0000882800

false

Q2

--12-31

P3Y

0000882800

2023-01-01

2023-06-30

0000882800

2023-06-30

0000882800

2022-12-31

0000882800

us-gaap:NonrelatedPartyMember

2023-06-30

0000882800

us-gaap:NonrelatedPartyMember

2022-12-31

0000882800

us-gaap:RelatedPartyMember

2023-06-30

0000882800

us-gaap:RelatedPartyMember

2022-12-31

0000882800

us-gaap:SeriesEPreferredStockMember

2023-06-30

0000882800

us-gaap:SeriesEPreferredStockMember

2022-12-31

0000882800

us-gaap:SeriesFPreferredStockMember

2023-06-30

0000882800

us-gaap:SeriesFPreferredStockMember

2022-12-31

0000882800

2023-04-01

2023-06-30

0000882800

2022-04-01

2022-06-30

0000882800

2022-01-01

2022-06-30

0000882800

2021-12-31

0000882800

2022-06-30

0000882800

us-gaap:VehiclesMember

2023-06-30

0000882800

srt:MinimumMember

us-gaap:OfficeEquipmentMember

2023-06-30

0000882800

srt:MaximumMember

us-gaap:OfficeEquipmentMember

2023-06-30

0000882800

us-gaap:EquipmentMember

2023-06-30

0000882800

PACV:TradeNameMember

PACV:SanDiegoFarmersOutletIncMember

2023-06-30

0000882800

PACV:TradeNameMember

PACV:SeaportMeatCompanysMember

2023-06-30

0000882800

PACV:WholesaleCustomerRelationshipsMember

PACV:SanDiegoFarmersOutletIncMember

2023-06-30

0000882800

PACV:WholesaleCustomerRelationshipsMember

PACV:SeaportMeatCompanysMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:HenryMahgereftehMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:HenryMahgereftehMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:MrAdvanceMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:MrAdvanceMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:DiagonalLendingMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:DiagonalLendingMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:ClearThinkCapitalPartnersMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:ClearThinkCapitalMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:LGHInvestmentsMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:LGHInvestmentMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:JeffersonCapitalMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:JeffersonCapitalMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:SmallBusinessAdministrationLoanMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:SmallBusinessAdministrationLoanMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:DicerMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:DicerMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:TCAGlobalFundMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:TCAGlobalFundMember

2023-01-01

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:TCAGlobalFundTwoMember

2023-06-30

0000882800

PACV:PromissoryNoteMember

PACV:TCAGlobalFundTwoMember

2023-01-01

2023-06-30

0000882800

PACV:CapCallMember

2023-06-30

0000882800

PACV:CapCallMember

2023-01-01

2023-06-30

0000882800

PACV:NewCoCapitalGroupMember

2023-06-30

0000882800

PACV:NewCoCapitalGroupMember

2023-01-01

2023-06-30

0000882800

PACV:LendsParkCorpMember

2023-06-30

0000882800

PACV:LendsParkCorpMember

2023-01-01

2023-06-30

0000882800

PACV:FinancingArrangementMember

2023-02-23

0000882800

PACV:FinancingArrangementMember

2023-06-30

0000882800

PACV:TCAGlobalFundMember

2018-05-01

0000882800

PACV:TCAGlobalFundMember

2023-06-30

0000882800

PACV:TCASpecialSituationsCreditStrategiesICAVMember

2019-12-17

0000882800

PACV:TCASpecialSituationsCreditStrategiesICAVMember

2023-06-30

0000882800

PACV:SeaportGroupEnterprisesLLCMember

2020-07-20

0000882800

PACV:SeaportGroupEnterprisesLLCMember

2020-07-19

2020-07-20

0000882800

PACV:RevenueBasedFactoringAgreementWithCapCallMember

PACV:SeaportGroupEnterpirsesLLCMember

2020-09-30

0000882800

PACV:RevenueBasedFactoringAgreementWithLendsparkCapitalMember

PACV:SeaportGroupEnterpirsesLLCMember

2022-06-30

0000882800

PACV:RevenueBasedFactoringAgreementWithLendsparkCapitalMember

PACV:SeaportGroupEnterpirsesLLCMember

2023-03-31

0000882800

PACV:ClearThinkCapitalPartnersMember

PACV:NoteAgreementMember

2021-03-31

0000882800

PACV:ClearThinkCapitalPartnersMember

PACV:NoteAgreementMember

2021-06-30

0000882800

PACV:ClearThinkCapitalPartnersMember

PACV:NoteAgreementMember

2021-01-01

2021-03-31

0000882800

PACV:ClearThinkCapitalPartnersMember

PACV:NoteAgreementMember

2023-06-30

0000882800

PACV:LGHFinancialMember

2023-06-30

0000882800

PACV:JeffersonStreetCapitalMember

2022-12-31

0000882800

PACV:JeffersonStreetCapitalMember

2023-06-30

0000882800

us-gaap:PreferredStockMember

2023-06-30

0000882800

us-gaap:SeriesEPreferredStockMember

2023-01-01

2023-06-30

0000882800

us-gaap:SeriesFPreferredStockMember

2023-01-01

2023-06-30

0000882800

us-gaap:CommonStockMember

2023-06-30

0000882800

PACV:LeaseOneMember

2023-01-01

2023-06-30

0000882800

PACV:LeaseTwoMember

2023-01-01

2023-06-30

0000882800

PACV:SanDiegoFarmersOutletIncMember

2023-06-30

0000882800

PACV:SanDiegoFarmersOutletIncMember

2023-01-01

2023-06-30

0000882800

PACV:SeaportGroupEnterpriseLLCMember

2023-06-30

0000882800

PACV:SanDiegoFarmersOutletIncMember

2018-05-01

0000882800

PACV:SanDiegoFarmersOutletIncMember

2018-05-01

2018-05-01

0000882800

PACV:SeaportGroupEnterpriseLLCMember

2019-12-01

0000882800

PACV:SeaportGroupEnterpriseLLCMember

2019-12-01

2019-12-01

0000882800

PACV:OneCustomerMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-06-30

0000882800

PACV:OneVendorMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-06-30

0000882800

PACV:SeaportMeatCompanysMember

2023-01-01

2023-06-30

0000882800

PACV:SeaportMeatCompanysMember

2023-06-30

0000882800

us-gaap:SubsequentEventMember

2023-08-23

2023-08-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

PACV:Integer

utr:sqft

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2023

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For

the transition period from ___________ to _____________

Commission

File Number 000-54584

PACIFIC

VENTURES GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

75-2100622 |

| (State

or other jurisdiction |

|

(I.R.S.

Employer |

| of

incorporation or organization) |

|

Identification

No.) |

| 117

West 9th Street Suite 316 Los Angeles California |

|

90015 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

310-392-5606

(Registrant’s

telephone number, including area code)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or, an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company”, and “emerging growth company”, in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of June 30, 2023, there were 824,861,624 shares of the registrant’s common stock, $.001 par value per share, issued and outstanding.

PACIFIC

VENTURES GROUP, INC.

TABLE

OF CONTENTS

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements

PACIFIC

VENTURES GROUP, INC.

Consolidated

Balance Sheets

| | |

For the six months | | |

December 31, | |

| | |

ended

June 30, 2023 | | |

2022 | |

| | |

(unaudited) | | |

(audited) | |

| ASSETS | |

| | |

| |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | (2,125 | ) | |

$ | 259,938 | |

| Accounts receivable | |

| 751,074 | | |

| 1,129,670 | |

| Inventory Asset | |

| 1,176,481 | | |

| 898,995 | |

| Other Current Asset | |

| 34,379 | | |

| 34,379 | |

| Right to Use Asset | |

| 171,000 | | |

| 267,000 | |

| Deposits | |

| 16,845 | | |

| 16,845 | |

| Total Current Assets | |

| 2,147,654 | | |

| 2,606,826 | |

| Fixed Assets | |

| | | |

| | |

| Fixed assets, net | |

$ | 487,464 | | |

$ | 591,638 | |

| Total Fixed Assets | |

| 487,464 | | |

| 591,638 | |

| Other Assets | |

| | | |

| | |

| Intangible Assets | |

$ | 2,758,436 | | |

$ | 2,864,508 | |

| Right to Use Asset | |

| 185,002 | | |

| 125,002 | |

| Rent & Utilities Deposit | |

| 5,520 | | |

| 5,520 | |

| Total Other Assets | |

| 2,948,958 | | |

| 2,995,030 | |

| TOTAL ASSETS | |

$ | 5,584,076 | | |

$ | 6,193,494 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,804,194 | | |

$ | 3,779,490 | |

| Accrued expenses | |

| 1,734,552 | | |

| 1,639,049 | |

| Lease Liability | |

| 171,000 | | |

| 267,000 | |

| Current portion, notes payable | |

| 4,745,135 | | |

| 5,339,639 | |

| Current portion, notes payable – related party | |

| - | | |

| - | |

| Current

portion, notes payable | |

| - | | |

| - | |

| Current portion, leases payable | |

| 15,126 | | |

| 23,611 | |

| Total Current Liabilities | |

$ | 11,470,007 | | |

$ | 11,048,789 | |

| | |

| | | |

| | |

| Long-Term Liabilities: | |

| | | |

| | |

| Notes payable | |

$ | 15,791,972 | | |

$ | 14,879,353 | |

| Notes payable – related party | |

| - | | |

| - | |

| Lease Liability | |

| 174,250 | | |

| 114,250 | |

| Total Long-Term Liabilities | |

| 15,966,222 | | |

| 14,993,603 | |

| | |

| | | |

| | |

| Total Liabilities | |

$ | 27,436,229 | | |

$ | 26,042,392 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | |

| | | |

| | |

| Preferred stock, $.001 par value, 10,000,000 shares authorized, 4,000,000 Series E,

issued and outstanding | |

$ | 4,000 | | |

$ | 4,000 | |

| 10,000 Series F, issued and outstanding | |

| 10 | | |

| 10 | |

| Preferred

stock value | |

| | | |

| | |

| Common stock, $0.001 par value, 900,000,000 shares authorized, and 804,861,624

issued and outstanding at June 30, 2023, | |

| 1,373,752 | | |

| 1,037,509 | |

| Additional paid in capital | |

| 7,951,703 | | |

| 8,080,996 | |

| Accumulated deficit | |

| (31,181,617 | ) | |

| (28,971,411 | ) |

| | |

| | | |

| | |

| Total Stockholders’ Equity (Deficit) | |

$ | (21,852,152 | ) | |

$ | (19,848,897 | ) |

| | |

| | | |

| | |

| Total Liabilities and Stockholders’ Equity (Deficit) | |

$ | 5,584,076 | | |

$ | 6,193,494 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

PACIFIC

VENTURES GROUP, INC.

Consolidated

Statements of Operations

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

For the three

months ended | | |

For the six

months ended | |

| | |

June 30 | | |

June 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Sales, net of

discounts | |

$ | 7,374,505 | | |

$ | 10,533,673 | | |

$ | 15,068,746 | | |

$ | 20,918,818 | |

| Cost

of Goods Sold | |

| 6,495,726 | | |

| 8,995,533 | | |

| 12,894,400 | | |

| 17,696,217 | |

| Gross Profit | |

| 878,779 | | |

| 1,538,140 | | |

| 2,174,346 | | |

| 3,222,601 | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 1,091,431 | | |

| 1,724,815 | | |

| 2,291,085 | | |

| 3,237,368 | |

| Marketing and Advertising | |

| 13,195 | | |

| 24,868 | | |

| 30,891 | | |

| 53,705 | |

| Amortization and Depreciation

expense | |

| 105,182 | | |

| 124,682 | | |

| 210,465 | | |

| 249,363 | |

| Professional fees | |

| 167,969 | | |

| 469,819 | | |

| 312,077 | | |

| 539,450 | |

| Officer

Compensation | |

| 75,000 | | |

| 92,500 | | |

| 150,000 | | |

| 167,500 | |

| Operating Expenses/(Loss) | |

| 1,452,777 | | |

| 2,436,683 | | |

| 2,994,518 | | |

| 4,247,385 | |

| Income/ (Loss) from Operations | |

| (573,998 | ) | |

| (898,543 | ) | |

| (820,172 | ) | |

| (1,024,785 | ) |

| Other Non-Operating Income

and Expenses | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| (741,782 | ) | |

| (1,427,412 | ) | |

| (1,559,126 | ) | |

| (2,406,038 | ) |

| Provision

for income taxes | |

| | | |

| | | |

| | | |

| | |

| Net Ordinary Income/(Loss) | |

| (1,315,780 | ) | |

| (2,325,955 | ) | |

| (2,379,298 | ) | |

| (3,430,822 | ) |

| Other Income / Expense | |

| | | |

| | | |

| | | |

| | |

| Other

Income – Other | |

| 145,561 | | |

| 41,123 | | |

| 162,439 | | |

| 65,764 | |

| Net

Income/(Loss) | |

$ | (1,170,219 | ) | |

| (2,284,832 | ) | |

$ | (2,216,859 | ) | |

| (3,365,058 | ) |

| Basic

and Diluted Loss per Share – Common Stock | |

$ | (0.00145 | ) | |

$ | (0.01026 | ) | |

$ | (0.00275 | ) | |

$ | (0.01512 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Shares Outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic

and Diluted Class A Common Stock | |

| 804,861,624 | | |

| 222,610,721 | | |

| 804,861,624 | | |

| 222,610,721 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

PACIFIC

VENTURES GROUP, INC.

Consolidated

Statements of Cash Flows

| | |

2023 | | |

2022 | |

| | |

For the six

months ended |

|

| | |

June 30 |

|

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| OPERATING ACTIVITIES | |

| | | |

| | |

| Net

loss | |

$ | (2,216,858 | ) | |

$ | (3,365,058 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Shares

issued for services | |

| - | | |

| | |

| Depreciation

& Amortization Expense | |

| 210,465 | | |

| 249,363 | |

| | |

| | | |

| | |

| Changes

in operating assets and liabilities | |

| | | |

| | |

| Accounts

receivable | |

| 378,595 | | |

| 227,750 | |

| Inventory | |

| (277,487 | ) | |

| (593,656 | ) |

| Other

Current Assets | |

| - | | |

| (66,628 | ) |

| Other

Assets | |

| - | | |

| | |

| Accounts

payable | |

| 961,327 | | |

| 112,638 | |

| Accrued

expenses | |

| 148,877 | | |

| 81,629 | |

| Other

Current liabilities | |

| 1,516 | | |

| 7,001 | |

| Capitalized

interest or penalty fees | |

| 1,074,417 | | |

| 914,279 | |

| Other

Changes in Assets | |

| | | |

| | |

| Net Cash

Provided by / (Used in) Operating Activities | |

| 280,853 | | |

| (2,432,681 | ) |

| INVESTING ACTIVITIES | |

| | | |

| | |

| Receivable

– Related | |

| - | | |

| | |

| Purchase

of equipment, building & improvements & fixed assets | |

| (219 | ) | |

| | |

| Goodwill

and Intangible Assets | |

| - | | |

| | |

| Net Cash

Provided by / (Used In) Investing Activities | |

| (219 | ) | |

| - | |

| | |

| | | |

| | |

| FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds

from notes payable | |

| 678,233 | | |

| 3,375,413 | |

| Proceeds

from notes payable – Related | |

| - | | |

| | |

| Repayment

of notes payable | |

| (1,188,095 | ) | |

| (1,226,806 | ) |

| Repayment

of notes payable – Related | |

| - | | |

| | |

| Proceeds

from long-term loans | |

| 85,511 | | |

| 325,000 | |

| Repayment

of long-term loans | |

| (125,000 | ) | |

| (145,000 | ) |

| Repayment

of debt by Shares | |

| (206,950 | ) | |

| (1,486,073 | ) |

| Shares

Issued for Debt | |

| 206,950 | | |

| 1,626,307 | |

| Shares

Issued for Services | |

| - | | |

| 488,050 | |

| Shares

Issued For Cash | |

| - | | |

| | |

| Preferred

Stocks Issued | |

| - | | |

| | |

| Common

Stock Issued In Exchange of Preferred shares | |

| - | | |

| | |

| Prior

period adjustment to retained earnings | |

| 6,653 | | |

| | |

| Net Cash

Provided by / (Used in) Financing Activities | |

| (542,698 | ) | |

| 2,956,892 | |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN

CASH | |

| (262,064 | ) | |

| 524,211 | |

| CASH AT BEGINNING OF

PERIOD | |

| 259,938 | | |

| 16,435 | |

| | |

| | | |

| | |

| CASH AT END OF PERIOD | |

$ | (2,125 | ) | |

$ | 540,646 | |

| | |

| | | |

| | |

| SUPPLEMENTAL

DISCLOSURES OF CASH FLOW INFORMATION | |

| | | |

| | |

| | |

| | | |

| | |

| CASH PAID

FOR: | |

| | | |

| | |

| Interest

fees | |

$ | 152,700 | | |

$ | 103,001 | |

| NON CASH

FINANCING ACTIVITIES: | |

| | | |

| | |

| Issuance

of shares for debt conversion | |

$ | 206,950 | | |

$ | 1,626,307 | |

The

accompanying notes are an integral part of these consolidated financial statements.

Pacific

Ventures Group, Inc.

Notes

to Unaudited Condensed Consolidated Financial Statements

June

30, 2023

(Unaudited)

1.

NATURE OF OPERATIONS

Pacific

Ventures Group, Inc. (the “Company,” “we,” “us” or “our”) was incorporated under the

laws of the state of Delaware on October 3, 1986, under the name AOA Corporation. On November 12, 1991, the Company changed its name

to American Eagle Group, Inc. On October 22, 2012, the Company changed its name to “Pacific Ventures Group, Inc.”

Unless

the context requires otherwise or unless otherwise stated, references to “our Company,” “Pacific Ventures,” “PACV,”

“we,” “us,” “our” and similar references refer to Pacific Ventures Group, Inc. and its consolidated

subsidiaries.

Our

Company

We

strive to be one of America’s great meat processors and a leading foodservice distributor in the Southwest. Built through organic

growth and acquisitions, we trace our roots back over 30 years to a few heritage companies with long legacies in food innovation and

customer service.

We

strive to inspire and empower chefs and foodservice operators to bring great food experiences to consumers. This mission is supported

by our strategy of Best Foods at Best Prices which is centered on providing customers with the innovative products business support

they need to operate their businesses profitably.

We

supply approximately 400 customer locations in the Southwest. These customer locations include independently owned single and multi-unit

restaurants, regional restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations,

colleges and universities. We provide more than 3,000 fresh, frozen, and dry food stock-keeping units, or SKUs, as well as non-food items,

sourced from multiple suppliers. Our sales associates manage customer relationships at local and regional levels. Our distribution facilities

and fleet of approximately 15 trucks allow us to operate efficiently and provide high levels of customer service.

Our

Industry

America’s

food distribution industry has many companies competing in the space, including local, regional, and national foodservice distributors.

Foodservice distributors typically fall into three categories, representing differences in customer focus, product offering, and supply

chain:

| |

● |

Broadline

distributors which offer a “broad line” of products and services; |

| |

|

| |

● |

System

distributors which carry products specified for large chains; and |

| |

|

| |

●

|

Specialized

distributors which primarily focus on specific product categories (e.g., meat or produce) or customer types. |

Our

Business Strategy

Our

Best Foods at Best Prices strategy is built on a differentiation focus in product assortment, customer experience and innovation. Through

this strategy, we also serve our customers as consultants and business partners, bringing our customers personalized solutions and tailoring

a suite of innovative products and services to fit each customer’s needs.

The

Best Foods Portion of our strategy features more than 500 products that are sustainably sourced or contribute to waste reduction. Our

private brand portfolio is guided by a spirit of innovation and a commitment to delivering superior quality products and value to customers.

While we offer products under a spectrum of private brands, and at different price points, all are designed to deliver quality, performance

and value to our customers.

Best

Prices is aimed at providing operators reliability and flexibility in our service model supported by tools and resources to support

them in running their businesses. This means on-time and complete orders and customer choice via the multi-channel offering we must serve

our customers.

Acquisitions

have also historically played an important role in supporting the execution of our growth strategy.

Products

and Brands

We

have a broad assortment of products and brands designed to meet customers’ needs. In many categories, we offer products under a

spectrum of private brands based on price and quality covering a range of values and qualities.

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles

of Consolidation

The

consolidated financial statements include the Company, Snöbar Holdings, San Diego Farmers Outlet, Seaport Meat Company, MGD, IPIC

and the Trust, which was established to hold IPIC, which in turn holds liquor licenses. All inter-company accounts have been eliminated

during consolidation. See the discussion in Note 1 above for variable interest entity treatment of the Trust and IPIC.

Use

of Estimates

The

preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities, at the

date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ

from those estimates.

Revenue

Recognition

The

Company recognizes revenue in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) 606, Revenue from Contracts with Customers, which requires that five basic steps be followed to recognize revenue:

(1) a legally enforceable contract that meets criteria standards as to composition and substance is identified; (2) performance obligations

relating to provision of goods or services to the customer are identified; (3) the transaction price, with consideration given to any

variable, noncash, or other relevant consideration, is determined; (4) the transaction price is allocated to the performance obligations;

and (5) revenue is recognized when control of goods or services is transferred to the customer with consideration given, whether that

control happens over time or not. Determination of criteria (3) and (4) are based on our management’s judgments regarding the fixed

nature of the selling prices of the products and services delivered and the collectability of those amounts. The adoption of ASC 606

did not result in a change to the accounting for any of the in-scope revenue streams; as such, no cumulative effect adjustment was recorded.

Unearned

Revenue

Certain

amounts are received pursuant to agreements or contracts and may only be used in the conduct of specified transactions, or the related

services are yet to be performed. These amounts are recorded as unearned or deferred revenue and are recognized as revenue in the year/period

the related expenses are incurred, or services are performed. As of June 30, 2023, the Company has $ 0.0 in deferred revenue. As of December

31, 2022, the Company also had $ 0.0 deferred revenue.

Leases

ASC

842, Leases, was required to be adopted for all financial years beginning after December 15, 2018 and requires long term leases (longer

than 12 month) to be capitalized with a corresponding liability for the term of the lease and expensed over that term. Currently the

Company has 2 long-term leases SDFO & Seaport Meat Company.

Shipping

and Handling Costs

The

Company’s shipping costs are all recorded as operating expenses for all periods presented.

Disputed

Liabilities

The

Company may from time to time be involved in a variety of disputes, claims, and proceedings concerning its business operations and certain

liabilities. We determine whether an estimated loss from a contingency should be accrued by assessing whether a loss is deemed probable

and can be reasonably estimated. We assess our potential liability by analyzing our litigation and regulatory matters using available

information. We develop our views on estimated losses in consultation with outside counsel handling our defense in these matters, which

involves an analysis of potential results, assuming a combination of litigation and settlement strategies. Should developments in any

of these matters cause a change in our determination as to an unfavorable outcome and result in the need to recognize a material accrual

or should any of these matters result in a final adverse judgment or be settled for significant amounts, they could have a material adverse

effect on our results of operations, cash flows and financial position in the period or periods in which such change in determination,

judgment or settlement occurs. As of June 30, 2023, the Company has $0 in disputed liabilities on its balance sheet.

Cash

Equivalents

The

Company considers highly liquid instruments with original maturity of three months or less to be cash equivalents. As of June 30, 2023,

the Company has a negative cash balance of $2,125 in cash and cash equivalents, compared to $259,938 on December 31, 2022.

Accounts

Receivable

As

of June 30, 2023, Accounts Receivable are stated at net realizable value of $751,074. This value includes an appropriate allowance for

estimated uncollectible accounts. As of June 30, 2023, the Company wrote off $0 of bad debt expense. The Company wrote off $0 of bad

debts during the three (3) months ended June 30, 2023, and thus has not set an allowance for doubtful accounts.

Inventories

Inventories

are stated at the lower of cost or market value. Cost has been determined using the first-in, first-out method. Inventory quantities

on-hand are regularly reviewed, and where necessary, reserves for excess and unusable inventories are recorded. Inventory consists of

finished goods beef, pork, chicken, seafood, all other restaurant related goods, and the related packaging materials. As of June 30,

2023, the Company had total inventory assets of $1,176,481 consisting of all of Seaport Meat Company’s inventory assets of fresh

and frozen proteins and seafood and all other restaurants supply items. As of June 30, 2022, the Company has $1,986,870 in inventories.

Income

Taxes

Deferred

taxes are provided on an asset and liability method whereby deferred tax assets are recognized for deductible temporary differences and

operating loss carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are

the difference between the reported amounts of assets and liabilities and their tax basis. Deferred tax assets are reduced by a valuation

allowance when, in the opinion of management, it is more likely than not that some portion or all the deferred tax assets will not be

realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Net

Income/(Loss) Per Common Share

Income/(loss)

per share of common stock is calculated by dividing the net income/(loss) by the weighted average number of shares of common stock outstanding

during the period. The Company has no potentially dilutive securities. Accordingly, basic and dilutive income/(loss) per common share

are the same.

Property

and Equipment

Property

and equipment are carried at cost less accumulated depreciation and includes expenditures that substantially increase the useful lives

of existing property and equipment. Maintenance, repairs, and minor renovations are expensed as incurred. Upon sale or retirement of

property and equipment, the cost and related accumulated depreciation are eliminated from the respective accounts and the resulting gain

or loss is included in the results of operations. The Company provides for depreciation of property and equipment using the straight-line

method over the estimated useful lives or the term of the lease, as appropriate. The estimated useful lives are as follows: vehicles,

five years; office furniture and equipment, three to fifteen years; equipment, three years.

Identifiable

Intangible Assets

As

of June 30, 2023, the Company’s Identifiable Intangible Assets are as follows:

Intangible

Assets

Identifiable

Intangible Assets

SCHEDULE

OF IDENTIFIABLE INTANGIBLE ASSETS

| Trade Name (San Diego Farmers Outlet) | |

$ | 141,000 | |

| Trade Name (Seaport Meat) | |

$ | 449,000 | |

| Wholesale Customer Relationships (San Diego Farmers Outlet) | |

$ | 266,000 | |

| Wholesale Customer Relationships (Seaport Meat) | |

$ | 2,334,239 | |

| | |

| | |

| Total Identifiable Intangible Assets | |

$ | 3,190,239 | |

Goodwill

SCHEDULE OF GOODWILL

| Total Goodwill | |

$ | 370,234 | |

| | |

| | |

| Total Intangible Assets and Goodwill | |

$ | 3,560,473 | |

| | |

| | |

| Total Accumulated Amortization | |

$ | (802,037 | ) |

| | |

| | |

| Total Intangible Assets & Goodwill (net) | |

$ | 2,758,436 | |

Fair

Value of Financial Instruments

The

carrying amounts of the Company’s financial instruments, which include cash, accounts receivable, accounts payable, and accrued

expenses are representative of their fair values due to the short-term maturity of these instruments.

Concentration

of Credit Risk

Financial

instruments that potentially subject the Company to concentration of credit risk consist primarily of cash and accounts receivable. The

Company maintains cash balances at financial institutions within the United States which are insured by the Federal Deposit Insurance

Corporation (“FDIC”) up to limits of approximately $250,000. The Company has not experienced any losses regarding its bank

accounts and believes it is not exposed to any risk of loss on its cash bank accounts.

Critical

Accounting Policies

The

Company considers revenue recognition and the valuation of accounts receivable, allowance for doubtful accounts, and inventory and reserves

as its significant accounting policies. Some of these policies require management to make estimates and assumptions that may affect the

reported amounts in the Company’s financial statements.

Recent

Accounting Pronouncements

In

June 2009, the FASB established the Accounting Standards Codification (“Codification” or “ASC”) as the source

of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial

statements in accordance with generally accepted accounting principles in the United States (“GAAP”). Rules and interpretive

releases of the Securities and Exchange Commission (the “SEC”) issued under authority of federal securities laws are also

sources of GAAP for SEC registrants. Existing GAAP was not intended to be changed as a result of the Codification, and accordingly the

change did not impact our financial statements. The ASC does change the way the guidance is organized and presented.

In

April 2015, FASB issued Accounting Standards Update (“ASU”) No. 2015-03, “Interest – Imputation of Interest (Subtopic

835-30): Simplifying the Presentation of Debt Issuance Costs”, to simplify presentation of debt issuance costs by requiring that

debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying

amount of that debt liability, consistent with debt discounts. The ASU does not affect the recognition and measurement guidance for debt

issuance costs. For public companies, the ASU is effective for financial statements issued for fiscal years beginning after December

15, 2015, and interim periods within those fiscal years. Early application is permitted.

In

April 2015, FASB issued ASU No. 2015-04, “Compensation – Retirement Benefits (Topic 715): Practical Expedient for the Measurement

Date of an Employer’s Defined Benefit Obligation and Plan Assets”, which permits the entity to measure defined benefit plan

assets and obligations using the month-end that is closest to the entity’s fiscal year-end and apply that practical expedient consistently

from year to year. The ASU is effective for public business entities for financial statements issued for fiscal years beginning after

December 15, 2015, and interim periods within those fiscal years. Early application is permitted.

In

April 2015, FASB issued ASU No. 2015-05, “Intangibles – Goodwill and Other – Internal-Use Software (Subtopic 350-40):

Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement”, which provides guidance to customers about whether

a cloud computing arrangement includes a software license. If such includes a software license, then the customer should account for

the software license element of the arrangement consistent with the acquisition of other software licenses. If the arrangement does not

include a software license, the customer should account for it as a service contract. For public business entities, the ASU is effective

for annual periods, including interim periods within those annual periods, beginning after December 15, 2015. Early application is permitted.

We are currently reviewing the provisions of this ASU to determine if there will be any impact on our results of operations, cash flows

or financial condition.

In

April 2015, FASB issued ASU No. 2015-06, “Earnings Per Share (Topic 260): Effects on Historical Earnings per Unit of Master Limited

Partnership Dropdown Transactions”, which specifies that, for purposes of calculating historical earnings per unit under the two-class

method, the earnings (losses) of a transferred business before the date of a drop-down transaction should be allocated entirely to the

general partner. In that circumstance, the previously reported earnings per unit of the limited partners (which is typically the earnings

per unit measure presented in the financial statements) would not change as a result of the dropdown transaction. Qualitative disclosures

about how the rights to the earnings (losses) differ before and after the dropdown transaction occurs for purposes of computing earnings

per unit under the two-class method also are required. The ASU is effective for fiscal years beginning after December 15, 2015, and interim

periods within those fiscal years. Earlier application is permitted.

In

June 2014, FASB issued ASU No. 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements,

Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation”. The update removes all incremental

financial reporting requirements from GAAP for development stage entities, including the removal of Topic 915 from the FASB Accounting

Standards Codification. In addition, the update adds an example disclosure in Risks and Uncertainties (Topic 275) to illustrate one way

that an entity that has not begun planned principal operations could provide information about the risks and uncertainties related to

the company’s current activities. Furthermore, the update removes an exception provided to development stage entities in Consolidations

(Topic 810) for determining whether an entity is a variable interest entity-which may change the consolidation analysis, consolidation

decision, and disclosure requirements for a company that has an interest in a company in the development stage. The update is effective

for the annual reporting periods beginning after December 15, 2014, including interim periods therein. Early application is permitted

with the first annual reporting period or interim period for which the entity’s financial statements have not yet been issued (Public

business entities) or made available for issuance (other entities). Our company adopted this pronouncement.

In

June 2014, FASB issued ASU No. 2014-12, “Compensation – Stock Compensation (Topic 718); Accounting for Share-Based Payments

When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period”. The amendments

in this ASU apply to all reporting entities that grant their employees share-based payments in which the terms of the award provide that

a performance target that affects vesting could be achieved after the requisite service period. The amendments require that a performance

target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. A reporting

entity should apply existing guidance in Topic 718 as it relates to awards with performance conditions that affect vesting to account

for such awards. For all entities, the amendments in this ASU are effective for annual periods and interim periods within those annual

periods beginning after December 15, 2015. Earlier adoption is permitted. Entities may apply the amendments in this ASU either (a) prospectively

to all awards granted or modified after the effective date or (b) retrospectively to all awards with performance targets that are outstanding

as of the beginning of the earliest annual period presented in the financial statements and to all new or modified awards thereafter.

If retrospective transition is adopted, the cumulative effect of applying this Update as of the beginning of the earliest annual period

presented in the financial statements should be recognized as an adjustment to the opening retained earnings balance at that date. Additionally,

if retrospective transition is adopted, an entity may use hindsight in measuring and recognizing the compensation cost. This updated

guidance is not expected to have a material impact on our results of operations, cash flows or financial condition.

In

August 2014, the FASB issued ASU 2014-15 on “Presentation of Financial Statements Going Concern (Subtopic 205-40) – Disclosure

of Uncertainties about an Entity’s Ability to Continue as a Going Concern”. Currently, there is no guidance in GAAP about

management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going

concern or to provide related footnote disclosures. The amendments in this Update provide that guidance. In doing so, the amendments

are intended to reduce diversity in the timing and content of footnote disclosures. The amendments require management to assess an entity’s

ability to continue as a going concern by incorporating and expanding upon certain principles that are currently in U.S. auditing standards.

Specifically, the amendments (1) provide a definition of the term substantial doubt, (2) require an evaluation every reporting period

including interim periods, (3) provide principles for considering the mitigating effect of management’s plans, (4) require certain

disclosures when substantial doubt is alleviated as a result of consideration of management’s plans, (5) require an express statement

and other disclosures when substantial doubt is not alleviated, and (6) require an assessment for a period of one year after the date

that the financial statements are issued (or available to be issued).

All

other newly issued accounting pronouncements which are not yet effective have been deemed either immaterial or not applicable.

We

reviewed all other recently issued accounting pronouncements and determined these have no current applicability to the Company or their

effect on the financial statements would not have been significant.

3.

GOING CONCERN

The

accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As shown in

the accompanying consolidated financial statements, the Company has incurred a net loss of $2,216,858 for the six (6) months ended June

30, 2023, and has an accumulated deficit of $31,181,617 as of June 30, 2023.

In

order to continue as a going concern, the Company will need, among other things, additional capital resources. The Company is significantly

dependent upon its ability, and will continue to attempt, to secure equity and/or additional debt financing. There are no assurances

that the Company will be successful and without sufficient financing it would be unlikely for the Company to continue as a going concern.

The

unaudited consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded

assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. These unaudited consolidated

financial statements do not include any adjustments that might arise from this uncertainty.

4.

INVENTORIES

As

of June 30, 2023, the Company had inventory assets for a total of $1,176,481. The Company had inventory assets of $898,995 as of December

31, 2022.

5.

PROPERTY, PLANT AND EQUIPMENT

Property,

plant and equipment on June 30 2023, and December 31, 2022, consisted of:

SCHEDULE

OF PROPERTY, PLANT AND EQUIPMENT

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Computers | |

| 12,007 | | |

$ | 11,788 | |

| Office Furniture | |

| 23,908 | | |

| 23,908 | |

| Building & Improvement | |

| 29,673 | | |

| 29,673 | |

| Forklift 1 | |

| 4,533 | | |

| 4,533 | |

| Forklift 2 | |

| 2,871 | | |

| 2,871 | |

| Truck 2019 Hino 155 3710 | |

| 24,865 | | |

| 24,865 | |

| Truck 2019 Hino 155 7445 | |

| 34,213 | | |

| 34,213 | |

| Truck 2018 Hino 155 5647 | |

| 30,181 | | |

| 30,181 | |

| Machinery & Equipment | |

| 1,109,811 | | |

| 1,109,811 | |

| Leasehold Improvements | |

| 66,932 | | |

| 66,932 | |

| Office Equipment | |

| 62,400 | | |

| 62,400 | |

| Vehicles | |

| 409,108 | | |

| 409,108 | |

| Accumulated Depreciation | |

| (1,323,037 | ) | |

| (932,054 | ) |

| | |

| | | |

| | |

| Property, plant and equipment | |

$ | 487,464 | | |

$ | 878,229 | |

Depreciation

and Amortization expenses for the six (6) months ended June 30, 2023, was $210,465.23 compared to $249,363 for the same period of June

30, 2022.

6.

ACCRUED EXPENSE

As

of June 30, 2023, the Company had accrued expenses of $1,734,552 compared to $1,639,049 for the year-end December 31, 2022.

7.

INCOME TAX

The

Company accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities

for the expected future tax consequences of events that have been included in the financial statements. Under this method, deferred tax

assets and liabilities are determined based on the differences between the financial statement and tax bases of assets and liabilities

using enacted tax rates in effect for the year in which the differences are expected to reverse.

8.

NOTES PAYABLE

The

following table presents a summary of the Company’s promissory notes issued to unrelated third parties as of June 30, 2023:

SCHEDULE

OF PROMISSORY NOTES ISSUED TO UNRELATED THIRD PARTIES

| | |

Note Amount | | |

Issuance Date | |

Balance | |

| Henry Mahgerefteh | |

$ | 144,000 | | |

2/15/15 | |

$ | 111,180 | |

| Mr. Advance | |

| 132,434 | | |

6/1/23 | |

| 132,434 | |

| 1800 Diagonal Lending | |

| | | |

7/12/17 | |

| 181,799 | |

| Clear Think Capital | |

| 1,405,000 | | |

3 loans | |

| 1,227,600 | |

| LGH Investments | |

| 850,000 | | |

2 loans | |

| 454,800 | |

| Jefferson Capital | |

| 330,000 | | |

12/1/22 | |

| 182,000 | |

| SBA Loan | |

| 309,900 | | |

4/1/20 | |

| 300,000 | |

| Dicer | |

| 64,678 | | |

7/20/20 | |

| 64,707 | |

| TCA Global fund | |

| 2,150,000 | | |

5/1/18 | |

| 4,337,398 | |

| TCA Global fund 2 | |

| 3,000,000 | | |

12/17/19 | |

| 9,321,955 | |

| | |

$ | 9,186,624 | | |

| |

$ | 16,387,884 | |

Purchase

Receivables

SCHEDULE

OF PURCHASE RECEIVABLES

| | |

Amount | | |

Issuance Date | |

Balance | |

| Cap Call | |

$ | 1,000,000 | | |

3 loans-2020 | |

$ | 1,417,713 | |

| NewCo Capital Group | |

| 506,000 | | |

March 2023 | |

| 287,300 | |

| Lends Park Corp | |

| 3,119,163 | | |

6/30/22 | |

| 2,444,210 | |

| | |

$ | 4,625,163 | | |

| |

$ | 4,149,223 | |

On

Feb 23, 2023, the Company entered into a financing arrangement with 1800 Diagonal Lending pursuant to which the Company borrowed a total

principal of $258,449. As of June 30, 2023 the balance of the note is $181,799 .

On

May 1, 2018, Pacific Ventures Group entered into a secured promissory note with TCA Global Master Fund. The note was secured by interests

in tangible and intangible property of Pacific Ventures Group. The effective interest rate on the note is 16%. The outstanding balance

of the notes with TCA Global Fund for San Diego Farmers Outlet is $4,337,398 as of June 30, 2023, which includes capitalized interests.

On

December 17, 2019, Pacific Ventures Group entered into a secured promissory note with TCA Special Situations Credit Strategies ICAV.

The note was secured by interests in tangible and intangible property of Pacific Ventures Group. The effective interest rate is 16%.

The outstanding balance of the notes for Seaport Meat is $9,321,955 as of June 30, 2023, which includes capitalized interests.

On

July 20, 2020, Seaport Group Enterprises LLC entered a note in the amount of $150,000.00 for a new piece of machinery in order to upgrade

the processing line. The note is payable monthly in installment payments of $2,500.00. As of June 30, 2023, the note is current.

In

September 2020, Seaport Group Enterprises LLC entered into a revenue-based factoring agreement with Cap Call and received an aggregate

of $1,000,000 CAP Call in exchange for $1,300,000.00 of future receipts relating to monies collected from customers or other third-party

payors. Under the terms of the agreement, the Company is required to make weekly payments for 40 weeks.

In

June of 2022, Seaport Group Enterprises LLC entered into a revenue-based factoring agreement with Lendspark Capital and received an aggregate

of $ 2,637,600.00 Lendspark in exchange for 3,250,000.00 of future receipts to monies collected from customers or other third-party payors.

Under the terms of the agreement, the Company is required to make daily payments for 46 weeks.

In

March of 2023, Seaport Group Enterprises LLC entered into a revenue-based factoring agreement with NewCo and received an aggregate of

$400,000 NewCo in exchange for $552,000 of future receipts to monies collected from customers or other third-party payors. Under the

terms of the agreement, the Company is required to make daily payments for 30 weeks.

In

the first and second quarter 2021, the Company entered into a note agreement with ClearThink Capital Partners with a total amount of

$1,405,000. In the first quarter of 2021, the Company entered into a note agreement of $325,000. The notes can be repaid in cash or converted

common stock or a combination of both. Balance of all the notes is $1,227,600. As of June 30, 2023, the notes are current.

In

the second quarter of 2021, the Company entered into note agreements with LGH Financial in the total amount of $454,800. The note can

be repaid in cash or converted common stock or a combination of both. As of June 30, 2023, the note is current.

In

December of 2022, the Company entered into a note agreement with Jefferson Street Capital in the amount of $330,000. The note can be

repaid or convertible into common stock or a combination of both. As of June 30, 2023 the balance of the note is $182,000 and the note

is current.

As

of June 30, 2023, the Company had short-term notes payable of $595,912 and long-term notes payable of $15,791,972. The Company had purchase

receivables of $4,149,223.

9.

STOCKHOLDERS’ EQUITY

Common

Stock and Preferred Stock

The

Company is authorized to issue up to 10,000,000 shares of its preferred stock, $0.001 par value per share. The Company designated 6,000,000

shares of preferred stock as Series E Preferred Stock (the “Series E Preferred Stock”). Under the rights, preferences and

privileges of the Series E Preferred Stock, for every share of Series E Preferred Stock held, the holder thereof has the voting rights

equal to 10 shares of common stock. As of June 30, 2023, there were 4,000,000 shares of Series E Preferred Stock issued and outstanding.

Additionally, Company has designated 10,000 shares of Series F Preferred Stock and 10,000 shares of the Series F Preferred Stock are

issued and outstanding. Each share of Series F Preferred Stock is convertible into 0.1% of the issued and outstanding stock at the time

of conversion.

From

January 1, 2023, through June 30, 2023, the Company issued 336,242,982 shares of its common stock.

The

Company is authorized to issue up to 900,000,000 shares of its common stock, $0.001 par value per share. Holders of common stock have

one vote per share. As of June 30, 2023, and the same period in 2022, there were 804,861,624 and 222,610,721 shares of the Company’s

common stock issued and outstanding, respectively.

10.

COMMITMENTS, CONTINGENCIES AND UNCERTAINTIES

Operating

Lease

The

Company is currently obligated under two operating leases for office spaces and associated building expenses. Both leases are on a month-to-month

basis at a monthly rate of $525 and 650, respectively.

SDFO

operations are located at 10407 Friars Rd, San Diego, CA 92110, where they occupy an aggregate of approximately 10,000 square feet pursuant

to leases. The 5-year leases are on an annual basis at a monthly rate of $6,000 per month.

Seaport

Group Enterprise LLC is located at 2533 Folex Way, Spring Valley CA 91978, where they occupy an aggregate of approximately 12,000 square

feet pursuant to the lease. The 5-year leases are on an annual basis starting at a monthly rate of $15,345.00 per month.

San

Diego Farmers Outlet and Seaport Meat Company Operating Leases

The

Company on May 1, 2018, assumed a lease agreement for a facility site and entered into a lease agreement for office space for San Diego

Farmers Outlet. The lease has a term of five years expiring on April 30, 2023.

Future

minimum lease payments, as set forth in the lease, are below:

SCHEDULE

OF FUTURE MINIMUM RENTAL PAYMENT FOR OPERATING LEASE

| | |

| |

| YEAR | |

AMOUNT | |

| 2023 | |

$ | 72,000 | |

| 2024 | |

$ | 72,000 | |

| 2025 | |

$ | 72,000 | |

| 2026 | |

$ | 24,000 | |

The

Company on December 1, 2019, entered into a lease agreement for a facility site for office space for Seaport Meat Company. The lease

has a term of five years expiring on November 30, 2024.

Future

minimum lease payments, as set forth in the lease, are below:

SCHEDULE

OF FUTURE MINIMUM RENTAL PAYMENT FOR OPERATING LEASE

| | |

| |

| YEAR | |

AMOUNT | |

| 2023 | |

$ | 177,000 | |

| 2024 | |

$ | 177,000 | |

| 2025 | |

$ | 177,000 | |

| 2026 | |

$ | 177,000 | |

| 2027 | |

$ | 162,250 | |

Concentration

Risk

The

Company is potentially subject to concentration risk in its sales revenue and from a major supplier of goods for sale.

Major

Customer

The

Company has one major customer that accounted for approximately 52% and $14,157,385of sales for the six months ended June 30, 2023. The

Company expects to maintain this relationship with the customer.

Major

Vendor

The

Company has one major vendor that accounted for approximately 66% and $11,625,590 of cost of sales for the six months ended June 30,

2023. The Company expects to maintain this relationship with the vendor.

11.

SUBSEQUENT EVENTS

Management

has evaluated subsequent events, in accordance with FASB ASC Topic 855, “Subsequent Events,” through the date which the financial

statements were available to be issued, and there are no material subsequent events requiring disclosure except as set forth below.

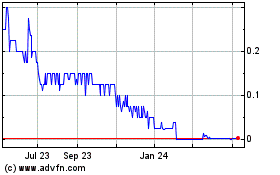

Amendment of Certificate of Amendment

On August 25, 2023, the Company

amended its Certificate of Incorporation to implement a 250-for-1 reverse split of the Company’s common stock. The Company intends

to file an appropriate Corporate Action with FINRA, to obtain approval of such reverse split. The Company is unable to predict when FINRA

approval will be obtained.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking

Statements

Statements

in this Quarterly Report on Form 10-Q (this “Quarterly Report”) which are not historical in nature are “forward-looking

statements” within the meaning of the federal securities laws. These statements often include words such as “believe,”

“expect,” “project,” “anticipate,” “intend,” “plan,” “outlook,”

“estimate,” “target,” “seek,” “will,” “may,” “would,” “should,”

“could,” “forecast,” “mission,” “strive,” “more,” “goal,” or

similar expressions and are based upon various assumptions and our experience in the industry, as well as historical trends, current

conditions, and expected future developments. However, you should understand that these statements are not guarantees of performance

or results, and there are several risks, uncertainties and other important factors that could cause our actual results to differ materially

from those expressed in the forward-looking statements, including, among others:

| |

● |

any

declines in the consumption of food prepared away from home; |

| |

● |

the

extent and duration of the negative impact of the COVID-19 pandemic on us; |

| |

● |

cost

inflation/deflation and commodity volatility; |

| |

● |

competition; |

| |

● |

reliance

on third-party suppliers and interruption of product supply or increases in product costs; |

| |

● |

changes

in our relationships with customers and group purchasing organizations; |

| |

● |

our

ability to increase or maintain the highest margin portions of our business; |

| |

● |

effective

integration of acquired businesses; |

| |

● |

achievement

of expected benefits from cost savings initiatives; |

| |

● |

increases

in fuel costs; |

| |

● |

economic

factors affecting consumer confidence and discretionary spending; |

| |

● |

changes

in consumer eating habits; |

| |

● |

reputation

in the industry; |

| |

● |

labor

relations and costs and continued access to qualified and diverse labor; |

| |

● |

cost

and pricing structures; |

| |

● |

changes

in tax laws and regulations and resolution of tax disputes; |

| |

● |

environmental,

health and safety and other government regulation, including actions taken by national, state and local governments to contain the

COVID-19 pandemic, such as travel restrictions or bans, social distancing requirements, and required closures of non-essential businesses; |

| |

● |

product

recalls and product liability claims; |

| |

● |

adverse

judgments or settlements resulting from litigation; |

| |

● |

disruption

of existing technologies and implementation of new technologies; |

| |

● |

cybersecurity

incidents and other technology disruptions; |

| |

● |

management

of retirement benefits and pension obligations; |

| |

● |

extreme

weather conditions, natural disasters and other catastrophic events, including pandemics and the rapid spread of contagious illnesses; |

| |

● |

risks

associated with intellectual property, including potential infringement; |

| |

|

indebtedness

and restrictions under agreements governing indebtedness; and |

| |

● |

interest

rate increases. |

We

caution that the factors described herein, and other factors could cause our actual results of operations and financial condition to

differ materially from those expressed in any forward-looking statements we make and that investors should not place undue reliance on

any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made,

and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such

statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time

to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our

results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements.

Basis

of Presentation

The

unaudited financial statements for the six months ended June 30, 2023 and 2022, include a summary of our significant accounting policies

and should be read in conjunction with the discussion below. In the opinion of management, all material adjustments necessary to present

fairly the results of operations for such periods have been included in these audited financial statements. All such adjustments are

of a normal recurring nature.

The

following discussion and analysis is intended to help the reader understand the Company, our financial condition and results of operations

and our present business environment. It should be read together with our consolidated financial statements and related notes contained

elsewhere in this Quarterly Report. The following discussion and analysis contains certain financial measures that are not required by,

or presented in accordance with, accounting principles generally accepted in the U.S. (“GAAP”). We believe these non- GAAP

financial measures provide meaningful supplemental information about our operating performance and liquidity.

COVID-19

Should

the negative economic impact caused by the COVID-19 pandemic, including the response thereto, result in continuing long-term economic

weakness in the United States and/or globally, our ability to maintain or expand our business could be negatively impacted. However,

we are unable to make any prediction in this regard.

Inflation

During

2022, inflation became a significant negative factor in our operations and it continues to be a significant pressure on our ability to

operate at a profit. Since Spring 2022, food costs have increased dramatically and our margins have been reduced. These inflationary

pressures continue to impact our operations. However, given the current economic volatility, we are unable to predict with certainty

how our operating results will be impacted by inflation during the remainder of 2023 and the first half of 2024.

Operating

Metrics

Case

growth—Case growth, by customer type (e.g., independent restaurants) is reported as of a point in time. Customers periodically

are reclassified, based on changes in size or other characteristics, and when those changes occur, the respective customer’s historical

volume follows its new classification.

Organic

growth—Organic growth includes growth from operating business that has been reflected in our results of operations for at least

12 months.

Strategy

During

the first six months of 2023, the Company’s strategy has been focused on:

| |

● |

incrementally

increase sales and profitability of San Diego Farmers Outlet (SDFO) and Seaport Meat Company. |

| |

● |

Reduce

expenditures for San Diego Farmers Outlet by consolidating operations with Seaport Meat Company |

| |

● |

acquisition

of food production or distribution companies that are synergistic with SDFO and Seaport Meat Company. |

Seaport

is looking to improve the current processing line and add and upgrade to a more efficient and automated processing line. This will allow

Seaport to operate more efficiently and reduce the amount of overtime hours on the production line. Seaport plans to increase its customer

base.

We

plan to grow SDFO’s wholesale business by expanding its delivery territory from 40 miles to a 75-mile radius and add to the current

fleet of delivery trucks. The Company has already begun marketing to new restaurants in the area, most notably Asian and Italian restaurants,

and have let restaurants know that SDFO can deliver the finest produce in market.

We

plan to relaunch Snöbar production and distribution by partnering with third-party manufacturers and co-packers, and with third-party

distributors that can sell Snöbar products to high-end restaurants, resorts, cruise lines and hotels worldwide. Initially, the focus

will be on establishing major accounts in four core markets consisting of Southern California, Phoenix, Las Vegas and Miami. The larger

vision is to sell products in grocery stores such as Kroger, Wal-Mart and others, and thereafter to begin a national marketing program

to all U.S. retailers. It is essentially a top-down marketing plan where products are placed with the largest retailer then trickle down

to the smallest seller in each market area

We

plan to grow through acquisitions of similar meat and food processing/distributing companies located within the Southwest. Our company

has identified and are currently speaking with a few key opportunities.

We

plan to acquire food production and distribution businesses that will help the Company grow its food, beverage and alcohol-related products

businesses. We continue to engage in preliminary discussions with potential investors in order to properly fund potential acquisitions,

however, there are no assurances that the required funding will be available on terms acceptable to us, or at all.

Going

Concern

The

accompanying consolidated financial statements have been prepared assuming we will continue as a going concern. As discussed in this

Quarterly Report and in the notes to the Company’s consolidated financial statements included elsewhere herein, we have

incurred operating losses, and as of June 30, 2023 and December 31, 2022, we have accumulated deficit of $31,181,617 and

$28,971,411, respectively. At June 30, 2023, we had a negative cash position and a working capital deficiency of $9,322,354. These

factors raise substantial doubt about our ability to continue as a going concern.

Our

ability to continue as a going concern is dependent upon our generating operating cash flow and raising capital sufficient to fund operations.

Our business strategy may not be successful in funding ongoing operations and accelerating our domestic and international expansion,

and if we cannot continue as a going concern, our stockholders may lose their entire investment in us.

Plan

of Operation for the Next Twelve Months

Our

plan is to achieve meaningful sales revenue from the sale of the SDFO and Seaport Meat Company products to meet our operating needs.

It is also unlikely that we will be able to satisfy all of our obligations to pay interest and repay principal due and payable within

the next 12 months under the various forms of our outstanding debt. Although we have been able to extend the maturity dates as well as

repayment terms of a substantial amount of such debt, there is no assurance that we will be able to further extend such repayments or

maturity dates to avoid a default, as such further extension depends on the consent of the holders of such debt. If we are unable to

make such payments and repayments and unable to extend and delay required payments or maturities of such debt, the holders of such debt

will have the right to take legal action seeking enforcement of the debt. If any legal action is taken against us, we would face the

risk of having to deplete our limited cash resources to defend against such suit or face the entry of a default judgment. In either event,

such action would have grave impact on our operations. Our ability to continue operations will be dependent upon the successful completion

of additional long-term or permanent equity financing, the support of creditors and shareholders, and, ultimately, the achievement of

profitable operations. There can be no assurances that we will be successful, which would in turn significantly affect our ability to

be successful in our new business plan. If not, we will likely be required to reduce operations or liquidate assets. We will continue

to evaluate our projected expenditures relative to our available cash and to seek additional means of financing in order to satisfy our

working capital and other cash requirements.

Results

of Operations

Six

Months Ended June 30, 2023, as Compared to Six Months Ended June 30, 2022

Revenues

— The Company recorded $15,068,746 sales revenue for the six months ended June 30, 2023, as compared to $20,918,818 for the

same period of June 30, 2022. The Company had $1,176,481 inventory of saleable merchandise as of June 30, 2023, as compared to $898,995

for the same period ending June 30, 2022.

Operating

Expenses — Total cash provided in operating expenses for the six months ended June 30, 2023, was $280,853 as compared to $2,432,681

of cash used in the same period in 2022.

Selling,

General and Administrative Expenses — Selling, general and administrative expenses for the six months ended June 30, 2023,

decreased to $2,291,085 from $3,237,368 in the same period in 2022, which was due to an decrease in various business expenses.

Marketing

and Advertising Expenses – Marketing and advertising expenses for the six months ended June 30, 2023, was $30,891 compared

to $53,705 on June 30, 2022.

Professional

fees – Professional fees expense for the six months ended June 30, 2023, was $312,077, which includes accounting, legal fees

and consulting services compared to $539,450 during the same period in 2022.

Depreciation

and Amortization Expenses — Depreciation and Amortization expenses for the six months ended June 30, 2023, and the same period

in 2022 were $210,465 and $249,363, respectively.

Salaries

and Wages — Salaries and wages expense, in the form of payroll expenses, which is included under selling & general expenses

for the six months ended June 30, 2023, was $515,033 as compared to $1,488,112 for the prior same period in 2022.

Other

Non-Operating Income and Expenses — For the six months period ended June 30, 2023, the Company recorded interest and penalty

expenses in the amount of $1,559,126 for a non-operating loss in the same amount. In the six months ended June 30, 2022, the Company

recorded other non-operating expenses of $2,406,038 in interest expense for a non-operating loss in the same amount.

Net

Loss — Net loss for six months ended June 30, 2023, was $2,216,858, as compared to net loss of $3,365,058 for the six months

in the same period ended June 30, 2022.

Financial

Condition, Liquidity and Capital Resources

As

of June 30, 2023, the Company had a working capital deficit of $9,322,354 consisting of $2,125 in cash or cash equivalents overdraft,

$751,074 in accounts receivable, $1,176,481 in inventory, $205,379 in other assets and $16,845 in deposits, offset by accounts payable

of $4,804,194, accrued expenses of $1,734,552, equipment of $15,126, current portion of notes payable of $4,745,135 and $171,000 in other

current liabilities.

For

the six months period ended June 30, 2023, the Company provided $280,853 of cash in operating activities, had used $219 in cash for investing

activities and used $542,698 cash from financing activities, resulting in a decrease in total cash of $262,064 and a negative cash balance

of $2,125 for the period. For the six months period ended June 30, 2022, the Company used cash of $2,432,681 in operating activities,

had $0 in cash for investing activities and provided cash of $2,956,892 from financing activities, resulting an increase in cash of $524,211

and a cash balance of $540,646 at the end of such period.

Total

current assets as of June 30, 2023, was $2,147,654, while current liabilities were $11,470,007. The Company has incurred a net loss of

$2,216,858 for the six months period ended June 30, 2023, largely due the increase in operating expenses, and increase in interest. During

the six months period ended June 30, 2023, the Company had an accumulated deficit of $31,181,617. These factors raise substantial doubt

about our ability to continue as a going concern.

Changes

in the composition of our Notes Payable and Notes Payable-Related Parties are presented in the table below:

| | |

As of June 30, 2023 | | |

As of Dec 31, 2022 | |

| | |

$ Current | | |

$ Long-Term | | |

$ Current | | |