0001082733false1479652050001399213280.0001100000000000.0010.0010.0012000000030000000113992340132764011399234013992340139923401327640132764011132764012114111399234011399213281399234013276701139921328348261534348261765851327670225000000225001105291330292114110211411102340403400004385532500000.00980.0060.00550.003610.020.02128036752536738267095741980462414653969571602250000.0014.9704.970.008400.008400000000001518000P9M29DP11M16DP8M30D00000010827332021-07-012021-12-310001082733vism:ConsultantsMember2021-09-300001082733vism:ConsultantsMember2021-07-012021-09-300001082733vism:DirectorsAndOfficersMember2021-07-012021-09-3000010827332021-07-012021-09-3000010827332021-07-012021-07-3100010827332021-07-310001082733vism:CommonStockWarrantMember2021-07-310001082733vism:DirectorsAndOfficersMember2021-09-300001082733us-gaap:FairValueInputsLevel3Member2021-06-300001082733us-gaap:FairValueInputsLevel2Member2021-06-300001082733us-gaap:FairValueInputsLevel1Member2021-06-300001082733vism:WarrantsMemberus-gaap:FairValueInputsLevel3Member2021-06-300001082733vism:WarrantsMemberus-gaap:FairValueInputsLevel2Member2021-06-300001082733vism:DerivativeLiabilityWarrantsMemberus-gaap:FairValueInputsLevel1Member2021-06-300001082733vism:ConvertibleNotesMemberus-gaap:FairValueInputsLevel3Member2021-06-300001082733vism:ConvertibleNotesMemberus-gaap:FairValueInputsLevel2Member2021-06-300001082733vism:ConvertibleNotesMemberus-gaap:FairValueInputsLevel1Member2021-06-300001082733vism:ThreatSurfaceSolutionsGroupMember2021-07-012021-12-310001082733vism:ThreatSurfaceSolutionsGroupMember2020-07-012021-06-300001082733vism:MrMarkLuckyMember2021-06-300001082733vism:OutstandingOptionsMember2021-07-012021-12-310001082733vism:OutstandingOptionsMember2020-07-012021-06-300001082733vism:StockOption2Member2021-07-012021-12-310001082733vism:StockOption2Member2020-07-012021-06-300001082733vism:StockOption1Member2021-07-012021-12-310001082733vism:StockOption1Member2020-07-012021-06-300001082733vism:StockOption1Member2021-06-300001082733vism:OutstandingOptionsMember2021-12-310001082733vism:OutstandingOptionsMember2021-06-300001082733vism:StockOption2Member2021-12-310001082733vism:StockOption2Member2021-06-300001082733vism:StockOption1Member2021-12-310001082733vism:CommonStockWarrantsMember2021-07-012021-12-310001082733vism:CommonStockWarrantsMember2019-01-310001082733vism:CommonStockWarrantsMember2021-07-310001082733vism:CommonStockWarrantsMember2021-12-310001082733vism:SecuritiesPurchaseAgreementMember2021-07-012021-12-310001082733vism:SecuritiesPurchaseAgreementMember2021-12-310001082733vism:ConsultantsMember2021-07-012021-12-310001082733vism:ConsultantsMember2020-07-012021-06-300001082733vism:ConsultantsMember2019-07-012020-06-300001082733vism:ConsultantsMember2021-12-310001082733vism:DirectorsMember2021-07-012021-12-310001082733vism:DirectorsMember2020-07-012021-06-300001082733vism:DirectorsMember2019-07-012020-06-300001082733vism:DirectorsMember2021-12-310001082733vism:WarrantFiveMember2021-07-012021-12-310001082733vism:WarrantFourMember2021-07-012021-12-310001082733vism:WarrantThreeMember2021-07-012021-12-310001082733vism:WarrantTwoMember2021-07-012021-12-310001082733vism:WarrantOneMember2021-07-012021-12-310001082733vism:WarrantFiveMember2021-12-310001082733vism:WarrantFourMember2021-12-310001082733vism:WarrantThreeMember2021-12-310001082733vism:WarrantTwoMember2021-12-310001082733vism:WarrantOneMember2021-12-310001082733srt:MaximumMembervism:NotesPayableMember2021-12-310001082733srt:MaximumMembervism:NotesPayableMember2021-06-300001082733srt:MinimumMembervism:NotesPayableMember2021-06-300001082733srt:MinimumMembervism:NotesPayableMember2021-12-310001082733srt:MinimumMembervism:NotesPayableMember2020-06-300001082733vism:NotesPayableMember2021-10-012021-10-310001082733vism:NotesPayableMember2021-06-300001082733srt:MaximumMembervism:ConvertibleNotesPayablesMember2021-12-310001082733srt:MaximumMembervism:ConvertibleNotesPayablesMember2021-06-300001082733srt:MinimumMembervism:ConvertibleNotesPayablesMember2021-06-300001082733srt:MinimumMembervism:ConvertibleNotesPayablesMember2021-12-310001082733srt:MinimumMembervism:ConvertibleNotesPayablesMember2020-06-300001082733vism:ConvertibleNotesPayablesMember2021-09-012021-09-3000010827332014-05-0600010827332013-07-2200010827332013-07-012013-07-2200010827332014-05-012014-05-060001082733vism:ConvertibleNotesPayablesMember2020-06-300001082733vism:ConvertibleNotesPayablesMember2021-06-300001082733vism:ConvertibleNotesPayablesMember2021-12-310001082733vism:LabrysMember2021-07-012021-12-310001082733vism:LabrysMember2020-07-012021-06-300001082733vism:AuctusFundsMember2020-07-012021-06-300001082733vism:FirstFireGlobalOpportunitiesFundLlcMember2020-07-012021-06-3000010827332021-03-310001082733srt:MaximumMember2019-07-012020-06-300001082733srt:MaximumMember2020-07-012020-12-310001082733srt:MaximumMember2021-07-012021-12-310001082733srt:MaximumMember2020-07-012021-06-300001082733srt:MinimumMember2019-07-012020-06-300001082733srt:MinimumMember2020-07-012020-12-310001082733srt:MinimumMember2021-07-012021-12-310001082733srt:MinimumMember2020-07-012021-06-300001082733us-gaap:RetainedEarningsMember2021-10-012021-12-310001082733us-gaap:AdditionalPaidInCapitalMember2021-10-012021-12-310001082733us-gaap:CommonStockMember2021-10-012021-12-3100010827332021-09-300001082733us-gaap:RetainedEarningsMember2021-09-300001082733us-gaap:AdditionalPaidInCapitalMember2021-09-300001082733us-gaap:CommonStockMember2021-09-300001082733vism:SeriesAAPreferredStockMember2021-09-300001082733vism:SeriesBPreferredStocksMember2021-09-300001082733vism:SeriesAPreferredStocksMember2021-09-300001082733us-gaap:RetainedEarningsMember2021-12-310001082733us-gaap:AdditionalPaidInCapitalMember2021-12-310001082733us-gaap:CommonStockMember2021-12-310001082733vism:SeriesAAPreferredStockMember2021-12-310001082733vism:SeriesBPreferredStocksMember2021-12-310001082733vism:SeriesAPreferredStocksMember2021-12-310001082733us-gaap:RetainedEarningsMember2021-07-012021-12-310001082733us-gaap:AdditionalPaidInCapitalMember2021-07-012021-12-310001082733us-gaap:CommonStockMember2021-07-012021-12-310001082733us-gaap:RetainedEarningsMember2020-10-012020-12-310001082733us-gaap:AdditionalPaidInCapitalMember2020-10-012020-12-310001082733us-gaap:CommonStockMember2020-10-012020-12-3100010827332020-09-300001082733us-gaap:RetainedEarningsMember2020-09-300001082733us-gaap:AdditionalPaidInCapitalMember2020-09-300001082733us-gaap:CommonStockMember2020-09-300001082733vism:SeriesAAPreferredStockMember2020-09-300001082733vism:SeriesBPreferredStocksMember2020-09-300001082733vism:SeriesAPreferredStocksMember2020-09-300001082733us-gaap:RetainedEarningsMember2021-06-300001082733us-gaap:AdditionalPaidInCapitalMember2021-06-300001082733us-gaap:CommonStockMember2021-06-300001082733vism:SeriesAAPreferredStockMember2021-06-300001082733vism:SeriesBPreferredStocksMember2021-06-300001082733vism:SeriesAPreferredStocksMember2021-06-300001082733us-gaap:RetainedEarningsMember2020-07-012021-06-300001082733us-gaap:AdditionalPaidInCapitalMember2020-07-012021-06-300001082733us-gaap:CommonStockMember2020-07-012021-06-3000010827332020-12-310001082733us-gaap:RetainedEarningsMember2020-12-310001082733us-gaap:AdditionalPaidInCapitalMember2020-12-310001082733us-gaap:CommonStockMember2020-12-310001082733vism:SeriesAAPreferredStockMember2020-12-310001082733vism:SeriesBPreferredStocksMember2020-12-310001082733vism:SeriesAPreferredStocksMember2020-12-310001082733us-gaap:RetainedEarningsMember2020-07-012020-12-310001082733us-gaap:AdditionalPaidInCapitalMember2020-07-012020-12-310001082733us-gaap:CommonStockMember2020-07-012020-12-310001082733us-gaap:RetainedEarningsMember2020-06-300001082733us-gaap:AdditionalPaidInCapitalMember2020-06-300001082733us-gaap:CommonStockMember2020-06-300001082733vism:SeriesAAPreferredStockMember2020-06-300001082733vism:SeriesBPreferredStocksMember2020-06-300001082733vism:SeriesAPreferredStocksMember2020-06-300001082733us-gaap:RetainedEarningsMember2019-07-012020-06-300001082733us-gaap:AdditionalPaidInCapitalMember2019-07-012020-06-300001082733us-gaap:CommonStockMember2019-07-012020-06-3000010827332019-06-300001082733us-gaap:RetainedEarningsMember2019-06-300001082733us-gaap:AdditionalPaidInCapitalMember2019-06-300001082733us-gaap:CommonStockMember2019-06-300001082733vism:SeriesAAPreferredStockMember2019-06-300001082733vism:SeriesBPreferredStocksMember2019-06-300001082733vism:SeriesAPreferredStocksMember2019-06-3000010827332020-07-012020-12-3100010827332019-07-012020-06-3000010827332020-07-012021-06-3000010827332020-10-012020-12-3100010827332021-10-012021-12-310001082733vism:SeriesAAConvertibleStocksMember2021-06-300001082733vism:SeriesAAConvertibleStocksMember2021-12-310001082733vism:SeriesAAConvertibleStocksMember2020-06-300001082733vism:SeriesBConvertiblePreferredStockMember2021-06-300001082733vism:SeriesBConvertiblePreferredStockMember2021-12-310001082733vism:SeriesBConvertiblePreferredStockMember2020-06-300001082733vism:SeriesAConvertiblePreferredStockMember2021-06-300001082733vism:SeriesAConvertiblePreferredStockMember2021-12-310001082733vism:SeriesAConvertiblePreferredStockMember2020-06-3000010827332020-06-3000010827332021-06-3000010827332021-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

As filed with the Securities and Exchange Commission on March 14, 2022.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VISIUM TECHNOLOGIES, INC. |

(Exact name of registrant as specified in its charter) |

Florida | | 7371 | | 87-0449667 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

4094 Majestic Lane, Suite 360

Fairfax, VA 22033

(703) 273-0383

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark Lucky

Chief Executive Officer and Chief Financial Officer

Visium Technologies, Inc.

4094 Majestic Lane, Suite 360

Fairfax, VA 22033

(703) 273-0383

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Joseph M. Lucosky, Esq. Scott E. Linsky, Esq. Lucosky Brookman LLP 101 Wood Avenue South, 5th Floor Woodbridge, NJ 08830 Tel. No.: (732) 395-4400 Fax No.: (732) 395-4401 | Gregory Sichenzia, Esq. Sichenzia Ross Ference LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 Telephone: (212) 930-9700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| · | Public Offering Prospectus. A prospectus to be used for the public offering of shares of Visium Technologies, Inc. (the “Company”) common stock (the “Public Offering Prospectus”) through the underwriter named on the cover page of the Public Offering Prospectus. |

| · | Resale Prospectus. A prospectus to be used for the resale by the selling shareholders (the “Selling Shareholders”) set forth therein of shares of the Company’s common stock (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| · | it contains different outside and inside front covers and back covers; |

| · | it contains different Offering sections in the Prospectus Summary section beginning on page 1; |

| · | it contains different Use of Proceeds sections on page 11; |

| · | a Selling Shareholder section is included in the Resale Prospectus; |

| · | the Dilution section from the Public Offering Prospectus on page 12 is deleted from the Resale Prospectus; |

| · | the Capitalization section from the Public Offering Prospectus on page 11 is deleted from the Resale Prospectus; |

| · | the Underwriting section from the Public Offering Prospectus on page 35 is deleted from the Resale Prospectus and a Selling Shareholders Plan of Distribution is inserted in its place; and |

| · | the Legal Matters section in the Resale Prospectus on page 37 deletes the reference to counsel for the underwriter. |

The Company has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages, as well as the deletion of certain sections and disclosures in the Public Offering Prospectus and will be used for the resale offering by the Selling Shareholders.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED March 14, 2022 |

Common Stock

VISIUM TECHNOLOGIES, INC.

This is a firm commitment public offering of shares of common stock of Visium Technologies, Inc.

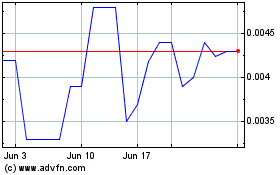

We have applied to list our common stock on the Nasdaq Capital Market under the symbol “VISM”. If our listing application is not approved, we will not proceed with the offering. Our common stock is currently quoted on the OTCPink Marketplace operated by OTC Markets Group Inc. (the “OTCPink”) under the trading symbol “VISM”.

We expect to effect a -for- reverse stock split of our outstanding common stock prior to the completion of this offering. The bona fide estimate of the range of the maximum offering price is from to and the maximum number of securities offered is (after giving effect to the reverse stock split). The actual public offering price per share will be determined through negotiations between us and the underwriter at the time of pricing and may be at a discount to the current market price. Therefore, the estimated public offering price used throughout this prospectus may not be indicative of the final offering price.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 4 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. This prospectus will be updated and made available for delivery to the extent required by the federal securities laws. Our business, financial condition, results of operations, and prospects may have changed since that date.

Unless the context otherwise requires, references in this prospectus to “we,” “us,” “our,” the “Registrant,” the “Company,” and “Visium” refer to Visium Technologies, Inc., unless otherwise specified. In addition, unless the context otherwise requires, “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; and “Securities Act” refers to the Securities Act of 1933, as amended.

This prospectus provides a general description of the securities being offered. You should read the entire prospectus before making an investment decision to purchase our securities.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus supplement. This summary does not contain all the information that you should consider before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated by reference herein. In particular, attention should be directed to our “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment decision.

Our Business

Visium is a provider of cyber security visualization, big data analytics and automation that operates in the traditional cyber security space, as well as in the cloud-based technology and Internet of Things spaces. In March 2019, Visium entered into a software license agreement with MITRE Corporation to license a patented technology known as CyGraph, a tool for cyber warfare analytics, visualization and knowledge management. CyGraph is a military-grade, highly scalable big data analytics tool for cyber security, based on graph database technology. The development of the technology was sponsored by the US Army and is currently in use by the U.S. Army Cyber Command. CyGraph provides advanced analytics for cybersecurity situational awareness that is scalable, flexible and comprehensive. Visium has completed significant proprietary product development efforts to commercialize CyGraph which the Company has rebranded as TruContextTM. The commercialization efforts included adding functionality to the core technology to make it a native cloud application, adding multi-user and multi-tenant capability, enhancing the graphical user interface, (“GUI”) to make the application more intuitive to use, and adding enhanced dashboard and reporting capabilities. TruContext would typically be deployed by an enterprise and be used by the cyber analyst to intuitively understand the massive amount of data flowing through the network environment, giving him actionable information in real-time to ensure that the network is protected from threats. The analyst will understand the relationships of the assets in the data center, the communication patterns, and cybersecurity exposures, in real-time.

TruContext provides visualization, advanced cyber monitoring intelligence, threat hunting, forensic and root cause analysis, data modeling, analytics, and automation to help reduce risk, simplify security, and deliver better security outcomes. Our mission is to help people see and understand data, empowering decision-makers to make more informed and more timely decisions. Our solutions put the power of data into the hands of everyday people, allowing a broad population of business users to engage with their data, ask questions, solve problems, and create value.

Our products dramatically reduce the complexity, and expense associated with traditional business intelligence applications. Our software allows people to access information, perform analysis, and share results without assistance from technical specialists. By putting powerful analytical technology directly into the hands of people who make decisions with data, we accelerate the pace of informed and intelligent decision-making. Our TruContext platform enables our customers to reduce or streamline their siloed and layered security products, simplifying operations while providing a comprehensive solution. Our solution automates certain previously manual tasks, freeing up personnel to focus on their most important objectives.

TruContext can be deployed in a broad range of use cases such as cyber security threat intelligence and forensics, IT/OT critical infrastructure security, supply chain analytics, anti-fraud, law enforcement, compliance, and health care. For example, a breach of your network might go undetected for months, as was the case with the Solar Winds hack that occurred in 2019-2020. In that case the hackers went undetected for 14 months. A Solar Winds type breach may not be preventable, but with TruContext analyzing streaming network data in real-time, this hack would almost certainly have been identified and remediated very quickly.

TruContext is a very effective tool for proactively and iteratively searching through networks to detect and isolate advanced threats that evade existing security solutions. Should a breach occur, TruContext can quickly perform forensics and root cause analysis, identifying when an incident occurred, how it occurred, and the downstream effects of the incident to the network.

One of the top challenges faced by Security practitioners is to keep up with the increase in new cyber attacks while investigating and remediating existing threats. Time is of essence while investigating potential threats and determining the scope and root-cause of a potential reach.

Shortage of resources and experienced personnel continues to limit the ability of companies to conduct thorough investigations. Root cause analysis and forensics are key to intelligently securing the network.

TruContext directly addresses these challenges by:

Providing real-time comprehensive visualized information on security events, that

| · | allow the cyber warrior to immediately pinpoint the root cause of the breach; and |

| · | know with certainty the priority and required remediation. |

The real-time ingestion of and visualization of massive amounts of data simplifies the cyber effort, allowing the cyber analyst intuitively understand the security posture of the organization at a glance.

Using TruContext makes the cyber analyst significantly more productive by eliminating false positives and prioritizing threat events.

TruContext ingests cyber data from any source, making the data generated by other cyber tools easily understood and actionable. TruContext give the security analyst the ability to combine, layer, filter, and query data with a no-code user interface in a way that no other analytics platform can do.

There are some sophisticated and powerful cybersecurity tools currently available, but they all lack one thing – providing a comprehensive contextualized understanding of their data. Analysts have too many tools that don’t communicate, creating silos of data/information. TruContext brings all the information for a comprehensive visualization.

On average, according to CrowdStrike, the time from breach to harm caused by threat actors is 98 minutes making the ability to:

| 1. | Identify malicious hacks in real time; and |

| 2. | To perform threat hunting critically important for the security analyst |

Using the MITRE ATT&CK framework, TruContext can hunt threats beyond the physical network boundary so that the analyst fully understands his security posture in real time.

TruContext leverages MITRE’s ATT&CK® framework, which is a globally-accessible knowledge base of adversary tactics and techniques based on real-world observations. The ATT&CK knowledge base is used as a foundation for the development of specific threat models and methodologies in the private sector, in government, and in the cybersecurity product and service community

Corporate Information

Our principal offices are located at 4094 Majestic Lane, Suite 360, Fairfax, Virginia 22033. Our telephone number is (703) 273-0383. We currently operate in a virtual office arrangement.

Our common stock is quoted on the OTCPink under the symbol “VISM.”

Recent Developments

On February 7, 2022, the Company entered into two securities purchase agreements with two separate institutional investors. Under these agreements, each investor separately purchased a promissory note with a face value of $270,000, for a total combined principal amount of $540,000 and a combined purchase price of $496,800. The closing of the purchase agreements occurred on February 7, 2022. Each promissory note was issued with original issue discount of $21,600 ($43,200 in the aggregate), each bear interest of 8% per year and mature on February 7, 2023. The promissory notes are convertible into shares of the Common Stock at conversion price of $0.0018 per share, subject to adjustment (the “Conversion Shares”). The Company has the right to prepay each promissory note in full, including accrued but unpaid interest, without prepayment penalty provided an event of default, as defined therein, has not occurred. The promissory notes contain events of defaults and negatives covenants customary for transactions of this nature. Pursuant to the securities purchase agreements, the Company issued to the investors an aggregate 54,000,000 commitment shares of the Company’s common stock (the “Commitment Shares”) as a condition to closing. In connection with the securities purchase agreements, the Company entered into a Registration Rights Agreements with each of the investors, pursuant to which the Company is obligated to file a registration statement covering the sale of the Commitment Shares and the shares of the Company’s common stock that may be issued to the investors pursuant to the conversion of the promissory notes. Resale of the Commitment Shares is being registered with the registration statement that this primary offering prospectus forms a part, with alternate disclosures for a resale prospectus that this registration statement also forms a part.

On February 23, 2022, the Company entered into a securities purchase agreement with one institutional investor. Under this agreement, the investor separately purchased a promissory note with a face value of $270,000 and a purchase price of $248,400. The closing of the purchase agreements occurred on February 23, 2022. The promissory note was issued with original issue discount of $21,600, bears interest of 8% per year and mature on February 23, 2023. The promissory note is convertible into Conversion Shares at conversion price of $0.0018 per share, subject to adjustment. The Company has the right to prepay the promissory note in full, including accrued but unpaid interest, without prepayment penalty provided an event of default, as defined therein, has not occurred. The promissory note contains events of defaults and negatives covenants customary for transactions of this nature. Pursuant to the securities purchase agreement, the Company issued to the investors an aggregate 27,000,000 commitment shares of the Company’s common stock (the “Commitment Shares”) as a condition to closing. In connection with the securities purchase agreement, the Company entered into a Registration Rights Agreements with the investor, pursuant to which the Company is obligated to file a registration statement covering the sale of the Commitment Shares and the shares of the Company’s common stock that may be issued to the investor pursuant to the conversion of the promissory note. Resale of the Commitment Shares is being registered with the registration statement that this primary offering prospectus forms a part, with alternate disclosures for a resale prospectus that this registration statement also forms a part.

THE OFFERING

Securities offered by us: | shares of common stock |

| |

Common stock outstanding prior to this offering (1) | 3,805,071,242 |

| |

Common stock to be outstanding after the offering (1) | |

| |

Over-allotment option | We have granted the underwriters the option to purchase up to additional shares of Common Stock from us at a price per share equal to the public offering price per share, less the underwriting discounts payable by us, solely to cover over-allotments, if any. |

| |

Use of proceeds | We expect to receive net proceeds from this offering of approximately $ (assuming a public offering price of $ per share, set forth on the cover page of this prospectus), or approximately $ if the underwriters exercise in full their over-allotment option to purchase up to additional shares of our common stock, after deducting the underwriting discounts and commissions and estimated offering expenses of approximately $ payable by us. We intend to direct approximately $ of the net proceeds of the offering towards working capital, and other general corporate purposes which may include potential future business acquisitions and to a lesser extent repayment of debt. Pending the use of the net proceeds of this offering as described above, we may invest the net proceeds in short-term interest-bearing investment grade instruments. See “Use of Proceeds” for additional information. |

| |

Risk Factors | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 4 before deciding to invest in our securities. |

| |

OTCPink trading symbol: | VISM |

| |

Proposed Nasdaq trading symbol: | We have applied to list our common stock on the Nasdaq Capital Market under the symbol “VISM.” No assurance can be given that our application will be approved. |

Prior to the consummation of this offering, we expect to effect a -for- reverse stock split of our issued and outstanding common stock (the “Reverse Stock Split”). No fractional shares of the Company’s common stock will be issued as a result of the Reverse Stock Split. Any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share.

The total number of shares of our common stock that will be outstanding after this offering is based on 3,802,071,242 shares of common stock outstanding as of March 9, 2022, and 10,000,000,000 authorized shares of common stock. Unless otherwise indicated, the shares of common stock outstanding after this offering excludes the following:

| ● | 3,000,000 shares issuable upon the exercise of outstanding stock options; |

| ● | 117,000,000 shares reserved for future issuances under our equity compensation plans; |

| ● | 6,814,782 shares of common stock issuable upon the exercise of outstanding warrants; |

| ● | completion of the Reverse Stock Split. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties and include statements regarding, among other things, our projected revenue growth and profitability, our growth strategies and opportunity, anticipated trends in our market and our anticipated needs for working capital. Forward-looking statements are generally identifiable by the use of words like “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements may be found under the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as in this prospectus generally. In particular, this prospectus includes statements relating to future actions, prospective products, market acceptance, future performance or results of current and anticipated products, sales efforts, expenses, and the outcome of contingencies such as legal proceedings and financial results.

Examples of forward-looking statements in this prospectus include, but are not limited to, our expectations regarding our business strategy, ability to complete and recognize the benefits from acquisitions, business prospects, operating results, operating expenses, working capital, liquidity, and capital expenditure requirements. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the cost, terms and availability of components, pricing levels, the timing and cost of capital expenditures, competitive conditions, and general economic conditions. These statements are based on our management’s expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect.

Important factors that could cause actual results to differ materially from the results and events anticipated or implied by such forward-looking statements include, but are not limited to:

| ● | changes in the market acceptance of our products; |

| | |

| ● | increased levels of competition; |

| | |

| ● | the effect of the COVID-19 pandemic on our business; |

| | |

| ● | changes in political, economic, or regulatory conditions generally and in the markets in which we operate; |

| | |

| ● | our relationships with our key customers; |

| | |

| ● | our ability to retain and attract senior management and other key employees; |

| | |

| ● | our ability to quickly and effectively respond to new technological developments; |

| | |

| ● | our ability to protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others and prevent others from infringing on our proprietary rights; and |

| | |

| ● | other risks, including those described in the “Risk Factors” discussion of this prospectus. |

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this prospectus are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise.

RISK FACTORS

The common shares of our Company are considered speculative. You should carefully consider the following risks and uncertainties in addition to other information in this annual report in evaluating our Company and our business before purchasing our common shares. Our business, operating or financial condition could be harmed due to any of the following risks:

Risks Related to Our Company

Management and our auditors have raised substantial doubts as to our ability to continue as a going concern.

Our financial statements have been prepared assuming we will continue as a going concern. Since inception we have experienced recurring net losses which losses caused an accumulated deficit of approximately $54.5 million as of December 31, 2021. These factors, among others, raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We currently have a working capital deficit and negative cash flow from operations and are uncertain if and when we will be able to pay our current liabilities.

Our working capital deficit was approximately $2.0 million as of December 31, 2021. This deficit consists of $382,000 in current assets, offset by $2,366,000 in current liabilities. In addition, we had negative cash flow from operations for the six months ended December 31, 2021, of approximately $923,600. We do not have any liquid or other assets that can be liquidated to pay our current liabilities while we continue to incur additional liabilities to our officer and certain service providers who are working to prepare the documents required to be filed with the Securities and Exchange Commission to enable our common shares to be registered for trading. Since we currently have limited operations, the only ways we have of paying our current liabilities are to issue our common or preferred shares to our creditors or to issue unsecured promissory notes, which may include certain features such as convertibility into common or preferred shares or warrants to purchase additional common or preferred shares in the future.

We had $1,039,304 of convertible notes, notes payable, and accrued interest payable as of December 31, 2021, of which $1,039,304 of this amount is past due, and we do not have the funds necessary to pay these obligations.

In addition to funding our operating expenses, we need capital to pay various debt obligations totaling approximately $1,039,304 as of December 31, 2021, which are either currently past due or which are due in the current fiscal year. Currently, there is $317,431 principal amount of the convertible notes payable, which is past due, $205,000 principal of the notes payable which is past due, and $368,908 of accrued interest which is past due. The interest on the past due principal amounts will continue to accrue monthly at their stated rates. Holders of past due notes do not have a security interest in our assets. The existence of these obligations provides additional challenges to us in our efforts to raise capital to fund our operations.

In the event we consummate a transaction with a profitable company, we may not be able to utilize our net operating loss carryover, which may have a negative impact on your investment.

If we enter into a combination with a business that has operating income, we cannot assure you that we will be able to utilize all or even a portion of our existing net operating loss carryover for federal or state tax purposes following such a business combination. If we are unable to make use of our existing net operating loss carryover, the tax advantages of such a combination may be limited, which could negatively impact the price of our stock and the value of your investment. These factors will substantially increase the uncertainty, and thus the risk, of investing in our shares.

There are a number of factors related to our common stock, which may have an adverse effect on our shareholders.

Shareholders’ interests in our Company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities. In the event that we are required to issue additional shares, enter into private placements to raise financing through the sale of equity securities or acquire business interests in the future from the issuance of shares of our common stock to acquire such interests, the interests of existing shareholders in our Company will be diluted and existing shareholders may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we do issue additional shares, it will cause a reduction in the proportionate ownership and voting power of all existing shareholders.

We have certain provisions in our Articles of Incorporation and Bylaws, and there are other provisions under Florida law, that may serve to make a takeover of our Company more difficult.

Provisions of our articles of incorporation and bylaws may delay or prevent a takeover, which may not be in the best interests of our stockholders. Provisions of our articles of incorporation and bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may be called, and may delay, defer, or prevent a takeover attempt. In addition, certain provisions of Florida law also may be deemed to have certain anti-takeover effects which include that control of shares acquired in excess of certain specified thresholds will not possess any voting rights unless these voting rights are approved by a majority of a corporation’s disinterested stockholders.

Voting power of our shareholders is highly concentrated by insiders.

Our officers and directors control, either directly or indirectly, a substantial portion of our voting securities. As of December 31, 2021, our executive officer and directors beneficially owns 770,098,096 shares of Common Stock, or approximately 21.3% of our outstanding shares of Common Stock. In addition, our executive officer owns the only issued and outstanding share of Series AA Convertible Preferred Stock, which entitles him to 51% of the Common votes on any matter requiring a shareholder vote. Therefore, our management may significantly affect the outcome of all corporate actions and decisions for an indefinite period of time including the election of directors, amendment of charter documents and approval of mergers and other significant corporate transactions.

Our common stock is quoted in the over the counter market on the OTCPink.

Our common stock is quoted on the OTCPink. OTCPink offers a quotation service to companies that are unable to list their securities on an exchange or for companies, such as ours, whose securities are not eligible for quotation on the OTC Bulletin Board. The requirements for quotation on the OTCPink are considerably lower and less regulated than those of the OTC Bulletin Board or an exchange. Because our common stock is quoted on the OTCPink, it is possible that even fewer brokers or dealers would be interested in making a market in our common stock, which further adversely impacts its liquidity.

The tradability of our common stock is limited under the penny stock regulations which may cause the holders of our common stock difficulty should they wish to sell their shares.

Because the quoted price of our common stock is less than $5.00 per share, our common stock is considered a “penny stock,” and trading in our common stock is subject to the requirements of Rule 15g-9 under the Exchange Act. Under this rule, broker/dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker/dealer must make an individualized written suitability determination for the purchaser and receive the purchaser’s written consent prior to the transaction. SEC regulations also require additional disclosure in connection with any trades involving a “penny stock,” including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. These requirements severely limit the liquidity of securities in the secondary market because few broker or dealers are likely to undertake these compliance activities and this limited liquidity will make it more difficult for an investor to sell his shares of our common stock in the secondary market should the investor wish to liquidate the investment. In addition to the applicability of the penny stock rules, other risks associated with trading in penny stocks could also be price fluctuations and the lack of a liquid market.

Our share price is volatile and may be influenced by numerous factors that are beyond our control.

Market prices for shares of technology companies such as ours are often volatile. The market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including:

| ● | fluctuations in digital currency and stock market prices and trading volumes of similar companies; |

| | |

| ● | general market conditions and overall fluctuations in U.S. equity markets; |

| | |

| ● | sales of large blocks of our common stock, including sales by our executive officers, directors, and significant stockholders; |

| | |

| ● | discussion of us or our stock price by the press and by online investor communities; and |

| | |

| ● | other risks and uncertainties described in these risk factors. |

We have no current plans to pay dividends on our Common Stock and investors must look solely to stock appreciation for a return on their investment.

We do not anticipate paying any further cash dividends on our common stock in the foreseeable future. We currently intend to retain all future earnings to fund the development and growth of our business. Any payment of future dividends will be at the discretion of our board of directors and will depend on, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends and other considerations that the board of directors deems relevant. Investors may need to rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize a return on their investment. Investors seeking cash dividends should not purchase our common stock.

Risks Related to Our Industry

Economic conditions may affect our ability to obtain financing and to complete a merger or acquisition.

Due to general economic conditions, rapid technological advances being made in some industries, and shortages of available capital, our management believes that there are numerous firms seeking even the limited additional capital, which we will need. In the presence of these economic conditions, we may have difficulty raising sufficient capital to support the investigation of potential business opportunities, and to consummate a merger or acquisition. These factors substantially increase the uncertainty, and thus the risk, of investing in our shares.

In March 2020, a novel coronavirus (“COVID-19”) emerged and has subsequently spread worldwide. The World Health Organization declared COVID-19 a pandemic resulting in federal, state, and local governments mandating various restrictions, including travel restrictions, restrictions on public gatherings, stay at home orders and advisories and quarantining of people who may have been exposed to the virus. The Delta variant of COVID-19, which appears to be the most transmissible and contagious variant to date, has caused a surge in COVID-19 cases globally. The impact of the Delta variant, or other variants that may emerge, cannot be predicted at this time, and could depend on numerous factors, including the availability of vaccines in different parts of the world, vaccination rates among the population, the effectiveness of COVID-19 vaccines against the Delta, Omicron and other variants, and the response by governmental bodies to reinstate mandated business closures, orders to “shelter in place,” and travel and transportation restrictions. As of December 31, 2021, COVID-19 has not had a material impact on our results of operations or financial condition.

The IT security market is rapidly evolving within the increasingly challenging cyber threat landscape and the continuing use of hybrid on-premise and cloud-based environments. As a result of unanticipated market, industry or company developments our sales may not continue to grow at current rates or may decline, and our share price could decrease.

We operate in a rapidly evolving industry focused on securing organizations’ IT systems and sensitive data. Our solutions focus on safeguarding privileged accounts, credentials, and secrets. Privileged accounts are those accounts within an organization that give users, applications, and machine identities the highest levels of access, or “privileged” access, to IT systems and infrastructure, industrial control systems, applications and data both on-premises and in cloud environments. While breaches of such privileged accounts have continued to gain media attention in recent years, IT security spending within enterprises is often concentrated on endpoint and network security products designed to stop threats from penetrating corporate networks. Organizations may allocate all or most of their IT security budgets to these products and may not adopt our solutions in addition to such products. Organizations are moving portions of their IT systems to be managed by third parties, primarily infrastructure, platform and application service providers, and may rely on such providers’ internal security measures.

Further, security solutions such as ours, which are focused on disrupting cyber attacks by insiders and external perpetrators that have penetrated an organization’s on-premise or cloud environment, represent a security layer designed to respond to advanced threats and more rigorous compliance standards and audit requirements. However, advanced cyber attackers are skilled at adapting to new technologies and developing new methods of gaining access to organizations’ sensitive data. As our customers’ technologies and business plans evolve and become more complex, we expect them to face new and increasingly sophisticated methods of attack. We face significant challenges in ensuring that our solutions effectively identify and respond to such attacks without disrupting the performance of our customers’ IT systems. As a result, we must continually modify and improve our products, services, and licensing models in response to market and technology trends to ensure we are meeting market needs and continue providing valuable solutions that can be deployed in a variety of environments, including cloud and hybrid.

We cannot guarantee that we will be able to anticipate future market needs and opportunities or be able to develop or acquire product enhancements or new products to meet such needs or opportunities in a timely manner or at all. Delays in developing, completing or delivering new or enhanced products could cause our offerings to be less competitive, impair customer acceptance of our solutions and result in delayed or reduced revenue for our solutions.

In addition, any changes in compliance standards or audit requirements that reduce the priority for the types of controls, security, monitoring and analysis that our solutions provide would adversely impact demand for our solutions. It is therefore difficult to predict how large the market will be for our solutions. If our solutions are not viewed by organizations as necessary, or if customers do not recognize the benefit of our solutions as a critical layer of an effective security strategy, then our revenues may not continue to grow at their current rate or may decline, which could cause our share price to decrease in value.

Our reputation and business could be harmed based on real or perceived shortcomings, defects or vulnerabilities in our solutions or the provision of our services, or due to the failure of our customers, channel partners, managed security service providers, or subcontractors to correctly implement, manage and maintain our solutions, resulting in loss of existing or new customers, lawsuits, or financial losses.

Security products and solutions are complex in design and deployment and may contain errors that are not capable of being remediated or detected until after their deployment. Any errors, defects, or misconfigurations could cause our products or services to not meet specifications, be vulnerable to security attacks or fail to secure networks and could negatively impact customer operations and harm our business and reputation. In particular, we may suffer significant adverse publicity and reputational harm, including a downgrade in our industry leadership position by industry analysts, if our solutions (or the services we provide in relation to our solutions) are associated, or are believed to be associated with, or fail to reasonably protect against, a significant breach or a breach at a high profile customer, managed service provider network, or third party system utilized by us as part of our cloud-based security solution.

Further, the third-party data hosting facilities used for the provision of our SaaS solutions may experience damages, interruptions or other unanticipated problems that could result in disruptions in the provision of these solutions. Any disruptions or other performance problems with our SaaS solutions could harm our reputation and business, damage our customers’ businesses, subject us to potential liability, cause customers to terminate or not renew their subscriptions to our SaaS solutions and make it more challenging for us to retain existing customers and acquire new customers.

False detection of threats (referred to as “false positives”), while typical in our industry, may reduce perception of the reliability of our products and may therefore adversely impact market acceptance of our products. If our solutions restrict legitimate privileged access by authorized personnel to IT systems and applications by falsely identifying those users as attackers or otherwise unauthorized, our customers’ businesses could be harmed.

Our solutions not only reinforce but also rely on the common security concept of placing multiple layers of security controls throughout an IT system. The failure of our customers, channel partners, managed service providers or subcontractors to correctly implement and effectively manage and maintain our solutions (and the environments in which they are utilized), or to consistently implement and utilize generally accepted and comprehensive, multi-layered security measures and processes in customer networks, may lessen the efficacy of our solutions. Additionally, our customers or our channel partners may independently develop plug-ins or change existing plug-ins or APIs that we provided to them for interfacing purposes in an incorrect or insecure manner. Such failures or actions may lead to security breaches and data loss, which could result in a perception that our solutions failed. Further, our failure to provide our customers and channel partners with adequate services or inaccurate product documentation related to the use, implementation and maintenance of our solutions, could lead to claims against us.

An actual or perceived cyber-attack, other security breach or theft of our customers’ data, regardless of whether the breach or theft is attributable to the failure of our products, SaaS solutions or the services we provided in relation thereto, could adversely affect the market’s perception of the efficacy of our solutions and our industry standing, cause current or potential customers to look to our competitors for alternatives to our solutions and subject us to lawsuits, indemnity claims and financial losses, as well as the expenditure of significant financial resources to analyze, correct or eliminate any vulnerabilities. In addition, provisions in our license agreements that attempt to limit our liabilities towards our customers, channel partners and relevant third parties may not withstand legal challenges, and certain liabilities may not be limited or capped. Additionally, any insurance coverage we may have may not adequately cover all claims asserted against us or may cover only a portion of such claims. An actual or perceived cyber-attack could also cause us to suffer reputational harm, lose existing customers and potential new customers, or deter new and existing customers from purchasing or implementing our products.

We face intense competition from a wide variety of IT security vendors operating in different market segments and across diverse IT environments, which may challenge our ability to maintain or improve our competitive position or to meet our planned growth rates.

The IT security market in which we operate is characterized by intense competition, constant innovation, rapid adoption of different technological solutions and services, and evolving security threats. We compete with a multitude of companies that offer a broad array of IT security products that employ different approaches and delivery models to address these evolving threats.

We may face competition due to changes in the manner that organizations utilize IT assets and the security solutions applied to them, such as the provision of privileged account security functionalities as part of public cloud providers’ infrastructure offerings, or cloud-based identity management solutions. Limited IT budgets may also result in competition with providers of other advanced threat protection solutions such as McAfee, LLC, Palo Alto Networks, Splunk Inc., and Dynatrace. We also may compete, to a certain extent, with vendors that offer products or services in adjacent or complementary markets to privileged access management, including identity management vendors. Some of our competitors are large companies and have deeper technical and financial resources and broader customer bases used to bring competitive solutions to the market. These companies may already have existing relationships as an established vendor for other product offerings, and certain customers may prefer one single IT vendor for product security procurement rather than purchasing solely based on product performance. Such companies may use these advantages to offer products and services that are perceived to be as effective as ours at a lower price or for free as part of a larger product package or solely in consideration for maintenance and services fees, which could result in increased market pressure to offer our solutions and services at lower prices. They may also develop different products to compete with our current solutions and respond more quickly and effectively than we do to new or changing opportunities, technologies, standards, or client requirements or enjoy stronger sales and service capabilities in certain regions. Additionally, niche vendors are developing and marketing lower cost solutions with limited privileged access management functionality that may impact our ability to maintain premium market pricing. Our competitors may enjoy potential competitive advantages over us, such as:

| · | greater name recognition, a longer operating history and a larger customer base, notwithstanding the increased visibility of our brand in recent years since our initial public offering; |

| | |

| · | larger sales and marketing budgets and resources; |

| | |

| · | broader distribution and established relationships with channel partners, advisory firms and customers; |

| | |

| · | increased effectiveness in protecting, detecting and responding to cyber attacks; |

| | |

| · | greater or localized resources for customer support and provision of services; |

| | |

| · | greater speed at which a solution can be deployed and implemented; |

| | |

| · | greater resources to make acquisitions; |

| | |

| · | larger intellectual property portfolios; and |

| | |

| · | greater financial, technical, and other resources. |

Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources and capabilities. Current or potential competitors have been acquired and consolidated or may be acquired by third parties with greater resources in the future. As a result of such acquisitions, our current or potential competitors may be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, take advantage of other opportunities more readily or develop and expand their product and service offerings more quickly than we do. Larger competitors with more diverse product offerings may reduce the price of products that compete with ours in order to promote the sale of other products or may bundle them with other products, which would lead to increased pricing pressure on our products and could cause the average sales prices for our products to decline. Similarly, we may also face increased competition following an acquisition of new lines of business that compete with providers of such technologies or from security vendors or other companies in adjacent markets extending their solutions into privilege access management. We may be at a competitive disadvantage to our privately-held competitors, as they may not face the same accounting, auditing and legal standards we do as a public company. Such privately-held competitors may face less public scrutiny than we do and may be less risk-averse than we are, and therefore may have greater operational flexibility.

Furthermore, an increasing number of independent industry analysts and researchers, regularly evaluate, compare and publish reviews regarding the functionality of IT security products, including ours. These reviews may significantly influence the market perception of our products, and our reputation and brand could be harmed if they publish negative reviews of our products or increasingly positive reviews of our competitors’ products, or do not view us as a market leader.

In addition, other IT security technologies exist or could be developed in the future by current or future competitors, and our business could be materially and adversely affected if such technologies are widely adopted. We may not be able to successfully anticipate or adapt to changing technology or customer requirements on a timely basis, or at all. If we fail to keep up with technological changes or to convince our customers and potential customers of the value of our solutions even in light of new technologies, our business, results of operations and financial condition could be materially and adversely affected.

If we are unable to increase sales of our solutions to new customers, our future results of operations may be harmed.

An important part of our growth strategy involves continued investment in direct marketing efforts, channel partner relationships, and infrastructure to add new customers. The number and rate at which new customers may purchase our products and services depends on a number of factors, including those outside of our control, such as customers’ perceived need for our solutions, competition, general economic conditions, market transitions, product obsolescence, technological change, shifts in buying patterns, the timing and duration of hardware refresh cycles, financial difficulties and budget constraints of our current and potential customers, public awareness of security threats to IT systems, and other factors. These new customers, if any, may renew their contracts with us and purchase additional solutions at lower rates than we have experienced in the past, which could affect our financial results.

We rely on large amounts of data from a variety of sources to support our solutions and the loss of access to or the rights to use such data could reduce the efficacy of our solutions and harm our business.

Like many of our industry peers, we leverage large amounts of data related to threats, vulnerabilities, cyberattacks, and other cybersecurity intelligence to develop and maintain a number of our products and services. We collect, develop and store portions of this data using third parties and our own technology. We cannot be assured that such third parties or our technology that support the collection, development or storage of such data, and the sources of such data itself, will continue to be effective or available and the loss or reduction in quality of such data may adversely impact the efficacy of our solutions. Changes in laws or regulations in the United States or foreign jurisdictions or the actions of governmental or quasi-governmental entities may increase the costs to collect, develop or store such data, partially or completely prohibit use of such, or could result in disclosure of such data to the public or other third parties, which may reduce its value to us or as part of our solutions and thereby harm our business.

Risks Related to our Common Stock and this Offering

Persons who purchase shares of our common stock may lose their money without us ever being able to develop a market.

In the event that no market to purchase our common stock ever develops, it is likely that the entire investment of a purchaser in our common stock would be lost.

We expect to seek to raise additional funds in the future, which may be dilutive to stockholders or impose operational restrictions.

We are currently seeking additional funding through equity and/or debt financing arrangements and we expect to raise additional capital in the future to help fund development of our future expansion plans. If we raise additional capital through the issuance of equity or convertible debt securities, the percentage ownership of our current stockholders will be reduced. We may also enter strategic transactions, compensate employees or consultants, or settle outstanding payables using equity that may be dilutive. Our stockholders may experience additional dilution in net book value per share and any additional equity securities may have rights, preferences, and privileges senior to those of the holders of our common stock. If we cannot raise additional funds, we will have to delay development activities of our expansion plans.

Investors in this offering will experience immediate and substantial dilution in net tangible book value.

The public offering price per share is substantially higher than the net tangible book value per share of our outstanding shares of common stock. As a result, investors in this offering will incur an immediate dilution of $ per share based on the assumed public offering price of $ per share, which is the mid-point of the estimated offering price range described on the cover of this prospectus. Investors in this offering will pay a price per share that substantially exceeds the book value of our assets after subtracting our liabilities. To the extent that the warrants sold in this offering are exercised, you will experience further dilution. See “Dilution” for a more complete description of how the value of your investment will be diluted upon the completion of this offering.

Our stock price is likely to be highly volatile because of several factors, including a limited public float.

The market price of our common stock has been volatile in the past and is likely to be highly volatile in the future because there has been a relatively thin trading market for our stock, which causes trades of small blocks of stock to have a significant impact on our stock price. You may not be able to resell shares of our common stock following periods of volatility because of the market’s adverse reaction to volatility.

Other factors that could cause such volatility may include, among other things:

| ● | actual or anticipated fluctuations in our operating results; |

| ● | the absence of securities analysts covering us and distributing research and recommendations about us; |

| ● | overall stock market fluctuations; |

| ● | announcements concerning our business or those of our competitors; |

| ● | actual or perceived limitations on our ability to raise capital when we require it, and to raise such capital on favorable terms; |

| ● | conditions or trends in the industry; |

| ● | changes in market valuations of other similar companies; |

| ● | future sales of common stock; |

| ● | departure of key personnel or failure to hire key personnel; and |

| ● | general market conditions. |

Any of these factors could have a significant and adverse impact on the market price of our common stock. In addition, the stock market in general has at times experienced extreme volatility and rapid decline that has often been unrelated or disproportionate to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock, regardless of our actual operating performance.

The price per share of our common stock offered under this prospectus may not accurately reflect the value of your investment.

The offering price for shares of common stock offered under this prospectus has been determined by negotiation among us and the underwriters. We cannot predict the price at which our shares of common stock will trade upon the closing of the offering, and there can be no assurance that an active and liquid trading market will develop after closing or, if developed, that such a market will be sustained at the offering price. In addition, if an active public market does not develop or is not maintained, holders of our shares of common stock may have difficulty selling their shares.

Our management has broad discretion in using the net proceeds from this Offering.

We have stated, in only a general manner, how we intend to use the net proceeds from this offering. See “Use of Proceeds.” We cannot, with any assurance, be more specific at this time. We will have broad discretion in the timing of the expenditures and application of proceeds received in this offering. If we fail to apply the net proceeds effectively, we may not be successful in implementing our business plan. You will not have the opportunity to evaluate all of the economic, financial or other information upon which we may base our decisions to use the net proceeds from this offering.

If our shares of common stock are listed on a national exchange, we will be subject to potential delisting if we do not meet or continue to maintain the listing requirements of the national exchange. Moreover, the cost of remaining compliant with the listing requirements will be expensive.

We intend to apply for our shares of common stock to become listed on a national exchange. An approval of our listing application by a national exchange will be subject to, among other things, our fulfilling all of the listing requirements of such national exchange. In addition, each national exchange has rules for continued listing, including, without limitation, minimum market capitalization and other requirements. Failure to maintain our listing, or de-listing from this market, would make it more difficult for shareholders to dispose of our shares of common stock and more difficult to obtain accurate price quotations on our shares of common stock. This could have an adverse effect on the price of our shares of common stock. Moreover, the cost of remaining compliant with the listing requirements will be expensive, and our Board of Directors has determined that the benefits of such listing outweigh the potential costs. Our ability to issue additional securities for financing or other purposes, or otherwise to arrange for any financing we may need in the future, may also be materially and adversely affected if our shares of common stock are not traded on a national securities exchange.

If we are delisted from the Nasdaq Capital Market, your ability to sell your securities could also be limited by the penny stock restrictions, which could further limit the marketability of your shares.

If our securities become listed on Nasdaq, and then subsequently delisted from Nasdaq, it could come within the definition of “penny stock” as defined in the Exchange Act and would then be covered by Rule 15g-9 of the Exchange Act. Rule 15g-9 imposes additional sales practice requirements on broker-dealers who sell securities to persons other than established customers and accredited investors. For transactions covered by Rule 15g-9, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Consequently, Rule 15g-9, if it were to become applicable, would affect the ability or willingness of broker-dealers to sell our securities, and accordingly would affect the ability of stockholders to sell their securities in the public market. These additional procedures could also limit our ability to raise additional capital in the future

A significant portion of our total outstanding shares will be eligible to be sold into the market in the near future. This could cause the market price of our common stock to significantly decrease, even if our business is doing well.

Sales of a substantial number of our shares of common stock in the public market could occur at any time. These sales, or the perception in the market that these sales may occur, could result in a decrease in the market price of our shares of common stock. Immediately after this offering, we will have outstanding shares of common stock, based on the number of shares of common stock outstanding as of , 2022. This includes the shares that we are selling in this offering, which may be resold in the public market immediately without restriction, unless purchased by our affiliates or existing shareholders, and 54,000,000 shares of common stock held by the Selling Shareholders. Of the remaining shares, shares are currently restricted as a result of securities laws or 90-day or 180-day lock-up agreements (which may be waived, with or without notice, by the Representative) but will be able to be sold beginning 90 or 180 days, as applicable, after this offering, unless held by one of our affiliates, in which case the resale of those securities will be subject to volume limitations under Rule 144 of the Securities Act. See “Shares Eligible for Future Sale.” Once we register these shares, they can be freely sold in the public market, subject to volume limitations applicable to affiliates and the lock-up agreements referred to above and described in the section of this prospectus entitled “Underwriting.”

We cannot assure you that the common stock will be liquid or that it will remain listed on a securities exchange.

We cannot assure you that we will be able to maintain the listing standards of Nasdaq or any other national market. If we are delisted from any national market, then our common stock will not trade. In addition, delisting of our common stock could further depress our stock price, substantially limit liquidity of our common stock and materially adversely affect our ability to raise capital on terms acceptable to us, or at all. Delisting could also have other negative results, including the potential loss of confidence by suppliers and employees, the loss of institutional investor interest and fewer business development opportunities.

The proposed Reverse Stock Split may decrease the liquidity of our common stock.

The liquidity of our common stock may be affected adversely by the proposed Reverse Stock Split given the reduced number of shares of common stock that will be outstanding following the reverse stock split. In addition, the reverse stock split may increase the number of stockholders who own odd lots (less than 100 shares) of our common stock, creating the potential for such stockholders to experience an increase in the cost of selling their common stock and greater difficulty effecting such sales.

Following the Reverse Stock Split, the resulting market price of our common stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.