First Quarter Highlights

- Total clinical documentation volume reaches a quarterly

high of 866 million lines for the first quarter of 2011; a 39%

increase versus prior year same period

- Adjusted EBITDA increases 94% versus prior year same

period to $26.8 million

- Adjusted Net Income per diluted share - adjusted for

the IPO and exchange offer up 82% versus prior year same period to

$0.31

- Continued strong free cash flow

- Customers' demand increases offshore volume goal, and

volumes edited post speech recognition continue to

grow

- Integration of Spheris completed, and integration of

MedQuist Inc. and MedQuist Holdings commences

- Legacy litigation resolved

- Updates guidance to reflect first quarter

performance

The highlights above, as well as the discussion below, contain

certain non-GAAP financial measures that, together with applicable

GAAP financial measures, we utilize to evaluate the results of our

performance. Refer to the section of this release entitled

"Non-GAAP Financial Measures" for further discussion, as well as

the tables attached to this release that reconcile these non-GAAP

financial measures to applicable GAAP financial measures.

MedQuist Holdings Inc. (Nasdaq:MEDH), a leading provider of

integrated clinical documentation solutions for the U.S. healthcare

industry, announced its financial results for the three months

ended March 31, 2011.

Operating Results

Net revenues increased 31% to $111.2 million for the first

quarter of 2011, including $31.0 million in net revenues

contributed by the acquisition of Spheris compared with $85.1

million for the first quarter of 2010. The Spheris acquisition was

closed in April 2010. Volumes improved versus prior year same

quarter due to the impacts of the Spheris acquisition as well as

approximately 3% of organic growth unrelated to the impacts of the

acquisition. Additionally, volumes improved to 866 million lines

for the current quarter representing an improvement of 2% versus

the fourth quarter of 2010.

Adjusted EBITDA for the first quarter of 2011 was $26.8 million,

or 24% of net revenues, compared with $13.8 million, or 16% of net

revenues, for the first quarter of 2010. The year-over-year

increase in Adjusted EBITDA and margin is the result of higher

utilization of offshore resources and higher percentage of volume

edited post speech recognition, as well as synergies realized from

adding volumes from the Spheris acquisition to our scalable

platform. Adjusted EBITDA for the first quarter of 2011 versus the

fourth quarter of 2010 reflects the seasonal variations in volumes

and higher employer taxes, as well as movement of volumes to the

Company's global production facilities.

Adjusted net income for the first quarter of 2011 was $16.4

million, or $0.31 per diluted share – adjusted for the IPO and

exchange offer, compared with $8.7 million, or $0.17 per diluted

share – adjusted for the IPO and exchange offer, in the first

quarter of 2010. Net income attributable to common shareholders for

the first quarter of 2011 was $2.3 million, or $0.05 per diluted

share, compared with $1.4 million, or $0.04 per diluted share,

reported in the first quarter of 2010.

During the three months ended March 31, 2011, we recorded net

restructuring charges of $5.4 million including approximately $3.2

million from a reduction in workforce and a charge of $1.5 million

representing future lease payments on MedQuist Inc.'s former

corporate headquarters in Mt. Laurel, New Jersey, and former data

center in Sterling, Virginia, offset by estimated sublease rentals.

The future minimum lease payments on the Mt. Laurel facility total

$2.5 million. In addition, we recorded non-cash stock compensation

charges of $0.7 million due to the acceleration of stock option

vesting and the extension of the stock option exercise period for

terminated employees. The benefits from these restructuring efforts

are not expected to be fully realized until 2012.

The Company also recognized $9.7 million of income associated

with the termination of its customer accommodation program, offset

by $1.8 million in charges of related litigation costs and $0.4

million of fees incurred in connection with the minority

shareholder litigation associated with our exchange offers.

| Operating Metrics |

|

Q1 2011 |

|

Q4 2010 |

|

Q1 2010 |

| Total clinical documentation

volume: |

|

866 million lines |

|

850 million lines |

|

624 million lines |

| Transcription volumes

processed offshore: |

|

41% |

|

42% |

|

41% |

| Transcription volumes edited post

speech recognition: |

|

72% |

|

71% |

|

57% |

Peter Masanotti, Chief Executive Officer of MedQuist Holdings,

said, "We are off to a good start to 2011 and in line with our plan

for the year. The sequential and year-over-year volume improvement

came from organic growth and our ability to stabilize the Spheris

book of business. The sustained increase in post speech recognition

editing continues to enhance our productivity and our focus on

achieving integration savings is significantly reducing our direct

costs.

"Customers' demand for our offshore resources continues to

accelerate, and we are building a sizable inventory. Given the size

and complexity of this new work, we are executing a very

conservative rollout of these conversions. The strong demand gives

us increased confidence that we can reach our goal of 50% offshore

by the end of the year."

Liquidity and Capital Structure

As of March 31, 2011, the Company had $75.6 million in cash and

$269.5 million in debt and capital lease obligations. During the

first quarter of 2011, the Company paid its scheduled $5 million

term loan payment plus an additional $20 million in optional

prepayment amounts on its senior facility, thereby satisfying its

principal amortization obligations on its term loan through the

first quarter of 2012. Free cash flow for the first quarter of

2011 increased to $13.3 million compared with $8.8 million in the

first quarter of 2010. The first quarter capital expenditures were

higher than expected average quarterly expenditures for the

remainder of the year due to costs associated with integration

work. In the second quarter, the Company expects to pay an

additional $12.0 million related to the IPO and exchange

offers.

The Company's high level of cash generated as compared to its

Adjusted EBITDA reflects its continued ability to utilize available

tax attributes to absorb current period taxes. At December 31,

2010, the Company had federal net operating loss carry forward

amounts of approximately $102 million with approximately 80%

available through 2014 to help off-set future period taxable income

amounts. Additionally, the Company had approximately $194

million of capitalized tax intangibles, of which approximately 60%

are expected to be amortized for tax purposes over the next five

years. Utilization of the net operating loss carry forwards and

intangible amortization amounts are subject to annual limitations

in future years but are anticipated to result in low cash tax

amounts paid in the near term.

In accordance with the terms of a Settlement Stipulation entered

into in connection with the settlement of MedQuist Inc. shareholder

litigation and subject to final approval of the settlement by the

Court, the 3% of remaining issued and outstanding shares of

MedQuist Inc. not already owned by MedQuist Holdings Inc. are to be

exchanged on the same terms as the public exchange initiated on

February 3, 2011, through a short-form merger that is expected to

be completed by the end of the third quarter of 2011. In connection

with this short-form merger and to immediately reduce duplicate

costs of being a public company, MedQuist Inc. delisted its common

stock from NASDAQ. Subsequent to completing the short-form

merger, fully diluted shares outstanding will increase to

approximately 52 million.

Performance Goals for 2011

Based on the first quarter results, the Company has updated its

previously issued performance goals for 2011 as noted below:

| Total clinical documentation volume: |

3.5 billion to 3.7 billion lines |

| Adjusted EBITDA: |

$113 million to $116 million |

| Adjusted Net Income: |

$1.26 to $1.33 per diluted share – |

| |

adjusted for the IPO and exchange

offer |

Commenting on the 2011 outlook, Mr. Masanotti added, "I'm

pleased with the improving outlook for the year and confident the

integration work will allow us to have one set of goals and

objectives across companies, driving efficiencies that will allow

us to reduce costs in accordance with our plan and provide better

service to our customers. The current market environment also

continues to play to our strengths as smaller clinical

documentation providers are struggling to compete with our ability

to provide end-to-end clinical solutions combined with speech

recognition and offshore resources."

Investor Conference Call and Web Simulcast

MedQuist Holdings will host a conference call on May 16, 2011,

at 9:00 a.m. CT to discuss its results of operations for the first

quarter of 2011. The number to call for the interactive

teleconference is (212) 231-2901. A replay of the conference call

will be available through Monday, May 23, 2011, by dialing (402)

977-9140 and entering the confirmation number, 21520377.

A live broadcast of MedQuist Holdings quarterly conference call

will be available online at the Company's website,

www.medquistholdings.com, under Investor Relations or

http://www.videonewswire.com/event.asp?id=78513 on May 16, 2011,

beginning at 9:00 a.m. CT. The online replay will follow

shortly after the call and continue for one year. About

MedQuist Holdings

MedQuist Holdings is a leading provider of integrated clinical

documentation solutions for the U.S. healthcare system, and the

largest provider by revenue of clinical documentation based on

physicians' dictation of patient interaction, or the physician

narrative, in the United States. MedQuist Holdings serves more than

2,400 hospitals, clinics, and physician practices throughout the

United States, including 40% of hospitals with more than 500

licensed beds.

MedQuist Holdings' solutions convert the physician narrative

into a high quality and customized electronic record, and enable

hospitals, clinics, and physician practices to improve the quality

of clinical data as well as accelerate and automate the

documentation process. We believe our solutions improve physician

productivity and satisfaction, enhance revenue cycle performance,

and facilitate the adoption and use of electronic

health records. For more information, please visit our website

at www.medquistholdings.com.

Forward-Looking Statements

Information provided and statements contained in this press

release that are not purely historical, such as

statements regarding our 2011 financial and operating performance,

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, Section 21E of the Securities Exchange

Act of 1934 and the Private Securities Litigation Reform Act of

1995. Such forward-looking statements only speak as of the date of

this press release and MedQuist Holdings Inc. assumes no obligation

to update the information included in this press release.

Statements made in this press release that are forward-looking in

nature may involve risks and uncertainties. Accordingly, readers

are cautioned that any such forward-looking statements are not

guarantees of future performance and are subject to certain risks,

uncertainties and assumptions that are difficult to predict,

including, without limitation, specific factors discussed herein

and in other releases and public filings made by MedQuist Holdings

Inc. (including filings by MedQuist Holdings Inc. with the SEC).

Although MedQuist Holdings believes that the expectations reflected

in such forward-looking statements are reasonable as of the date

made, expectations may prove to have been materially different from

the results expressed or implied by such forward-looking

statements. Unless otherwise required by law, MedQuist Holdings

also disclaims any obligation to update its view of any such risks

or uncertainties or to announce publicly the result of any

revisions to the forward-looking statements made in this press

release.

| |

|

|

| MedQuist Holdings Inc.

and Subsidiaries |

| Consolidated Statements

of Operations |

| (In thousands, except

per share amounts) |

| Unaudited |

| |

|

|

| |

Three Months

Ended |

| |

March

31, |

| |

2011 |

2010 |

| Net revenues |

$ 111,236 |

$ 85,087 |

| Cost of revenues |

66,021 |

54,615 |

| Gross profit |

45,215 |

30,472 |

| Operating costs and

expenses: |

|

|

| Selling, general and administrative |

16,192 |

14,480 |

| Research and development |

2,251 |

2,281 |

| Depreciation and amortization |

8,418 |

6,139 |

| Cost of legal proceedings, settlements

and accommodations |

(7,513) |

1,043 |

| Acquisition and restructuring |

6,878 |

984 |

| |

|

|

| Total operating costs and

expenses |

26,226 |

24,927 |

| Operating income |

18,989 |

5,545 |

| |

|

|

| Equity in income of affiliated company |

-- |

514 |

| Other income |

10 |

77 |

| Interest expense, net |

(7,037) |

(1,869) |

| |

|

|

| Income from continuing operations

before income taxes and noncontrolling interests |

11,962 |

4,267 |

| |

|

|

| Income tax provision (benefit) |

1,144 |

(20) |

| |

|

|

| Net income from continuing

operations |

10,818 |

4,287 |

| |

|

|

| Income from discontinued

operations, net of tax |

-- |

30 |

| Net income |

10,818 |

4,317 |

| |

|

|

| Less: Net income attributable to

noncontrolling interests |

(1,506) |

(2,229) |

| |

|

|

| Net income attributable to

MedQuist Holdings Inc. |

$ 9,312 |

$ 2,088 |

| |

|

|

| Net income per common share from

continuing operations |

|

|

| Basic |

$ 0.06 |

$ 0.04 |

| Diluted |

$ 0.05 |

$ 0.04 |

| |

|

|

| Net income per common share from

discontinued operations |

|

|

| Basic |

$ -- |

$ -- |

| Diluted |

$ -- |

$ -- |

| |

|

|

| Net income per common share

attributable to MedQuist Holdings Inc. |

|

|

| Basic |

$ 0.06 |

$ 0.04 |

| Diluted |

$ 0.05 |

$ 0.04 |

| |

|

|

| Weighted average shares

outstanding: |

|

|

| Basic |

40,933 |

35,013 |

| Diluted |

41,980 |

35,183 |

| |

|

|

| MedQuist Holdings Inc.

and Subsidiaries |

| Consolidated Balance

Sheets |

| (In

thousands) |

| Unaudited |

| |

|

|

| |

March 31, |

December 31, |

| |

2011 |

2010 |

| Assets |

|

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ 75,635 |

$ 66,779 |

| Accounts receivable, net of allowance of

$1,662 and $1,466, respectively |

77,997 |

82,038 |

| Other current assets |

20,164 |

23,706 |

| Total current assets |

173,796 |

172,523 |

| |

|

|

| Property and equipment, net |

24,492 |

23,018 |

| Goodwill |

90,250 |

90,268 |

| Other intangible assets, net |

105,080 |

107,962 |

| Deferred income taxes |

7,023 |

6,896 |

| Other assets |

13,621 |

14,212 |

| |

|

|

| Total assets |

$ 414,262 |

$ 414,879 |

| |

|

|

| Liabilities and Equity |

|

|

| Current liabilities: |

|

|

| Current portion of long term debt |

$ 7,946 |

$ 27,817 |

| Accounts payable |

14,049 |

11,358 |

| Accrued expenses |

37,088 |

36,917 |

| Accrued compensation |

20,071 |

16,911 |

| Deferred revenue |

9,393 |

10,570 |

| Related party payable |

5,000 |

-- |

| Total current liabilities |

93,547 |

103,573 |

| Long term debt |

261,543 |

266,677 |

| Deferred income taxes |

5,307 |

4,221 |

| Related party payable - noncurrent |

4,406 |

3,537 |

| Other non-current liabilities |

2,449 |

2,360 |

| Total liabilities |

367,252 |

380,368 |

| Commitments and contingencies |

|

|

| Equity |

|

|

| Preferred stock -- $0.10 par value;

authorized 25,000 shares; none issued or outstanding |

-- |

-- |

| Common stock -- $0.10 par value;

authorized 300,000 shares; 49,168 and 35,158 shares issued and

outstanding, respectively |

4,917 |

3,516 |

| Additional paid in capital |

141,287 |

148,265 |

| Accumulated deficit |

(97,867) |

(107,179) |

| Accumulated other comprehensive loss |

(729) |

(663) |

| Total MedQuist Holdings Inc.

stockholders' equity |

47,608 |

43,939 |

| Noncontrolling interests |

(598) |

(9,428) |

| Total equity |

47,010 |

34,511 |

| |

|

|

| Total liabilities and equity |

$ 414,262 |

$ 414,879 |

| |

|

|

| MedQuist Holdings Inc.

and Subsidiaries |

| Consolidated Statements

of Cash Flow |

| (In

thousands) |

| Unaudited |

| |

|

| |

Three Months

Ended |

| |

2011 |

2010 |

| Operating activities: |

|

|

| Net income |

$ 10,818 |

$ 4,317 |

| |

|

|

| Adjustments to reconcile net income to cash

provided by operating activities: |

|

|

| Depreciation and amortization |

8,418 |

6,363 |

| Equity in income of affiliated

company |

-- |

(515) |

| Deferred income taxes |

1,091 |

(359) |

| Share based compensation |

978 |

144 |

| Provision for doubtful accounts |

170 |

779 |

| Non-cash interest expense |

858 |

-- |

| Other |

(796) |

(139) |

| Changes in operating assets and

liabilities: |

|

|

| Accounts receivable |

3,458 |

(182) |

| Other current assets |

(414) |

(141) |

| Other non-current assets |

(135) |

109 |

| Accounts payable |

(1,188) |

(1,622) |

| Accrued expenses |

(1,837) |

(1,246) |

| Accrued compensation |

3,136 |

(1,577) |

| Deferred revenue |

(1,177) |

(598) |

| Other non-current liabilities |

59 |

(151) |

| Net cash provided by operating

activities |

$ 23,439 |

$ 5,182 |

| |

|

|

| Investing activities: |

|

|

| Purchase of property and equipment |

(4,343) |

(1,928) |

| Purchases of capitalized intangible

assets |

(2,345) |

(1,109) |

| Payments for acquisitions and interests

in affiliates, net of cash acquired |

-- |

(7,685) |

| Net cash used in investing activities |

(6,688) |

(10,722) |

| |

|

|

| Financing activities: |

|

|

| Proceeds from debt |

-- |

2,769 |

| Repayment of debt |

(25,789) |

(3,085) |

| Debt issuance costs |

-- |

(195) |

| Net proceeds from issuance of common

stock |

22,320 |

-- |

| Payments for offering costs |

(4,504) |

-- |

| Net cash used in financing activities |

(7,973) |

(511) |

| |

|

|

| Effect of exchange rate changes |

78 |

125 |

| |

|

|

| Net increase (decrease) in cash and cash

equivalents |

8,856 |

(5,926) |

| |

|

|

| Cash and cash equivalents - beginning of

period |

66,779 |

29,633 |

| |

|

|

| Cash and cash equivalents - end of

period |

$ 75,635 |

$ 23,707 |

| |

|

|

| MedQuist Holdings Inc.

and Subsidiaries |

| Reconciliation of Net

Income to Adjusted EBITDA |

| (In

thousands) |

| Unaudited |

| |

|

|

| |

Three Months

Ended |

| |

March

31, |

| |

2011 |

2010 |

| |

|

|

| Net income attributable to MedQuist Holdings

Inc. |

$ 9,312 |

$ 2,088 |

| |

|

|

| Net income attributable to noncontrolling

interests |

1,506 |

2,229 |

| Income from discontinued operations, net of

tax |

-- |

(30) |

| Income tax provision (benefit) |

1,144 |

(20) |

| Interest expense, net |

7,037 |

1,869 |

| Depreciation and amortization |

8,418 |

6,139 |

| Acquisition and restructuring |

6,878 |

984 |

| Cost of legal proceedings, settlements and

accommodations |

(7,513) |

1,043 |

| Equity in income of affiliated company |

-- |

(514) |

| Adjusted EBITDA |

$ 26,782 |

$ 13,788 |

| |

|

|

| Adjusted EBITDA as a percentage of net

revenues |

24.1% |

16.2% |

| |

|

|

| MedQuist Holdings Inc.

and Subsidiaries |

| Free Cash

Flow |

| (In

thousands) |

| Unaudited |

| |

|

|

| |

Three Months

Ended |

| |

March

31, |

| |

2011 |

2010 |

| |

|

|

| Adjusted EBITDA |

$ 26,782 |

$ 13,788 |

| Less: Interest expense (net of non-cash

interest expense of $858 and $60, respectively) |

(6,179) |

(1,809) |

| Capital expenditures (including

capitalized software development costs) |

(6,688) |

(3,037) |

| Current tax provision |

(598) |

(110) |

| Free Cash Flow |

$ 13,317 |

$ 8,832 |

| |

|

|

| |

|

|

| |

|

|

| MedQuist Holdings Inc.

and Subsidiaries |

| Adjusted Net

Income |

| (In

thousands) |

| Unaudited |

| |

|

|

| |

Three Months

Ended |

| |

March

31, |

| |

2011 |

2010 |

| Adjusted Net Income: |

|

|

| |

|

|

| Adjusted EBITDA |

$ 26,782 |

$ 13,788 |

| Less: Amortization of capitalized

intangible assets (excluding acquired intangibles) |

(3,598) |

(3,172) |

| Interest expense (net of non-cash

interest expense of $858 and $60, respectively) |

(6,179) |

(1,809) |

| Current tax provision |

(598) |

(110) |

| Adjusted Net Income |

$ 16,407 |

$ 8,697 |

| |

|

|

| Adjusted Net Income Per Share - Adjusted for

IPO and Exchange Offer: |

|

|

| Basic (a) |

$ 0.32 |

$ 0.17 |

| Diluted (a) |

$ 0.31 |

$ 0.17 |

| |

|

|

| (a) Based on proforma shares

outstanding for the IPO and Exchange Offer. See Share Calculation

below. |

| |

|

|

| MedQuist Holdings Inc.

and Subsidiaries |

| Share

Calculation |

| (In

thousands) |

| Unaudited |

| |

|

|

| |

Three Months

Ended |

| |

March

31, |

| |

2011 |

2010 |

| |

|

|

| MedQuist Holdings Shares |

|

|

| Basic outstanding |

40,933 |

35,013 |

| Effect of dilutive options |

1,047 |

170 |

| Diluted shares |

41,980 |

35,183 |

| |

|

|

| Proforma impact of Minority Interest Shares

(1) |

|

|

| Minority interest - basic |

7,906 |

11,685 |

| Minority interest - diluted |

7,906 |

11,685 |

| |

|

|

| Proforma impact of IPO and Minority

Shareholder Shares (2) |

|

|

| Basic |

2,309 |

4,320 |

| Diluted |

2,309 |

4,320 |

| |

|

|

| Proforma Shares Outstanding for IPO and

Exchange Offer |

|

|

| Basic |

51,148 |

51,018 |

| Fully Diluted |

52,195 |

51,188 |

| |

|

|

| (1) Assumes the issuance of our

common stock in exchange for shares of MedQuist Inc. common stock

pursuant to terms of private and public exchange offers, which will

increase our ownership in MedQuist Inc. from 69.5% to 100%. Also

assumes exercise of in-the-money MedQuist Inc. options. We

have completed our exchange offers, and we currently own

approximately 97% of MedQuist Inc. |

| |

|

|

| (2) Adjusts for timing of

issuance of shares of common stock to a related party during the

quarter, as well as unissued shares to another minority owner. |

Total Clinical Documentation Volume

Management believes that total clinical documentation volume is

an important measure of the Company's operating results. Total

clinical documentation volume is defined as total lines processed

on our clinical documentation platforms and/or transcribed or

edited by our personnel.

Non-GAAP Financial Measures

In addition to the United States generally accepted

accounting principles, or GAAP, results provided throughout this

document, MedQuist Holdings Inc. has provided certain

non-GAAP financial measures to help evaluate the results of our

performance. The Company believes that these non-GAAP financial

measures, when presented in conjunction with comparable GAAP

financial measures, are useful to both management and investors in

analyzing the Company's ongoing business and operating performance.

The Company believes that providing the non-GAAP information to

investors, in addition to the GAAP presentation, allows investors

to view the Company's financial results in the way that management

views financial results. The tables attached to this press release

include a reconciliation of these historical non-GAAP financial

measures to the most directly comparable GAAP financial

measures.

We also present Adjusted EBITDA and Adjusted Net Income on a

forward-looking basis as part of our Performance Goals for

2011. We are unable to present a quantitative reconciliation

of these forward-looking non-GAAP financial measures to the most

directly comparable forward-looking GAAP financial measures because

management cannot predict, with sufficient reliability,

contingencies relating to potential changes in tax valuation

allowances, potential changes to customer accommodation accruals,

potential restructuring impacts, contingencies related to past and

future acquisitions, and changes in fair values of our derivative

instruments, all of which are difficult to estimate primarily due

to dependencies on future events.

Adjusted EBITDA

Adjusted EBITDA, a non-GAAP financial measure, is defined by the

Company as Net Income excluding taxes, interest, equity in income

of an affiliated company, depreciation, amortization, cost of legal

proceedings and settlements, acquisition and restructuring charges,

discontinued operations and certain non-recurring accrual

reversals. Management believes Adjusted EBITDA is useful as

supplemental measures of the Company's financial results because it

removes costs not related to the Company's operating performance.

Management believes that Adjusted EBITDA should be considered in

addition to, but not as a substitute for items presented in

accordance with GAAP that are presented in this press release. A

reconciliation of Net income to Adjusted EBITDA is provided

above.

Free Cash Flow

Free Cash Flow, a non-GAAP financial measure, is defined by the

Company as Adjusted EBITDA less interest expense (net of non-cash

interest), less capital expenditures (including capitalized

software development costs), and less current tax

provision. Management believes that utilization of Free Cash

Flow is an important non-GAAP measure of the Company's ability to

convert operating results into cash.

Adjusted Net Income

Adjusted Net Income, a non-GAAP financial measure, is defined by

the Company as Adjusted EBITDA less amortization expense for

capitalized intangible assets (excluding acquired intangibles),

less interest expense (net of non-cash interest), and less current

tax provision. We measure Adjusted Net Income based on Proforma

Shares Outstanding (see below). Management believes that

utilization of Adjusted Net Income is an important non-GAAP

financial measure of our normalized operating results.

Proforma Shares Outstanding for Exchange

Offer

For purposes of evaluating our results on per-share metrics,

many of our computations utilize proforma share

computations. Our measure of proforma shares includes our

Basic and Diluted share computations utilized for GAAP purposes,

plus our estimate of the impacts of minority interest shares

outstanding.

Proforma Shares Outstanding for Initial Public Offering

and Exchange Offer

For purposes of evaluating our results on per-share metrics,

many of our computations utilize proforma share

computations. Our measure of proforma shares include our Basic

and Diluted share computations utilized for GAAP purposes, plus our

estimate of the impacts of minority interest shares outstanding and

shares issued by us to a related party during the quarter in

connection with our initial public offering and shares to be issued

to another minority shareholder.

CONTACT: Investor Contacts:

Tony James

Chief Financial Officer

tjames@medquist.com

(615) 261-1509

Tripp Sullivan

Corporate Communications, Inc

tripp.sullivan@cci-ir.com

(615) 324-7335

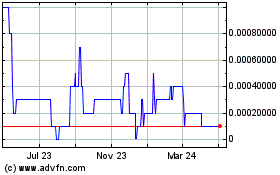

Medx (CE) (USOTC:MEDH)

Historical Stock Chart

From Jun 2024 to Jul 2024

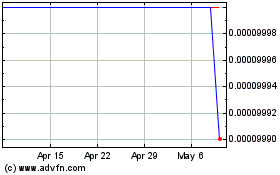

Medx (CE) (USOTC:MEDH)

Historical Stock Chart

From Jul 2023 to Jul 2024