Current Report Filing (8-k)

September 11 2019 - 11:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2019

SUMMER ENERGY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

|

000-35496

|

20-2722022

|

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

5847 San Felipe Street #3700

Houston, Texas 77057

(Address of principal executive offices)

(713) 375-2790

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

SUME

|

OTCQB

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

|

Item 5.02(e)

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

|

|

|

Officers; Compensatory Arrangements of Certain Officers.

|

|

Amendment of Compensatory Arrangements of Certain Officers and Term of their Employment

Summer Energy Holdings, Inc. (the “Company”) previously entered into employment agreements (the “Employment Agreements”) with Jaleea P. George to serve as Secretary, Treasurer, and Chief Financial Officer of the Company and with Neil M. Leibman to serve as Chief Executive Officer of the Company (Ms. George and Mr. Leibman are collectively referred to herein as the “Executives”). The Company previously amended the Employment Agreements, as disclosed in the Company’s Current Report on Form 8-K filed on February 2, 2018. On September 5, 2019, the Company entered into a Second Amendment to Employment Agreement with each of the Executives (respectively, the “George Amendment” and the “Leibman Amendment” and collectively the “Amendments”). The Amendments amended Section 1(a) of each of the Employment Agreements by extending the term of employment for each of the Executives for an additional term of two years, with the new two-year term commencing effective January 1, 2019. The George Amendment provides that Ms. George’s annual base salary will be increased to $200,000. The Amendments also amended Exhibit A to each of the Employment Agreements pursuant to which the Executives were granted additional equity incentives in the form of options to purchase common stock of the Company. Pursuant to the Leibman Amendment, Mr. Leibman will be granted an option to purchase 150,000 shares of the Company’s common stock at an exercise price equal to $1.50 per share, unless the price per share of common stock as reported on the OTC Markets on the date such option is granted is greater than $1.50, in which case the exercise price shall be equal to the price per share quoted on the OTC Markets on the date such option is granted, with 75,000 shares vesting on January 1, 2020 and the remaining 75,000 shares vesting on January 1, 2021. Pursuant to the George Amendment, Ms. George will be granted an option to purchase 170,000 shares of the Company’s common stock at an exercise price equal to $1.50 per share, unless the price per share of common stock as reported on the OTC Markets on the date such option is granted is greater than $1.50, in which case the exercise price shall be equal to the price per share quoted on the OTC Markets on the date such option is granted, with 85,000 shares vesting on January 1, 2020 and the remaining 85,000 shares vesting on January 1, 2021. Pursuant to the Amendments, the Executives are also entitled to additional equity compensation in the form of options to purchase common stock of the Company in the event the Company achieves certain performance benchmarks. All other material provisions of the Employment Agreements remain in full force and effect.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

SUMMER ENERGY HOLDINGS, INC.

|

|

|

|

|

Date:

|

September 10, 2019

|

|

By:

|

/s/ Jaleea P. George

|

|

Name:

|

Jaleea P. George

|

|

Title:

|

Chief Financial Officer

|

4845-2578-1156

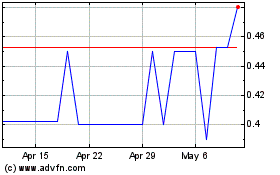

Summer Energy (QB) (USOTC:SUME)

Historical Stock Chart

From Jun 2024 to Jul 2024

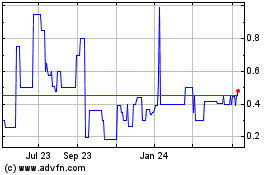

Summer Energy (QB) (USOTC:SUME)

Historical Stock Chart

From Jul 2023 to Jul 2024