Northwest Biotherapeutics Inc - Current report filing (8-K)

January 03 2008 - 4:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): December 31, 2007

NORTHWEST BIOTHERAPEUTICS,

INC.

(Exact name of registrant as

specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

|

0-33393

|

|

94-3306718

|

|

(State or other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

7600 Wisconsin Avenue, Suite

750, Bethesda, MD

|

|

20814

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code:

(240) 497-9024

|

|

|

|

|

(Former name or former address if changed since last report.)

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

|

Item 5.02

|

|

Departure of Directors or Principal Officers; Election of Directors;

Appointment of Principal Officers

;

Compensatory Arrangements of Certain

Officers.

|

On December 31,

2007, the Board of Directors of Northwest Biotherapeutics, Inc. (the

“Company”) approved the grant of stock options under the

Company’s 2007 Stock Option Plan to Alton L. Boynton, the Company’s

President and Chief Executive Officer, and Marnix Bosch, the Company’s

Chief Technical Officer. Dr. Boynton’s option award covers 2,807,048

shares of the Company’s common stock, and Dr. Bosch’s award

covers 1,081,539 shares. The awards have a 10-year term and the exercise price

of the options is $0.60 per share.

The Option Agreements covering these

option awards are attached as Exhibits 99.1 and 99.2 to this Current Report on

Form 8-K, respectively, and are incorporated herein by reference. The principal

terms of each option award are described below.

Boynton Option Award.

The option award for Dr. Boynton vests according to the following schedule:

|

|

•

|

|

804,768 shares are vested as of the grant date;

|

|

|

•

|

|

500,576 shares will vest on June 23, 2008; and

|

|

|

•

|

|

41,714 shares will vest each month, on the 23rd of each month, beginning

on July 23, 2008 and ending on June 23, 2011.

|

In addition, all options for

Dr. Boynton will vest in full if DCVax® Brain or another DCVax®

product receives FDA

approval for commercial sale in the United States.

If Dr. Boynton’s

employment is terminated without Cause (as defined in the 2007 Stock Option

Plan), the options

will continue to vest in accordance with the schedule

described above and will be exercisable for their full exercise

period, as

long as Dr. Boynton executes a separation and release agreement reasonably

acceptable to the Company and

does not work for or with a competing company

during the vesting period.

If Dr. Boynton resigns, the

vesting of the options will cease on the last day of his employment, but if

Dr.

Boynton provides 90 days’ advance notice of such resignation

and complies with certain other obligations to provide

good faith efforts

during such 90-day period, the options will be exercisable for 90 days

following the last day of his

employment.

If Dr. Boynton’s

employment is terminated for Cause, options which are already vested as of the

date of

termination will expire one business day after such termination.

In order to avoid

adverse tax consequences, Dr. Boynton was required to specify the exercise

dates for the option, which are as follows:

The option may be exercised at any

time during the designated year of exercise, provided that the option can

only

be exercised to the extent vested. The option will be forfeited to the

extent not exercised in a designated year.

Bosch Option Award.

The option award for Dr. Bosch vests according to the following

schedule:

|

|

•

|

|

188,687 shares are vested as of the grant date;

|

|

|

•

|

|

223,208 shares will vest on June 23, 2008; and

|

|

|

•

|

|

18,601 shares will vest each month, on the 23rd of each month, beginning

on July 23, 2008 and ending on May 23, 2011, and 18,609 shares will vest

on June 23, 2011.

|

2

All options for Dr. Bosch

will vest in full if DCVax® Brain or another DCVax® product receives

FDA approval for

commercial sale in the United States.

If Dr. Bosch’s

employment is terminated without Cause (as defined in the 2007 Stock Option

Plan), the options will

continue to vest until the last day of

Dr. Bosch’s employment, and will be exercisable for their full

exercise period,

as long as Dr. Bosch executes a separation and

release agreement reasonably acceptable to the Company.

If Dr. Bosch resigns, the

vesting of the options will cease on the last day of his employment, but if

Dr. Bosch

provides 90 days’ advance notice of such

resignation and complies with certain other obligations to provide good

faith

efforts during such 90-day period, the options will be exercisable

for 90 days following the last day of his

employment, as long as

Dr. Bosch does not work for, with, or for the benefit of a competing

company in any capacity

during the one year period following the

termination of his employment.

If Dr. Bosch’s

employment is terminated for Cause, options which are already vested as of the

date of termination

will expire one business day after such termination.

In order to avoid

adverse tax consequences, Dr. Bosch was required to specify the exercise

dates for the option, which are as follows:

The option may be exercised at any

time during the designated year of exercise, provided that the option can

only

be exercised to the extent vested. The option will be forfeited to the

extent not exercised in a designated year.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits.

99.1 Form of Stock Option Agreement, by

and between Alton L. Boynton and the Company, dated December 31, 2007.

99.2 Form of Stock Option Agreement, by

and between Marnix Bosch and the Company, dated December 31, 2007.

3

SIGNATURES

Pursuant to the requirements of

Section 12 of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

January 3, 2007

NORTHWEST BIOTHERAPEUTICS, INC.

By

/

s/ Anthony Deasey

Anthony P. Deasey

Senior Vice President & Chief

Financial Officer

4

EXHIBIT INDEX

|

|

|

|

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

99.1

|

|

Form of Stock Option Agreement, by and between

Alton L. Boynton and the Company, dated December 31, 2007.

|

|

99.2

|

|

Form of Stock Option Agreement, by and between

Marnix Bosch and the Company, dated December 31, 2007.

|

5

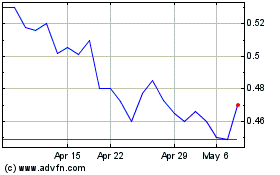

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jul 2023 to Jul 2024