Agriterra Ltd Acknowledgment of £11,372,682 Compensation Award (0645E)

May 25 2012 - 2:00AM

UK Regulatory

TIDMAGTA

RNS Number : 0645E

Agriterra Ltd

25 May 2012

Agriterra Ltd / Ticker: AGTA / Index: AIM / Sector:

Agriculture

25 May 2012

Agriterra Ltd ('Agriterra' or 'the Company')

Acknowledgment of GBP11,372,682 Compensation Award to

Agriterra

Agriterra Ltd, the AIM listed pan African agricultural company,

is pleased to announce that following its instigation of

international arbitration proceedings, the Ministry of Petroleum

and Mining of the Republic of South Sudan ('the MPM') has

acknowledged in writing the Company's entitlement to receive a

compensation payment, as assessed by the country's National

Petroleum Commission ('NPC'), of GBP11,372,682 ('the

Compensation'). In the same communication, the MPM acknowledged

that compensation should have been paid much earlier and has

confirmed that it will be paid to the Company within one year.

The Compensation is acknowledged as being partial recompense for

the work undertaken and the substantial investment made by the

Company on the Block Ba oil concession area in Southern Sudan,

during its previous incarnation as White Nile Limited ('White

Nile'), an oil and gas exploration company. White Nile commenced

exploration work on Block Ba in 2005 and continued exploratory

activities prior to the NPC's decision to prohibit exploration work

in the area, in June 2007.

Whilst this recent communication from the MPM is a positive

development in the Company's efforts to achieve a resolution to

this long running matter, and arises from the Board's initiation of

international arbitration proceedings, the Company has now called

for a meeting with the relevant authorities in the Republic of

South Sudan in an effort to expedite payment of the

Compensation.

The Company also retains, as a legacy asset, a 20% interest in

the South Omo block in Ethiopia, which London listed Tullow Oil plc

('Tullow') and Africa Oil Corp have farmed into the development of.

Initial results announced by Tullow following drilling in Block

10BB in Kenya, which houses the same petroleum system as South Omo,

have been highly positive, increasing the prospectivity of the

South Omo Block. Should a discovery be made on the South Omo block,

Agriterra's 20% interest could prove to be significant for the

Company's shareholders and Agriterra looks forward to future

announcements from Tullow regarding this concession.

Agriterra CEO Andrew Groves said, "Our legacy oil assets are

continuing to look extremely promising, with the South Omo block

prominent in Tullow and Africa Oil east African exploration plans.

An GBP11 million cash payment from the South Sudanese, represents

approximately 30% of our current market capitalisation and further

enhances our already strong balance sheet on a non dilutive

basis."

** ENDS **

For further information please visit www.agriterra-ltd.com or

contact:

Andrew Groves Agriterra Ltd Tel: +44 (0) 20 7408

9200

Jonathan Wright Seymour Pierce Ltd Tel: +44 (0) 20 7107

8000

David Foreman Seymour Pierce Ltd Tel: +44 (0) 20 7107

8000

Andy Cuthill MC Peat & Co LLP Tel: +44 (0) 20 7104

2332

Susie Geliher St Brides Media & Finance Tel: +44 (0) 20 7236

Ltd 1177

Notes

Agriterra Ltd is an AIM listed agricultural company with four

divisions: beef, maize, cocoa and palm oil. Its cattle ranching

business, Mozbife, currently has a 4,000 strong herd, a land

holding of over 16,250 hectares, a feedlot and a 4,000 head per

month abattoir which is under construction. In addition to selling

meat from its own herds, throughput for the feedlot and abattoir

will be supplemented using cattle bought in from local

communities.

The Company's maize buying and milling operations, DECA and

Compagri, are located in Chimoio and Tete in central and

north-western Mozambique respectively. These collect maize from

circa 350,000 farmers using the Company's own vehicle fleet,

process it into mealie meal, the African staple, and then sell it

back to the local market, into supermarkets and to the World Food

Programme. Combined sales for the year ended 31 May 2011 totalled

28,822 tonnes maize meal generating revenue of US$13.6 million.

Agriterra's cocoa business is based in Sierra Leone, through its

100% subsidiary Tropical Farms Limited, which is currently a buying

and trading operation, but provides an ideal conduit to branch out

into cocoa production in West Africa. Its strategy is to establish

itself as a secure, sustainable and traceable source of supply to

meet the requirements of the major cocoa consumers who are placing

increased emphasis in this area.

The Company has expanded its portfolio of agricultural products

through the addition of palm oil, and holds a lease over

approximately 45,000 hectares of brownfield agricultural land in an

area suitable for palm oil production in the Pujehun District in

the Southern Province of Sierra Leone. This area of Sierra Leone,

which is close to the Liberian border, receives one the highest

levels of rainfall in Sierra Leone, which in itself, receives some

of the highest rainfall globally. In addition, the lease area is

located on the equatorial belt, which is the most favourable

geographical location for palm oil production.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUSASRUVAVUAR

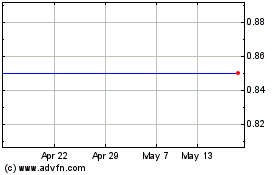

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From May 2024 to Jun 2024

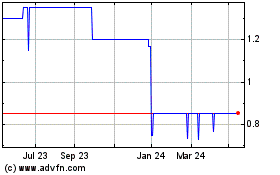

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Jun 2023 to Jun 2024