UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURUTIES EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2010

Commission file number 333-132258

Independence Energy Corp.

(Exact Name of Registrant as Specified in Its Charter)

Nevada 20-3866475

(State or Other Jurisdiction of (I.R.S. Employer

Incorporation or Organization) Identification No.)

445 - 708 11th Avenue SW

Calgary, AB, Canada

(Address of Principal Executive Offices & Zip Code)

|

Telephone (403)264-2710 Facsimile (775)243-9320

(Telephone Number)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and

posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.232.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K is not contained herein, and will not be contained, to the

best of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [X]

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

As of April 26, 2010, the registrant had 24,000,000 shares of common stock

issued and outstanding. No market value has been computed based upon the fact

that no active trading market had been established as of April 26, 2010.

INDEPENDENCE ENERGY CORP.

TABLE OF CONTENTS

Page No.

--------

Part I

Item 1. Business 3

Item 1A. Risk Factors 5

Item 2. Properties 7

Item 3. Legal Proceedings 7

Item 4. Submission of Matters to a Vote of Securities Holders 7

Part II

Item 5. Market for Registrant's Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities 7

Item 7. Management's Discussion and Analysis of Financial Condition

and Results of Operations 8

Item 8. Financial Statements and Supplementary Data 11

Item 9. Changes in and Disagreements with Accountants on Accounting

and Financial Disclosure 20

Item 9A. Controls and Procedures 20

Part III

Item 10. Directors and Executive Officers 22

Item 11. Executive Compensation 23

Item 12. Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters 24

Item 13. Certain Relationships and Related Transactions 25

Item 14. Principal Accounting Fees and Services 25

Part IV

Item 15. Exhibits 26

Signatures 26

|

2

PART I

ITEM 1. BUSINESS

GENERAL INFORMATION

We were incorporated in the State of Nevada on November 30, 2005 under the name

"Oliver Creek Resources Inc.". At inception, we were an exploration stage

company engaged in the acquisition, exploration and development of natural

resource properties.

We completed a form SB-2 Registration Statement under the Securities Act of 1933

with the U.S. Securities and Exchange Commission registering 1,000,000 units at

a price of $0.05 per unit. Each unit consisted of one share and one share

purchase warrant. Each share purchase warrant was valid for a period of two

years from the date of the prospectus and expired on March 22, 2008 with none

being exercised. The offering was completed on June 12, 2006 for total proceeds

to the company of $50,000 (1,000,000 units at $0.05).

On October 12, 2006 our common stock shares were approved for trading on the

Over-the-Counter Bulletin Board under the symbol OVCR.

We have had one resource property to date known as the Thistle Claim located in

British Columbia, Canada. We completed Phase I of the exploration program on our

Thistle Claim which consisted of conducting detailed geological mapping of all

roads within and buttressing the claims and silt sampling of every drainage or

draw. Based on the information available to us from our Phase I exploration

program, we determined that the Thistle Claim did not, in all likelihood,

contain a commercially viable mineral deposit, and we therefore abandoned any

further exploration on the property.

As a result, we are investigating several other business opportunities to

enhance shareholder value, and are focused on the oil and gas industry with the

acquisition of oil and natural gas assets both in Canada and the United States.

These consist of natural gas production and oils sands exploration in Canada and

off-shore exploration in the Texas Gulf area of the Unites States. Subject to

completing due diligence and funding sources being available we intend to pursue

business opportunities in the oil and gas business.

We will require additional funding to proceed. We cannot provide investors with

any assurance that we will be able to raise sufficient funds to fund any work in

the oil and gas business.

Effective August 12, 2008, we affected a 12 for one forward stock split of our

issued and outstanding common stock. As a result, our authorized capital remains

at 75,000,000 shares of common stock with a par value of $0.001 and our issued

and outstanding shares increased from 2,000,000 shares of common stock to

24,000,000 shares of common stock.

Also effective August 12, 2008, we have changed our name from "Oliver Creek

Resources Inc." to "Independence Energy Corp.". The change of name was approved

by our directors and a majority of our shareholders.

The name change, forward stock split and reduction of authorized capital became

effective with the Over-the-Counter Bulletin Board at the opening for trading on

August 12, 2008 under the new stock symbol "IDNG".

As of January 31, 2010 we had generated no revenues. We have been issued an

opinion by our auditor that raises substantial doubt about our ability to

continue as a going concern based on our current financial position.

3

COMPETITION

We do not currently compete directly with anyone for the exploration or removal

of oil and natural gas assets as we have no properties on which we are carrying

out exploration activities.

BANKRUPTCY OR SIMILAR PROCEEDINGS

There has been no bankruptcy, receivership or similar proceeding.

REORGANIZATIONS, PURCHASE OR SALE OF ASSETS

There have been no material reclassifications, mergers, consolidations, or

purchase or sale of a significant amount of assets not in the ordinary course of

business.

COMPLIANCE WITH GOVERNMENT REGULATION

We will be required to comply with all regulations, rules and directives of

governmental authorities and agencies applicable to the acquisition of oil and

natural gas assets both in Canada and the United States.

PATENTS, TRADEMARKS, FRANCHISES, CONCESSIONS, ROYALTY AGREEMENTS, OR LABOR

CONTRACTS

We have no current plans for any registrations such as patents, trademarks,

copyrights, franchises, concessions, royalty agreements or labor contracts. We

will assess the need for any copyright, trademark or patent applications on an

ongoing basis.

NEED FOR GOVERNMENT APPROVAL FOR ITS PRODUCTS OR SERVICES

We are not required to apply for or have any government approval for our

products or services.

RESEARCH AND DEVELOPMENT COSTS DURING THE LAST TWO YEARS

We have not expended funds for research and development costs since inception.

We paid $1,745 for the geology report on our original exploration target

property and incurred $6,091.16 in exploration expenses.

NUMBER OF EMPLOYEES

We currently have one employee, which is our executive officer Bruce Thomson.

Mr. Thomson currently devotes 2 - 5 hours per week to company matters, he plans

to devote as much time as the board of directors determines is necessary to

manage the affairs of the company. There are no formal employment agreements

between the company and our current employee.

REPORTS TO SECURITIES HOLDERS

We provide an annual report that includes audited financial information to our

shareholders. We make our financial information equally available to any

interested parties or investors through compliance with the disclosure rules of

Regulation S-K for a small business issuer under the Securities Exchange Act of

1934. We are subject to disclosure filing requirements including filing Form

10-K annually and Form 10-Q quarterly. In addition, we will file Form 8K and

other proxy and information statements from time to time as required. We do not

intend to voluntarily file the above reports in the event that our obligation to

file such reports is suspended under the Exchange Act. The public may read and

copy any materials that we file with the Securities and Exchange Commission,

("SEC"), at the SEC's Public Reference Room in Washington, DC. The public may

4

obtain information on the operation of the Public Reference Room by calling the

SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov)

that contains reports, proxy and information statements, and other information

regarding issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

WE HAVE HAD NEGATIVE CASH FLOWS FROM OPERATIONS AND IF WE ARE NOT ABLE TO OBTAIN

FURTHER FINANCING, OUR BUSINESS OPERATIONS MAY FAIL.

We had cash in the amount of $3,081 as of January 31, 2010. We do not have

sufficient funds to independently finance the acquisition and development of

prospective oil and gas properties, nor do we have the funds to independently

finance our daily operating costs. We do not expect to generate any revenues for

the foreseeable future. Accordingly, we will require additional funds, either

from equity or debt financing, to maintain our daily operations and to locate,

acquire and develop a prospective property. Obtaining additional financing is

subject to a number of factors, including market prices for oil and gas,

investor acceptance of any property we may acquire in the future, and investor

sentiment. Financing, therefore, may not be available on acceptable terms, if at

all. The most likely source of future funds presently available to us is through

the sale of equity capital. Any sale of share capital, however, will result in

dilution to existing shareholders. If we are unable to raise additional funds

when required, we may be forced to delay our plan of operation and our entire

business may fail.

WE CURRENTLY DO NOT GENERATE REVENUES, AND AS A RESULT, WE FACE A HIGH RISK OF

BUSINESS FAILURE.

We do not hold an interest in any business or revenue generating property. We

are currently focusing on the location and acquisition of oil and gas

properties. We have not generated any revenues to date. In order to generate

revenues, we will incur substantial expenses in the location, acquisition and

development of a prospective property. We therefore expect to incur significant

losses into the foreseeable future. We recognize that if we are unable to

generate significant revenues from our activities, our entire business may fail.

There is no history upon which to base any assumption as to the likelihood that

we will be successful in our plan of operation, and we can provide no assurance

to investors that we will generate any operating revenues or achieve profitable

operations.

DUE TO THE SPECULATIVE NATURE OF THE EXPLORATION OF OIL AND GAS PROPERTIES,

THERE IS SUBSTANTIAL RISK THAT OUR BUSINESS WILL FAIL.

The business of oil and gas exploration and development is highly speculative

involving substantial risk. There is generally no way to recover any funds

expended on a particular property unless reserves are established and unless we

can exploit such reserves in an economic manner. We can provide investors with

no assurance that any property interest that we may acquire will provide

commercially exploitable reserves. Any expenditure by our company in connection

with locating, acquiring and developing an interest in an oil and gas property

may not provide or contain commercial quantities of reserves.

EVEN IF WE DISCOVER COMMERCIAL RESERVES, WE MAY NOT BE ABLE TO SUCCESSFULLY

OBTAIN COMMERCIAL PRODUCTION.

Even if we are successful in acquiring an interest in a property that has proven

commercial reserves of oil and gas, we will require significant additional funds

in order to place the property into commercial production. We can provide no

assurance to investors that we will be able to obtain the financing necessary to

extract such reserves.

IF WE ARE UNABLE TO HIRE AND RETAIN KEY PERSONNEL, WE MAY NOT BE ABLE TO

IMPLEMENT OUR PLAN OF OPERATION AND OUR BUSINESS MAY FAIL.

5

Our success will be largely dependent on our ability to hire and retain highly

qualified personnel. This is particularly true in the highly technical

businesses of oil and gas exploration. These individuals may be in high demand

and we may not be able to attract the staff we need. In addition, we may not be

able to afford the high salaries and fees demanded by qualified personnel, or we

may fail to retain such employees after they are hired. At present, we have not

hired any key personnel. Our failure to hire key personnel when needed will have

a significant negative effect on our business.

OUR COMMON STOCK IS ILLIQUID AND SHAREHOLDERS MAY BE UNABLE TO SELL THEIR

SHARES.

There is currently a limited market for our common stock and we can provide no

assurance to investors that a market will develop. If a market for our common

stock does not develop, our shareholders may not be able to re-sell the shares

of our common stock that they have purchased and they may lose all of their

investment. Public announcements regarding our company, changes in government

regulations, conditions in our market segment or changes in earnings estimates

by analysts may cause the price of our common shares to fluctuate substantially.

In addition, stock prices for junior oil and gas companies fluctuate widely for

reasons that may be unrelated to their operating results. These fluctuations may

adversely affect the trading price of our common shares.

PENNY STOCK RULES WILL LIMIT THE ABILITY OF OUR STOCKHOLDERS TO SELL THEIR

STOCK.

The Securities and Exchange Commission has adopted regulations which generally

define "penny stock" to be any equity security that has a market price (as

defined) less than $5.00 per share or an exercise price of less than $5.00 per

share, subject to certain exceptions. Our securities are covered by the penny

stock rules, which impose additional sales practice requirements on

broker-dealers who sell to persons other than established customers and

"accredited investors". The term "accredited investor" refers generally to

institutions with assets in excess of $5,000,000 or individuals with a net worth

in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly

with their spouse. The penny stock rules require a broker-dealer, prior to a

transaction in a penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document in a form prepared by the Securities and

Exchange Commission which provides information about penny stocks and the nature

and level of risks in the penny stock market. The broker-dealer also must

provide the customer with current bid and offer quotations for the penny stock,

the compensation of the broker-dealer and its salesperson in the transaction and

monthly account statements showing the market value of each penny stock held in

the customer's account. The bid and offer quotations, and the broker-dealer and

salesperson compensation information, must be given to the customer orally or in

writing prior to effecting the transaction and must be given to the customer in

writing before or with the customer's confirmation. In addition, the penny stock

rules require that prior to a transaction in a penny stock not otherwise exempt

from these rules; the broker-dealer must make a special written determination

that the penny stock is a suitable investment for the purchaser and receive the

purchaser's written agreement to the transaction. These disclosure requirements

may have the effect of reducing the level of trading activity in the secondary

market for the stock that is subject to these penny stock rules. Consequently,

these penny stock rules may affect the ability of broker-dealers to trade our

securities. We believe that the penny stock rules discourage investor interest

in and limit the marketability of our common stock.

THE FINANCIAL INDUSTRY REGULATORY AUTHORITY, OR FINRA, HAS ADOPTED SALES

PRACTICE REQUIREMENTS WHICH MAY ALSO LIMIT A SHAREHOLDER'S ABILITY TO BUY AND

SELL OUR STOCK.

In addition to the "penny stock" rules described above, FINRA has adopted rules

that require that in recommending an investment to a customer, a broker-dealer

must have reasonable grounds for believing that the investment is suitable for

that customer. Prior to recommending speculative low priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to

obtain information about the customer's financial status, tax status, investment

objectives and other information. Under interpretations of these rules, FINRA

believes that there is a high probability that speculative low priced securities

6

will not be suitable for at least some customers. FINRA requirements make it

more difficult for broker-dealers to recommend that their customers buy our

common stock, which may limit your ability to buy and sell our stock and have an

adverse effect on the market for its shares.

ITEM 2. PROPERTIES

We currently utilize space at the premises of Bruce Thomson, the officer and

director of the company. The company pays Mr. Thomson $125 per month rent. The

premises are located at 445 - 708 11th Avenue SW, Calgary, AB. The facilities

include an answering machine, a fax machine, computer and office equipment. We

intend to use these facilities for the time being until we feel we have outgrown

them. We currently have no investment policies as they pertain to real estate,

real estate interests or real estate mortgages.

ITEM 3. LEGAL PROCEEDINGS

We are not currently involved in any legal proceedings and we are not aware of

any pending or potential legal actions.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Effective August 12, 2008, we affected a 12 for one forward stock split of our

issued and outstanding common stock. As a result, our authorized capital remains

at 75,000,000 shares of common stock with a par value of $0.001 and our issued

and outstanding shares increased from 2,000,000 shares of common stock to

24,000,000 shares of common stock.

Also effective August 12, 2008, we have changed our name from "Oliver Creek

Resources Inc." to "Independence Energy Corp.". The change of name was approved

by our directors and a majority of our shareholders.

PART II

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

On October 12, 2006 our common stock was listed for quotation on the

Over-the-Counter Bulletin Board under the symbol OVCR. There has been no active

trading market and thus no high and low sales prices to report. On August 12,

2008, we have changed our name from "Oliver Creek Resources Inc." to

"Independence Energy Corp.". The name change became effective with the

Over-the-Counter Bulletin Board at the opening for trading on August 12, 2008

under the new stock symbol "IDNG".

SHARES AVAILABLE UNDER RULE 144

There are currently 12,000,000 shares of common stock that are considered

restricted securities under Rule 144 of the Securities Act of 1933. All

12,000,000 shares are held by our officer and director. In general, under Rule

144 as amended, a person who has beneficially owned and held restricted

securities for at least six months, including affiliates, may sell publicly

without registration under the Securities Act, within any three-month period,

assuming compliance with other provisions of the Rule, a number of shares that

do not exceed the greater of(i) one percent of the common stock then outstanding

or, (ii) the average weekly trading volume in the common stock during the four

calendar weeks preceding such sale.

7

HOLDERS

As of January 31, 2010, we have 24,000,000 Shares of $0.001 par value common

stock issued and outstanding held by 29 shareholders of record.

The stock transfer agent for our securities is Holladay Stock Transfer, 2939

North 67th Place, Scottsdale, Arizona 85251, telephone (480)481-3940.

DIVIDENDS

We have never declared or paid any cash dividends on our common stock. For the

foreseeable future, we intend to retain any earnings to finance the development

and expansion of our business, and we do not anticipate paying any cash

dividends on its common stock. Any future determination to pay dividends will be

at the discretion of the Board of Directors and will be dependent upon then

existing conditions, including our financial condition and results of

operations, capital requirements, contractual restrictions, business prospects,

and other factors that the board of directors considers relevant.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

RESULTS OF OPERATIONS

SUMMARY FOR YEARS ENDING JANUARY 31, 2010 AND 2009

Year Ended January 31,

2010 2009

-------- --------

Revenue $ Nil $ Nil

Operating Expenses $ 13,583 $ 24,790

Net Loss $ 13,583 $ 24,790

|

EXPENSES

Our operating expenses for the years ended January 31, 2010 and 2009 are

outlined in the table below:

Year Ended January 31,

2010 2009

-------- --------

General and administrative $ 3,583 $ 7,366

Professional fees $ 10,000 $ 17,424

Consulting fees $ 0 $ 0

|

REVENUE

We have not earned any revenues since our inception and we do not anticipate

earning revenues in the upcoming quarter.

8

EQUITY COMPENSATION

We currently do not have any stock option or equity compensation plans or

arrangements.

LIQUIDITY AND FINANCIAL CONDITION

WORKING CAPITAL

At At Percentage

January 31, January 31, Increase/

2010 2009 Decrease

-------- -------- --------

Current Assets $ 3,081 $ 6,068 -50%

Current Liabilities $ 11,796 $ 1,200 +983%

Working Capital (deficit) $ (8,715) $ 4,868 -279%

|

CASH FLOWS

Year Ended Year Ended

January 31, January 31,

2010 2009

-------- --------

Net Cash Used in Operating Activities $ 11,783 $ 24,785

Net Cash Provided by Investing Activities $ 0 $ 0

Net Cash Provided by Financing Activities $ 8,796 $ 0

DECREASE IN CASH DURING THE PERIOD $ 2,987 $ 24,785

|

We have generated no revenue since inception and have incurred $68,715 in

expenses through January 31, 2010. We had a net loss of $13,583 and $24,790 for

the years ended January 31, 2010 and 2009, respectively. These expenses

consisted of professional fees and administrative expenses.

Our cash in the bank at January 31, 2010 was $3,081. At the same time our

outstanding liabilities were $11,796. Cash provided by financing activities

since inception is as follows:

1. On November 30, 2005, a total of 1,000,000 shares of Common Stock were

issued to Mr. Thomson, a director, in exchange for cash in the amount

of $10,000, or $.01 per share.

2. During the months of April - June, 2006 1,000,000 units from the

Company's registered SB-2 offering were sold reflecting 1,000,000

units of common stock at issued price $0.05 per unit for a total of

$50,000. Each unit consisted of one share and one share purchase

warrant. Each share purchase warrant was valid for a period of two

years from the date of the prospectus, expiring on March 22, 2008.

None of the warrants were exercised prior to expiration.

3. Effective August 12, 2008, we affected a 12 for one forward stock

split of our issued and outstanding common stock. As a result, our

authorized capital remains at 75,000,000 shares of common stock with a

par value of $0.001 and our issued and outstanding shares increased

from 2,000,000 shares of common stock to 24,000,000 shares of common

stock.

GOING CONCERN

We are an exploration stage company and currently have no operations. Our

independent auditor has issued an audit opinion for the company which includes a

statement expressing substantial doubt as to our ability to continue as a going

concern.

9

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements that have or are reasonably likely to

have a current or future effect on our financial condition, changes in financial

condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources that is material to stockholders.

PLAN OF OPERATION

We have had one resource property to date known as the Thistle Claim located in

British Columbia, Canada. We completed Phase I of the exploration program on our

Thistle Claim which consisted of conducting detailed geological mapping of all

roads within and buttressing the claims and silt sampling of each drainage or

draw. Based on the information available to us from our Phase I exploration

program, we determined that the Thistle Claim did not, in all likelihood,

contain a commercially viable mineral deposit, and we therefore abandoned any

further exploration on the property.

As a result, we are investigating several other business opportunities to

enhance shareholder value, and are focused on the oil and gas industry with the

acquisition of oil and natural gas assets both in Canada and the United States.

These consist of natural gas production and oils sands exploration in Canada and

off-shore exploration in the Texas Gulf area of the Unites States. Subject to

completing due diligence and funding sources being available we intend to pursue

business opportunities in the oil and gas business.

We will require additional funding to proceed. We cannot provide investors with

any assurance that we will be able to raise sufficient funds to fund any work in

the oil and gas business.

10

ITEM 8. FINANCIAL STATEMENTS

Chang G. Park, CPA, Ph. D.

* 2667 CAMINO DEL RIO S. PLAZA B * SAN DIEGO * CALIFORNIA 92108-3707 *

* TELEPHONE (858)722-5953 * FAX (858) 761-0341 * FAX (858) 433-2979

* E-MAIL changgpark@gmail.com *

Report of Independent Registered Public Accounting Firm

To the Board of Directors of

Independence Energy corp.

(An Exploration Stage Company)

We have audited the accompanying balance sheets of Independence energy Corp.

(formerly Oliver Creek Resources, Inc.) (the exploration stage "Company") as of

January 31, 20010 and 2009 and the related statements of operations, changes in

shareholders' equity and cash flows for the years then ended and for the period

from November 30, 2005 (inception) to January 31, 2009. These financial

statements are the responsibility of the Company's management. Our

responsibility is to express an opinion on these financial statements based on

our audit.

We conducted our audit in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan

and perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement. An audit includes examining, on a

test basis, evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting principles used and

significant estimates made by management, as well as evaluating the overall

financial statement presentation. We believe that our audit provides a

reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in

all material respects, the financial positions of Independence energy Corp. as

of January 31, 2010 and 2009, and the results of its operations and its cash

flows for the years then ended and the period of November 30, 2005 (inception)

to January 31, 2010 in conformity with U.S. generally accepted accounting

principles.

The financial statements have been prepared assuming that the Company will

continue as a going concern. As discussed in Note 3 to the financial statements,

the Company's losses from operations raise substantial doubt about its ability

to continue as a going concern. The financial statements do not include any

adjustments that might result from the outcome of this uncertainty.

/s/ Chang Park

-------------------------------

CHANG G. PARK, CPA

April 28, 2009

San Diego, CA. 92108

|

Member of the California Society of Certified Public Accountants

Registered with the Public Company Accounting Oversight Board

11

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

Balance Sheets

As of As of

January 31, January 31,

2010 2009

-------- --------

ASSETS

CURRENT ASSETS

Cash $ 3,081 $ 6,068

-------- --------

TOTAL CURRENT ASSETS 3,081 6,068

-------- --------

$ 3,081 $ 6,068

======== ========

LIABILITIES & STOCKHOLDERS' EQUITY (DEFICIT)

CURRENT LIABILITIES

Accounts Payable 3,000 1,000

Due to Related Party -- 200

Loan Payable to Director 8,796 --

-------- --------

TOTAL CURRENT LIABILITIES 11,796 1,200

-------- --------

TOTAL LIABILITIES 11,796 1,200

STOCKHOLDERS' EQUITY (DEFICIT)

Common stock, ($0.001 par value, 75,000,000 shares

authorized; 24,000,000 shares issued and outstanding

as of January 31, 2010 and January 31, 2009) 24,000 24,000

Additional paid-in capital 36,000 36,000

Deficit accumulated during exploration stage (68,715) (55,132)

-------- --------

TOTAL STOCKHOLDERS' EQUITY (DEFICIT) (8,715) 4,868

-------- --------

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY (DEFICIT) $ 3,081 $ 6,068

======== ========

|

See Notes to Financial Statements

12

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

Statements of Operations

November 30, 2005

(inception)

Year Ended Year Ended through

January 31, January 31, January 31,

2010 2009 2010

------------ ------------ ------------

REVENUES

Revenues $ -- $ -- $ --

------------ ------------ ------------

TOTAL REVENUES -- -- --

OPERATING COSTS

Administrative Expenses 3,583 7,366 28,488

Professional fees 10,000 17,424 40,324

------------ ------------ ------------

TOTAL OPERATING COSTS 13,583 24,790 68,812

OTHER INCOME (EXPENSES)

Gain from currency exchange -- -- 97

------------ ------------ ------------

TOTAL OTHER INCOME -- -- 97

------------ ------------ ------------

NET INCOME (LOSS) $ (13,583) $ (24,790) $ (68,715)

============ ============ ============

BASIC AND DILUTED EARNINGS (LOSS) PER SHARE $ (0.00) $ (0.00)

============ ============

WEIGHTED AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING 24,000,000 24,000,000

============ ============

|

See Notes to Financial Statements

13

INDEPENDECE ENERGY CORP.

(An Exploration Stage Company)

Statement of Changes in Stockholders' Equity

From November 30, 2005 (Inception) through January 31, 2010

Deficit

Accumulated

Common Additional During

Common Stock Paid-in Exploration

Stock Amount Capital Stage Total

----- ------ ------- ----- -----

BALANCE, NOVEMBER 30, 2005 -- $ -- $ -- $ -- $ --

Stock issued for cash on November 30, 2005

@ $0.000833 per share 12,000,000 12,000 (2,000) 10,000

Net loss, January 31, 2006 (8) (8)

----------- -------- -------- --------- --------

Balance, January 31, 2006 12,000,000 12,000 (2,000) (8) 9,992

----------- -------- -------- --------- --------

Stock issued for cash from SB-2 offering

@ $0.00416667 per share 12,000,000 12,000 38,000 50,000

Net loss, January 31, 2007 (14,303) (14,303)

----------- -------- -------- --------- --------

Balance, January 31, 2007 24,000,000 24,000 36,000 (14,310) 45,690

----------- -------- -------- --------- --------

Net loss, January 31, 2008 (16,032) (16,032)

----------- -------- -------- --------- --------

Balance, January 31, 2008 24,000,000 24,000 36,000 (30,342) 29,658

----------- -------- -------- --------- --------

Net loss, January 31, 2009 (24,790) (24,790)

----------- -------- -------- --------- --------

BALANCE, JANUARY 31, 2009 24,000,000 24,000 36,000 (55,132) 4,868

----------- -------- -------- --------- --------

Net loss, January 31, 2010 (13,583) (13,583)

----------- -------- -------- --------- --------

BALANCE, JANUARY 31, 2010 24,000,000 $ 24,000 $ 36,000 $ (68,715) $ (8,715)

=========== ======== ======== ========= ========

|

Note: On August 12, 2008 the Company effected a 12 for 1 forward split of its

share capital such that every one share of common stock issued and

outstanding prior to the split was exchanged for twelve post-split shares

of common stock.

See Notes to Financial Statements

14

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

Statements of Cash Flows

November 30, 2005

(inception)

Year Ended Year Ended through

January 31, January 31, January 31,

2010 2009 2010

-------- -------- --------

CASH FLOWS FROM OPERATING ACTIVITIES

Net income (loss) $(13,583) $(24,790) $(68,715)

Adjustments to reconcile net loss to net cash

provided by (used in) operating activities:

Changes in operating assets and liabilities:

Increase (decrease) in Accounts Payable 2,000 -- 3,000

Increase (decrease) in Due to Related Party (200) 5 --

-------- -------- --------

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES (11,783) (24,785) (65,715)

CASH FLOWS FROM INVESTING ACTIVITIES

NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES -- -- --

CASH FLOWS FROM FINANCING ACTIVITIES

Increase (decrease) in Loan Payable to Director 8,796 -- 8,796

Issuance of common stock -- -- 24,000

Additional paid-in capital -- -- 36,000

-------- -------- --------

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES 8,796 -- 68,796

-------- -------- --------

NET INCREASE (DECREASE) IN CASH (2,987) (24,785) 3,081

CASH AT BEGINNING OF YEAR 6,068 30,853 --

-------- -------- --------

CASH AT END OF YEAR $ 3,081 $ 6,068 $ 3,081

======== ======== ========

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

Cash paid during year for:

Interest $ -- $ -- $ --

======== ======== ========

Income Taxes $ -- $ -- $ --

======== ======== ========

|

See Notes to Financial Statements

15

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2010

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Independence Energy Corp. (formerly Oliver Creek Resources Inc., the "Company")

was incorporated under the laws of the State of Nevada on November 30, 2005. The

Company was formed to engage in the acquisition, exploration and development of

natural resource properties.

The Company is in the exploration stage. Its activities to date have been

limited to capital formation, organization and development of its business plan.

The Company has completed the initial phase of its exploration program.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. BASIS OF ACCOUNTING

The Company's financial statements are prepared using the accrual method of

accounting. The Company has elected a January 31, year-end.

B. BASIC NET LOSS PER SHARE

Basic loss per share includes no dilution and is computed by dividing loss

available to common stockholders by the weighted average number of common shares

outstanding for the period. Dilutive loss per share reflects the potential

dilution of securities that could share in the losses of the Company. Because

the Company does not have any potentially dilutive securities, the accompanying

presentation is only of basic loss per share. Diluted earnings (loss) per share

are the same as basic earnings (loss) per share due to the lack of dilutive

items in the Company.

C. CASH EQUIVALENTS

The Company considers all highly liquid investments purchased with an original

maturity of three months or less to be cash equivalents.

D. USE OF ESTIMATES AND ASSUMPTIONS

The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and

the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates.

16

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2010

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

E. INCOME TAXES

Income taxes are provided in accordance with ASC 740, INCOME TAXES. A deferred

tax asset or liability is recorded for all temporary differences between

financial and tax reporting and net operating loss carry forwards. Deferred tax

expense (benefit) results from the net change during the year of deferred tax

assets and liabilities. Deferred tax assets are reduced by a valuation allowance

when, in the opinion of management, it is more likely than not that some portion

or all of the deferred tax assets will not be realized. Deferred tax assets and

liabilities are adjusted for the effects of changes in tax laws and rates on the

date of enactment.

F. REVENUE

The Company records revenue on the accrual basis when all goods and services

have been performed and delivered, the amounts are readily determinable, and

collection is reasonably assured. The Company has not generated any revenue

since its inception.

G. ADVERTISING

The Company will expense its advertising when incurred. There has been no

advertising since inception.

H. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In February 2010, the FASB issued Accounting Standards Update ("ASU")

No.2010-09, "Amendments to Certain Recognition and Disclosure Requirements"

("ASU2010-09"), which is included in the FASB Accounting Standards Codification

(the "ASC") Topic 855 (Subsequent Events). ASU 2010-09 clarifies that an SEC

filer is required to evaluate subsequent events through the date that the

financial statements are issued. ASU 2010-09 is effective upon the issuance of

the final update and did not have a significant impact on the Company's

financial statements.

In June 2009, the FASB issued guidance now codified as ASC 105, Generally

Accepted Accounting Principles as the single source of authoritative accounting

principles recognized by the FASB to be applied by nongovernmental entities in

the preparation of financial statements in conformity with U.S. GAAP, aside from

those issued by the SEC. ASC 105 does not change current U.S. GAAP, but is

intended to simplify user access to all authoritative U.S. GAAP by providing all

authoritative literature related to a particular topic in one place. The

adoption of ASC 105 did not have a material impact on the Company's financial

statements, but did eliminate all references to pre-codification standards.

17

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2010

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

The Company has implemented all new accounting pronouncements that are in effect

and that may impact its financial statements and does not believe that there are

any other new accounting pronouncements that have been issued that might have a

material impact on its financial position or results of operations.

NOTE 3. GOING CONCERN

The accompanying financial statements are presented on a going concern basis.

The Company had no operations during the period from November 30, 2005

(inception) to January 31, 2010 and generated a net loss of $68,715. This

condition raises substantial doubt about the Company's ability to continue as a

going concern. The Company is currently in the exploration stage and has minimal

expenses, though it currently has a cash balance of $3,081 it has insufficient

cash to cover the expenses they will incur during the next twelve months.

NOTE 4. RELATED PARTY TRANSACTIONS

The Company neither owns nor leases any real or personal property. From

September 1, 2008 the Company has paid a director $100 per month for use of

office space and service. Bruce Thomson, sole officer and director of the

Company is involved in other business activities and may, in the future, become

involved in other business opportunities as they become available, he may face a

conflict in selecting between the Company and his other business interests. The

Company has not formulated a policy for the resolution of such conflicts.

As of January 31, 2010, there is a loan payable due to Bruce Thomson for $8,796,

with no specific repayment terms.

NOTE 5. INCOME TAXES

As of January 31, 2010

----------------------

Deferred tax assets:

Net operating tax carryforwards $ 23,363

Other 0

--------

Gross deferred tax assets 23,363

Valuation allowance (23,363)

--------

Net deferred tax assets $ 0

========

Realization of deferred tax assets is dependent upon sufficient future taxable

|

income during the period that deductible temporary differences and carryforwards

are expected to be available to reduce taxable income. As the achievement of

required future taxable income is uncertain, the Company recorded a valuation

allowance.

18

INDEPENDENCE ENERGY CORP.

(An Exploration Stage Company)

Notes to Financial Statements

January 31, 2010

NOTE 6. NET OPERATING LOSSES

As of January 31, 2010, the Company has a net operating loss carryforwards of

approximately $68,715. Net operating loss carryforward expires twenty years from

the date the loss was incurred.

NOTE 7. STOCK TRANSACTIONS

Transactions, other than employees' stock issuance, are in accordance with

paragraph 8 of SFAS 123. Thus issuances shall be accounted for based on the fair

value of the consideration received. Transactions with employees' stock issuance

are in accordance with paragraphs (16-44) of SFAS 123. These issuances shall be

accounted for based on the fair value of the consideration received or the fair

value of the equity instruments issued, or whichever is more readily

determinable.

On November 30, 2005 the Company issued a total of 12,000,000 shares of common

stock to one director for cash in the amount of $10,000.

On June 12, 2006 the Company issued 12,000,000 units from the Company's

registered SB-2 offering reflecting 12,000,000 shares of common stock.

On August 12, 2008 the Company effected a 12 for 1 forward split of its issued

and outstanding share capital such that every one share of common stock issued

and outstanding prior to the split was exchanged for twelve post-split shares of

common stock. The number of shares referred to in the previous paragraphs is

post-split number of shares. The Company's post-split authorized capital remains

unchanged at 75,000,000 shares of common stock with a par value of $0.001 per

share. All share amounts have been retroactively adjusted for all periods

presented.

As of January 31, 2010 the Company had 24,000,000 shares of common stock issued

and outstanding.

NOTE 8. STOCKHOLDERS' EQUITY

The stockholders' equity section of the Company contains the following class of

capital stock as of January 31, 2010:

Common stock, $ 0.001 par value: 75,000,000 shares authorized; 24,000,000 shares

issued and outstanding.

NOTE 9. SUBSEQUENT EVENTS

The Company has evaluated subsequent events through the date the financial

statements were issued and filed with the Securities and Exchange Commission.

The Company has determined that there were no such events that warrant

disclosure or recognition in the financial statements.

19

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES

Under the supervision and with the participation of our management, including

our principal executive officer and the principal financial officer (our

president), we have conducted an evaluation of the effectiveness of the design

and operation of our disclosure controls and procedures, as defined in Rules

13a-15(e) and 15d-15(e) under the Securities and Exchange Act of 1934, as of the

end of the period covered by this report. Based on this evaluation, our

principal executive officer and principal financial officer concluded as of the

evaluation date that our disclosure controls and procedures were effective such

that the material information required to be included in our Securities and

Exchange Commission reports is accumulated and communicated to our management,

including our principal executive and financial officer, recorded, processed,

summarized and reported within the time periods specified in Securities and

Exchange Commission rules and forms relating to our company, particularly during

the period when this report was being prepared.

MANAGEMENT'S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining adequate internal

control over financial reporting, as such term is defined in Rules 13a-15(f) and

15d-15(f) under the Exchange Act, for the company.

Internal control over financial reporting includes those policies and procedures

that: (1) pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reflect the transactions and dispositions of our assets;

(2) provide reasonable assurance that transactions are recorded as necessary to

permit preparation of financial statements in accordance with generally accepted

accounting principles, and that our receipts and expenditures are being made

only in accordance with authorizations of its management and directors; and (3)

provide reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use or disposition of our assets that could have a

material effect on the financial statements. Management recognizes that there

are inherent limitations in the effectiveness of any system of internal control,

and accordingly, even effective internal control can provide only reasonable

assurance with respect to financial statement preparation and may not prevent or

detect material misstatements. In addition, effective internal control at a

point in time may become ineffective in future periods because of changes in

conditions or due to deterioration in the degree of compliance with our

established policies and procedures.

A material weakness is a significant deficiency, or combination of significant

deficiencies, that results in there being a more than remote likelihood that a

material misstatement of the annual or interim financial statements will not be

prevented or detected.

Under the supervision and with the participation of our president, management

conducted an evaluation of the effectiveness of our internal control over

financial reporting, as of January 31, 2010, based on the framework set forth in

Internal Control-Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission (COSO). Based on our evaluation under

this framework, management concluded that our internal control over financial

reporting was not effective as of the evaluation date due to the factors stated

below.

20

Management assessed the effectiveness of the Company's internal control over

financial reporting as of evaluation date and identified the following material

weaknesses:

INSUFFICIENT RESOURCES: We have an inadequate number of personnel with requisite

expertise in the key functional areas of finance and accounting.

INADEQUATE SEGREGATION OF DUTIES: We have an inadequate number of personnel to

properly implement control procedures.

LACK OF AUDIT COMMITTEE & OUTSIDE DIRECTORS ON THE COMPANY'S BOARD OF DIRECTORS:

We do not have a functioning audit committee or outside directors on our board

of directors, resulting in ineffective oversight in the establishment and

monitoring of required internal controls and procedures.

Management is committed to improving its internal controls and will (1) continue

to use third party specialists to address shortfalls in staffing and to assist

the Company with accounting and finance responsibilities, (2) increase the

frequency of independent reconciliations of significant accounts which will

mitigate the lack of segregation of duties until there are sufficient personnel

and (3) may consider appointing outside directors and audit committee members in

the future.

Management, including our president, has discussed the material weakness noted

above with our independent registered public accounting firm. Due to the nature

of this material weakness, there is a more than remote likelihood that

misstatements which could be material to the annual or interim financial

statements could occur that would not be prevented or detected.

This annual report does not include an attestation report of our registered

public accounting firm regarding internal control over financial reporting.

Management's report was not subject to attestation by the our registered public

accounting firm pursuant to temporary rules of the SEC that permit us to provide

only management's report in this annual report.

CHANGES IN INTERNAL CONTROLS OVER FINANCIAL REPORTING

There have been no changes in our internal control over financial reporting that

occurred during the last fiscal quarter for our fiscal year ended January 31,

2010 that have materially affected, or are reasonably likely to materially

affect, our internal control over financial reporting.

21

PART III

ITEM 10. DIRECTOR AND EXECUTIVE OFFICER

The director and officer of Independence Energy Corp., whose one year term will

expire 11/30/10, or at such a time as his successor(s) shall be elected and

qualified is as follows:

Name & Address Age Position Date First Elected Term Expires

-------------- --- -------- ------------------ ------------

Bruce Thomson, B.A.Sc. 52 President, 11/30/05 11/30/10

68 Everwillow Park SW Secretary,

Calgary AB Treasurer,

Canada T2Y 5C6 CFO, CEO &

Director

|

The foregoing person is a promoter of Independence Energy Corp., as that term is

defined in the rules and regulations promulgated under the Securities and

Exchange Act of 1933.

Directors are elected to serve until the next annual meeting of stockholders and

until their successors have been elected and qualified. Officers are appointed

to serve until the meeting of the board of directors following the next annual

meeting of stockholders and until their successors have been elected and

qualified.

Mr. Thomson currently devotes 2 - 5 hours per week to company matters. Mr.

Thomson intends to devote as much time as the board of directors deems necessary

to manage the affairs of the company in the future.

No executive officer or director of the corporation has been the subject of any

order, judgment, or decree of any court of competent jurisdiction, or any

regulatory agency permanently or temporarily enjoining, barring, suspending or

otherwise limiting him or her from acting as an investment advisor, underwriter,

broker or dealer in the securities industry, or as an affiliated person,

director or employee of an investment company, bank, savings and loan

association, or insurance company or from engaging in or continuing any conduct

or practice in connection with any such activity or in connection with the

purchase or sale of any securities.

No executive officer or director of the corporation has been convicted in any

criminal proceeding (excluding traffic violations) or is the subject of a

criminal proceeding which is currently pending.

RESUME

Bruce Thomson has been the President, CEO, Treasurer, CFO, and Director of the

Company since inception. From April 2005 to the present he has been President,

CEO and a Director of Premium Petroleum Inc. In August 2005, Premium Petroleum

Inc. was acquired by Premium Petroleum Corp., a publicly-traded Wyoming

corporation trading on the Pink Sheets that is in business of oil and gas

exploration and development; from which time Bruce Thomson has been the

President, CEO, and director. From 2000 to the present, he has been a

self-employed business consultant involved in venture capital finance.

Mr. Thomson graduated in 1970 from the University of British Columbia located in

Vancouver, BC, obtaining the degree of Bachelor of Applied Science in Electrical

Engineering (B.A.Sc.). Through option courses he also completed 50% of the

required credits toward an MBA degree while studying engineering. In 1991 he

passed the Canadian Securities Course from the Canadian Securities Institute and

22

obtained a securities license allowing him to practice as an investment advisor

to do venture capital financing and retail brokerage in Canada, which he did

until April 2000.

During the period of 1982 to 1987 Mr. Thomson was a founding shareholder and

director of Hycroft Resources and Development Corporation, a successful gold

mining company which traded on the Toronto Stock Exchange. After raising over

$50,000,000 in funding, the company's Cowfoot Project near Winnemucca, Nevada,

was put into production and yielded over 100,000 ounces of gold per year for 12

years.

Mr. Thomson has over 30 years of entrepreneurial business experience in private

and public companies, with expertise in management, marketing, and finance.

ITEM 11. EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

Change in

Pension

Value and

Non-Equity Nonqualified

Incentive Deferred All

Name and Plan Compen- Other

Principal Stock Option Compen- sation Compen-

Position Year Salary Bonus Awards Awards sation Earnings sation Totals

------------ ---- ------ ----- ------ ------ ------ -------- ------ ------

B Thomson 2010 0 0 0 0 0 0 0 0

CEO, President 2009 0 0 0 0 0 0 0 0

& Director 2008 0 0 0 0 0 0 0 0

|

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

Option Awards Stock Awards

----------------------------------------------------------------- ----------------------------------------------

Equity

Incentive

Equity Plan

Incentive Awards:

Plan Market or

Awards: Payout

Equity Number of Value of

Incentive Number Unearned Unearned

Plan Awards; of Market Shares, Shares,

Number of Number of Number of Shares Value of Units or Units or

Securities Securities Securities or Units Shares or Other Other

Underlying Underlying Underlying of Stock Units of Rights Rights

Unexercised Unexercised Unexercised Option Option That Stock That That That

Options (#) Options (#) Unearned Exercise Expiration Have Not Have Not Have Not Have Not

Name Exercisable Unexercisable Options (#) Price Date Vested(#) Vested Vested Vested

---- ----------- ------------- ----------- ----- ---- --------- ------ ------ ------

B Thomson 0 0 0 0 0 0 0 0 0

|

23

DIRECTOR COMPENSATION

Change in

Pension

Value and

Fees Non-Equity Nonqualified

Earned Incentive Deferred

Paid in Stock Option Plan Compensation All Other

Name Cash Awards Awards Compensation Earnings Compensation Total

---- ---- ------ ------ ------------ -------- ------------ -----

B Thomson 0 0 0 0 0 0 0

|

There are no current employment agreements between the company and its executive

officer.

On November 30, 2005, a total of 1,000,000 shares of Common Stock were issued to

Mr. Thomson in exchange for cash in the amount of $10,000 U.S., or $.01 per

share. The terms of these stock issuances were as fair to the company, in the

opinion of the Board of Directors, as could have been made with an unaffiliated

third party. In making this determination they relied upon the fact that the

1,000,000 shares were valued at $0.01and purchased for $10,000 in cash.

Effective August 12, 2008, we affected a 12 for one forward stock split of our

issued and outstanding common stock. As a result Mr. Thomson now has a total of

12,000,000 shares of our common stock.

The officer currently devotes an immaterial amount of time to manage the affairs

of the company. Mr. Thomson currently devotes approximately 2 - 5 hours per

week. He has agreed to work with no remuneration until such time as the company

receives sufficient revenues necessary to provide management salaries. At this

time, management cannot accurately estimate when sufficient revenues will occur

to implement this compensation, or what the amount of the compensation will be.

There are no annuity, pension or retirement benefits proposed to be paid to

officers, directors or employees in the event of retirement at normal retirement

date pursuant to any presently existing plan provided or contributed to by the

company or any of its subsidiaries, if any.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information on the ownership of Independence

Energy's voting securities by officers, directors and major shareholders as well

as those who own beneficially more than five percent of our common stock:

Name & Address No. of Percentage of

of Beneficial Owner Shares Ownership

------------------- ------ ---------

Bruce Thomson 12,000,000 50%

68 Everwillow Park SW

Calgary, AB

Canada T2Y 5C6

All Officers and

Directors as a Group 12,000,000 50%

----------

|

(1) The person named above may be deemed to be a "parent" and "promoter" of the

Company, within the meaning of such terms under the Securities Act of 1933,

as amended, by virtue of his direct holdings in the Company.

24

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The principal executive office and telephone number are provided by Mr. Thomson,

the officer and a director of the corporation. Between February 1, 2006 and

January 31, 2007 the company paid Mr. Thomson $100 per month rent for the use of

the premises. Beginning in September 2008 the company again began paying Mr.

Thomson $100 a month for the use of the premises.

As of January 31, 2010, there is a total of $8,796 that is owed to Bruce Thomson

by the Company for expenses that he has paid on behalf of the company. The loan

is interest free and payable on demand.

On November 30, 2005, a total of 1,000,000 shares of Common Stock were issued to

Mr. Thomson in exchange for $10,000 US, or $.01 per share. All of such shares

are "restricted" securities, as that term is defined by the Securities Act of

1933, as amended, and are held by an officer and director of the Company. (See

"Principal Stockholders".) Effective August 12, 2008, we affected a 12 for one

forward stock split of our issued and outstanding common stock. As a result Mr.

Thomson now has a total of 12,000,000 shares of our common stock.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

The total fees charged to the company for audit services were $10,000, for

audit-related services were $Nil, for tax services were $Nil and for other

services were $Nil during the year ended January 31, 2010.

The total fees charged to the company for audit services were $10,000, for

audit-related services were $Nil, for tax services were $Nil and for other

services were $Nil during the year ended January 31, 2009.

25

PART IV

ITEM 15. EXHIBITS

The following exhibits are included with this filing:

Exhibit

Number Description

------ -----------

* 3(i) Articles of Incorporation

* 3(ii) Bylaws

31 Sec. 302 Certification of CEO/CFO

32 Sec. 906 Certification of CEO/CFO

|

SIGNATURES

In accordance with the requirements of the Securities Act of 1933, the

registrant certifies that it has reasonable grounds to believe it meets all of

the requirements for filing Form 10-K and authorized this registration statement

to be signed on its behalf by the undersigned, in the city of Calgary, province

of Alberta, on April 26, 2010.

Independence Energy Corp.

/s/ Bruce Thomson

-------------------------------------

By: Bruce Thomson

(Principal Executive Officer)

|

In accordance with the requirements of the Securities Act of 1933, this

registration statement was signed by the following person in the capacities and

date stated.

/s/ Bruce Thomson April 26, 2010

------------------------------------- --------------

Bruce Thomson, President & Director Date

(Principal Executive Officer,

Principal Financial Officer,

Principal Accounting Officer)

|

26

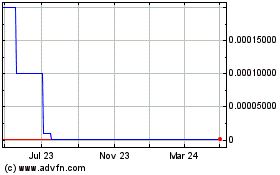

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Jun 2024 to Jul 2024

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Jul 2023 to Jul 2024