UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 3)

*

Summer Energy Holdings, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

Series A Preferred Stock, par value $0.001 per share

Series B Preferred Stock, par value $0.001 per share

(Title of Class of Securities)

865634 109

(CUSIP Number)

Summer Energy Holdings, Inc.

800 Bering Drive, Suite 260, Houston, Texas, 77057

713-375-2790

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 21, 2014

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

[ ]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only).

Neil M. Leibman

|

|

2

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3

|

SEC Use Only

|

|

4

|

Source of Funds (See Instructions)

PF

|

|

5

|

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6

|

Citizenship or Place of Organization

United States

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

7

|

Sole Voting Power

Common Stock: 1,854,155

(1)

Series A Preferred Stock: 413,000

Series B Preferred Stock: 500,000

|

|

8

|

Shared Voting Power

0

|

|

9

|

Sole Dispositive Power

Common Stock: 1,854,155

(1)

Series A Preferred Stock: 413,000

Series B Preferred Stock: 500,000

|

|

10

|

Shared Dispositive Power

0

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

Common Stock: 1,854,155

(1)

Series A Preferred Stock: 413,000

Series B Preferred Stock: 500,000

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13

|

Percent of Class Represented by Amount in Row (11)

Common Stock

(2)

: 13.3%

Series A Preferred Stock: 50%

Series B Preferred Stock: 27.7%

|

|

14

|

Type of Reporting Person (See Instructions)

IN

|

|

(1)

|

Includes 46,479 shares held of record by Boxer Capital, Ltd., a Texas limited partnership. Leibman is general partner of Boxer Capital, Ltd. and has sole voting and dispositive power over such shares. Also includes 1,807,576 shares held of record by MAA Holdings Limited, a Texas limited partnership. Leibman is general partner of MAA Holdings Limited and has sole voting and dispositive power over such shares. Also includes 100 shares held of record by Leibman.

|

|

(2)

|

Based on the total amount of outstanding shares of common stock listed in the Issuer’s Form 10-Q filed with the SEC on November 14, 2013.

|

This Amendment No. 3 to Schedule 13D amends the previous Schedule 13D filed by the Reporting Person on January 30, 2013, as amended by Amendment No. 1 filed on May 3, 2013 and as further amended by Amendment No. 2 filed on September 11, 2013 (collectively, as amended the “Original 13D”), relating to the securities of Summer Energy Holdings, Inc., a Nevada corporation (the “Company” or the “Issuer”). This Amendment No. 3 is being filed to reflect the acquisition by the Reporting Person of preferred stock of the Issuer. Except as amended herein, the information in the Original 13D is unchanged and has been omitted from this Amendment No. 3. Capitalized terms used herein without definition have the meanings assigned thereto in the Original 13D.

Item 1. Security and Issuer

The class of equity securities to which this Schedule 13D relates is (i) common stock, $0.001 par value per share (“Common Stock”); (ii) Series A preferred stock, $0.001 per share (“Series A Preferred Stock”); and (iii) Series B preferred stock, $0.001 per share (“Series B Preferred Stock”) of Summer Energy Holdings, Inc., a Nevada corporation (the “Company” or the “Issuer”), with its principal executive offices at 800 Bering Drive, Suite 260, Houston, Texas 77057.

Item 3. Source and Amount of Funds or Other Consideration

Item 3 of the Original 13D is hereby supplemented with the following:

Pursuant to a Series B Preferred Stock Purchase Agreement entered into with the Company, the Reporting Person purchased 500,000 shares of an unregistered class of preferred stock designated as Series B Preferred Stock for a purchase price of $500,000 using personal funds. The Series B Preferred Stock is convertible into common stock at the election of the Reporting Person, with an initial conversion price of $1.00 per share. The Certificate of Designation provides certain adjustments to the conversion price to adjust for stock splits, adjustments, and issuance of additional shares of stock. The Series B Preferred Stock will also automatically be converted upon the earlier to occur of (A) the affirmative election of the holders of fifty percent (50%) of the outstanding shares of Series B Preferred, voting as a separate class, or (B) the affirmative vote of the board of directors upon the closing of a firmly underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933, as amended, which values the Company at least $50 million and in which the gross proceeds to the Company (after underwriting discounts, commissions and fees) are at least $10 million.

Item 4. Purpose of Transaction

Item 4 of the Original 13D is hereby supplemented with the following:

|

(a)

|

As set forth in Item 3, pursuant to a Series B Preferred Stock Purchase Agreement, the Reporting Person purchased 500,000 shares of an unregistered class of preferred stock designated as Series B Preferred Stock on February 21, 2014.

|

Item 5. Interest in Securities of the Issuer

Item 5 of the Original 13D is hereby supplemented with the following:

|

(a)

|

The Reporting Person is the holder of record of 413,000 shares of Series A Preferred Stock, which represents 50% of the issued and outstanding shares of Series A Preferred Stock, and 500,000 shares of Series B Preferred Stock, which represents approximately 27.7% of the issued and outstanding shares of Series B Preferred Stock.

|

|

(b)

|

Other than the transactions described in Item 3 above, the Reporting Person has not been involved in any transactions involving the securities of the Company in the last 60 days.

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Please see Items 3, 4 and 5, above. No other contracts, arrangements, understandings or relationships are present than as otherwise disclosed in response to Items 3, 4 and 5, above.

Item 7. Material to Be Filed as Exhibits

Series B Preferred Stock Purchase Agreement (incorporated herein by reference to Schedule 10.1 of the Issuer’s Form 8-K filed with the Securities and Exchange Commission on February 24, 2014).

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

March 19, 2014

/s/ Neil M. Leibman

Date Signature

By: Alexander N. Pearson, Attorney-in-Fact Pursuant to Power of Attorney dated December 12, 2012 previously filed with the Securities and Exchange Commission as Exhibit 24.1 to Schedule 13G filed on December 12, 2012 on behalf of Neil M. Leibman, which Power of Attorney is incorporated by reference).

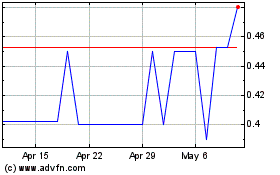

Summer Energy (QB) (USOTC:SUME)

Historical Stock Chart

From Jun 2024 to Jul 2024

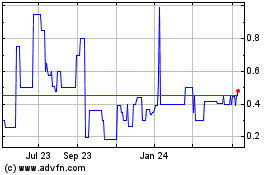

Summer Energy (QB) (USOTC:SUME)

Historical Stock Chart

From Jul 2023 to Jul 2024