UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported):

December 15,

2011

INDEPENDENCE ENERGY CORP.

(Exact name of registrant as specified in its Charter)

|

Nevada

|

000-54323

|

20-3866475

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

708 – 11

th

Avenue SW, Suite 445, Calgary, Alberta, Canada, T2R 0E4

(Address of Principal Executive Offices)

(403) 266-4141

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “

Filings

”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

In this Form 8-K, references to “we,” “our,” “us,” “our company,” “the Company,” “Independence” or the “Registrant” refer to Independence Energy Corp., a Nevada corporation.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

ACQUISITION OF OIL AND GAS ASSETS

On December 15, 2011, we closed the acquisition of a 2.5% interest in the Quinlan Lease from Wise Oil and Gas LLC, with the option to increase that interest to 10%. On December 23, 2011 we closed an additional 2.5% for a total of 5%. The cost of 1% of interest in the Quinlan Lease is $15,616. The Quinlan Lease is located in Pottawatomie County, Oklahoma, within the NE Shawnee Field Township 11 North, Range 4 East. The Quinlan 1, 2, 3 and 4 wells are all located within Section 19. The four wells lie between the Nemaha ridge to the west and then on to the west flank of the Seminloe-Cushing ridge (Hunton Uplift) to the East and North of Pauls Valley. A full description of the property subject to the Quinlan Lease can be found further in this Current Report, under the section titled “Description of Property”.

A full description of the Quinlan Lease is included further in this Current Report, under the heading “Description of Property”.

CORPORATE HISTORY AND STRUCTURE

Our Corporate History and Background

We were incorporated in the State of Nevada on November 30, 2005 under the name "Oliver Creek Resources Inc." At inception, we were an exploration stage company engaged in the acquisition, exploration and development of natural resource properties.

We completed a form SB-2 Registration Statement under the Securities Act of 1933 with the U.S. Securities and Exchange Commission registering 1,000,000 units at a price of $0.05 per unit. Each unit consisted of one share and one share purchase warrant. Each share purchase warrant was valid for a period of two years from the date of the prospectus and expired on March 22, 2008 with none being exercised. The offering was completed on June 12, 2006 for total proceeds to the company of $50,000 (1,000,000 units at $0.05).

On October 12, 2006 our common stock shares were approved for trading on the Over-the-Counter Bulletin Board under the symbol "OVCR".

Effective August 12, 2008, we affected a 12 for one forward stock split of our issued and outstanding common stock. As a result, our authorized capital remains at 75,000,000 shares of common stock with a par value of $0.001 and our issued and outstanding shares increased from 2,000,000 shares of common stock to 24,000,000 shares of common stock. Also effective August 12, 2008, we have changed our name from "Oliver Creek Resources Inc." to "Independence Energy Corp.". The change of name was approved by our directors and a majority of our shareholders.

The name change, forward stock split and reduction of authorized capital became effective with the Over-the-Counter Bulletin Board at the opening for trading on August 12, 2008 under the new stock symbol "IDNG".

OUR BUSINESS

We are an oil and gas company engaged in the exploration for and production of oil and natural gas, throughout the United States. Upon the closing of the 2.5% interest in the Quinlan Lease on December 15, 2011, we began generating revenue from the operating well on the property. On December 23, 2011 we closed an additional 2.5% for a total of 5%. A full description of the property subject to the Quinlan Lease can be found further in this Current Report, under the section titled “Description of Property”.

As of the date of this Report, we have acquired a percentage working interest in an oil and gas property. If the property is viable and can be developed, we will receive a pro-rata share of any revenues generated from the property, equivalent to our percentage working interest. If the property is not viable, we expect the operator to plug the wells; however, we will not be responsible for any portion of the costs related to the plugging of the wells. There are leases underlying the wells in which we own working interests; however we are not the holder of these leases and therefore we are not responsible for the payment or evaluation of any obligations under such leases. The leaseholder of the property is responsible for paying and maintaining the leases. If we are successful in generating revenues from our working interests in this oil and gas property, we intend to acquire working interests in additional wells in the project area, subject to obtaining additional financing. Our business strategy also includes seeking opportunities for mergers or acquisitions with other companies or entities.

Our plan of operations for the next 12 months is to obtain revenues from our current interest in the Quinlan Lease and to acquire and explore development stage oil and gas properties. We will require additional capital to carry out our current business plan. We currently do not have sufficient financing to fully execute our business plan and there is no assurance that we will be able to obtain the necessary financing to do so.

We may not be able to fund our cash requirements through our current operations. Historically, we have been able to raise a limited amount of capital through private placements of our equity stock, but we are uncertain about our continued ability to raise funds privately. Further, we believe that our company may have difficulties raising capital until we locate a prospective property through which we can pursue our plan of operation. If we are unable to secure adequate capital to continue our acquisition efforts, our shareholders may lose some or all of their investment and our business may fail.

Markets

The United States ranks as the third highest oil producing country in the world and ranks first as the country with the highest consumption of oil. The United States ranks as the second highest natural gas producing country in the world and ranks first as the country with the highest consumption of natural gas. (

U.S. Energy Information Administration

. 2009. Retrieved on January 27, 2012 from and publicly available at: http://www.eia.gov/countries/index.cfm?view=production).

Currently, oil and natural gas fuel more than 97 percent of America’s vehicles, whether on land, sea, or in the air. Oil and natural gas are also key components in the vast majority of all manufactured goods. Whether it’s surgical equipment, fertilizers, phones, CDs, paints or fuels, the oil and natural gas industry supports our day-to-day safety, mobility, health and lifestyle. (

Energy Tomorrow.

Retrieved on January 27, 2012 from and publicly available at: http://energytomorrow.org/issues/oil-and-gas-101/petroleum-products/).

Further, the demand for oil and gas is expected to significantly rise. The U.S. will require 21 percent more energy in 2035 than in 2009 with more than half of the energy demand expected to be met by oil and natural gas. Today, oil accounts for 37 percent of our energy use with the lion’s share of it fueling 94 percent of our transportation energy needs. Although ethanol and other biofuels are expected to grow rapidly in the future and steadily displace some oil use, the U.S. Energy Information Administration forecasts oil will continue to account for the largest share of our energy needs filling 33 percent of total energy demand and 85 percent of our transportation needs in 2035. (“Energizing America. Facts for Addressing Energy Policy.”

energyAPI.

May 2, 2011. Retrieved January 27, 2012 from and publicly available at http://www.api.org/aboutoilgas/upload/truth_primer4.pdf.)

Future U.S. Energy Demand:

The U.S. will require 21 percent more energy in 2035 than in 2009.

(Calculated in Quadrillion British Thermal Units “BTU”).

Globally, the demand for energy has also hit all time highs and countries such as China and India are driving this demand. India and China will account for 45 percent of the increase in global primary energy demand by 2030, with both countries more than doubling their energy use over that period (“The World’s 10 Biggest Oil Consumers.”

Rediff Business.

March 12, 2010. Retrieved on January 27, 2012 from and publicly available at: http://business.rediff.com/slide-show/2010/mar/12/slide-show-1-worlds-10-biggest-oil-consumers.htm#contentTop). As the population density increases, the demand for oil and gas will rise. Of course, the price history of oil and gas is not one of constant increase, and every investor should be aware of this.

Recent forecasts by the U.S. Energy Information Administration estimate that sustaining a 3.2 percent rate of annual growth in the global economy from 2007 to 2035 (measured in purchasing power parity) will require an expansion of about 24.5 million barrels per day in global oil supplies. That is an increase equivalent to nearly doubling the current consumption of North America. The growth in demand for natural gas worldwide is expected to be even larger, increasing by 45 percent from 2007 to 2035. Despite significant growth of renewables and improvements in energy efficiency, more than half of the world’s energy demand will be met in 2035 by oil and natural gas, as is the case today. (“Energizing America. Facts for Addressing Energy Policy.”

energyAPI.

May 2, 2011. Retrieved on January 27, 2012 from and publicly available at http://www.api.org/aboutoilgas/upload/truth_primer4.pdf.)

Future Global Energy Demand:

The World will require 49 percent more energy in 2035 than in 2007.

(Calculated in Quadrillion British Thermal Units “BTU”).

Source: “Energizing America. Facts for Addressing Energy Policy.”

energyAPI.

May 2, 2011.

Retrieved on July 22, 2011 from and publicly available at

http://www.api.org/aboutoilgas/upload/truth_primer4.pdf

.

There are significant risks associated with direct investing in oil and gas projects. However, we believe that direct investments in oil & gas can provide high potential returns and cash flow. There have been many new discoveries in oil and gas developmental technology, including faster drilling speeds, greater access to resources, better completion techniques and even turn-key drilling commitments for drilling deeper than 20,000 feet. Oil and gas prices are now sufficiently high enough to warrant drilling deeper and spending more money to do it. Ten or more years ago, oil drilling was very risky, largely due to the probability of hitting a dry well. However, technology has come a long way since then. The latest techniques include the use of satellite mapping and horizontal drilling. This enables producers to locate and drill more effectively, thus reducing cost.

Significant oil and gas discoveries that are announced today often result from investments begun by companies as far back as a decade or more ago. Since the year 2000, our industry invested over 2 trillion dollars in U.S. capital projects to meet the growing demand for oil and natural gas. The worldwide economic downturn, along with lower oil and natural gas prices and tight credit markets, caused some oil and natural gas producers to cut their capital budget plans in 2009. However, investments have since rebounded. (“Energizing America. Facts for Addressing Energy Policy.”

energyAPI.

May 2, 2011. Retrieved on January 27, 2012 from and publicly available at http://www.api.org/aboutoilgas/upload/truth_primer4.pdf.)

Competition

The oil and gas industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior oil and gas companies, independent producers and institutional and individual investors who are actively seeking to acquire oil and gas properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of oil and gas interests is intense with many oil and gas leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the oil and gas companies with which we compete for financing and for the acquisition of oil and gas properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring oil and gas interests of merit or on exploring or developing their oil and gas properties. This advantage could enable our competitors to acquire oil and gas properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further oil and gas interests or explore and develop our current or future oil and gas properties.

We also compete with other junior oil and gas companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior oil and gas companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their oil and gas properties or the price of the investment opportunity. In addition, we compete with both junior and senior oil and gas companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, oil and gas exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of energy legislation and/or regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including international political conditions, overall levels of supply and demand for oil and gas, and the markets for synthetic fuels and alternative energy sources.

In the face of competition, we may not be successful in acquiring, exploring or developing profitable oil and gas properties or interests, and we cannot give any assurance that suitable oil and gas properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the oil and gas industry by:

|

·

|

relying on the strength of our management’s contacts; and

|

|

·

|

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

|

Government Regulations

Our current and future operations and exploration activities are or will be subject to various laws and regulations in the United States. These laws and regulations govern the protection of the environment, conservation, prospecting, development, energy production, taxes, labor standards, occupational health and safety, toxic substances, chemical products and materials, waste management and other matters relating to the oil and gas industry. Permits, registrations or other authorizations may also be required to maintain our operations and to carry out our future oil and gas exploration and production activities, and these permits, registrations or authorizations will be subject to revocation, modification and renewal.

Governmental authorities have the power to enforce compliance with lease conditions, regulatory requirements and the provisions of required permits, registrations or other authorizations, and violators may be subject to civil and criminal penalties including fines, injunctions, or both. The failure to obtain or maintain a required permit may also result in the imposition of civil and criminal penalties, and third parties may have the right to sue to enforce compliance.

We expect to be able to comply with all applicable laws and regulations and do not believe that such compliance will have a material adverse effect on our competitive position. We have obtained and intend to obtain all environmental permits, licenses and approvals required by all applicable regulatory agencies to maintain our current oil and gas operations and to carry out our future exploration activities. We are not aware of any material violations of environmental permits, licenses or approvals issued with respect to our operations, and we believe that the operators of the properties in which we have an interest comply with all applicable laws and regulations. We intend to continue complying with all environmental laws and regulations, and at this time we do not anticipate incurring any material capital expenditures to do so.

Compliance with environmental requirements, including financial assurance requirements and the costs associated with the cleanup of any spill, could have a material adverse effect on our capital expenditures, earnings or competitive position. Our failure to comply with any laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of injunctive relief, or both. Legislation affecting the oil and gas industry is subject to constant review, and the regulatory burden frequently increases. Changes in any of the laws and regulations could have a material adverse effect on our business, and in view of the many uncertainties surrounding current and future laws and regulations, including their applicability to our operations, we cannot predict their overall effect on our business.

U.S. Regulations

Our operations are or will be subject to various types of regulation at the federal, state and local levels in the United States. Such regulation covers permits required for drilling wells; bonding requirements for drilling or operating wells; the implementation of spill prevention plans; submissions and permits relating to the presence, use and release of certain materials incidental to oil and gas operations; the location of wells; the method of drilling and casing wells; the use, transportation, storage and disposal of fluids and materials used in connection with drilling and production activities; surface usage and the restoration of properties upon which wells have been drilled; the plugging and abandoning of wells; and the transportation of oil and gas.

The sale of liquid hydrocarbons was subject to federal regulation under the Energy Policy and Conservation Act of 1975, which amended various acts, including the Emergency Petroleum Allocation Act of 1973. These regulations and controls included mandatory restrictions upon the prices at which most domestic crude oil and various petroleum products could be sold. All price controls and restrictions on the sale of crude oil at the wellhead have been withdrawn. It is possible, however, that such controls may be reimposed in the future but when, if ever, such re-imposition might occur and the effect thereof cannot be predicted.

The sale of certain categories of natural gas in interstate commerce is subject to regulation under the Natural Gas Act and the Natural Gas Policy Act of 1978 (“NGPA”). Under the NGPA, a comprehensive set of statutory ceiling prices applies to all first sales of natural gas unless the gas is specifically exempt from regulation (i.e., unless the gas is “deregulated”). Administration and enforcement of the NGPA ceiling prices are delegated to the Federal Energy Regulatory Commission (“FERC”). In June 1986, FERC issued Order No. 451, which, in general, is designed to provide a higher NGPA ceiling price for certain vintages of old gas. It is possible that the leaseholders of our oil and gas properties may in the future acquire significant amounts of natural gas subject to NGPA price regulations and/or FERC Order No. 451.

Our operations are or will also be subject to various conservation matters, including the regulation of the size of drilling and spacing units or proration units, the number of wells which may be drilled in a unit, and the unitization or pooling of oil and gas properties. In this regard, some states allow forced pooling or the integration of tracts to facilitate exploration while other states rely on the voluntary pooling of lands and leases, which may make it more difficult to develop oil and gas properties. In addition, state conservation laws establish maximum rates of production from oil and gas wells, generally limit the venting or flaring of gas and impose certain requirements regarding the ratable purchase of produced oil and gas. The effect of these regulations is to limit the amounts of oil and gas we may be able to produce from our wells and to limit the number of wells or the locations at which we may be able to drill.

Oil and natural gas exploration and production activities on federal lands are subject to the

National Environmental Policy Act

(NEPA). The NEPA requires federal agencies, including the Department of the Interior, to evaluate major agency actions that have the potential to significantly impact the environment. In the course of such evaluations, an agency will typically prepare an environmental assessment on the potential direct, indirect and cumulative impacts of a proposed project and, if necessary, will prepare a more detailed environmental impact statement that may be made available for public review and comment. This process has the potential to delay or limit the development of oil and natural gas projects.

The

Resource Conservation and Recovery Act

(RCRA) and comparable state laws regulate the generation, transportation, treatment, storage, disposal and cleanup of “hazardous wastes” as well as the disposal of non-hazardous wastes. Under the auspices of the U.S. Environmental Protection Agency, or EPA, individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. While drilling fluids, produced waters, and many other wastes associated with the exploration, development, and production of crude oil, natural gas, or geothermal energy constitute “solid wastes”, which are regulated under the less stringent non-hazardous waste provisions, there is no assurance that the EPA or individual states will not in the future adopt more stringent and costly requirements for the handling of non-hazardous wastes or categorize some non-hazardous wastes as hazardous.

The

Comprehensive Environmental Response, Compensation and Liability Act

(CERCLA), also known as “Superfund”, and analogous state laws, impose joint and several liability, without regard to fault or legality of conduct, on persons who are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the owner or operator of the site where the release occurred and any company that disposed or arranged for the disposal of the hazardous substance at the site. Under CERCLA, such persons may be liable for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances into the environment.

The

Water Pollution Control Act

, also known as the Clean Water Act, and analogous state laws, impose restrictions and strict controls on the discharge of pollutants, including produced waters and other oil and natural gas wastes, into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or the relevant state. The Clean Water Act also prohibits the discharge of dredge and fill material into regulated waters, including wetlands, unless authorized by a permit issued by the U.S. Army Corps of Engineers. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations.

The

Clean Air Act

and associated state laws and regulations regulate emissions of various air pollutants through the issuance of permits and the imposition of other requirements. In addition, the EPA has developed, and continues to develop, stringent regulations governing emissions of toxic air pollutants at specified sources. In order to construct production facilities, we may be required to obtain permits before work can begin. These regulations may increase the costs of compliance for such facilities, and federal and state regulatory agencies may impose administrative, civil and criminal penalties for non-compliance.

We may be subject to the requirements of the

Occupational Safety and Health Act

(OSHA) and comparable state statutes. The OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of CERCLA, and similar state statutes require that we organize and/or disclose information about hazardous materials used or produced in our operations.

Research and Development Expenditures

We have not incurred any research and development expenditures over the past two fiscal years.

Employees

Currently, we do not have any employees. Additionally, we have not entered into any consulting or employment agreements with our president, chief executive officer, treasurer, secretary or chief financial officer. Our directors, executive officers and certain contracted individuals play an important role in the running of our company. We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed.

We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark

DESCRIPTION OF PROPERTY

Headquarters and Administration Offices

We currently utilize space at the premises of Bruce Thomson, an officer and director of the company. The company pays Mr. Thomson $125 per month rent. The premises are located at 445 - 708 11th Avenue SW, Calgary, AB. The facilities include an answering machine, a fax machine, computer and office equipment. We intend to use these facilities for the time being until we feel we have outgrown them. We currently have no investment policies as they pertain to real estate, real estate interests or real estate mortgages.

Quinlan Lease

On December 15, 2011, we closed the acquisition of a 2.5% interest in the Quinlan Lease from Wise Oil and Gas LLC, with the option to increase that interest to 10%. On December 23, 2011 we closed an additional 2.5% for a total of 5%. The cost of 1% of interest in the Quinlan Lease is $15,616. The Quinlan Lease is located in Pottawatomie County, Oklahoma, within the NE Shawnee Field Township 11 North, Range 4 East. The Quinlan 1, 2, 3 and 4 wells are all located within Section 19. The four wells lie between the Nemaha ridge to the west and then on to the west flank of the Seminloe-Cushing ridge (Hunton Uplift) to the East and North of Pauls Valley.

The The Quinlan Lease lies within the NE Shawnee Field in Sections 13 and 24, Township 11 North, Range 4 East and Sections 18 and 19, Township 11 North, Range 5 East, Pottawatomie County, Oklahoma, and is approximately 11 miles north and east of Shawnee near the junction of State Highway 9A and Interstate I40 East. The Quinlan’s #1, #2, #3, and #4 (the sale water well) all lie in Section 19 of the above township & range and are in the southern most portion of the Central Oklahoma Platform. The Central Oklahoma Platform is located between two large sedimentary basins, the Anadarko Basin to the west and the Arkoma Basin to the east and southeast. The field with the four wells lie between the Nemaha Ridge to the west and then on to west flank of the Seminole-Cushing Ridge (Hunton Uplift) to the east and north of the Pauls Valley Uplift. The forces responsible for creating regional structures in the Ordovician appear to have begun in the middle Devonian epeirogeny. At this time, uplift occurred from the northeast, creating a regional dip to the southwest in the Hunton Limestone and older formations; therefore, with associated faulting with these uplifts allowed these ancient structures to accumulate oil reserves. The Wilzetta Fault occurred during this major uplift period and is a major fault system trending Northeast-Southwest and extending many miles both to the north and south of the NE Shawnee Field and is considered to be the west boundary fault to the field. Specifically, the field appears to be trapping oil in several faulted anticlinal features with production being reflected in the Hunton Limestone, Viola Limestone, and the 1

st

Wilcox Sand.

The Quinlan #1 was originally open hole completed in the 1

st

Wilcox Sandstone from 4,778' to 4,782', the Simpson Dolomite from 4,742' to 4,750' and the Viola Limestone from 4,726' to 4,732' were tested several years later. Later production from the Quinlan #1 was documented producing an oil cut from 8 - 15%, (i.e. 100 barrels of total volume = 8 to 15 barrels are oil) on a daily basis from the 1

st

Wilcox Sandstone (Primary Objective), Viola Limestone and Simpson Dolomite (Second Objective). Finally, the Hunton Limestone formation was perforated and produced on a forty acre spacing pattern and was also perforated in the Quinlan #2. Since November 2009 when the well was purchased by Nitro Petroleum Inc., the Quinlan #1 has produced 13,946 barrels of oil from the Hunton Limestone.

The Quinlan #2 was originally drilled to the base of the Simpson Dolomite formation and completed in the Hunton Limestone. The Hunton Limestone was perforated from 4,594' to 4,604'. In

1976, the well was deepened to the 1

st

Wilcox and perforated in the Viola Limestone from 4,720' to 4,733' and the Simpson Dolomite from 4,756' to 4,762'.

The Quinlan #3 was tested in the Hunton Limestone and proved to be uneconomical due to a very low oil production rate with heavy water production. The current plan by the operator is to re-enter the well around the 1

st

of June of this year and perforate the Viola limestone in an attempt to replicate the Quinlan #2 production.

The Quinlan #4 was the last well to be drilled in the field with the goal of finding the Hunton Limestone productive. Unfortunately, the down dip Hunton Limestone had incurred a facies change becoming heavily dolomitized with very low crystalline porosity. The 1

st

Wilcox Sandstone was tested after logs indicated a productive interval with a contradicting sample evaluation. Eventual testing results indicated fresh water had been injected into the zone from an adjacent well without being reported to the proper authorities thus creating anonymous log inferences. The well was completed as a salt water field disposal well in the 1

st

Wilcox Sandstone which subsequently improved the overall field economics.

Summary of Estimated Oil and Gas Reserves as of Fiscal-Year End

Due to our recent acquisition of our interest in the Quinlan Lease, we do not have any audited or independently verified figures for production or reserve reporting. We currently own a 5% interest in the Quinlan Leases.

Wise Oil and Gas is the operator of the Quinlan Lease. Wise oil & Gas has been a fully licenced Oil & Gas Operator since 1989 in the State of Oklahoma. Wise Oil and Gas own and operate wells throughout the State of Oklahoma and continue to do so since 1989. Wise Oil and Gas is the operator of the Independence Energy's working interest in the Quinlan project. Larry Wise has extensive oil and gas operating experience. Mr. Wise worked as a Junior Field Engineer with Phillips 66 Petroleum Company 1977-1979. From 1979-1982 he worked for Jerry Scott Company as Completion Superintendent overseeing 14 drilling rigs and over 300 producing properties; 1982-1988 with JOMC Oil Co; 1988-1993 with Texas United Petroleum and 1993-1999 with Pottawatomie County Energy serving as President, Fund Raiser and Chief Operating Officer for all three companies. From 1999 through to 2006 he operated Wise Oil and Gas Company, LLC and served as an independent Engineering Consultant responsible for all operations of Morris E. Stewart Oil Company, OKC, Ok., Kirrie Oil Company, OKC, Ok., HoCo, Inc. Oil Company, Wichita Falls, TX., and Buccaneer Energy Corporation, Tampa Bay, FL

The following table shows our gross and net acreage position on the Quinlan Lease as of January 27, 2012. Please note that we hold a total of 5% turnkey working interest in the property.

|

Property

|

|

Gross Acreage

(developed)

|

|

|

Net Acreage

(developed)

|

|

|

Gross Acreage

(undeveloped)

|

|

|

Net Acreage

(undeveloped)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quinlan Lease

|

|

|

120

|

|

|

|

120

|

|

|

|

80

|

|

|

|

80

|

|

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR OVERALL BUSINESS OPERATIONS

We Have A Limited Operating History With Significant Losses And Expect Losses To Continue For The Foreseeable Future.

We have yet to establish any history of profitable operations. We have incurred net losses of $13,719 and $13,583 for the fiscal years ended January 31, 2011 and 2010, respectively. As a result, at January 31, 2011, we had an accumulated deficit of $82,434. We have not generated any revenues since our inception and do not anticipate that we will generate revenues which will be sufficient to sustain our operations. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will require the successful commercialization of our oil and gas properties. We may not be able to successfully commercialize our properties or ever become profitable.

There Is Doubt About Our Ability To Continue As A Going Concern Due To Recurring Losses From Operations, Accumulated Deficit And Insufficient Cash Resources To Meet Our Business Objectives, All Of Which Means That We May Not Be Able To Continue Operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended January 31, 2011 and 2010, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 2 to our consolidated financial statements for the year ended January 31, 2011, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises doubt about our ability to continue as a going concern.

We May Not Be Able To Secure Additional Financing To Meet Our Future Capital Needs Due To Changes In General Economic Conditions.

We anticipate needing significant capital to acquire additional properties, conduct exploration and development needed to bring our existing oil and gas properties into increased production and/or to continue to seek out appropriate joint venture partners or buyers for certain oil and gas properties. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Our Business And Operating Results Could Be Harmed If We Fail To Manage Our Growth Or Change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled geologists, mappers, drillers, engineers, technical personnel and adequate funds in a timely manner.

We May Not Have Access To The Supplies And Materials Needed For Exploration, Which Could Cause Delays Or Suspension Of Our Operations.

Competitive demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times in our exploration programs. Furthermore, fuel prices are rising. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower can be obtained.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have limited history of revenues from operations and have limited significant tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. We have a limited operating history and must be considered in the development stage. Our success is significantly dependent on a successful acquisition, drilling, completion and production program. Our operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves, extract the reserves economically, and/or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

The potential profitability of oil and gas ventures depends upon factors beyond our control.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

Adverse weather conditions can also hinder drilling operations. A productive well may become uneconomic in the event water or other deleterious substances are encountered which impair or prevent the production of oil and/or gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. The marketability of oil and gas, which may be acquired or discovered, will be affected by numerous factors beyond our control. These factors include the proximity and capacity of oil and gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. These factors cannot be accurately predicted and the combination of these factors may result in our company not receiving an adequate return on invested capital.

Oil and gas operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company

.

Oil and gas operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations are also subject to federal, state, and local laws and regulations, which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages, which it may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Exploration and production activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations.

In general, our exploration and production activities are subject to certain federal, state and local laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Compliance with these laws and regulations has not had a material effect on our operations or financial condition to date. Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry.

RISKS ASSOCIATED WITH OUR INDUSTRY

The nature of oil and gas exploration makes the estimates of costs uncertain, and our operations may be adversely affected if we underestimate such costs.

We will share a portion of the ongoing costs of exploration and development of the oil and gas properties in which we have working interests, in a proportion equal to our working interests. It is difficult to project the operating costs associated with an exploratory drilling program. Complicating factors include the inherent uncertainties of drilling in unknown formations, the costs associated with encountering various drilling conditions, such as over-pressured zones and tools lost in the hole, and changes in drilling plans and locations as a result of prior exploratory wells. If the operators of our oil and gas interests underestimate the costs or potential challenges of such programs, we may be required to seek additional funding or abandon our interests.

The oil and gas industry is highly competitive and there is no assurance that we will be successful in acquiring additional working interests in other oil and gas properties.

The oil and natural gas industry is intensely competitive. We compete with numerous individuals and companies for working interests in desirable oil and gas properties. Many of these individuals and companies with whom we compete have substantially greater financial and operational resources than we have. If we cannot compete for working interests in oil and gas properties, our business operations could be harmed.

There can be no assurance that oil or gas in any commercial quantity will be discovered on our oil and gas interests which could cause our business to fail.

Exploration for economic reserves of oil and gas is subject to a number of risks. Few properties that are explored are ultimately developed into producing oil and/or gas wells. If oil or gas is not discovered on any of our current or future working interests in any commercial quantity, our business will fail. In addition, a productive well may become uneconomic in the event water or other deleterious substances are encountered which impair or prevent the production of oil and/or gas from the well. Production from any well may be unmarketable if it is permeated with water or other deleterious substances. Also, the marketability of oil and gas which may be acquired or discovered will be affected by numerous related factors, including the proximity and capacity of oil and natural gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection, all of which could result in greater expenses than revenue generated by the wells.

Prices and markets for oil and gas are unpredictable and tend to fluctuate significantly, which could reduce profitability, growth and the value of our business.

Our revenues and earnings, if any, will be highly sensitive to the prices of oil and gas. Prices for oil and gas are subject to large fluctuations in response to relatively minor changes in the supply and demand for oil and gas, market uncertainty and a variety of additional factors beyond our control. These factors include, without limitation, governmental fixing, pegging, controls or any combination of these and other factors, changes in domestic, international, political, social and economic environments, worldwide economic uncertainty, the availability and cost of funds for exploration and production, the actions of the Organization of Petroleum Exporting Countries, governmental regulations, political stability in the Middle East and elsewhere, war, or the threat of war, in oil producing regions, the foreign supply of oil, the price of foreign imports and the availability of alternate fuel sources. Significant changes in long-term price outlooks for crude oil or natural gas could have a material adverse effect on revenues as well as the value of our interests in the wells.

Amendments to current laws and regulations governing the oil and gas industry could have a material adverse impact on our proposed business.

The oil and gas industry is subject to substantial regulation relating to the exploration, development, upgrading, marketing, pricing, taxation, and transportation of, oil and gas. Amendments to current laws and regulations governing operations and activities of oil and gas exploration and extraction operations could have a material adverse impact on our working interests and in turn, cause us to abandon our interests or cause our business to fail.

Our business could be impaired if the leaseholders and operators of our oil and gas interests fail to comply with applicable regulations.

Failure to comply with government regulations could subject the leaseholders and operators of our oil and gas interests to civil and criminal penalties and require them to forfeit property rights or licenses, which in effect could cause us to lose our working interests. They may also be required to take corrective actions for failure to comply with applicable regulations which could require substantial capital expenditures, a portion of which we would be required to bear. As a result, our business operations and profitability could deteriorate due to regulatory constraints.

We may be unable to establish or maintain strategic relationships with industry participants, which may diminish our ability to conduct our operations.

Our potential to enter into strategic commercial arrangements or partnerships to obtain additional working interests in oil and gas properties and to grow our business depends upon our ability to develop and maintain close working relationships with industry participants and government officials. We may not be able to establish these strategic relationships, or if established, we may not be able to maintain them due to several factors including the inexperience of our management in the oil and gas industry, our limited number of working interests in oil and gas properties and the limited number of hours our management currently devotes to our business. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities that we would not otherwise be inclined to undertake. If strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

RISKS RELATED TO THE MARKET FOR OUR STOCK

The market price of our common stock can become volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock can become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include: our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the

expectations of financial market analysts and investors; changes in financial estimates by us or by any securities analysts who might cover our stock; speculation about our business in the press or the investment community; significant developments relating to our relationships with our customers or suppliers; stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; customer demand for our products; investor perceptions of our industry in general and our Company in particular; the operating and stock performance of comparable companies; general economic conditions and trends; announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; changes in accounting standards, policies, guidance, interpretation or principles; loss of external funding sources; sales of our common stock, including sales by our directors, officers or significant stockholders; and additions or departures of key personnel. Securities class action litigation is often instituted against companies following periods of volatility in their stock price. Should this type of litigation be instituted against us, it could result in substantial costs to us and divert our management’s attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to the operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our Company at a time when you want to sell your interest in us. We do not intend to pay dividends on shares of our common stock for the foreseeable future.

We have never declared or paid any cash dividends on shares of our common stock.

We intend to retain any future earnings to fund the operation and expansion of our business and, therefore, we do not anticipate paying cash dividends on shares of our common stock in the foreseeable future.

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. If our common stock becomes a “penny stock,” we may become subject to Rule 15g-9 under the Exchange Act, or the Penny Stock Rule. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by the Penny Stock Rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

We are not likely to pay cash dividends in the foreseeable future.

We intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate. Should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions.

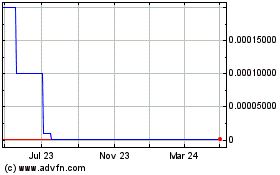

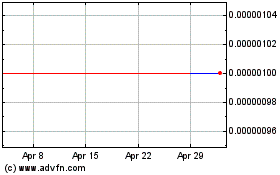

Our common stock is illiquid and subject to price volatility unrelated to our operations.

If a market for our common stock does develop, its market price could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting us or our competitors. In addition, the stock market itself is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

A large number of shares may be eligible for future sale and may depress our stock price.

We may be required, under terms of future financing arrangements, to offer a large number of common shares to the public, or to register for sale by future private investors a large number of shares sold in private sales to them.

Sales of substantial amounts of common stock, or a perception that such sales could occur, and the existence of options or warrants to purchase shares of common stock at prices that may be below the then-current market price of our common stock, could adversely affect the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities, either of which would decrease the value of any earlier investment in our common stock.

FINANCIAL STATEMENTS AND EXHIBITS

Our Audited Financial Statements for the years ended January 31, 2011 and 2010, as well as the unaudited Interim Financial Statements as of October 31, 2011, are found below beginning on pages F-1 of this Current Report.

INDEPENDENCE ENERGY CORP.

(A Development Stage Company)

FINANCIAL STATEMENTS

JANUARY 31, 2011

TABLE OF CONTENTS

|

|

|

Page

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

F-2

|

|

|

|

|

|

Balance Sheets

|

|

F-3

|

|

|

|

|

|

Statements of Operations

|

|

F-4

|

|

|

|

|

|

Statement of Stockholders Equity

|

|

F-5

|

|

|

|

|

|

Statements of Cash Flows

|

|

F-6

|

|

|

|

|

|

Notes to the Financial Statements

|

|

F-7

|

|

Chang G. Park, CPA, Ph. D.

t

2667 CAMINO DEL RIO SOUTH PLAZA B

t

SAN DIEGO

t

CALIFORNIA 92108-3707

t

t

TELEPHONE (858)722-5953

t

FAX (858) 761-0341

t

FAX (858) 433-2979

t

E-MAIL

changgpark@gmail.com

t

|

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Independence Energy Corp.

We have audited the accompanying balance sheets of Independence Energy Corp. (

An Exploration Stage “Company

”) as of January 31, 2011 and 2010 and the related statements of operations, changes in shareholders’ equity and cash flows for the years then ended January 31, 2011 and 2010, and for the period from

November 30, 2005

(inception) to January 31, 2011. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Independence Energy Corp. as of January 31, 2011, and the result of its operations and its cash flows for the years then ended and for the period from November 30, 2005 (inception) to January 31, 2011 in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company’s losses from operations raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/

Chang Park

CHANG G. PARK, CPA

May 2, 2011

San Diego, CA. 92108

Member of the California Society of Certified Public Accountants

Registered with the Public Company Accounting Oversight Board

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

|

|

|

As of

|

|

|

As of

|

|

|

|

|

January 31,

|

|

|

January 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

1,311

|

|

|

$

|

3,081

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

|

1,311

|

|

|

|

3,081

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

1,311

|

|

|

$

|

3,081

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

|

5,320

|

|

|

|

3,000

|

|

|

Due to Related Party

|

|

|

425

|

|

|

|

-

|

|

|

Loan Payable to Director

|

|

|

18,000

|

|

|

|

8,796

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Current Liabilities

|

|

|

23,745

|

|

|

|

11,796

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

23,745

|

|

|

|

11,796

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity (Deficit)

|

|

|

|

|

|

|

|

|

|

Common stock, ($0.001 par value, 75,000,000 shares

|

|

|

|

|

|

|

|

|

|

authorized; 24,000,000 shares issued and outstanding

|

|

|

|

|

|

|

|

|

|

as of January 31, 2011 and January 31, 2010).

|

|

|

24,000

|

|

|

|

24,000

|

|

|

Additional paid-in capital

|

|

|

36,000

|

|

|

|

36,000

|

|

|

Deficit accumulated during exploration stage

|

|

|

(82,434

|

)

|

|

|

(68,715

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders' Equity (Deficit)

|

|

|

(22,434

|

)

|

|

|

(8,715

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY (DEFICIT)

|

|

$

|

1,311

|

|

|

$

|

3,081

|

|

See Notes to Financial Statements

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

|

|

|

|

|

|

|

|

|

November 30, 2005

|

|

|

|

|

Year

|

|

|

Year

|

|

|

(inception)

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

through

|

|

|

|

|

January 31,

|

|

|

January 31,

|

|

|

January 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenues

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Costs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative Expenses

|

|

|

3,719

|

|

|

|

3,583

|

|

|

|

32,207

|

|

|

Professional fees

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

50,324

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Costs

|

|

|

13,719

|

|

|

|

13,583

|

|

|

|

82,531

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain from currency exchange

|

|

|

-

|

|

|

|

-

|

|

|

|

97

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income

|

|

|

-

|

|

|

|

-

|

|

|

|

97

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss)

|

|

$

|

(13,719

|

)

|

|

$

|

(13,583

|

)

|

|

$

|

(82,434

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings (loss) per share

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of

common shares outstanding

|

|

|

24,000,000

|

|

|

|

24,000,000

|

|

|

|

|

|

See Notes to Financial Statements

INDEPENDECE ENERGY CORP.

(An Exploration Stage Company)

Statement of Changes in Stockholders' Equity

From November 30, 2005 (Inception) through January 31, 2011

|

|

|

|

|

|

|

|

|

|

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During

|

|

|

|

|

|

|

|

Common

|

|

|

|

|

|

|

|

|

Exploration

|

|

|

|

|

|

|

|

Stock

|

|

|

Amount

|

|

|

Capital

|

|

|

Stage

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, November 30, 2005

|

|

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock issued for cash on November 30, 2005

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

@ $0.000833 per share

|

|

|

12,000,000

|

|

|

|

12,000

|

|

|

|

(2,000

|

)

|

|

|

|

|

|

|

10,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss, January 31, 2006

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8

|

)

|

|

|

(8

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, January 31, 2006

|

|

|

12,000,000

|

|

|

|

12,000

|

|

|

|

(2,000

|

)

|

|

|

(8

|

)

|

|

|

9,992

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock issued for cash from SB-2 offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

@ $0.00416667 per share

|

|

|

12,000,000

|

|

|

|

12,000

|

|

|

|

38,000

|

|

|

|

|

|

|

|

50,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss, January 31, 2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(14,303

|

)

|

|

|

(14,303

|

)