By Anne Steele

Hedge-fund billionaire William Ackman's deal for a stake in

Universal Music Group wouldn't be his family's first brush with the

music industry -- though it could be more lucrative.

His grandfather, Herman Ackman, wrote a song in 1926 that he

sold for $150 on Tin Pan Alley, the old-time New York City hub of

publishers who dominated pop music. "Put Your Arms Where They

Belong (For They Belong to Me)" turned out to be a hit, with more

than 750,000 copies sold.

Mr. Ackman opened his first meeting with Universal management

with the tale, according to people involved in the deal.

Executives at the largest music company in the world connected

the dots to find that Universal, through acquisitions over the past

century of music-business consolidation, owns Mr. Ackman's

grandfather's recordings. While the companies were going back and

forth on the mechanics of the potential special-purpose acquisition

company deal, Universal executives tracked down two 78s of the song

and the sheet music, then mounted and framed them as a gift to Mr.

Ackman, according to the people.

If the transaction goes through, the bid by Mr. Ackman's

Pershing Square Tontine Holding Ltd for 10% of Universal Music

Group would mark a new high point in the industry's resurgent

growth, which has sparked interest from Wall Street investment and

private-equity firms such as KKR & Co., to everyday investors

like those who can buy shares in publicly traded music-investment

company Hipgnosis Songs Fund Ltd.

Mr. Ackman's potential deal would value Universal Music Group at

about $40 billion, and could be inked in the next few weeks, people

familiar with the matter said. Universal parent Vivendi SE said

Friday that the transaction is subject to a shareholder vote later

this month to distribute 60% of Universal's shares and list the

company in the Netherlands.

In a sign that some investors are disappointed -- or confused --

by Mr. Ackman's plans, Pershing Square Tontine shares fell 13%

Friday to $21.68, though they are still trading above their $20

July IPO price.

SPACs, empty shells that raise money with the sole purpose of

looking for a target to merge with and bring public, have exploded

in popularity as companies seek alternatives to a traditional

IPO.

Universal is the uncontested dominant player in the record

business, commanding some 40% market share in the U.S. and 30%

globally.

Market share is key in the streaming economy, especially as it

accounts for more than 80% of recorded-music revenue in the U.S.

and more than 60% globally. Spotify and other services pay out

revenue from subscriptions and advertising based on market

share.

Universal's artists are consistently topping the charts and

among the top-streamed around the world. Nine of the top 10

recording artists of 2020 -- and slices of the tenth -- are on

Universal's roster, according to the International Federation of

the Phonographic Industry.

Over the past two years, artists, managers and music executives

have seen a surge of financial players interested in music. They

want to reap the benefits of a stable asset that has bucked

economic downturns, including during the Covid-19 pandemic, and

that promises to grow as the world comes online with streaming

services like Spotify and Apple Music.

Vivendi held discussions with various private-equity firms and

other potential investors interested in taking a piece of the

company, according to one of the people. Mr. Ackman set himself

apart, this person said, with his genuine interest in the business,

connection with management and eye for growth.

"The total addressable market is every person on the planet,"

said Mr. Ackman about Universal. "Every time a song gets played on

Spotify, Apple, Peloton, YouTube, the artist gets paid, the

songwriter gets paid and Universal gets paid."

Mr. Ackman started discussing a potential combination with

Universal and Vivendi in November after Jacqueline Reses, a

Pershing Square Tontine director, introduced him to a member of

Vivendi's board, some of the people familiar with the matter

said.

This week, Mr. Ackman flew to Paris, where he met Vincent

Bolloré, the billionaire chairman of the supervisory board, and

Vivendi CEO Arnaud de Puyfontaine, one of the people said. It was

their first face-to-face get-together after months of Zoom

meetings.

On Wednesday night, Mr. Ackman had dinner with Mr. Bolloré on

the roof of Vivendi's offices overlooking the Arc de Triomphe. By

Thursday, Mr. Ackman was back in New York and they agreed on a deal

via Zoom.

While streaming has room to grow as markets around the world

increasingly come online, the music business is increasingly

looking to new partners across social media, videogames and fitness

for revenue opportunities.

Universal artists include some of the most-streamed in the

business, such as Taylor Swift, Billie Eilish and Drake, and its

publishing arm houses some of the world's best-known songwriter

catalogs, including Bob Dylan's.

Mr. Ackman said he believes streaming is going to grow for a

long time, and described Universal Chairman and Chief Executive

Officer Lucian Grainge as an icon of the industry.

Consumers embraced streaming over the past five years, which has

made it possible for music to be played everywhere--not just on a

car radio or blaring from a CD player. It is in your ears while you

exercise, cook and play videogames. Spotify and others upended the

model of owning CDs or digital downloads, with consumers instead

paying a monthly fee or listening to ads in exchange for access to

essentially all of the music in the world.

Maureen Farrell contributed to this article.

(END) Dow Jones Newswires

June 04, 2021 17:34 ET (21:34 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

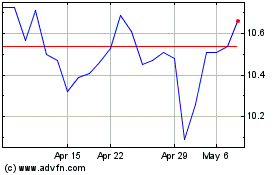

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Dec 2023 to Dec 2024