Current Report Filing (8-k)

June 25 2014 - 3:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported) June 25, 2014 (June 20, 2014)

_______________

MINERCO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

_______________

|

NEVADA

|

333-156059

|

27-2636716

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

20 Trafalgar Square

Suite 455

Nashua, NH 03063

(Address of principal executive offices, including zip code.)

(888) 473-5150

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

|

|

|

On June 20, 2014, Minerco Resources, Inc. (“we” or the “Company”) entered into an Agreement (the “Exchange Agreement”) with John F. Powers, an individual and our Principal Executive Officer (“Powers”), where, among other things, the Company and Powers shall exchange Powers’ thirty million (30,000,000) shares of the Company’s common stock for fifty-three thousand (53,000) shares of the Company’s Class ‘B’ Preferred stock.

|

|

|

The summary of the Exchange Agreement is as follows (the entire Exchange Agreement is attached as Exhibit 10.1 to this Current Report on Form 8-K filed with the Securities and Exchange Commission):

|

|

|

WHEREAS, Powers is the Chief Executive Officer (“CEO”) of the Company and has been the Company’s CEO since September 21, 2012; and

|

|

|

WHEREAS, Powers holds thirty million (30,000,000) shares of the Company’s common stock (the “Common Stock”); and

|

|

|

WHEREAS, Powers is willing to exchange thirty million (30,000,000) shares of the Company’s common stock for fifty-three thousand (53,000) shares of the Company’s Class ‘B’ Preferred stock AND the Company is willing to exchange Powers’ thirty million (30,000,000) shares of the Company’s common stock for fifty-three thousand (53,000) shares of the Company’s Class ‘B’ Preferred stock; and

|

|

|

WHEREAS, The exchange of the Common Stock for the Series B Preferred Stock will be made in reliance upon the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “1933 Act”).

|

|

|

1. Exchange. Powers agrees to exchange his thirty million (30,000,000) shares of the Company’s common stock for fifty-three thousand (53,000) shares of the Company’s Class ‘B’ Preferred stock. The exchange of the Common Stock for the Series B Preferred Stock will be made in reliance upon the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “1933 Act”).

|

|

|

The foregoing description of the Exchange Agreement is qualified in its entirety by reference to the full text of the Exchange Agreement, attached as Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission and incorporated herein by reference.

|

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

| |

|

|

|

Incorporated by reference

|

|

|

|

Exhibit

|

|

Document Description

|

|

Form

|

|

Date

|

|

Number

|

|

Filed herewith

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange Agreement, Minerco – J. Powers, dated June 20, 2014

|

|

|

|

|

|

|

|

X

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Dated: June 25, 2014

|

MINERCO RESOURCES, INC.

|

| |

|

|

| |

By:

|

/s/ John F. Powers

|

| |

|

John F. Powers |

Exhibit 10.1

AGREEMENT TO EXCHANGE

COMMON SHARES FOR CLASS B PREFERRED SHARES

THIS AGREEMENT, dated as of June 20, 2014 is entered into by and between Minerco Resources, Inc. (the “Company”) and John F. Powers (”Powers”).

WITNESSETH:

WHEREAS, Powers is the Chief Executive Officer (“CEO”) of the Company and has been the Company’s CEO since September 21, 2012; and

WHEREAS, Powers holds thirty million (30,000,000) shares of the Company’s common stock (the “Common Stock”); and

WHEREAS, Powers is willing to exchange thirty million (30,000,000) shares of the Company’s common stock for fifty-three thousand (53,000) shares of the Company’s Class ‘B’ Preferred stock AND the Company is willing to exchange Powers’ thirty million (30,000,000) shares of the Company’s common stock for fifty-three thousand (53,000) shares of the Company’s Class ‘B’ Preferred stock; and

WHEREAS, The exchange of the Common Stock for the Series B Preferred Stock will be made in reliance upon the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “1933 Act”).

NOW, THEREFORE, in consideration for the foregoing, the parties hereto agree as follows:

|

1.

|

Exchange. Powers agrees to exchange his thirty million (30,000,000) shares of the Company’s common stock for fifty-three thousand (53,000) shares of the Company’s Class ‘B’ Preferred stock. The exchange of the Common Stock for the Series B Preferred Stock will be made in reliance upon the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “1933 Act”).

|

|

2.

|

Powers Representations, Warranties, Etc. Powers represents and warrants to, and covenants and agrees with, the Company as follows:

|

|

a.

|

Due Authorization. Powers has all requisite legal capacity to execute, deliver and perform this Agreement and the transactions hereby contemplated. This Agreement constitutes a valid and binding agreement on the part of Powers and is enforceable in accordance with its terms.

|

|

b.

|

No Consents; No Contravention. The execution, delivery and performance by Powers of this Agreement (i) requires no authorization, registration, consent, approval or action by or in respect of, or filings with, any governmental body, agency or official or other person (including but not limited to the Securities and Exchange Commission), and (ii) do not contravene, conflict with, result in a breach of or constitute a default under any material provision of applicable law or regulation, or of any material agreement to which Powers is a party.

|

|

3.

|

Company Representations, Etc. The Company represents and warrants to Powers that:

|

|

a.

|

Exchange Agreement. This Agreement and the transactions contemplated hereby, have been duly and validly authorized by the Company. This Agreement has been duly executed and delivered by the Company and is a valid and binding agreement of the Company enforceable in accordance with its terms, subject as to enforceability to general principles of equity and to bankruptcy, insolvency, moratorium, and other similar laws affecting the enforcement of creditors' rights generally.

|

|

b.

|

Non-contravention. The execution and delivery of this Agreement by the Company, and the consummation by the Company of the other transactions contemplated by this Agreement do not and will not conflict with or result in a breach by the Company of any of the terms or provisions of, or constitute a default under (i) the articles of incorporation or by-laws of the Company, (ii) any indenture, mortgage, deed of trust, or other material agreement or instrument to which the Company is a party or by which it or any of its properties or assets are bound, (iii) to its knowledge, any existing applicable law, rule, or regulation or any applicable decree, judgment, or (iv) to its knowledge, order of any court, United States federal or state regulatory body, administrative agency, or other governmental body having jurisdiction over the Company or any of its properties or assets, except such conflict, breach or default which would not have a material adverse effect on the transactions contemplated herein. The Company is not in violation of any material laws, governmental orders, rules, regulations or ordinances to which its property, real, personal, mixed, tangible or intangible, or its businesses related to such properties, are subject.

|

|

c.

|

Approvals. No authorization, approval or consent of any court, governmental body, regulatory agency, self-regulatory organization, or stock exchange or market is required to be obtained by the Company for the Exchange as contemplated by this Agreement, except such authorizations, approvals and consents that have been obtained.

|

|

4.

|

Certain Covenants And Acknowledgments. The Company undertakes and agrees to make all necessary filings in connection with the exchange effected hereby under any United States laws and regulations, and to provide a copy thereof to Powers promptly after such filing.

|

|

5.

|

Governing Law; Miscellaneous. This Agreement shall be governed by and interpreted in accordance with the laws of the State of Nevada. A facsimile transmission of this signed Agreement shall be legal and binding on all parties hereto. This Agreement may be signed in one or more counterparts, each of which shall be deemed an original. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Agreement or the validity or enforceability of this Agreement in any other jurisdiction. This Agreement may be amended only by an instrument in writing signed by the party to be charged with enforcement. This Agreement, and the related agreements referred to herein, contain the entire agreement of the parties with respect to the subject matter hereto, superceding all prior agreements, understandings or discussions.

|

|

6.

|

Notices. Any notice required or permitted hereunder shall be given in writing (unless otherwise specified herein) and shall be deemed effectively given, (i) on the date delivered, (a) by personal delivery, or (b) if advance copy is given by fax, (ii) seven business days after deposit in the United States Postal Service by regular or certified mail, or (iii) three business days mailing by international express courier, with postage and fees prepaid, addressed to each of the other parties thereunto entitled at the last known mailing address, or at such other addresses as a party may designate by ten days advance written notice to each of the other parties hereto.

|

|

7.

|

Successors And Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

|

IN WITNESS WHEREOF, the Company and Powers have caused this Agreement to be executed by their duly authorized representatives on the date as first written above.

| |

MINERCO RESOURCES, INC. |

|

| |

|

|

|

|

|

By:

|

/s/ V. Scott Vanis |

|

| |

|

Name: V. Scott Vanis

|

|

| |

|

Title: Chairman

|

|

| |

|

|

|

| |

JOHN F. POWERS

|

|

| |

|

|

|

| |

By:

|

/s/ John F. Powers |

|

| |

|

Name: John F. Powers |

|

| |

|

|

|

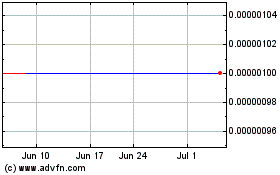

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jun 2024 to Jul 2024

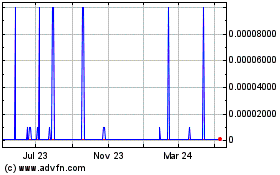

Minerco (CE) (USOTC:MINE)

Historical Stock Chart

From Jul 2023 to Jul 2024