Registration No._______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

NORTHWEST BIOTHERAPEUTICS, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

8731

|

|

94-3306718

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer Identification Number)

|

4800 Montgomery Lane, Suite 800

Bethesda, Maryland 20814

(240) 497-9024

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Linda F. Powers

Chief Executive Officer

Northwest Biotherapeutics, Inc.

4800 Montgomery Lane, Suite 800

Bethesda, Maryland 20814

(240) 497-9024

Copies of notices and other communications should be sent to:

Peter Campitiello, Esq.

Tarter Krinsky & Drogin LLP

1350 Broadway

New York, New York 10018

Tel: 212-216-8085

Fax: 212-216-8001

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box:

x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box:

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

¨

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

|

Amount to be

Registered

|

|

|

Proposed

Maximum

Offering

Price Per

Share (1)

|

|

|

Proposed

Maximum

Aggregate

Offering Price (2)

|

|

|

Amount of

Registration Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value per share, issuable pursuant to the Purchase Agreement

|

|

|

(1)7,000,000

|

|

|

$

|

0.39

|

|

|

$

|

2,730,000

|

|

|

$

|

312.86

|

|

|

TOTAL (1)

|

|

|

7,000,000

|

|

|

$

|

0.39

|

|

|

$

|

2,730,000

|

|

|

$

|

312.86

|

|

|

|

(1)

|

We are registering shares of our common stock (the “Put Shares”) that we may put to Four M Purchasers, LLC (“Four M Purchasers” or “Selling Stockholder”) pursuant to a Purchase Agreement (the “Purchase Agreement”) between the Selling Stockholder and the Registrant, entered into as of November 14, 2011. In the event of stock splits, stock dividends, or similar transactions involving the common stock, the number of common shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In the event that adjustment provisions of the Purchase Agreement require the Registrant to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the Registrant will file a new registration statement to register those additional shares.

|

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee under Rule 457 under the Securities Act, using the last closing price as reported on the Over-the-Counter Bulletin Board (the “OTCBB”) on January 9, 2012, which was $0.39 per share

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDER MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT, OF WHICH THIS PROSPECTUS FORMS A PART, FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

In this Prospectus references to “Northwest Biotherapeutics,” the “Company,” “we,” “us,” and “our” refer to Northwest Biotherapeutics, Inc. and its subsidiary.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JANUARY 10, 2012

NORTHWEST BIOTHERAPEUTICS, INC.

7,000,000 Shares of Common Stock, par value $0.001

This Prospectus relates to resales by selling stockholder Four M Purchasers, LLC, a Delaware limited liability company (“Selling Stockholder”) of up to

7,000,000

shares (the “Put Shares”) of our common stock, par value $0.001 per share (the “Common Stock”), which are put shares that we will put to the Selling Stockholder pursuant to the Purchase Agreement dated November 14, 2011, by and between the Selling Stockholder and us (the “Purchase Agreement”).

Under the Purchase Agreement, we will notify the Selling Stockholder from time to time of our intention to sell a specified amount of Put Shares to the Selling Stockholder pursuant to the Purchase Agreement. The Selling Stockholder will then purchase such Put Shares from us on, and to the extent of, the terms and conditions set forth in the Purchase Agreement. The maximum aggregate amount of Put Shares that we may sell to the Selling Stockholder through this put arrangement, if all conditions of the Purchase Agreement are satisfied, will be an aggregate of $2.5 million of such Put Shares over a period of up to six (6) months following the effective date of this Registration Statement. For more information about the Selling Stockholder, please see the section of this prospectus entitled “Selling Stockholder”.

We will not receive any proceeds directly from the resales of the Put Shares by the Selling Stockholder. We will, however, receive proceeds from the sale of our Put Shares to the Selling Stockholder pursuant to the Purchase Agreement as described above. When we put an amount of Put Shares to the Selling Stockholder, the price per share that the Selling Stockholder will pay to us will be determined in accordance with a formula set forth in the Purchase Agreement. Generally, the price per share will be determined by a backward-looking, fixed price formula of ninety-five percent (95%) of the average of the three (3) lowest closing bid prices of our Common Stock during the five (5) trading days prior to the notification date.

The total amount of Put Shares which may be sold pursuant to this prospectus and registration statement would constitute approximately 4.7% of our issued and outstanding Common Stock as of January 10, 2012, if all of the shares had been sold by that date.

The Selling Stockholder may sell the Put Shares from time to time at the prevailing market price on the Over-the Counter Bulletin Board (“OTCBB”), or on an exchange if our shares of Common Stock become listed for trading on such an exchange, or in negotiated transactions on such terms and conditions as may be acceptable to investors purchasing the Put Shares in such resale transactions (including with respect to any price discounts and/or warrants). The Selling Stockholder is an "underwriter" within the meaning of the Securities Act of 1933, as amended (the “Securities Act”) in connection with the resale of our Common Stock under the Purchase Agreement. No other underwriter or person has been engaged, to date, to facilitate the sale of shares of our common stock in this offering; however, other parties may be so engaged during the term of the Purchase Agreement. This offering will terminate six (6) months after the registration statement to which this prospectus is made a part is declared effective by the SEC. For more information, please see the section of this prospectus entitled "Plan of Distribution."

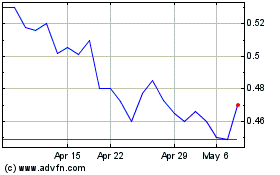

Our Common Stock is registered under Section 12(g) of the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is quoted on the FINRA OTCBB under the symbol “NWBO.OB”. The last reported sale price per share of our Common Stock as reported by the OTCBB on January 9, 2012, was $0.39. These prices will fluctuate based on the demand for our Common Stock.

We will be responsible for all fees and expenses incurred in connection with the preparation and filing of this registration statement, and the implementation of the transactions contemplated herein, including, without limitation, any price discounts and/or warrants provided to investors who purchase the Put Shares, and any underwriters' discounts or commissions and other fees and expenses relating to the re-sale of the Put Shares by the Selling Stockholder.

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD INVEST IN OUR COMMON STOCK ONLY IF YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. YOU SHOULD CAREFULLY READ AND CONSIDER THE SECTION OF THIS PROSPECTUS TITLED "RISK FACTORS" BEGINNING ON PAGE [6] BEFORE BUYING ANY SHARES OF OUR COMMON STOCK.

THE SECURITIES AND EXCHANGE COMMISSION AND STATE SECURITIES REGULATORS HAVE NOT APPROVED OR DISAPPROVED OF THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is January 10, 2012.

TABLE OF CONTENTS

|

|

|

Page

|

|

Part I - Information Required in Prospectus

|

|

|

|

Forward-Looking Statements

|

|

1

|

|

Prospectus Summary

|

|

2

|

|

Risk Factors

|

|

6

|

|

Risk Factors Relating to this Offering

|

|

6

|

|

Risk Factors Relating to Operation of Northwest Biotherapeutics, Inc.

|

|

9

|

|

Risk Factors Relating to the Securities Markets and Investments in Our Common Stock

|

|

15

|

|

Use of Proceeds

|

|

18

|

|

Determination of Offering Price

|

|

19

|

|

Dilution

|

|

19

|

|

The Selling Stockholder

|

|

19

|

|

The Purchase Agreement

|

|

20

|

|

The Offering

|

|

20

|

|

Plan of Distribution

|

|

22

|

|

Description of Securities to be Registered

|

|

25

|

|

Description of Business

|

|

26

|

|

Interest of Named Experts and Counsel

|

|

43

|

|

Description of Property

|

|

43

|

|

Legal Proceedings

|

|

44

|

|

Market for Common Equity and Related Matters

|

|

44

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

46

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures

|

|

52

|

|

Directors, Executive Officers, Promoters and Control Persons

|

|

52

|

|

Executive Compensation

|

|

55

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters

|

|

63

|

|

Certain Relationships and Party Related Party Transactions

|

|

66

|

|

Part II - Information Not Required in Prospectus

|

|

|

|

Other Expenses of Issuance and Distribution

|

|

69

|

|

Indemnification of Directors, Officers, Employees, and Agents

|

|

70

|

|

Recent Sales of Unregistered Securities

|

|

70

|

|

Where You Can Find More Information

|

|

76

|

|

Exhibits

|

|

77

|

|

Undertakings

|

|

84

|

|

Signatures

|

|

85

|

|

Financial Statements

|

|

F-1

|

|

FORWARD-LOOKING STATEMENTS

This Prospectus contains forward-looking statements. Such forward-looking statements include statements regarding, among other things (a) our business development plans, (b) anticipated trends in our industry, (c) our future financing plans and (d) our anticipated needs for working capital. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may”, “will”, “should”, “expect”, “anticipate”, “estimate”, “believe”, “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements or otherwise. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” as well as in this Prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not misleading.

|

PROSPECTUS SUMMARY

This Prospectus is part of a registration statement we filed with the SEC. You should rely only on the information provided in this Prospectus and incorporated by reference in this Prospectus. We have not authorized anyone to provide you with information different from that contained in or incorporated by reference into this Prospectus. This Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the Common Stock offered by this Prospectus. This Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. The Selling Stockholder is offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted.

Neither the delivery of this Prospectus nor any sale made in connection with this Prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this Prospectus or that the information contained by reference to this Prospectus is correct as of any time after its date. The information in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of common stock. The rules of the SEC may require us to update this Prospectus in the future.

The following summary highlights selected information contained in this Prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire Prospectus carefully, including the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the financial statements and the notes to the financial statements included in this Prospectus, and you should conduct due diligence analysis of the Company.

The Offering

|

Common Stock Being Offered By Selling Stockholder

|

|

7,000,000 shares of Common Stock issuable to Four M Purchasers, LLC pursuant to the Purchase Agreement with us dated November 14, 2011 (the “Purchase Agreement”).

|

|

|

|

|

|

Offering Price

|

|

The offering price for shares of our Common Stock will be determined by prevailing prices established on the OTCBB, or as negotiated in private transactions, or as otherwise described in the “Plan of Distribution.”

|

|

|

|

|

|

Terms of the Offering

|

|

The Selling Stockholder will determine when and how it will sell the Put Shares of Common Stock offered in this Prospectus.

|

|

|

|

|

|

Termination of the Offering

|

|

The offering will conclude upon the earlier of (i) such time as all of the Common Stock contemplated in this Registration Statement has been sold, or (ii) six (6) months after the effective date of this Registration Statement.

|

|

|

|

|

|

Use of Proceeds

|

|

We are not selling any of the Put Shares of Common Stock in this offering and, as a result, will not receive any proceeds directly from this offering. We will, however, receive proceeds from our sale of those Put Shares to the Selling Stockholder pursuant to the Purchase Agreement. Such proceeds will be used for working capital, reduction of indebtedness, acquisitions and general corporate purposes.

|

|

|

|

|

|

OTCBB Trading Symbol

|

|

“NWBO.OB”

|

|

|

|

|

|

Risk Factors

|

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page [6].

|

Summary of Our Financial Information

The summary financial data set forth below as of December 31, 2009 and 2010 and September 30, 2011 and for the periods ending December 31, 2009 and 2010 and September 30, 2010 and 2011 are derived from our financial statements included elsewhere in this prospectus. The summary financial data should be read in conjunction with our audited consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and results of Operations” included elsewhere in this prospectus.

NORTHWEST BIOTHERAPEUTICS, INC.

(A Development Stage Company)

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

|

|

|

Three months ended

|

|

|

Nine months ended

|

|

|

Period from

March 18,

1996

(Inception) to

|

|

|

|

|

September 30

|

|

|

September 30

|

|

|

September 30,

|

|

|

|

|

2010

|

|

|

2011

|

|

|

2010

|

|

|

2011

|

|

|

2011

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research material sales

|

|

$

|

10

|

|

|

$

|

10

|

|

|

$

|

10

|

|

|

$

|

10

|

|

|

$

|

580

|

|

|

Contract research and development from related parties

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,128

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research grants and other

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,061

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

10

|

|

|

|

10

|

|

|

|

10

|

|

|

|

10

|

|

|

|

2,769

|

|

|

Operating cost and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of research material sales

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

382

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,606

|

|

|

|

3,565

|

|

|

|

4,791

|

|

|

|

11,474

|

|

|

|

88,286

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administration

|

|

|

1,412

|

|

|

|

2,804

|

|

|

|

4,680

|

|

|

|

10,675

|

|

|

|

72,664

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

2

|

|

|

|

2

|

|

|

|

2

|

|

|

|

6

|

|

|

|

2,359

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on facility sublease

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

895

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset impairment loss and other (gain) loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,445

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating costs and expenses

|

|

|

3,020

|

|

|

|

6,371

|

|

|

|

9,473

|

|

|

|

22,155

|

|

|

|

167,031

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(3,010

|

)

|

|

|

(6,361

|

)

|

|

|

(9,463

|

)

|

|

|

(22,145

|

)

|

|

|

(164,262

|

)

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Valuation of reclassified equity contracts

|

|

|

-

|

|

|

|

8,875

|

|

|

|

-

|

|

|

|

7,413

|

|

|

|

14,172

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan conversion inducement

|

|

|

|

|

|

|

-

|

|

|

|

(4,522

|

)

|

|

|

(125

|

)

|

|

|

(10,415

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative valuation gain (loss)

|

|

|

-

|

|

|

|

338

|

|

|

|

-

|

|

|

|

29

|

|

|

|

83

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of intellectual property and property and equipment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

3,664

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(2,371

|

)

|

|

|

(2,370

|

)

|

|

|

(5,968

|

)

|

|

|

(5,426

|

)

|

|

|

(39,342

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income and other

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,707

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

(5,381

|

)

|

|

|

482

|

|

|

|

(19,953

|

)

|

|

|

(20,254

|

)

|

|

|

(194,393

|

)

|

|

Issuance of common stock in connection with elimination of Series A and Series A-1 preferred stock preferences

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(12,349

|

)

|

|

Modification of Series A preferred stock warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(2,306

|

)

|

|

Modification of Series A-1 preferred stock warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(16,393

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A preferred stock dividends

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(334

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A-1 preferred stock dividends

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(917

|

)

|

|

Warrants issued on Series A and Series A-1 preferred stock dividends

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(4,664

|

)

|

|

Accretion of Series A preferred stock mandatory redemption obligation

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,872

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A preferred stock redemption fee

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,700

|

)

|

|

Beneficial conversion feature of Series D preferred stock

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(4,274

|

)

|

|

Net income (loss) applicable to common stockholders

|

|

$

|

(5,381

|

)

|

|

$

|

482

|

|

|

$

|

(19,953

|

)

|

|

$

|

(20,254

|

)

|

|

$

|

(239,202

|

)

|

|

Net income (loss) per share applicable to common stockholders — basic

|

|

$

|

(0.08

|

)

|

|

$

|

0.01

|

|

|

$

|

(0.31

|

)

|

|

$

|

(0.24

|

)

|

|

|

|

|

|

Weighted average shares used in computing basic income (loss) per share

|

|

|

70,413

|

|

|

|

95,123

|

|

|

|

65,361

|

|

|

|

85,680

|

|

|

|

|

|

|

Net income (loss) per share applicable to common stockholders - diluted

|

|

$

|

(0.08

|

)

|

|

$

|

0.00

|

|

|

$

|

(0.31

|

)

|

|

$

|

(0.24

|

)

|

|

|

|

|

|

Weighted average shares used in computing diluted net income (loss) per share

|

|

|

70,413

|

|

|

|

123,136

|

|

|

|

65,361

|

|

|

|

85,680

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

As of September 30,

|

|

|

|

|

2009

|

|

|

2010

|

|

|

2011

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

65

|

|

|

$

|

153

|

|

|

$

|

1,643

|

|

|

Working capital (deficit)

|

|

|

(19,329

|

)

|

|

|

(25,885

|

)

|

|

|

(44,332

|

)

|

|

Total Assets

|

|

|

103

|

|

|

|

294

|

|

|

|

1,893

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long term obligations, net of current portion and discounts

|

|

|

1,359

|

|

|

|

1,854

|

|

|

|

1,898

|

|

|

Total stockholders' equity (deficit)

|

|

|

(20,686

|

)

|

|

|

( 27,684

|

)

|

|

|

(46,150

|

)

|

RISK FACTORS

Our business, financial condition, operating results and prospects are subject to the following material risks. Additional risks and uncertainties not presently foreseeable to us may also impair our business operations. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and our stockholders may lose all or part of their investment in the shares of our Common Stock.

Risks Related to this Offering

There may not be an active, liquid trading market for our Common Stock.

Our Common Stock is currently listed on the Over-The-Counter Bulletin Board, or OTCBB, which is generally recognized as being a less active market than NASDAQ, the stock exchange on which our Common Stock originally was listed. Also, the pool of potential investors who may buy and sell on the OTCBB is limited. Many institutional investors have policies which preclude them from doing so. You may not be able to sell your shares at the time desired or at the price desired. There may be significant consequences associated with our stock trading on the OTCBB rather than a national exchange. The effects of not being able to list our securities on a national exchange include:

|

|

•

|

limited dissemination of the market price of our securities;

|

|

|

•

|

limited interest by investors in our securities;

|

|

|

•

|

volatility of our stock price due to low trading volume;

|

|

|

•

|

increased difficulty in selling our securities in certain states due to “blue sky” restrictions; and

|

|

|

•

|

limited ability to issue additional securities or to secure additional financing.

|

The market for our Common

Stock may be limited, because our Common Stock is subject to “penny stock” rules.

Our Common Stock is subject to the SEC’s “penny stock” rules. As a result, broker-dealers may experience difficulty in completing customer transactions, and trading activity in our securities may be adversely affected. Under the “penny stock” rules promulgated under the Exchange Act, broker-dealers who recommend such securities to persons other than institutional accredited investors must:

|

|

•

|

make a special written suitability determination for the purchaser;

|

|

|

•

|

receive the purchaser’s written agreement to a transaction prior to sale;

|

|

|

•

|

provide the purchaser with risk disclosure documents which identify certain risks associated with investing in “penny stocks” and which describe the market for these “penny stocks” as well as a purchaser’s legal remedies; and

|

|

|

•

|

obtain a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before a transaction in a “penny stock” can be completed.

|

As a result of these rules, broker-dealers may find it difficult to effectuate customer transactions, and trading activity in our Common Stock may be adversely affected. As a result, the market price of our Common Stock may be depressed, and stockholders may find it more difficult to sell our Common Stock.

Your ability to sell your shares in the secondary trading market may be limited, because our Common Stock is quoted on the “OTCBB.”

Our Common Stock is currently quoted on the over-the-counter market on the OTCBB, as described above. Consequently, the liquidity of our Common Stock is quite limited, not only in regard to the number of shares that are bought and sold, but also through delays in the timing of transactions, and lack of coverage by security analysts and the news media of our Company. As a result, prices for shares of our Common Stock may be lower than might otherwise be the case if our Common Stock were quoted and traded on NASDAQ or a national securities exchange.

The price of our Common Stock may be highly volatile.

The share prices of publicly traded biotechnology and emerging pharmaceutical companies, particularly companies without consistent product revenues and earnings, can be highly volatile and are likely to remain highly volatile in the future. The price which investors may realize in sales of their shares of our Common Stock may be materially different than the price at which our Common Stock is quoted, and will be influenced by a large number of factors, some specific to us and our operations, and some unrelated to our operations. Such factors may cause the price of our stock to fluctuate frequently and substantially. Such factors may include large purchases or sales of our Common Stock, positive or negative events relating to other companies developing immune therapies for cancer, positive or negative events relating to healthcare and the overall pharmaceutical and biotech sector, currency fluctuations, legislative or regulatory changes, and/or general economic conditions. In the past, shareholder class action litigation has been brought against other companies that experienced volatility in the market price of their shares. Whether or not meritorious, litigation brought against a company following fluctuations in the trading price of its common stock can result in substantial costs, divert management’s attention and resources, and harm the company’s financial condition and results of operations.

Toucan Capital and its affiliates are the principal holders of our shares of

Common Stock, and this concentration of ownership may have a negative effect on the market price of our Common Stock.

As of September 30, 2011, Toucan Capital and its affiliates (including Cognate BioServices and Ms. Linda Powers, who also serves as our Chief Executive Officer and Chairperson of the Board of Directors), collectively beneficially owned an aggregate of 22,617,015 shares of our Common Stock, representing approximately 23.3 percent of our issued and outstanding Common Stock. In addition, as of September 30, 2011, Toucan Capital and its affiliates hold warrants that are exercisable for an aggregate of approximately 41,426,983 shares of our Common Stock. This concentration of ownership may adversely affect the trading price of our common stock because investors may perceive disadvantages in owning stock of companies with controlling stockholders. Toucan Capital and its affiliates have the ability to exert substantial influence over all matters requiring approval by our stockholders, including the election and removal of directors and any proposed merger, consolidation or sale of all or substantially all of our assets. This influence could have the effect of delaying, deferring or preventing a change in control, or impeding a merger or consolidation, takeover or other business combination that could be favorable to investors.

We do not intend to pay any cash dividends in the foreseeable future and, therefore, any return on your investment in our Common Stock must come from increases in the market price of our Common Stock.

We have not paid any cash dividends on our Common Stock to date in the Company’s history, and we do not intend to pay cash dividends on our Common Stock in the foreseeable future. We intend to retain future earnings, if any, for reinvestment in the development and expansion of our business. Also, any credit agreements which we may enter into with institutional lenders may restrict our ability to pay dividends. Therefore, any return on your investment in our capital stock must come from increases in the fair market value and trading price of our Common Stock.

Our ongoing operations will require substantial ongoing funding through equity and/or debt issuances. This may have a negative effect on the market price of our Common Stock, and will dilute existing share ownership.

Clinical trials are very expensive (especially when they involve a large numbers of patients and trial sites) and require substantial funding throughout their execution. We currently have a large, 240-patient clinical trial in brain cancer under way, and it involves many trial sites. We also have plans for additional clinical trials with other cancers. The initiation, execution and completion (if successful) of such trials is how biotech companies like ours move their products towards commercialization and build company value. At the same time, such operations require substantial amounts of ongoing funding throughout their execution. Such funding must be obtained through issuance of equity and/or incurring debt (which is usually convertible debt, convertible into equity at the investor’s option). Accordingly, we will have to obtain substantial ongoing funding throughout the execution of our clinical trials through the issuance of substantial additional equity and/or incurring substantial additional debt. This may have a negative effect on the market price of our Common Stock, and it will dilute existing share ownership.

The Purchase Agreement overall will involve registration and sale of a significant amount of our Common Stock, over a period of up to six (6) months. This may have a negative effect on the market price of our Common Stock, and will dilute existing share ownership.

Under the Purchase Agreement, we may sell up to an aggregate of $2.5 million of our Common Stock to the Selling Stockholder during the six (6) month period after this registration statement becomes effective. The actual number of shares which we may end up selling is unknown at present, as we do not yet know how much of that capacity we will choose to use, nor the timing of when we will choose to use it, nor the market price of our stock at the various times we choose to use it. However, the number of shares that we will sell under the Purchase Agreement, and that the Selling Stockholder will, in turn, re-sell in the market, is likely to be substantial. As with any small biotech company stock, our Common Stock may experience negative effects from the sale of additional stock during the course of the clinical trials, and such additional stock will dilute existing share ownership.

This registration statement is registering the first 7,000,000 shares of our Common Stock for re-sale by the Selling Stockholder pursuant to the Purchase Agreement. Such re-sale may have a negative effect on the market price of our Common Stock, and will dilute existing share ownership.

Pursuant to this registration statement, of which this Prospectus forms a part, we are registering 7,000,000 shares of our Common Stock. These shares comprise the first tranche of the total potential shares to be registered and sold pursuant to the Purchase Agreement, as described above. This first tranche of shares constitutes a substantial amount, relative to our total issued and outstanding shares at present. The sale of these shares may have a negative effect on the market price of our Common Stock, and will dilute existing share ownership.

Substantial amounts of our previously issued Common Stock are now and/or will soon be eligible for re-sale under Rule 144. This may have a negative effect on the market price of our Common Stock.

In general, under Rule 144, a person (or persons whose shares are aggregated) who has satisfied a six- month holding period may, under certain circumstances, sell within any three-month period a number of securities which does not exceed the greater of 1% of the then outstanding shares of common stock or the average weekly trading volume of the class during the four calendar weeks prior to such sale. In addition, under certain circumstances Rule 144 also permits the sale of securities, without any limitation, by a person who is not an affiliate of the Company (as such term is defined in Rule 144(a)(1)), and who has satisfied a one-year holding period.

As of September 30, 2011, approximately 43,727,329 shares of our Common Stock were previously issued as restricted securities as defined under Rule 144 of the Securities Act of 1933, as amended (the “Act”) and are outstanding. Of these, approximately 43,727,329 shares of such restricted stock have been outstanding for more than six (6) months and some or all of these shares may be resold without registration pursuant to Rule 144. If substantial amounts of such shares are sold pursuant to Rule 144, this may have a negative effect on the market price of our Common Stock.

The Selling Stockholder will pay less than the then-quoted market price for our Common Stock, under the formula specified in the Purchase Agreement, and this could have a negative effect on the market price of our Common Stock.

As is generally the case in stock sale arrangements of the type established in the Purchase Agreement, the Put Shares of Common Stock that we will put to the Selling Stockholder will be purchased by the Selling Stockholder at a discount price. In our case, the discount price will be equal to a formula specified in the Purchase Agreement: the price will be ninety-five percent (95%) of the average of the three (3) lowest closing bid prices of our Common Stock during the five (5) trading days prior date on which the Company delivers the Put Notice to the Selling Stockholder under the Purchase Agreement. To the extent that we (the Company) choose to exercise the put right, and sell Put Shares to the Selling Stockholder, your ownership interest will be diluted. As is generally the case in stock sale arrangements of the type established in the Purchase Agreement, it is anticipated that the Selling Stockholder, in turn, will sell the Put Shares of our Common Stock immediately upon receiving the Put Shares in order to minimize their risk and exposure in regard to the Put Shares, and in order to realize any profit involved. When the Selling Stockholder resells the Put Shares, this could have a negative effect on the market price of our Common Stock.

We may not have access to the full amount available under the Purchase Agreement.

The only way we are able to access the funding provided for in the Purchase Agreement is by selling Put Shares of our Common Stock to the Selling Stockholder. In order for us to be able to sell Put Shares, there must be an effective registration statement in place covering the resale of such Put Shares by the Selling Stockholder, and certain other conditions must be met.

So, our ability to sell Put Shares of our Common Stock to the Selling Shareholder will not begin until this Registration Statement, of which this Prospectus is a part, is declared effective by the SEC, and will only continue as long as this Registration Statement remains effective.

Our ability to sell further Put Shares to the Selling Stockholder, beyond the initial Put Shares covered in this registration statement, will only arise if and to the extent that we prepare and file one or more additional registration statements covering the re-sale of further Put Shares under the Purchase Agreement, and such registration statements become effective (and if certain other conditions are satisfied.

These subsequent registration statements may be subject to review and comment by the Staff of the SEC. Therefore, the timing of these subsequent registration statements cannot be assured, nor can their effectiveness be assured. Accordingly, there is no guarantee that we will be able to draw down all or any portion of the rest of the funding that is potentially available to us under the Purchase Agreement.

Risks Related to Operations of Northwest Biotherapeutics, Inc.

The requirements of the Sarbanes-Oxley Act of 2002 and other U.S. securities laws

impose substantial costs, and may drain our resources and distract our management.

We are subject to certain of the requirements of the Sarbanes-Oxley Act of 2002 in the U.S., as well as the reporting requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Exchange Act requires, among other things, filing of annual reports on Form 10-K, quarterly reports on Form 10-Q and periodic reports on Form 8-K following the happening of certain material events, with respect to our business and financial condition. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls over financial reporting. Our existing controls have some weaknesses, as described below. Meeting the requirements of the Exchange Act and the Sarbanes-Oxley Act may strain our resources and may divert management's attention from other business concerns, both of which may have a material adverse effect on our business.

Our management has identified internal control deficiencies, which our management and our independent auditor believe constitute material weaknesses.

In connection with the preparation of our financial statements for the year ended December 31, 2010, and prior years, our management identified certain internal control deficiencies that, in the aggregate, represent material weaknesses, including:

|

|

•

|

lack of a sufficient number of independent directors on our audit committee

|

|

|

•

|

lack of a financial expert on our audit committee

|

|

|

•

|

insufficient segregation of duties in our finance and accounting function due to limited personnel

|

As part of our independent auditors’ communications with our Company’s audit committee with respect to audit procedures for the year ended December 31, 2010, our independent auditors informed the audit committee that these deficiencies constituted material weaknesses, as defined by Auditing Standard No. 5, “An Audit of Internal Control Over Financial Reporting that is Integrated with an Audit of Financial Statements and Related Independence Rule and Conforming Amendments,” established by the Public Company Accounting Oversight Board, or PCAOB. We intend to take appropriate and reasonable steps, in due course, to make the necessary improvements to address these deficiencies, but the timing of such steps is uncertain and the availability of funding and resources for such steps are also uncertain. Our ability to attract qualified individuals to serve on our Board and to take on key management roles within the Company is also uncertain. Our failure to successfully remedy the existing weaknesses could lead to heightened risk for financial reporting mistakes and irregularities, and/or lead to a loss of public confidence in our internal controls that could have a negative effect on the market price of our Common Stock.

We will need to continue raising substantial funding, on an ongoing basis, for general corporate purposes and operations, including our clinical trials. Such funding may not be available or may not be available on attractive terms.

As of September 30, 2011, we had approximately $1.6 million of cash on hand. We will need substantial additional funding, on an ongoing basis, in order to continue execution of our clinical trials to move our product candidates towards commercialization, to continue prosecution and maintenance of our large patent portfolio, to continue development and optimization of our manufacturing and distribution arrangements, and for other corporate purposes. We are pursuing financing with several parties, which we hope to complete later this year in addition to the sales of Put Shares under the Purchase Agreement. However, there can be no assurance that we will be able to complete any of the financings, or that the terms for such financings will be attractive. Any financing, if available, may include restrictive covenants and provisions that could limit our ability to take certain actions, preference provisions for the investors, and/or discounts, warrants or other incentives. Any financing will involve issuance of equity and/or debt, and such issuances will be dilutive to existing shareholders. If we are unable to obtain additional funds on a timely basis or on acceptable terms, we may be required to curtail or cease some or all of our operations at any time.

We are likely to continue to incur substantial losses, and may never achieve

profitability.

We have incurred net losses every year since our formation in March 1996, and had a deficit accumulated during the development stage of approximately $239.2 million as of September 30, 2011, of which $112.6 million was cash expenditures over the years and $126.6 million was non-cash accounting measures. We expect that these losses will continue, and we anticipate negative cash flows from operations for the foreseeable future. We may never achieve or sustain profitability.

Our auditors have issued a “going concern” audit opinion.

Our independent auditors have indicated, in their report on our December 31, 2010 financial statements (and in their reports on our financial statements for preceding years), that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities, that may result if we do not continue as a going concern. Therefore, you should not rely on our consolidated balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation.

As a development stage company with a novel technology and unproven business strategy,

our limited history of operations makes an evaluation of our business and prospects

difficult.

We have had a limited operating history and we are still in the process of developing our product candidates through clinical trials. Our technology is novel and involves mobilizing the immune system to fight a patient’s cancer. Immune therapies have been pursued by many parties for decades, and have experienced many failures. In addition, our technology involves personalized treatment products – a new approach to medical products that involves new product economics and business strategies, which have not yet been shown to be commercially feasible or successful. We have not yet gone through scale-up of our operations to commercial scale. This limited operating history, along with the novelty of our technology, product economics, and business strategy, and the limited scale of our operations to date, makes it difficult to assess our prospects for generating revenues commercially in the future.

We will need to expand our management and technical personnel as our operations progress, and we may not be able to recruit such additional personnel and/or retain existing personnel.

We employ eight (8) full-time employees. The rest of our personnel are retained on a consulting or contractor basis. Biotech companies would typically have a larger number of employees by the time they reach late stage clinical trials. Such trials require extensive management activities and skill sets, including scientific, medical, regulatory (FDA or foreign counterpart), manufacturing, distribution and logistics, site management, business, financial, legal and public relations outreach to both the patient community and physician community. In addition, for overall company operations, other necessary management activities and skill sets involve intellectual property, administrative, regulatory (SEC), investor relations and other.

In order to fully perform all these diverse functions, with late stage trials under way at many sites across the U.S. and outside the U.S., we will need to expand our management and technical personnel. However, the pool of such personnel with expertise and experience with living cell products, such as our DCVax

®

immune cell product, is very limited. In addition, our Company is small and has limited resources, our business prospects are uncertain and our stock price is volatile. For some or all of such reasons, we may not be able to recruit all the management and technical personnel we need, and/or we may not be able to retain all of our existing personnel. In such event, we may have to continue our operations with a smaller than usual team of personnel, and our business and financial results may suffer.

We rely at present on a single relationship with a third-party contract

manufacturer in the U.S. As a result, we may be at risk for capacity limitations and/or supply disruptions.

We currently rely upon a single contract manufacturer, Cognate BioServices, to produce all of our DCVax

®

product in the US, and to supervise the production of our DCVax

®

product candidates outside the US. The majority owners of Cognate is Toucan Capital, one of our majority stockholders, and its affiliates. We have an agreement in place with Cognate pursuant to which Cognate has agreed to provide manufacturing and other services for the next five years, in connection with our Phase II clinical trial for DCVax

®

-L and other programs. The agreement requires us to make certain minimum monthly payments to Cognate in order to have dedicated manufacturing capacity available for our products, irrespective of whether we actually order any DCVax

®

products are manufactured. The agreement also specifies the amounts we must pay for Cognate's actual manufacturing of DCVax

®

for patients.

Problems with Cognate or its facilities or processes could result in a failure to produce, or a delay in production, of adequate supplies of our DCVax

®

product candidates. A number of factors could cause interruptions or delays, including the inability of a supplier to provide raw materials, equipment malfunctions or failures, damage to a facility due to natural disasters, changes in FDA regulatory requirements or standards that require modifications to our manufacturing processes, action by the FDA or by us that results in the halting or slowdown of production of components or finished products due to regulatory issues, Cognate going out of business or failing to produce product as contractually required, and/or other similar factors. Because manufacturing processes for our DCVax

®

product candidates are highly complex, require specialized facilities and personnel that are not widely available in the industry, involve equipment and training with long lead times, and are subject to lengthy FDA approval processes, alternative qualified production capacity may not be available on a timely basis or at all. Difficulties, delays or interruptions in Cognate's manufacturing and supply of our DCVax

®

product candidates could require us to stop enrolling additional new patients into our trial, and/or require us to stop the trial or other program, increase our costs, damage our reputation and, if our product candidates are approved for sale, cause us to lose revenue or market share if Cognate is unable to timely meet market demands.

The manufacturing of our product candidates will have to be greatly scaled up for commercialization, and neither we nor other parties have experience with such scale-up.

As is usual with clinical trials, our clinical trial of DCVax

®

-L for brain cancer involves a number of patients that is a small fraction of the number of potential patients for whom DCVax

®

-L may be applicable in the commercial market. The same will be true of our other clinical programs with our other DCVax

®

product candidates. If our DCVax

®

-L (and/or other DCVax

®

product candidates) are approved for commercial sale, it will be necessary to greatly scale up the volume of manufacturing, far above its level for the trials. Neither we nor our contract manufacturer, Cognate BioServices, have experience with such scale-up. In addition, there are virtually no consultants or advisors in the industry who have such experience and can provide guidance or assistance, because active immune therapies such as DCVax

®

are a fundamentally new category of product in two major ways: these active immune therapy products consist of living cells (not chemical or biologic compounds) and the products are personalized. No such products have ever gone through and successfully completed the necessary scale-up for commercialization. Only one such product has even reached approval (Dendreon’s Provenge) and substantial difficulties have been encountered so far by Dendreon in trying to do the large-scale scale-up of manufacturing for commercialization.

The necessary specialized facilities, equipment and personnel may not be available or obtainable for the scale-up of manufacturing of our product candidates.

The manufacture of living cells requires specialized facilities, equipment and personnel which are entirely different than what is required for manufacturing of chemical or biologic compounds. Scaling up the manufacturing of living cell products to volume levels required for commercialization will require enormous amounts of these specialized facilities, equipment and personnel – especially where, as in the case of our DCVax

®

product candidates, the product is personalized and must be made for each patient individually. Since living cell products are so new, and have barely begun to reach commercialization, the supply of the specialized facilities, equipment and personnel needed for them has not yet developed. It may not be possible for us (or Cognate) to obtain all of the specialized facilities, equipment and personnel needed for commercialization of our DCVax

®

product candidates. This could delay or halt our commercialization.

Our technology is novel, involves complex immune system elements, and may not prove to be effective.

The scientific community and physician community have been trying for over 100 years to develop active immune therapies for cancer. There have been many different immune therapy product designs – and many product failures and company failures. To date, only one active immune therapy has reached approval (Dendreon’s Provenge). The immune system is complex, with many diverse elements, and the state of scientific understanding of the immune system is still limited. Some immune therapies previously developed by other parties showed surprising and unexpected toxicity in clinical trials. Other immune therapies developed by other parties delivered promising results in early clinical trials, but failed in later stage clinical trials. To date, we have only conducted early stage trials in limited numbers of patients. Although the results of those trials were quite positive, those results may not be achieved in our later stage clinical trials, such as the 240-patient trial we are now conducting in brain cancer, and our product candidates may not ultimately be found to be effective.

Clinical trials for our product candidates are expensive and time consuming, and their

outcome is uncertain.

The process of obtaining and maintaining regulatory approvals for new therapeutic products is expensive, lengthy and uncertain. It can vary substantially, based upon the type, complexity and novelty of the product involved. Late stage clinical trials, such as our 240-patient trial in brain cancer, are especially expensive (typically requiring tens of millions of dollars), and take years to reach their outcomes. Such outcomes often fail to reproduce the results of earlier trials. It is often necessary to conduct multiple late stage trials in order to obtain sufficient results to support product approval, which further increases the expense. Sometimes trials are further complicated by changes in requirements while the trials are under way (for example, when the standard of care changes for the disease that is being studied in the trial). Accordingly, any of our current or future product candidates could take a significantly longer time to gain regulatory approval than we expect, or may never gain approval, either of which could delay or stop the commercialization of our DCVax

®

product candidates.

We have limited experience in conducting and managing clinical trials.

We rely on third parties to assist us, on a contract services basis, in managing and monitoring all of our clinical trials. We do not have experience conducting late stage clinical trials ourselves, without third party service firms, nor do we have experience in supervising such third parties in managing late stage, multi-hundred patient clinical trials prior to the trials that we currently have under way. Our lack of experience and/or our reliance on these third party service firms may result in delays, or failure to complete these trials successfully and on time. If the third parties fail to perform, we may not be able to find sufficient alternative suppliers of those services in a reasonable time period, or on commercially reasonable terms, if at all. If we were unable to obtain alternative suppliers of such services, we might be forced to delay, suspend or stop our 240-patient Phase II clinical trial of DCVax

®

L for brain cancer.

Multiple late stage clinical trials of our lead product (DCVax-L for brain cancer) may be required before we can obtain regulatory approval.

Typically, companies conduct multiple late stage clinical trials of their product candidates before seeking product approval. Our current 240-patient clinical trial of DCVax

®

-L for brain cancer is our first late stage trial, and is a Phase II (not Phase III) trial. While under certain circumstances, both the FDA and the European Medicines Agency (“EMA”) will accept a Phase II study as a single study in support of approval, it is not yet known whether they will do so in this case. Even if the results are as positive and compelling as in our early stage trials, we may be required to conduct additional late stage trials before we can obtain product approval. This would substantially delay our commercialization. There is also some possibility that changes requested by the FDA could complicate the application process for product approval. In addition, a number of products are under development for brain cancer and at least one has recently been approved in the US. It is possible that the standard of care for brain cancer could change while our Phase II trial is still under way. This could necessitate further clinical trials with our DCVax

®

-L product candidate for brain cancer.

Costly and time-consuming studies of our DCVax®-L product for brain cancer, and/or additional clinical trials, may be required before we can obtain regulatory approval.

With biologics products, “the process is the product” (i.e., the manufacturing process is considered to be as integral to the product as is the composition of the product itself). If any changes are made in the manufacturing process, and such changes are considered material by the regulatory authorities, the company sponsor may be required to conduct equivalency studies to show that the product is equivalent under the changed manufacturing processes as under the original manufacturing processes, and/or the company sponsor may even be required to conduct additional clinical trials. Our manufacturing processes have undergone some changes during the early clinical trials. Accordingly, we may be required to conduct equivalency studies, and/or additional clinical trials, before we can obtain product approval, unless the regulatory authorities are satisfied that the changes in processes do not affect the quality, efficacy or safety of the product.

We may not receive regulatory approvals for our product candidates or there may be a delay in obtaining such approvals

.

Our products and our ongoing development activities are subject to regulation by regulatory authorities in the countries in which we or our collaborators and distributors wish to test, manufacture or market our products. For instance, the FDA will regulate the product in the U.S. and equivalent authorities, such as theEMA, will regulate in other jurisdictions. Regulatory approval by these authorities will be subject to the evaluation of data relating to the quality, efficacy and safety of the product for its proposed use.

The time taken to obtain regulatory approval varies between countries. In the US, for products without "Fast Track" status, it can take up to eighteen (18) months after submission of an application for product approval to receive the FDA's decision. Even with Fast Track status, FDA review and decision can take up to twelve (12) months. At present, we do not have Fast Track status for our lead product, DCVax-L for brain cancer.

Different regulators may impose their own requirements and may refuse to grant, or may require additional data before granting, an approval, notwithstanding that regulatory approval may have been granted by other regulators. Regulatory approval may be delayed, limited or denied for a number of reasons, including insufficient clinical data, the product not meeting safety or efficacy requirements or any relevant manufacturing processes or facilities not meeting applicable requirements as well as case load at the regulatory agency at the time.

We may fail to comply with regulatory requirements.

Our success will be dependent upon our ability, and our collaborative partners’ abilities, to maintain compliance with regulatory requirements, including current good manufacturing practices (“cGMP”) and safety reporting obligations. The failure to comply with applicable regulatory requirements can result in, among other things, fines, injunctions, civil penalties, total or partial suspension of regulatory approvals, refusal to approve pending applications, recalls or seizures of products, operating and production restrictions and criminal prosecutions.

Regulatory approval of our product candidates may be withdrawn at any time.

After regulatory approval has been obtained for medicinal products, the product and the manufacturer are subject to continual review and there can be no assurance that such approval will not be withdrawn or restricted. Regulators may also subject approvals to restrictions or conditions, or impose post-approval obligations on the holders of these approvals, and the regulatory status of such products may be jeopardized if such obligations are not fulfilled. If post-approval studies are required, such studies may involve significant time and expense.

Our product candidates will require a different distribution model than conventional

therapeutic products, and this may impede commercialization of our product candidates.

Our DCVax

®

product candidates consist of living human immune cells. Such products are entirely different from chemical or biologic drugs, and require different processing for the handling, distribution and delivery than chemical or biologic drugs. One crucial difference is that our DCVax

®

products must remain frozen throughout the distribution and delivery process, until the time of administration to the patient, and cannot be handled at room temperature. In addition, our DCVax

®

product candidates are personalized and they involve ongoing treatment cycles over several years for each patient. Each product shipment for each patient must be tracked and managed individually. For all of these reasons, among others, we will not be able to simply use the distribution networks and processes that already exist for conventional drugs. It may take time for shipping companies, hospitals, pharmacies and physicians to adapt to the requirements for handling, distribution and delivery of these products, which may adversely affect our commercialization.

Our product candidates will require different marketing and sales methods and personnel than conventional

therapeutic products. Also, we lack sales and marketing experience. These factors may result in significant

difficulties in commercializing our product candidates.

The commercial success of any of our product candidates will depend upon the strength of our sales and marketing efforts. We do not have a marketing or sales force and have no experience in marketing or sales of products like our lead product, DCVax

®

-L for brain cancer. To fully commercialize our product candidates, we will need to recruit and train marketing staff and a sales force with technical expertise and ability to manage the distribution of our DCVax

®