Current Report Filing (8-k)

October 03 2014 - 3:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2014

|

SOUTHCORP CAPITAL, INC.

|

| (Exact name of registrant as specified in its charter) |

|

| Delaware |

| (State or other jurisdiction of incorporation) |

|

000-21155

|

|

46-5429720

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

|

205 Ave Del Mar #984

San Clemente, CA 92674

|

|

(Address of principal executive offices) (zip code)

|

|

(949) 461-1471

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Item 1.01 Entry into a Material Definitive Agreement.

On September 30, 2014, we executed a Securities Purchase Agreement with KBM Worldwide, Inc., whereby we issued a convertible promissory note dated September 22, 2014, to KBM Worldwide, Inc. bearing interest on the unpaid balance at the rate of eight percent, in the original principal amount of $42,500.

The note is convertible into shares of our common stock by dividing the Conversion Amount (as defined below) by the applicable Conversion Price then in effect on the date specified in the notice of conversion. The term “Conversion Amount” means, with respect to any conversion of a note, the sum of (1) the principal amount of the note to be converted in such conversion plus (2) at KBM Worldwide, Inc.’s option, accrued and unpaid interest, if any, on such principal amount at the interest rates provided in the note to the Conversion Date; provided, however, that Mind Solutions shall have the right to pay any or all interest in cash plus (3) at our option, Default Interest, if any, on the amounts referred to in the immediately preceding clauses (1) and/or (2) plus (4) at KBM Worldwide, Inc.’s option, any amounts owed to KBM Worldwide, Inc. under the note.

The conversion price (the “Conversion Price”) shall be the Variable Conversion Price (subject to equitable adjustments for stock splits, stock dividends or rights offerings by Mind Solutions relating to our securities or the securities of any subsidiary of Mind Solutions, combinations, recapitalization, reclassifications, extraordinary distributions and similar events). The “Variable Conversion Price” shall mean 51 percent multiplied by the Market Price (as defined in the note). “Market Price" means the average of the lowest three Trading Prices (as defined below) for our common stock during the 30 Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Trading Price” means, for any security as of any date, the closing bid price on the Over-the-Counter Bulletin Board, Pink Sheets electronic quotation system or applicable trading market (the “OTC”) as reported by a reliable reporting service (“Reporting Service”) designated by the Holder (i.e. Bloomberg) or, if the OTC is not the principal trading market for such security, the closing bid price of such security on the principal securities exchange or trading market where such security is listed or traded or, if no closing bid price of such security is available in any of the foregoing manners, the average of the closing bid prices of any market makers for such security that are listed in the “pink sheets.” If the Trading Price cannot be calculated for such security on such date in the manner provided above, the Trading Price shall be the fair market value as mutually determined by Mind Solutions and the holders of a majority in interest of the note being converted for which the calculation of the Trading Price is required in order to determine the Conversion Price of such note.

“Trading Day” shall mean any day on which shares of our common stock are tradable for any period on the OTC, or on the principal securities exchange or other securities market on which shares of our common stock are then being traded.

All shares of our common stock to be issued to KBM Worldwide, Inc. are to be issued free of any restrictions pursuant to Rule 144 under the Securities Act.

The note further provides for anti-dilution adjustments in favor of KBM Worldwide, Inc., in the event we offer additional shares of our common stock.

As of the date of this report, $42,500 of the note remains unpaid. There have been no conversions of the note.

At September 30, 2014, the registrant had outstanding 249,057,315 shares of common stock, par value $0.0001 per share.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SouthCorp Capital, Inc. |

|

| |

|

|

|

| Dated: October 3, 2014 |

By |

/s/ Joseph Wade |

|

| |

|

Name: Joseph Wade |

|

| |

|

Title: CEO |

|

3

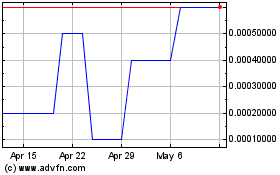

Southcorp Capital (CE) (USOTC:STHC)

Historical Stock Chart

From Apr 2024 to May 2024

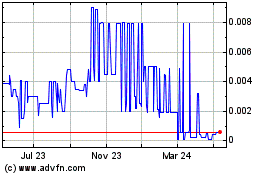

Southcorp Capital (CE) (USOTC:STHC)

Historical Stock Chart

From May 2023 to May 2024