By Maureen Farrell, Cara Lombardo and Anne Steele

Hedge-fund billionaire William Ackman's special-purpose

acquisition company is nearing a deal with Universal Music Group

that would value the world's largest music business at about $40

billion, people familiar with the matter said.

Both sides confirmed negotiations early Friday, a day after The

Wall Street Journal first reported the talks. Neither side gave

detail of how advanced discussions were.

A deal, if consummated, would be the largest SPAC transaction on

record, exceeding the roughly $35 billion that Singaporean

ride-hailing company Grab Holdings Inc. was valued at in a similar

deal recently, according to Dealogic. It would have a so-called

enterprise value, taking into consideration Universal's debt, of

about $42 billion.

It isn't guaranteed Universal and the SPAC, Pershing Square

Tontine Holdings Ltd., will reach a deal. If they do, it could be

completed in the next few weeks and isn't subject to any additional

due diligence, the people said.

The deal, which would hand Mr. Ackman's entities a 10% stake in

a newly public Universal, would have a EUR33 billion, or $40

billion, equity value and a EUR35 billion enterprise value, a

measurement that takes into consideration the amount of debt and

cash a company has on its balance sheet.

Pershing Square said Friday it would pay about $4 billion for

the 10% stake. Vivendi SE, the French media conglomerate that owns

Universal, confirmed the size of the stake sale under

negotiation.

Universal is the record label behind artists including Lady

Gaga, Taylor Swift, Billie Eilish and the Weeknd. Its stable also

includes classic acts such as Queen and the Beatles, and last year

it bought Bob Dylan's entire publishing catalog.

Tencent Holdings Ltd. owns about 20% of Universal after the

Chinese internet conglomerate doubled its stake last year in a deal

that valued the business at about EUR30 billion.

Universal has benefited from an increase in revenue from music

streaming on services such as Spotify Technology SA. Universal had

about EUR7.4 billion in revenue last year, accounting for nearly

half of Vivendi's total.

Vivendi said in February it planned to spin off the business and

list it in the Netherlands later this year, with 60% of Universal's

shares distributed to the French company's investors. That plan is

still in place. As a result of the Pershing Square transaction, the

investment firm and Vivendi would each hold an additional 10%, with

Tencent retaining a 20% stake, the people said.

SPACs, or empty shells that raise money with the sole purpose of

looking for a target to merge with and bring public, have exploded

in popularity as companies seek alternatives to a traditional

IPO.

So far in 2021, at least 330 SPACs have raised $104 billion,

blowing through last year's record of more than $80 billion,

according to Dealogic. They typically have two years to find a

target.

Enthusiasm for SPACs has faded recently among investors, as some

of the highest-profile deals haven't met lofty financial targets

and regulators have been increasing scrutiny on the

transactions.

Pershing Square Tontine raised about $4 billion in a New York

Stock Exchange IPO last year. Vivendi said in a news release last

month it was considering selling 10% of Universal's shares to a

U.S. investor, without naming one.

Mr. Ackman made a splash in July when he raised his SPAC and

said he was on the hunt for a large private company to take public.

Since then, one of the biggest guessing games on Wall Street has

been predicting which company might strike a deal with him.

He initially told investors a deal could be made public by the

end of March, before recently telling The Wall Street Journal that

he had been working on one transaction since November, but needed

more time.

Mr. Ackman has experience with SPACs, having helped flip Burger

King Holdings Inc. public through one he co-founded in 2012, well

before the current SPAC craze took hold. While his firm, Pershing

Square Capital Management LP, made its name agitating at companies

including Herbalife Nutrition Ltd. and Automatic Data Processing

Inc., he has shifted his focus in recent years to friendlier

investments in companies such as Starbucks Corp.

His SPAC sought to differentiate itself from other vehicles that

have come under fire for appearing to enrich sponsors at the

expense of other shareholders.

Mr. Ackman and other executives agreed to pay more for a smaller

portion of its shares instead of taking the typical 20% cut for a

nominal fee. Analysts have said that should make them more focused

on profiting from the company's long-term performance, rather than

the deal itself.

Pershing Square Tontine shares closed Thursday at $25.05 and

were trading down around 5% after hours after the Journal reported

on the potential deal.

Corrie Driebusch contributed to this article.

Write to Maureen Farrell at maureen.farrell@wsj.com, Cara

Lombardo at cara.lombardo@wsj.com and Anne Steele at

Anne.Steele@wsj.com

(END) Dow Jones Newswires

June 04, 2021 04:13 ET (08:13 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

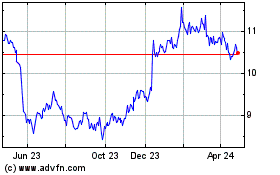

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

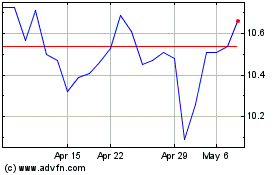

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Dec 2023 to Dec 2024