false

2023

FY

0001511820

0001511820

2023-01-01

2023-12-31

0001511820

2023-06-30

0001511820

2024-07-10

0001511820

2023-12-31

0001511820

2022-12-31

0001511820

2022-01-01

2022-12-31

0001511820

us-gaap:CommonStockMember

2021-12-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001511820

us-gaap:RetainedEarningsMember

2021-12-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001511820

GNTW:SubTotalMember

2021-12-31

0001511820

us-gaap:NoncontrollingInterestMember

2021-12-31

0001511820

2021-12-31

0001511820

us-gaap:CommonStockMember

2022-12-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001511820

us-gaap:RetainedEarningsMember

2022-12-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001511820

GNTW:SubTotalMember

2022-12-31

0001511820

us-gaap:NoncontrollingInterestMember

2022-12-31

0001511820

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001511820

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001511820

GNTW:SubTotalMember

2022-01-01

2022-12-31

0001511820

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0001511820

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001511820

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001511820

GNTW:SubTotalMember

2023-01-01

2023-12-31

0001511820

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-12-31

0001511820

us-gaap:CommonStockMember

2023-12-31

0001511820

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001511820

us-gaap:RetainedEarningsMember

2023-12-31

0001511820

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001511820

GNTW:SubTotalMember

2023-12-31

0001511820

us-gaap:NoncontrollingInterestMember

2023-12-31

0001511820

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

2023-12-31

0001511820

us-gaap:AccountsPayableAndAccruedLiabilitiesMember

2022-12-31

0001511820

GNTW:OriginalAcquisitionMember

2018-05-06

2018-05-07

0001511820

GNTW:OriginalAcquisitionMember

2018-05-07

0001511820

GNTW:StemtechInternationalMember

2023-12-31

0001511820

GNTW:StemtechInternationalMember

2022-12-31

0001511820

GNTW:LFRAcquisitionMember

2023-01-01

2023-12-31

0001511820

GNTW:LFRAcquisitionMember

2023-03-31

0001511820

GNTW:LFRAcquisitionMember

2023-03-30

2023-03-31

0001511820

GNTW:PatentProductsMember

2023-01-01

2023-12-31

0001511820

GNTW:PatentProductsMember

2022-01-01

2022-12-31

0001511820

GNTW:TradeNamesAndTrademarksMember

2023-01-01

2023-12-31

0001511820

GNTW:TradeNamesAndTrademarksMember

2022-01-01

2022-12-31

0001511820

GNTW:CustomerOrDistributionListMember

2023-01-01

2023-12-31

0001511820

GNTW:CustomerOrDistributionListMember

2022-01-01

2022-12-31

0001511820

GNTW:NonCompeteAgreementMember

2023-01-01

2023-12-31

0001511820

GNTW:NonCompeteAgreementMember

2022-01-01

2022-12-31

0001511820

GNTW:MiramarFloridaMember

GNTW:SunbearnPropertiesIncMember

2021-08-16

0001511820

GNTW:SecuredRoyalParticipationAgreementMember

2023-12-31

0001511820

GNTW:SecuredRoyalParticipationAgreementMember

2022-12-31

0001511820

GNTW:VehicleAndEquipmentLoansMember

2023-12-31

0001511820

GNTW:VehicleAndEquipmentLoansMember

2022-12-31

0001511820

GNTW:NotesPayableMember

2023-12-31

0001511820

GNTW:NotesPayableMember

2022-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2023-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001511820

GNTW:SecuredRoyaltyParticipationAgreementsMember

2023-03-15

2023-03-16

0001511820

GNTW:VehicleAndEquipmentLoansMember

2019-12-31

0001511820

GNTW:ThreeLendersMember

2019-12-31

0001511820

GNTW:ThreeLendersMember

2019-01-01

2019-12-31

0001511820

GNTW:FourLendersMember

2020-12-31

0001511820

GNTW:AllLendersMember

2023-12-31

0001511820

GNTW:AllLendersMember

2022-12-31

0001511820

GNTW:TwoPromissoryNotesMember

GNTW:InvestorsMember

2021-10-20

0001511820

GNTW:TwoPromissoryNotesMember

GNTW:InvestorsMember

2023-06-11

2023-06-12

0001511820

GNTW:SharingServicesGlobalCorporationMember

2023-12-31

0001511820

GNTW:SharingServicesGlobalCorporationMember

2022-12-31

0001511820

GNTW:PromissoryNotesMember

GNTW:InvestorsMember

2023-07-21

0001511820

GNTW:PromissoryNotesMember

2023-07-21

0001511820

2023-07-21

0001511820

GNTW:NineInstallmentsMember

GNTW:PromissoryNotesMember

2023-07-20

2023-07-21

0001511820

GNTW:FinalTwoInstallmentsMember

GNTW:PromissoryNotesMember

2023-07-20

2023-07-21

0001511820

GNTW:PromissoryNotesMember

GNTW:InvestorsMember

2023-12-14

0001511820

GNTW:PromissoryNotesMember

2023-12-14

0001511820

GNTW:PromissoryNotesMember

2023-01-01

2023-12-31

0001511820

GNTW:PromissoryNotesMember

2023-12-31

0001511820

GNTW:PromissoryNotesMember

2023-10-24

0001511820

GNTW:PromissoryNotesMember

2023-11-20

0001511820

GNTW:TwoNotesMember

2023-12-31

0001511820

GNTW:TwoNotesMember

2022-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-12-31

0001511820

GNTW:ConvertibleNotesPayable1Member

GNTW:ExtensionAgreementMember

2022-01-01

2022-12-31

0001511820

GNTW:ConvertibleNotesPayable1Member

GNTW:SecondExtensionAgreementMember

2022-08-17

2022-08-18

0001511820

GNTW:ConvertibleNotesPayable2Member

GNTW:WarrantsMember

2022-07-12

2022-07-13

0001511820

GNTW:ConvertibleNotesPayable2Member

us-gaap:CommonStockMember

2022-07-12

2022-07-13

0001511820

GNTW:ConvertibleNotesPayable2Member

2022-07-12

2022-07-13

0001511820

GNTW:LeoniteFund1Member

2022-07-12

2022-07-13

0001511820

GNTW:LeoniteFund1Member

2023-05-25

2023-05-26

0001511820

us-gaap:ConvertibleNotesPayableMember

GNTW:MCUSAndLeoniteMember

2022-07-01

2022-12-31

0001511820

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-12-31

0001511820

GNTW:PromissoryNotesMember

2023-01-01

2023-01-31

0001511820

GNTW:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-02-27

2023-02-28

0001511820

GNTW:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-02-28

0001511820

GNTW:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-06-30

0001511820

GNTW:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001511820

GNTW:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-09-20

2023-09-21

0001511820

GNTW:ConvertiblePromissoryNoteMember

GNTW:InvestmentAgreementMember

GNTW:InstitutionalInvestorMember

2023-03-27

0001511820

GNTW:MCUSMember

2023-04-11

0001511820

GNTW:MCUSMember

2023-04-10

2023-04-11

0001511820

GNTW:MCUSMember

2023-04-30

2023-05-01

0001511820

GNTW:MCUSMember

2023-05-01

0001511820

GNTW:MCUSMember

2023-12-31

0001511820

GNTW:MCUSMember

2023-01-01

2023-12-31

0001511820

GNTW:SecuredConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

2023-08-10

2023-08-11

0001511820

GNTW:SharingServicesGlobalCorporationMember

2023-04-30

2023-05-01

0001511820

GNTW:ConvertibleNote1Member

2023-12-31

0001511820

GNTW:ConvertibleNote2Member

2023-12-31

0001511820

GNTW:ConvertibleNote3Member

2023-12-31

0001511820

GNTW:ConvertibleNote1Member

2022-12-31

0001511820

GNTW:ConvertibleNote2Member

2022-12-31

0001511820

GNTW:ConvertibleNote3Member

2022-12-31

0001511820

GNTW:ThreeConvertibleNotesMember

2023-12-31

0001511820

GNTW:ThreeConvertibleNotesMember

2022-12-31

0001511820

GNTW:ConvertibleNotesMember

2021-12-31

0001511820

us-gaap:WarrantMember

2021-12-31

0001511820

GNTW:ConvertibleNotesMember

2022-01-01

2022-12-31

0001511820

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001511820

GNTW:ConvertibleNotesMember

2022-12-31

0001511820

us-gaap:WarrantMember

2022-12-31

0001511820

GNTW:ConvertibleNotesMember

2023-01-01

2023-12-31

0001511820

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001511820

GNTW:ConvertibleNotesMember

2023-12-31

0001511820

us-gaap:WarrantMember

2023-12-31

0001511820

us-gaap:MeasurementInputSharePriceMember

2022-01-01

2022-12-31

0001511820

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-12-31

0001511820

us-gaap:MeasurementInputPriceVolatilityMember

2022-01-01

2022-12-31

0001511820

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-01-01

2022-12-31

0001511820

srt:MinimumMember

2022-12-31

0001511820

srt:MaximumMember

2022-12-31

0001511820

2023-05-05

0001511820

GNTW:OfficersEmployeesAndVendorsMember

2023-01-01

2023-12-31

0001511820

GNTW:VestingOfCommonStockOfOneOfficerMember

2023-01-01

2023-12-31

0001511820

GNTW:VestingOfCommonStockOfOneOfficerMember

2022-01-01

2022-12-31

0001511820

GNTW:OfficersEmployeesAndVendorsMember

GNTW:AccumulatedPastServicesMember

2023-01-01

2023-12-31

0001511820

GNTW:OfficersEmployeesAndVendorsMember

GNTW:AccumulatedPastServicesMember

GNTW:ChairmanAndCEOMember

2023-01-01

2023-12-31

0001511820

GNTW:AVendorMember

2023-12-31

0001511820

GNTW:LFRMember

2023-01-01

2023-12-31

0001511820

GNTW:NoteholderMember

2022-06-07

2022-06-08

0001511820

GNTW:NoteExtensionMember

2022-06-07

2022-06-08

0001511820

GNTW:LoanExtensionMember

GNTW:NoteSept2021Member

2022-07-12

2022-07-13

0001511820

GNTW:LoanExtensionMember

GNTW:NoteMay2022Member

2022-08-17

2022-08-18

0001511820

GNTW:ANoteHolderMember

2022-08-25

2022-08-26

0001511820

GNTW:NotesPayableMember

2022-09-18

2022-09-19

0001511820

GNTW:NotesPayableMember

2022-09-20

2022-09-21

0001511820

GNTW:NotesPayableMember

2022-09-28

2022-09-29

0001511820

GNTW:NotesPayableMember

2022-12-08

2022-12-09

0001511820

GNTW:NotesPayable1Member

2022-12-08

2022-12-09

0001511820

GNTW:NotesPayableMember

2023-01-12

2023-01-13

0001511820

GNTW:NotesPayableMember

2023-01-22

2023-01-23

0001511820

GNTW:NotesPayableMember

2023-04-25

2023-04-26

0001511820

GNTW:NotesPayableMember

2023-06-06

2023-06-07

0001511820

GNTW:NotesPayableMember

2023-04-30

2023-05-01

0001511820

GNTW:NotesPayableMember

2023-06-20

2023-06-21

0001511820

GNTW:NotesPayableMember

2023-06-11

2023-06-12

0001511820

GNTW:NotesPayableMember

2023-08-07

2023-08-08

0001511820

GNTW:NotesPayableMember

2023-09-20

2023-09-21

0001511820

GNTW:ChairmanAndCEOMember

2023-01-01

2023-12-31

0001511820

GNTW:PresidentAndCOOMember

2023-01-01

2023-12-31

0001511820

GNTW:CorporateSecretaryMember

2023-12-31

0001511820

GNTW:CorporateSecretaryMember

2023-01-01

2023-12-31

0001511820

srt:ChiefFinancialOfficerMember

2023-01-01

2023-12-31

0001511820

srt:ChiefFinancialOfficerMember

2023-12-31

0001511820

GNTW:BoardMember

2023-01-01

2023-12-31

0001511820

GNTW:BoardMember

GNTW:PrincipalPortionMember

2023-01-01

2023-12-31

0001511820

GNTW:BoardMember

GNTW:InterestPortionMember

2023-01-01

2023-12-31

0001511820

GNTW:CommonDirectorMember

2021-09-01

2021-09-30

0001511820

GNTW:CommonDirectorMember

GNTW:FundsReceivedIn2021Member

2023-01-01

2023-12-31

0001511820

GNTW:CommonDirectorMember

GNTW:FundsReceivedIn2021Member

2023-12-31

0001511820

GNTW:CommonDirectorMember

GNTW:FundsReceivedIn2021Member

2022-12-31

0001511820

GNTW:ChairmanAndCEOMember

2022-12-31

0001511820

GNTW:ChairmanAndCEOMember

2022-01-01

2022-12-31

0001511820

GNTW:ChairmanAndCEOMember

2021-01-01

2021-12-31

0001511820

GNTW:PastAndCurrentDirectorsMember

2022-09-06

2022-09-07

0001511820

GNTW:CurrentDirectorsMember

2022-12-28

2022-12-29

0001511820

GNTW:CurrentDirectorMember

2022-12-31

0001511820

GNTW:CurrentDirectorMember

2021-12-31

0001511820

GNTW:CorporateSecretaryMember

2022-12-28

2022-12-29

0001511820

GNTW:CorporateSecretaryMember

2022-01-01

2022-12-31

0001511820

GNTW:CommonDirectorMember

2022-12-31

0001511820

GNTW:CommonDirectorMember

2021-12-31

0001511820

GNTW:CEOMember

2022-01-01

2022-12-31

0001511820

srt:AmericasMember

2023-01-01

2023-12-31

0001511820

srt:AmericasMember

2022-01-01

2022-12-31

0001511820

srt:LatinAmericaMember

2023-01-01

2023-12-31

0001511820

srt:LatinAmericaMember

2022-01-01

2022-12-31

0001511820

srt:AsiaMember

2023-01-01

2023-12-31

0001511820

srt:AsiaMember

2022-01-01

2022-12-31

0001511820

srt:AmericasMember

2023-12-31

0001511820

srt:AmericasMember

2022-12-31

0001511820

srt:LatinAmericaMember

2023-12-31

0001511820

srt:LatinAmericaMember

2022-12-31

0001511820

srt:AsiaMember

2023-12-31

0001511820

srt:AsiaMember

2022-12-31

0001511820

us-gaap:GeographicDistributionDomesticMember

2023-01-01

2023-12-31

0001511820

us-gaap:GeographicDistributionDomesticMember

2022-01-01

2022-12-31

0001511820

us-gaap:GeographicDistributionForeignMember

2023-01-01

2023-12-31

0001511820

us-gaap:GeographicDistributionForeignMember

2022-01-01

2022-12-31

0001511820

us-gaap:NonUsMember

2023-12-31

0001511820

2023-10-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 333-172172

STEMTECH CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada |

|

87-2151440 |

|

State or other jurisdiction

of incorporation or organization |

|

(IRS. Employer

Identification No.) |

4851 Tamiami Trail North, Suite 200

Naples, FL 34103

www.stemtech.com

(Address of principal executive offices)

(954) 715-6000

Registrant’s telephone number, including

area code

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Name of each exchange on which registered |

| None |

|

N/A |

Securities registered pursuant to Section 12(g)

of the Act:

| Common Shares - $0.001 par value |

(Title of Class)

Indicate by check mark whether the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form

10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether

any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of

the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting

stock held by non-affiliates of the registrant as of the last business day of the registrants most recently completed second fiscal quarter,

based on the price at which the common equity was last sold on the OTC Markets on June 30, 2022 was approximately $1,683,169. For purposes

of this computation only, all officers, directors and 5% or greater stockholders of the registrant are deemed to be “affiliates.”

As of July 10, 2024, the registrant had 116,769,707

shares of common stock with par value $0.001 issued and outstanding.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements.

These statements relate to future events or our future financial performance. These statements often can be identified by the use of terms

such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,”

“approximate” or “continue,” or the negative thereof. We intend that such forward-looking statements be subject

to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements,

which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in

the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could

cause actual results and events to differ materially from historical results of operations and events and those presently anticipated

or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after

the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

All dollar amounts refer to US dollars unless

otherwise indicated.

PART I

Item 1: Description of Business

Stemtech Corporation and its Subsidiaries (collectively,

the “Company”, or “Stemtech”) was incorporated in the State of Nevada, USA on September 4, 2009 under the name

Globe Net Wireless Corp. with ticker symbol “GNTW”. Our corporate name was changed to Stemtech Corporation in the state of

Nevada.in August 2021. We were listed on the OTCQB market under symbol “STEK” in April 2021. Stemtech is a global network

marketing company that develops science-based products that it believes supports wellness by helping the body maintain healthy stem cell

physiology, also known as stem cell enhancers. Known as the Stem Cell Nutrition Company®, the Company is a pioneer in stem cell science,

and believes it can demonstrate that adult stem cells function as the natural renewal system of the body. The Company believes our products

enhance and support the work of the body’s stem cells by releasing more stem cells, helping to circulate them in the blood and migrate

them into tissues, where they can perform their daily function of renewal for optimal health. Our Mission is to enhance wellness and prosperity

around the world. These products are marketed internationally by the Companies subsidiaries and through independent distributors. The

Company markets its products under the following brands: RCM System, stemrelease3™, StemFlo® MigraStem® and OraStem®

(Oral Health Care). Stemtech also introduced a new skincare product in December 2022: Cellect One® Rapid Renew Stem Cell Peptide

Night Cream.

On August 19, 2021, Stemtech Corporation (“Stemtech”),

a (Delaware corporation), entered into a Merger Agreement (the “Merger Agreement”) with Globe Net Wireless Corp. (“Globe

Net” or “GNTW”). The merger is accounted for as a reverse acquisition and recapitalization in accordance with the Accounting

Standards Codification topic 805, Business Combinations (“ASC 805”). Management evaluated the guidance contained in

ASC 805 with respect to the identification of the acquirer in the merger and concluded, based on a consideration of the pertinent facts

and circumstances, that Stemtech acquired Globe Net for financial accounting purposes. On November 9, 2021, the Company changed its fiscal

year end date from August to December.

Basis of Presentation

The accompanying consolidated financial statements

have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

The summary of significant accounting policies presented below is designed to assist in understanding the Company’s consolidated

financial statements. Such consolidated financial statements and accompanying notes are the representations of the Company’s management,

who is responsible for their integrity and objectivity. All intercompany accounts and transactions have been eliminated in consolidation.

The consolidated financial statements include the accounts of Stemtech Corporation (Parent) and its (12) subsidiaries:

| 1. |

Stemtech HealthSciences Corp (U.S.A.) (“Stemtech HealthSciences”) |

| 2. |

Stemtech Canada, Inc. (“Canada”) |

| 3. |

Stemtech Health Sciences S. de R.L. de C.V. (“Mexico”) |

| 4. |

Stemtech Services SARL de C.V. (Mexico) (“Stemtech Mexico”) |

| 5. |

Stemtech Malaysia Holdings Sdn. Bhd. (“Malaysia Holdings”) |

| 6. |

Stemtech Malaysia Sdn. Bhd. (“Malaysia”) |

| 7. |

Stemtech Taiwan Holding, Inc. (“Taiwan”) |

| 8. |

Stemtech Taiwan Branch |

| 9. |

Tecrecel S.A. (“Ecuador”) |

| 10. |

Food & Health Tech Foodhealth SA (“FHT Ecuador”) |

| 11. |

Life Factor Research (“LFR”) – 100% |

| 12. |

Stemtech IP Holdings, LLC |

Item 1A. Risk Factors.

We are a smaller reporting company as defined

in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 1B. Unresolved Staff Comments.

None.

Item 1C. Cybersecurity.

We

recognize the critical importance of developing, implementing, and maintaining robust cybersecurity measures to safeguard our information

systems and protect the confidentiality, integrity, and availability of our data. We currently have security measures in place to protect

our clients, customers, employees, and vendor information and prevent data loss and other security breaches. We also only use third

party software for accounting, billing and payroll that have successful SOC 1 type 2 compliance. Both management and the Board are actively

involved in the continuous assessment of risks from cybersecurity threats, including prevention, mitigation, detection, and remediation

of cybersecurity incidents.

Our

current cybersecurity risk assessment program consists of an annual review of our risks and policies. The program outlines governance,

policies and procedures, and technology we use to oversee and identify risks from cybersecurity threats.

Our

President & COO and CEO are responsible for overseeing our business operations and are responsible for day-to-day assessment and management

of risks from cybersecurity threats, including the prevention, mitigation, detection, and remediation of cybersecurity incidents. We also

use the services of an outside consulting firm to monitor activity and advise the company of cybersecurity protocols.

We

routinely undertake activities to prevent, detect, and minimize the effects of cybersecurity incidents, including an annual risk review,

policy reviews and revisions. In addition, we maintain business continuity, contingency, and recovery plans for use in the event of a

cybersecurity incident by the administering of local and cloud based back up of files. and emails.

We engaged and used the advice of a third-party consultant

to help us assess and identify risks from cybersecurity threats, including the threat of a cybersecurity incident, and manage our risk

assessment program. Among other things, these providers have recommended periodic evaluations of the work stations.

We have multiple controls in place in order to prevent breaches,

some of these controls include:

| a. | FMA/2FA, this is our first AND most important first line of defense,

no one should have MFA bypassed or disabled, with no exceptions. |

| b. | Email Banner for external emails. This banner assists us to identify

any phishing / impersonation email and cannot be bypassed. |

| c. | Conditional Access Policy (CAP): Rejects connections to Exchange Online

from un-authorized countries. We are further enhancing this control by implementing ACL's (access lists) in our CRM and ERP systems and

any other mission critical platform. ALL platforms should have MFA enforced, any platform not supporting MFA in 2024 is deemed high-risk

and immediately replaced as it is obsolete and poses high-risk to the Company. |

As

of the date of this report, no cybersecurity incident (or aggregation of incidents) or cybersecurity threat has materially affected our

results of operations or financial condition. However, an actual or perceived breach of our security could damage our reputation and cause

existing Independent Business Partners (IBPs or distributors) / customers to discontinue, as well as prevent us from attracting new clients

/ customers. and / or subject us to third-party lawsuits, regulatory fines or other actions or liabilities, any of which could adversely

affect our business, operating results or financial condition. We currently do not carry a cyber liability insurance policy, but are evaluating

whether to acquire one to mitigate any financial impact of a cybersecurity breach.

Item 2. Properties.

On August 16, 2021, the Company extended its office

space lease with Sunbeam Properties Inc. to rent approximately 5,003 square feet of space in Miramar, Florida. The Company pays $9,027

per month in rent until the end of the extended lease September 30, 2024. Stemtech has sublet the space to a tenant who pays Stemtech

$9,097 to occupy the space. The Company incurred lease expense for its operating leases of $73,309 and $85,629 for the years ended December

31, 2023 and 2022, respectively.

Item 3. Legal Proceedings.

On August 6, 2019, Ray

Carter, the former CEO prior to the Company’s Bankruptcy, filed a lawsuit against the Company’s subsidiary Stemtech

HealthSciences, alleging unpaid salary and vacation time dating to a period predating the Company’s current management team

taking control in 2018. Mr. Carter’s claim is in the amount of $267,000. The Company has counter-sued Ray Carter personally

and deems this matter non-meritorious. At the same time, the Company has accrued $267,000 which is included in accounts payable and

accrued liabilities in the consolidated balance sheets at December 31, 2023 and 2022. Mr. Carter’s request for Summary

Judgment was dismissed by the Court on March 3, 2023.

Item 4. Mine Safety Disclosures.

Not Applicable.

PART II

Item 5. Market for Registrant’s Common

Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

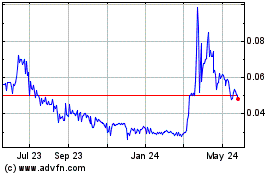

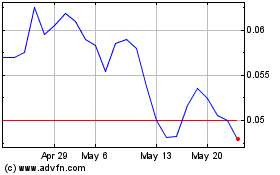

Market Information

Stemtech’s common shares have been quoted

on the NASD OTC Bulletin Board under the symbol “STEK” since April 13, 2022. The table below gives the high and low bid information

for each fiscal quarter of trading for the last two fiscal years. The bid information was obtained from Pink OTC Markets Inc. and reflects

inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

The closing share prices presented below represent

prices between broker-dealers and do not include retail mark-ups and mark-downs or any commission to the dealer.

| QUARTER ENDED |

|

HIGH |

|

|

LOW |

|

| December 31, 2021 |

|

$ |

2.20 |

|

|

$ |

2.05 |

|

| March 31, 2022 |

|

$ |

2.55 |

|

|

$ |

2.55 |

|

| June 30, 2022 |

|

$ |

5.00 |

|

|

$ |

5.00 |

|

| September 30, 2022 |

|

$ |

0.72 |

|

|

$ |

0.63 |

|

| December 31, 2022 |

|

$ |

0.10 |

|

|

$ |

0.08 |

|

Holders of Stemtech’s Common Stock

The Company had 112 registered holders of its common

stock as of April 12, 2024.

Dividends

Stemtech has declared no dividends on its common

shares and is not subject to any restrictions that limit its ability to pay dividends on its common shares. Dividends are declared at

the sole discretion of Stemtech’s Board of Directors.

Recent Sales of Unregistered Securities

None.

Penny Stock Rules

Trading in Stemtech’s Common Stock is subject

to the “penny stock” rules. The Securities and Exchange Commission (“SEC”) has adopted regulations that generally

define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

These rules require that any broker-dealer who

recommends Stemtech’s Common Stock to persons other than prior customers and accredited investors, must, prior to the sale, make

a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the transaction.

Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure

schedule explaining the penny stock market and the risks associated with trading in the penny stock market. In addition, broker-dealers

must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities

they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions

in Stemtech’s securities, which could severely limit their market price and liquidity of Stemtech’s securities. The application

of the “penny stock” rules may affect your ability to resell Stemtech’s securities.

Item 6. Selected Financial Data.

The Company is a smaller reporting company as

defined by Rule 12b-2 of the Exchange Act and is not required to provide the information required under this item.

Item 7. Management’s Discussion and Analysis

of Financial Condition and Results of Operations.

The following discussion should be read in

conjunction with our financial statements, including the notes thereto, appearing elsewhere in this annual report. The following discussion

contains forward-looking statements that reflect our plans, estimates and beliefs. Stemtech’s actual results could differ materially

from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include but are not

limited to those discussed below and elsewhere in this annual report. Stemtech’s audited financial statements are stated in United

States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Company Overview

Stemtech Corporation was incorporated under the

laws of the State of Nevada, U.S. on September 4, 2009. Our registration statement on Form S-1 was filed with the SEC was declared effective

on May 15, 2013. On August 19, 2021, the Company entered into a Merger Agreement with Stemtech Corporation by which the Company acquired

one hundred percent of the shares of STEMTECH CORPORATION in exchange for the issuance of 37,060,000 shares of the Company, approximately

85% of the issued and outstanding shares of the Company.

Stemtech has pioneered and patented a whole new

category of dietary supplements. Stemtech’s advanced Stem Cell Nutrition formulations are one-of-a-kind natural products designed

to help support the three most important aspects of stem cell physiology: 1) Releasing more stem cells; 2) their circulation in the blood;

and 3) Migration into tissues, where they can perform their daily function of renewal and rejuvenation for optimal health. We actually

harness the incredible power of adult stem cells. How does this work? Adult stem cells are released from your bone marrow into the bloodstream,

they then Circulate in the bloodstream and flow to the tissues most in need. As they arrive, the adult stem cells migrate into the tissues,

reproduce and become new, healthy cells of those tissues. This process takes place every single day, even without tissue damage, as part

of the natural renewal system of the body. It is important to understand that Stemtech’s products do not contain stem cells. They

are composed of natural botanicals and other ingredients that have been clinically documented to support the performance of your own adult

stem cells. Stemtech also offers our all-natural OraStem toothpaste, which is a tooth whitener, breath freshener, anti-microbial, stem

cell attracting and promotes good gum health. In December 2022, our new Cellect One® Rapid Renew Stem Cell Peptide Night Cream.

Cellect One is a Stemtech proprietary formula containing an FDA patented ingredient, Red Oak Bark, which enables deep penetration to promote

good skin health.

While sales of products obviously create the cash

flow, our real business model is not just “sales”, but lateral penetration. We do this through our IBPs - “Independent

Business Partner” Sales Forces, and we invest much energy in growing our IBPs. Post public listing and funding, Stemtech is projecting

the addition of 30,000 new independent business partner reps over the next 12 to 24 months, adding to the existing IBPs. With an enhanced

compensation plan, IBPs will be even more incentivized to build their network, attracting additional industry leaders. IBPs are a testimonial

to our product and business model, lowering our customer acquisition costs. We have added two international licensing agreements for selling

Stemtech products while not using the network marketing sales model. This is a new revenue stream.

We reinstituted contests, travel incentives, cruises,

other trips, Business Academies for Training, regional conferences, our Annual Convention with new product launches. Our IBPs offer highly

flexible yet steady income which is most adapted to todays “Laptop & Cellphone Lifestyle”, with structured and organized

weekly Corporate training calls, a personalized website, back-office tracking, oversight and management Tools, Reports, Training Materials

and Social Sharing. Stemtech also launched the Stemtech AdvanceOffice Mobile App, in September 2022,

improving communication, sharing of information, training videos and other content for recruiting, on-boarding, customer retention and

measuring key performance indicators for the IBP business.

Stemtech announced two exciting programs in June

2023, with the enhancement of a Rank Advancement Bonus as well as a Caribbean cruise which took place in December 2023. Sales continue

to come in from returning consumers who believe in the quality products. Since the cash infusions noted in “Financing” infra,

the Company now has the resources to contact and re-engage the over 200,000 former distributors. With this new cash infusion, the

Company has engaged experienced marketing and social media professionals to initiate new marketing strategies which are expected to bring

increased activity. Moreover, we are now better positioned to absorb significant new clientele as the Company has directed significant

cash towards our inventory. Management conservatively believes that given the expected cash on hand and working expenditures as describe

above, we can reinvigorate sales to be more consistent with the Company’s previous revenue historically, as we were recognized 4

times in the Inc 5000 Magazine’s list of fastest growing companies.

In the future, below this IBP level, we are contemplating

our Direct To Consumer (“DTC”) network marketing distribution model. This integrative model allows us access to an immediate

global presence and ability to operate in multiple countries on any continent. We are uniquely positioned, to implement this DTC model

in areas not currently distributing Stemtech products, as this method requires no up-front or required buy-in of inventory, with monthly

shipments available for known recurring sales. This platform will enable us to operate at the intersection of the ecommerce economy, social

economy and gig economy. Recently, we have licensed the African nations of Kenya, Ghana, Nigeria, Uganda and the Democratic Republic of

Congo for distribution of Stemtech products. In this distribution agreement, we are prepaid for the product by the distributor who is

responsible for the registration and licensing plus shipping of the product where Stemtech does not have the network marketing model in

place. The Company plans to look at opportunities in other global areas as well to expand our brand and distribution of Stemtech products.

The Company has been making great strides the

past year, having obtained our “Orastem” trademark registration in Mexico as noted in our press release of August 23, 2022.

In addition, Stemtech filed our new ‘stemceuticals’ trademark registration. We have introduced a new stem cell skin care product.

Life Factor Research brings their expertise in research, development and product formulations enabling the Company to now organically

develop whole new lines of Stemceuticals. This new arrangement enables Stemtech to offer more new, cutting-edge products to an ever-growing

market interested in improved health and quality of life.

Implications of Being an Emerging Growth Company

Emerging Growth Company - We are an emerging growth

company as defined in Section 2(a)(19) of the Securities Act of 1933, as amended, or the Securities Act. We will continue to be an emerging

growth company until: (i) the last day of our fiscal year during which we had total annual gross revenues of at least $1.07 billion; (ii)

the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective

registration statement under the Securities Act; (iii) the date on which we have, during the previous 3-year period, issued more than

$1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a large accelerated filer, as defined in Section 12b-2

of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which means the market value of our common stock that is held

by non-affiliates exceeds $700 million as of the prior June 30.

As an emerging growth company, we are exempt from:

| |

· |

Sections 14A(a) and (b) of the Exchange Act, which require companies to hold stockholder advisory votes on executive compensation and golden parachute compensation; |

| |

· |

The requirement to provide, in any registration statement, periodic report or other report to be filed with the SEC certain modified executive compensation disclosure under Item 402 of Regulation S-K or selected financial data under Item 301 of Regulation S-K for any period before the earliest audited period presented in our initial registration statement; |

| |

· |

Compliance with new or revised accounting standards until those standards are applicable to private companies; |

| |

· |

The requirement under Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, to provide auditor attestation of our internal controls and procedures; and |

| |

· |

Any Public Company Accounting Oversight Board, or “PCAOB”, rules regarding mandatory audit firm rotation or an expanded auditor report, and any other PCAOB rules subsequently adopted unless the Commission determines the new rules are necessary for protecting the public. |

We have elected to use the extended transition

period for complying with new or revised accounting standards under Section 102(b)(1) of the Jumpstart Our Business Startups Act.

We are also a smaller reporting company as defined

in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are not required to provide selected financial data pursuant to

Item 301 of Regulation S-K, nor are we required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley

Act of 2002. We are also permitted to provide certain modified executive compensation disclosure under Item 402 of Regulation S-K.

Basis of Presentation

The accompanying consolidated financial statements

have been prepared in accordance with U.S. GAAP. Such consolidated financial statements and accompanying notes are the representations

of the Company’s management, which is responsible for their integrity and objectivity. All intercompany accounts and transactions

have been eliminated in consolidation.

Critical Accounting Policies

This Management’s Discussion and Analysis of

Financial Condition and Results of Operations discusses our consolidated financial statements, which have been prepared in accordance

with U.S. GAAP. In connection with the preparation of our consolidated financial statements, we are required to make assumptions and estimates

about future events, and apply judgments that affect the reported amounts of assets, liabilities, revenue, expenses and the related disclosures.

We base our assumptions, estimates and judgments on historical experience, current trends and other factors that management believes to

be relevant at the time our consolidated financial statements are prepared. On a regular basis, management reviews the accounting policies,

assumptions, estimates and judgments to ensure that our consolidated financial statements are presented fairly and in accordance with

U.S. GAAP. However, because future events and their effects cannot be determined with certainty, actual results could differ from our

assumptions and estimates, and such differences could be material.

Our significant accounting policies are discussed

in Note 2, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements included elsewhere in this report.

Critical Accounting Estimates

Our discussion and analysis of our financial condition

and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with U.S. GAAP.

The preparation of our consolidated financial statements and related disclosures requires us to make estimates, assumptions and judgments

that affect the reported amounts of assets, liabilities and expenses and related disclosures. Management believes that there are no critical

accounting estimates in these consolidated financial statements.

New Accounting Pronouncements

We do not expect recent accounting pronouncements

will have a material impact on our consolidated financial position, results of operations or cash flows. See Note 2 in the accompanying

consolidated financial statements for additional information.

Results of Operations

Our consolidated financial statements have been

prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability

and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation. We expect

we will require additional capital to meet our long-term operating requirements. We expect to raise additional capital through, among

other things, the sale of equity or debt securities.

Year Ended December 31, 2023 Compared to the

Year Ended December 31, 2022.

During the years ended December 31, 2023 and 2022,

net sales were $4,921,531 and $4,559,399, respectively. The increase of $362,132 is primarily due to slight increases in the overall sales

of the subsidiaries due to the increase in IBPs in 2023.

During the years ended December 31, 2023 and 2022,

our total operating expenses were $8,144,437 and $8,418,761, respectively. The decrease of $274,324 is primarily attributable to cost

cutting measures.

During the years ended December 31, 2023 and 2022,

total non-operating expenses were $1,207,433 and $3,513,830, respectively, resulting in a decrease of $2,306,397. The difference is primarily

due to the gain on settlement of derivative liabilities of $1,366,298 in 2023, the increase in interest expense of $795,190 and a decrease

in gain on extinguishment of debt of $2,985,224 partially offset by the changes in fair value of derivative liabilities of $4,711,957

from a loss of $3,223,271 at December 31, 2022 to a gain of $1,488,686 at December 31, 2023 in connection with the note payable issued

in September 2021. We also implemented a significant reduction of staff and realignment of their duties to existing staff.

Our net loss for the years ended December 31,

2023 and 2022, was $5,431,979 and $8,632,828, respectively. The decrease in net loss was caused by the factors described above.

Liquidity and Capital Resources

In spite of increasing revenues, we are not yet profitable,

and we cannot provide any assurance of when we will be profitable. We incurred a net loss of $5,431,979 and $8,632,828 for the years ended

December 31, 2023 and 2022, respectively. During the year ended December 31, 2023, we met our short-term liquidity requirements from our

existing cash reserves and proceeds from the issuance of notes payable of $2,236,000, offset by net payments of financing arrangements

of $189,700 and note payable payments of $466,872.

As of December 31, 2023, our current assets were $400,710

compared to $612,370 in current assets at December 31, 2022. As of December 31, 2023, our current liabilities were $6,462,036 compared

to $7,415,791 at December 31, 2022. Current liabilities at December 31, 2023 were comprised of $2,708,906 of accounts payable and accrued

expenses, $1,596,960 in convertible notes, $1,889,321 of non-convertible notes payable, $143,944 of factoring liability, $66,866 in current

operating lease liabilities and $56,039 in deferred revenues.

Stockholders’ deficit increase from $3,171,918

as of December 31, 2022 to $2,778,765 at December 31, 2023. This change was primarily caused by the conversion of convertible notes and

accrued interest to common stock of $2,403,453, and reclassification of derivative liabilities to additional paid in capital of $1,011,451,

offset by a net loss of $5,431,979 during the year ended December 31, 2023.

Cash Flows from Operating Activities

We have not generated positive cash flows from

operating activities. For the year ended December 31, 2023, net cash flows used in operating activities were $2,036,312, which is primarily

due to the net loss of $5,431,979, partially offset by adjustments to reconcile the net loss used in operations of $2,304,613 and the

changes in working capital including accounts payable and accrued expenses of $1,091,354. The adjustments to reconcile the net loss used

in operations consisted of increase in amortization of debt discount of $2,797,403, non-cash interest expense from issuance on debt (derivative)

of $1,623,579, non-cash charges of $1,098,832 (including: depreciation and amortization of $587,797, stock compensation expense of $439,054

and amortization of right of use asset of $71,981), stock issued for services of $434,025 and cancellation of shares returned by shareholders

of $19,890, offset by gain on extinguishment of debt $814,132, gain from the change in fair value of derivative liabilities of $1,488,686

and gain on settlement of derivative liabilities of $1,366,298. Adjustments for changes in operating assets and liabilities were due to

a decrease in inventories of $109,728, an increase in deferred revenues of $16,869, a decrease in prepaid expenses and other current assets

of $110,338 and an increase in long term deposits of $643, a decrease in accounts payable and accrued expenses of $957,056, a decrease

in operating lease liabilities of $75,267, and an decrease of in accounts receivable of $26,727. For the year ended December 31, 2022,

net cash flows used in operating activities were $1,216,948.

Cash Flows from Financing Activities

We have financed our operations primarily from

either the issuance of our shares of common stock or notes payable. For the year ended December 31, 2023, we generated $1,579,428 cash

from financing activities which consists of $2,236,000 from proceeds from notes payables, offset by $189,700 payments of factoring arrangement

and payments on notes payable of $466,872. For the year ended December 31, 2022, net cash flows provided by financing activities were

$338,734.

Plan of Operation and Funding

We expect that working capital requirements will

continue to be funded through a combination of our existing funds and further issuances of equity securities and debt instruments.

Existing working capital, further advances

and debt instruments, and anticipated cash flow are expected to be adequate to fund our operations over the next three months.

Generally, we have financed operations to date through the proceeds of the private placement of equity and debt instruments. In

connection with our business plan, management anticipates additional increases in operating expenses and capital expenditures

relating to: (i) acquisition of inventory; (ii) developmental expenses associated with a start-up business; and (iii) marketing

expenses. We intend to finance these expenses with further issuances of securities and director loans. Thereafter, we expect we will

need to raise additional capital and generate revenues to meet long-term operating requirements. Additional issuances of equity or

convertible debt securities will result in dilution to our current shareholders. Additional financing may not be available upon

acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to

take advantage of prospective new business endeavors or opportunities, which could significantly and materially restrict our

business operations. We will have to raise additional funds in the next twelve months in order to sustain and expand our operations.

We currently do not have a specific plan of how we will obtain such funding; however, we anticipate that additional funding will be

in the form of equity financing from the sale of our common stock. We have and will continue to seek to obtain short-term loans from

our directors, although no future arrangement for additional loans has been made. We do not have any agreements with our directors

concerning these loans. We do not have any arrangements in place for any future equity financing.

Off-Balance Sheet Arrangements

As of the date of this report, we do not have

any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes

in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material

to investors.

Stockholders’ Deficit

Authorized Shares

Effective May 5, 2023, the Company is authorized

to issue up to 400,000,000 shares of common stock, $0.001 par value. Prior to May 5, 2023, the Company was authorized to issue up to 200,000,000

shares (see Note 9). Each outstanding share of common stock entitles the holder to one vote per share on all matters submitted to a stockholder

vote. All shares of common stock are non-assessable and non-cumulative, with no pre-emptive rights.

Commitments and Contingencies

None.

Financing

On March 27, 2023, the Company and an institutional

investor (the “Holder”) executed an investment agreement for up to $7,000,000 through a convertible promissory note, share

purchase agreement and warrant agreement (the “2023 Note”). The 2023 Note has a principal amount of up to $7,000,000 with

an original issue discount of 12% and is to be disbursed in four (4) disbursements as set forth as follows: (i) the first disbursement

in the amount of $1,000,000 occurred on March 27, 2023; (ii) the second disbursement in the amount of $200,000 is due within three (3)

days after the filing of an S-1 registration statement; (iii) the third disbursement in the amount of $500,000 is due forty-five (45)

days after effectiveness of an S-1 registration statement; and (iv) $120,000 is due forty-five (45) days after the third disbursement.

The 2023 Note carries an interest rate equal to seven percent (7%) per annum and is redeemable by the Company at any time at an amount

equal to one hundred twenty-five percent (125%) of the then outstanding principal and interest accrued on the Note. All additional disbursements

will be made at the Holder’s discretion, at any time, and if the Holder’s broker refuses to custody the securities issued

in connection therewith, the Holder will have no obligation to make a disbursement under the disbursement schedule but will have the option

to make such disbursement.

Future financing through equity investments is

likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more

favorable for our new investors. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants

or other derivative securities, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future

capital and financing, including investment banking fees, legal fees, accounting fees, and other costs. We may also be required to recognize

non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact

our financial condition.

Our ability to obtain needed financing may be

impaired by such factors as the capital markets, both generally and specifically in the nutraceutical industry, which could impact the

availability or cost of future financing. If the amount of capital we are able to raise from financing activities, together with our revenue

from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may

be required to cease operations.

We have no plans, arrangements or contingencies

in place in the event that we cease operations.

Item 7A. Quantitative and Qualitative Disclosures

about Market Risk.

We are a smaller reporting company as defined

by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Item 8. Financial Statements and Supplementary

Data.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Stemtech Corporation

Consolidated

Financial Statements

December 31,

2023

Report

of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of

Stemtech Corporation and Subsidiaries

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated

balance sheets of Stemtech Corporation and Subsidiaries (the “Company”) as of December 31, 2023 and 2022, and the related

consolidated statements of operations and comprehensive loss, changes in stockholders’ deficit, and cash flows for each of the two

years in the period ended December 31, 2023, and the related notes (collectively referred to as the “consolidated financial statements”).

In our opinion, the consolidated financial statements present fairly, in all material respects, the consolidated financial position of

the Company as of December 31, 2023 and 2022, and the consolidated results of its operations and its cash flows for each of the two years

in the period ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying consolidated financial statements

have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 of the notes to consolidated financial

statements, the Company has suffered recurring losses from operations since inception and has a significant working capital deficit and

a significant accumulated deficit. These conditions raise substantial doubt about its ability to continue as a going concern. Management’s

plans regarding these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that

might result from the outcome of this uncertainty.

Basis for Opinion

These consolidated financial statements are the

responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements

based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”)

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards

of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess

the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures

that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the

consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by

management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide

a reasonable basis for our opinion.

/s/ Turner, Stone & Company, LLP

We have served as the Company’s auditor since 2020.

Dallas, Texas

July 10, 2024

Stemtech Corporation

Consolidated Balance Sheets

| | |

| | | |

| | |

| | |

As of December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash | |

$ | 114,166 | | |

$ | 132,487 | |

| Accounts receivable, net | |

| 61,494 | | |

| 34,767 | |

| Inventory, net | |

| 48,325 | | |

| 158,053 | |

| Prepaid expenses and other current assets | |

| 176,725 | | |

| 287,063 | |

| TOTAL CURRENT ASSETS | |

| 400,710 | | |

| 612,370 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 10,056 | | |

| 27,296 | |

| Intangible assets, net | |

| 2,710,568 | | |

| 2,994,000 | |

| Long term deposits | |

| 23,708 | | |

| 23,065 | |

| Operating lease right-of-use assets, net | |

| 70,820 | | |

| 142,801 | |

| Goodwill | |

| 467,409 | | |

| 467,409 | |

| TOTAL ASSETS | |

$ | 3,683,271 | | |

$ | 4,266,941 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 2,708,906 | | |

$ | 3,396,543 | |

| Notes payable | |

| 1,889,321 | | |

| 446,246 | |

| Convertible debentures, net of discount | |

| 1,596,960 | | |

| 482,885 | |

| Operating lease liabilities, current | |

| 66,866 | | |

| 119,065 | |

| Deferred revenues | |

| 56,039 | | |

| 39,170 | |

| Factoring liability | |

| 143,944 | | |

| 214,249 | |

| Derivative liabilities | |

| – | | |

| 2,717,633 | |

| TOTAL CURRENT LIABILITIES | |

| 6,462,036 | | |

| 7,415,791 | |

| | |

| | | |

| | |

| Operating lease liabilities, long term | |

| – | | |

| 23,068 | |

| TOTAL LIABILITIES | |

| 6,462,036 | | |

| 7,438,859 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES (Note 12) | |

| – | | |

| – | |

| | |

| | | |

| | |

| STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Common stock - $0.001 par value; 400,000,000 shares authorized; 104,988,853 and 53,442,147 shares issued and outstanding as of December 31, 2023 and 2022, respectively | |

| 104,989 | | |

| 53,442 | |

| Additional paid in capital | |

| 24,726,722 | | |

| 19,391,400 | |

| Accumulated other comprehensive loss | |

| 190,503 | | |

| (247,760 | ) |

| Accumulated deficit | |

| (27,061,486 | ) | |

| (21,631,241 | ) |

| Stemtech Corporation stockholders’ deficit | |

| (2,039,272 | ) | |

| (2,434,159 | ) |

| Non-controlling interest in subsidiaries | |

| (739,493 | ) | |

| (737,759 | ) |

| TOTAL STOCKHOLDERS’ DEFICIT | |

| (2,778,765 | ) | |

| (3,171,918 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

$ | 3,683,271 | | |

$ | 4,266,941 | |

See accompanying Notes to Consolidated Financial

Statements

Stemtech Corporation

Consolidated Statements of Operations and Comprehensive

Loss

| | |

| | | |

| | |

| | |

For The Years Ended | |

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| NET SALES | |

$ | 4,921,531 | | |

$ | 4,559,399 | |

| | |

| | | |

| | |

| COST OF GOODS SOLD: | |

| | | |

| | |

| Cost of goods sold | |

| 731,339 | | |

| 1,100,903 | |

| Freight-in | |

| 270,301 | | |

| 63,115 | |

| TOTAL COST OF GOODS SOLD | |

| 1,001,640 | | |

| 1,164,018 | |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 3,919,891 | | |

| 3,395,381 | |

| | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | |

| Commissions | |

| 1,187,025 | | |

| 1,047,400 | |

| Selling and marketing | |

| 504,075 | | |

| 533,397 | |

| General and administrative | |

| 6,439,537 | | |

| 6,837,964 | |

| Research and development | |

| 13,800 | | |

| – | |

| TOTAL OPERATING EXPENSES | |

| 8,144,437 | | |

| 8,418,761 | |

| | |

| | | |

| | |

| OPERATING LOSS | |

| (4,224,546 | ) | |

| (5,023,380 | ) |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | |

| Change in fair value of derivative liability | |

| 1,488,686 | | |

| (3,223,271 | ) |

| Interest expense | |

| (4,893,033 | ) | |

| (4,097,843 | ) |

| Other income and expenses, net | |

| 16,484 | | |

| 7,928 | |

| Gain on settlement of derivative liabilities | |

| 1,366,298 | | |

| – | |

| Gain on extinguishment of debt | |

| 814,132 | | |

| 3,799,356 | |

| TOTAL OTHER EXPENSE, NET | |

| (1,207,433 | ) | |

| (3,513,830 | ) |

| | |

| | | |

| | |

| LOSS BEFORE INCOME TAXES | |

| (5,431,979 | ) | |

| (8,537,210 | ) |

| | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| – | | |

| (95,618 | ) |

| | |

| | | |

| | |

| NET LOSS | |

| (5,431,979 | ) | |

| (8,632,828 | ) |

| | |

| | | |

| | |

| NET LOSS ATTRIBUTABLE TO NONCONTROLLING

INTERESTS | |

| (1,734 | ) | |

| (87,905 | ) |

| | |

| | | |

| | |

| NET LOSS AVAILABLE TO COMMON STOCKHOLDERS | |

$ | (5,430,245 | ) | |

$ | (8,544,923 | ) |

| | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | |

| Basic | |

$ | (0.07 | ) | |

$ | (0.19 | ) |

| Diluted | |

$ | (0.07 | ) | |

$ | (0.19 | ) |

| | |

| | | |

| | |

| Shares used to compute loss per share | |

| | | |

| | |

| Basic | |

$ | 83,469,544 | | |

$ | 46,014,138 | |

| Diluted | |

$ | 83,469,544 | | |

$ | 46,014,138 | |

| | |

| | | |

| | |

| Comprehensive loss | |

| | | |

| | |

| Net loss available to common stockholders | |

$ | (5,430,245 | ) | |

$ | (8,544,923 | ) |

| Change in foreign currency translation adjustments | |

| 438,263 | | |

| 182,495 | |

| Comprehensive loss available to common stockholders | |

$ | (4,991,982 | ) | |

$ | (8,362,428 | ) |

See accompanying Notes to Consolidated Financial

Statements

Stemtech Corporation

Consolidated Statements of Changes in Stockholders’

Deficit

For the Years Ended December 31, 2023 and 2022

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock | | |

Additional | | |

| | |

Accumulated Other Compre-

hensive | | |

| | |

Non- | | |

Total | |

| | |

No. of Shares | | |

Amount | | |

Paid-in Capital | | |

Accumulated

Deficit | | |

Income

(Loss) | | |

Sub total | | |

controlling

Interest | | |

Stockholders’

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at December 31, 2021 | |

| 44,685,673 | | |

$ | 44,685 | | |

$ | 10,116,296 | | |

$ | (13,086,318 | ) | |

$ | (430,255 | ) | |

$ | (3,355,592 | ) | |

$ | (649,854 | ) | |

$ | (4,005,446 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock based compensation | |

| – | | |

| – | | |

| 439,053 | | |

| – | | |

| – | | |

| 439,053 | | |

| – | | |

| 439,053 | |

| Stock issued for services | |

| 3,584,344 | | |

| 3,586 | | |

| 3,553,546 | | |

| – | | |

| – | | |

| 3,557,132 | | |

| – | | |

| 3,557,132 | |

| Stock issued for cash | |

| 37,314 | | |

| 37 | | |

| 99,965 | | |

| – | | |

| – | | |

| 100,002 | | |

| – | | |

| 100,002 | |

| Conversion of convertible notes and accrued interest to common stock | |

| 4,114,816 | | |

| 4,114 | | |

| 823,886 | | |

| – | | |

| – | | |

| 828,000 | | |

| – | | |

| 828,000 | |

| Stock issued for loan extension | |

| 945,512 | | |

| 946 | | |

| 4,158,728 | | |

| – | | |

| – | | |

| 4,159,674 | | |

| – | | |

| 4,159,674 | |

| Shares issued as debt issuance cost | |

| 74,488 | | |

| 74 | | |

| 199,926 | | |

| – | | |

| – | | |

| 200,000 | | |

| – | | |

| 200,000 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| 182,495 | | |

| 182,495 | | |

| – | | |

| 182,495 | |

| Non-controlling interest | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (87,905 | ) | |

| (87,905 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (8,544,923 | ) | |

| – | | |

| (8,544,923 | ) | |

| – | | |

| (8,544,923 | ) |

| Balance at December 31, 2022 | |

| 53,442,147 | | |

$ | 53,442 | | |

$ | 19,391,400 | | |

$ | (21,631,241 | ) | |

$ | (247,760 | ) | |

$ | (2,434,159 | ) | |

$ | (737,759 | ) | |

$ | (3,171,918 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at December 31, 2022 | |

| 53,442,147 | | |

$ | 53,442 | | |

$ | 19,391,400 | | |

$ | (21,631,241 | ) | |

$ | (247,760 | ) | |

$ | (2,434,159 | ) | |

$ | (737,759 | ) | |

$ | (3,171,918 | ) |

| Stock based compensation | |

| – | | |

| – | | |

| 439,054 | | |

| – | | |

| – | | |

| 439,054 | | |

| – | | |

| 439,054 | |

| Stock issued for services | |

| 6,115,200 | | |

| 6,115 | | |

| 427,910 | | |

| – | | |

| – | | |

| 434,025 | | |

| – | | |

| 434,025 | |

| Conversion of convertible notes and accrued interest to common stock | |

| 30,371,836 | | |

| 30,372 | | |

| 2,373,081 | | |

| – | | |

| – | | |

| 2,403,453 | | |

| – | | |

| 2,403,453 | |

| Settlement of accrued liabilities for common stock | |

| 12,149,670 | | |

| 12,150 | | |

| 794,926 | | |

| – | | |

| – | | |

| 807,076 | | |

| – | | |

| 807,076 | |

| Stock issued for LFR Acquisition | |

| 2,400,000 | | |

| 2,400 | | |

| 269,520 | | |

| – | | |

| – | | |

| 271,920 | | |

| – | | |

| 271,920 | |

| Reclassification of derivative liabilities to APIC | |

| – | | |

| – | | |

| 1,011,451 | | |

| – | | |

| – | | |

| 1,011,451 | | |

| – | | |

| 1,011,451 | |

| Stock issued for loan extension | |

| 510,000 | | |

| 510 | | |

| 19,380 | | |

| – | | |

| – | | |

| 19,890 | | |

| – | | |

| 19,890 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| 438,263 | | |

| 438,263 | | |

| – | | |

| 438,263 | |

| Non-controlling interest | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (1,734 | ) | |

| (1,734 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (5,430,245 | ) | |

| – | | |

| (5,430,245 | ) | |

| – | | |

| (5,430,245 | ) |