Inca Worldwide (OTC:QEDN) announces that it will introduce Sacha Inchi in the US and Canadian Market.

August 09 2019 - 10:59AM

InvestorsHub NewsWire

Inca Worldwide (OTC:QEDN) announces

that it will introduce Sacha Inchi in the US and Canadian

Market.

August 9, 2019 -- InvestorsHub NewsWire --

GMS has enough product to start the Daymon Contract and to start

selling on Amazon. Amazon has already give GMS / INCA USD 100,000

on AWS credits.

Colombia has over 2,200 hectares of Sacha Inchi planted and GMS has

contracted with enough farmers to bring products to the market.

Sacha Inchi is a seed rich in Omega 3,6,9 and a complete protein

with all 9 amino acids. Sacha Inchi is a real superfood that can

penetrate the ethnic market, the non-GMO market, Vegan food, the

gluten-free market, the pet food market, the non-lactose milk

market, and Omega markets these markets are estimated to be over

107 billion dollars by 2020. Today the CEO will be discussing with

Daymon the best strategy to start the Daymon contract. The ministry

of exports in Colombia is working with GMS to open an account with

Amazon and to start delivering products to Amazon warehouse. Kate

Bahnsen CEO said:" We are happy to be in a position to bring Sacha

Inchi to the USA market and to start working with Daymon and Amazon

to bring our Sacha Inchi Snacks to our shareholders and future

consumers. Thank you for your support"

Nanny Katharina (Kate) Bahnsen

CEO of Inca Worldwide

CFO of Cacique Mining

Representante Legal Green Mine

Solutions (GMS)

COL:

57(310) 379-1039

USA(702)490-5925

https://twitter.com/IncaSnacks

https://www.instagram.com/sachainchiandkate/

Email: katebahnsen@incaworldwide.com

Caution

Concerning Forward-Looking Statements:

Our public communications and SEC filings may

contain "forward-looking statements" – that is, statements related

to future, not past, events. In this context, forward-looking

statements often address our expected future business and financial

performance and financial condition, and often contain words such

as "expect," "anticipate," "intend," "plan," "believe," "seek,"

"see," "will," "would," or "target."

Forward-looking statements by their nature

address matters that are, to different degrees, uncertain, such as

statements about our announced plan to reduce the size of our

financial services businesses, including expected cash and non-cash

charges associated with this plan and earnings per share of QED

retained businesses (Verticals); expected income; earnings per

share; revenues; organic growth; growth and productivity associated

with our Digital business; margins; cost structure; restructuring

charges; acquisition-related synergies; cash flows; returns on

capital and investment; capital expenditures, capital allocation or

capital structure; and dividends.

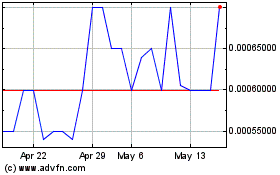

QED Connect (PK) (USOTC:QEDN)

Historical Stock Chart

From Oct 2024 to Nov 2024

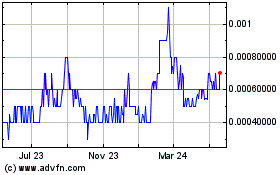

QED Connect (PK) (USOTC:QEDN)

Historical Stock Chart

From Nov 2023 to Nov 2024