Current Report Filing (8-k)

April 30 2021 - 8:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 27, 2021

SUGARMADE,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-23446

|

|

94-3008888

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

750

Royal Oaks Dr., Suite 108

Monrovia,

CA

|

|

91016

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (888) 982-1628

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

8.01. Other Events.

On

April 27, 2021 (the “Effective Date”), Sugarmade, Inc. (the “Company”) entered into an amendment (the

“LOI Amendment”) to the March 28, 2021 letter of intent (the “LOI”) entered into by and between the Company

and Lemon Glow Company, Inc., a California corporation (“Lemon Glow”, and, together with the Company, the “Parties”).

As

described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”)

on April 1, 2021, on March 28, 2021 the Parties entered into the LOI. Under the terms of the LOI, the Parties agreed to enter

into an acquisition agreement pursuant to which the Company would acquire Lemon Glow for a purchase price of $23,280,000, $4,656,000

of which will be paid in cash and $18,624,000 of which will be paid in equity.

The

Parties mutually agreed that the LOI would be valid for a period of thirty (30) days from the date of signing, which was March

28, 2021, after which the terms of the LOI would no longer be valid. Therefore, the LOI would expire on April 28, 2021, unless

amended to extend the term of the LOI.

On

the Effective Date, pursuant to the LOI Amendment, the Parties agreed to amend the LOI by extending the term of the LOI to forty-five

days (45) from March 28, 2021 – or May 12, 2021.

Pursuant

to the LOI Amendment, the Parties confirmed their intent to close the transaction outlined in the LOI and to close as soon as is possible,

but not later than May 12, 2021. Additionally, the Parties affirmed the reason for the extension of the term of the LOI does not pertain

to any disagreement or any intention to change the proposed terms outlined in the LOI, but instead was done to provide additional time

for the Parties to complete certain corporate actions necessary to effect the acquisition of Lemon Glow by the Company, certain of

which require filings that must be received and processed by State governmental bodies that, as of the date of this Current Report on

Form 8-K, have not yet been processed. Additionally, the LOI Amendment was entered into to provide additional time for the drafting of

the definitive acquisition agreement pursuant to which the Company intends to acquire Lemon Glow, as well as the completion of all necessary

due diligence that the Parties have agreed must occur before the definitive agreement may be entered into by the Parties.

The

foregoing description of the LOI is qualified by the description of the LOI in the Company’s Current Report on Form 8-K

filed with the SEC on April 1, 2021, the description of which is incorporated by reference herein.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

SUGARMADE,

INC.

|

|

|

|

|

|

Date:

April 30, 2021

|

By:

|

/s/

Jimmy Chan

|

|

|

Name:

|

Jimmy

Chan

|

|

|

Title:

|

Chief

Executive Officer and Chief Financial Officer

|

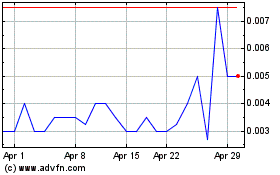

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Apr 2024 to May 2024

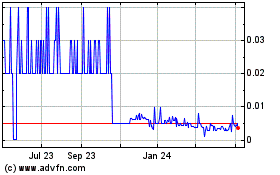

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From May 2023 to May 2024