 14,900 13,344

---------- ----------

TOTAL ASSETS 43,757 27,510

---------- ----------

LIABILITIES

Current liabilities

Trade and other payables (5,301) (2,678)

NET ASSETS 38,456 24,832

========== ==========

EQUITY

Issued capital 1,957 1,387

Share premium 148,530 131,593

Share based payment reserve 1,620 1,360

Translation reserve 296 (1,782)

Retained earnings (113,947) (107,726)

TOTAL EQUITY ATTRIBUTABLE TO

OWNERS OF THE PARENT 38,456 24,832

========== ==========

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 May 2012

Year ended Year ended

31 May 31 May

2012 2011

$'000 $'000

----------- -----------

Operating activities

Loss before tax (6,916) (2,171)

Adjustments for:

- Depreciation of property, plant

and equipment 1,877 1,228

- Loss on disposal of property, plant

and equipment 12 5

- Share based payment charge 100 -

- Increase in Biological assets (400) (214)

- Foreign exchange 150 (141)

- Net interest expense / (income) 116 (159)

Operating cash flow before movements in

working capital (5,061) (1,452)

Working capital adjustments:

- (Increase) / decrease in inventory (3,505) 1,973

- Increase in receivables (1,545) (547)

- (Decrease / increase in payables (690) 261

----------- -----------

Cash (used in) / from operations (10,801) 235

Finance charges (164) -

Interest received 48 159

Net cash (used in) / from continuing operating

activities (10,917) 394

Net cash from / (used in) discontinued

activities 721 (198)

----------- -----------

Net cash (used in) / from operating

activities (10,196) 196

----------- -----------

Taxation

Corporate tax paid (60) (38)

----------- -----------

Net cash outflow from taxation (60) (38)

----------- -----------

Investing activities

Purchase of intangible asset - (250)

Purchase of subsidiary net of debt (283) -

acquired

Purchase of property, plant and

equipment (7,575) (2,568)

Proceeds on sale of property, plant

and equipment 96 38

Purchase of biological assets (1,428) (255)

Proceeds on sale of investment in financial

assets - 128

----------- -----------

Net cash used in investing activities (9,190) (2,907)

Financing activities

Proceeds from issue of share capital 15,000 6,883

Share issue costs (610) (161)

Draw down of bank loan 123 -

Net cash from financing activities 14,513 6,722

----------- -----------

Net (decrease) / increase in cash and

cash equivalents (4,933) 3,973

Cash and cash equivalents at start

of the year 8,172 3,442

Exchange rate adjustment 314 757

Cash and cash equivalents at end

of the year 3,553 8,172

=========== ===========

1. Segment reporting

The directors consider that the Group's continuing activities

comprise the segments of grain processing, beef production and

cocoa businesses, and other unallocated expenditure in one

geographical segment, Africa.

Revenue represents sales to external customers in the country of

domicile of the group company making the sale.

Year ending 31 May Grain Beef Cocoa Unallocated Total

2012

$'000 $'000 $'000 $'000 $'000

-------- -------- ------ ------------ --------

Revenue 9,681 895 3,250 - 13,826

-------- -------- ------ ------------ --------

Segment results

- Operating loss (1,203) (2,310) (578) (2,709) (6,800)

- Interest (expense)

/ income (138) - - 22 (116)

-------- -------- ------ ------------ --------

Loss before tax (1,341) (2,310) (578) (2,687) (6,916)

-------- -------- ------ ------------ --------

Income tax (26) - - - (26)

-------- -------- ------ ------------ --------

Loss after tax (1,367) (2,310) (578) (2,687) (6,942)

======== ======== ====== ============ ========

Year ending 31 May Grain Beef Cocoa Unallocated Total

2011

============================= ======= ====== ====== ============ ========

$'000 $'000 $'000 $'000 $'000

============================= ------- ------ ------ ------------ --------

Revenue 13,533 55 - - 13,588

============================= ------- ------ ------ ------------ --------

Segment results

============================= ======= ====== ====== ============ ========

- Operating profit

/ (loss) 270 (958) - (1,642) (2,330)

============================= ======= ====== ====== ============ ========

- Interest income/(expense) 141 0 - 18 159

============================= ------- ------ ------ ------------ --------

Profit / (loss) before

tax 411 (958) - (1,624)

============================= ======= ====== ====== ============ ========

Income tax (168) - - - (168)

============================= ------- ------ ------ ------------ --------

Profit / (loss) after

tax 243 (958) - (1,624) (2,339)

============================= ======= ====== ====== ============ ========

The segment assets and liabilities at 31 May 2012 are as

follows:

Grain Beef Cocoa Unallocated Total

$'000 $'000 $'000 $'000 $'000

------- ------- ------ ------------ -------

Assets 17,934 12,410 2,633 10,780 43,757

Liabilities 595 35 154 4,517 5,301

The segment assets and liabilities at 31 May 2011 are as

follows:

Grain Beef Cocoa Unallocated Total

$'000 $'000 $'000 $'000 $'000

------- ------ ------ ------------ -------

Assets 17,648 5,112 - 4,750 27,510

Liabilities 532 124 - 2,022 2,678

**ENDS**

Notes

Agriterra Ltd is an AIM listed agricultural company with four

divisions: beef, maize, cocoa and palm oil. Its cattle ranching

business, Mozbife, has a herd in excess of 4,600 head, a land

holding of over 16,250 hectares, a feedlot and a 4,000 head per

month capacity abattoir. In addition to selling meat from its own

herds, throughput for the feedlot and abattoir will be supplemented

using cattle bought in from local communities.

The Company's maize buying and milling operations, DECA and

Compagri, are located in Chimoio and Tete in central and

north-western Mozambique respectively. These collect maize from

circa 350,000 farmers using the Company's own vehicle fleet,

process it into mealie meal, the African staple, and then sell it

back to the local market, into supermarkets and to the World Food

Programme.

Agriterra's cocoa business is based in Sierra Leone, through its

100% subsidiary Tropical Farms Limited, which is currently a buying

and trading operation, but provides an ideal conduit to branch out

into cocoa production in West Africa. Its strategy is to establish

itself as a secure, sustainable and traceable source of supply to

meet the requirements of the major cocoa consumers who are placing

increased emphasis in this area.

The Company has expanded its portfolio of agricultural products

through the addition of palm oil, and holds a lease over

approximately 45,000 hectares of brownfield agricultural land in an

area suitable for palm oil production in the Pujehun District in

the Southern Province of Sierra Leone. This area of Sierra Leone,

which is close to the Liberian border, receives one the highest

levels of rainfall in Sierra Leone, which in itself, receives some

of the highest rainfall globally. In addition, the lease area is

located on the equatorial belt, which is the most favourable

geographical location for palm oil production.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPGGPGUUPPPPR

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From May 2024 to Jun 2024

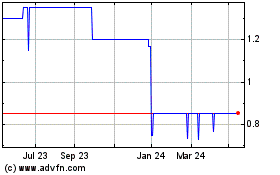

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Jun 2023 to Jun 2024