UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14 (c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

☐

Preliminary Information Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2))

☒ Definitive

Information Statement

SIMPLICITY

ESPORTS AND GAMING COMPANY

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

| |

1) |

Title of each

class of securities to which transactions applies: |

| |

|

|

|

| |

|

|

|

| |

2) |

Aggregate number

of securities to which transactions applies: |

| |

|

|

|

| |

|

|

| |

3) |

Per unit price

or other underlying value of transactions computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee

is calculated and state how it was determined): |

| |

|

|

|

| |

|

|

| |

4) |

Proposed maximum

aggregate value of transactions: |

| |

|

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

|

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1)

Amount Previously Paid:

2)

Form, Schedule or Registration Statement No:

3)

Filing Party:

4)

Date Filed:

Simplicity

Esports and Gaming Company

7000

W. Palmetto Park Rd., Suite 505

Boca

Raton, FL 33433

December 16, 2022

THIS

IS A NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’

MEETING

WILL BE HELD TO CONSIDER ANY MATTERS DESCRIBED HEREIN.

Dear

Stockholder:

We

are providing this information statement to you as a stockholder of record of our outstanding common stock, $0.0001 par value per share

(the “Common Stock”), at the close of business on September 1, 2022, in connection with the adoption of an amendment to our

third amended and restated certificate of incorporation, as amended (the “Certificate of Incorporation”) by our Board of

Directors (the “Board”) and by written consent of the holders of a majority of the voting power of the issued and outstanding

capital stock of the Company (the “Approving Stockholders”) entitled to vote thereon, including our Common Stock and our

Series X preferred stock, par value $0.0001 per share (“Series X Preferred Stock”), where each share of Series X Preferred

Stock has a number of votes equal to all of the other votes entitled to be cast on any matter by any of our other shares or securities,

plus one, increasing the number of our authorized shares of Common Stock from 36,000,000 to 250,000,000, referred to herein as the “Corporate

Action.”

Our

Board of Directors approved the Corporate Action on September 1, 2022. The Approving Stockholders, acting by written consent in lieu

of a special meeting, approved the Corporate Action on September 1, 2022.

The

written consent that we received from the Approving Stockholders constitutes the only stockholder approval required for the Corporate

Action under Delaware law and our Certificate of Incorporation and bylaws. As a result, no further action by any other stockholder is

required to approve the Corporate Action and we have not solicited, and will not be soliciting, your approval of the Corporate Action.

This

notice and the accompanying Information Statement are being mailed on or about December 16, 2022, to the record holders of our Common

Stock as of September 1, 2022. This notice and the accompanying Information Statement shall constitute notice to you of the Corporate

Action by written consent in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended, and in accordance

with Delaware law and our bylaws.

NO

VOTE OR OTHER ACTION OF OUR STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THE ACCOMPANYING INFORMATION STATEMENT. WE ARE NOT ASKING FOR

A PROXY AND YOU ARE NOT REQUESTED TO SEND US A PROXY.

| December 16, 2022 |

By Order of the Board of Directors

of |

| |

SIMPLICITY ESPORTS AND GAMING COMPANY |

| |

|

| |

/s/ Roman

Franklin |

| |

Roman Franklin |

| |

Chief Executive Officer |

SIMPLICITY

ESPORTS AND GAMING COMPANY

7000

W. Palmetto Park Rd., Suite 505

Boca

Raton, FL 33433

(855)

345-9467

Information

Statement Pursuant to Section 14C

of the Securities Exchange Act of 1934

This

Information Statement is being provided on or about December 16, 2022, to all holders of record on September 1, 2022 (the “Record

Date”) of the common stock, $0.0001 par value per share (the “Common Stock”), and Series X preferred stock, $0.0001

par value per share (the “Series X Preferred Stock”), of Simplicity Esports and Gaming Company, a Delaware corporation (“Simplicity

Esports” or the “Company”), in connection with the adoption of an amendment to our third amended and restated certificate

of incorporation, as amended (the “Certificate of Incorporation”) by our Board of Directors (the “Board”) and

by written consent of the holders of a majority of the voting power of the issued and outstanding capital stock of the Company (the “Approving

Stockholders”) entitled to vote thereon, including our Common Stock and our Series X Preferred Stock, where each share of Series

X Preferred Stock has a number of votes equal to all of the other votes entitled to be cast on any matter by any of our other shares

or securities, plus one, increasing the number of our authorized shares of Common Stock from 36,000,000 to 250,000,000, referred to herein

as the “Corporate Action.”

On

September 1, 2022, our Board approved the Corporate Action. To eliminate the costs and management time involved in holding a special

meeting of stockholders and to effect the Corporate Action as quickly as possible in order to accomplish the purposes of our Company,

we chose to obtain the written consent of the holders of a majority of the Company’s voting power to approve the Corporate Action

in accordance with Sections 228 and 242 of the Delaware General Corporation Law (the “DGCL”) and our bylaws. On the Record Date, the Approving Stockholders approved the Corporate Action by written consent.

Since

the Board and holders of a majority of the voting power of the Company’s issued and outstanding shares of capital stock have voted

in favor of the Corporate Action, all corporate actions necessary to approve the amendment increasing the number of our authorized shares

of Common Stock to 250,000,000 has been completed. Because the Corporate Action has already been approved by the holders of a majority

of the voting power of the Company’s outstanding shares of capital stock, you are not required to take any action. This Information

Statement provides notice to you that the Corporate Action has been approved. You will receive no further notice of the approval nor

of the effective date of the Corporate Action other than pursuant to reports which the Company will be required to file with the Securities

and Exchange Commission (the “SEC”).

NOTICE

PURSUANT TO SECTION 228 — Pursuant to Section 228 of the DGCL, we are required to provide prompt notice of the taking of corporate

action by written consent to our stockholders who have not consented in writing to such action. This Information Statement serves as

the notice required by Section 228 of the DGCL.

Our

Common Stock is quoted on the OTCQB market tier of the OTC Markets Group Inc. under the symbol “WINR.” The last sale price

of our Common Stock as reported on the OTCQB on December 14, 2022 was $0.0289.

RECORD

DATE AND VOTING SECURITIES

Only

stockholders of record at the close of business on the Record Date, September 1, 2022, are entitled to notice of the information disclosed

in this Information Statement. As of the Record Date, our authorized securities consist of 36,000,000 shares of Common Stock and 1,000,000

shares of preferred stock, $0.0001 par value per share (the “Preferred Stock”).

As

of the Record Date, there were outstanding two classes of stock entitled to vote on the Corporate Action: 3,120,161 shares of

Common Stock, and one share of Series X Preferred Stock. The share of Series X Preferred Stock has a number of votes equal to all of

the other votes entitled to be cast on any matter by any of our other shares or securities, plus one. The Series X Preferred Stock is

entitled to vote on any matter submitted to the holders of the Common Stock for a vote, and to vote together with the Common Stock on

such matter.

EXPENSES

The

costs of preparing, printing and mailing this Information Statement will be borne by the Company.

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’

MEETING

WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS

INFORMATION

STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF

INFORMING

YOU OF THE MATTERS DESCRIBED HEREIN.

INCREASE

IN AUTHORIZED SHARES OF COMMON STOCK

The

following is a summary of certain matters related to the increase in the number of our authorized shares of Common Stock from 36,000,000

to 250,000,000 (the “Authorized Shares Increase”).

The

effective date of the Authorized Shares Increase will be determined at the sole discretion of the Board of Directors and will be publicly

announced. The Authorized Shares Increase will become effective upon the filing of a certificate of amendment to the Certificate of Incorporation

relating to the Authorized Shares Increase with the Secretary of State of the State of Delaware. The Board of Directors currently intends

for the Authorized Shares Increase to become effective as soon as reasonably practicable in light of applicable regulations.

Our

Board believes it is in our best interests to increase the number of authorized shares of Common Stock in order to give us greater flexibility

in considering and planning for future corporate needs. In the past and as part of the effort to maintain operations until a more significant

capital raising transaction can be completed, our Company completed various transactions pursuant to which we issued substantial amounts

of Common Stock and convertible notes and warrants obligating our Company to reserve shares of our authorized Common Stock for future

issuance. Consequently, we currently lack a sufficient number of authorized but unissued shares of Common Stock should the opportunity

to raise additional capital become available. Our management believes that the terms on which such equity might be raised will be more

favorable to our Company if we have Common Stock available for immediate issuance.

In

addition to the reasons stated above, our Board believes it is in our Company’s best interests to increase the number of authorized

shares of Common Stock in order to give us greater flexibility in considering and planning for future corporate needs, including, but

not limited to, raising capital, potential strategic transactions, including mergers, acquisitions and business combinations, stock dividends,

grants under equity compensation plans, stock splits or financings, as well as other general corporate transactions. The Board believes

that additional authorized shares of Common Stock are necessary to enable us to take timely advantage of opportunities that may become

available to us. Although our management is exploring whether there are opportunities for our Company to raise additional capital to

support our ongoing operations, we do not have any definitive plans, arrangements, understandings or agreements regarding the issuance

of the additional shares of Common Stock that will result from adoption of the Authorized Shares Increase. Except as otherwise required

by law, the newly authorized shares of Common Stock will be available for issuance at the discretion of our Board (without further action

by the stockholders) for future corporate needs, including those outlined above. While effecting the Authorized Shares Increase would

not have any immediate dilutive effect on the proportionate voting power or other rights of existing stockholders, any future issuance

of additional authorized shares of our Common Stock may, among other things, dilute the earnings per share of our Common Stock and the

equity and voting rights of those holding equity at the time the additional shares are issued.

Any

newly authorized shares of Common Stock will be identical to the shares of Common Stock now authorized and outstanding. The Authorized

Shares Increase will not affect the rights of current holders of our Common Stock, none of whom have preemptive or similar rights to

acquire the newly authorized shares.

Effective

Time

The

effective time of the Authorized Shares Increase, if the proposed Authorized Shares Increase is implemented at the discretion of the

Board, will be the date and time that the certificate of amendment effecting the Authorized Shares Increase is filed with the Delaware

Secretary of State or such later time as is specified therein. The exact timing of the Authorized Shares Increase will be determined

by our Board based on its evaluation as to when such action will be the most advantageous to Simplicity Esports and its stockholders,

and the effective date will be publicly announced. The Authorized Shares Increase may be delayed or abandoned without further action

by the stockholders at any time prior to effectiveness of the related certificate of amendment filed with the Delaware Secretary of State,

notwithstanding stockholder adoption and approval of the Authorized Shares Increase, if the Board, in its sole discretion, determines

that it is in the best interests of the Company and its stockholders to delay or abandon the Authorized Shares Increase.

DESCRIPTION

OF CAPITAL STOCK

The

Company is currently authorized to issue 36,000,000 shares of Common Stock and 1,000,000 shares of Preferred Stock. If the Authorized

Shares Increase is effectuated, the Company will be authorized to issue 250,000,000 shares of Common Stock. As of the Record Date, there

were outstanding 3,120,161 shares of Common Stock and one share of Series X Preferred Stock. The one share of Series X Preferred

Stock is held by Mr. Franklin, the Company’s Chief Executive Officer, principal financial officer, principal accounting officer,

member of the Company’s Board of Directors, and greater than 5% stockholder, and one of the Approving Stockholders. The one share

of Series X Preferred Stock has a number of votes equal to all of the other votes entitled to be cast on any matter by any other shares

or securities of the Company, plus one. The Series X Preferred Stock does not have any economic or other interest in the Company. The

share of Series X Preferred Stock may not be transferred after issuance. If any transfer is attempted, the Series X Preferred Stock will

be automatically redeemed by the Company at a redemption price of $1.00.

At

the election of the holder of the Series X Preferred Stock at any time following the date that the Company has amended its Certificate

of Incorporation to increase the authorized shares of Common Stock such that there are sufficient authorized but unissued shares of Common

Stock to permit conversion of the Series X Preferred Stock as set forth in the Certificate of Designations, the Series X Preferred Stock

is convertible into 500,000,001 shares of the Company’s Common Stock.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS.

The

following table sets forth the number of shares of and percent of the Company’s Common Stock beneficially owned as of the Record

Date, by all directors, our named executive officers, our directors and executive officers as a group, and persons or groups known by

us to own beneficially 5% or more of our Common Stock.

Unless

otherwise noted, the business address of each of the beneficial owners listed below is c/o Simplicity Esports and Gaming Company, 7000

W. Palmetto Park Rd., Suite 505, Boca Raton, FL 33433.

| Name of Beneficial Owner | |

Amount and

Nature of

Beneficial

Ownership | | |

Percentage

of Class (1) | |

| Directors and Executive Officers | |

| | | |

| | |

| Roman Franklin | |

| 450,408 | (2) | |

| 13.2 | %(3) |

| Max Hooper | |

| 21,188 | (4) | |

| * | |

| Edward Leonard Jaroski | |

| 34,938 | (5) | |

| 1.1 | % |

| William H. Herrmann, Jr. | |

| 25,540 | (6) | |

| * | |

| Nancy Hennessey (7) | |

| 146,394 | (8) | |

| 4.5 | % |

| All directors and officers as a group (4 persons) | |

| 532,074 | (9) | |

| 15.4 | % |

| Principal Shareholders (more than 5%): | |

| | | |

| | |

| Jed Kaplan | |

| 322,245 | (10) | |

| 10.2 | % |

*

less than 1%.

(1)

The percentages in the table have been calculated on the basis of treating as outstanding for a particular person, all shares of our

capital stock outstanding on the Record Date. On the Record Date, there were 3,120,161 shares of our Common Stock outstanding.

To calculate a stockholder’s percentage of beneficial ownership, we include in the numerator and denominator the Common Stock outstanding

and all shares of our Common Stock issuable to that person in the event of the exercise of outstanding warrants and other derivative

securities owned by that person which are exercisable within 60 days of the Record Date. Common stock warrants and derivative securities

held by other stockholders are disregarded in this calculation. Therefore, the denominator used in calculating beneficial ownership among

our stockholders may differ. Unless we have indicated otherwise, each person named in the table has sole voting power and sole investment

power for the shares listed opposite such person’s name.

(2) Includes

(i) 6,375 shares of Common Stock owned indirectly through Mr. Franklin’s wife, Alyssia Franklin; and (ii) 300,000 shares of Common

Stock issuable upon exercise of stock options that have vested or will vest within 60 days of the Record Date.

(3)

In addition, Mr. Franklin holds one share of the Company’s Series X Preferred Stock, which represents 100% of the issued and outstanding

shares of Series X Preferred Stock. The one share of Series X Preferred Stock has a number of votes equal to all of the other votes entitled

to be cast on any matter by any other shares or securities of the Company, plus one. The Series X Preferred Stock does not have any economic

or other interest in the Company. The share of Series X Preferred Stock may not be transferred after issuance. If any transfer is attempted,

the Series X Preferred Stock will be automatically redeemed by the Company at a redemption price of $1.00.

At

the election of the Series X Preferred Stock holder at any time following the date that the Company has amended its Certificate of Incorporation

to increase the authorized shares of Common Stock such that there are sufficient authorized but unissued shares of Common Stock to permit

conversion of the Series X Preferred Stock as set forth in the Certificate of Designations, the Series X Preferred Stock is convertible

into 500,000,001 shares of the Company’s Common Stock.

(4) Includes

(i) 1,813 shares of Common Stock owned directly by Merging Traffic, Inc.; (ii) 1,250 shares of our Common Stock issuable upon exercise

of 1,250 warrants owned directly by Merging Traffic, Inc. with an exercise price of $92.00 which expire on May 22, 2024 that have vested

or will vest within 60 days of the Record Date; (iii) 10,000 shares of our Common Stock issuable upon exercise of stock options that

have vested or will vest within 60 days of the Record Date. Dr. Hooper is Managing Director of Merging Traffic, Inc.

(5) Includes

(i) 7,500 shares of our Common Stock issuable upon exercise of 7,500 warrants with an exercise price of $92.00 which expire on May 22,

2024 that have vested or will vest within 60 days of the Record Date; and (ii) 10,000 shares of Common Stock issuable upon exercise of

stock options that have vested or will vest within 60 days of the Record Date.

(6) Includes

(i) 1,250 shares of our Common Stock issuable upon exercise of 1,250 warrants with an exercise price of $92.00 which expire on May 22,

2024 that have vested or will vest within 60 days of the Record Date; and (ii) 10,000 shares of Common Stock issuable upon exercise of

stock options that have vested or will vest within 60 days of the Record Date.

(7) Ms.

Hennessey is the Company’s former Chief Financial Officer. Ms. Hennessey ceased to be the Company’s Chief Financial Officer

on June 28, 2022.

(8) Includes

125,000 shares of Common Stock issuable upon exercise of vested stock options.

(9) Represents

shares beneficially owned by Messrs. Franklin, Hooper, Jaroski and Herrmann. Includes 340,000 shares of Common Stock issuable upon exercise

of stock options that have vested or will vest within 60 days of the Record Date.

(10) Includes

(i) 6,250 shares of Common Stock issuable upon exercise of 6,250 warrants with an exercise price of $92.00 which expire on May 22, 2024

that have vested or will vest within 60 days of the Record Date; and (ii) 45,000 shares of Common Stock issuable upon exercise of stock

options that have vested or will vest within 60 days of the Record Date. On May 18, 2022, Jed Kaplan resigned as a member of the Board

of Directors of the Company effective immediately and no longer holds any positions with the Company.

DISSENTERS’

RIGHTS

Under

the DGCL, our stockholders are not entitled to dissenters’ rights or appraisal rights with respect to any of the Corporate Actions

and we will not independently provide our stockholders with any such rights.

INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No

director, executive officer, nominee for election as a director, associate of any director, executive officer or nominee, or any other

person, has any substantial interest, direct or indirect, in the Corporate Actions that is not shared by all other stockholders.

ADDITIONAL

INFORMATION

We

are subject to the disclosure requirements of the Exchange Act, and in accordance therewith, file reports, information statements and

other information, including annual and quarterly reports on Form 10-K and 10-Q, respectively, with the SEC. Reports and other information

filed by the Company can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington,

DC 20549. Copies of such material can also be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street,

N.E., Washington, DC 20549 at prescribed rates. In addition, the SEC maintains a web site on the Internet (http://www.sec.gov)

that contains reports, information statements and other information regarding issuers that file electronically with the SEC through the

EDGAR (Electronic Data Gathering, Analysis and Retrieval) system.

You

may request a copy of documents filed with or furnished to the SEC by us, at no cost, by writing to Simplicity Esports and Gaming Company,

at 7000 W. Palmetto Park Rd., Suite 505, Boca Raton, FL 33433, Attn: Corporate Secretary, or by calling the Company at (855) 345-9467.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Additional

copies of this Information Statement may be obtained at no charge by writing to us at Simplicity Esports and Gaming Company, at 7000

W. Palmetto Park Rd., Suite 505, Boca Raton, FL 33433, Attn: Corporate Secretary, or by calling the Company at (855) 345-9467.

If

hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders

who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate

copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered.

You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and

(iii) the address to which the Company should direct the additional copy of the Information Statement, to Simplicity Esports and Gaming

Company, at 7000 W. Palmetto Park Rd., Suite 505, Boca Raton, FL 33433, Attn: Corporate Secretary, or by calling the Company at (855)

345-9467.

If

multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would

prefer the Company to mail each stockholder a separate copy of future mailings, you may mail notification to, or call the Company at,

the address and phone number in the preceding paragraph. Additionally, if current stockholders with a shared address received multiple

copies of this Information Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to

stockholders at the shared address, notification of such request may also be made by mail or telephone to the address or phone number

provided in the preceding paragraph.

| |

SIMPLICITY ESPORTS AND GAMING COMPANY |

| |

| December 16, 2022 |

/s/ Roman Franklin |

| |

Roman Franklin |

| |

Chief Executive Officer |

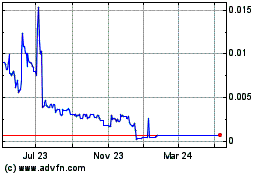

Simplicity Esports and G... (CE) (USOTC:WINR)

Historical Stock Chart

From Feb 2025 to Mar 2025

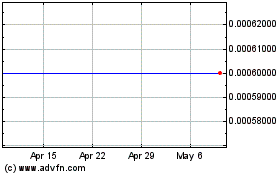

Simplicity Esports and G... (CE) (USOTC:WINR)

Historical Stock Chart

From Mar 2024 to Mar 2025