Ackman's SPAC Deal to End All SPACs -- Heard on the Street

June 04 2021 - 11:12AM

Dow Jones News

By Stephen Wilmot

Hedge-fund billionaire William Ackman launched the biggest-ever

special-purpose acquisition company last year. Now his message is

that SPACs have had their day.

On Friday, French media conglomerate Vivendi and Pershing Square

Tontine Holdings, Mr. Ackman's $4 billion SPAC, confirmed a report

in The Wall Street Journal that the two parties are in talks. The

SPAC would take a 10% stake in Universal Music Group, Vivendi's

crown jewel.

This isn't your usual SPAC deal. In February, Vivendi said it

would spin out UMG later this year in the Netherlands. That is

still happening. Rather than merging with its target as other SPACs

have, Pershing Square Tontine wants to give its shareholders access

to the planned listing at a set enterprise value of EUR35 billion,

or roughly $42 billion.

On the Vivendi side the news isn't surprising. The company gave

a detailed update on UMG last month, including that it was in talks

with an "American investor" over a 10% stake. If those talks came

to nothing, the alternative was to sell those shares via an initial

public offering. Vivendi will still distribute 60% of UMG to its

own shareholders and keep 10% for itself. Chinese tech giant

Tencent bought the remaining 20% last year.

The deal value is within expectations. Tencent bought in at an

enterprise value of EUR30 billion, and the recorded music business

has thrived during the pandemic. The new valuation would put UMG at

a higher multiple of revenues but a lower multiple of earnings than

its smaller, less profitable peer Warner Music, which went public

last year. Vivendi shares, which jumped almost 20% after the

company said it would spin off UMG, fell less than 1% Friday.

For Pershing Square Tontine investors there is more to digest.

For one, Mr. Ackman's departure from the usual route of a merger

with a startup cements worries that the recent boom in SPAC

listings has left too much money chasing too few quality targets

all at once. SPACs typically have two years to complete a deal

before returning funds to shareholders.

Moreover, the UMG deal won't be the end of Pershing Square

Tontine, which will enjoy an afterlife as a time-unlimited

acquisition vehicle with $2.9 billion in fire power. Roughly half

of that money is what is left after it buys 10% of UMG and

distributes it to its own shareholders. The rest will come from

"forward-purchase" agreements with other funds in the Pershing

Square empire -- similar to the "private investment in public

equity" or PIPE money institutional investors contribute in a

typical SPAC deal. Such agreements also fund part of the UMG

deal.

Importantly, Pershing Square Tontine's second life won't be

subject to the usual SPAC deadlines for spending its cash. The UMG

deal qualifies as the "initial business combination" that stops the

clock ticking.

As if that weren't enough, Mr. Ackman is also creating a

completely new kind of acquisition company with up to $10.6 billion

in firepower, most of it from the sale of "special-purpose

acquisition rights," or SPARs. It is like a SPAC, except that

investors have the right to buy in rather than providing the money

upfront. It is also free from the usual time pressures: The rights

last an extendible five-year term. Pershing Square Tontine

shareholders will get these transferable rights as part of the

Universal deal.

All told, Pershing Square Tontine shareholders get shares in

Universal and a stake in an extended-life acquisition vehicle --

together theoretically worth the SPAC's $20-a-share IPO value -- as

well as the right to be part of a bigger venture. Investors have

understandably struggled to get their head around this. On Friday,

the stock opened at about $22, down 10%, following much volatility

in post- and premarket trading.

Guessing Mr. Ackman's big target has been one of Wall Street's

favorite games in recent months. If the result seems a bit

underwhelming, at least it comes with the prospect of even bigger

deals to come. Just don't call them SPACs.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

June 04, 2021 11:05 ET (15:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

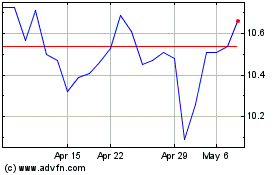

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Dec 2023 to Dec 2024