UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

| VASO CORPORATION |

| (Name of Registrant as Specified in its Charter) |

________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

VASO CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

On November 15, 2022

To our Stockholders:

An annual meeting of stockholders will be held at the Grand Hyatt Tampa Bay Hotel, 2900 Bayport Drive, Tampa, Florida 33607 on Tuesday, November 15, 2022, beginning at 10:00 A.M. EST. Stockholders may also attend the meeting by video conference at the corporate offices of Vaso Corporation located at 137 Commercial Street, Suite 200, Plainview, New York 11803. At the meeting, you will be asked to vote on the following matters:

| | 1. | Election of two directors in Class II, to hold office until the 2025 Annual Meeting of Stockholders. |

| | | |

| | 2. | Ratification of the appointment of UHY LLP as our independent registered public accountants for the year ending December 31, 2022. |

| | | |

| | 3. | Any other matters that properly come before the meeting. |

The above matters are set forth in the proxy statement attached to this notice to which your attention is directed.

If you are a stockholder of record at the close of business on September 23, 2022, you are entitled to vote at the meeting or at any adjournment or postponement of the meeting. This notice and proxy statement is first being mailed to stockholders on or about October 3, 2022.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on November 15, 2022: The Proxy Statement and Report on Form 10-K are available at www.proxyvote.com for registered holders and for beneficial owners.

| | | By Order of the Board of Directors, | |

| | | | |

| | /s/ Jun Ma | |

| | | JUN MA | |

| | | Chief Executive Officer and President | |

Dated: October 3, 2022

Plainview, New York

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN FLORIDA OR NEW YORK, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING PRE-ADDRESSED POSTAGE-PAID ENVELOPE AS DESCRIBED ON THE ENCLOSED PROXY CARD. YOUR PROXY, GIVEN THROUGH THE RETURN OF THE ENCLOSED PROXY CARD, MAY BE REVOKED PRIOR TO ITS EXERCISE BY FILING WITH OUR CORPORATE SECRETARY PRIOR TO THE MEETING A WRITTEN NOTICE OF REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE, OR BY ATTENDING THE MEETING AND VOTING IN PERSON.

THIS PAGE LEFT INTENTIONALLY BLANK

VASO CORPORATION

137 Commercial Street, Suite 200

Plainview, NY 11803

_______________

PROXY STATEMENT

_______________

ANNUAL MEETING OF STOCKHOLDERS

November 15, 2022

This proxy statement is being furnished to the holders of common stock, par value $.001, per share (the “common stock”) of Vaso Corporation (the “Company”) in connection with the solicitation by and on behalf of its board of directors (the “Board”) of proxies for use at the Annual Meeting of Stockholders (“Annual Meeting”). Our Annual Meeting will be held on November 15, 2022 at the Grand Hyatt Tampa Bay Hotel, 2900 Bayport Drive, Tampa, Florida 33607 at 10:00 A.M. EST. You may also attend the Annual Meeting by video conference at our corporate offices located at 137 Commercial Street, Suite 200, Plainview, New York 11803. This proxy statement contains information about the matters to be considered at the meeting or any adjournments or postponements of the meeting. This notice and proxy statement is first being mailed to stockholders on or about October 3, 2022.

ABOUT THE MEETING

What is being considered at the meeting?

You will be voting on the following:

| · | election of two Class II directors; |

| · | ratification of the appointment of our independent registered public accountants; and |

| · | any other matters that properly come before the meeting. |

Who is entitled to vote at the meeting?

You may vote if you were a stockholder of record as of the close of business on September 23, 2022. Each share of stock is entitled to one vote.

How do I vote?

You can vote in four ways:

| | · | by attending the meeting in Florida or New York in person; |

| | · | by completing, signing and returning the enclosed proxy card; |

| | · | by the internet at www.proxyvote.com, or; |

| | · | by phone at 1-800-690-6903. |

Voting by Proxy

For stockholders whose shares are registered in their own names, as an alternative to voting in person at the Annual Meeting, you may vote by proxy via the Internet, by telephone or, for those stockholders who receive a paper proxy card in the mail, by mailing a completed proxy card. For those stockholders who receive a Notice of Internet Availability of Proxy Materials, the Notice of Internet Availability of Proxy Materials provides information on how to access your proxy card, which contains instructions on how to vote via the Internet or by telephone. For those stockholders who receive a paper proxy card, instructions for voting via the Internet or by telephone are set forth on the proxy card; alternatively, such stockholders who receive a paper proxy card may vote by mail by signing and returning the mailed proxy card in the prepaid and addressed envelope that is enclosed with the proxy materials. In each case, your shares will be voted at the Annual Meeting in the manner you direct.

If your shares are registered in the name of a bank or brokerage firm (your record holder), you may also submit your voting instructions over the Internet or by telephone by following the instructions provided by your record holder in the Notice of Internet Availability of Proxy Materials. If you received printed copies of the proxy materials, you can submit voting instructions by telephone or mail by following the instructions provided by your record holder on the enclosed voting instructions card. Those who elect to vote by mail should complete and return the voting instructions card in the prepaid and addressed envelope provided.

Voting at the Meeting

If your shares are registered in your own name, you have the right to vote in person at the Annual Meeting by using the ballot provided at the Annual Meeting, or if you requested and received printed copies of the proxy materials by mail, you can complete, sign and date the proxy card enclosed with the proxy materials you received and submit it at the Annual Meeting. If you hold shares through a bank or brokerage firm and wish to be able to vote in person at the Annual Meeting, you must obtain a “legal proxy” from your brokerage firm, bank or other holder of record and present it to the inspector of elections with your ballot at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the meeting as described above so that your vote will be counted if you later decide not to attend the Annual Meeting. Submitting your proxy or voting instructions in advance of the meeting will not affect your right to vote in person should you decide to attend the Annual Meeting.

Can I change my mind after I vote?

Yes, you may change your mind at any time before the vote is taken at the meeting. You can do this by (1) signing another proxy with a later date and returning it to us prior to the meeting, (2) filing with our corporate secretary (Corporate Secretary, Vaso Corporation 137 Commercial Street, Suite 200, Plainview, New York 11803) a written notice revoking your proxy, or (3) voting again at the meeting.

What if I return my proxy card but do not include voting instructions?

Proxies that are signed and returned but do not include voting instructions will be voted FOR the election of the nominees for director described herein; and FOR the ratification of our appointment of UHY LLP as our independent registered public accountants.

What does it mean if I receive more than one proxy card?

It means that you have multiple accounts with brokers and/or our transfer agent. Please vote all of these shares. We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is American Stock Transfer & Trust Company (718) 921-8200.

Will my shares be voted if I do not provide my proxy?

If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy. Your shares may be voted under certain circumstances if they are held in the name of a brokerage firm. Under current rules of the New York Stock Exchange to which its members are subject, brokerage firms holding shares of common stock in “street name” may vote, in their discretion, on behalf of their clients if such clients have not furnished voting instructions with respect to ratification of the selection of the Company’s independent registered public accounting firm, but not with respect to the election of directors or any of the other proposals. Such voted shares are counted for the purpose of establishing a quorum. A broker non-vote occurs when a broker cannot exercise discretionary voting power and has not received instructions from the beneficial owner.

How many votes must be present to hold the meeting?

Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by mail. Proxies submitted that contain abstentions or broker non-votes will be deemed present at our meeting. In order for us to conduct our meeting, a majority of the shares of our outstanding common stock as of the close of business on September 23, 2022, must be present at the meeting. This is referred to as a quorum. On September 23, 2022, there were 175,127,878 shares of common stock outstanding and entitled to vote as a single class.

What vote is required to approve each item?

Directors are elected by a plurality of the votes cast. This means that the nominee for a slot with the most votes, or, if there are two or more nominees for a class, the two or more nominees, as the case may be, with the most votes for a particular class, will be elected to fill the available slot(s) for that class. Shares that are not voted, either because you marked your proxy card to withhold authority to vote for one or more nominees or because they are broker non-votes, will have no impact on the election of directors.

The ratification of the appointment of UHY LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the total votes cast on the proposal (whether in person or by proxy) by holders entitled to vote on the proposal, assuming a quorum is present at the meeting. An abstention will be counted as a vote against that proposal and broker non-votes are not considered votes cast with respect to that matter, and consequently, will have no effect on the votes on that matter.

Our officers and directors directly or beneficially own 44.56% of our voting power and intend to vote FOR the election of the nominees for directors described herein and FOR the ratification of our appointment of UHY LLP as our independent registered public accountants.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the beneficial ownership of shares of our common stock as of August 31, 2022 of (i) each person known by us to beneficially own 5% or more of the shares of outstanding common stock, based solely on filings with the SEC, (ii) each of our executive officers and directors, and (iii) all of our executive officers and directors as a group. Except as otherwise indicated, all shares are beneficially owned, and investment and voting power is held by the persons named as owners.

The percentage of beneficial ownership for the table is based on 175,127,878 shares of our common stock outstanding as of August 31, 2022. To our knowledge, except under community property laws or as otherwise noted, the persons and entities named in the table have sole voting and sole investment power over their shares of our common stock. Unless otherwise indicated, each beneficial owner listed below maintains a mailing address of c/o Vaso Corporation, 137 Commercial Street, Suite 200, Plainview, New York 11803.

*Less than 1% of the Company's common stock

| 1. | No officer or director owns more than one percent of the issued and outstanding common stock of the Company unless otherwise indicated. |

| 2. | Applicable percentages are based on 175,127,878 shares of common stock outstanding as of August 31, 2022, adjusted as required by rules promulgated by the SEC. |

| 3. | Joshua Markowitz is the record holder of 350,000 shares of our common stock. Additionally, he has voting power and dispositive power over 55,738,318 shares of our common stock in his capacity as executor of the estate of Simon Srybnik (the “Estate”), comprised of the following: 25,714,286 shares of common stock owned by Kerns Manufacturing, of which the Estate is the majority shareholder; 17,815,007 shares of common stock owned by Living Data Technology Corp, of which the Estate is the majority shareholder; and 12,209,025 shares of common stock owned by the Estate. |

Compliance with Section 16(a) of The Securities Exchange Act

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than ten percent of a registered class of our equity securities ("Reporting Persons") to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission (the "SEC") and the National Association of Securities Dealers, Inc. (the "NASD"). These Reporting Persons are required by SEC regulation to furnish us with copies of all Forms 3, 4 and 5 they file with the SEC and the NASD. Based solely upon our review of the copies of the forms it has received, we believe that all Reporting Persons complied with all filing requirements applicable to them with respect to transactions during the year ended December 31, 2021.

PROPOSAL ONE

ELECTION OF DIRECTORS

Our Certificate of Incorporation provides for a Board consisting of not less than three nor more than nine directors. Our Board now consists of six directors. The Board has three classes of directors: Class I, whose term will expire in 2024 currently consisting of Mr. Markowitz and Mr. Rios; Class II, whose term will expire in 2022 currently consisting of Mr. Movaseghi and Ms. Moen; and Class III, whose term will expire in 2023, currently consisting of Dr. Ma and Mr. Lieberman. The directors each intend to serve on the Board until his or her successor is duly elected and qualified. The Board has nominated Mr. Movaseghi and Ms. Moen for election as Class II directors to serve until the 2025 annual meeting of stockholders or until their successors are duly elected and qualified.

Assuming a quorum is present, the nominee for a slot with the most votes, or, if there are two or more nominees for a class, the two or more nominees, as the case may be, with the most votes for a particular class, will be elected to fill the available slot(s) for that class. Consequently, any shares not voted at the meeting, whether by abstention or otherwise, will have no effect on the election of directors. Shares represented by executed proxies in the form enclosed will be voted, unless otherwise indicated, for the election as directors of the nominee(s) identified above unless any such nominee shall be unavailable, in which event such shares will be voted for a substitute nominee designated by the Board. The Board has no reason to believe that any of the nominees will be unavailable or, if elected, will decline to serve.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF THE ABOVE NOMINEES AS DIRECTORS.

PROPOSAL TWO

PROPOSAL FOR RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board, upon the recommendation of the Audit Committee, recommends that the stockholders ratify the appointment of UHY LLP as our Company's independent registered public accounting firm to audit our financial statements for the fiscal year ending December 31, 2022.

Our Audit Committee has determined that the provision of services by UHY LLP other than for audit-related services is compatible with maintaining the independence of UHY LLP as our independent accountants. In accordance with the Audit Committee charter, the Audit Committee approves all audit and non-audit services provided by UHY LLP as our independent accountants.

The proposal will be adopted only if it receives the affirmative vote of a majority of the total votes cast on the proposal by holders entitled to vote at the Annual Meeting on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF UHY LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

BOARD OF DIRECTORS

Information about the Directors

As of September 23, 2022, the members of our Board of Directors are:

| Name of Director | | Age | | Principal Occupation | | Director Since |

| Joshua Markowitz (2) | | 66 | | Chairman of the Board and Director | | June, 2015 |

| David Lieberman | | 77 | | Vice Chairman of the Board and Director | | February, 2011 |

| Jun Ma | | 59 | | President, Chief Executive Officer and Director | | June, 2007 |

| Behnam Movaseghi (1) (2) | | 69 | | Director | | July, 2007 |

| Edgar Rios (1) | | 70 | | Director | | February, 2011 |

| Jane Moen | | 42 | | President of VasoHealthcare and Director | | March, 2020 |

| | (1) | Member of the Audit Committee |

| | (2) | Member of Compensation Committee |

The following is a brief account of the business experience for at least the past five years of our directors:

Joshua Markowitz has been a director since June 2015, and was appointed Chairman of the Board of the Company in August 2016. Mr. Markowitz has been a practicing attorney in the State of New Jersey for in excess of 30 years. He is currently a senior partner in the New Jersey law firm of Markowitz O'Donnell, LLP and also President of Kerns Manufacturing Corporation.

David Lieberman has been a director of the Company and the Vice Chairman of the Board, since February 2011. Mr. Lieberman has been a practicing attorney in the State of New York for more than 40 years, specializing in corporation and securities law. He is currently of counsel at the law firm of Ortoli Rosenstadt LLP, which performs certain legal services for the Company and its subsidiaries. Mr. Lieberman is a former Chairman of the Board of Herley Industries, Inc., which was sold in March, 2011.

Jun Ma, PhD, has been a director since June 2007 and was appointed President and Chief Executive Officer of the Company on October 16, 2008. Dr. Ma has held various positions in academia and business, and prior to becoming President and CEO of the Company, had provided technology and business consulting services to several domestic and international companies in aerospace, automotive, biomedical, medical device, and other industries, including Kerns Manufacturing Corp. and Living Data Technology Corp., both of which are stockholders of our Company. Dr. Ma received his PhD degree in mechanical engineering from Columbia University, MS degree in biomedical engineering from Shanghai University, and BS degree in precision machinery and instrumentation from University of Science and Technology of China.

Behnam Movaseghi, CPA, has been a director since July 2007. Mr. Movaseghi has been treasurer and secretary of Kerns Manufacturing Corporation since 2000, and controller from 1990 to 2000. For approximately ten years prior thereto Mr. Movaseghi was a tax and financial consultant. Mr. Movaseghi is a Certified Public Accountant.

Edgar G. Rios has been a director of the Company since February 2011. Mr. Rios was most recently the co-founder, CEO and Managing Member of SHD Oil & Gas LLC, an oil and gas exploration and development firm operating on the reservation of the Three Affiliate Tribes in North Dakota. Previously, Mr. Rios was a co-founder, Executive Vice President, General Counsel and Director of AmeriChoice Corporation from its inception in 1989 through its acquisition by UnitedHealthcare in 2002 and continued as a senior executive with United Healthcare through 2007. Prior to co-founding AmeriChoice, Mr. Rios was a senior executive with a number of businesses that provided technology services and non-technology products to government purchasers. Over the years, Mr. Rios also has been an investor, providing seed capital to various technology and nontechnology start-ups. Mr. Rios serves on the Board of Advisors of Columbia Law School as well as on the Board of Trustees of Meharry Medical School and the Brookings Institution in Washington; and as a director of the An-Bryce Foundation and Los Padres Foundation in Virginia. Mr. Rios holds a J.D. from Columbia University Law School and an A.B. from Princeton University.

Jane Moen has been a director since March 2020. Ms. Moen has been President of the Company’s wholly-owned subsidiary, Vaso Diagnostics, Inc. d/b/a VasoHealthcare since June 2018, following a remarkable career track record at VasoHealthcare, starting as an Account Manager at the inception of VasoHealthcare in April 2010 and being promoted to Regional Manager in January 2012, Director of Product Business Lines in July 2012 and Vice President of Sales in April 2016. Jane Moen has been in the medical sales industry for over 17 years, having had prior experience with Ledford Medical Sales, Vital Signs, Inc., Pfizer Inc. and Ecolab, Inc.

Directors’ Compensation

Each of the non-employee directors receives an annual fee of $30,000 as well as a fee of $2,500 for each Board of Directors and Committee meeting attended, except for the Chairman who receives a flat fee of $120,000 per annum starting April 1, 2021. Committee chairs receive an additional annual fee of $5,000. These fees are either paid in cash, or common stock valued at the fair market value of the common stock on the date of grant, which is the meeting date. The Company also reimburses directors for reasonable expenses incurred in attending meetings.

The table below summarizes compensation paid in the year ended December 31, 2021 by the Company to its then directors:

| | | Fees Earned or Paid in Cash | | | Stock Awards | | | Option Awards | | | Non-equity Incentive Plan Compensation | | | Nonqualified Deferred Compensation Earnings | | | All Other Compensation (1) | | | Total | |

| Name | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| David Lieberman | | | 40,000 | | | | - | | | | - | | | | - | | | | - | | | | 28,828 | | | | 68,828 | |

| Joshua Markowitz | | | 132,500 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 132,500 | |

| Behnam Movaseghi | | | 57,500 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 57,500 | |

| Edgar Rios | | | 57,500 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 57,500 | |

| | (1) | Health benefit premiums. |

Board Meetings and Attendance

Our Board held four meetings during the year ended December 31, 2021. Each director attended or participated in all meetings of the Board.

Audit Committee and Audit Committee Financial Expert

The Board has a standing Audit Committee. The Board has determined that each director who serves on the Audit Committee is independent, as the term is defined by applicable Securities and Exchange Commission ("SEC") rules. During the year ended December 31, 2021, the Audit Committee consisted of Edgar Rios, committee chair, and Behnam Movaseghi. The members of the Audit Committee have substantial experience in assessing the performance of companies, gained as members of the Company’s Board of Directors and Audit Committee, as well as by serving in various capacities in other companies or governmental agencies. As a result, they each have an understanding of financial statements. The Board believes that Behnam Movaseghi fulfills the role of the financial expert on this committee.

The Audit Committee regularly meets with our independent registered public accounting firm without the presence of management.

The Audit Committee operates under a charter approved by the Board of Directors. The Audit Committee charter is available on our website.

Compensation Committee

Our Compensation Committee annually establishes, subject to the approval of the Board of Directors and any applicable employment agreements, the compensation that will be paid to our executive officers during the coming year, as well as administers our stock-based benefit plans. During the year ended December 31, 2021, the Compensation Committee consisted of Joshua Markowitz, committee chair, and Behnam Movaseghi. None of these persons have been officers or employees of the Company at the time of their position on the committee, or, except as otherwise disclosed, had any relationship requiring disclosure herein.

The Compensation Committee operates under a charter approved by the Board of Directors. The Compensation Committee charter is available on our website.

Nominating Committee

The Company does not maintain a standing nominating committee.

THE MANAGEMENT

As of August 27, 2021, our executive officers are:

| Name of Officer | | Age | | Position held with the Company |

| Jun Ma, PhD | | 59 | | President and Chief Executive Officer |

| Peter Castle | | 54 | | Chief Operating Officer |

| Michael J. Beecher | | 77 | | Co-Chief Financial Officer and Secretary |

| Jonathan P. Newton | | 61 | | Co-Chief Financial Officer, Vice President of Finance and Treasurer |

Peter Castle was a director from August 2010 to December 2019 and was appointed the Chief Operating Officer of the Company after the NetWolves acquisition in June 2015. Prior to the acquisition, Mr. Castle was the President and Chief Executive Officer of NetWolves Network Services, LLC, where he has been employed since 1998. At NetWolves, Mr. Castle also held the position of Chief Financial Officer from 2001 until October 2009, Vice President of Finance since January 2000, Controller from August 1998 until December 1999 and Treasurer and Secretary from August 1999.

Michael J. Beecher, CPA, is currently Co-Chief Financial Officer and joined the Company as Chief Financial Officer in September 2011. Prior to joining Vasomedical, Mr. Beecher was Chief Financial Officer of Direct Insite Corp., a publicly held company, from December 2003 to September 2011. Prior to his position at Direct Insite, Mr. Beecher was Chief Financial Officer and Treasurer of FiberCore, Inc., a publicly held company in the fiber-optics industry. From 1989 to 1995 he was Vice-President Administration and Finance at the University of Bridgeport. Mr. Beecher began his career in public accounting with Haskins & Sells, an international public accounting firm. He is a graduate of the University of Connecticut, a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

Jonathan P. Newton served as Chief Financial Officer of the Company from September 1, 2010 to September 8, 2011, and is currently Co-Chief Financial Officer, Vice President of Finance and Treasurer. From June 2006 to August 2010, Mr. Newton was Director of Budgets and Financial Analysis for Curtiss-Wright Flow Control. Prior to his position at Curtiss-Wright Flow Control, Mr. Newton was Vasomedical’s Director of Budgets and Analysis from August 2001 to June 2006. Prior positions included Controller of North American Telecommunications Corp., Accounting Manager for Luitpold Pharmaceuticals, positions of increasing responsibility within the internal audit function of the Northrop Grumman Corporation and approximately three and one half years as an accountant for Deloitte Haskins & Sells, during which time Mr. Newton became a Certified Public Accountant. Mr. Newton holds a B.S. in Accounting from SUNY at Albany, and a B.S. in Mechanical Engineering from Hofstra University.

Executive Compensation

The following table sets forth the annual and long-term compensation of our Chief Executive Officer and each of our most highly compensated officers and employees who were serving as executive officers or employees at the end of the last completed fiscal year for services rendered for the years ended December 31, 2021 and 2020.

| Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) (1) | | | Option Awards ($) (1) | | Non-Equity Incentive Plan Compensation ($) | | Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) (2) | | | Total ($) | |

| Jun Ma, PhD | | 2021 | | | 500,000 | | | | 100,000 | | | | | | | | | | | | | 87,065 | | | | 687,065 | |

| Chief Executive Officer | | 2020 | | | 500,000 | | | | 75,000 | | | | | | | | | | | | | 59,548 | | | | 634,548 | |

| Peter C. Castle | | 2021 | | | 350,000 | | | | 35,000 | | | | | | | | | | | | | 13,950 | | | | 398,950 | |

| Chief Operating Officer (1) | | 2020 | | | 343,437 | | | | 52,500 | | | | | | | | | | | | | 13,950 | | | | 409,887 | |

| Michael J. Beecher | | 2021 | | | 108,000 | | | | 20,000 | | | | | | | | | | | | | 3,362 | | | | 131,362 | |

| Co-Chief Financial Officer | | 2020 | | | 120,000 | | | | 12,600 | | | | | | | | | | | | | 3,360 | | | | 135,960 | |

| Jane Moen | | 2021 | | | 275,000 | | | | 225,000 | | | | | | | | | | | | | 26,931 | | | | 526,931 | |

| President of Vasohealthcare (2) | | 2020 | | | 275,000 | | | | 74,250 | | | | 20,000 | | | | | | | | | | 11,450 | | | | 380,700 | |

| Jonathan P. Newton | | 2021 | | | 200,000 | | | | 50,000 | | | | | | | | | | | | | | 11,618 | | | | 261,618 | |

| Co-Chief Financial Officer and Treasurer | | 2020 | | | 190,000 | | | | 30,000 | | | | | | | | | | | | | | 8,722 | | | | 228,722 | |

| 1. | Represents fair value on the date of grant. See Note C to the Consolidated Financial Statements included in our Form 10–K for the year ended December 31, 2021 for a discussion of the relevant assumptions used in calculating grant date fair value. |

| 2. | Represents tax gross-ups, vehicle allowances, Company-paid life insurance, and amounts matched in the Company’s 401(k) Plan. |

Employment Agreements

On March 21, 2011, the Company entered into an Employment Agreement with its President and Chief Executive Officer, Dr. Jun Ma, for a three-year term ending on March 14, 2014. The agreement was amended in 2013 and in 2015 and again in 2019 for a five-year term ending May 31, 2024 and to provide for a continuing one-year term, unless earlier terminated by the Company, but in no event can extend beyond May 31, 2026. The Employment Agreement currently provides for annual compensation of $500,000. Dr. Ma is eligible to receive a bonus for each fiscal year during the employment term. The amount and the occasion for payment of such bonus, if any, shall be at the discretion of the Board of Directors. Dr. Ma also is eligible for an award under any long-term incentive compensation plan and grants of options and awards of shares of the Company’s stock, as determined at the Board of Directors’ discretion. The Employment Agreement further provides for reimbursement of certain expenses, and certain severance benefits in the event of termination prior to the expiration date of the Employment Agreement.

Equity compensation plan information

We maintain various stock plans under which stock options and stock grants are awarded at the discretion of our Board or its compensation committee. The purchase price of the shares under the plans and the shares subject to each option granted is not less than the fair market value on the date of the grant. The term of each option is generally five years and is determined at the time of the grant by our Board or the Compensation Committee. The participants in these plans are officers, directors, employees and consultants of the Company and its subsidiaries and affiliates.

The following table provides information concerning outstanding options, unvested stock and equity incentive plan awards for the named executives as of December 31, 2021:

| | | Option Awards | | Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options - Exercisable | | Number of Securities Underlying Unexercised Options - Unexercisable | | Equity Incentive Plan Awards: Number of Underlying Unexercised Unearned Options | | Option Exercise Price | | Option Expiration Date | | Number of Shares or Units of Stock That Have Not Vested | | | Market Value of Shares or Units of Stock That Have Not Vested | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested | |

| Jun Ma, PhD | | | | | | | | | | | | | 2,000,000 | | | | 100,000 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jane Moen | | | | | | | | | | | | | 600,000 | | | | 30,000 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jonathan P. Newton | | | | | | | | | | | | | 300,000 | | | | 15,000 | | | | - | | | | - | |

The future vesting dates of the above stock awards as of December 31, 2021 are:

The following information is provided about our current stock plans not approved by stockholders:

2013 Stock Option and Stock Issuance Plan

On October 30, 2013, the Board of Directors approved the 2013 Stock Plan (the “2013 Plan”) for officers, directors, employees and consultants of the Company. The stock issuable under the 2013 Plan shall be shares of the Company’s authorized but unissued or reacquired common stock. The maximum number of shares of common stock which may be issued under the 2013 Plan is 7,500,000 shares.

The 2013 Plan is comprised of two separate equity programs, the Options Grant Program, under which eligible persons may be granted options to purchase shares of common stock, and the Stock Issuance Program, under which eligible persons may be issued shares of common stock directly, either through the immediate purchase of such shares or as a bonus for services rendered to the Company.

During the year ended December 31, 2020, 90,000 shares of common stock were granted under the 2013 Plan, 251,250 shares were forfeited, and 77,369 shares were withheld for withholding taxes.

2016 Stock Option and Stock Issuance Plan

On June 15, 2016, the Board of Directors ("Board") approved the 2016 Stock Plan (the "2016 Plan") for officers, directors, and senior employees of the Company or any subsidiary of the Company. The stock issuable under the 2016 Plan shall be shares of the Company's authorized but unissued or reacquired common stock. The maximum number of shares of common stock that may be issued under the 2016 Plan is 7,500,000 shares.

The 2016 Plan consists of a Stock Issuance Program, under which eligible persons may, at the discretion of the Board, be issued shares of common stock directly, as a bonus for services rendered or to be rendered to the Company or any subsidiary of the Company.

No shares of common stock or options were granted under the 2016 Plan during the year ended December 31, 2021.

2019 Stock Option and Stock Issuance Plan

On May 10, 2019, the Board of Directors ("Board") approved the 2019 Stock Plan (the "2019 Plan") for officers, directors, and senior employees of the Company or any subsidiary of the Company. The stock issuable under the 2019 Plan shall be shares of the Company's authorized but unissued or reacquired common stock. The maximum number of shares of common stock that may be issued under the 2019 Plan is 15,000,000 shares.

The 2019 Plan consists of a Stock Issuance Program, under which eligible persons may, at the discretion of the Board, be issued shares of common stock directly, as a bonus for services rendered or to be rendered to the Company or any subsidiary of the Company.

During the year ended December 31, 2021, no shares or options were granted under the 2019 Plan.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2021, the Compensation Committee consisted of Joshua Markowitz, committee chair, and Behnam Movaseghi. Neither of these persons were officers or employees of the Company during the time they held positions on the committee, or, except as otherwise disclosed, had any relationship requiring disclosure herein.

In accordance with rules promulgated by the Securities and Exchange Commission, the information included under the captions “Compensation Committee Report on Executive Compensation”, and “Audit Committee Report” will not be deemed to be filed or to be proxy soliciting material or incorporated by reference in any prior or future filings by us under the Securities Act of 1933 or the Securities Exchange Act.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The compensation of our executive officers is generally determined by the Compensation Committee of our Board, subject to applicable employment agreements. Each member of the Compensation Committee is a director who is not our employee. The following report with respect to certain compensation paid or awarded to our executive officers during the year ended December 31, 2021 is furnished by the directors who comprised the Compensation Committee during 2021.

Compensation Discussion and Analysis

Executive Compensation Objectives

Our compensation programs are intended to enable us to attract, motivate, reward and retain the management talent required to achieve corporate objectives, and thereby increase stockholder value. It is our policy to provide incentives to senior management to achieve both short-term and long-term objectives and to reward exceptional performance and contributions to the development of our business. To attain these objectives, our executive compensation program generally includes a competitive base salary, bonuses and stock-based compensation. It is our belief that balancing cash and equity aligns executive compensation with shareholder interests. Compensation to our CEO for 2021 was pursuant to a prior contractual agreement, as amended.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including the principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions. A copy of the Code of Business Conduct and Ethics will be provided to any person, without charge, upon request to (516) 997-4600 or to Investor Relations, Vaso Corporation 137 Commercial Street, Suite 200, Plainview, New York 11803. The Code is also available on our website www.vasocorporation.com. Amendments to the Code of Business Conduct and Ethics that apply to our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions, if any, will be posted on our website. We will disclose any waivers of provisions of our Code of Business Conduct and Ethics that apply to our directors and principal executive, financial and accounting officers by disclosing such information on a Current Report on Form 8-K.

Section 162(m) of the Federal Income Tax Code

Generally, Section 162(m) denies deduction to any publicly held company for certain compensation exceeding $1,000,000 paid to the chief executive officer and the four other highest paid executive officers, excluding, among other things, certain performance-based compensation. The Compensation Committee and Board intend that the stock and stock options issued qualify for the performance-based exclusion under Section 162(m). The Compensation Committee will continually evaluate to what extent Section 162 will apply to its other compensation programs.

| | Respectfully submitted, |

| | |

| | The Compensation Committee Joshua Markowitz (Chairman) Behnam Movaseghi |

AUDIT COMMITTEE REPORT

This is a report of the Audit Committee of our Board. This report shall not be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934 and shall not otherwise be deemed to be filed under either such Act.

On December 31, 2021, our Audit Committee consisted of Edgar Rios (Chairman) and Behnam Movaseghi. The current members of the Audit Committee satisfy the applicable independence requirements. We intend to comply with future audit committee requirements as they become applicable to us. The Audit Committee oversees the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements included in the Company’s Report on Form 10-K for the year ended December 31, 2021.

As required by its written charter, which sets forth its responsibilities and duties, the Audit Committee reviewed and discussed our audited financial statements for the year ended December 31, 2021 with our independent auditors. The Audit Committee reviewed and discussed with MaloneBailey LLP, the Company’s independent registered public accounting firm, who are responsible for expressing an opinion on the conformity of those audited financial statements with the accounting principles generally accepted in the United States of America, their judgments as to the quality, and not just the acceptability, of the Company’s accounting principles and such other matters required to be discussed by Auditing Standard No. 16, “Communication With Audit Committees,” as adopted by the Public Company Accounting Oversight Board. The Audit Committee has also received and reviewed the written disclosures and the letter from our prior auditors, MaloneBailey LLP as required by Independence Standard No. 1, “Independence Discussions with Audit Committees,” as amended by the Independence Standards Board.

Based on these reviews and discussions, the Audit Committee recommended to the Board that the financial statements referred to above be included in the Company’s Report on Form 10-K for the year ended December 31, 2021 for filing with the Securities and Exchange Commission.

The Audit Committee has also reviewed and discussed the fees paid to MaloneBailey LLP during the year ended December 31, 2021 for audit and non-audit services, which are set forth below under “Audit Fees” and has considered whether the provision of the non-audit services is compatible with maintaining MaloneBailey LLP’s independence and concluded that it is.

| | Respectfully submitted, |

| | |

| | The Audit Committee Edgar Rios (Chairman) Behnam Movaseghi |

Independent auditor

MaloneBailey, LLP was our independent registered public accounting firm and performed the audits of our consolidated financial statements for the years ended December 31, 2021 and 2020. The following table sets forth all fees for such periods:

| | (1) | The Audit Committee has adopted a policy that requires advance approval of all audit, audit-related, tax services, and other services performed by the Company’s independent auditor. Accordingly, the Audit Committee must approve the permitted service before the independent auditor is engaged to perform it. In accordance with such policies, the Audit Committee approved all of the services relative to the above fees. |

| | | |

| | (2) | Audit fees consist of aggregate fees billed and to be billed for professional services rendered for the audit of our annual financial statements, review of the interim financial statements included in quarterly reports, and consents issued in connection with registration statements or services that are normally provided by the independent auditors in connection with statutory and regulatory filings or engagements for the fiscal years ended December 31, 2021 and 2020. |

FINANCIAL STATEMENTS AND INCORPORATION BY REFERENCE

A copy of our Report to Stockholders for the year ended December 31, 2021 has been provided to all stockholders as of the Record Date. Stockholders are referred to the report for financial and other information about us, but such report is not incorporated in this proxy statement and is not a part of the proxy soliciting material.

MISCELLANEOUS INFORMATION

As of the date of this Proxy Statement, the Board does not know of any business other than that specified above to come before the meeting, but, if any other business does lawfully come before the meeting, it is the intention of the persons named in the enclosed Proxy to vote in regard thereto in accordance with their judgment.

We will pay the cost of soliciting proxies in the accompanying form. In addition to solicitation by use of the mails, certain of our officers and regular employees may solicit proxies by telephone or personal interview. We may also request brokerage houses and other custodians and nominees and fiduciaries, to forward soliciting material to the beneficial owners of stock held of record by such persons, and may make reimbursement for payments made for their expense in forwarding soliciting material to such beneficial owners.

“Householding” of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers household proxy materials, delivering a single proxy statement to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, please notify your broker if your shares are held in a brokerage account or us if you hold registered shares. We will deliver promptly upon written or oral request a separate copy of the annual report or proxy statement, as applicable, to a security holder at a shared address to which a single copy of the documents was delivered. You can notify us by: sending a written request to Investor Relations, Vaso Corporation 137 Commercial Street, Suite 200, Plainview, NY 11803; calling us at (516) 997-4600; or emailing us at ir@vasocorporation.com if (i) you wish to receive a separate copy of an annual report or proxy statement for this meeting; (ii) you would like to receive separate copies of those materials for future meetings; or (iii) you are sharing an address and you wish to request delivery of a single copy of annual reports or proxy statements if you are now receiving multiple copies of annual reports or proxy statements.

Stockholder Proposals for 2023 Annual Meeting

Proposals of stockholders intending to be presented at the 2023 Annual Meeting of Stockholders pursuant to SEC Rule 14a-8 must be received at our principal office not later than June 5, 2023 to be included in the proxy statement for that meeting.

| | By Order of the Board of Directors, |

| | |

| | JUN MA |

| | Chief Executive Officer and President |

Dated: October 3, 2022

Plainview, New York

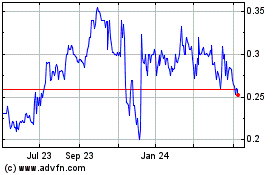

Vaso (QX) (USOTC:VASO)

Historical Stock Chart

From Mar 2024 to Apr 2024

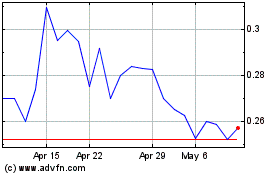

Vaso (QX) (USOTC:VASO)

Historical Stock Chart

From Apr 2023 to Apr 2024