TIDMADM

5 March 2020

Admiral Group plc announces a record Group profit before tax of GBP526.1

million for the year ended 31 December 2019

2019 Results Highlights

2019 2018 % change

Group's share of profit before GBP526.1 GBP479.3

tax(*1) million million +10%

GBP522.6 GBP476.2

Group statutory profit before tax million million +10%

Earnings per share 148.3 pence 137.1 pence +8%

Full year dividend 140.0 pence 126.0 pence +11%

Return on equity(*1) 52% 56% -7%

Group turnover(*1) GBP3.46 billion GBP3.28 billion +5%

Group net revenue GBP1.35 billion GBP1.26 billion +7%

Group customers(*1) 6.98 million 6.51 million +7%

UK insurance customers(*1) 5.48 million 5.24 million +4%

International car insurance

customers(*1) 1.42 million 1.22 million +16%

Group's share of price comparison

profit(*1) GBP18.0 million GBP8.8 million +105%

Statutory price comparison profit GBP14.7 million GBP6.6 million +123%

Solvency ratio (post dividend)(*2) 190% 194% -2%

(*1) Alternative Performance Measures - refer to the end of the report

for definition and explanation

(*2) Unaudited. Refer to capital structure and financial position

section later in the report for further information

Around 10,000 staff each receive free shares worth up to GBP3,600 under

the employee share scheme based on the full year 2019 results. All staff

will also receive a one-off GBP500 bonus to reflect the Group's strong

performance in 2019.

Comment from David Stevens, Group Chief Executive Officer:

"Admiral tends, year after year, to exhibit a relentless forward

momentum, which my predecessor described as "going like a freight

train".

"Was 2019 another "freight train" year?

"Very much so. In so many ways.

"It was a year which saw profits exceed GBP500 million for the first

time, on the back of substantial reserve releases. We crossed the

million mark in household policyholders, and added 200,000 new car

insurance customers overseas.

"Alongside this rapid progress on many fronts, some data points were

stubbornly stable. The number of consecutive years amongst the top

performers in the "Best Companies" list only nudged up from 19 years to

20. The percentage of staff saying they are proud to work for Admiral

was stuck in a narrow band in the mid-90's. As was the percentage of

customers who said they wanted to renew with Admiral following a claim.

"Consistently happy staff, consistently happy customers. Hopefully

happy shareholders.

"I announced this morning that I am going to be stepping down as CEO in

12 months' time. I fully expect that Admiral's talented senior

management, led by our very talented CEO designate, Milena Mondini, will

be more than ready to maintain, or even stoke up, Admiral's relentless

momentum."

Annette Court, Admiral Group Chair, commented:

"I am delighted to report another year of record profit in 2019 and a

strong set of results. It was also pleasing to receive a recent award as

the only company to appear in the Sunday Times Best Large Company to

Work For shortlist every year since the inception of the awards 20 years

ago. These results are testament to our people, who continue to be at

the core of our success and highlight every day the real difference that

they make through their focus on great customer service.

"Following from the announcement today of Admiral's CEO David Stevens

informing the Board of his intention to retire in twelve months' time,

I'd like to thank him for his amazing contribution over the past 27

years to Admiral's success. Since he's not leaving for another 12 months,

I'll reserve my fuller accolades until that time.

"Having been through a comprehensive and robust succession process, the

Board is confident that in Milena Mondini we have a natural successor

and a leader for the next generation, supported by a very strong

management team. Milena brings a deep appreciation of the special

Admiral culture, entrepreneurial spirit, commercial track record and

people development skills."

Dividend

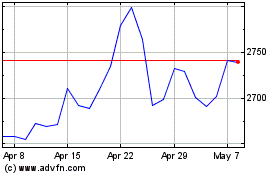

The Board has proposed a final dividend of 77.0 pence per share (2018:

66.0p) representing a normal dividend (65% of post-tax profits) of 56.3

pence and a special dividend of 20.7 pence per share. The dividend will

be paid on 1 June 2020. The ex-dividend date is 7 May 2020 and the

record date is 11 May 2020.

Management presentation

Analysts and investors will be able to access the Admiral Group

management presentation which commences at 11am GMT on Thursday 5 March

2020 by registering at the following link

https://pres.admiralgroup.co.uk/admiral037/vip_connect. A copy of the

presentation slides will be available at www.admiralgroup.co.uk

Chair Statement

2019 marks another year of very strong results for Admiral, and also the

announcement of a change of leadership. It is hard to sum up the amazing

contribution that David has made to the Group over the last 27 years.

As one of the founders he has overseen the business grow from a standing

start to become one of the UK's largest motor insurers, employing over

10,000 people, serving seven million customers and with a market value

today of over GBP6 billion.

David isn't going just yet and I don't want to use up all my accolades

until he actually steps down in 12 months' time. David brings a unique

combination of great brainpower, integrity, innovation, caring and

humility. As an individual, his compassion for colleagues and customers

alike encapsulates Admiral's approach and ethos. Suffice to say, it

continues to be a real pleasure to work with him.

Having been through a comprehensive and robust succession process, the

Board is confident that in Milena we have a natural successor and a

leader for the next generation. We have a wealth of management talent

at Admiral and bringing this through has always been a central pillar to

Admiral's management philosophy as the business evolves alongside its

customers. Milena brings a deep appreciation of the special Admiral

culture, entrepreneurial spirit, commercial track record and people

development skills.

Looking back at 2019

I am delighted to report another year of strong performance in 2019,

beating many records. This is once again due to our people. They make

the real difference at Admiral. Their focus on serving our customers,

the distinctive culture and their contribution to the communities in

which Admiral operates is what makes Admiral truly different.

The Group has continued to grow with turnover increasing by 5% to GBP3.5

billion, whilst customer numbers are 7% higher than 2018 at 6.98

million. The Group's share of pre-tax profit increased by 10% to GBP526

million driven by UK Motor insurance, with strong releases of prior year

claims reserves. Once again we were impacted by Ogden (the Personal

Injury Discount Rate). Although the final rate was set at -0.25%, and

therefore lower than our expectations, we were able to deliver

significantly increased profits resulting in an early trading update to

notify the market of higher than expected profit. Earnings per share

rose by 8% and return on equity was 52%. The Group's solvency ratio

remains robust at 190% (194% at the end of 2018).

This strong performance was due to contributions from businesses across

the Group. Particularly of note was UK Insurance (Motor, Household,

Travel), European insurance and Confused.com. Our Loans business

continues to develop well and we continue to build this business with

our usual cautious approach. We have encountered more challenges in the

US, so we still continue to strengthen fundamentals there.

Focusing on the UK, we maintained a disciplined approach and prioritised

profitability over growth, by increasing prices as a result of continued

claims inflation. This led to modest growth over the period. The

regulatory environment in the UK continues to evolve, with whiplash

reform and the FCA market pricing study being key features of 2019 and

into 2020. Approximately 80% of Admiral customers shop around at renewal,

so we are encouraged that the majority choose to remain with us and is

an indicator of our good customer experience and competitive pricing.

As a result of our Brexit restructuring, 1 January 2019 marked the start

of operations for our European insurance hub in Madrid. The hub allows

us to underwrite and support our growing European insurance businesses

and ensures that we are well placed for a full range of potential

circumstances without disrupting our customers.

Dividend

Our dividend policy remains that we pay a normal dividend of 65% of

post-tax profit and distribute each year the available surplus over and

above what we retain to meet regulatory requirements, the future

development of our business and appropriate buffers. The Directors have

recommended a final dividend of 77 pence per share (2018: 66 pence per

share) for the year to 31 December 2019 representing a distribution of

90% of our second half earnings.

This will bring the total dividend for the year to 140 pence per share,

an overall increase of 11%. This represents a pay-out ratio of 94%. The

Group has delivered a Total Shareholder Return (TSR) of 361% over the

last 10 years.

Group Board in 2019

The Board recognises the need for a strong corporate governance

framework and supporting processes across the Group and believes that

good governance, with the tone set from the top, is a key factor in

delivering sustainable business performance and creating value for all

the Group's stakeholders.

We reviewed our Group strategy in 2019 which remains straightforward and

highly focused on building customer-centric, sustainable businesses for

the long-term. We strive to keep doing what we're doing, and do it

better year after year.

In our UK insurance business, we remain determined to strengthen our

core competitive advantages and pursue our culture of innovation and

test and learn approach. For example, we are continuing to deploy

technology relating to digital and self-service to improve the customer

experience and overall efficiencies.

We also continue to take what we do well and what we learn to new

markets and new products, both in the UK and abroad. We are agile enough

to adapt to evolving business environments and encourage entrepreneurial

initiatives to solve challenges and offer the best outcome to our

customers, people and investors. One example is the launch of Household

insurance in France.

From a governance perspective, we have applied the principles of the new

Corporate Governance Code which ensures that we will continue to take on

board the views of all of our stakeholders in our discussions and

decision making. As you would expect, we already have strong links with

our people and in 2019, the Board revisited and enhanced several areas

of focus including our culture, engagement, diversity, our impact on the

environment and climate change, and how we give back and participate in

the communities in which we operate through our Ministry of Giving.

To ensure that we further enhance the strong links between the Board and

Admiral employees, we have set up an Employee Consultation Group (ECG).

This group, elected by employees, meets on a regular basis and provides

a two-way link between the Board and wider staff. I and other members of

the Board have had the privilege of attending these sessions and I am

impressed by the passion and energy our people have for continuing to

shape the business and a real desire to ensure that we remain a great

company to work for. An example of this is considering ways in which we

can better use flexible working.

There is further work to do to ensure that views of our international

employees across the Group are better represented, so we will be

building on this approach over the next twelve months.

Once again Admiral was recognised as a Great Place to Work in 2019. We

were awarded the Sunday Times best company to work for in the UK, 7(th)

best multinational workplace in Europe, 3(rd) best workplace for women

in the UK and 18(th) best workplace in the world! Of course, this his

doesn't happen by accident. We continue to believe that if people like

what they do, they do it better. Our people feel involved because they

have a voice, they are shareholders in our business, and they genuinely

care.

Having our people as shareholders remains a distinctive element of

Admiral's incentive schemes These are designed to ensure that decisions

are made by management to support long-term value growth, that the right

behaviours are rewarded and that our people's interests are aligned with

those of shareholders. Our core belief is that over the long-term, share

appreciation depends on delivering great outcomes for our customers.

During the year, I had the pleasure of visiting our operations in the UK,

France, Italy, Spain and the US where I was able to engage with a wide

variety of people. It is always wonderful to see the Admiral culture so

deeply ingrained in offices across the globe. This culture was just as

clearly embedded for me at the annual Staff General Meeting and the

annual management off-site event. In 2019, the Board also attended a

Claims education session in Newport as part of our ongoing Board

education programme, and we each had the opportunity to engage with

claims employees and visit a local repairer which was very insightful in

seeing more evidence of our service in practice.

The Board and I feel that there is a good balance of experience, skills

and knowledge to support and challenge the management team, and that

operations are supported by effective governance and control systems.

There have been no changes to the Board composition in 2019 following

three new appointments in 2018 but the Board and I expect to appoint an

additional non-executive director with a technology background in early

2020. We will continue to review all aspects of diversity to ensure that

we are well-prepared to guide the Group through our next phase of

growth.

During the year the Board and each of its Committees undertook reviews

of their effectiveness. As part of the three-year cycle we undertook an

external effectiveness review of the Board in 2019, including

consideration of the principles of the 2018 Corporate Governance Code.

The conclusions provided useful feedback on its performance.

Our focus areas for the Board remain to:

-- Continue to build on the remarkably special Admiral culture and in so

doing putting our people, customers and wider impact on the community at

the heart of what we do

-- Continue the history of growth, profitability and innovation

-- Invest in the development and growth of our people -- we have focused on

the quality and development of our senior management team, added to our

talent base by some external hires, and reviewed our succession pipeline

--Ensure excellent governance and the highest standards

Our role in Society

Admiral takes its role in society very seriously and has an active

approach to Corporate Responsibility (more information in Corporate

Social Responsibility Report on the Admiral website) We are proud to be

Wales' only FTSE 100 headquartered company and employ over 7,000 people

in South Wales. Our people play an active part in the communities in

which we operate. We carefully consider our impact on the community and

environment, including factors such as the green credentials of our

buildings, raising funds for multiple charities, and considering the

impact of climate change across the business.

This year we reviewed our responsible investment policy with regard to

our ESG positioning. We aim to be an economically strong and responsible

business over the long-term, guided by a clear purpose, to make a

positive and significant impact not just to our customers and our people

but to the economy and society.

Thank you

On behalf of the Board I would like to thank everyone at Admiral for

their continued hard work and contribution to the Group's results in

2019. I would also like to thank our shareholders for their support and

confidence. Most of all I would like to thank our customers for placing

their business with us.

Annette Court

Group Chair

4 March 2020

Chief Executive's Statement

The combination of a new decade and an imminent, if not immediate,

change of leadership at Admiral provides me with a valid excuse to

comment across a longer time period than a typical CEO statement in an

annual report.

Almost a decade ago, my predecessor, Henry, with his inimitable talent

for a colourful phrase to light up a CEO statement, described the

company as a "snowball going like a freight train -- downhill" (2010's

CEO statement). I know I'm not alone in having enjoyed Henry's CEO

statements, with his penchant for colourful, often gastronomic,

analogies. I confess, however, in this instance, I might have avoided

both "snowball" -- with associations of fragility and transience - and

"downhill" -- with associations of, well... "downhill"; neither of which

entirely reassured on the sustainability of Admiral's model.

But I did love "going like a freight train". A freight train -- not

racy, not glamourous (who needs a glamourous insurance company); but

progressing ever onwards with a relentless, implacable forward momentum.

That relentless forward momentum has seen us grow, year in year out,

over the decade with the number of customers we serve growing from 1.9

million to 7.0 million overall, and from just over 100k to 1.4 million

beyond the UK, while also growing our profits from GBP206 million to

GBP526 million.

Did 2019 itself fit into this narrative of relentless momentum?

Very much so. In so many ways.

It was a year which saw profits exceed GBP500 million for the first time,

on the back of substantial reserve releases. We crossed the million

mark in household policyholders and sold our first household policy

beyond the UK. By year end, we had almost sold our 100,000th loan (and

have, at time of writing, done so). We believe (hard to prove it) we

have become the biggest (non-fleet) van insurer in the UK, only 2.5

years after starting to underwrite van insurance.

Alongside this rapid progress on many fronts, some data points were

stubbornly stable. The number of consecutive years amongst the top

performers in the "Best Places To Work" only nudged up from 19 years to

20.

The percentage of staff saying they are proud to work for Admiral was

stuck in a narrow band in the mid-90's. As was the percentage of

customers who said they wanted to renew with Admiral following a claim.

Consistently happy staff, consistently happy customers.

Reassuringly stable outcomes, that are fundamental to our relentless

forward momentum; a momentum fuelled by a sustainably healthy culture:

-- A culture that, in many different ways, attracts & retains people, at all

levels, who are simply better at their jobs than most of their peers in

the industry.

-- A culture that respects and promotes a set of fundamental skills in risk

selection, claim handling, customer support and expense control that are

core to success in insurance.

-- A culture that emphasises the long term over the short term; long term

prosperity ahead of short-term financials; a sustainable balance in the

outcomes for staff, customers and shareholders.

It is a source of huge satisfaction to me, as I contemplate the end of

my period of stewardship of Admiral, that I will leave a wonderful

company in the hands of a wonderful top management team in Geraint,

Cristina, Scott & Elena, very ably supported by great leaders running

important subsidiaries and key Group functions. They are collectively

more than capable, of not just sustaining, but also of evolving,

Admiral's potent culture. And I am particularly glad that, in Milena, I

have a successor who has the intelligence, the values, the track record

and the clarity of vision to take on the role of Group CEO; to

"reinterpret" the culture, to maintain its relevance over the next

decade; to reinforce the elements that remain key to our future success;

and, equally importantly, to set aside elements that will inevitably

slip past their "sell-by" date.

Thereby ensuring that Admiral will continue to "go like a freight train"

in the years to come.

David Stevens, CBE

Group Chief Executive Officer

4 March 2020

Chief Financial Officer's Review

A headline 10% increase in pre-tax profit - to a new record level - is a

really pleasing result, and so I'll start my review by looking at what's

driving that very positive move:

Group share pre-tax profit

GBPm 2019 2018 Change

UK Insurance 597 556 +41

International Insurance (1) (1) -

Comparison 18 9 +9

Admiral Loans (8) (12) +4

Share scheme cost (53) (49) (4)

Other (27) (24) (3)

Profit 526 479 +47

The standout item is the GBP41m improvement in UK Insurance profit.

GBP11m of that comes from an improved household result (more below). UK

Motor profitability moved ahead by around GBP30m to GBP591m.

When trying to assess the change, it's important to remember that the

Ogden Discount Rate (see later in the report for more detail) has

distorted both years' results. Firstly, 2018 was positively impacted

(GBP66m) when we changed our assumption of the rate, ahead of its

announcement, from -0.75% to 0% at year-end. When the new rate (-0.25%)

was announced (mid-2019), 2019's result took a hit of around GBP33m to

adjust for our slight optimism. That means that the underlying profit

move is bigger than the GBP47m in the table above, though the changes in

the Ogden rate during the period make meaningful comparison difficult.

Thankfully we should see some stability in Ogden in the coming years.

What is clear is that UK motor profit is materially higher in 2019 than

prior years. That has been driven by unusually high UK motor reserve

releases that resulted from improved reserve estimates across a number

of years. This in part is due to some 'unclogging' of large claims

settlements caused by the recent certainty, but also generally much more

positive trends on big claims than we expected. Admiral of course is

(and I believe always should be) consistently prudent in setting

reserves and normally expects significant releases, but 2019 has been

well above average (29% v 21% over the previous five years). Profit

commission revenue was also well ahead of recent years.

To give an idea of quantum, if the reserve release for 2019 (defined as

reserve releases on Admiral's original net share of the business as a

percentage of current year net premium revenue) was in line with the

average of the prior five years, Group profit would have been around

GBP430 million to GBP450 million.

It's also worth noting that the level of conservatism in the reserves

(we usually think of it in terms of the margin above best estimate in

percentage terms) is unchanged year-on-year. We were expecting it to

reduce somewhat at 2019 year-end, but the scale and nature of the

positive moves on the back years has led us to continue being as

cautious as at the end of 2018 for the time being.

We would expect (though can't guarantee of course) significant releases

again in 2020, though possibly not quite of the magnitude seen in 2019.

We might expect the level of conservatism within the reserves to reduce

if 2020 trends are a bit more usual.

A few other observations from the results:

-- Within the UK Insurance result above, our Household business made a

profit of around GBP8m. Still relatively small to the Group (it would be

over twice as big if the cost of quota share reinsurance was excluded),

but a decent GBP11m or so improvement on 2018's weather-impacted

result. The business continued to grow nicely, with 17% more customers

insured. We're hoping for some improvement in the non-weather loss ratio

in the coming years

-- In contrast (and a bit disappointingly), the International Insurance

result remained flat at a GBP1m loss in 2019. This comprised a better

European result (GBP9m v GBP7m) offset by a higher US loss (GBP10m v

GBP8m). This four-point-higher-loss-ratio-driven US result is discussed

further below, whilst the overall international result needs to be

considered alongside a very healthy 16% growth in the number of active

policies at year-end

-- The Comparison segment produced a very pleasing (stellar even?) doubling

of profit (GBP18m v GBP9m). Confused.com led the way and more detail on

that is below. Revenue growth was also strong at 14%

-- Admiral Loans grew its outstanding balances to GBP455m (+52%) whilst

revenue more than doubled. Importantly, headcount was basically flat, a

nice insight into the efficiency of the business. The loss reduced to

GBP8m - in line with expectation and arrears were also in line with plan

--Finally, 'other' costs were up around GBP8m on last year. The biggest

component as you can see is the Admiral share scheme charge which

increased (GBP49m to GBP53m) as a result of improved vesting assumptions

(improved financial results and strong shareholder return) and the

higher share price. We will also pay all our employees a cash bonus of

GBP500 in recognition of the huge contribution to the Group's strong

2019 results (around GBP6m)

Further details on the numbers are set out throughout the strategic

review section of the report.

Highlight -- Confused.com

Picking a highlight from such a strong set of results was reassuringly

tough. Options included a good turnaround in UK household profit (plus

decent growth, surpassing one million customers), strong growth and an

improved result at L'olivier in France, continued great progress in

Admiral Loans (not forgetting the UK motor profit). But there's one

standout for me, so let's hear a bit more about Confused.com.

The improvement in performance under Louise and team's leadership over

the past two years has been stark:

2017 2018 2019 2019 v 2017

Revenue GBP87.1m GBP95.1m GBP112.7m +29%

Operating profit GBP10.1m GBP14.3m GBP20.4m +102%

Operating profit

% 12% 15% 18% +50%

A number of factors have contributed to that very nice doubling of

profit v 2017 -- even more focus on profitability and cost efficiency,

very notable improvements in marketing, customer experience and product.

From a marketing perspective, brand awareness has significantly improved

and, in particular, spontaneous awareness almost doubled in 2019. No

doubt you'll have enjoyed Confused.com's sponsorship of the Rugby World

Cup on TV whilst desperately hoping for a Welsh win. Marketing

efficiency was also improved.

Confused's product offering is better than it was two years back, as is

the customer journey. Results from products beyond car insurance

comparison have improved significantly.

Great work Louise plus Andy, John, Karen, Sam, Steve, Tamsin and the

whole Confused.com team!

Less pleasing -- Elephant Auto

For balance and as hinted above, a disappointment in 2019 was the

reversal in the trend of improving financials for Elephant Auto and

associated write down of the carrying value in the parent company

financial statements.

The last few years have seen some great progress at Elephant. Some

examples from 2019 include notable improvements in service levels

(leading to a big increase in Net Promotor Score) and technology (online

self-service as one example), launching a second brand and diversifying

distribution channels, amongst others.

But 2019 will probably be most remembered for a deterioration in loss

ratio (2019 underwriting year is projected around 77% v 74% for 2018 at

the same point of development) when we were expecting the opposite.

Much action is being and has been taken (including underwriting rule

changes and significant rate increases) and improving the loss ratio

will continue to be a (or actually, the) major area of focus in 2020.

Some additional conservatism has also been built into the booked

reserves at the end of 2019.

Partly because of the result being worse than plan, we changed to using

shorter-term projections for the carrying value impairment test. Whilst

we remain confident that Elephant's result will improve in the

short-term, and the business will go onto profitability in the (ideally)

not too distant future, this led us to conclude that further impairment

to the carrying value was required and a GBP66m charge was taken in the

2019 parent company accounts.

I have faith in our team in Richmond to improve the results in 2020 (no

pressure Alberto!).

Finally, I should also give an update on the status of our internal

capital model. Our team has continued its intensive work, with key tasks

during 2019 including remediation of previous findings and having the

updated model retested, by independent internal and external validators.

Positively, none of that work has moved the overall capital position

materially.

In terms of next steps -- we expect to move into a pre-application phase

with the PRA and Gibraltar regulators in the middle of 2020. That

process involves an assessment of our application against the

requirements and can last six months. After that there would be a

further number of months for us to fix any issues that came out of that

review. Then we'd be in a position to make a formal application, and

realistically we'd now expect that to be in 2021.

In March 2016's CFO statement I counted myself very lucky to have worked

for Admiral's first CEO, Henry Engelhardt, who was about to retire after

a reasonable 25 year shift in charge. The exact same sentiment applies

to my current boss - Admiral's second CEO and cofounder, David. We'll

pay fuller tribute when David actually steps down after the transition,

so I'll just say that I'm very delighted we've been able to name Milena

as David's successor. Having sat back-to-back to her for a year or so

(occasionally getting a word in), I know she'll do an amazing job as

Admiral's third CEO and I'm really forward to working with her and

continuing to be part of Admiral's leadership team for the foreseeable.

Congratulations Milena!

Geraint Jones

Chief Financial Officer

4 March 2020

2019 Group Overview

GBPm 2019 2018 2017

Turnover (GBPbn) *1*2 3.46 3.28 2.96

Underwriting profit including investment

income*1 238.0 211.2 177.7

Profit commission 114.9 93.2 67.0

Net other revenue and expenses 182.3 183.1 170.2

Operating profit 535.2 487.5 414.9

Group Statutory profit before tax 522.6 476.2 403.5

Group's Share of profit before tax*1 526.1 479.3 405.4

UK Insurance 597.4 555.6 465.5

International Insurance (0.9) (1.1) (14.3)

Comparison 18.0 8.8 7.1

Loans (8.4) (11.8) (4.4)

Other (80.0) (72.2) (48.5)

Group's Share of profit before tax*1 526.1 479.3 405.4

Key metrics:

Group loss ratio*1*2 64.9% 67.3% 66.2%

Group expense ratio*1*2 23.7% 22.9% 21.5%

Group combined ratio*1 88.6% 90.2% 87.7%

Customer numbers (million) 6.98 6.51 5.73

Earnings per share 148.3p 137.1p 117.2p

Dividends 140.0p 126.0p 114.0p

Return on Equity*1 52% 56% 55%

Solvency Ratio 190% 194% 205%

(*1) Alternative Performance Measures -- refer to the end of this report

for definition and explanation

(*2) See note 13 for a reconciliation of Turnover and reported loss and

expense ratios to the financial statements

Key highlights of the Group's result for 2019 are as follows:

-- Continued growth in turnover (GBP3.46 billion, up 5% on 2018) and

customer numbers (6.98 million, up 7% on 2018)

-- Group's share of pre-tax profits of GBP526.1 million (2018: GBP479.3

million) and statutory profit before tax of GBP522.6 million (2018:

GBP476.2 million)

-- The main driver of the strong growth in Group profit was a higher UK

Insurance result, which benefitted from very positive development in

prior years claims costs and elevated reserve releases and profit

commission, partially offset by higher central costs

-- UK Insurance turnover and customers both increased by 2% and 4%

respectively to GBP2.63 billion and 5.5 million (2018: GBP2.58 billion

and 5.2 million), as the business continued to prioritise margin over

volume by increasing rates ahead of the market

-- UK Household saw strong growth in turnover and customer numbers, with an

improved result of GBP7.5 million (2018: GBP3.0 million loss) after more

benign weather experience in 2019 in comparison to 2018

-- The European insurance businesses delivered a higher profit of GBP8.7

million (2018: GBP6.4 million), offset by an increased loss in the US

insurance business (GBP9.6m in 2019 v GBP7.5m in 2018). The overall

international insurance loss was GBP0.9 million (2018: GBP1.1 million

loss).

--The Comparison businesses recorded aggregate profits (excluding

minority interests' share) of GBP18.0 million (2018: GBP8.8 million),

with the increase mainly driven by a very strong profit from

Confused.com of GBP20.4 million (2018: GBP14.3 million)

Change in UK discount rate ('Ogden')

Following the announcement in mid-2019 by the UK Government, the Ogden

discount rate, which is used in setting personal injury compensation,

was changed to minus 0.25% from the existing minus 0.75% rate that had

been in place since February 2017. The change came into effect on 5

August 2019 and the minus 0.25% rate is expected to remain in place for

up to the next five years.

Admiral assumed a 0% rate in setting best estimate claims reserves at 31

December 2018 and 2018's pre-tax profit was positively impacted by GBP66

million as a result of the move from minus 0.75%. As a result of the

actual rate being 25 basis points lower than the assumed 0%, 2019's

profit before tax is adversely impacted by around GBP33 million.

Earnings per share

Earnings per share increased by 8% to 148.3 pence (2018: 137.1 pence),

with growth slightly lower than the pre-tax profit growth of 10% due to

an increase in the weighted average number of shares.

Dividends

The Group's dividend policy is to pay 65% of post-tax profits as a

normal dividend and to pay a further special dividend comprising

earnings not required to be held in the Group for solvency capital

requirements including management internal risk appetite above the

regulatory minimum.

The Board has proposed a final dividend of 77.0 pence per share

(approximately GBP222 million), split as follows:

-- 56.3 pence per share normal dividend, based on the dividend policy of

distributing 65% of post-tax profits; plus

-- A special dividend of 20.7 pence per share

This final dividend is 17% ahead of the 2018 final dividend (66.0 pence

per share), with a pay-out ratio of 90% for H2 2019.

The total dividend for the 2019 financial year is 140.0 pence per share,

reflecting an 11% increase on 2018 and a 94% pay-out ratio.

The payment is due on 1 June 2020, ex-dividend date 7 May 2020 and

record date 11 May 2020.

Return on equity

The Group's return on equity was 52% in 2019, lower than the 56% in

2018. Whilst the Group's share of post-tax profits grew by 9%, the

group's share of average equity grew faster at 19% resulting in a lower

overall return. The significant growth in profits in the second half of

2019 contributed to the increase in the group's share of equity.

Capital structure and financial position

The Group's co-insurance and reinsurance arrangements for the UK Car

Insurance business are in place at least until the end of 2020. The

Group's net retained share of that business is 22%. Munich Re will

underwrite 40% of the business, through co-insurance (30%) and

reinsurance (10%) arrangements, until at least the end of 2020.

Extensions beyond 2020 are expected to be confirmed during the first

half of 2020.

Similar longer-term arrangements are in place in the Group's

international insurance operations and the UK Household and Van

businesses.

The Group continues to manage its capital to ensure that all entities

are able to continue as going concerns and that regulated entities

comfortably meet regulatory capital requirements. Surplus capital within

subsidiaries is paid up to the Group holding company in the form of

dividends.

The Group's regulatory capital is based on the Solvency II Standard

Formula, with a capital add-on to reflect recognised limitations in the

Standard Formula with respect to Admiral's business (predominantly in

respect of profit commission arrangements in co- and reinsurance

agreements and risks arising from claims including Periodic Payment

Order (PPO) claims).

The Group continues to develop its partial internal model to form the

basis of future capital requirements and expects to enter the PRA's

pre-application process during 2020. Formal application for regulatory

approval to use the model is expected to follow in 2021. In the interim

period before submission, the current capital add-on basis will continue

to be used to calculate the regulatory capital requirement.

The estimated and unaudited regulatory Solvency II position for the

Group at the date of this report is as follows:

Group capital position (unaudited)

Group GBPbn

---------------------------------------------- -----

Eligible Own Funds (pre 2019 final dividend) 1.42

2019 final dividend 0.22

Eligible Own Funds (post 2019 final dividend) 1.20

Solvency II capital requirement(*1) 0.63

Surplus over regulatory capital requirement 0.57

Solvency ratio (post dividend)(*2) 190%

*1 Solvency capital requirement includes updated capital add-on which

is subject to regulatory approval.

*2 Solvency ratio calculated on a volatility adjusted basis.

The Group's capital includes GBP200 million ten year dated subordinated

bonds. The rate of interest is fixed at 5.5% and the bonds mature in

July 2024. The bonds qualify as tier two capital under the Solvency II

regulatory regime.

Estimated sensitivities to the current Group solvency ratio are

presented in the table below. These sensitivities cover the two most

material risk types, insurance risk and market risk, and within these

risks cover the most significant elements of the risk profile. Aside

from the catastrophe events, estimated sensitivities have not been

calibrated to individual return periods.

Solvency ratio sensitivities (unaudited)

2019 2018

UK Motor -- incurred loss ratio +5% -23% -27%

UK Motor -- 1 in 200 catastrophe event -1% -2%

UK Household -- 1 in 200 catastrophe event -2% -2%

Interest rate -- yield curve down 50 bps -5% -12%

Credit spreads widen 100 bps -8% -5%

Currency -- 25% movement in euro and US dollar -3% -3%

ASHE -- long term inflation assumption up 0.5% -3% -10%

Loans -- 100% worsening in experience -3% -1%

The sensitivity to interest rates and long-term ASHE inflation is lower

at the end of 2019, compared to the previous year end. This reflects a

reduction in the assumption of the number of open claims that are

expected to settle as periodic payment orders.

Taxation

The tax charge reported in the consolidated income statement is GBP94.2

million (2018: GBP85.7 million), equating to 18.0 % of pre-tax profit

(2018: 18.0%).

Investments and cash

Investment strategy

Admiral Group's underlying investment strategy remains the same - the

main focus is on capital preservation, with additional priorities

including low volatility of returns, high levels of liquidity and

appropriate matching of asset/liability duration and currency. All

objectives continue to be met. The Group's Investment Committee performs

regular reviews of the strategy to ensure it remains appropriate.

Admiral's investment approach evolved in two main ways during 2019:

-- Formal adoption of a responsible investment strategy which focusses on

ensuring Environmental, Social and Governance criteria are considered

within investment decision making

-- Widening the opportunity set of investments to achieve greater returns

without material change in market risk capital allocated to investments.

Examples included high quality (AAA) asset backed securities, private

debt assets and global bond strategies, actively managed on a total

return basis

Cash and investments analysis

GBPm 2019 2018 2017

--------------------------------------------------- ------- ------- -------

Fixed income and debt securities 1,957.8 1,568.6 1,493.5

Money market funds and other fair value instruments 1,160.2 1,301.1 1,074.3

Cash deposits 116.5 100.0 130.0

Cash 281.7 376.8 326.8

Total 3,516.2 3,346.5 3,024.6

Investment and interest income in 2019 was GBP35.3 million, a decrease

of GBP0.7 million on 2018 (GBP36.0 million). 2019 investment income is

negatively impacted by an accrual of GBP12.9 million relating to quota

share reinsurance arrangements (2018: nil). Excluding this, investment

and interest income in 2019 was GBP48.2 million, an increase of GBP12.2

million compared to 2018 due to higher average balances and an increase

in the average rate of return in 2019, partly due to the changes noted

above. Fixed income was increased by rebalancing other holdings, and new

mandates including very high-quality asset backed securities and senior

private debt.

The underlying rate of return for the year (excluding accruals related

to reinsurance contract funds withheld) on the Group's cash and

investments was 1.4% (2018: 1.2%).

The Group continues to generate significant amounts of cash and its

capital-efficient business model enables the distribution of the

majority of post-tax profits as dividends.

Cash flow

GBPm 2019 2018 2017

--------------------------------------------------- ------- ------- -------

Operating cash flow, before movements in

investments 518.1 488.5 617.6

Transfers to financial investments (188.7) (248.8) (229.4)

Operating cash flow 329.4 239.7 388.2

Tax payments (92.8) (55.6) (55.9)

Investing cash flows (capital expenditure) (33.6) (23.9) (22.7)

Financing cash flows (392.4) (346.8) (310.0)

Loans funding through special purpose entity 85.9 220.2 -

Net contributions from non-controlling interests 1.6 19.3 -

Foreign currency translation impact 6.8 (2.9) 0.6

Net cash movement (95.1) 50.0 0.2

--------------------------------------------------- ------- ------- -------

Movement in unrealised gains on investments 34.6 (26.6) 11.2

Movement in accrued interest 41.5 49.7 37.0

Net increase in cash and financial investments 169.7 321.9 277.8

The main items contributing to the operating cash inflow are as follows:

GBPm 2019 2018 2017

---------------------------------------------------- ------- ------- ------

Profit after tax 428.4 390.5 331.6

Change in net insurance liabilities 50.4 176.6 53.2

Net change in trade receivables and liabilities 27.4 14.9 195.2

Change in loans and advances to customers (168.7) (242.9) (65.2)

Non-cash income statement items 86.4 63.7 30.9

Taxation expense 94.2 85.7 71.9

Operating cash flow, before movements in investments 518.1 488.5 617.6

---------------------------------------------------- ------- ------- ------

Net cash and investments have increased by GBP169.7 million or 5% (2018:

GBP321.9 million, 11%). The main drivers include the Group's share of

increase in funding for the Admiral Loans business, increased tax

payments in 2019 (due to timing) and increased dividend payments.

The Group's results are presented in the following sections as:

-- UK Insurance -- including UK Motor (Car and Van), Household, Travel

-- International Insurance -- including L'olivier (France), Admiral Seguros

(Spain), ConTe (Italy), Elephant (US)

-- Comparison -- including Confused.com (UK), LeLynx (France), Rastreator

(Spain), Compare.com (US), Preminen (emerging markets)

UK and European Insurance Review -- Milena Mondini, Group CEO Designate

What an eventful year! I'm sure that 2019 will remain particularly

memorable for breaking the half billion profit record. In the UK,

unusually high reserve releases in UK motor was the driver, whilst the

European operations showed a combined profit for the second year.

While in the UK, the theme was 'discipline' and we slowed growth in a

high claims inflation environment, in Europe, the focus was 'growth'

(still with discipline) in order to reach economies of scale and gather

more data to improve technical results and customer outcomes.

Our 2019 strategy review has strengthened our belief that sustainable

growth for Admiral Group will be achieved by building on our competitive

advantages and driving product diversification in all the countries in

which we operate. On both points, it has been great to witness stronger

collaboration amongst our insurance businesses across the world over the

past twelve months.

Most ongoing business priorities are similar in the different countries:

a better digital experience for our customers, excellence in analytics,

continuous improvements in technology and new product development, all

enabled by new ways of working.

At the same time, we increased focus on product diversification, with a

view to deploy our core competencies and to better serve our customers.

In the UK, we saw our household team hit a key milestone of 1 million

customers, and continued growth in our van and travel insurance

businesses. In Europe, we expanded into the household insurance market

with the launch of Homebrella in France, a renter focused product, prior

to the launch of a fully-fledged renters and owner proposition in early

2020.

Overall, 2019 was a good year focusing on what we do best, and what we

do next -- supported by a strong team and an even stronger focus to

continue to build a long-term business for the future.

UK Insurance Review -- Cristina Nestares, CEO UK Insurance

One of the things I enjoy most about my role at Admiral is that I get an

opportunity to visit the various sites we have across South Wales,

Canada and India and to spend time with the people that really make this

company. And by that, I mean the people who sell our policies, talk to

our customers, and most importantly help them when they need it most --

whether that's to get insurance for their new car or dealing with their

needs if their home has been flooded.

It's our people's enthusiasm to come to work that makes Admiral's

culture a little bit different and makes it a great place to work, which

drives forward our desire to improve the service and products we offer

to customers. And ultimately, providing great service and keeping our

customers happy (along with strong, disciplined underwriting capability,

of course) drives and delivers our results each year.

This year's results are a new high for the business, as very strong back

year developments have resulted in record releases and our highest ever

recorded profits. Whilst this release is much higher than we've seen in

recent years and largely influenced by increased settlement speeds due

to Ogden certainty, I believe that it also demonstrates of our

market-leading ability to price risks and our effective claims handling

processes.

Moving forward with automation and digital capabilities is fundamental

if we're to ensure that Admiral maintains its position at the forefront

of the insurance market in the UK, and we've made strong strides this

year that will help us into the future.

An example is the launch of our InstaQuote household product.

Throughout our history, we've recognised that our customers want quick,

efficient and value-for-money services, which is exactly what this tool

provides. It's dramatically reduced the time taken to get a price,

which makes life easier for the customer, and has helped us to break

through the 1 million customers mark just 7 years after launching! We

also won the Moneynet Personal Finance Best Household Insurer award in

2019!

In addition to improving the household customer journey, we've also been

enhancing our motor insurance journey by opening more digital

communication routes to help customers interact with us and make changes

via the web and to register claims electronically. The traditional

channels are still available, of course, but many of our customers (both

young and old) favour quicker, more flexible channels of interaction,

which have the added benefit of efficiency for us.

In the last couple of years, this increased investment has contributed

to the slight increase in our expense ratio (albeit from a very low base,

and with additional levies being the greatest contributor to the expense

ratio increase in 2019). However, these changes leave us well placed to

deal with the challenges and customer demands of 2020 and beyond. The

development of digital channels and automating our back-office processes

are also important for the claims reforms (or Civil Liability Bill) that

come into force in the second half of 2020, which should allow us to

service claims under the lower cost regime and pass the savings to

customers whilst maintaining our competitive advantage.

Whilst on the topic of regulation and customers, we welcome the pricing

study that is being undertaken by the FCA, particularly in relation to

the household market where many customers' policies have stagnated at a

single provider and increased in price for many years. When we launched

Confused.com in 2002, we saw that customers wanted pricing transparency

and the best price, and the comparison channel has delivered most of our

motor and car customers ever since. We're therefore very pleased that

changes to encourage customers to shop around (as most of our motor and

home customers already do) and will provide Admiral with further

opportunity to grow the Household customer base towards its second

million!

In conclusion, I'd like to thank our people for their hard work in 2019

and our customers for their trust in us -- as ultimately, we are here to

serve our customers!

UK Insurance review

UK Insurance financial performance

GBPm 2019 2018 2017

--------------------------------------------------- ------- ------- -------

Turnover(*1) 2,635.0 2,575.7 2,354.0

Total premiums written 2,321.7 2,269.8 2,098.0

Net insurance premium revenue 533.2 523.9 491.6

Underwriting profit including investment income(*1) 257.4 227.7 206.2

Profit commission and other income 340.0 327.9 259.3

Group's share of UK insurance profit before tax(*1) 597.4 555.6 465.5

(*1) Alternative Performance Measures -- refer to note 13 at the end of

this report for definition and explanation

Split of UK Insurance profit before tax

GBPm 2019 2018 2017

------------------------------------- ----- ----- -----

Motor 591.5 561.7 461.4

Household 7.5 (3.0) 4.1

Travel (1.6) (3.1) -

Group's share of UK insurance profit 597.4 555.6 465.5

Key performance indicators

2019 2018 2017

------------------------------------ ----- ----- -----

Vehicles insured at year end 4.37m 4.32m 3.96m

Households insured at year end 1.01m 0.87m 0.66m

Travel policies insured at year end 0.09m 0.05m -

Total UK Insurance customers(*1) 5.47m 5.24m 4.62m

(*1) Alternative Performance Measures -- refer to the end of the report

for definition and explanation.

Key highlights for the UK insurance business for 2019 include:

-- Modest growth in Motor customers but continued strong growth in Household

with Admiral increasing rates ahead of the market throughout 2019 for

Motor and maintaining rates for Household

-- A 5% increase in UK Motor profit to GBP591.5 million (2018: GBP561.7

million) primarily as a result of increased reserve releases due to an

increase in the speed of settlements of large bodily injury claims and

increased certainty post the change in the Ogden rate in mid-2019

-- This is partially offset by an adverse change in the 'one-off' Ogden

impacts (favourable impact in 2018, adverse impact in 2019). Refer to the

UK motor section below for further analysis of the underlying growth on

key metrics such as loss ratio, reserve releases and profit commission

-- Household profit of GBP7.5 million (2018: GBP3.0 million loss) as a

result of more benign weather experience in 2019

-- Travel insurance product saw a lower loss of GBP1.6 million (2018: GBP3.1

million loss)

UK Motor Insurance financial review

GBPm 2019 2018 2017

--------------------------------------------------- ------- ------- -------

Turnover(*1) 2,455.3 2,423.1 2,246.9

Total premiums written(*1) 2,158.5 2,132.1 2,001.5

Net insurance premium revenue 452.6 452.5 433.2

Investment income(*2) 30.4 32.2 32.6

--------------------------------------------------- ------- ------- -------

Net insurance claims (164.7) (189.2) (214.2)

Net insurance expenses (74.7) (72.0) (59.7)

Underwriting profit including investment income(*3) 243.6 223.5 191.9

Profit commission 112.2 95.0 64.7

Underwriting profit and profit commission 355.8 318.5 256.6

Net other revenue(*4) 235.7 243.2 204.8

UK Motor Insurance profit before tax 591.5 561.7 461.4

*1 Alternative Performance Measures -- refer to the end of this report

for definition and explanation

*2 Investment income includes GBP2.8 million of intra-group interest

(2018: GBP0.7 million; 2017: nil)

*3 Underwriting profit excludes contribution from underwritten

ancillaries (included in net other revenue)

*4 Net other revenue includes instalment income and contribution from

underwritten ancillaries and is analysed later in the report.

Key performance indicators

GBPm 2019 2018 2017

--------------------------------------------- --------- --------- ---------

Reported motor loss ratio(*1,*2) 60.7% 63.5% 64.1%

Reported motor expense ratio(*1,*3) 19.1% 18.4% 16.2%

Reported motor combined ratio 79.8% 81.9% 80.3%

Written basis Motor expense ratio 18.5% 17.5% 15.8%

Reported loss ratio before releases 87.6% 88.1% 85.3%

Claims reserve releases -- original net

share(*1,*4) GBP121.7m GBP111.4m GBP92.1m

Claims reserve releases -- commuted

reinsurance(*1,*5) GBP121.7m GBP109.6m GBP73.8m

Total claims reserve releases GBP243.4m GBP221.0m GBP165.9m

Other Revenue per vehicle GBP66 GBP67 GBP64

Vehicles insured at year end 4.37m 4.32m 3.96m

*1 Alternative Performance Measures -- refer to the end of this report

for definition and explanation

*2 Motor loss ratio adjusted to exclude impact of reserve releases on

commuted reinsurance contracts. Reconciliation in note 13b.

*3 Motor expense ratio is calculated by including claims handling

expenses that are reported within claims costs in the income statement.

Reconciliation in note 13c.

*4 Original net share shows reserve releases on the proportion of the

portfolio that Admiral wrote on a net basis at the start of the

underwriting year in question.

*5 Commuted reinsurance shows releases, net of loss on commutation, on

the proportion of the account that was originally ceded under quota

share reinsurance contracts but has since been commuted and hence

reported in underwriting profit rather than profit commission.

UK Motor profit increased by 5% during 2019 to GBP591.5 million (2018:

GBP561.7 million) and vehicles insured rose very modestly to 4.37

million (2018: 4.32 million), whilst the reported combined ratio

improved to 79.8% (2018: 81.9%). Net insurance premium revenue was

consistent with the prior period. The results were impacted by a number

of factors:

-- The current period loss ratio was 87.6% (2018: 88.1%). As highlighted

below, there are a number of offsetting movements that net to the overall

improvement of 0.5%pts:

Reported Motor Loss Ratio

Current Releases on

Period Loss Original Net Reported

Ratio Share Loss Ratio

2018 88.1% -24.6% 63.5%

Prior period impact of Ogden change

(-0.75% to 0%) - +4.0% +4.0%

Change in underlying current period

loss ratio -1.5% - -1.5%

Change in underlying claims reserve

release - -8.7% -8.7%

2019 (excluding Ogden change) 86.6% -29.3% 57.3%

Add Impact of Ogden change (0% to

- 0.25%) +1.0% +2.4% +3.4%

-------------------------------------

2019 87.6% -26.9% 60.7%

-------------------------------------

-- The unfavourable Ogden change in 2019 (0% to minus -0.25%) increased the

current period loss ratio by 1.0 ppt. Excluding this impact, the current

period loss ratio is 86.6%, which can be compared to the 2018 ratio of

88.1% (both at Ogden 0%). The underlying improvement of 1.5 ppts reflects

a slightly lower level of margin held above the projected ultimate

outcome for the current accident year, when compared to 2018 at the same

point.

-- Reserve releases on Admiral's original net share of business improved the

reported loss ratio by 26.9 ppts in 2019. Excluding the adverse Ogden

impact increases this to 29.3 ppts which is 4.7 ppts higher than in 2018

(24.6 ppts) and well above historical results. The underlying increase,

after excluding the favourable one-off Ogden impact in 2018 is 8.7 ppts.

-- This underlying improvement in the level of reserve release is unusually

large and the main driver of the increase in reported profits. It is the

result of a significant level of favourable development in ultimate

projections of prior underwriting years which in turn can be broadly

attributed to an increase in the speed of settlements in larger bodily

injury claims following the confirmation of the new Ogden rate.

-- Despite the significant level of reserve release (in both projected

ultimate and financial statement loss ratios), the margin held above

ultimate outcomes in the financial statement reserves remains both

significant and prudent. In both absolute and relative terms, the

aggregate level of margin held across current and prior underwriting

years, remains consistent with that held at the end of 2018.

-- Reserve releases from commuted reinsurance and profit commission were

higher in 2019, as follows:

Reserve

releases

-- commuted Profit

GBPm reinsurance commission Total

2018 109.6 95.0 204.6

Prior period Impact of Ogden change

(- 0.75% to 0%) -17.2 -18.4 -35.6

Change in underlying commuted releases +11.3 - +11.3

Change in loss on commutation +27.0 - +27.0

Change in underlying profit commission - +44.5 +44.5

----------------------------------------

2019 (excluding Ogden change) 130.7 121.1 251.8

Add Impact of Ogden change (0% to

minus 0.25%) -9.1 -8.8 -17.9

----------------------------------------

2019 121.7 112.2 233.9

----------------------------------------

-- Releases on reserves originally reinsured but since commuted is higher at

GBP121.7 million (v GBP109.6 million in 2018)

-- There are a number of offsetting underlying movements, including a lower

impact of the accounting loss on commutation (2019: GBP4.9 million; 2018:

GBP31.9 million) and an underlying improvement in the level of commuted

releases in line with the favourable development noted above, offset by

an unfavourable net impact of one-off Ogden changes in both years

-- The trend is similar for profit commission which improved to GBP112.2

million (2018: GBP95.0 million). Underlying profit commission improved by

GBP44.5m, primarily as a result of the favourable development of prior

underwriting years

-- Investment income was slightly lower than 2018 at GBP30.4 million (2018:

GBP32.2 million) with an underlying increase of GBP11.1m (due to both an

increase in yield and growth in the asset base) more than offset by

notional investment income accruals on reinsurance funds withheld

balances of GBP12.9 million (2018: GBPnil)

-- The written and reported basis expense ratios increased in 2019 with a

number of factors impacting: non-acquisition costs was the main driver

primarily through levies and to a lesser extent, investment in IT and

claims as the skills and foundations to build further competitive

advantages in these areas are strengthened

-- Other revenue (including ancillary products underwritten by Admiral) and

instalment income decreased to GBP235.7 million (2018: GBP243.2 million)

primarily resulting from lower contribution from optional ancillaries

Market prices remained subdued during the year with some evidence of

increases in the later months as a result of elevated levels of claims

inflation. Admiral continued to prioritise margin over growth, and

increased prices ahead of the market. As a result, slight new business

growth and good retention contributed to customer numbers (4.37 million

v 4.32 million) and turnover (GBP2.46 billion v GBP2.42 billion) being

both up by 1%.

Claims and reserves

Notable claims trends for Admiral and the market in 2019 were similar to

2018, including a slow-down in the reduction in small injury claims

frequency and continuing inflation in damage claims costs. The first

projection of the impact of large bodily injury claims on the 2019 loss

ratio is consistent with the projection of 2018 at the end of 2018.

The Group continues to reserve conservatively, setting claims reserves

in the financial statements well above actuarial best estimates to

create a margin held to allow for unforeseen adverse development.

As noted above, the Group experienced continued positive development of

claims costs on previous underwriting years as a result of increased

speed of large bodily injury settlements and increased certainty related

to the Ogden rate, in addition to a small number of positive very large

claims settlements. These factors led to another significant release of

reserves in the financial statements in the period (GBP121.7 million on

Admiral's original net share, up from GBP111.4 million). The margin held

in reserves is prudent and significant and remained at a consistent

level year-on-year.

UK Car Insurance -- co-insurance and reinsurance

Admiral makes significant use of proportional risk sharing agreements,

where insurers outside the Group underwrite a majority of the risk

generated, either through co-insurance or quota share reinsurance

contracts. These arrangements include profit commission terms (see

below) which allow Admiral to retain a significant portion of the profit

generated.

Munich Re and it's subsidiary entity, Great Lakes will underwrite 40% of

the UK motor business until at least 2020, with future extension options

available to Munich Re until 2022. 30% of this total is on a

co-insurance basis, with the remaining 10% under a quota share

reinsurance agreement from 2017 onwards.

The Group also has other quota share reinsurance arrangements confirmed

to the end of 2020 covering 38% of the business written and expects to

extend these or similar arrangements beyond 2020 during the first half

of 2020.

The nature of the co-insurance proportion underwritten by Munich Re (via

Great Lakes) is such that 30% of all motor premium and claims for the

2019 year accrue directly to Great Lakes and are not reflected in the

Group's financial statements. Similarly, Great Lakes reimburses the

Group for its proportional share of expenses incurred in acquiring and

administering this business.

The quota share reinsurance arrangements result in all motor premiums

and claims that are ceded to reinsurers being included in the Group's

financial statements, but these figures are adjusted to exclude the

reinsurer share, resulting in a net result for the Group.

The Group also purchases excess of loss reinsurance to provide

protection against large claims and reviews this cover annually. The

level of cover purchased for 2020 reduced slightly compared to 2019 due

to significant increases in market prices for cover.

Profit commission

Admiral is potentially able to earn material amounts of profit

commission revenue from co- and reinsurance partners, depending on the

profitability of the insurance business underwritten by the partner.

Revenue is recognised in the income statement in line with the booked

loss ratios on Admiral's retained underwriting.

Note 5c to the financial statements analyses profit commission income by

business, type of contract and by underwriting year.

Commutations of quota share reinsurance

Admiral tends to commute its UK Car Insurance quota share reinsurance

contracts for an underwriting year 24 months after inception, assuming

there is sufficient confidence in the profitability of the business

covered by the reinsurance contract.

After the commutation is executed, movements in booked loss ratios

result in reserve releases (or strengthening if the booked loss ratio

were to increase) rather than reduced or increased reinsurance claims

recoveries or profit commission.

During the first half of 2019, the majority of the 2017 quota share

contracts were commuted. At 31 December 2019, quota share reinsurance

contracts remained in place for a small portion of 2017 and the full

2018 and 2019 underwriting years. No further contracts were commuted in

the second half of 2019 (as is usual).

As noted above, in 2019 Admiral recognised reserve releases from

commuted reinsurance contracts of GBP121.7 million (2018: 109.6

million).

Refer to note 5d(v) of the financial statements for further analysis of

reserve releases on commuted quota share reinsurance contracts.

Other Revenue and Instalment Income

UK Motor Insurance Other Revenue -- analysis of contribution:

GBPm 2019 2018 2017

--------------------------------------------------- ------ ------ ------

Contribution from additional products & fees 202.1 206.5 187.3

Contribution from additional products underwritten

by Admiral(*1) 13.9 13.6 15.0

Instalment income 83.9 81.4 56.1

Other revenue 299.9 301.5 258.4

Internal costs (64.2) (58.3) (53.6)

Net other revenue 235.7 243.2 204.8

Other revenue per vehicle(*2) GBP66 GBP67 GBP64

--------------------------------------------------- ------ ------ ------

Other revenue per vehicle net of internal costs GBP56 GBP57 GBP54

*1 Included in underwriting profit in income statement but re-allocated

to Other Revenue for purpose of KPIs.

*2 Other revenue (before internal costs) divided by average active

vehicles, rolling 12-month basis.

Admiral generates Other revenue from a portfolio of insurance products

that complement the core car insurance product, and also fees generated

over the life of the policy.

The most material contributors to net Other revenue continue to be:

-- Profit earned from motor policy upgrade products underwritten by Admiral,

including breakdown, car hire and personal injury covers

-- Revenue from other insurance products, not underwritten by Admiral

-- Fees such as administration and cancellation fees

--Interest charged to customers paying for cover in instalments

Overall contribution (Other revenue net of costs plus instalment income)

decreased to GBP235.7 million (2018: GBP243.2 million). This is in line

with the half year expectation of a small reduction. Whilst there were a

number of smaller offsetting changes within the total, the main reasons

for the decrease is reduced optional ancillary contribution and fees,

which reflects an increase in transactions completed digitally and

changes to the customer journey. This was slightly offset by an increase

in instalment income primarily due to the growth in the underlying book

and an increase in customers paying by instalments.

Other revenue was equivalent to a decrease to GBP66 per vehicle (gross

of costs; 2018: GBP67), as a result of the factors mentioned above. Net

Other Revenue (after deducting costs) per vehicle was GBP56 (2018:

GBP57).

UK Household Insurance financial performance

GBPm 2019 2018 2017

------------------------------------- ----- ----- -----

Turnover(*1) 171.3 146.0 107.1

Total premiums written(*1) 154.9 131.1 96.5

Net insurance premium revenue 37.2 31.2 23.1

Underwriting profit/(loss)(*1*2) 0.7 (6.3) (0.8)

------------------------------------- ----- ----- -----

Profit commission and other income 6.8 3.3 4.9

UK Household insurance profit/(loss) 7.5 (3.0) 4.1

*1 Alternative Performance Measures -- refer to the end of this report

for definition and explanation

*2 Underwriting profit/(loss) excluding contribution from underwritten

ancillaries

Key performance indicators

2019 2018 2017

--------------------------------------------- --------- ------- -------

Reported household loss ratio(*1) 69.1% 92.3% 73.5%

Reported household expense ratio(*1) 28.9% 28.1% 30.0%

Reported household combined ratio(*1) 98.0% 120.4% 103.5%

Impact of extreme weather and subsidence(*1) - 19.1% -

Households insured at year end(*1) 1,011,900 865,800 659,800

(*1) Alternative Performance Measures -- refer to the end of this

report for definition and explanation

The number of properties insured increased by 17% to 1.01 million (2018:

0.87 million). Turnover increased by 17% to GBP171.3 million (2018:

GBP146.0 million). New business market volumes continued to increase,

customer retention remained strong, and shopping increased via the

comparison channels.

2019 saw more benign weather than in 2018. A combined ratio of 98%

(2018: 120%) resulted in a small net underwriting profit of GBP0.7

million (2018: underwriting loss of GBP6.3 million), which was

supplemented by net other revenue and profit commission of GBP6.8

million (2018: GBP3.3 million).

UK Household insurance -- reinsurance

The Group's Household business is supported by long-term proportional

reinsurance arrangements covering 70% of the risk. In addition, the

Group has non-proportional reinsurance to cover the risk of catastrophes

stemming from weather events.

UK Insurance Regulatory environment

The UK Insurance business operates predominantly under the regulation

of:

-- the UK Financial Conduct Authority (FCA) and Prudential Regulatory

Authority (PRA) which regulate the Group's UK registered subsidiaries

including EUI Limited (an insurance intermediary) and Admiral Insurance

Company Limited (AICL; an insurer); and

-- the Financial Services Commission (FSC), which regulates the Group's

Gibraltar-based insurance company (Admiral Insurance (Gibraltar) Limited,

AIGL), in that territory.

The Group is required to maintain capital at a level prescribed by the

lead regulator for Solvency II purposes, the PRA, and maintains a

surplus above that required level at all times.

International Insurance review

Spain -- Pascal Gonzalvez -- Acting CEO (Sarah Harris is on maternity

leave), Admiral Seguros

In 2019, Admiral Seguros accelerated its growth despite difficult market

conditions and we finished the year with more than 290,000 customers.

We managed to increase our new business sales by 16% while the

comparison market was shrinking. This was made possible by the

structural changes on Rastreator where the user experience was

significantly improved by guaranteeing the final price to customers,

having a significant impact on conversion. Our strategy to diversify our

acquisition channels has also been bearing fruit with the development of

a broker channel that is contributing to the accelerated growth.

It was pleasing to see our overall technical results moving in the right

direction despite challenges in the cost of growth. Loss ratios are

improving on prior years as expected, whilst being slightly higher than

anticipated for the 2019 underwriting year as a result of new business

growth. This was offset by a decrease in our expense ratio as we

improved internal efficiencies.

In 2020, we're planning to keep exploring alternative acquisition

channels. In our core business, we're about to launch new initiatives

to improve loss ratio (e.g. improved anti-fraud capabilities and

innovation in risk selection). We'll also be accelerating in improving

customer experience through digital capabilities (self-service) and

operational optimisation (automation).

France -- Pascal Gonzalvez -- CEO, L'olivier Assurance

2019 was another year of strong performance for L'olivier Assurance.

It was a year of fast growth despite unfavourable market conditions.

Our portfolio increased by 32%, while at the same time the aggregator

market (our main acquisition channel) was shrinking. We're pleased to

see our efforts on brand awareness, direct acquisition, and conversion

showing progress and paving the way for further development in the

coming years.

Not only did we grow fast, but we also grew stronger. Our portfolio

grew while having some significant operational improvements. As a

consequence, our customers like us more and more! The benefits of our

investments toward an effortless customer journey started to materialise

with peaks in customer satisfaction (net promoter score), persistency,

and referrals, to name a few.

On the claims side, loss ratios have developed well for prior years,

resulting in reserve releases. However, the business experienced a

deterioration in the 2019 loss ratio, partly due to the strong growth of

new business in 2019.

2020 is the beginning of a new chapter for L'olivier as we embark on our

multi-product journey and the launch of a new household insurance

product. After launching our insurtech named Homebrella (a home

insurance product for renters and expats in France) in 2019, we'll also

launch a broader household product under the brand L'olivier in early

2020.

We look forward to continuing to #makeithappen J

Italy -- Costantino Moretti -- CEO, ConTe

ConTe closed 2019 with a profit for the sixth year in a row, whilst also

achieving significant growth in turnover of 16% year-on-year.

The direct market wasn't particularly favourable and we experienced

single digit growth and challenging competition, especially via