TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on June 30, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SANUWAVE Health, Inc.

(Exact name of registrant as specified in its charter)

Nevada | | | 3841 | | | 20-1176000 |

(State or other Jurisdiction

of Incorporation or Organization) | | | (Primary Standard Industrial

Classification Code Number) | | | (I.R.S. Employer

Identification No.) |

11495 Valley View Road

Eden Prairie, Minnesota 55344

(770) 419-7525

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Morgan C. Frank

Interim Chief Executive Officer

SANUWAVE Health, Inc.

11495 Valley View Road

Eden Prairie, Minnesota 55344

(770) 419-7525

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Ben A. Stacke

Griffin D. Foster

Faegre Drinker Biddle & Reath LLP

2200 Wells Fargo Center

90 South Seventh Street

Minneapolis, Minnesota 55402

(612) 766-7000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | | | Accelerated filer ☐ |

Non-accelerated filer ☒ | | | Smaller reporting company ☒ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

TABLE OF CONTENTS

The information in this prospectus is not complete and may be changed. The selling stockholders described herein may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell the securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated June 30, 2023

PRELIMINARY PROSPECTUS

96,687,519 Shares of Common Stock

This prospectus relates to the possible resale or other disposition, from time to time, of up to 96,687,519 shares of our common stock, par value $0.001 per share (“Common Stock”), by the selling stockholders named in this prospectus. The shares consist of (1) 30,694,450 shares of Common Stock issuable upon the exercise of certain Common Stock Purchase Warrants with an exercise price of $0.067 per share of Common Stock (the “First Warrants”), as further described herein; (2) 30,694,450 shares of Common Stock issuable upon the exercise of certain Common Stock Purchase Warrants with an exercise price of $0.04 per share of Common Stock (the “Second Warrants,” and together with the First Warrants, the “Warrants”), as further described herein; and (3) 35,298,619 shares of Common Stock issuable upon the conversion of certain Future Advance Convertible Promissory Notes (the “Notes”) as described herein.

The shares offered by this prospectus may be sold by the selling stockholders from time to time in the over-the-counter market or any other national securities exchange or automated interdealer quotation system on which our Common Stock is then listed or quoted, through negotiated transactions or otherwise at market prices prevailing at the time of sale or at negotiated prices, as described under “Plan of Distribution” herein.

All net proceeds from the sale of the shares of Common Stock covered by this prospectus will go to the selling stockholders. We will receive none of the proceeds from the sale of the shares of Common Stock covered by this prospectus by the selling stockholders. We may receive proceeds upon the exercise of outstanding Warrants for shares of Common Stock covered by this prospectus if the Warrants are exercised for cash. We are only paying expenses relating to the registration of the shares of Common Stock with the Securities and Exchange Commission (the “SEC”), but all selling and other expenses incurred by the selling stockholders will be borne by them.

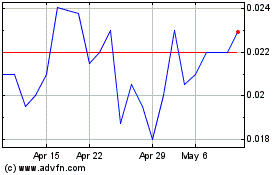

Our Common Stock is quoted on the OTCQB market under the symbol “SNWV.” The last reported sale price for shares of our Common Stock on June 27, 2023 was $0.021 per share.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page

5 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2023

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements in this prospectus that are not historical facts are hereby identified as “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Forward-looking statements convey our current expectations or forecasts of future events. All statements in this prospectus, including those made by the management of the Company, other than statements of historical fact, are forward-looking statements. Examples of forward-looking statements include statements regarding: results of operations, liquidity, and operations, restrictions and new regulations on our operations and processes, including the execution of clinical trials; the Company’s future financial results, operating results, and projected costs; market acceptance of and demand for UltraMIST and PACE® systems; management’s plans and objectives for future operations; industry trends; regulatory actions that could adversely affect the price of or demand for our approved products; our intellectual property portfolio; our business, marketing and manufacturing capacity and strategy; estimates regarding our capital requirements, the anticipated timing of the need for additional funds, and our expectations regarding future capital-raising transactions, including through investments by strategic partners for market opportunities, which may include strategic partnerships or licensing agreements, or raising capital through the conversion of outstanding warrants or issuances of securities; product liability claims; economic conditions that could adversely affect the level of demand for our products; timing of clinical studies and eventual U.S. Food and Drug Administration (“FDA”) approval of our products; financial markets; the competitive environment; supplier and customer disputes; and our plans to remediate our material weaknesses in our disclosure controls and procedures and our internal control over financial reporting. These forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof and include the assumptions that underlie such statements. Forward-looking statements may contain words such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” and “continue,” the negative of these terms, or other comparable terminology.

Any or all of our forward-looking statements in this prospectus may turn out to be inaccurate. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. They may be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including the risks, uncertainties and assumptions described in the section titled “Risk Factors” in this prospectus or any prospectus supplement, and under a similar heading in any other annual, periodic or current report we file with the SEC. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur as contemplated, and actual results could differ materially from those anticipated or implied by the forward-looking statements.

You should read this prospectus, the registration statement of which this prospectus is a part, any prospectus supplement or any free writing prospectus and the information incorporated by reference herein and therein completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this prospectus by these cautionary statements.

You should not unduly rely on these forward-looking statements, which speak only as of the date of this prospectus. Unless required by law, we undertake no obligation to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise. You should read carefully the factors described in the “Risk Factors” section of this prospectus or any prospectus supplement, and under a similar heading in any other annual, periodic or current report we file with the SEC, to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements.

TABLE OF CONTENTS

This summary highlights selected information contained in greater detail elsewhere in this prospectus. This summary may not contain all of the information that you should consider before investing in our Common Stock. You should carefully read the entire prospectus, any prospectus supplement or any free writing prospectus, and the information incorporated by reference herein and therin before making an investment decision.

Except as otherwise indicated by the context, references in this prospectus to “we,” “us,” “our” and the “Company” are to the consolidated business of SANUWAVE Health, Inc.

Our Company

We are an ultrasound and shock wave technology company using patented systems of noninvasive, high-energy, acoustic shock waves or low intensity and non-contact ultrasound for regenerative medicine and other applications. Our focus is regenerative medicine utilizing noninvasive, acoustic shock waves or ultrasound to produce a biological response resulting in the body healing itself through the repair and regeneration of tissue, musculoskeletal, and vascular structures. Our two primary systems are UltraMIST® and PACE®. UltraMIST and PACE are the only two FDA approved directed energy systems for wound healing.

The UltraMIST system provides, through a fluid mist, a low-frequency, non-contact, and pain free ultrasound energy deep inside the wound bed that promotes healing from within. The ultrasound acoustic waves promote healing by reducing inflammation and bacteria in the wound bed, while also increasing the growth of new blood vessels to the area. The UltraMIST system treatment must be administered by a healthcare professional. This proprietary technology has been cleared by the FDA for the promotion of wound healing through wound cleansing and maintenance debridement combined with ultrasound energy deposited inside the wound that stimulates tissue regeneration.

The PACE systems use acoustic waves generated by the Company’s Pulsed Acoustic Cellular Expression (PACE) technology to converge at precise selected targets to produce an extremely short duration compression burst. The precise targeting of tissue with PACE® technology provides healthcare professionals with a tool to positively influence cellular form and function, which can result in pain relief, improved circulation, and tissue regeneration. The PACE® system treatment must be administered by a healthcare professional. The Company sells three PACE systems including:

• | dermaPACE®: Used to treat Diabetic Foot Ulcers and other chronic wounds |

• | orthoPACE®: Used to treat acute musculoskeletal conditions |

• | Profile: Used to provide therapeutic treatment of musculoskeletal conditions |

Our portfolio of wound treatment solutions provides patients with a noninvasive technology that boosts the body’s normal healing and tissue regeneration processes. The Company is marketing its UltraMIST and PACE systems for usage primarily in the United States.

Regarding the non-contact and non-thermal low frequency ultrasound UltraMIST system, the Company is focused on the following:

• | Growth and expansion of sales across the United States |

• | Improvement of the functionality and ease-of-use for both medical personnel and patients |

• | Find antibacterial and anti-biofilm solutions to replace the saline solution used to produce the mist used by this system to conduct the ultrasound toward its target, which the Company believes would make the system more effective in treating bacterial infections associated with skin conditions |

• | Design new applicators capable of treating large skin conditions, for improved efficiency in such cases. |

The Company is focused on further developing our PACE proprietary technology to activate healing in:

• | Acute and chronic wound conditions, including diabetic foot ulcers, venous and arterial ulcers, pressure sores, burns and other skin eruption conditions; |

TABLE OF CONTENTS

• | Orthopedic applications, such as eliminating chronic pain in joints from trauma, arthritis or tendons/ligaments inflammation or tendinopathies, speeding the healing of fractures (including nonunion or delayed-union conditions), improving bone density in osteoporosis, fusing bones in the extremities and spine, and other potential sports injury applications; |

• | Plastic/cosmetic applications such as cellulite smoothing, graft and transplant acceptance, skin tightening, scarring and other potential aesthetic uses; and |

• | Cardiovascular applications for removing plaque due to atherosclerosis, eliminating occlusions and blood clots, and improving heart muscle and cardiac valves performance. |

In addition to healthcare uses, our high-energy, acoustic pressure shock waves, due to their powerful pressure gradients and localized cavitational effects, may have applications in secondary and tertiary oil exploitation, for cleaning industrial waters and food liquids, unclogging pipes and filtration systems, and finally for maintenance of industrial installations and underwater structures by disrupting biofilms formation and eliminating fouling. The Company intends to pursue these opportunities through licensing and/or partnership opportunities.

Corporate Information

We were incorporated in the State of Nevada on May 6, 2004, under the name Rub Music Enterprises, Inc. (“RME”). SANUWAVE, Inc. was incorporated in the State of Delaware on July 21, 2005. In December 2006, Rub Music Enterprises, Inc. ceased operations and became a shell corporation.

On September 25, 2009, RME and RME Delaware Merger Sub, Inc., a Nevada corporation and wholly-owned subsidiary of RME (the “Merger Sub”), entered into a reverse merger agreement with SANUWAVE, Inc. Pursuant to the merger agreement, the Merger Sub merged with and into SANUWAVE, Inc., with SANUWAVE, Inc., as the surviving entity and a wholly-owned subsidiary of the Company.

In November 2009, we changed our name to SANUWAVE Health, Inc. Our principal executive offices are located at 11495 Valley View Road, Eden Prairie, Minnesota 55344, and our telephone number is (770) 419-7525. Our website address is www.sanuwave.com. The information on our website is not a part of this prospectus.

TABLE OF CONTENTS

Total Common stock being offered by the selling stockholders

96,687,519 shares of Common Stock consisting of (1) 30,694,450 shares of Common Stock issuable upon the exercise of the First Warrants, (2) 30,694,450 shares of Common Stock issuable upon the exercise of the Second Warrants, and (3) 35,298,619 shares of Common Stock issuable upon the conversion of the Notes.

Use of Proceeds

All net proceeds from the sale of the shares of Common Stock covered by this prospectus will go to the selling stockholders. We will receive none of the proceeds from the sale of the shares of Common Stock covered by this prospectus by the selling stockholders. We may receive proceeds upon the exercise of outstanding Warrants for shares of Common Stock covered by this prospectus if the Warrants are exercised for cash. See “Use of Proceeds.”

Risk Factors

See “Risk Factors” in this prospectus, any prospectus supplement and the information incorporated by reference herein and therein for a discussion of factors you should carefully consider before deciding to invest in our Common Stock.

Ticker Symbol for Common Stock

“SNWV”

TABLE OF CONTENTS

Investing in our Common Stock involves a high degree of risk. We urge you to carefully consider all of the information contained in or incorporated by reference in this prospectus, any prospectus supplement or any free writing prospectus, including the risk factors under the heading “Risk Factors” in this prospectus and any prospectus supplement, and under a similar heading in any other annual, periodic or current report we file with the SEC. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. The discussion of risks includes or refers to forward-looking statements; you should read the explanation of the qualifications and limitations on such forward-looking statements discussed elsewhere in this prospectus.

Risks Related to the Common Stock Offered by the Selling Stockholders

If the selling stockholders sell significant amounts of our Common Stock, or the perception exists that these sales could occur, such events could cause the price of our Common Stock to decline.

This prospectus covers the resale from time to time by the selling stockholders of up to 96,687,519 shares of our Common Stock. Once the registration statement of which this prospectus is a part is declared effective, shares of Common Stock issued upon the exercise of Warrants or the conversion of Notes will be available for resale in the public market. If the selling stockholders sell significant amounts of our Common Stock following the effectiveness of the registration statement of which this prospectus is a part, the market price of our Common Stock could decline. Further, the perception of these sales could impair our ability to raise additional capital through the sale of our equity securities.

None of the proceeds from the sale of our Common Stock by the selling stockholders in this offering will be available to us.

We will not receive any proceeds from the sale of our Common Stock by the selling stockholders in this offering. The selling stockholders will receive all proceeds from the sale of such shares. Consequently, none of the proceeds from such sale by the selling stockholders will be available to us for our use. See “Use of Proceeds.”

TABLE OF CONTENTS

All net proceeds from the sale of the shares of Common Stock covered by this prospectus will go to the selling stockholders. We will receive none of the proceeds from the sale of the shares of Common Stock covered by this prospectus by the selling stockholders. We may receive proceeds upon the exercise of outstanding Warrants for shares of Common Stock covered by this prospectus if the Warrants are exercised for cash. If all of such Warrants are exercised for cash in full at their current exercise prices, the proceeds would be approximately $3.3 million. We intend to use the net proceeds of such Warrant exercises, if any, for working capital purposes. We can make no assurances that any of the Warrants will be exercised, or if exercised, that they will be exercised for cash, the quantity which will be exercised or the period in which they will be exercised.

TABLE OF CONTENTS

The shares being sold pursuant to this prospectus were sold by the Company to the selling stockholders as described below.

May 2023 Securities Purchase Agreement, Notes and Warrants

On May 9, 2023, we entered into a Securities Purchase Agreement (the “Purchase Agreement”), with the purchasers identified on the signature pages thereto (the “Purchasers”) for our sale in a private placement (the “Private Placement”) of (i) the Notes in an aggregate principal amount of approximately $1.2 million, (ii) First Warrants to purchase an additional approximately 30.7 million shares of Common Stock with an exercise price of $0.067 per share and (iii) Second Warrants to purchase an additional approximately 30.7 million shares of Common Stock with an exercise price of $0.04 per share. The exercise price of the Warrants is subject to adjustment, including if we issue or sell shares of Common Stock or Share Equivalents (as defined in the Warrants) for an effective consideration price less than the exercise price of the Warrants or if we list our shares of Common Stock on The Nasdaq Capital Market and the average volume weighted average price of such Common Stock for the five trading days preceding such listing is less than $0.04 per share; provided, however, that the exercise price of the Warrants shall never be less than $0.01 per share. The Warrants have a five-year term. The closing of the Private Placement occurred on May 9, 2023 (the “Closing Date”). At the Closing Date, we received total proceeds of approximately $1.2 million.

The securities in the Private Placement were offered and sold in a transaction exempt from registration under the Securities Act in reliance on Section 4(a)(2) thereof. Each Purchaser represented that it was an accredited investor.

Notes

As described above, on May 9, 2023, we issued Notes to the Purchasers in an aggregate principal amount of approximately $1.2 million. Pursuant to the Notes, we promised to pay each Purchaser in cash and/or in shares of Common Stock, at a conversion price of $0.04 (the “Conversion Price”), the principal amount (subject to reduction pursuant to the terms of the Note, the “Principal”) as may be advanced in disbursements (each, a “Disbursement” and together, the “Disbursements” with total principal of outstanding Disbursements equaling Principal), and to pay interest at a rate of fifteen percent (15%) per annum (“Interest”) on any outstanding Principal at the applicable Interest rate from the date of the Notes until the Notes are accelerated, converted, redeemed or otherwise. The Conversion Price of the Notes is subject to adjustment, including if we issue or sell shares of Common Stock for a price per share less than the Conversion Price of the Notes or if we list our shares of Common Stock on The Nasdaq Capital Market and the average volume weighted average price of such Common Stock for the five trading days preceding such listing is less than $0.04 per share; provided, however, that the Conversion Price shall never be less than $0.01.

In connection with the Private Placement, on May 9, 2023, we entered into a security agreement in favor of each Purchaser to secure our obligations under the Notes (the “Security Agreement”).

The rights of each Purchaser to receive payments under its Notes are subordinate to the rights of NH Expansion Credit Fund Holdings LP (“North Haven Expansion”) pursuant to a subordination agreement, which we and the Purchasers entered into with North Haven Expansion on May 9, 2023, in connection with the Private Placement (the “Subordination Agreement”).

Registration Rights Agreement

In connection with the Purchase Agreement, we also entered into a registration rights agreement with the Purchasers on May 9, 2023 (the “Registration Rights Agreement”), pursuant to which we agreed to file a registration statement (the “Registration Statement”) with the SEC no later than sixty (60) days following the Closing Date to register the resale of the number of shares of Common Stock issuable upon conversion of the Notes and exercise of the Warrants issued pursuant to such Purchase Agreement (the “Registrable Securities”) and to cause the Registration Statement to become effective within one-hundred eighty (180) days following the Closing Date. We shall use our best efforts to keep the Registration Statement continuously effective under the Securities Act, until all Registrable Securities have been sold, or may be sold without the requirement to be in compliance with Rule 144(c)(1) of the Securities Act and otherwise without restriction or limitation pursuant to Rule 144 of the Securities Act, as determined by our counsel.

TABLE OF CONTENTS

Material Relationships with Selling Stockholders

The selling stockholders include Manchester Explorer, L.P., an affiliate of the Company, and director Ian Miller.

Morgan Frank, our interim Chief Executive Officer and Chairman of our board of directors, has been a principal at the life sciences focused investment fund Manchester Management since 2003 and a director of Manchester Explorer Cayman Ltd since 2013, each of which are affiliates of Manchester Explorer, L.P., a selling stockholder.

Other than as described above, none of the selling stockholders has had any material relationship with us or any of our predecessors or affiliates within the past three years.

Selling Stockholder Table

The table set forth below lists the selling stockholders and other information regarding the beneficial ownership (as determined under Section 13(d) of the Exchange Act, and the rules and regulations thereunder) of the shares of Common Stock held by each of the selling stockholders as of June 27, 2023. The Notes and the Warrants are subject to certain beneficial ownership limitations, which provide that a holder of such securities will not have the right to exercise any portion thereof if such holder, together with its affiliates and any other persons acting as a group together, would beneficially own in excess of 4.99% or 9.99%, as applicable, of the number of shares of Common Stock outstanding immediately after giving effect to such exercise, provided that such holder may increase or decrease such limitation up to a maximum of 9.99% of the number of shares of Common Stock outstanding. In the case of the Warrants, such limitation may only be increased or decreased upon at least 61 days’ prior notice to us.

Unless otherwise indicated, we believe, based on information supplied by the following persons, that the persons named in the table below have sole voting and investment power with respect to all shares of Common Stock that they beneficially own. The registration of the offered shares does not mean that any or all of the selling stockholders will offer or sell any of the shares of Common Stock.

Berkeley Greenwood | | | 2,362,500 | | | 2,362,500 | | | — | | | * |

Blackwell Partners LLC - Series A(1) | | | 198,583,797 | | | 8,131,568 | | | 190,452,229 | | | 4.99% |

Christopher Davis | | | 76,562,500 | | | 11,812,500 | | | 64,750,000 | | | 4.99% |

Clive Caunter | | | 3,937,500 | | | 3,937,500 | | | — | | | * |

Dirk Horn | | | 7,875,000 | | | 7,875,000 | | | — | | | * |

Ian Miller | | | 18,543,564 | | | 3,937,500 | | | 14,606,064 | | | 2.54% |

Londer Securities SA(2) | | | 23,625,000 | | | 23,625,000 | | | — | | | * |

Manchester Explorer, L.P.(3) | | | 262,642,840 | | | 23,625,000 | | | 239,017,840 | | | 4.99% |

Robert Gambi | | | 9,843,750 | | | 9,843,750 | | | — | | | * |

Solas Capital Partners II, LP(4) | | | 31,064,513 | | | 1,357,887 | | | 29,706,626 | | | 4.99% |

Solas Capital Partners, LP(4) | | | 16,270,459 | | | 179,314 | | | 16,091,145 | | | 2.78% |

*

| Represents less than 1% of our outstanding common stock. |

(1)

| Tucker Golden is the Managing Member of Solas Capital Management, LLC, an Investment Advisor to Blackwell Partners LLC – Series A, with sole voting and investment discretion with respect to the shares. |

(2)

| Leonardo Zampatti is the director of Londer Securities SA. |

(3)

| James Besser is the Managing Member of Manchester Explorer, L.P. Morgan Frank, our interim Chief Executive Officer and Chairman of our board of directors, has been a principal at the life sciences focused investment fund Manchester Management since 2003 and a director of Manchester Explorer Cayman Ltd since 2013, each of which are affiliates of Manchester Explorer, L.P. |

(4)

| Tucker Golden is the Managing Member of the General Partnership of each of Solas Capital Partners, LP and Solas Capital Partners II, LP. |

TABLE OF CONTENTS

Offering of Shares by Selling Stockholders Upon Exercise of Warrants and Conversion of Notes

We are registering the resale of shares of Common Stock issuable to the selling stockholders from time to time after the date of this prospectus upon the exercise of Warrants or conversion of Notes. See “Selling Stockholders” for additional information. We will not receive any proceeds from the resale of shares of Common Stock by selling stockholders in this offering. We may receive proceeds upon the exercise of outstanding Warrants for shares of Common Stock covered by this prospectus if the Warrants are exercised for cash. See “Use of Proceeds.”

The selling stockholders may sell all or a portion of the shares of Common Stock held by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of Common Stock are sold through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of Common Stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

• | on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

• | in the over-the-counter market; |

• | in transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

• | through the writing or settlement of options, whether such options are listed on an options exchange or otherwise; |

• | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

• | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

• | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

• | an exchange distribution in accordance with the rules of the applicable exchange; |

• | privately negotiated transactions; |

• | short sales made after the date the registration statement of which this prospectus forms a part is declared effective by the SEC; |

• | broker-dealers may agree with a selling stockholder to sell a specified number of such shares at a stipulated price per share; |

• | a combination of any such methods of sale; and |

• | any other method permitted pursuant to applicable law. |

The selling stockholders may also sell shares of Common Stock under Rule 144 promulgated under the Securities Act, if available, rather than under this prospectus. In addition, the selling stockholders may transfer the shares of Common Stock by other means not described in this prospectus. If the selling stockholders effect such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the shares of Common Stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of Common Stock or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of Common Stock in the course of hedging in positions they assume. The selling stockholders may also sell shares of Common Stock short and deliver shares of Common Stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders may also loan or pledge shares of Common Stock to broker-dealers that in turn may sell such shares.

TABLE OF CONTENTS

The selling stockholders may pledge or grant a security interest in some or all of the shares of Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provisions of the Securities Act amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer and donate the shares of Common Stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

To the extent required by the Securities Act and the rules and regulations thereunder, the selling stockholders and any broker-dealer participating in the distribution of the shares of Common Stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed, to any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of Common Stock is made, a prospectus supplement, if required, will be distributed, which will set forth the aggregate amount of shares of Common Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the shares of Common Stock in violation of any applicable securities laws.

Under the securities laws of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any selling stockholder will sell any or all of the shares of Common Stock registered pursuant to the registration statement, of which this prospectus forms a part.

The selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of Common Stock by the selling stockholders and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the shares of Common Stock to engage in market-making activities with respect to the shares of Common Stock. All of the foregoing may affect the marketability of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common Stock.

Once sold under the registration statement, of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our affiliates.

TABLE OF CONTENTS

DESCRIPTION OF SECURITIES TO BE REGISTERED

Common Stock

The following description of our Common Stock, together with the additional information we include in any applicable prospectus supplements, summarizes the material terms and provisions of our Common Stock that the selling stockholders may offer under this prospectus. It may not contain all the information that is important to you. For the complete terms of our Common Stock, please refer to our Articles of Incorporation, as amended (the “Articles of Incorporation”), and our Bylaws (the “Bylaws”), which are incorporated by reference into the registration statement which includes this prospectus. The Nevada Revised Statutes (the “NRS”) may also affect the terms of our Common Stock. If we so indicate in a prospectus supplement, the terms of any security offered under that prospectus supplement may differ from the terms we describe below.

Our Articles of Incorporation provide for one class of Common Stock. In addition, our Articles of Incorporation authorize shares of undesignated preferred stock, the rights, preferences and privileges of which may be designated from time to time by our board of directors.

Our authorized capital stock consists of 2,505,000,000 shares, all with a par value of $0.001 per share, of which:

• | 2,500,000,000 shares are designated as Common Stock; and |

• | 5,000,000 shares are designated as preferred stock. |

As of March 31, 2023, we had 555,637,651 outstanding shares of Common Stock, held by 200 stockholders of record. As of March 31, 2023, there were (i) outstanding warrants (excluding the Warrants issued in May 2023) for the purchase of an aggregate of 1,208,213,019 shares of Common Stock with a weighted average exercise price of $0.08 per share, (ii) outstanding options for the purchase of an aggregate of 19,286,150 shares of Common Stock with a weighted average exercise price of $0.27 per share, and (iii) outstanding convertible promissory notes (excluding the Notes issued in May 2023) convertible into an aggregate of approximately 624,577,107 shares of Common Stock. In addition, as of March 31, 2023, 5,200,550 shares of our Common Stock were available for issuance pursuant to the Amended and Restated 2006 Stock Incentive Plan.

Voting Rights

Each holder of shares of our Common Stock is entitled to one vote per share on all matters submitted to a vote of our Common Stockholders. Cumulative voting in the election of directors is not allowed, which means that the holders of more than 50% of the outstanding shares can elect all the directors if they choose to do so and, in such event, the holders of the remaining shares will not be able to elect any directors. The affirmative vote of a plurality of the shares of Common Stock voted at a stockholders meeting where a quorum is present is required to elect directors and to take other corporate actions. Our Articles of Incorporation do not provide for a classified board of directors; all directors of the Company are elected annually.

Dividends

Subject to provisions of the NRS and to any future rights which may be granted to the holders of any series of our preferred stock, holders of our Common Stock are entitled to receive ratably such dividends, if any, as may be declared by our board of directors out of legally available funds. However, the current policy of our board of directors is to retain earnings, if any, for the operation and expansion of the Company.

Liquidation Rights

Upon liquidation, dissolution or winding-up, the holders of our Common Stock are entitled to share ratably in all of our assets which are legally available for distribution, after payment of or provision for all liabilities and the liquidation preference of any outstanding preferred stock.

Other Rights

The holders of our Common Stock do not have any preemptive, conversion or redemption rights by virtue of their ownership of our Common Stock.

TABLE OF CONTENTS

Warrants

The following is a brief summary of material provisions of the Warrants related to the shares of Common Stock offered for resale and issuable upon the exercise of the Warrants.

Exercise Price and Terms

Each Warrant entitles the holder thereof to purchase beginning at such time as our authorized and unissued shares of Common Stock are at a number sufficient to permit the exercise or conversion of all outstanding securities exercisable for, or convertible into, Common Stock and until such Warrant’s expiration date shares of our Common Stock at a price of $0.067 per share for the First Warrants or $0.04 per share for the Second Warrants, subject to certain adjustments referred to below. The Warrants expire on May 9, 2028. Each Warrant may be exercised at any time in whole or in part at the applicable exercise price until expiration of the Warrant. No fractional shares will be issued upon the exercise of the Warrants.

Adjustments

The exercise price and the number of shares of Common Stock purchasable upon the exercise of the Warrants are subject to adjustment upon the occurrence of certain events, including stock dividends, stock splits, combinations or reclassifications of the Common Stock. Additionally, an adjustment would be made in the case of a reclassification or exchange of Common Stock, consolidation or merger of our Company with or into another corporation (other than a consolidation or merger in which we are the surviving corporation) or sale of all or substantially all of our assets in order to enable holders of the Warrants to acquire the kind and number of shares of stock or other securities or property receivable in such event by a holder of the number of shares of Common Stock that might otherwise have been purchased upon the exercise of the Warrant. No adjustment to the number of shares and exercise price of the shares subject to the Warrants will be made for dividends (other than stock dividends), if any, paid on our Common Stock.

The exercise price of the Warrants is also subject to adjustment if we issue or sell shares of Common Stock or Share Equivalents (as defined in the Warrants) for an effective consideration price less than the exercise price of the Warrants or if the Company lists its shares of Common Stock on The Nasdaq Capital Market and the average volume weighted average price of such Common Stock for the five trading days preceding such listing is less than $0.04 per share; provided, however, that the exercise price of the Warrants shall never be less than $0.01 per share.

Transfer, Exchange and Exercise

The Warrants may be presented to us for exchange or exercise at any time on or prior to their expiration date, at which time the Warrants become wholly void and of no value. The Warrants are transferable, in whole or in part, upon surrender of the Warrants at the principal office of the Company or its designated agent, together with a written assignment.

Warrantholder Not a Stockholder

The Warrants do not confer upon holders any voting, dividend or other rights as stockholders of our Company.

Notes

The following is a brief summary of material provisions of the Notes related to the shares of Common Stock offered for resale and issuable upon the conversion of the Notes. The Notes contain customary events of default and covenants, including limitations on incurrences of indebtedness and liens.

Interest Rate and Conversion Price

We promised to pay each holder in cash and/or in shares of Common Stock, at a Conversion Price of $0.04, the Principal as may be advanced in Disbursements, and to pay Interest at a rate of 15% per annum on any outstanding Principal at the applicable Interest rate from the date of the Notes until the Notes are accelerated, converted, redeemed or otherwise.

TABLE OF CONTENTS

Maturity

The Notes mature on May 9, 2024, at which time all Principal and accrued and unpaid Interest shall be payable in cash, shares of our Common Stock or a combination thereof at the holder’s discretion.

Conversion

At such time as our authorized and unissued shares of Common Stock are at a number sufficient to permit the exercise or conversion of all outstanding securities exercisable for, or convertible into, Common Stock, any holder may convert any portion of the outstanding Principal and accrued and unpaid Interest into shares of our Common Stock at the then effective Conversion Price. If we list our shares of Common Stock on The Nasdaq Capital Market, then, upon the approval of the board of directors, all Principal and accrued and unpaid Interest under this Note shall automatically convert into Common Stock at the then effective Conversion Price.

Redemptions

At our option and upon 30 days’ notice to the holder, the Notes may be redeemed at any time at an amount equal to 125% of the outstanding Principal and accrued and unpaid Interest.

At any time after a holder becomes aware of an Event of Default (as defined in the Notes), the holder may require us to redeem all or any portion of its Note by delivering written notice to us. Each portion of the Note subject to redemption shall be redeemed in cash at a price equal to Principal plus accrued and unpaid Interest calculated from the Event of Default at the default interest rate of 20% per annum (the “Event of Default Redemption Price”). In addition, we are obligated to pay aggregate liquidated damages of $250,000 pro-rata to the holders of the Notes, plus an amount in cash equal to 1% of the Event of Default Redemption Price for each 30-day period during which redemptions fail to be made, with a cap at 5%.

Adjustments

The Conversion Price of the Notes is subject to adjustment, including if we issue or sell shares of Common Stock for a price per share less than the Conversion Price of the Notes or if we list our shares of Common Stock on The Nasdaq Capital Market and the average volume weighted average price of such Common Stock for the five trading days preceding such listing is less than $0.04 per share; provided, however, that the Conversion Price shall never by less than $0.01.

Security and Subordination

In connection with the issuance of the Notes, on May 9, 2023 we entered into a security agreement in favor of each Purchaser to secure our obligations under the Notes.

The rights of the holders of the Notes are subordinate to the rights of North Haven Expansion pursuant to a subordination agreement, which we and the Purchasers entered into with North Haven Expansion on May 9, 2023.

Noteholder Not a Stockholder

The Notes do not confer upon holders any voting, dividend or other rights as a stockholder of our Company.

Anti-Takeover Provisions

Provisions in our Articles of Incorporation and Bylaws may discourage certain types of transactions involving an actual or potential change of control of our Company which might be beneficial to us or our security holders. In addition, Section 78.438 of the Nevada Revised Statutes prohibits a Nevada corporation with 200 or more stockholders of record from engaging in a business combination with an interested stockholder (generally defined as a person which together with its affiliates owns, or within the last two years has owned, 10% of our voting stock) unless the business combination is approved in a prescribed manner. Further, Nevada law contains provisions governing “acquisition of controlling interest” in Sections 78.378 through 78.3793 of the Nevada Revised Statutes. This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to the acquired shares, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or in part. The Control Share Acquisition Act

TABLE OF CONTENTS

provides that a person or entity acquires “control shares” whenever it acquires shares that, but for the operation of the Control Share Acquisition Act, would bring its voting power within any of the following three ranges: 20 to 33-1/3%; 33-1/3% to 50%; or more than 50%. A “control share acquisition” is generally defined as the direct or indirect acquisition of either ownership or voting power associated with issued and outstanding control shares. The stockholders or board of directors of a corporation may elect to exempt the stock of the corporation from the provisions of the Control Share Acquisition Act through adoption of a provision to that effect in the articles of incorporation or bylaws of the corporation. Our Articles of Incorporation and Bylaws do not exempt our Common Stock from the Control Share Acquisition Act. The Control Share Acquisition Act is applicable only to shares of “Issuing Corporations” as defined by the Nevada law. An Issuing Corporation is a Nevada corporation which (i) has 200 or more stockholders, with at least 100 of such stockholders being both stockholders of record and residents of Nevada, and (ii) does business in Nevada directly or through an affiliated corporation. At this time, we do not believe we have 100 stockholders of record that are residents of Nevada and we do not conduct business in Nevada directly. Therefore, the provisions of the Control Share Acquisition Act are believed not to apply to acquisition of our shares and will not until such time as these requirements have been met. At such time as they may apply, the provisions of the Control Share Acquisition Act may discourage companies or persons interested in acquiring a significant interest in or control of us, regardless of whether such acquisition may be in the interest of our stockholders. The existence of the foregoing provisions and other potential anti-takeover measures could limit the price that investors might be willing to pay in the future for shares of our Common Stock. They could also deter potential acquirers of our Company, thereby reducing the likelihood that you could receive a premium for your Common Stock in an acquisition.

As noted above, our Articles of Incorporation permit our board of directors to issue shares of any class or series of preferred stock in the future without stockholder approval and upon such terms as our board of directors may determine. The rights of the holders of Common Stock will be subject to, and may be adversely affected by, the rights of the holders of any class or series of preferred stock that may be issued in the future.

Our Bylaws generally provide that any board vacancy, including a vacancy resulting from an increase in the authorized number of directors, may be filled by a majority of the directors, even if less than a quorum.

Additionally, our Bylaws provide that stockholders must provide timely notice in writing to bring business before an annual meeting of stockholders or to nominate candidates for election as directors at an annual meeting of stockholders. Notice for an annual meeting is timely if our Secretary receives the written notice not less than 50 days nor more than 75 days prior to the meeting; provided, however, that in the event less than 60 days notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the close of business on the tenth day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made. Our Bylaws also specify the form and content of a stockholder’s notice. These provisions may prevent stockholders from bringing matters before an annual meeting of stockholders or from making nominations for directors at an annual meeting of stockholders.

Trading Information

Our Common Stock is currently quoted on the OTCQB market under the symbol “SNWV.”

Transfer Agent

The transfer agent and registrar for our Common Stock and preferred stock is Securities Transfer Corporation, 2901 N. Dallas Parkway, Suite 380, Plano, Texas 75093.

TABLE OF CONTENTS

Certain legal matters will be passed upon for us by Hutchison & Steffen, PLLC, Las Vegas, Nevada.

The consolidated financial statements as of December 31, 2022 and December 31, 2021 and for the years then ended incorporated by reference in this prospectus and in the registration statement have been so incorporated in reliance on the report of Marcum LLP, an independent registered public accounting firm, (the report on the financial statements contains an explanatory paragraph regarding the Company’s ability to continue as a going concern) appearing in our annual report on Form 10-K for the year ended December 31, 2022, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-1 with the SEC to register the resale of shares of our Common Stock being offered by this prospectus. For further information with respect to us and our Common Stock, please see the registration statement on Form S-1 and the exhibits thereto. In addition, we file annual, quarterly and current reports, proxy and information statements with the SEC. The SEC maintains a website, https://www.sec.gov, that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. Our SEC filings are also available to the public on our website, www.sanuwave.com. Information contained on our website should not be considered part of, or incorporated by reference into, this prospectus.

TABLE OF CONTENTS

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows “incorporation by reference” into this prospectus of information that we file with the SEC. This permits us to disclose important information to you by referencing these filed documents. Any information referenced this way is considered to be a part of this prospectus and any information filed by us with the SEC subsequent to the date of this prospectus automatically will be deemed to update and supersede this information. We incorporate by reference the following documents which we have filed with the SEC (excluding any documents or portions of such documents that have been “furnished” but not “filed” for purposes of the Exchange Act):

• | Our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 31, 2023; |

• | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, as filed with the SEC on May 11, 2023; |

• | Description of our Common Stock contained in our Registration Statement on Form 10-SB, as filed with the SEC on December 18, 2007, as updated by Exhibit 4.22 to the Company’s Form 10-K for the year ended December 31, 2022, and any and all amendments or reports filed for the purpose of updating such description. |

We incorporate by reference all documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus and prior to the termination of the offering, with the exception of any information furnished under Item 2.02 and Item 7.01 (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01) of Form 8-K, which is not deemed filed and which is not incorporated by reference herein. Any such filings shall be deemed to be incorporated by reference and to be a part of this prospectus from the respective dates of filing of those documents.

This prospectus is part of a registration statement and does not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this prospectus, any prospectus supplement or any free writing prospectus about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement at the SEC’s website, as provided above.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide to any person, including any beneficial owner, to whom a prospectus is delivered, at no cost, upon written or oral request, a copy of any or all of the reports or documents that have been incorporated by reference in the prospectus contained in the registration statement but not delivered with the prospectus. You should direct requests for documents to:

SANUWAVE Health, Inc.

11495 Valley View Road

Eden Prairie, Minnesota 55344

Attn: Toni Rinow, Chief Financial Officer

Telephone: (770) 419-7525

You should rely only on the information incorporated by reference or presented in this prospectus, any prospectus supplement or any free writing prospectus. We have not authorized anyone else to provide you with different information. The selling stockholders are not making an offer of these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this prospectus, any prospectus supplement or any free writing prospectus is accurate as of any date other than the dates on those documents.

TABLE OF CONTENTS

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 13.

| Other Expenses of Issuance and Distribution |

The following table lists the costs and expenses payable by the Company in connection with the sale of the Common Stock covered by this prospectus. All amounts shown are estimates except for the SEC registration fee.

SEC registration fee | | | $205 |

Legal fees and expenses | | | $25,000 |

Accounting fees and expenses | | | $10,000 |

Total | | | $35,205 |

ITEM 14.

| Indemnification of Directors and Officers |

The Nevada General Corporation Law (the “NGCL”) provides that a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer unless (i) such act or omission constituted a breach of his or her fiduciary duties as a director or officer, and (ii) his or her breach of those duties involved intentional misconduct, fraud or a knowing violation of law. Under the NGCL, a corporation may indemnify directors and officers, as well as other employees and individuals, against any threatened, pending or completed action, suit or proceeding, except an action by or in the right of the corporation, by reason of the fact that he or she is or was a director, officer, employee or agent of the corporation so long as such person acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent, does not, of itself, create a presumption that the person did not act in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, or that, with respect to any criminal action or proceeding, he or she had reasonable cause to believe that his or her conduct was unlawful.

The NGCL further provides that indemnification may not be made for any claim as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that, in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper. To the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding or in defense of any claim, issue or matter therein, the corporation must indemnify him or her against expenses, including attorney’s fees, actually and reasonably incurred in connection with the defense. The NGCL provides that this is not exclusive of other rights to which those seeking indemnification may be entitled under any bylaw, agreement, vote of stockholders, or disinterested directors or otherwise.

The Bylaws and contractual arrangements with certain of the Company’s directors and officers provide that the Company is required to indemnify its directors and officers to the fullest extent permitted by law. The Bylaws and these contractual arrangements also require the Company to advance expenses incurred by a director or officer in connection with the defense of any proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is not entitled to be indemnified by the Company. The Bylaws also permit the Company to purchase and maintain errors and omissions insurance on behalf of any director or officer for any liability arising out of his or her actions in a representative capacity. The Company does not presently maintain any such errors and omissions insurance for the benefit of its directors and officers.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities

TABLE OF CONTENTS

(other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by the Company is against public policy as expressed hereby in the Securities Act and the Company will be governed by the final adjudication of such issue.

ITEM 15.

| Recent Sales of Unregistered Securities |

In connection with each of the following unregistered sales and issuances of securities, except as otherwise provided below, the Company relied upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, for transactions not involving a public offering based in part upon the representations provided by the purchasers.

Stock Issued Upon Warrant Exercises for Cash

Subsequent to December 31, 2019, the Company issued 1,000,000 shares of Common Stock upon the exercise of 1,062,811 Class P Warrants, for cash consideration of $10,000,000, and 62,811 shares of Common Stock upon the exercise of Series A Warrants, for cash consideration of $2,097.88, under the terms of the respective warrant agreements.

On August 6, 2020, the Company issued 5,200,000 shares of Common Stock upon the exercise of 5,200,000 Class K Warrants to purchase shares of Common Stock for $0.08 per share under the terms of the Class K warrant agreement, for forgiveness of interest payable of $416,000.

On August 6, 2020, the Company issued 2,000,000 shares of Common Stock upon the exercise of 2,000,000 Class K Warrants to purchase shares of Common Stock for $0.11 per share under the terms of the Class K warrant agreement, for forgiveness of interest payable of $220,000.

Consulting and Endorsement Arrangements

From September 2020 through May 1, 2023, the Company issued 1,000,000 shares of Common Stock to Customized Medical LLC, 300,000 shares of Common Stock to James Terwilliger, 100,000 shares of Common Stock to Jay Shah, 6,500,000 shares of Common Stock to the Howard Todd Horbert Trust UA 11-8-1994, 7,847,500 shares of Common Stock to Michael Nemelka, the brother of a former member of our board of directors, 5,000,000 shares of Common Stock to Millennium Park Capital LLC, and 3,000,000 shares of Common Stock to Encode LLC in exchange for certain consulting services. On June 13, 2022, the Company issued 1,000,000 shares of Common Stock to Deontay Wilder and 250,000 shares of Common Stock to Kenneth E. Lippe in connection with an endorsement.

Conversion of Liabilities

Subsequent to December 31, 2019, the Company issued 1,496,989 shares of Common Stock upon the exercise of 416,667 Class L Warrants, under the terms of the respective warrant agreements, and 1,080,322 upon the conversion of interest and bonus shares pursuant to the terms of the short term note payable. The other warrant exercise constituted the conversion of a short term note payable in the outstanding amount of $208,109 with the receipt of notices of Class L warrant exercises, all pursuant to the terms of the short term note payable.

Cashless Warrant Exercise, Exempt From Registration Pursuant to Securities Act Section 3(a)(9)

On February 3, 2021, the Company issued 10,925,000 shares of its Common Stock to LGH Investments, LLC (“LGH”) upon the cashless exercise of warrants to purchase 11,400,000 shares of Common Stock issued to LGH under the terms of the warrant agreement.

Employee Stock Option Grant

Subsequent to December 31, 2019, the Company granted to new employees options to purchase an aggregate of 100,000 shares of Common Stock at an exercise price of $0.026 per share, which options vested upon issuance.

TABLE OF CONTENTS

HealthTronics Warrants

On August 6, 2020, the Company entered into a letter agreement (the “HealthTronics Agreement”) with HealthTronics, Inc. (“HealthTronics”), pursuant to which the Company paid off all outstanding debt due and owed to HealthTronics. Pursuant to the HealthTronics Agreement, as consideration for the extinguishment of the debt due and owed to HealthTronics, (i) the Company paid to HealthTronics an amount in cash equal to $4,000,000, (ii) HealthTronics exercised all of its outstanding Class K Warrants to purchase 7,200,000 shares of Common Stock, (iii) the Company issued to HealthTronics a convertible promissory note in the principal amount of $1,372,743, and (iv) the Company and HealthTronics entered into a Securities Purchase Agreement dated August 6, 2020 pursuant to which the Company issued to HealthTronics an aggregate of 8,275,235 shares of Common Stock and a warrant to purchase up to an additional 8,275,235 shares of Common Stock (the “HealthTronics Warrant”). The HealthTronics Warrant has an exercise price of $0.25 per share and a three-year term.

August 2020 Transactions

On August 6, 2020, the Company entered into a Securities Purchase Agreement (the “2020 Purchase Agreement”) with certain accredited investors for the sale by the Company in a private placement (the “2020 Private Placement”) of an aggregate of 123,550,000 shares of Common Stock and accompanying Class E Warrants to purchase up to an additional 123,550,000 shares of Common Stock (the “2020 Private Placement Warrants”), at a purchase price of $0.20 per 2020 Private Placement Share and accompanying 2020 Private Placement Warrant. The 2020 Private Placement Warrants have an exercise price of $0.25 per share and a three-year term. The exercise price of the 2020 Private Placement Warrants is subject to adjustment, including if the Company lists its shares of Common Stock on The Nasdaq Capital Market and the exercise price of the 2020 Private Placement Warrants exceeds the Post-Listing Threshold Price (as defined in the 2020 Private Placement Warrants) for the five trading days preceding such listing. The closing of the 2020 Private Placement occurred on August 6, 2020. The Company has granted the purchasers indemnification rights with respect to its representations, warranties, covenants and agreements under the 2020 Purchase Agreement. We received $24,710,000 in cash proceeds in connection with the sale of securities to the selling stockholders. In connection with the 2020 Private Placement, H.C. Wainwright & Co., LLC, as exclusive placement agent for the 2020 Private Placement, received warrants to purchase up to 9,266,250 shares of Common Stock on the same terms as the 2020 Private Placement Warrants, a cash fee and certain expenses.

On August 6, 2020, the Company issued a promissory note to Celularity Inc. (“Celularity”) in the principal amount of $4,000,000 in connection with the asset purchase agreement with Celularity. The note has a maturity date of August 6, 2021 and accrues interest at a rate equal to 12.0% per annum. As the note was not repaid prior to January 1, 2021, Celularity may elect to convert the outstanding principal amount plus any accrued but unpaid interest thereon into shares of Common Stock at a conversion price of $0.10 per share.

On August 6, 2020, the Company entered into a Note and Warrant Purchase and Security Agreement (the “NWPSA”), with the noteholder party thereto and North Haven Expansion, as agent. The NWPSA provides for (i) the sale and purchase of secured notes (the “NH Notes”) in an aggregate original principal amount of $15,000,000 and (ii) the issuance of warrants equal to 2.0% of the fully-diluted Common Stock of the Company as of the issue date (the “NH Warrant”). The NH Warrant has an exercise price of $0.01 per share and a 10-year term. The principal amount outstanding on the NH Notes shall accrue interest at a per annum rate equal to the sum of (A) the greater of (x) the Prime Rate (as defined in the NWPSA) in effect as of each interest payment date, and (y) 3.00%, plus (B) 9.00%. All unpaid principal and accrued interest are due and payable in full on September 30, 2025. In addition to the foregoing interest amounts, interest at a per annum rate equal to 3.00% shall be paid in kind. The Notes are secured by substantially all of the assets of the Company, SANUWAVE, Inc. and their respective domestic subsidiary guarantors.

On August 6, 2020, the Company terminated that certain line of credit agreement with A. Michael Stolarski, a member of the Company’s board of directors, dated December 29, 2017 and as amended November 12, 2018, in the amount of $1,000,000 (the “Stolarski Line of Credit”). As consideration for the termination of the Stolarski Line of Credit, the Company issued to A. Michael Stolarski a convertible promissory note in the principal amount of $223,511 (the “Stolarski Note”). The Stolarski Note has a maturity date of August 6, 2021 and accrues interest at a rate equal to 12.0% per annum. As the Stolarski Note was not repaid prior to January 1, 2021, the holder may elect to convert the outstanding principal amount plus any accrued but unpaid interest thereon into shares of Common Stock at a conversion price of $0.10 per share.

TABLE OF CONTENTS

April 2021 Securities Purchase Agreement and Warrants

On April 20, 2021, the Company entered into a Securities Purchase Agreement (the “Leviston Purchase Agreement”) with Leviston Resources LLC (“Leviston”) for the sale by the Company in a private placement (the “Leviston Private Placement”) of (i) the Company’s future advance convertible promissory note in an aggregate principal amount of up to $3,402,000 (the “Leviston Note”) and (ii) a warrant to purchase an additional 16,666,667 shares of Common Stock (the “Leviston Warrant”). The Leviston Warrant has an exercise price of $0.18 per share and a four-year term. The closing of the Leviston Private Placement occurred on April 20, 2021.

As noted above, on April 20, 2021, the Company issued the Leviston Note to Leviston in an aggregate principal amount of up to $3,402,000 (the “Aggregate Amount”), which was to be advanced in disbursements by Leviston, as set forth in the Leviston Note. On May 14, 2021, the Leviston Note was amended to increase the Aggregate Amount to $4,217,217. On April 21, 2021, Leviston advanced a disbursement of $750,000, which is net of an original issue discount of 8%. On May 14, 2021, Leviston advanced a second disbursement of $750,000, also net of an original issue discount of 8%. A $250,000 disbursement was made on September 3, 2021, which was subject to the same terms and conditions as the April and May disbursements. In addition, a $500,000 disbursement was made on September 3, 2021 in accordance with notes issued to LGH, Quick Capital, LLC (“Quick Capital”), Jeffrey Benton, Karl W. Brewer and the David S. Nagelberg 2003 Revocable Trust (the “Nagelberg Trust”), which were subject to substantially the same terms and conditions as Leviston’s disbursement. In connection with this disbursement, each of LGH and Quick Capital received a future advance convertible promissory note in an aggregate principal amount of up to $108,000 and a warrant to purchase 555,556 shares of Common Stock, Mr. Benton received a future advance convertible promissory note in an aggregate principal amount of up to $50,000 and a warrant to purchase 277,778 shares of Common Stock, Mr. Brewer received a future advance convertible promissory note in an aggregate principal amount of up to $150,000 and a warrant to purchase 833,333 shares of Common Stock, and the Nagelberg Trust received a future advance convertible promissory note in an aggregate principal amount of up to $100,000 and a warrant to purchase 555,556 shares of Common Stock.

September 2021 Securities Purchase Agreements and Warrants

On September 3, 2021, the Company entered into Securities Purchase Agreements (the “2021 Purchase Agreements”), with certain accredited investors (collectively, the “2021 Purchasers”) for the sale by the Company in a private placement (the “2021 Private Placement”) of (i) the Company’s future advance convertible promissory notes in an aggregate principal amount of up to $543,478 (the “2021 Notes”) and (ii) warrants to purchase an additional 2,777,779 shares of Common Stock of the Company (the “2021 Warrants”). The 2021 Warrants have an exercise price of $0.18 per share and a five-year term. The closing of the 2021 Private Placement occurred on September 7, 2021. The Company received financing from an accredited investor in the net amount of $250,000 as an additional disbursement under an existing future advance convertible note issued to such accredited investor on April 20, 2021; the Company previously received an additional disbursement from such accredited investor in the net amount of $750,000 on May 15, 2021.

Notes