Bollore Doesn't Rule Out Vivendi Tender Offer

June 11 2021 - 7:17AM

Dow Jones News

By Mauro Orru

Bollore SE isn't ruling out a tender offer for Vivendi SE if its

ownership of the media group were to exceed a threshold set by

France's markets regulator.

Vivendi said Friday that it had received a letter from Bollore

Group, a conglomerate steered by the family of French billionaire

Vincent Bollore, stating that if its shareholding were to exceed

30% of Vivendi's share capital or voting rights, the company

wouldn't ask for an exemption from the obligation to file a tender

offer for Vivendi.

Requirements from France's AMF oblige companies exceeding that

threshold in another listed firm to submit a tender offer, although

exemptions are possible.

Bollore is Vivendi's largest shareholder with a stake of about

27%, according to FactSet. However, the company won't necessarily

exceed 30% "since the Bollore Group companies have the option of

selling Vivendi shares, in particular to avoid the crossing of the

threshold," Vivendi said.

The announcement comes as Vivendi is due to hold its annual

general meeting on June 22, when it will ask shareholders to back a

share capital reduction by up to 50% through a public share buyback

offer to be followed by the cancellation of repurchased shares.

Vivendi said Bollore could take part in the share capital

reduction by tendering its shares to the share buyback offer,

although a decision hasn't been made as yet.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

June 11, 2021 07:14 ET (11:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

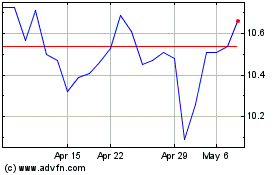

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

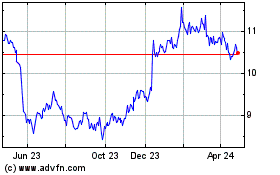

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Dec 2023 to Dec 2024