AEW UK REIT PLC Net Asset Value(s) (3337W)

August 18 2015 - 4:30AM

UK Regulatory

TIDMAEWU

RNS Number : 3337W

AEW UK REIT PLC

18 August 2015

NAV Update for the period 12 May to 31 July 2015

18 August 2015

AEW UK REIT plc (LSE: AEWU) (the "Company") announces its Net

Asset Value for the period ended 31 July 2015.

Highlights

-- Launch of the Company on 12 May 2015 raising GBP100.5 million

of equity (before costs and expenses)

-- Properties acquired during the period for total of GBP22.85

million (net of acquisition costs)

-- Fair Value independent valuation of the property portfolio as

at 31 July 2015 of GBP22.85 million; no change for valuation on

acquisition and acquisition costs have been written-off

-- Investment of GBP9.75m in AEW UK Core Property Fund

-- NAV per share at 31 July 2015 of 97.12 pence

Net Asset Value

The Company's unaudited NAV as at 31 July 2015 was GBP97.6m, or

97.12 pence per share. This is the first NAV announcement since

launch on 12 May 2015. As at 31 July 2015, the Company owned

investment properties with a Fair Value of GBP22.85m, the

investment in AEW UK Core Property Fund is valued at GBP9.79m and

the Company had cash balances of GBP65.6m.

Pence per GBP

share million

NAV (after launch costs) 98.03 98.51

Portfolio acquisition costs (1.06) (1.07)

Valuation change in property portfolio 0.00 0.00

Income earned for the period 0.32 0.33

Expenses for the period (0.17) (0.17)

Dividend paid for the period 0.00 0.00

NAV at 31 July 2015 97.12 97.60

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards and incorporates

the independent portfolio valuation as at 31 July 2015 and income

for the period.

Portfolio activity

The Company entered the REIT regime with effect from 5 June 2015

following the submission of the application to HM Revenue &

Customs.

The Company acquired its first property, Eastpoint Business Park

in Oxford in June 2015. Purchased for GBP8.2 million with a 9.4%

net initial yield, this property provides 75,000 square feet and

comprises of 5 self-contained office buildings. There are 3 vacant

units that are covered with 12 month rental guarantees. The

weighted average unexpired lease term ("WAULT") are 6 years to

break and 7.9 years to expiry. This property has an ERV of

GBP829,050 and a reversionary yield of 9.12%.

Purchased in June 2015 for GBP9.25 million, 69-75 Above Bar

Street in Southampton is a 27,247 square foot retail unit

comprising of 3 units, fully let to Barclays Bank, Waterstones and

Blacks. This property has a net initial yield of 8.75% and a WAULT

of 6.2 years. This property has an ERV of GBP579,000 and a

reversionary yield of 5.92%.

The acquisition of Sandford House, Solihull completed in July

2015 for a purchase price of GBP5.4 million. This property provides

34,418 square feet of office space in a prime Birmingham office

location. The property is fully let to The Secretary of State for

Communities and Local Government and has a net initial yield of

10.9%. This property has an ERV of GBP715,000 and a reversionary

yield of 8.51%. The WAULT is 1.8 years to break and 4.5 years to

expiry.

All purchase prices are net of acquisition costs.

The Company has invested GBP9.75m in the AEW UK Core Property

Fund.

The sector weighting, by value, of the direct investment

portfolio as at 31 July 2015 was 59.5% offices and 40.5%

retail.

Post quarter end activity

The Company has made 2 further acquisitions during August

2015.

Valley Retail Park, Belfast was purchased for GBP7.15 million

(net of acquisition costs). This property is a modern 100,413

square foot retail park located in Newtonabbey, Belfast. This

property has a net initial yield of 12.8% and a WAULT of 3.5 years

to break and 7 years to expiry. The ERV for the property is

GBP953,923 and the reversionary yield is 13.8%.

225 Bath Street, Glasgow was purchased for GBP12.2 million

(including an amount for rent top up; net of acquisition costs).

This property comprises a refurbished 87,827 square foot office

building and is currently fully let to 6 tenants. This property has

a net initial yield of 10.0% and a WAULT of 2.3 years to break and

4.5 years to expiry. The ERV for the property is just over

GBP1,315,000 which equates to a reversionary yield of 10.2%.

Taking into account the above two acquisitions, the sector

weighting by value of the direct investment portfolio as at 18

August 2015 was 61.1% offices and 38.9% retail.

The Company will publish the unaudited half yearly report for

the period ended 31 October 2015 during December 2015.

Portfolio Manager's comment

Alex Short, of AEW UK Investment Management LLP, the Company's

Investment Manager, commented "We are pleased to have now completed

five acquisitions for the Company and are working in line with our

proposed timetable as set out to investors prior to the Company's

launch. The Company is currently under offer, or close to being

under offer on, a number of similar deals and consequently expects

to be able to make further announcements over the coming

weeks."

Enquiries

Investor Relations Company Secretary

Dana Eisner, AEW UK Investment Marco Murray, Capita

Management LLP Asset Services

dana.eisner@aeweurope.com Marco.Murray@capita.co.uk

T: 020 7016 4883 T: 020 7954 9792

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVSFLSAAFISEEA

(END) Dow Jones Newswires

August 18, 2015 04:30 ET (08:30 GMT)

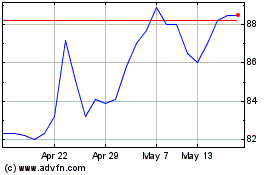

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jun 2024 to Jul 2024

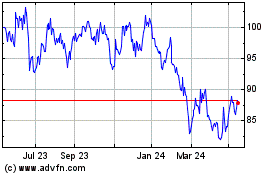

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jul 2023 to Jul 2024