UNITED STATES

SECURITIES EXCHANGE COMMISSION

Washington, D.C. 20549

ANNUAL REPORT PURSUANT TO

THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended September 30, 2015

Commission File Number 000-29621

XSUNX, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Colorado

|

84-1384159

|

|

(State of Incorporation)

|

(I.R.S. Employer

Identification No.)

|

65 Enterprise, Aliso Viejo, CA 92656

(Address of Principal Executive Offices) (Zip Code)

(949) 330-8060

(Registrant’s Telephone Number)

Securities registered pursuant to Section 12(b) of the Act: Title of each class: None

Name of Each Exchange on which Registered: N/A

Securities registered pursuant to Section 12(g) of the Act:

Title of each class: Common Stock, no par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o NO x

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes x NO o

Check if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

|

(Check one):

|

|

|

|

|

o Large accelerated filer

|

oAccelerated filer

|

o Non-accelerated filer

|

x Smaller reporting company

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) (Check one): Yes o NO x

As of March 31, 2015, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $8,381,201 based on the closing price as reported on the OTCBB.

As of January 8, 2016, there were 704,918,657 shares of the registrant’s company common voting stock outstanding.

TABLE OF CONTENTS

| |

|

Page

|

| |

|

|

|

PART I

|

| |

|

|

|

Item 1.

|

|

1

|

| |

|

|

|

Item 1A.

|

|

6

|

| |

|

|

|

Item 1B.

|

|

13

|

| |

|

|

|

Item 2.

|

|

13

|

| |

|

|

|

Item 3.

|

|

13

|

| |

|

|

|

Item 4.

|

|

13

|

| |

|

|

|

PART II

|

| |

|

|

|

Item 5.

|

|

14

|

| |

|

|

|

Item 6.

|

|

15

|

| |

|

|

|

Item 7.

|

|

15

|

| |

|

|

|

Item 7A.

|

|

19

|

| |

|

|

|

Item 8.

|

|

19

|

| |

|

|

|

Item 9.

|

|

19

|

| |

|

|

|

Item 9A.

|

|

19

|

| |

|

|

|

Item 9B.

|

|

20

|

| |

|

|

|

PART III

|

| |

|

|

|

Item 10.

|

|

21

|

| |

|

|

|

Item 11.

|

|

23

|

| |

|

|

|

Item 12.

|

|

25

|

| |

|

|

|

Item 13.

|

|

26

|

| |

|

|

|

Item 14.

|

|

26

|

| |

|

|

|

PART IV

|

| |

|

|

|

Item 15.

|

|

27

|

| |

|

|

|

|

28

|

| |

|

|

|

|

F-1

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Securities Act of 1933, as amended (the “Securities Act”) which are subject to risks, uncertainties and assumptions that are difficult to predict. All statements in this Annual Report on Form 10-K, other than statements of historical fact, are forward-looking statements. These forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements include statements, among other things, concerning our business strategy, including anticipated trends and developments in and management plans for, our business and the markets in which we operate; future financial results, operating results, revenues, gross margin, operating expenses, products, projected costs and capital expenditures; research and development programs; sales and marketing initiatives; and competition. In some cases, you can identify these statements by forward-looking words, such as “estimate”, “expect”, “anticipate”, “project”, “plan”, “intend”, “believe”, “forecast”, “foresee”, “likely”, “may”, “should”, “goal”, “target”, “might”, “will”, “could”, “predict” and “continue”, the negative or plural of these words and other comparable terminology.

The forward-looking statements are only predictions based on our current expectations and our projections about future events. All forward-looking statements included in this Annual Report on Form 10-K are based upon information available to us as of the filing date of this Annual Report on Form 10-K. You should not place undue reliance on these forward-looking statements. We undertake no obligation to update any of these forward-looking statements for any reason. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by these statements. These factors include the matters discussed in the section entitled “Item 1A: Risk Factors” and elsewhere in this Form 10-K. You should carefully consider the risks and uncertainties described under this section.

For further information about these and other risks, uncertainties and factors, please review the disclosure included in this report under Item 1A “Risk Factors.”

PART I

In this Report, we use the terms “Company,” “XsunX,” “we,” “us,” and “our,” unless otherwise indicated, or the context otherwise requires, to refer to XsunX, Inc.

Organization

XsunX, Inc. (“XsunX,” the “Company” or the “issuer”) is a Colorado corporation formerly known as Sun River Mining Inc. “Sun River”). The Company was originally incorporated in Colorado on February 25, 1997. Effective September 24, 2003, the Company completed a plan of reorganization and name change to XsunX, Inc.

Business Overview

XsunX specializes in the sale, design, and installation of solar photovoltaic power generation (PV), and energy saving technologies that provide our clients long term savings, predictability, and control of their energy costs. Our background and experience spans virtually all aspects of solar including technology assessment, design, and development.

The Company has developed a highly skilled team of qualified engineering and specialty contractors with extensive commercial and residential solar experience necessary to service the diverse conditions that can be encountered in the design and installation of PV, and energy saving technologies. The company couples this superior design and delivery capability with factory direct pricing, and zero down financing options to provide our clients with energy solutions that can quickly pay for themselves.

Our business development objectives are to capitalize on the demand within the California commercial and residential markets for the installation of solar electric power systems. The demand, underscored in a 2015 market data report from the U.S. Solar Energy Industries Association (SEIA) indicates $11.7 billion dollars was invested into PV system installations in California in 2014 representing a 66% increase over the previous year, and nationally capacity is forecasted to double through the addition of roughly 20,000 megawatts (MW) in the 2015-16 period with California leading the way. Helping to drive these significant solar adoption numbers are continued cost reductions, coupled with government tax and investment incentives providing significant investment incentives for consumers whom we market to in efforts to make sales.

We have historically focused our operations toward commercial rooftop solar power sales. In the second half of 2015 period we began to expand our marketing efforts to include residential sales, however an area in which we believe we can establish distinct marketing and sales advantages is through the sale and delivery of commercial solar carport systems.

While we believe that the commercial and residential rooftop solar will continue to offer sales growth opportunities, non-residential solar carport systems can, in many instances, provide us the opportunity to offer customers larger project sizing, greater electricity savings, and the ability to differentiate XsunX from competitors.

In the 2015 period we established the capabilities to design, directly source all of the major system components, and deliver solar carport systems allowing us to eliminate reliance on costly third party specialty subcontractors whom we believe the majority of our competitors rely on. This has allowed us to reduce our carport structure installation costs by approximate 35%, and the overall PV system cost by approximately 15% which, we believe, provides us with a distinct pricing advantage for solar carports within the greater Southern California markets that we serve.

Market for Solar Power

We believe that a significant demand for our solar power energy solutions is developing, in part, as a result of following propositions:

| |

•

|

|

We provide the ability to control and predict future energy costs. Our customers invest in the ability to self-generate power to offset and/or eliminate the purchase of third party utility provided electric energy. These investments provide predictability and control of energy costs, and can significantly reduce overall energy costs while insulating clients from rising retail electricity prices.

|

| |

•

|

|

Maturity and dependability of solar technologies. The results and benefits from investments in solar power systems have begun to produce long term statistical data. This historical performance data allows investment benefits for near and long term future operations to be accurately estimated. This provides customers greater reliance on future results, and the confidence to make investments.

|

| |

•

|

|

Rapid capital recovery of solar investments. Reports provided by U.S. Energy Department indicate that the installed price reductions for solar PV systems are driving record installation demand. These cost reductions for the major components that make up PV systems allow us to provide per watt pricing that, coupled with tax and operating benefits, can often result in capital investment recovery within 3 to 4 years.

|

Our Approach

We provide customers with a turn-key suite of services and products. Our customer relationship development begins with a financial analysis providing detailed estimated investment benefits and results over the first twenty five years of a solar power systems life span. Through this process we tailor our system designs to maximize the financial benefits and returns for each customer. Our strategy is to develop and deliver systems that can provide the client with the greatest benefits. We then focus on 100% customer satisfaction by consistently matching customer expectations with our performance, and the delivery of our systems.

The key elements of our approach include:

| |

•

|

|

Lead Generation. We market our services utilizing efforts that include wide area advertising in regional newspapers, door-to-door canvasing, list generation and target marketing, and customer referrals. Our sales development efforts work with prospective customers from initial interest through tailored proposals and, ultimately, signed contracts. We plan to grow our sales efforts and team while continually reviewing market trends, and the adoption of new approaches to engage more customers.

|

| |

•

|

|

Detailed Investment Analysis. We use information related to our customer’s energy usage, costs, planned operations, and tax basis to determine optimal solar system and investment sizing. We combine this data and provide customers with 25 year investment projections that detail capital recovery expectations, system performance and energy savings, tax and operating benefits, and property re-sale value improvement estimates.

|

| |

•

|

|

Financing. We have established relationships with lenders and have been approved to offer their finance options to prospective customers. Through our lender association network we offer customers financing options that include commercial equipment loans, lease options, power purchase agreements (PPA’s), PACE & HERO financing through property tax assessment, and we offer clients the option to apply utility incentives towards system purchase buy-downs thereby reducing up front out of pocket expenditures or the amount of capital financed.

|

| |

•

|

|

Design & Engineering. To ensure accuracy we perform our site surveys directly and do not rely on third party services. We then finalize designs that will match proposed financial results, and work with a highly skilled team of qualified engineers with extensive commercial solar experience to ensure compliance with all codes, and best practices for the solar system operation.

|

| |

•

|

|

Installation. We make the installation process simple for our customers. Once we complete the design and engineering of a solar energy system, we obtain all necessary building permits. Then, as the general contractor and construction manager, we provide all materials and components and use highly qualified licensed specialty contractors with extensive commercial and solar experience to provide on-site assembly of solar systems, utility interconnections, and roofing or structural work. We manage and ensure local building department approvals, and arrange for interconnection to the power grid with the utility.

|

| |

•

|

|

Monitoring, Maintenance, and Service. We provide our customers with real-time facility wide monitoring of both solar energy generation and facility wide energy consumption. In addition to providing clients with a better understanding of their energy usage, and the opportunity to modify their usage to realize savings, these monitoring systems allow us to confirm the continuing proper operation of installed solar energy systems. We also service what we sell and provide customers with a single source for all system maintenance or warranty coordination and service.

|

Our Customers

Our customers, and key market, are owner occupied commercial facilities. We do not focus on specific industries or business type, but typically we have found manufacturing, storage, warehousing, agricultural, and single story commercial office space facilities offer greater opportunities for the placement of solar systems. While we can offer financing solutions through our network of lenders for non-owner occupied facilities the greatest financial benefits can be realized by owner occupied commercial facilities.

We work to identify “best” candidates for our systems and we have found that facilities in excess of 3,000 square feet of roof area, and monthly utility costs in excess of $350 provide the minimum practical entry point for our services. However, “best” candidates typically require a minimum of 29kW (kilowatt) in solar system sizing, and have monthly utility costs in excess of $650. In the 2015 fiscal period we provided proposals for systems ranging in size from 20kW to 980kW with 30kW to 200kW providing the largest number of sales opportunities.

The diversity of our customer type presents us with a diverse scope of installation requirements. We routinely encounter installation applications that may require roof mounting, ground or post mounting, carport systems, and custom applications necessary to overcome physical site conditions.

As we work to expand our marketing and customer acquisition efforts we intend to seek sales opportunities for government facilities, and respond to proposal requests for utility scale solar power operations.

Sales, Marketing, and Planned Operations

We have traditionally focused our sales efforts and operations on the delivery of commercial solar power systems in the California market. We believe that our focus provides us long term benefits for brand development as a commercial solar power specialist within a market that we believe to be in the early stages of growth, and poised for a broad adoption of solar power generation.

We see this as a significant business development opportunity as management has the skillset associated with construction management, the licensing qualifications necessary for us to qualify as a licensed contractor in California, we have extensive experience associated with solar PV technologies and the design requirements associated with the delivery of a commercial solar power system, and there is a market demand available for us to provide these services to. We believe that these efforts may provide us with the fastest path to increasing revenue generation, and the ability to reduce future dependency on the sale of debt or equity to fund operations.

In the second half of 2015 period we began to expand our marketing efforts to include residential sales, however an area in which we believe we can establish distinct marketing and sales advantages is through the sale and delivery of commercial solar carport systems.

While we believe that the commercial and residential rooftop solar will continue to offer sales growth opportunities, non-residential solar carport systems can, in many instances, provide us the opportunity to offer customers larger project sizing, greater electricity savings, and the ability to differentiate XsunX from competitors.

In the 2015 period we established the capabilities to design, directly source all of the major system components, and deliver solar carport systems allowing us to eliminate reliance on costly third party specialty subcontractors whom we believe the majority of our competitors rely on. This has allowed us to reduce our carport structure installation costs by approximate 35%, and the overall PV system cost by approximately 15% which, we believe, provides us with a distinct pricing advantage for solar carports within the greater Southern California markets that we serve.

We plan to market the advantages we have developed through efforts that include advertising, direct outside sales, targeted direct marketing, commissioned consultants, and the referral of satisfied customers.

Solar System Operations and Supply

We purchase major components such as solar panels, inverters, and solar module mounting hardware directly from manufacturers and supply houses. When possible, we have establish direct factory purchasing relationships. We have selected these suppliers and components based on cost, reliability, warranty coverage, ease of installation, application design and suitability, and technology advantages.

Additionally, to compete favorably we have establish relationships with lenders through which we can introduce financing options for the systems we design and install. These financing options provide an alternative cash management solution for our target customers, and a sales inducement to purchase systems.

For the foreseeable future we anticipate that we will purchase the system components for each project on an as-needed basis from suppliers at the then-prevailing prices pursuant to purchase orders issued. Due to the volatility of component pricing we do not anticipate any supplier arrangements that will contain long-term pricing or volume commitments. Should our sales results, volume, and market conditions warrant we may in the future elect to make purchase commitments to ensure sufficient supply and reduced pricing of the components that we use.

Our operations focus is to provide complete solar power project design, management of engineering, facility preparation, installation of systems, repair or restoration to all affected areas resulting from the installation process, and any ongoing maintenance agreements as may be sold. To accomplish this we use the services of licensed service professionals in each of the representative trades or specialties necessary. Additionally, we provide qualified staff to supervise project operations, inspections, and system start up and energizing. In the 2016 fiscal period we anticipate that the addition of direct delivery of solar carport systems may allow our sales to increase, and we plan to expand our direct project management capabilities through the addition of qualified field supervisory and engineering staff.

CIGSolar® Thin Film Operations

Prior to the start of our commercial solar power sales operations we had, through September 2013, devoted the majority of our resources to the development of a low cost solution for the manufacture of Copper Indium Gallium Selenide (CIGS) thin film solar cells which we call CIGSolar®. Our target market and customer for this technology are manufacturers who produce solar cells and assemble solar modules.

During the 2012 and 2013 periods all manufacturers of thin film solar technologies experienced a significant erosion of any cost advantages that their technologies may have provided relative to the use of silicon technologies. As a result of the rapid and unprecedented cost reductions to the use of silicon technologies, the thin film industry has experienced a significant reduction to the number of companies that produce, or intended to produce, thin film solar products in the 2014 and 2015 periods as compared to earlier periods. Silicon solar modules are anticipated to remain the dominant technology and increase market share in 2016 while thin film technology production is anticipated to continue to lose market share.

In response to these continuing trends we do not plan to devote resources towards additional testing, calibration, or enhancements to our thin film technologies.

Competition

We believe that our primary competitors are traditional utilities who have a well-established relationship with our target customers, and provide the ease of a status quo relationship without upfront investment costs. To compete with these traditional utilities our products and services must present compelling financial incentives to induce customers to make initial investments that, prior to the application of investment incentives, may equal 8 to 10 years of typical incremental traditional utility service costs.

Helping to accelerate the capital recovery timelines, and the attractiveness of purchasing our systems, are City, State, and Federal government based installation and tax incentives. Additionally, net energy metering (NEM) programs provide customers the ability to receive credits from their respective utility for the production of solar power that at times may be unused and sent into the utility network. Together these programs often help to accelerate capital recovery timelines for customers to within 3 to 5 years.

To compete with a traditional utility we present customers with compelling differentiating benefits to support commercial solar power investment decisions. These include lifecycle investment rate of returns that can exceed 30%, long term control and predictability of energy costs, reductions to facility operating costs, increased property or business re-sale value, turn-key system installation, the management of available utility incentives, and the ability to view all aspects of electrical power usage to further improve operational efficiencies. Based on these factors we believe that we compete favorably with traditional utilities in the regions we service.

We also compete with companies that provide products and services in other segments of the solar energy and energy-related products value chain. To expand our sales and revenue options, and to improve our competitive position, we plan to offer customers more options that we anticipate will include energy storage systems, energy efficiency consultations, and additional energy-related products and services.

In the 2015 period we established the capabilities to design, directly source all of the major system components, and deliver solar carport systems allowing us to eliminate reliance on costly third party specialty subcontractors whom we believe the majority of our competitors rely on. This has allowed us to reduce our carport structure installation costs by approximate 35%, and the overall PV system cost by approximately 15% which, we believe, provides us with a distinct pricing advantage for solar carports within the greater Southern California markets that we serve.

Our plan for operations is to offer customers distinct practical benefits as an all-in-one provider. However, we cannot assure that we will be able to compete successfully in the solar power industry, or that future competition will not have a material adverse effect on our business, operating results, and financial condition.

Intellectual Property

The following is an outline of certain patents and technologies we have developed, attempted to develop, have acquired, or licensed:

The Company has previously worked to develop a hybrid manufacturing solution to produce high performance Copper Indium Gallium (di) Selenide (CIGS) thin film solar cells. Our technology, which we call CIGSolar®, focuses on the mass production of individual thin-film CIGS solar cells that match silicon solar cell dimensions and could offered as a non-toxic, high-efficiency and lowest-cost alternative to the use of silicon solar cells.

In April 2012 we filed claims related to our thermal effusion source design. In October 2014 we received a Restriction Requirement from the United States Patent and Trademark Office that reports the results of the initial examination of the patent application. The examination by the USPTO asserts that the application is directed to two distinct inventions and has issued a restriction requirement. The term “restriction” is applied where the Examiner believes that two (2) or more inventions are separately claimed in the same patent application. Thus, by issuing the restriction requirement, the Examiner is asserting that our application covers more than one invention.

After completing a review of options related to modifying our patent application, and the limited market conditions related to the demand for thin film technologies, we elected to abandon our claims. We do not anticipate any further efforts related to filing or pursuing patent claims related to our prior thin film CIGS efforts.

In September 2003, the Company was assigned the rights to three patents as part of an Asset Purchase Agreement with Xoptix Inc., a California corporation. The patents acquired were No. 6,180,871 for Transparent Solar Cell and Method of Fabrication (Device), granted on January 30, 2001; No. 6,320,117 for Transparent Solar Cell and Method of Fabrication (Method of Fabrication), granted on November 20, 2001; and No. 6,509,204 for Transparent Solar Cell and Method of Fabrication (formed with a Schottky barrier diode and method of its manufacture), granted on January 21, 2003. We do not currently employ nor envision the use of the above named patents in the development or commercialization of our CIGSolar® technology. Because of technological and business developments within the solar industry, we believe that these patents no longer provide business opportunities for the Company to pursue.

On July 10, 2012, the United States Patent and Trademark Office issued a certificate of registration No. 4,172,218 granting the Company a trademark for the use of “CIGSolar”.

We rely on trademark and copyright law, trade secret protection and confidentiality or license agreements with our employees, customers, partners and others to protect our proprietary rights. We have not been subject to any intellectual property claims.

Company History

XsunX is a Colorado corporation formerly known as Sun River Mining Inc. (“Sun River”). The Company was originally incorporated in Colorado on February 25, 1997. Effective September 24, 2003, the Company completed a Plan of Reorganization and Asset Purchase Agreement (the “Plan”).

Pursuant to the Plan, the Company acquired the following three patents from Xoptix, Inc., a California corporation for Seventy Million (70,000,000) shares of common stock (post reverse split one for twenty): No. 6,180,871 for Transparent Solar Cell and Method of Fabrication (Device), granted on January 30, 2001; No. 6,320,117 for Transparent Solar Cell and Method of Fabrication (Method of Fabrication), granted on November 20, 2001; and No. 6,509,204 for Transparent Solar Cell and Method of Fabrication (formed with a Schottky barrier diode and method of its manufacture), granted on January 21, 2003.

Pursuant to the Plan, the Company authorized the issuance of 110,530,000 (post reverse split) common shares. Prior to the Plan, the Company had no tangible assets and insignificant liabilities. Subsequent to the Plan, the Company completed its name change from Sun River Mining, Inc. to XsunX, Inc. The transaction was completed on September 30, 2003.

Government Contracts

There are no government contracts as of the fiscal year ended September 30, 2015.

Compliance with Environmental Laws and Regulations

The operations of the Company are subject to local, state and federal laws and regulations governing environmental quality and pollution control. Compliance with these regulations by the Company has required that, when necessary, we retain the use of consulting firms to assist in the engineering and design of systems related to equipment operations, management of industrial gas storage and delivery systems, and occupancy fire and safety construction standards to deal with emergency conditions. We do not anticipate that these costs will have a material effect on the Company’s operations or competitive position, and the cost of such compliance has not been material to date. The Company is unable to assess or predict at this time what effect additional regulations or legislation could have on its activities.

Employees and Consultants

As of the fiscal year ended September 30, 2015, we had three full-time employees including Mr. Tom Djokovich who is President and CEO. While we do add to, and reduce, the size of our workforce based on current needs this represents no full-time employee change to the same period ended 2014. To compensate our need for additional staff the Company also relies on qualified consultants and licensed professionals to perform specific functions that otherwise would require an employee. As we continue to expand our business developments efforts we may need to add staff to adequately respond to sales inquiries, project management, and general labor as warranted. We consider relations with our employees and consultants to be good.

Seasonality

Our operations can experience some seasonality with increased demand early and later in in each year.

Available Information

Our website address is www.xsunx.com. We make available on our website access to our Annual Report on Form 10-K, quarterly reports on Form 10-Q, and amendments to these reports that we have filed with the U.S. Securities and Exchange Commission (“SEC”). The information found on our website is not part of this or any other report we file with, or furnish to, the SEC.

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this Annual Report on Form 10-K, in evaluating XsunX and our business. If any of the following risks occur, our business, financial condition and results of operations could be materially and adversely affected. Accordingly, the trading price of our common stock could decline and you may lose all or part of your investment in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business operations.

We Have Not Generated Significant Revenues and Our Financial Statements Raise Substantial Doubt About Our Ability to Continue As A Going Concern.

We are in the early stages of executing our plans to grow our business through the sale, design, installation, and servicing of commercial solar power systems and, to date, have not generated any significant revenues. The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate our continuation as a going concern. Net loss for the years ended September 30, 2015 and 2014 was $(1,320,648) and $(1,949,887), respectively. Net cash used for operations was $(207,068) and $(368,368) for the years ended September 30, 2015 and 2014, respectively. At September 30, 2015, we had a working capital deficit of $(884,516). We had an accumulated deficit at September 30, 2015 and 2014 of $(42,385,570) and $(41,064,922), respectively.

The items discussed above and herein raise substantial doubt about our ability to continue as a going concern. We cannot assure you that we can achieve or sustain profitability in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. Revenues and profits, if any, will depend upon various factors, including whether our product development can be completed, whether our products will achieve market acceptance and whether we obtain additional financing. We may not achieve our business objectives and the failure to achieve such goals would have a materially adverse impact on us.

We expect that we will need to obtain additional financing to continue to operate our business, including expenditures to expand operations for the sales, design, and installation of solar PV systems, and, should we elect to complete the development of marketable thin film manufacturing technologies. This financing may be unavailable or available only on disadvantageous terms which could cause the use to curtail our business operations and delay the execution of our business plan.

We have in the past experienced substantial losses and negative cash flow from operations and have required financing, including equity and debt financing, in order to pursue the commercialization of products based on our technologies. We expect that we will continue to need significant financing to operate our business. Furthermore, there can be no assurance that additional financing will be available or that the terms of such additional financing, if available, will be acceptable to us. If additional financing is not available or not available on terms acceptable to us, our ability to fund our operations, successfully expand operations to include the sales, design, and installation of solar PV systems, complete the sales or development of marketable technologies, products, or services, develop a sales network, or otherwise respond to competitive pressures may be significantly impaired. We could also be forced to curtail our business operations, reduce our investments, decrease or eliminate capital expenditures and delay the execution of any portion or all of our business plans, including, without limitation, all aspects of our operations, which would have a material adverse effect on our business.

We may be required to raise additional financing by issuing new securities with terms or rights superior to those of our shares of common stock, which could adversely affect the market price of our shares of common stock and our business.

We will require additional financing to fund future operations, including expansion in current and new markets, development and acquisition, capital costs and the costs of any necessary implementation of technological innovations or alternative technologies. We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities, the percentage ownership of our current stockholders will be reduced, and the holders of the new equity securities may have rights superior to those of the holders of shares of common stock, which could adversely affect the market price and the voting power of shares of our common stock. If we raise additional funds by issuing debt securities, which we have relied on significantly during the year ended September 30, 2015, the holders of these debt securities could have some rights senior to those of the holders of shares of common stock, and the terms of these debt securities could impose restrictions on operations and create a significant interest and derivative expenses for us which could have a materially adverse effect on our business.

As we continue to expand our business development efforts within the solar PV system sales, design, and installation market existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic barriers to the purchase and use of solar energy systems that may significantly reduce demand for the solar energy systems we design and market.

Federal, state and local government regulations and policies concerning the electric utility industry, and internal policies and regulations promulgated by electric utilities, heavily influence the market for electricity generation products and services. These regulations and policies often relate to electricity pricing and the interconnection of customer-owned electricity generation. In the United States, governments and utilities continuously modify these regulations and policies. These regulations and policies could deter customers from purchasing renewable energy, including solar energy systems. This could result in a significant reduction in the potential demand for our solar energy systems. For example, utilities commonly charge fees to larger, industrial customers for disconnecting from the electric grid or for having the capacity to use power from the electric grid for back-up purposes. These fees could increase our target customers’ cost to use our systems and make them less desirable, thereby harming our future business, prospects, financial condition and results of operations.

In addition, any changes to government or internal utility regulations and policies that favor electric utilities could reduce our competitiveness and cause a significant reduction in demand for our products and services. For example, certain jurisdictions have proposed imposing a new charge that would disproportionately impact solar energy system customers who utilize net metering, either of which would increase the cost of energy to those customers and could reduce demand for our solar energy systems. Any similar government or utility policies adopted in the future could reduce demand for our products and services and adversely impact our growth.

We rely on net metering and related policies to offer competitive pricing to our target customers in our key market of California.

California has a regulatory policy known as net energy metering, or net metering. Net metering typically allows our target customers to interconnect their on-site solar energy systems to the utility grid and offset their utility electricity purchases by receiving a bill credit at the utility’s retail rate for energy generated by their solar energy system in excess of electric load that is exported to the grid. At the end of the billing period, the customer simply pays for the net energy used or receives a credit at the retail rate if more energy is produced than consumed. Our ability to sell solar energy systems or the benefits of the electricity they generate may be adversely impacted by the failure to expand existing limits on the amount of net metering, or the imposition of new charges that only or disproportionately impact customers that utilize net metering. Our ability to sell solar energy systems or the benefits of the electricity they generate may also be adversely impacted by the unavailability of expedited or simplified interconnection for grid-tied solar energy systems or any limitation on the number of customer interconnections or amount of solar energy that utilities are required to allow in their service territory or some part of the grid.

Limits on net metering, interconnection of solar energy systems and other operational policies in our key market could limit the number of solar energy systems installed there. For example, California utilities are currently required to provide net metering to their customers until the total generating capacity of net metered systems exceeds 5% of the utilities’ “aggregate customer peak demand.” This cap on net metering in California was increased to 5% in 2010 as utilities neared the prior cap of 2.5%. New California legislation passed in October 2013 establishes a process and timeline for developing a new program with no participation cap that would apply after the current cap of 5% is reached. If the current net metering caps in California, or other jurisdictions, are reached, or if the amounts of credit that customers receive for net metering are significantly reduced, our target customers will be unable to recognize the current cost savings associated with net metering. We anticipate that we will substantially rely on net metering to establish competitive pricing for our solar PV system sales with our prospective customers. The absence of net metering for customer acquisition would greatly limit demand and our ability to effectively market our solar energy system benefits.

As we continue to expand our business development efforts within the solar PV system sales, design, and installation market these business operations will depend on the availability of rebates, tax credits and other financial incentives. The expiration, elimination or reduction of these rebates, credits and incentives would adversely impact our planned business expansion.

U.S. federal, state and local government bodies provide incentives to end users, distributors, system integrators and manufacturers of solar energy systems to promote solar electricity in the form of rebates, tax credits and other financial incentives such as system performance payments and payments for renewable energy credits associated with renewable energy generation. We will rely on these governmental rebates, tax credits and other financial incentives to market the low cost operating and investment benefits of solar PV systems to our target customers. However, these incentives may expire on a particular date, end when the allocated funding is exhausted, or be reduced or terminated as solar energy adoption rates increase. Certain reductions or terminations could occur without warning.

The federal government currently offers a 30% investment tax credit under Section 48(a)(3) of the Internal Revenue Code, or the Federal ITC, for the installation of certain solar power facilities until December 31, 2016. This credit is due to adjust to 10% in 2017. Reductions in, or eliminations or expirations of, governmental incentives could adversely impact our future results of operations and our ability to offer solar PV systems as a competitive alternative to utility provided electricity.

A material drop in the retail price of utility-generated electricity or electricity from other sources would harm our business development efforts for the sale of solar PV systems and cause a material adverse effect to our future financial condition and results of operations.

Our target customer’s decision to invest in renewable energy through us will be primarily driven by their desire to pay less for electricity. The customer’s decision may also be affected by the cost of other renewable energy sources. Decreases in the retail prices of electricity from the utilities or from other renewable energy sources would harm our ability to offer competitive alternatives and could harm our business. The price of electricity from utilities could decrease as a result of any number of market conditions including:

| |

•

|

|

the construction of a significant number of new power generation plants, including nuclear, coal, natural gas or renewable energy technologies, and;

|

| |

•

|

|

a reduction in the price of natural gas as a result of new drilling techniques or a relaxation of associated regulatory standards;

|

A reduction in utility electricity prices would make the investment by our target customers into the solar PV systems that we design and install less economically attractive. In addition, a shift in the timing of peak rates for utility-generated electricity to a time of day when solar energy generation is less efficient could make our solar energy system offerings less competitive and reduce demand for our products and services. If the retail price of energy available from utilities were to decrease due to any of these reasons, or others, we would be at a competitive disadvantage, we may be unable to attract customers and our growth would be limited.

A material drop in the retail price of utility-generated electricity would particularly adversely impact our ability to attract commercial customers which represent our target customer base.

We anticipate that commercial customers will comprise a significant portion of our business, and the commercial market for energy is particularly sensitive to price changes. Typically, commercial customers pay less for energy from utilities than residential customers. Any future decline in the retail rate of energy for commercial entities could have a significant impact on our ability to attract commercial customers. We may be unable to offer solar energy systems for the commercial market that produce electricity at rates that are competitive with the price of retail electricity on a non-subsidized basis. If this were to occur, we would be at a competitive disadvantage to other energy providers and may be unable to attract new commercial customers, and our future business operations would be harmed.

Rising interest rates could adversely impact all aspects of current and planned business operations.

Changes in interest rates could have an adverse impact on our business by increasing the cost of capital for our target customers. For example rising interest rates may negatively impact our ability to provide financing sources on favorable terms to facilitate our customers’ purchase of our solar PV systems.

As we continue to expand our business development efforts within the solar PV system sales, design, and installation market we will act as the licensed general contractor for our customers and will be subject to risks associated with construction, cost overruns, delays, regulatory compliance and other contingencies, any of which could have a material adverse effect on our business and results of operations.

We intend to and are required to operate as a licensed contractor in every region we intend to service, and we will be responsible for every customer installation. For our commercial solar PV system projects, we intend to be the general contractor and construction manager, and we will typically rely on licensed subcontractors representing specialty trades such as electrical, roofing, and carpentry to install the commercial systems we sell. We may be liable to customers for any damage we cause to their facility, belongings or property during the installation of our systems. In addition, any shortages that may occur of skilled subcontractor labor for our commercial projects could significantly delay a project or otherwise increase our costs. Because our profit on a particular installation will be based in part on assumptions as to the cost of such project, cost overruns, delays or other execution issues may cause us to not achieve our expected margins or cover our costs for that project.

In addition, the installation of solar energy systems and the evaluation and modification of buildings that may be necessary as part of our business is subject to oversight and regulation in accordance with national, state and local laws and ordinances relating to building codes, safety, environmental protection, utility interconnection and metering, and related matters. Any new government regulations or utility policies pertaining to the systems we design and install may result in significant additional expenses to us and our future customers and, as a result, could cause a significant reduction in demand for our systems and services.

Compliance with occupational safety and health requirements and best practices can be costly, and noncompliance with such requirements may result in potentially significant monetary penalties, operational delays and adverse publicity.

The installation of solar energy systems will require our employees and any subcontractors that we engage to work at heights with complicated and potentially dangerous electrical systems. The evaluation and modification of buildings that may be necessary as part of our business may require our employees to work in locations that may contain potentially dangerous levels of asbestos, lead or mold. Our operations are subject to regulation under the U.S. Occupational Safety and Health Act, or OSHA, and equivalent state laws. Changes to OSHA requirements, or stricter interpretation or enforcement of existing laws or regulations, could result in increased costs. If we fail to comply with applicable OSHA regulations, even if no work-related serious injury or death occurs, we may be subject to civil or criminal enforcement and be required to pay substantial penalties, incur significant capital expenditures, or suspend or limit operations.

As we continue to expand our business development efforts within the solar PV system sales, design, and installation market future problems with product quality or performance may cause us to incur warranty expenses, and may damage our market reputation and cause our financial results to decline.

Customers in our target market of California who purchase solar energy systems are covered by a warranty of up to 10 years in duration for material defects and workmanship. In addition, we provide a pass-through of the major components such as module mounting, inverter and solar panel manufacturers’ warranties to our customers, which generally range from 10 to 25 years. We may also make extended warranties available at an additional cost to customers.

As we continue to expand our business development efforts within the solar PV system installation market we may be required to make assumptions and apply judgments regarding a number of factors, including our anticipated rate of warranty claims, and the durability, performance and reliability of the components employed in the assembly of solar energy systems. The Company has a limited history of project installations and will access potential warranty costs, and other allowances, based on our experience in servicing warranty claims as they may arise in the future.

If products and technologies that we market or products based on technologies we are developing cannot be developed for manufacture and sold commercially or our products or the products we market become obsolete or noncompetitive, we may be unable to recover our investments or achieve profitability which will have a materially adverse effect on our business.

There can be no assurance that any of the products that we will market that comprise the solar PV systems we intend to offer will gain or maintain market acceptance, or our research and development efforts will be successful or that we will be able to develop commercial applications for our products and technologies. Further, the areas in which we have developed technologies and products are characterized by rapid and significant technological change. Rapid technological development may result in our products becoming obsolete or noncompetitive. If products based on our technologies cannot be developed for manufacture and sold commercially or our products become obsolete or noncompetitive, we may be unable to recover our investments or achieve profitability. In addition, any commercialization schedule may be delayed if we experience delays in meeting development goals, if products based on our technologies exhibit technical defects, or if we are unable to meet cost or performance goals. In this event, potential purchasers of products based on our technologies may choose alternative technologies and any delays could allow potential competitors to gain market advantages.

There is no assurance that the market will accept the products that we offer or have developed once development has been completed which could have an adverse effect on our business.

There can be no assurance that products we market or products based on technologies that we may develop will be perceived as being superior to existing products or new products offered or being developed by competing companies or that such products will otherwise be accepted by consumers. The market prices for products based on our technologies may exceed the prices of competitive products based on existing technologies or new products based on technologies currently under development by competitors. There can be no assurance that the prices of products based on our technologies, or the technologies of others that we market will be perceived by consumers as cost-effective or that the prices of such products will be competitive with existing products or with other new products or technologies. If consumers do not accept products based on our technologies, we may be unable to recover our investments or achieve profitability.

There is no assurance that the market will accept our continued efforts to offer design, engineering, and installation services for solar electric PV systems which could have an adverse effect on our business.

The market for sales and installation of solar electric PV systems is highly competitive with limited barriers to entry by potential competitors. There can be no assurance that the products and services we will offer will be perceived as being superior or a better value to other similar products and services offered by competing companies or that such products will otherwise be accepted by consumers. If consumers do not accept our design, engineering, and installations services at the pricing we offer we may be unable to recover our investments, make sales of any significance, or achieve profitability.

Other companies, many of which have greater resources than we have, may develop or offer competing products or technologies which cause products based on our technologies or the technologies we market to become noncompetitive which could have an adverse effect on our business.

We have and will continue to compete with firms, both domestic and foreign, that perform research and development, as well as firms that manufacture, sell, or install solar products. In addition, we expect additional potential competitors to enter the markets for solar products and installation services in the future. Some of these competitors are large companies with longer operating histories, greater name recognition, access to larger customer bases, well-established business organizations and product lines and significantly greater resources and research and development staff and facilities. There can be no assurance that one or more such companies will not succeed in developing technologies or products that will become available for commercial sale prior to our products, that will have performance superior to products based on our technologies or that would otherwise render our products noncompetitive. If we fail to compete successfully, our business would suffer and we may lose or be unable to gain market share.

There continues to be a few thin film companies that produce thin film solar products such as First Solar and Solar Frontier, and a limited number of others, compared to previous periods, are currently working to develop and commercialize thin film manufacturing methods. Given the benefit of time, investment, and advances in manufacturing technologies any of these competing technologies may achieve manufacturing costs per watt lower than cost per watt to manufacture technologies developed by us. However, while these risks do exist the Company believes that the more prevalent and greater risk posing both the Company, and the thin film market, will continue to be further and prolonged market price reductions from manufacturers of silicon solar technologies. The majority of the companies within the silicon industry have greater resources to devote to research, development, manufacturing and marketing than we do.

The loss of strategic relationships used in provisioning the products that comprise the solar PV systems that we intend to offer, and strategic relationships used in any future development of our thin film manufacturing technologies and products could impede our ability to offer competitive solar PV system products or further the development of our products and have a material adverse effect on our business.

We have established a plan of operations under which a significant portion of our operations will rely on strategic relationships with third parties to provide materials and components necessary for the assembly of solar PV systems, systems design, assembly and support, and any future development of our thin film technologies. A loss of any of our third party relationships for any reason could cause us to experience difficulties in implementing our business strategy. There can be no assurance that we could establish other relationships of adequate expertise in a timely manner or at all.

We may suffer the loss of key personnel or may be unable to attract and retain qualified personnel to maintain and expand our business which could have a material adverse effect on our business.

Our success is highly dependent on the continued services of a limited number of skilled managers, technicians, and access to qualified consultants and licensed subcontractors. The loss of any of these individuals or resources will have a material adverse effect on us. In addition, our success will depend upon, among other factors, the recruitment and retention of additional highly skilled and experienced management and technical personnel. There can be no assurance that we will be able to retain existing employees or to attract and retain additional personnel on acceptable terms given the competition for such personnel in industrial, academic and nonprofit research sectors.

We may not be successful in protecting our intellectual property and proprietary rights and may be required to expend significant amounts of money and time in attempting to protect these rights. If we are unable to protect our intellectual property and proprietary rights, our competitive position in the market could suffer.

Our current intellectual property consists of trade secrets, and trade dress. Our success depends in part on our ability to create and maintain intellectual property to differentiate our services, how we provision our services, the ability to obtain patents as either business processes or technology development mature, and maintain adequate protection of our other intellectual property for our technologies and products in the U.S. and in other countries. The laws of some foreign countries do not protect proprietary rights to the same extent as do the laws of the U.S., and many companies have encountered significant problems in protecting their proprietary rights in these foreign countries. These problems may be caused by, among other factors, a lack of rules and methods for defending intellectual property rights. Also, the costs associated with the development of intellectual property rights can be significant and we may not be able to pursue rights initially in any region that we operate in and that may pose competitive challenges to us.

Our future commercial success may require us not to infringe on patents and proprietary rights of third parties, or breach any licenses or other agreements that we have entered into with respect to the products that we market, our technologies, products and businesses. The enforceability of patent positions cannot be predicted with certainty. We have in the past applied for patents covering certain aspects of the technology we have developed and we may elect to file additional patents, if any, as we deem appropriate. Patents, if issued, may be challenged, invalidated or circumvented. There can be no assurance that no other relevant patents have been issued that could block our ability to obtain patents or to operate as we would like. Others may develop similar technologies or may duplicate technologies developed by us.

We are not currently a party to any litigation with respect to any of our patent positions or trade secrets. However, if we become involved in litigation or interference proceedings declared by the United States Patent and Trademark Office, or other intellectual property proceedings outside of the U.S., we might have to spend significant amounts of money to defend our intellectual property rights. If any of our competitors file patent applications or obtain patents that claim inventions or other rights also claimed by us, we may have to participate in interference proceedings declared by the relevant patent regulatory agency to determine priority of invention and our right to a patent of these inventions in the U.S. Even if the outcome is favorable, such proceedings might result in substantial costs to us, including, significant legal fees and other expenses, diversion of management time and disruption of our business. Even if successful on priority grounds, an interference proceeding may result in loss of claims based on patentability grounds raised in the interference proceeding. Uncertainties resulting from initiation and continuation of any patent or related litigation also might harm our ability to continue our research or to bring products to market.

An adverse ruling arising out of any intellectual property dispute, including an adverse decision as to the priority of our inventions would undercut or invalidate our intellectual property position. An adverse ruling also could subject us to significant liability for damages, prevent us from using certain processes or products, or require us to enter into royalty or licensing agreements with third parties. Furthermore, necessary licenses may not be available to us on satisfactory terms, or at all.

Confidentiality agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information.

To protect our proprietary business methods, technologies and processes, we rely on trade secret protection and we have also sought formal legal devices such as patents. Although we have taken security measures to protect our trade secrets and other proprietary information, these measures may not provide adequate protection for such information. Our policy is to execute confidentiality and proprietary information agreements with each of our employees and consultants upon the commencement of an employment or consulting arrangement with us. These agreements generally require that all confidential information developed by the individual or made known to the individual by us during the course of the individual’s relationship with us be kept confidential and not be disclosed to third parties. These agreements also generally provide that technology conceived by the individual in the course of rendering services to us shall be our exclusive property. Even though these agreements are in place there can be no assurances that that trade secrets and proprietary information will not be disclosed, that others will not independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets, or that we can fully protect our trade secrets and proprietary information. Violations by others of our confidentiality agreements and the loss of employees who have specialized knowledge and expertise could harm our competitive position and cause our sales and operating results to decline as a result of increased competition. Costly and time-consuming litigation might be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection might adversely affect our ability to continue our research or bring products to market.

Downturns in general economic conditions could adversely affect our ability to attract customers and our potential for future profitability.

Downturns in general economic conditions can cause fluctuations in demand for any products we may offer, product prices, volumes and margins. Economic conditions may at any time not be favorable to our industry. A decline in the demand for our products and services or a shift to lower-margin products due to deteriorating economic conditions could adversely affect sales of our intended products and our profitability and could also result in impairments of certain of our assets.

Standards for compliance with section 404 of The Sarbanes-Oxley Act Of 2002 are subject to change, and if we fail to comply in a timely manner, our business could be harmed and our stock price could decline.

This annual report does not include an attestation report of the company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this annual report. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards and will impose significant additional expenses on us. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. If we cannot assess our internal control over financial reporting as effective, investor confidence and share value may be negatively impacted.

Our common stock is considered a “Penny Stock” and as a result, related broker-dealer requirements affect its trading and liquidity.

Our common stock is considered to be a “penny stock” since it meets one or more of the definitions in Rules 15g-2 through 15g-6 promulgated under Section 15(g) of the Exchange Act. These include but are not limited to the following: (i) the common stock trades at a price less than $5.00 per share; (ii) the common stock is not traded on a “recognized” national exchange; (iii) the common stock is not quoted on the NASDAQ Stock Market, or (iv) the common stock is issued by a company with average revenues of less than $6.0 million for the past three (3) years. The principal result or effect of being designated a “penny stock” is that securities broker-dealers cannot recommend our Common Stock to investors, thus hampering its liquidity.

Section 15(g) and Rule 15g-2 require broker-dealers dealing in penny stocks to provide potential investors with documentation disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the documents before effecting any transaction in a penny stock for the investor’s account. Potential investors in our Common Stock are urged to obtain and read such disclosure carefully before purchasing any of our shares.

Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives.

The trading market in our common stock is limited and may cause volatility in the market price.

Our common stock is currently traded on a limited basis on the OTC. The OTC is an inter-dealer, over-the-counter market that provides significantly less liquidity than the NASDAQ Stock Market and the other national markets. Quotes for stocks included on the OTC are not listed in the financial sections of newspapers as are those for the NASDAQ Stock Market. Therefore, prices for securities traded solely on the OTC may be difficult to obtain.

The quotation of our common stock on the OTC does not assure that a meaningful, consistent and liquid trading market currently exists, and in recent years such market has experienced extreme price and volume fluctuations that have particularly affected the market prices of many smaller companies like us. Thus, the market price for our common stock is subject to volatility and holders of common stock may be unable to resell their shares at or near their original purchase price or at any price. In the absence of an active trading market:

| |

•

|

investors may have difficulty buying and selling or obtaining market quotations;

|

| |

•

|

market visibility for our common stock may be limited; and

|

| |

•

|

a lack of visibility for our common stock may have a depressive effect on the market for our common stock.

|

Due to the low price of the securities, many brokerage firms may not be willing to effect transactions in the securities. Even if a purchaser finds a broker willing to effect a transaction in these securities, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such securities as collateral for any loans. Such restrictions could have a materially adverse effect on our business.

We may have difficulty raising necessary capital to fund operations as a result of market price volatility for our shares of common stock.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including:

| |

•

|

technological innovations or new products and services by us or our competitors;

|

| |

•

|

additions or departures of key personnel;

|

| |

•

|

sales of our common stock;

|

| |

•

|

our ability to integrate operations, technology, products and services;

|

| |

•

|

our ability to execute our business plan;

|

| |

•

|

operating results below expectations;

|

| |

•

|

loss of any strategic relationship;

|

| |

•

|

economic and other external factors; and

|

| |

•

|

period-to-period fluctuations in our financial results.

|

Because we have a limited operating history with limited revenues to date, you may consider any one of these factors to be material. Our stock price may fluctuate widely as a result of any of the above listed factors. In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If our business development plans are successful, we will require additional financing to continue to develop and exploit existing and new technologies and to expand into new markets. The exploitation of our technologies may, therefore, be dependent upon our ability to obtain financing through debt, equity or other means.

Item 1B. Unresolved Staff Comments

As of the date of this Annual Report on Form 10-K, there are no unresolved staff comments regarding our previously filed periodic or current reports under the Securities Exchange Act of 1934, as amended.

California Corporate Office Lease

At September 30, 2015 the Company leased corporate facilities located in Aliso Viejo, CA. The lease for the Aliso Viejo location is month to month at a rate of $200 per month. The Company may expand into larger facilities to support expanding operations in the 2016 fiscal period.

The Company owns no real property.

Item 3. Legal Proceedings

In the conduct of our business, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have, individually or in the aggregate, a material adverse effect on our business.

Item 4. Mining and Safety Disclosures

Not applicable

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

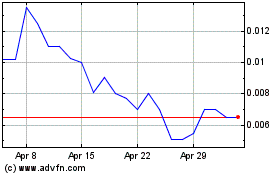

Price Range of Common Stock

The Company’s common stock trades on the OTC Market under the symbol “XSNX”. The range of high, low and close quotations for the Company’s common stock by fiscal quarter within the last two fiscal years, as reported by the OTC Markets, was as follows:

|

Year Ended September 30, 2015

|

|

High

|

|

|

Low

|

|

|

Close

|

|

First Quarter ended December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter ended March 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter ended June 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter ended September 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended September 30, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter ended December 31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter ended March 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter ended June 30, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter ended September 30, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

The market price for our common stock, like that of other technology or service companies, is highly volatile and is subject to fluctuations in response to variations in our operating results, announcements related to technological innovation or business development, or other events and factors. Our stock price may also be affected by broader market trends unrelated to our performance.

The above quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commission and may not necessarily represent actual transactions.

Number of Holders