Company to host conference call on April

5, 2018, at 11:00 a.m. ET

National American University Holdings, Inc. (the

“Company”) (NASDAQ:NAUH)

, which through

its wholly owned subsidiary operates National American University

(“

NAU” or

the “University”), a

regionally accredited, proprietary, multi-location institution of

higher learning, today reported unaudited financial results for its

fiscal 2018 third quarter and nine months ended February 28,

2018.

Management Commentary

Ronald L. Shape, Ed.D., President and Chief

Executive Officer of the Company, stated, “During the winter

2017-18 term, we worked diligently with Zenith Education Group to

enroll 450 students into NAU and are in touch with additional

students who have expressed interest in completing their studies at

our institution. We continued to see year-over-year growth in

graduate and doctoral enrollments, and were pleased to welcome

another new cohort of doctoral candidates in Ohio in the winter

term. Last month, we completed the Henley-Putnam University asset

purchase transaction. We are excited to now offer high-demand

course offerings in the areas of intelligence, counterterrorism,

and strategic security through NAU’s Henley-Putnam School of

Strategic Security, which is now part of the College of Military

Studies. We are supporting students who were active in their

Henley-Putnam coursework as of the date of closing and will work to

transition students into the new NAU format as this next term

begins. We anticipate everything to be fully integrated and

transitioned by June 1, and look forward to supporting these new

students through their academic journeys. Stabilizing and

increasing enrollments has continued to be a major focus, and we

expect the additional students from the recent developments with

Zenith and Henley-Putnam, combined with the continued growth in our

military, online, graduate, and Canada operations, to have a

positive impact on future terms. Our second online enrollment

center in Kansas City, Missouri, is now fully operational, and we

anticipate this will help to drive growth in online, which our

student population has increasingly gravitated towards.”

Dr. Shape continued, “On a related note, we

recently announced strategic operational consolidations of several

underutilized physical locations, which we expect will result in

approximately $11.6 million in annual savings once we are able to

exit the lease obligations. In doing so, we eliminated a majority

of the expense related to lease obligations for these locations and

made related staffing reductions, which accounts for approximately

$3 million in savings annually. There was minimal disruption to

affected students, and we have successfully transitioned students

impacted by these consolidations into existing operations. We

continue working to ensure students are receiving quality academic

programming with the necessary support services they need to

graduate and to succeed in the workplace after graduation. We

believe the institution is now better positioned to capitalize on

the growth in our enrollment drivers, which will pave the way for

the Company to achieve positive cash flow and return to

profitability.”

Operating Review

Enrollment Update

Total NAU student enrollment for the winter

2017-18 term was 5,981 students, compared to 7,314 during the prior

winter term. Students enrolled in 57,434 credit hours, compared to

62,607 credit hours during the prior winter term. The current

average age of NAU’s students continues to be in the mid-30s, with

those seeking undergraduate degrees remaining the highest portion

of NAU’s student population.

The following is a summary of student enrollment at February 28,

2018, and February 28, 2017, by degree level and by instructional

delivery method:

| |

|

February 28, 2018(Winter

’17-’18 Term) |

|

February 28,

2017(Winter ’16-’17

Term) |

|

|

|

No. of Students |

|

% of Total |

|

|

No. of Students |

|

% of Total |

|

| Continuing Ed |

|

- |

|

0.0 |

% |

|

202 |

|

2.8 |

% |

| Doctoral |

|

111 |

|

1.9 |

% |

|

98 |

|

1.3 |

% |

| Graduate |

|

393 |

|

6.6 |

% |

|

386 |

|

5.3 |

% |

| Undergraduate &

Diploma |

|

5,477 |

|

91.6 |

% |

|

6,628 |

|

90.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Total |

|

5,981 |

|

100.0 |

% |

|

7,314 |

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of Credits |

|

% of Total |

|

|

No. of Credits |

|

% of Total |

|

| On-Campus |

|

5,910 |

|

10.3 |

% |

|

11,642 |

|

18.6 |

% |

| Online |

|

46,229 |

|

80.5 |

% |

|

46,491 |

|

74.3 |

% |

| Hybrid |

|

5,295 |

|

9.2 |

% |

|

4,474 |

|

7.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Total |

|

57,434 |

|

100.0 |

% |

|

62,607 |

|

100.0 |

% |

Financial Review

The Company, through its wholly owned

subsidiary, operates in two business segments: academics, which

consists of NAU’s undergraduate, graduate, and doctoral education

programs and contributes the primary portion of the Company’s

revenue; and ownership in and development of multiple apartments

and condominium complexes from which it derives sales and rental

income. The real estate operations generated approximately 1.9% of

the Company’s revenue for the quarter ended February 28, 2018.

Fiscal 2018 Third Quarter Financial Results

- Total revenue for the FY 2018 third quarter was $18.2 million,

compared to $21.3 million in the prior-year period. Of this amount,

academic tuition revenue was $16.9 million, compared to $20.2

million in the prior-year period, and auxiliary (bookstore) revenue

was $1.0 million for the FY 2018 third quarter, compared to $0.9

million in the prior-year period. This decrease in academic revenue

was primarily a result of a decrease in enrollment, which was

partially offset by the new NAU Tuition Advantage plan that was

approved by NAU’s board of governors in November 2016 and became

effective in March 2017.

- Educational services expense for the FY 2018 third quarter

decreased to $6.2 million, or 34.9% of total academic segment

revenue, from $7.6 million, or 36.2%, in the prior-year period.

Educational services expense specifically relates to academics and

includes salaries and benefits of faculty and academic

administrators, costs of educational supplies, faculty reference

and support material and related academic costs.

- SG&A expenses for the FY 2018 third quarter decreased to

$13.8 million, or 75.8% of total revenue, from $15.3 million, or

71.8%, in the prior-year period. The percentage increase was

primarily a result of fixed costs on a decreasing revenue base and

additional expense to launch new programs and transfer programs for

closing institutions. Expenses related to growth initiatives such

as the College of Military Studies, Canada enrollments, and the new

online enrollment center totaled $1.8 million in the FY 2018 third

quarter, compared to $0.5 million for the same initiatives in the

prior-year period.

- Loss before income taxes and non-controlling interest for the

FY 2018 third quarter was $(3.8) million, compared to $(2.4)

million in the prior-year period, primarily as a result of

decreased revenue on lower enrollment, as well as increased

operating expenses related to $1.1 million in asset impairment

charges primarily related to the strategic consolidations of

several underutilized physical locations.

- Net loss attributable to the Company for the FY 2018 third

quarter was $(3.7) million, or ($0.15) per diluted share based on

24.3 million shares outstanding, compared to net loss attributable

to the Company of $(2.5) million, or ($0.10) per diluted share

based on 24.2 million shares outstanding, in the prior-year period,

primarily as a result of the reasons mentioned above.

- Losses before interest, tax, and depreciation and amortization

(“LBITDA”) for the FY 2018 third quarter were ($2.4) million,

compared to LBITDA of ($0.9) million in the prior-year period. A

table reconciling EBITDA/LBITDA to net loss can be found at the end

of this release.

- Adjusted LBITDA, which excludes loss on disposition of

property, for the FY 2018 third quarter was $(1.4) million,

compared to LBITDA of ($0.9) million in the prior-year period. A

table reconciling Adjusted EBITDA/LBITDA to net loss can be found

at the end of this release.

Fiscal 2018 Nine Months Financial Results

- Total revenues for the first nine months of FY 2018 were $58.0

million, compared to $64.4 million in the prior-year period. Of

this amount, total academic segment revenue was $56.5 million,

compared to $63.6 million in the prior-year period, as a result of

the decrease in enrollment. The Company continues to execute on its

strategic plan, which includes growing enrollments at its current

existing locations by investing in new program development and

expansion, academic advisor support, and student retention

initiatives, while adjusting operation size to be in line with the

needs of its student population.

- NAU’s educational services expense for the first nine months of

FY 2018 was $19.5 million, or 34.6% of the total academic segment

revenue, compared to $20.6 million, or 32.4%, in the prior-year

period.

- During the first nine months of FY 2018, SG&A expenses

decreased to $44.6 million, or 76.9% of total revenues, compared to

$47.2 million, or 73.3%, in the prior-year period.

- Loss before income taxes and non-controlling interest for the

first nine months of FY 2018 was $(11.5) million, compared to loss

before income taxes and non-controlling interest of $(6.6) million

in the prior-year period, primarily as a result of decreased

revenues offset by lower SG&A expenses.

- Net loss attributable to the Company during the first nine

months of FY 2018 was $(11.3) million, or $(0.47) per diluted share

based on 24.2 million shares outstanding, compared to net loss

attributable to the Company of $(5.3) million, or $(0.22) per

diluted share based on 24.1 million shares outstanding, in the

prior-year period.

- LBITDA for the first nine months of FY 2018 was $(7.4) million,

compared to LBITDA of $(2.1) million in the prior-year

period. A table reconciling EBITDA/LBITDA to net loss can be

found at the end of this release.

- Adjusted LBITDA, which excludes loss on disposition of

property, for the first nine months of FY 2018 was $(5.3) million,

compared to LBITDA of ($2.1) million in the prior-year period. A

table reconciling Adjusted EBITDA/LBITDA to net loss can be found

at the end of this release.

Balance Sheet Highlights

| (in millions except for

percentages) |

|

2/28/2018 |

|

5/31/2017 |

%

Change |

| Cash and Cash

Equivalents/Investments |

$ |

4.6* |

$ |

16.2 |

(71.3)

% |

| Working Capital |

|

1.3 |

|

11.2 |

(88.3)

% |

| Other Long-term

Liabilities |

|

2.9 |

|

4.0 |

(28.4)

% |

| Stockholders’

Equity |

|

17.8 |

|

29.9 |

(40.7)

% |

*Decrease in cash was primarily the result of

expenditures related to lease terminations, operating loss, and

dividends.

Conference Call Information

Management will discuss these results in a

conference call (with accompanying presentation) on Thursday, April

5, 2018, at 11:00 a.m. ET.

The dial-in numbers are:

(877) 407-9078 (U.S.)(201) 493-6745

(International)

Accompanying Slide Presentation and Webcast

The Company will have an accompanying slide

presentation available in PDF format at the “Investor Relations”

section of the NAU website at http://investors.national.edu. The

presentation will be made available 30 minutes prior to the

conference call. In addition, the call will be simultaneously

webcast over the Internet via the “Investor Relations” section of

the NAU website or by clicking on the conference call link:

http://national.equisolvewebcast.com/q3-2018.

About National American University Holdings,

Inc.

National American University Holdings, Inc.,

through its wholly owned subsidiary, operates National American

University, a regionally accredited, proprietary, multi-location

institution of higher learning offering associate, bachelor’s,

master’s, and doctoral degree programs in technical and

professional disciplines. Accredited by the Higher Learning

Commission, NAU has been providing technical and professional

career education since 1941. NAU opened its first location in Rapid

City, South Dakota, and has since grown to multiple locations in

several U.S. states. In 1998, NAU began offering online courses.

Today, NAU offers degree programs in traditional, online, and

hybrid formats, which provide students increased flexibility to

take courses at times and places convenient to their busy

lifestyles.

Forward Looking Statements

This press release may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 regarding the Company's business. Statements

made in this release, other than those concerning historical

financial information, may be considered forward-looking

statements, which speak only as of the date of this release and are

based on current beliefs and expectations and involve a number of

assumptions. These forward-looking statements include outlooks or

expectations for earnings, revenue, expenses or other future

financial or business performance, strategies or expectations, or

the impact of legal or regulatory matters on business, results of

operations or financial condition. Specifically, forward-looking

statements may include statements relating to the future financial

performance of the Company; the ability to continue to receive

Title IV funds; the growth of the market for the Company’s

services; expansion plans and opportunities; consolidation in the

market for the Company’s services generally; and other statements

preceded by, followed by or that include the words “estimate,”

“plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,”

“believe,” “seek,” “target” or similar expressions. These

forward-looking statements involve a number of known and unknown

risks and uncertainties or other assumptions that may cause actual

results or performance to be materially different from those

expressed or implied by those forward-looking statements. Other

factors that could cause the Company’s results to differ materially

from those contained in its forward-looking statements are included

under, among others, the heading “Risk Factors” in the Company’s

Annual Report on Form 10-K, which the Company filed on August 4,

2017, and in its other filings with the Securities and Exchange

Commission. The Company assumes no obligation to update the

information contained in this release.

Contact Information: National American University

Holdings, Inc.Dr. Ronald

Shape605-721-5220rshape@national.edu

Investor Relations CounselThe Equity Group

Inc.

Carolyne Y.

Sohn415-568-2255csohn@equityny.com

Adam Prior212-836-9606aprior@equityny.com

|

|

|

NATIONAL AMERICAN UNIVERSITY HOLDINGS, INC. AND

SUBSIDIARIES |

| |

|

|

|

|

|

|

|

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME |

|

|

| FOR

THE THREE MONTHS AND NINE MONTHS ENDED FEBRUARY 28, 2018 AND

2017 |

|

|

|

|

| (In thousands,

except share and per share amounts) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

February 28, |

|

February 28, |

| |

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| REVENUE: |

|

|

|

|

|

|

|

|

| Academic

revenue |

|

$ |

16,923 |

|

|

$ |

20,158 |

|

|

$ |

53,607 |

|

|

$ |

59,872 |

|

| Auxiliary

revenue |

|

|

955 |

|

|

|

891 |

|

|

|

2,930 |

|

|

|

3,699 |

|

| Rental

income — apartments |

|

|

349 |

|

|

|

282 |

|

|

|

1,049 |

|

|

|

873 |

|

|

Condominium sales |

|

|

- |

|

|

|

- |

|

|

|

455 |

|

|

|

- |

|

| Total

revenue |

|

|

18,227 |

|

|

|

21,331 |

|

|

|

58,041 |

|

|

|

64,444 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

educational services |

|

|

6,234 |

|

|

|

7,629 |

|

|

|

19,545 |

|

|

|

20,594 |

|

| Selling,

general and administrative |

|

|

13,817 |

|

|

|

15,321 |

|

|

|

44,633 |

|

|

|

47,228 |

|

| Auxiliary

expense |

|

|

686 |

|

|

|

591 |

|

|

|

2,079 |

|

|

|

2,694 |

|

| Cost of

condominium sales |

|

|

- |

|

|

|

- |

|

|

|

427 |

|

|

|

- |

|

| Loss on

lease termination |

|

|

- |

|

|

|

- |

|

|

|

362 |

|

|

|

- |

|

| Loss on

disposition of property |

|

|

1,076 |

|

|

|

2 |

|

|

|

2,071 |

|

|

|

8 |

|

| Total

operating expenses |

|

|

21,813 |

|

|

|

23,543 |

|

|

|

69,117 |

|

|

|

70,524 |

|

| OPERATING LOSS |

|

|

(3,586 |

) |

|

|

(2,212 |

) |

|

|

(11,076 |

) |

|

|

(6,080 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME

(EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

14 |

|

|

|

28 |

|

|

|

63 |

|

|

|

77 |

|

| Interest

expense |

|

|

(211 |

) |

|

|

(211 |

) |

|

|

(628 |

) |

|

|

(639 |

) |

| Other

income — net |

|

|

8 |

|

|

|

14 |

|

|

|

95 |

|

|

|

83 |

|

| Total

other expense |

|

|

(189 |

) |

|

|

(169 |

) |

|

|

(470 |

) |

|

|

(479 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS BEFORE INCOME

TAXES |

|

|

(3,775 |

) |

|

|

(2,381 |

) |

|

|

(11,546 |

) |

|

|

(6,559 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX BENEFIT

(EXPENSE) |

|

|

83 |

|

|

|

(143 |

) |

|

|

268 |

|

|

|

1,254 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

|

(3,692 |

) |

|

|

(2,524 |

) |

|

|

(11,278 |

) |

|

|

(5,305 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME

ATTRIBUTABLE TO NON-CONTROLLING |

|

|

(15 |

) |

|

|

(12 |

) |

|

|

(34 |

) |

|

|

(39 |

) |

|

INTEREST |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS ATTRIBUTABLE

TO NATIONAL AMERICAN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UNIVERSITY

HOLDINGS, INC. AND SUBSIDIARIES |

|

|

(3,707 |

) |

|

|

(2,536 |

) |

|

|

(11,312 |

) |

|

|

(5,344 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE

(LOSS) INCOME, NET OF TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains (losses) on investments, net of tax benefit

(expense) |

|

|

11 |

|

|

|

3 |

|

|

|

4 |

|

|

|

(2 |

) |

| COMPREHENSIVE LOSS

ATTRIBUTABLE TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NATIONAL AMERICAN

UNIVERSITY HOLDINGS, INC. |

|

$ |

(3,696 |

) |

|

$ |

(2,533 |

) |

|

$ |

(11,308 |

) |

|

$ |

(5,346 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Basic net loss

attributable to National American University |

|

$ |

(0.15 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.22 |

) |

| Holdings,

Inc. |

|

|

|

|

|

|

|

|

| Diluted net loss

attributable to National American University |

|

$ |

(0.15 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.22 |

) |

| Holdings,

Inc. |

|

|

|

|

|

|

|

|

| Basic weighted average

shares outstanding |

|

|

24,269,158 |

|

|

|

24,177,979 |

|

|

|

24,222,864 |

|

|

|

24,146,643 |

|

| Diluted weighted

average shares outstanding |

|

|

24,269,158 |

|

|

|

24,177,979 |

|

|

|

24,222,864 |

|

|

|

24,146,643 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

NATIONAL AMERICAN UNIVERSITY HOLDINGS, INC. AND

SUBSIDIARIES |

|

|

| |

|

|

|

|

| UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

| AS OF FEBRUARY

28, 2018 AND MAY 31, 2017 |

|

|

|

|

| (In thousands,

except share and per share amounts) |

|

|

|

|

| |

February 28, |

|

May 31, |

|

| |

|

2018 |

|

|

|

2017 |

|

|

|

ASSETS |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

| Cash and

cash equivalents |

$ |

4,638 |

|

|

$ |

11,974 |

|

|

| Available

for sale investments |

$ |

- |

|

|

$ |

4,183 |

|

|

| Student

receivables — net of allowance of $686 and $1,195 at February 28,

2018 |

|

|

|

|

|

|

|

|

| and May

31, 2017, respectively |

$ |

3,586 |

|

|

$ |

2,895 |

|

|

| Other

receivables |

$ |

724 |

|

|

$ |

458 |

|

|

| Income

taxes receivable |

$ |

2,397 |

|

|

$ |

2,301 |

|

|

| Prepaid

and other current assets |

$ |

1,638 |

|

|

$ |

1,649 |

|

|

| Total

current assets |

$ |

12,983 |

|

|

$ |

23,460 |

|

|

| Total property and

equipment - net |

$ |

27,194 |

|

|

$ |

31,318 |

|

|

| OTHER ASSETS: |

|

|

|

|

|

|

|

|

|

Restricted certificate of deposit |

$ |

1,250 |

|

|

$ |

- |

|

|

|

Condominium inventory |

$ |

190 |

|

|

$ |

621 |

|

|

| Land held

for future development |

$ |

229 |

|

|

$ |

229 |

|

|

| Course

development — net of accumulated amortization of $3,465 and $3,322

at |

|

|

|

|

|

|

|

|

| February

28, 2018 and May 31, 2017, respectively |

$ |

812 |

|

|

$ |

1,111 |

|

|

|

Other |

$ |

597 |

|

|

$ |

853 |

|

|

| Total

other assets |

$ |

3,078 |

|

|

$ |

2,814 |

|

|

| TOTAL |

$ |

43,255 |

|

|

$ |

57,592 |

|

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

| Current

portion of capital lease payable |

$ |

367 |

|

|

$ |

331 |

|

|

| Accounts

payable |

$ |

2,643 |

|

|

$ |

3,076 |

|

|

| Dividends

payable |

$ |

- |

|

|

$ |

1,094 |

|

|

| Income

taxes payable |

$ |

105 |

|

|

$ |

113 |

|

|

| Deferred

income |

$ |

3,312 |

|

|

$ |

1,691 |

|

|

| Accrued

and other liabilities |

$ |

5,240 |

|

|

$ |

5,906 |

|

|

| Total

current liabilities |

$ |

11,667 |

|

|

$ |

12,211 |

|

|

| DEFERRED INCOME

TAXES |

$ |

- |

|

|

$ |

194 |

|

|

| OTHER LONG-TERM

LIABILITIES |

$ |

2,870 |

|

|

$ |

4,010 |

|

|

| CAPITAL LEASE PAYABLE,

NET OF CURRENT PORTION |

$ |

10,957 |

|

|

$ |

11,237 |

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| STOCKHOLDERS'

EQUITY: |

|

|

|

|

|

|

|

|

| Common

stock, $0.0001 par value (50,000,000 authorized; 28,670,095 issued

and |

|

|

|

|

|

|

|

|

|

24,330,914 outstanding as of February 28, 2018; 28,557,968 issued

and 24,224,924 |

|

|

|

|

|

|

|

|

|

outstanding as of May 31, 2017) |

$ |

3 |

|

|

$ |

3 |

|

|

|

Additional paid-in capital |

$ |

59,258 |

|

|

$ |

59,060 |

|

|

|

Accumulated deficit |

$ |

(19,024 |

) |

|

$ |

(6,622 |

) |

|

| Treasury

stock, at cost (4,339,181 shares at February 28, 2018 and

4,333,044 |

|

|

|

|

|

|

|

|

| shares at

May 31, 2017) |

$ |

(22,494 |

) |

|

$ |

(22,481 |

) |

|

|

Accumulated other comprehensive loss, net of taxes - unrealized

loss |

|

|

|

|

|

|

|

|

| on

available for sale securities |

$ |

- |

|

|

$ |

(4 |

) |

|

| Total National American

University Holdings, Inc. stockholders' equity |

$ |

17,743 |

|

|

$ |

29,956 |

|

|

| Non-controlling

interest |

$ |

18 |

|

|

$ |

(16 |

) |

|

| Total stockholders'

equity |

$ |

17,761 |

|

|

$ |

29,940 |

|

|

| TOTAL |

$ |

43,255 |

|

|

$ |

57,592 |

|

|

| |

|

|

|

|

|

|

|

|

The following table provides a reconciliation of net loss

attributable to the Company to EBITDA/LBITDA and Adjusted

EBITDA/LBITDA:

|

|

|

Three Months EndedFebruary

28, |

|

|

Nine Months EndedFebruary

28, |

|

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(dollars in thousands) |

|

| Net Loss attributable

to the Company |

|

$ |

(3,707) |

|

|

|

$ |

(2,536) |

|

|

|

$ |

(11,312) |

|

|

|

$ |

(5,344) |

|

|

| Income attributable to

non-controlling interest |

|

|

15 |

|

|

|

|

12 |

|

|

|

|

34 |

|

|

|

|

39 |

|

|

| Interest Income |

|

|

(14) |

|

|

|

|

(28) |

|

|

|

|

(63) |

|

|

|

|

(77) |

|

|

| Interest Expense |

|

|

211 |

|

|

|

|

211 |

|

|

|

|

628 |

|

|

|

|

639 |

|

|

| Income Tax (Benefit)

Expense |

|

|

(83) |

|

|

|

|

143 |

|

|

|

|

(268) |

|

|

|

|

(1,254) |

|

|

| Depreciation and

Amortization |

|

|

1,137 |

|

|

|

|

1,260 |

|

|

|

|

3,577 |

|

|

|

|

3,857 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA (LBITDA) |

|

$ |

(2,441) |

|

|

|

$ |

(938) |

|

|

|

$ |

(7,404) |

|

|

|

$ |

(2,140) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on disposition of

property |

|

|

1,076 |

|

|

|

|

2 |

|

|

|

|

2,071 |

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA

(LBITDA) |

|

$ |

(1,365) |

|

|

|

$ |

(936) |

|

|

|

$ |

(5,333) |

|

|

|

$ |

(2,132) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA/LBITDA consists of income attributable to

the Company, less income from non-controlling interest, plus loss

from non-controlling interest, minus interest income, plus interest

expense (which is not related to any debt but to the accounting

required for the capital lease), plus income taxes, plus

depreciation and amortization. The Company uses EBITDA/LBITDA as a

measure of operating performance. Adjusted EBITDA/LBITDA consists

of EBITDA/LBITDA plus loss on disposition of property. However,

neither EBITDA/LBITDA nor Adjusted EBITDA/LBITDA is a recognized

measurement under U.S. generally accepted accounting principles, or

GAAP, and when analyzing its operating performance, investors

should use EBITDA/LBITDA and Adjusted EBITDA/LBITDA in addition to,

and not as alternatives for, income as determined in accordance

with GAAP. Because not all companies use identical calculations,

the Company’s presentation of EBITDA/LBITDA and Adjusted

EBITDA/LBITDA may not be comparable to similarly titled measures of

other companies and is therefore limited as a comparative measure.

Furthermore, as an analytical tool, EBITDA/LBITDA and Adjusted

EBITDA/LBITDA have additional limitations, including that (a) they

are not intended to be a measure of free cash flow, as they do not

consider certain cash requirements such as tax payments; (b) they

do not reflect changes in, or cash requirements for, its working

capital needs; and (c) although depreciation and amortization are

non-cash charges, the assets being depreciated and amortized often

will have to be replaced in the future, and EBITDA/LBITDA and

Adjusted EBITDA/LBITDA do not reflect any cash requirements for

such replacements, or future requirements for capital expenditures

or contractual commitments. To compensate for these limitations,

the Company evaluates its profitability by considering the economic

effect of the excluded expense items independently as well as in

connection with its analysis of cash flows from operations and

through the use of other financial measures.

The Company believes EBITDA/LBITDA and Adjusted

EBITDA/LBITDA to be useful to an investor in evaluating its

operating performance because they are widely used to measure a

company’s operating performance without regard to certain non-cash

expenses (such as depreciation and amortization) and expenses that

are not reflective of its core operating results over time. The

Company believes EBITDA/LBITDA and Adjusted EBITDA/LBITDA present

meaningful measures of corporate performance exclusive of its

capital structure, the method by which assets were acquired and

non-cash charges, and provides us with additional useful

information to measure its performance on a consistent basis,

particularly with respect to changes in performance from period to

period.

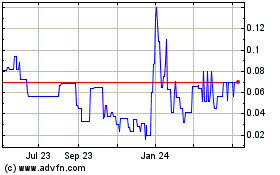

National American Univer... (QB) (USOTC:NAUH)

Historical Stock Chart

From Nov 2024 to Dec 2024

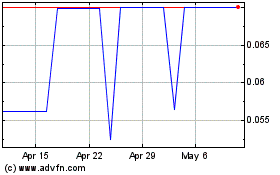

National American Univer... (QB) (USOTC:NAUH)

Historical Stock Chart

From Dec 2023 to Dec 2024