Current Report Filing (8-k)

September 03 2021 - 3:55PM

Edgar (US Regulatory)

0001351573

false

0001351573

2021-08-30

2021-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: August 30, 2021

PURE

HARVEST CORPORATE GROUP, INC.

(Name

of registrant as specified in its charter)

|

Colorado

|

333-212055

|

71-0942431

|

|

State

of Incorporation

|

Commission

File Number

|

IRS

Employer Identification No.

|

7400

E. Crestline Circle, #130

Greenwood Village, CO 80111

Address of principal executive offices

(800)

924-3716

Telephone

number, including area code

Former

name or former address if changed since last report

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

|

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section

12(b) of the Act:

|

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

None

|

N/A

|

N/A

|

Indicate by check mark

whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

Emerging Growth Company [X]

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13a of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

August 26, 2021, Pure Harvest Corporate Group, Inc. (the “Company”) completed the sale of a Promissory Note in the principal

amount of $400,000 (the “Note”) to AJB Capital Investments, LLC (the “Purchaser”) for a purchase price of $376,000,

in a private transaction exempt from registration under the Securities Act of 1933, as amended, in reliance on exemptions provided by

Section 4(a)(2) and Rule 506(b) of Regulation D promulgated thereunder. The Purchaser was an accredited or otherwise sophisticated investor

who had access to business and financial information on the Company. The Company paid Purchaser’s legal fees of $10,000 and $8,000

in finder’s fees in connection with the sale of the Note. After payment of the legal fees and finder’s fees and closing cost,

the sale of the Note resulted in $358,000 in net proceeds to the Company. The net proceeds from the sale will be used for working capital.

The

Note matures on February 25, 2022 (the “Maturity Date”), bears interest at a rate of 5% per annum for the first three months

and 10% per annum thereafter, and, following an event of default only, is convertible into shares of the Company’s common stock

at a conversion price equal to the lesser of 90% of the lowest trading price during (i) the 20 trading day period preceding the issuance

date of the note, or (ii) the 20 trading day period preceding date of conversion of the Note. The Note is also subject to covenants,

events of defaults, penalties, default interest and other terms and conditions customary in transactions of this nature.

Pursuant

to the terms of the Securities Purchase Agreement (the “SPA”), the Company paid a commitment fee to the Purchaser in the

amount of $220,000 (the “Commitment Fee”) in the form of 440,000 shares of the Company’s common stock (the “Commitment

Fee Shares”). During the six-month period following the six-month anniversary of the closing date, the Purchaser shall be entitled

to be issued additional shares of common stock of the Company to the extent the Purchaser’s sale of the Commitment Fee Shares results

in net proceeds to the Purchaser of an amount less than the Commitment Fee. If the Company repays the Note on or before the Maturity

Date, the Company may redeem 220,000 of the Commitment Fee Shares at a total redemption price of $1.00.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities

The

information set forth under Item 1.01 is incorporated herein by reference.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

August 30, 2021

PURE

HARVEST CORPORATE GROUP, INC.

PURE

HARVEST CORPORATE GROUP, INC.

Chief Executive Officer

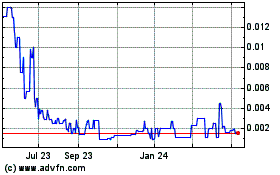

Pure Harvest Corporate (PK) (USOTC:PHCG)

Historical Stock Chart

From May 2024 to Jun 2024

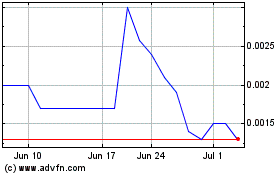

Pure Harvest Corporate (PK) (USOTC:PHCG)

Historical Stock Chart

From Jun 2023 to Jun 2024