Report of Foreign Issuer (6-k)

June 28 2017 - 6:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

Report of Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under the

Securities Exchange Act of 1934

For the month of June, 2017

Commission File Number

1-8910

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

(Translation of registrant’s name into English)

OTEMACHI FIRST SQUARE, EAST TOWER

5-1,

OTEMACHI

1-CHOME

CHIYODA-KU,

TOKYO

100-8116

JAPAN

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(7):

EXTRAORDINARY REPORT REGARDING MATTERS RESOLVED AT THE 32ND ORDINARY GENERAL MEETING OF SHAREHOLDERS

On June 28, 2017, the registrant filed with the Director General of the Kanto Local Finance Bureau an Extraordinary Report regarding

matters resolved at the registrant’s 32nd Ordinary General Meeting of Shareholders held on June 27, 2017 pursuant to the provisions of Article

24-5,

Paragraph 4 of the Financial Instruments and

Exchange Act and Article 19, Paragraph 2, Item

9-2

of the Cabinet Office Ordinance on Disclosure of Corporate Information, etc.

The information included herein contains forward-looking statements. The registrant desires to qualify for the “safe-harbor”

provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause the registrant’s actual results to differ materially from those set forth

in the attachment.

The registrant’s forward-looking statements are based on a series of assumptions, projections, estimates,

judgments and beliefs of the management of the registrant in light of information currently available to it regarding the registrant and its subsidiaries and affiliates, the economy and telecommunications industry in Japan and overseas, and other

factors. These projections and estimates may be affected by the future business operations of the registrant and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the

pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that

could cause actual results to differ materially from any future results that may be derived from the forward-looking statements, as well as other risks included in the registrant’s most recent Annual Report on Form

20-F

and other filings and submissions with the United States Securities and Exchange Commission.

No

assurance can be given that the registrant’s actual results will not vary significantly from any expectation of future results that may be derived from the forward-looking statements included herein.

The information on any website referenced herein or in the attached material is not incorporated by reference herein or therein.

The attached material is a translation of the Japanese original. The Japanese original is authoritative.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

|

|

|

|

|

By

|

|

/s/ Takashi Ameshima

|

|

|

|

Name:

|

|

Takashi Ameshima

|

|

|

|

Title:

|

|

Vice President

|

|

|

|

|

|

Investor Relations Office

|

Date: June 28, 2017

At the 32nd Ordinary General Meeting of Shareholders of Nippon Telegraph

and Telephone Corporation (“NTT”) held on June 27, 2017, one matter was resolved as stated below. NTT is filing this Extraordinary Report pursuant to the provisions of Article

24-5,

Paragraph 4 of

the Financial Instruments and Exchange Act and Article 19, Paragraph 2, Item

9-2

of the Cabinet Office Ordinance on Disclosure of Corporate Information, etc.

|

2.

|

Matters to be reported

|

|

(1)

|

Date the Ordinary General Meeting of Shareholders was held:

|

June 27, 2017

Item

Distribution of Earned Surplus

|

|

1.

|

Matters relating to

year-end

dividends

|

|

|

i.

|

Type of asset to be distributed: Cash

|

|

|

ii.

|

Matters relating to allotment of dividends and total amount of dividends to be distributed:

|

|

|

|

|

|

|

|

Per share of common stock:

|

|

¥

|

60

|

|

|

Total amount of dividends:

|

|

¥

|

120,922,050,660

|

|

|

|

iii.

|

Date on which the dividend becomes effective: June 28, 2017

|

|

(3)

|

Status of voting rights:

|

|

|

|

|

|

|

|

Number of shareholders holding voting rights

|

|

|

681,339 shareholders

|

|

|

Total number of voting rights

|

|

|

20,127,221 voting rights

|

|

|

(4)

|

Number of voting rights exercised for approval or disapproval of or abstention from the matter resolved, requirements for adopting the resolution and results thereof:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

|

Approval

(a)

|

|

|

Disapproval

|

|

|

Abstention

|

|

|

Total number

of voting rights

exercised

(b)

|

|

|

Approval

rate

((a)/(b))

|

|

|

Results of

resolutions

|

|

|

Distribution of Earned Surplus

|

|

|

16,295,467

voting rights

|

|

|

|

12,274

voting rights

|

|

|

|

2,911

voting rights

|

|

|

|

16,469,398

voting rights

|

|

|

|

98.94

|

%

|

|

|

Adopted

|

|

|

Notes: (1)

|

The requirement for adopting the resolution above is a majority vote in favor of the resolution of shareholders entitled to exercise their voting rights present at the meeting.

|

|

(2)

|

“Total number of voting rights exercised” is the sum of the number of voting rights exercised in advance up to and including the day before the Ordinary General Meeting of Shareholders plus the number of

voting rights of shareholders who attended the meeting.

|

|

(5)

|

Reason for not including certain voting rights held by shareholders attending the Ordinary General Meeting in the number of voting rights exercised for approval or disapproval of or abstention from the matter resolved:

|

The sum of the number of voting rights exercised up to and including the day before the meeting and the number of voting

rights held by principal shareholders whose votes had been confirmed on the day of the meeting met the approval requirements for the matter to be resolved. Accordingly, the number of voting rights held by shareholders (other than principal

shareholders) attending the Ordinary General Meeting and exercised for approval, disapproval or abstention have not been included.

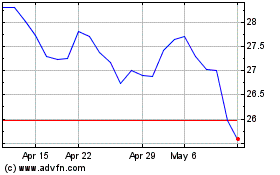

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From Apr 2024 to May 2024

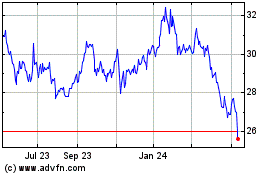

Nippon Telegraph and Tel... (PK) (USOTC:NTTYY)

Historical Stock Chart

From May 2023 to May 2024