TIDMAGTA

RNS Number : 6053B

Agriterra Ltd

22 February 2011

Agriterra Ltd / Ticker: AGTA / Index: AIM / Sector:

Agriculture

22 February 2011

Agriterra Ltd ('Agriterra' or 'the Group')

Interim Results

Agriterra Ltd, the AIM listed group focussed on the agricultural

sector in central and southern Africa, announces its results for

the six months ended 30 November 2010.

Chairman's Statement

The economic fundamentals for the agricultural sector are

extremely positive. The increasing focus on global food security

means that there are significant opportunities for the Group given

our personnel and experience. Africa offers huge development

potential and our ability to identify opportunities and build

substantial operations is proven through each of Desenvolvimento E

Comercializacao Agricola Limitada ('DECA'), Compagri Limitada

('Compagri') and Mozbife Limitada ('Mozbife'). These businesses

provide us with a solid platform to expand the Group in order to

capitalise on this rapidly growing sector and accordingly we are

actively evaluating additional opportunities in agriculture and

associated logistics businesses across the continent.

Our efforts during the period have remained centred on

consolidating our maize processing operation at our DECA facility

in Chimoio and expanding the Compagri facility in Tete, which

recommenced operations during the period and is now beginning to

contribute revenues to the Group. The expansion of our beef

ranching operations is continuing apace following a successful

calving season and development of our Vanduzi feedlot project.

Maize Processing - DECA and Compagri

Our grain processing facilities, which include the 40,000 tonne

capacity DECA facility at Chimoio, and the 12,600 tonne capacity

Compagri facility in the Tete Province of Mozambique, have achieved

notable successes during the period, with record sales made at both

operations.

We started the period with a strong maize stock pile, following

a record buying year in 2009, which enabled us to manage the

processing and sales of the product in-line with the recent

favourable pricing environment. The sale of 17,250 tonnes of maize

meal and bran, from both the DECA and Compagri facilities during

the period, resulted in record turnover for the maize businesses,

with revenue totalling US$5.2 million, more than double that of the

corresponding period in 2009. This increase in revenue, coupled

with the completion of construction and bedding down of the Tete

facility, has enabled the grain processing branch of the Agriterra

business to swing into profit at an operational level.

As buying and processing operations are ramped up, particularly

at the Compagri facility which caters for the booming mining area

of Tete and its surroundings, I believe that our maize processing

facilities will continue to provide a solid foundation and internal

cash flow for the continued expansion of the Group.

Mozbife

Beef ranching offers a material value opportunity in Africa. Our

rapidly growing ranching business in Mozambique remains an area of

significant expansion and investment for the Group, with total head

exceeding 1,100 across the 1,000ha Mavonde and 15,000ha Dombe

ranches by the end of the period.

The period under review encompassed the calving season, where we

experienced an 82% pregnancy rate and 100% survival rate of all

calves. This was a tremendous achievement for Mozbife, and

underpins the quality of our beef stock and high veterinarian

standards which we enforce across both ranches. This successful

breeding programme is critical both to the continued growth of the

herd and the improvement of animal quality as imported South

African Beefmaster stock is cross bred with native cattle to

develop a herd with excellent meat yield potential coupled with

high local disease resistance.

The Vanduzi abattoir/feedlot project is also advancing rapidly,

with the first feed pens and boundary fencing completed in the

period. Post period end saw the first delivery of animals ahead of

slaughter at the Beira abattoir, with dress out weight percentages

between 58% and 63%, which was more than 10% above management

expectations and an average sale price per animal in excess of

US$900. The attractive sale price for the animals highlights the

financial returns possible for an established beef ranching

operation in Mozambique and underpins the huge potential of

Mozbife.

Our extensive land clearing and preparation programme at Vanduzi

is also progressing encouragingly, with 170 hectares planted with

maize crop to ensure security of feedlot and a further 270 hectares

now cleared for additional planting. This, coupled with the planned

development of an abattoir by the Group, will provide Mozbife with

the foundations required to develop into one of southern Africa's

largest producers of beef. We have also recruited three highly

experienced ranching professionals, who have proven track records

in developing major beef operations, to manage the onward

development and growth of our herds and feedlot/abattoir

project.

Financial Results

For the period, the Group is reporting a pre-tax profit of

US$97,000 (H12009: loss of US$1,967,000) on turnover of

US$5,284,000 (H1 2009: US$2,480,000). Cash balances at the period

end remained healthy at $7,080,000, following a placing of

145,483,334 new ordinary shares at a price of 3 pence per placing

share, raising US$7 million before expenses. In addition the Group

had circa 29,500 tonnes of maize in stock at the end of the period,

ready to be processed and sold.

Outlook

We have a solid foundation and believe we are positioned to take

advantage of opportunities in the rapidly expanding agricultural

and logistics sector. The outlook for the maize processing

operations in the second half is positive with high current stock

levels and a ramp up in activity at Compagri, which we believe will

be underpinned by the current positive pricing environment for meal

and bran. With regards to our beef operations, with the business

progressing well, we look forward to a first revenue contribution

in H2 2011. Our objective is to build a breeding herd in excess of

10,000 with an initial target for 2012 of over 4,000 head.

Throughput in the feedlot will be augmented by bought in local

cattle, which will further contribute to revenues. On acquisitions,

as previously stated we are actively evaluating additional

opportunities in agriculture and associated logistics businesses

across the continent.

Finally, I would like to take this opportunity to thank our

shareholders for their continued support over the period, and to my

fellow board members and management teams for their unwavering

dedication to the future growth and success of the Group.

Phil Edmonds

Chairman

21 February 2011

For further information please visit www.agriterra-ltd.com or

contact:

Andrew Groves Agriterra Ltd Tel: +44 (0) 20 7408

9200

Jonathan Wright Seymour Pierce Ltd Tel: +44 (0) 20 7107

8000

David Foreman Seymour Pierce Ltd Tel: +44 (0) 20 7107

8000

Robin Henshall Matrix Corporate Capital Tel: +44 (0) 20 3206

LLP 7000

Nick Stone Matrix Corporate Capital Tel: +44 (0) 20 3206

LLP 7000

Hugo de Salis St Brides Media & Finance Tel: +44 (0) 20 7236

Ltd 1177

Susie Geliher St Brides Media & Finance Tel: +44 (0) 20 7236

Ltd 1177

Unaudited Consolidated Income Statement

For the six month period to 30 November 2010

Unaudited Unaudited

6 months 6 months Audited

to to year to

30 November 31 December 31 May

2010 2009 2010

Continuing Operations Note $'000 $'000 $'000

Revenue 4 5,284 2,480 8,791

Increase in value of biological

assets 63 - 22

Cost of sales (3,660) (1,965) (7,371)

------------- ------------- ------------

Gross profit 1,687 515 1,442

Operating expenses (2,248) (2,939) (5,686)

Other income 612 445 386

Operating profit /

(loss) 51 (1,979) (3,858)

Net finance income

/ (expense) 46 12 (46)

------------- ------------- ------------

Profit / (loss) before

taxation 97 (1,967) (3,904)

Income tax expense - - -

------------- ------------- ------------

Profit / (loss) for the

period from continuing

operations 97 (1,967) (3,904)

Discontinued operations

:

Loss for the period (10) (83) (920)

------------- ------------- ------------

Profit / (loss) for

the period attributable

to equity holders 87 (2,050) (4,824)

============= ============= ============

Earnings / (loss) per 5 0.02 cents (0.43 cents) (0.9 cents)

share:

Basic & diluted

Earnings / (loss) per 0.02 cents (0.43 cents) (0.8 cents)

share from continuing

operations:

Basic & diluted

Unaudited Consolidated Statement of Comprehensive Income

For the six month period to 30 November 2010

Unaudited Unaudited

6 months 6 months Audited

to to year to

30 November 31 December 31 May

2010 2009 2010

Note $'000 $'000 $'000

Profit / (loss) for

the period 87 (2,050) (4,824)

Other comprehensive income

net of tax

Foreign exchange translation

loss (1,337) (3,791) (6,005)

------------- ------------- ---------

Total comprehensive loss

for the period (1,250) (5,841) (10,829)

============= ============= =========

Comprehensive loss

attributable to equity

holders (1,250) (5,841) (10,829)

============= ============= =========

Unaudited Consolidated Balance Sheet

As at 30 November 2010

Unaudited Unaudited Audited

30 November 31 December 31 May

2010 2009 2010

Note $'000 $'000 $'000

Non current assets

Property, plant and

equipment 8,891 11,507 9,986

Investments - - 114

Biological assets 312 264 236

------------- ------------- ----------

Total non current assets 9,203 11,771 10,336

Current assets

Inventories 6,550 8,656 4,605

Trade and other receivables 2,140 1,874 1,019

Cash and cash equivalents 7,080 2,539 3,442

------------- ------------- ----------

Total current assets 15,770 13,069 9,066

Total assets 24,973 24,840 19,402

Current liabilities

Trade and other payables (2,407) (2,685) (2,176)

Net assets 22,566 22,155 17,226

============= ============= ==========

Equity

Issued capital 6 1,387 1,145 1,161

Share premium 131,548 124,259 125,184

Share based payment

reserve 1,360 1,281 1,360

Translation reserve (6,518) (2,967) (5,181)

Retained earnings (105,211) (101,563) (105,298)

------------- ------------- ----------

Total equity attributable

to equity holders of

the parent 22,566 22,155 17,226

============= ============= ==========

Consolidated Statement of Changes in Equity

Share

Ordinary Deferred based

share share Share payment Translation Retained

capital capital premium reserve reserve earnings Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

--------- --------- -------- -------- ------------ ---------- --------

Balances at 1

June 2009 801 238 119,349 1,281 824 (99,513) 22,980

Loss for the

period - - - - - (2,050) (2,050)

Other

comprehensive

income

Exchange

translation

differences

on foreign

operations - - - - (3,791) - (3,791)

--------- --------- -------- -------- ------------ ---------- --------

Total

comprehensive

income for

the period

Transactions

with owners - - - - (3,791) (2,050) (5,841)

Share issues 106 - 4,910 - - - 5,016

--------- --------- -------- -------- ------------ ---------- --------

Total

transactions

with owners 106 - 4,910 - - - 5,016

Balances at 30

November

2009 907 238 124,259 1,281 (2,967) (101,563) 22,155

Loss for the

period - - - - - (2,774) (2,774)

Other

comprehensive

income

Exchange

translation

differences

on foreign

operations - - - - (2,214) - (2,214)

--------- --------- -------- -------- ------------ ---------- --------

Total

comprehensive

income for

the period - - - - (2,214) (2,774) (4,988)

Transactions

with owners

Share based

payment

charge - - - 79 - - 79

Acquisition of

minority - - - - - (961) (961)

Share issues 16 - 925 - - - 941

Total

transactions

with owners 16 - 925 79 - (961) 59

Balances at 31

May 2010 923 238 125,184 1,360 (5,181) (105,298) 17,226

Profit for the

period - - - - - 87 87

Other

comprehensive

income

Exchange

translation

differences

on foreign

operations - - - - (1,337) - (1,337)

--------- --------- -------- -------- ------------ ---------- --------

Total

comprehensive

income for

the period - - - - (1,337) 87 (1,250)

Transactions

with owners

Share issue 226 - 6,364 - - - 6,590

--------- --------- -------- -------- ------------ ---------- --------

Total

transactions

with owners 226 - 6,364 - - - 6,590

Balances at 30

November

2010 1,149 238 131,548 1,360 (6,518) (105,211) 22,566

--------- --------- -------- -------- ------------ ---------- --------

Unaudited Consolidated Statement of Cash Flows

Unaudited Unaudited

6 months 6 months Audited

to to year to

For the six months 30 November 31 December 31 May

to 30 November 2010 2010 2009 2010

Operating activities Note $'000 $'000 $'000

Profit / (loss) before

tax 97 (2,050) (3,904)

Adjustments for:

Depreciation 499 291 1,359

Increase in value of biological

assets (63) - (22)

Profit on disposal

of assets (3) - (20)

Movements in exchange

rates (101) (834) (42)

Share based payment - - 79

Net interest (income)/expense (46) (12) 46

------------- ------------- ---------

Operating cash flow

before movements in

working capital 383 (2,605) (2,504)

Working capital adjustments:

- Increase in inventory (2,205) (6,937) (3,182)

- Increase in receivables (4) (393) (523)

- Increase / (decrease)

in payables 21 67 (506)

------------- ------------- ---------

Cash used in operations (1,805) (9,868) (6,715)

Net interest received

/ (paid) 46 12 (46)

Net cash used in continuing

operating activities (1,759) (9,856) (6,761)

Net cash used in discontinued

operating activities (520) (425) (783))

------------- ------------- ---------

Net cash outflow from operating

activities (2,279) (10,281) (7,544)

------------- ------------- ---------

Investing activities

Purchase of property, plant

and equipment (196) (532) (1,346)

Proceeds of sale of

property, plant and

equipment - - 135

Purchase of biological

assets - (57) (42)

Purchase / (sale) of

financial assets 125 - (125)

Net cash used in continuing

investing activities (71) (589) (1,378)

Net cash from discontinued

investing activities 100 - 3

------------- ------------- ---------

Net cash from / (used) in

investing activities 29 (589) (1,375)

------------- ------------- ---------

Financing activities

Proceeds from issue of share

capital 6,031 5,016 4,810

Net cash flow from financing

activities 6,031 5,016 4,810

------------- ------------- ---------

Net increase / (decrease)

in cash and cash equivalents 3,781 (5,484) (4,109)

Cash and cash equivalents

at start of the year 3,442 8,517 8,517

Effect of foreign exchange

rates (143) (124) (966)

------------- ------------- ---------

Cash and cash equivalents

at end of the period 7,080 2,539 3,442

============= ============= =========

Notes to the Unaudited Interim Group Financial Statements

1. General information

Agriterra Limited ('Agriterra' or 'the Company') and its

subsidiaries (together the 'Group') is focussed on the Agricultural

sector in Africa. Agriterra is a public limited company

incorporated and domiciled in the Guernsey. The address of its

registered office is Richmond House, St Julians Avenue, St Peter

Port, Guernsey GY1 1GZ

The Company is listed on the AIM Market of London Stock Exchange

plc.

The unaudited interim consolidated financial statements for the

six months ended 30 November 2010 were approved for issue by the

board on 18 February 2010.

The figures for the six months ended 30 November 2010 and the

six months ended 31 December 2009 are unaudited and do not

constitute full accounts. The comparative figures for the year

ended 31 May 2010 are extracts from the annual report and do not

constitute statutory accounts.

The unaudited interim consolidated financial statements have

been prepared in US Dollars as this is the currency of the primary

economic environment in which the Group operates.

2. Basis of preparation

The basis of preparation and accounting policies set out in the

Annual Report and Accounts for the period ended 31 May 2010 have

been applied in the preparation of these interim condensed

consolidated financial statements. These are in accordance with the

recognition and measurement criteria of International Financial

Reporting Standards (IFRSs) as adopted by the European Union (EU)

and with those of the Standing Interpretations issued by the

International Financial Reporting Interpretations Committee (IFRIC)

of the International Accounting Standards Board (IASB). References

to 'IFRS' hereafter should be construed as references to IFRSs as

adopted by the EU

3. Accounting policies

The accounting policies and methods of calculation adopted are

consistent with those of the financial statements for the period

ended 31 May 2010.

4. Segment information

The directors consider that the Group's activities comprise one

business segment, agriculture and other unallocated expenditure in

one geographical segment, Africa.

Continuing activities

6 months ending 30 November

2010 Agriculture Other Total

$'000 $'000 $'000

Revenue 5,284 - 5,284

------------ ------ ------

Operating profit 213 (162) 51

Interest income 46 - 46

------------ ------ ------

Profit / (loss) before tax 259 (162) 97

Income tax -

------

Profit for the period from

continuing activities 97

======

Continuing activities

6 months ending 30 November

2009 Agriculture Other Total

$'000 $'000 $'000

Revenue 2,480 - 2,480

------------ -------- --------

Operating loss (978) (1,001) (1,979)

Interest income 9 3 12

------------ -------- --------

Loss before tax (969) (998) (1,967)

Income tax -

--------

Loss for the period from

continuing activities (1,967)

========

Continuing activities

Period ending 31 May 2010 Agriculture Other Total

$'000 $'000 $'000

Revenue 8,791 - 8,791

------------ -------- ---------

Operating loss (2,170) (1,688) (3,858)

Interest income / (expense) 4 (50) (46)

------------ -------- ---------

Loss before tax (2,166) (1,738) (3,904)

Income tax -

---------

Loss for the period from

continuing activities (3,904))

=========

5. Earnings per share

The calculation of basic and diluted earnings per share is based

on the following data:

Unaudited Unaudited

Unaudited 6 months 11 months

6 months to to to

30 November 31 December 31 May

2010 2009 2010

$'000 $'000 $'000

Profit / (loss) the purpose of

calculating basic earnings per

share (profit / (loss)

attributable to equity

holders) 87 (2,050) (3,690)

--------------- ------------- ------------

Profit / (loss) for the

purpose of calculating basic

earnings per share from

continuing activities 97 (1,967) (4,824)

--------------- ------------- ------------

Number of shares

Weighted average number

of ordinary shares for the

purposes of calculating

basic and diluted loss per

share 548,901,427 479,077,718 515,129,499

--------------- ------------- ------------

Basic and diluted loss per

share (cents) 0.02 (0.43) (0.94)

Loss per share from continuing

activities (cents) 0.02 (0.41) (0.76)

6. Share Capital

Ordinary shares of 0.1p each

Authorised Allotted and fully paid

Number Number $'000

At 1 July 2009 845,000,000 473,821,554 801

Issue of shares - 63,950,000 106

-------------- ---------------- --------

At 30 November 2009 845,000,000 537,771,554 907

Issue of shares - 10,000,000 16

-------------- ---------------- --------

At 31 May 2010 845,000,000 547,771,554 923

Issue of shares - 145,483,334 226

-------------- ---------------- --------

At 30 November 2010 845,000,000 693,254,888 1,149

-------------- ---------------- --------

Deferred shares of 0.1p each

Authorised Allotted and fully paid

Number Number $'000

At period ends 155,000,000 155,000,000 238

-------------- ---------------- --------

Total share capital

At 30 November 2009 1,000,000,000 692,771,554 1,145

-------------- ---------------- --------

At 31 May 2010 1,000,000,000 702,771,554 1,161

-------------- ---------------- --------

At 30 November 2010 1,000,000,000 848,254,888 1,387

-------------- ---------------- --------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUCUPUPGGRG

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Jun 2024 to Jul 2024

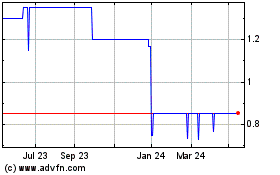

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Jul 2023 to Jul 2024