UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

December 8, 2014

Date of Report (Date of earliest event reported)

Searchlight Minerals Corp.

(Exact name of Registrant as specified in

its charter)

| Nevada |

000-30995 |

98-0232244 |

| (State or other jurisdiction |

(Commission File Number) |

(I.R.S. Employer |

| of incorporation) |

|

Identification No.) |

2360 W. Horizon Ridge Pkwy., Suite #100,

Henderson, Nevada 89052

(Address of principal executive offices)

(Zip Code)

(702) 939-5247

Registrant’s telephone number, including

area code

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive

Agreement.

Item 3.02 Unregistered Sales of Equity Securities.

Completion of Private Placement

On December 8, 2014,

Searchlight Minerals Corp., a Nevada corporation (“we,” “us,” “our” or the

“Company”), closed on the sale of $599,500 of our securities (the “Second Closing”) of a private

placement (the “Offering”) to certain investors. The securities were issued in reliance on exemptions from

registration pursuant to Section 4(2) of the Securities Act of 1933, as amended and Rule 506 of Regulation D thereunder. We

previously sold $1,005,700 of our securities in a first closing to the offering held on October 24, 2014. As of the Second

Closing on December 8, 2014, the Company has completed its Offering. We intend to use the net proceeds from the Offering for

general working capital purposes.

In the Second Closing, we sold 2,997,500

“Units,” with each Unit consisting of: one share of the Company’s common stock, $0.001 par value per share (each,

a “Share”); and one half of a common stock purchase warrant, where each full warrant (each, a “Warrant”)

will entitle the warrant holder to purchase one Share of the Company’s common stock at an exercise price of $0.30 per Share.

Such Warrants will expire five years from the date of issuance. Such Units were sold to 11 investors for gross proceeds of $599,500.

The price of each Unit was $0.20.

The foregoing descriptions of the

terms, conditions and restrictions of the Warrants do not purport and are not intended to be complete and are qualified in

their entirety by the complete texts thereof. A form of the Warrant issued in connection with the sale of Units is attached

to the Current Report on Form 8-K filed on October 28, 2014 as Exhibit 10.1 and is incorporated herein by

this reference. Please note however that such Warrant, including without limitation any representations and warranties

contained therein, is not intended as a document for investors or the public to obtain factual information about the current

state of affairs of the Company. Rather, investors and the public should look to other disclosures contained in our reports

under the Securities Exchange Act of 1934, as amended.

Item 7.01 REGULATION FD DISCLOSURE

Press Release

On December 12, 2014, we issued a press

release regarding the Second Closing, which is attached hereto as Exhibit 99.1.

The press release attached hereto is being

furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise subject to liability under that section, nor shall it be deemed incorporated

by reference into any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference

in such filing. By filing this report on Form 8-K and furnishing this information, the Company makes no admission as to the materiality

of any information in this report that is required to be disclosed solely by reason of Regulation FD.

Item 9.01 Financial Statements and Exhibits.

| Exhibit 10.1 |

Form of Warrant (1) |

| Exhibit 99.1 |

Press Release dated December 12, 2014, issued by Searchlight Minerals Corp. |

(1) Filed with the Securities and Exchange Commission

as an exhibit to our Current Report on Form 8-K filed on October 28, 2014.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

SEARCHLIGHT MINERALS CORP. |

| |

|

| |

|

|

| Dated: December 12, 2014 |

By: |

/s/ Martin B. Oring |

| |

|

Martin B. Oring |

| |

|

Chief Executive Officer |

EXHIBIT 99.1

SEARCHLIGHT MINERALS CORP. ANNOUNCES

CLOSING OF PRIVATE PLACEMENT FOR AGGREGATE GROSS PROCEEDS OF $1.6 MILLION

HENDERSON, Nevada (December 12, 2014) --

Searchlight Minerals Corp. (OTC BB: SRCH) (the “Company”), announced today that it has closed the second tranche of

its private placement offering (the “Offering”) for gross proceeds of $599,500. On October 24, 2014 the Company closed

a first tranche of the Offering for gross proceeds of $1,005,700.

At

the second closing of the Offering, the Company issued 2,997,500 units (the "Units") at a price of $0.20 per Unit. Each

Unit consisted of: one share of the Company’s common stock and one half of a common stock purchase warrant, where each full

warrant entitles the warrant holder to purchase one share of the Company’s common stock at an exercise price of $0.30 per

share. Such Warrants will expire five years from the date of issuance.

In the first closing of the Offering, the

Company issued 5,028,500 Units. Certain of such investors in the first closing were holders (“Note Holders”) of the

Company’s secured convertible promissory notes (“Notes”) that were issued pursuant to a Secured Convertible Note

Purchase Agreement entered into on September 18, 2013. Of the 5,028,500 Units, 4,395,000 were sold to sixteen investors for gross

proceeds of $879,000, and 633,500 Units were issued to thirteen Note Holders in consideration of cancellation of an aggregate of

$126,700 in debt owing by the Company to such Note Holders for interest payments due on the Notes as of September 18, 2014. Such

Note Holders include Luxor Capital Group, LP and certain of its associates and affiliates (collectively, “Luxor”),

who received $91,000 worth of Units in the first closing in consideration of cancellation of the September 18, 2014 interest payment

owed to them on their Notes. Luxor and certain other funds managed by Luxor are principal stockholders of the Company and Michael

Conboy, one of our directors, currently serves as Luxor’s Director of Research.

Altogether, out of the sixteen total Note

Holders, thirteen Note Holders (including Luxor), participated in the first closing. In addition to Luxor, affiliates of Martin

Oring, one of our directors, and our Chief Executive Officer and President, purchased $100,000 of Units for cash and received an

additional $8,225 worth of Units in consideration of the cancellation of the September 18, 2014 interest payment owed on Notes

held by such affiliates. The three remaining Note Holders elected to receive their September 18, 2014 interest payment in cash,

for an aggregate amount of $13,300.

In addition to the Offering, between September

10, 2014 and September 18, 2014, five Note Holders exercised their option as set forth in the September 18, 2013 Secured Convertible

Note Purchase Agreement to purchase $69,000 of additional Notes. Mr. Oring and certain affiliates of Mr. Oring purchased $35,250

of such Notes.

Proceeds from the private placement will

be used towards general working capital purposes. None of the securities offered in the Offering have been registered under the

Securities Act of 1933, as amended (the "Securities Act"), or applicable state securities laws. Accordingly, the securities

may not be offered or sold in the United States except pursuant to an effective registration statement or an applicable exemption

from the registration requirements of the Securities Act and such applicable state securities laws.

For more information on the Offering, please

see the Company’s current reports on Form 8-K as filed on October 28, 2014 and December 12, 2014.

About Searchlight Minerals Corp.

Searchlight Minerals Corp. is an exploration

stage company engaged in the acquisition and exploration of mineral properties and slag reprocessing projects. The Company holds

interests in the Clarkdale Slag Project, a mineral project located in Clarkdale, Arizona, which is a reclamation project to recover

precious and base metals from the reprocessing of slag produced from the smelting of copper ore mined at the United Verde Copper

Mine in Jerome, Arizona.

Searchlight Minerals Corp. is headquartered

in Henderson, Nevada, and its common stock is listed on the OTC Bulletin Board under the symbol “SRCH.” Additional

information is available on the Company's website at www.searchlightminerals.com and in the Company’s filings with the U.S.

Securities and Exchange Commission.

Forward-Looking Statements

This Press Release may contain, in addition

to historical information, forward-looking statements. Statements in this Press Release that are forward-looking statements are

subject to various risks and uncertainties concerning the specific factors disclosed under the heading “Risk Factors”

in the Company’s periodic filings with the Commission. When used in this Press Release in discussing the recent developments

on the Company’s mineral projects, including, without limitation, the resolution of certain issues relating to the operation

of production modules, the words such as “believe,” “could,” “may,” “expect” and

similar expressions are forward-looking statements. The risk factors that could cause actual results to differ from these forward-looking

statements include, but are not restricted to technical issues with the mineral projects that may affect production modules and

primary process components, challenges in moving from pilot plant scale to production scale, the risk that actual recoveries of

base and precious metals or other minerals re-processed from the slag material at the Clarkdale site will not be economically feasible,

uncertainty of estimates of mineralized material, operational risk, the Company’s limited operating history, uncertainties

about the availability of additional financing, geological or mechanical difficulties affecting the Company’s planned mineral

recovery programs, the risk that actual capital costs, operating costs and economic returns may differ significantly from the Company’s

estimates and uncertainty whether the results from the Company’s feasibility studies are sufficiently positive for the Company

to proceed with the construction of its processing facility, operational risk, the impact of governmental and environmental regulation,

financial risk, currency risk volatility in the prices of precious metals and other statements that are not historical facts as

disclosed under the heading “Risk Factors” in the Company’s periodic filings with securities regulators in the

United States. Consequently, risk factors including, but not limited to the aforementioned, may result in significant delays to

the projected or anticipated production target dates.

Contact Information:

RJ Falkner & Company, Inc., Investor

Relations Counsel at (800) 377-9893 or via email at info@rjfalkner.com.

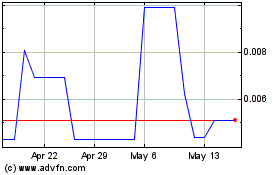

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Jun 2024 to Jul 2024

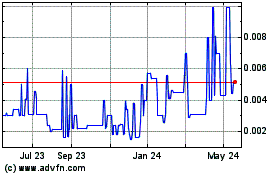

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Jul 2023 to Jul 2024