Current Report Filing (8-k)

September 28 2022 - 4:07PM

Edgar (US Regulatory)

0001708410

false

0001708410

2022-09-28

2022-09-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): September 28, 2022

SIMPLICITY

ESPORTS AND GAMING COMPANY

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38188 |

|

82-1231127 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

7000

W. Palmetto Park Rd., Suite 505

Boca

Raton, FL 33433

(Address

of Principal Executive Offices)

(855)

345-9467

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Current Report on Form 8-K contains forward-looking statements or statements which arguably imply or suggest certain things about our

future. Statements which express that we “believe,” “anticipate,” “expect,” or “plan to,”

and any other similar statements which are not historical fact, are forward-looking statements. These statements are based on assumptions

that we believe are reasonable, but there are a number of factors that could cause our actual results to differ materially from those

expressed or implied by these statements. You are cautioned not to place undue reliance on these forward-looking statements. The forward-looking

statements speak as of the date hereof, and we do not undertake any obligation to update or revise any forward-looking statements, except

as expressly required by law.

Item

1.01. Entry into a Material Definitive Agreement.

On

September 28, 2022, Simplicity Esports and Gaming Company (the “Company”) entered into an exchange agreement (the “Exchange

Agreement”), dated as of September 28, 2022, by and among the Company, Diverted River Technology, LLC (“Diverted River”),

the member(s) of Diverted River from time to time (the “Members”) and Zachary Johnson, as the Members’ representative.

Pursuant to the terms of the Exchange Agreement, the Company agreed to acquire from the Members 100% of the membership interests of Diverted

River held by the Members as of the closing (the “Closing”), in exchange for the issuance by the Company to the Members of

shares of the Company’s common stock equal to 80% of the issued and outstanding shares of the Company’s common stock as of

the Closing.

Following

the Closing, Diverted River will become a wholly owned subsidiary of the Company. Also following the Closing, it is expected that the

Company’s name will be changed to Diverted River Technology, Inc., and the business of the Company will become that of Diverted

River, an ETO focused on a sustainable, high margin, recurring revenue business model that requires limited capital expenditures.

At

the Closing, the Company will expand the size of the Company’s Board of Directors (the “Board”) by three persons, to

a total of seven persons, and will name Mr. Johnson and, within 90 days after Closing, two other persons, as directors on the Board,

one of whom will be an independent director. Also at the Closing, the Company will name Mr. Johnson as Chief Executive Officer of the

Company. Within 90 days of Closing, the Board will name a Chief Technology Officer, subject to Mr. Johnson’s approval. At the Closing,

the Company will also enter into employment agreements with Mr. Johnson and certain other Diverted River employees as identified and

agreed by the parties. Within 90 days of Closing, the Company will hire Velocity 42 Limited as its primary software developer.

The

Exchange Agreement contains certain covenants, representations and warranties customary for an agreement of this type. In addition, the

Closing is subject to the satisfaction or waiver of certain conditions, including, but not limited to, (i) the increase by the Company

of its authorized shares of common stock to 250,000,000 shares; (ii) execution by Diverted River of agreements with clients generating

at least $60,000 per month in revenue for at least 24 months following the Closing, with such agreements being in form and substance

as agreed to by the Company and Diverted River; (iii) settlement by the Company of any debt with landlords related to the closure of

the Company’s gaming center venues; (iv) the Company having obtained binding commitments from investors to invest at least $4,000,000,

through the issuance of shares of Company common stock; (v) repayment by the Company of its convertible notes, or execution of agreements

with noteholders to convert such notes into shares of Company common stock comprising no more than 12.5% of the issued and outstanding

common stock of the Company after giving effect to the Closing; (vi) reaching an agreement with warrant holders to amend the exercise

price to be $1.00 per share; (vii) execution of note amendments by holders of Company promissory notes that are not presently convertible

into shares of Company common stock such that the notes will be converted into Company common stock and such notes shall have been converted,

with such shares being included in the 12.5% limitation set forth in clause (v) hereof; (viii) provision by Diverted River of audited

financial statements; and (ix) completion of satisfactory due diligence reviews by the Company and Diverted River.

The

parties may terminate the Exchange Agreement pursuant to the terms of the Exchange Agreement, including, but not limited to, if the conditions

to Closing have not been satisfied or waived by December 15, 2022.

The

description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the Exchange Agreement,

a copy of which is filed as Exhibit 10.1 hereto and are incorporated herein by reference.

Item

9.01. Financial Statement and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SIMPLICITY ESPORTS AND GAMING COMPANY |

| |

|

|

| Date: September 28, 2022 |

By: |

/s/ Roman

Franklin |

| |

|

Roman Franklin |

| |

|

Chief Executive Officer |

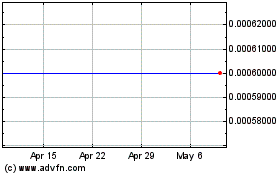

Simplicity Esports and G... (CE) (USOTC:WINR)

Historical Stock Chart

From Feb 2025 to Mar 2025

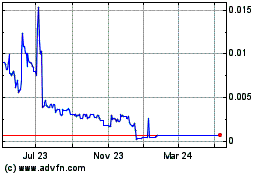

Simplicity Esports and G... (CE) (USOTC:WINR)

Historical Stock Chart

From Mar 2024 to Mar 2025