false

0001515317

0001515317

2024-01-07

2024-01-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 7, 2024

Magellan

Gold Corporation

(Exact Name of Registrant as Specified in its Charter)

| Nevada |

|

000-54658 |

|

27-3566922 |

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification number) |

602

Cedar Street, Suite 205

Wallace, Idaho |

|

83873 |

| (Address of principal executive offices) |

|

(Zip

Code) |

(208) 556-1600

(Registrant's telephone

number, including area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 | Entry into a Material Definitive Agreement. |

On January 7, 2024, Magellan Gold Corporation,

a Nevada corporation (the “Company”), entered into a purchase agreement (the “Purchase Agreement”) with Gold Express

Mines, Inc., a Nevada corporation (“GEM”), pursuant to which, among other things (i) the Company agreed to purchase certain

mineral assets owned and controlled by GEM for a purchase price equal to 5,500,000 shares of the Company’s common stock, par value

$0.001 per share (the “Common Stock”); and (ii) GEM agreed to assign to the Company a certain lease for mineral properties

(the “Cuprum Lease”) for a purchase price of 500,000 shares of Common Stock (collectively, the “Transactions”).

The Purchase Agreement contains representations,

warranties and covenants customary for a transaction of this size and nature.

The Company expects the closing of the Transactions

to occur no later than January 31, 2024, subject to certain closing conditions, including, but not limited to, (i) GEM delivering a quitclaim

deed transferring the unpatented mining claims; and (ii) GEM receiving all required consents to transfer Cuprum Lease.

The foregoing description of the Purchase Agreement

is a summary only, does not purport to be complete and is subject to, and qualified in its entirety by reference, to the Purchase Agreement,

a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Purchase Agreement contains representations

and warranties made by the parties as of specific dates and solely for their benefit. The representations and warranties reflect negotiations

between the parties and are not intended as statements of fact to be relied upon by the Company’s shareholders or any other person

or entity other than the parties to the Purchase Agreement and, in certain cases, represent allocation decisions among the parties and

are modified or qualified by correspondence or confidential disclosures made between the parties in connection with the negotiation of

the Purchase Agreement (which disclosures are not reflected in the Purchase Agreement itself, may not be true as of any date other than

the date made, or may apply standards of materiality in a way that is different from what may be viewed as material by shareholders).

Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other

time, and shareholders should not rely on them as statements of fact. Moreover, information concerning the subject matter of the representations

and warranties may change after the date of the Purchase Agreement.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Forward Looking Statements

Except for the historical matters contained herein,

statements in this Current Report on Form 8-K are forward-looking and are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are subject to a number of known and unknown risks and uncertainties that may

cause actual results, trends, performance or achievements of the Company, or industry trends and results, to differ from the future results,

trends, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, among

others, those relating to the proposed Transactions described in this Current Report on Form 8-K, including that the potential benefits

of the proposed Transactions may not be realized to the extent anticipated or at all, integration risks, and the risk that the conditions

to closing the proposed Transactions may not be satisfied and that the proposed Transactions may not otherwise be consummated when expected,

in accordance with the contemplated terms, or at all, and the risks related to the Company’s operations, results, financial condition

and growth strategy. Reference is also made to other economic, competitive, governmental, technological and other risks and factors discussed

in the Company’s filings with the SEC, including, without limitation, its Annual Report on Form 10-K for the year ended December

31, 2022 filed with the SEC on July 17, 2023, as amended by its Annual Report on Form 10-K/A for the year ended December 31, 2022 filed

with the SEC on July 18, 2023. Many of these risks and factors are beyond the Company’s control. In addition, past performance and

perceived trends may not be indicative of future results. The Company cautions that the foregoing factors are not exclusive. Any forward-looking

statements relating to the proposed Transactions are based on the Company’s current expectations, assumptions, estimates and projections

and involve significant risks and uncertainties, including the many variables that may impact or are related to consummation of the Transactions.

The Company assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or

changes in other factors affecting such forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

MAGELLAN GOLD CORPORATION

|

| |

|

|

| |

|

|

| Date: January 11, 2024 |

By: |

/s/ Michael Lavigne |

| |

Name: |

Michael Lavigne |

| |

Title: |

Chief Executive Officer |

EXHIBIT 10.1

Purchase Agreement between Gold Express Mines,

Inc.

and Magellan Gold Corp.

THIS AGREEMENT is made on January 7, 2024, between Gold Express Mines,

Inc., a Nevada corporation with its principal place of business at 250 Pehle Ave., Suite 200 Saddle Brook, NJ 07663 hereinafter the "Seller",

and Magellan Gold Corp, a Nevada corporation, hereinafter the “Buyer”, with its principal place of business at 602 Cedar Street,

Suite 205 Wallace, Idaho 83873

IN CONSIDERATION of the mutual covenants and agreements hereinafter

set forth, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree

as follows:

1. Purchase of Properties held by the Seller:

The Seller shall sell to the Buyer the mineral assets owned and controlled

by the Seller as listed in Appendix A. The purchase price for these assets shall be shares of the common stock of the Buyer totaling 5,500,000

shares.

2. Assignment of Leasehold Held by the Seller;

The Seller shall assign to the Buyer the Cuprum Project mineral lease

owned and controlled by the Seller as listed in Appendix B. The purchase price for these assets shall be shares of the common stock of

the Buyer totaling 500,000 shares. The form of assignment is contained herein as Appendix C.

3. Closing and Escrow.

| a) | The closing date shall be January 31, 2023, provided there are

no unforeseen delays. |

| b) | No later than the closing date the Seller shall transfer by Quitclaim

Deed the unpatented mining claims to be transferred. |

| c) | No later than the closing date the Seller shall gain approval

for and assign the Cuprum Project mineral lease. |

| d) | No later than the closing date the Buyer shall transfer a total

of 6,000,000 shares of its common stock to the Seller. |

4. Representations of Seller.

Seller covenants and represents:

| a) | That Seller is the sole Owner of the Purchased Assets with full

right to sell or dispose of it as Seller may choose. |

| b) | That the underlying mineral lease being sub-leased to the Buyer

is in good standing in all respects and that the Seller has the right and permission from the respective Lessor to sub-lease the mineral

lease to the Buyer. |

| c) | That Seller has no undischarged obligations affecting the Purchased

Assets or the underlying mineral leases being sold under this Agreement. |

| d) | That there are presently and will be at the time of closing,

no liens or security interests against the Purchased Assets or Leases being transferred or Sub-Leased herein. |

| e) | Consents. The Board of Directors of the Seller have unanimously

approved this agreement. |

| f) | Licenses. Permits and Consents. There are no licenses or permits

currently required by the Seller for the satisfaction of the sale of Assets or execution of this Agreement. |

| g) | Litigation. There are no actions, suits, proceedings, or investigations

pending or, to the knowledge of the Seller, threatened against or involving Seller or brought by Seller or affecting any of the purchased

property at law or in equity or admiralty or before or by any federal, state, municipal, or other governmental department, commission,

board, agency, or instrumentality, domestic or foreign. |

| h) | Compliance with Laws. To the best of its knowledge, Seller has

complied with and is operating its business in compliance with all laws, regulations, and orders applicable to the business conducted

by it, and the present uses by the Seller of the purchased property do not violate any such laws, regulations, and orders. Seller has

no knowledge of any material present or future expenditures that will be required with respect to any of Seller's facilities to achieve

compliance with any present statute, law, or regulation, including those relating to the environment or occupational health and safety. |

| i) | Disclosure. No representation or warranty by the Seller contained

in this Agreement, and no statement contained in any certificate or other instrument furnished or to be furnished to Buyer pursuant hereto,

or in connection with the transactions contemplated hereby, contains or will contain any untrue statement of a material fact or omits

or will omit to state any material fact that is necessary in order to make the statements contained therein not misleading. |

| j) | Environmental. To the best of the knowledge of the Seller there

presently is not, nor ever has been, any dumping or storage of toxic or hazardous wastes on the premises of the Purchased Assets. Seller

is not aware nor has Seller been notified by any private parties or government agencies of any environmental or reclamation requirements

or responsibilities with respect to the properties. |

6. Representations of Buyer.

The Buyer covenants and represents to the Seller as follows:

| a. | The shares to be issued to the Seller to be delivered by the

closing date are validly issued and properly approved by the Board of Directors of the Buyer and issued pursuant to a validly existing

exemption from registration. |

| b. | The transaction contemplated by this agreement has been approved

by a majority of the Members of the Board of Directors of the Buyer. |

7. Appendices.

The Appendices and other documents attached or referred to in this

Agreement are an integral part of this Agreement.

8. Entire Agreement.

This Agreement constitutes the sole and only agreement between Buyer

and Seller respecting the Business or the sale and purchase of it. This Agreement correctly sets forth the obligations of Buyer and Seller

to each other as of its date. Any additional agreements or representations respecting the Business or its sale to Buyer not expressly

set forth in this Agreement are null and void, unless otherwise required by law. Both parties agree to waive rights as to any conflicting

laws which may nullify this Agreement to the full extent allowable by law.

9. Conditions Precedent of Buyer.

The obligations of the Buyer hereunder are subject to the conditions

that on or prior to the closing date:

| a. | Representations and Warranties True at Closing. The representations

and warranties of the Seller contained in the Agreement or any certificate or document delivered pursuant to the provisions hereof or

in connection with the transactions contemplated hereby shall be true on and as of the closing date as though such representations and

warranties were made at and as of such date, except if such representations and warranties were made as of a specified date and such

representations and warranties shall be true as of such date. |

| b. | Seller's Compliance with Agreement. The Seller shall have performed

and complied with all agreements and conditions required by this Agreement to be performed or complied with by it prior to or at the

closing of the Agreement. |

| c. | Adverse Change. There shall have been between the purchase date

and the closing date no material adverse change in the purchased assets. |

10. Arbitration.

In the event the parties are not able to resolve any dispute between

them arising out of or concerning this Agreement, or any provisions hereof, whether in contract, tort, or otherwise at law or in equity

for damages or any other relief, then such dispute shall be resolved only by final and binding arbitration pursuant to the Federal Arbitration

Act and in accordance with the American Arbitration Association rules then in effect, conducted by a single neutral arbitrator and administered

by the American Arbitration Association in a location mutually agreed upon by the parties. The arbitrator's award shall be final, and

judgment may be entered upon it in any court having jurisdiction. If any legal or equitable action, proceeding or arbitration arises out

of or concerns this Agreement, the prevailing party shall be entitled to recover its costs and reasonable attorney's fees. The parties

agree to arbitrate all disputes and claims regarding this Agreement or any disputes arising because of this Agreement, whether directly

or indirectly, including Tort claims that are a result of this Agreement. The parties agree that the Federal Arbitration Act governs the

interpretation and enforcement of this provision. The entire dispute, including the scope and enforceability of this arbitration provision

shall be determined by the Arbitrator. This arbitration provision shall survive the termination of this Agreement.

11. Costs and Expenses.

Except as expressly provided to the contrary in this Agreement, each

party shall pay all its own costs and expenses incurred with respect to the negotiation, execution and delivery of this Agreement and

the exhibits hereto.

12. Miscellaneous Provisions.

a. Applicable

Law and Forum. This Agreement shall be construed under and in accordance with the laws of the State of Idaho. Both parties agree that

the jurisdiction of any disputes between the parties shall be resolved in the courts of the State of Idaho, and that any arbitration

between the parties shall be undertaken as indicated in paragraph 10 above.

b. Parties

Bound. This Agreement shall be binding on and inure to the benefit of the parties to this Agreement and their respective heirs, executors,

administrators, legal representatives, successors and assigns as permitted by this Agreement.

c. Legal

Construction. This Agreement shall be construed as to effectuate the intended purpose of the Agreement. In the event any one or more

of the provisions contained in this Agreement shall for any reason be held invalid, illegal, or unenforceable in any respect, this Agreement

shall be modified to otherwise effectuate the sale under the original intentions of the Parties. This may include striking the invalid,

illegal, or unenforceable provision as if they had never been contained in this Agreement, or modifying the invalid, illegal or unenforceable

provisions to make them compliant without modifying the original purpose of the Parties.

d. Amendments.

This Agreement may be amended by the Parties only by a written agreement.

e. Attorneys'

Fees. Should any arbitration or litigation be commenced between the parties to this Agreement concerning the rights and duties of either

party in relation to the Business or this Agreement, the prevailing party in the arbitration or litigation shall be entitled to (in addition

to any other relief that may be granted) a reasonable sum and attorneys' fees in the arbitration or litigation, which sum shall be determined

by the court or other person presiding in the arbitration or litigation or in a separate action brought for that purpose.

f. Signatories.

This Agreement shall be executed on behalf of Magellan Gold Corp., signed by Mike Lavigne and on behalf of Gold Express Mines, Inc.,

signed by John Ryan.

The Agreement shall be effective as of the date first written above.

Seller:

Gold Express Mines, Inc.

| By: ___________________________________ |

Date: January 7, 2024 |

John Ryan, President

Buyer:

Magellan Gold Corp.

| By: ___________________________________ |

Date: January 7, 2024 |

Mike Lavigne, President

APPENDIX A

BJM 1-79 (BLUE JACKET PROJECT)

| CLAIM NAME |

LOCATION DATE |

COUNTY |

COUNTY # |

BLM # |

| BJM 1 |

8/29/22 |

Idaho |

538282 |

ID105794291 |

| BJM 2 |

8/29/22 |

Idaho |

538283 |

ID105794292 |

| BJM 3 |

8/28/22 |

Idaho |

538284 |

ID105794293 |

| BJM 4 |

8/28/22 |

Idaho |

538285 |

ID105794294 |

| BJM 5 |

8/28/22 |

Idaho |

538286 |

ID105794295 |

| BJM 6 |

8/28/22 |

Idaho |

538287 |

ID105794296 |

| BJM 7 |

8/28/22 |

Idaho |

538288 |

ID105794297 |

| BJM 8 |

8/28/22 |

Idaho |

538433 |

ID105794298 |

| BJM 9 |

8/28/22 |

Idaho |

538289 |

ID105794299 |

| BJM 10 |

8/29/22 |

Idaho |

538290 |

ID105794300 |

| BJM 11 |

8/29/22 |

Idaho |

538291 |

ID105794301 |

| BJM 12 |

8/28/22 |

Idaho |

538292 |

ID105794302 |

| BJM 13 |

8/28/22 |

Idaho |

538293 |

ID105794303 |

| BJM 14 |

8/27/22 |

Idaho |

538294 |

ID105794304 |

| BJM 15 |

8/27/22 |

Idaho |

538295 |

ID105794305 |

| BJM 16 |

8/27/22 |

Idaho |

538296 |

ID105794306 |

| BJM 17 |

8/27/22 |

Idaho |

538297 |

ID105794307 |

| BJM 18 |

8/27/22 |

Idaho |

538298 |

ID105794308 |

| BJM 19 |

8/27/22 |

Idaho |

538299 |

ID105794309 |

| BJM 20 |

8/27/22 |

Idaho |

538300 |

ID105794310 |

| BJM 21 |

8/27/22 |

Idaho |

538301 |

ID105794311 |

| BJM 22 |

8/27/22 |

Idaho |

538302 |

ID105794312 |

| BJM 23 |

8/27/22 |

Idaho |

538303 |

ID105794313 |

| BJM 24 |

8/27/22 |

Idaho |

538304 |

ID105794314 |

| BJM 25 |

8/27/22 |

Idaho |

538305 |

ID105794315 |

| BJM 26 |

8/29/22 |

Idaho |

538431 |

ID105794316 |

| BJM 27 |

8/29/22 |

Idaho |

538432 |

ID105794317 |

| BJM 28 |

8/28/22 |

Idaho |

538306 |

ID105794318 |

| BJM 29 |

8/28/22 |

Idaho |

539307 |

ID105794319 |

| BJM 30 |

|

Idaho |

|

|

| BJM 31 |

|

Idaho |

|

|

| BJM 32 |

|

Idaho |

|

|

| BJM 33 |

|

Idaho |

|

|

| BJM 34 |

|

Idaho |

|

|

| BJM 35 |

|

Idaho |

|

|

| BJM 36 |

|

Idaho |

|

|

| BJM 37 |

|

Idaho |

|

|

| BJM 38 |

|

Idaho |

|

|

| BJM 39 |

|

Idaho |

|

|

| BJM 40 |

|

Idaho |

|

|

| BJM 41 |

|

Idaho |

|

|

| BJM 42 |

|

Idaho |

|

|

| BJM 43 |

|

Idaho |

|

|

| BJM 44 |

|

Idaho |

|

|

| BJM 45 |

|

Idaho |

|

|

| BJM 46 |

|

Idaho |

|

|

| BJM 47 |

|

Idaho |

|

|

| BJM 48 |

|

Idaho |

|

|

| BJM 49 |

|

Idaho |

|

|

| BJM 50 |

|

Idaho |

|

|

| BJM 51 |

|

Idaho |

|

|

| BJM 52 |

|

Idaho |

|

|

| BJM 53 |

|

Idaho |

|

|

| BJM 54 |

|

Idaho |

|

|

| BJM 55 |

|

Idaho |

|

|

| BJM 56 |

|

Idaho |

|

|

| BJM 57 |

|

Idaho |

|

|

| BJM 58 |

|

Idaho |

|

|

| BJM 59 |

|

Idaho |

|

|

| BJM 60 |

|

Idaho |

|

|

| BJM 61 |

|

Idaho |

|

|

| BJM 62 |

|

Idaho |

|

|

| BJM 63 |

|

Idaho |

|

|

| BJM 64 |

|

Idaho |

|

|

| BJM 65 |

|

Idaho |

|

|

| BJM 66 |

|

Idaho |

|

|

| BJM 67 |

|

Idaho |

|

|

| BJM 68 |

|

Idaho |

|

|

| BJM 69 |

|

Idaho |

|

|

| BJM 70 |

|

Idaho |

|

|

| BJM 71 |

|

Idaho |

|

|

| BJM 72 |

|

Idaho |

|

|

| BJM 73 |

|

Idaho |

|

|

| BJM 74 |

|

Idaho |

|

|

| BJM 75 |

|

Idaho |

|

|

| BJM 76 |

|

Idaho |

|

|

| BJM 77 |

|

Idaho |

|

|

| BJM 78 |

|

Idaho |

|

|

| BJM 79 |

|

Idaho |

|

|

CUPRUM 1-71 (COPPER CLIFF PROJECT)

| CLAIM NAME |

LOCATION DATE |

COUNTY |

COUNTY # |

BLM # |

| CUPRUM 1 |

5/14/21 |

Adams |

138151 |

ID105255174 |

| CUPRUM 2 |

5/14/21 |

Adams |

138152 |

ID105255175 |

| CUPRUM 3 |

5/14/21 |

Adams |

138153 |

ID105255176 |

| CUPRUM 4 |

5/14/21 |

Adams |

138154 |

ID105255177 |

| CUPRUM 5 |

5/14/21 |

Adams |

138155 |

ID105255178 |

| CUPRUM 6 |

5/14/21 |

Adams |

138156 |

ID105255179 |

| CUPRUM 7 |

5/14/21 |

Adams |

138157 |

ID105255180 |

| CUPRUM 8 |

5/14/21 |

Adams |

138158 |

ID105255181 |

| CUPRUM 9 |

5/14/21 |

Adams |

138159 |

ID105255182 |

| CUPRUM 10 |

5/14/21 |

Adams |

138160 |

ID105255183 |

| CUPRUM 11 |

5/14/21 |

Adams |

138161 |

ID105255184 |

| CUPRUM 12 |

5/14/21 |

Adams |

138162 |

ID105255185 |

| CUPRUM 13 |

5/14/21 |

Adams |

138163 |

ID105255186 |

| CUPRUM 14 |

5/15/21 |

Adams |

138164 |

ID105255187 |

| CUPRUM 15 |

5/15/21 |

Adams |

138165 |

ID105255188 |

| CUPRUM 16 |

5/15/21 |

Adams |

138166 |

ID105255189 |

| CUPRUM 17 |

5/15/21 |

Adams |

138167 |

ID105255190 |

| CUPRUM 18 |

5/15/21 |

Adams |

138168 |

ID105255191 |

| CUPRUM 19 |

5/15/21 |

Adams |

138169 |

ID105255192 |

| CUPRUM 20 |

5/15/21 |

Adams |

138170 |

ID105255193 |

| CUPRUM 21 |

5/15/21 |

Adams |

138171 |

ID105255194 |

| CUPRUM 22 |

5/15/21 |

Adams |

138172 |

ID105255195 |

| CUPRUM 23 |

5/15/21 |

Adams |

138173 |

ID105255196 |

| CUPRUM 24 |

5/15/21 |

Adams |

138174 |

ID105255197 |

| CUPRUM 25 |

5/15/21 |

Adams |

138175 |

ID105255198 |

| CUPRUM 26 |

5/15/21 |

Adams |

138176 |

ID105255199 |

| CUPRUM 27 |

5/15/21 |

Adams |

138177 |

ID105255200 |

| CUPRUM 28 |

5/10/22 |

Adams |

139697 |

ID105255201 |

| CUPRUM 29 |

5/10/22 |

Adams |

139698 |

ID105255202 |

| CUPRUM 30 |

5/10/22 |

Adams |

139699 |

ID105255203 |

| CUPRUM 31 |

5/10/22 |

Adams |

139700 |

ID105255204 |

| CUPRUM 32 |

5/10/22 |

Adams |

139701 |

ID105255205 |

| CUPRUM 33 |

5/10/22 |

Adams |

139702 |

ID105255206 |

| CUPRUM 34 |

5/10/22 |

Adams |

139703 |

ID105255207 |

| CUPRUM 35 |

5/10/22 |

Adams |

139704 |

ID105255208 |

| CUPRUM 36 |

5/10/22 |

Adams |

139705 |

ID105255209 |

| CUPRUM 37 |

5/10/22 |

Adams |

139706 |

ID105255210 |

| CUPRUM 38 |

5/10/22 |

Adams |

139707 |

ID105255211 |

| CUPRUM 39 |

5/10/22 |

Adams |

139708 |

ID105255212 |

| CUPRUM 40 |

5/10/22 |

Adams |

139709 |

ID105255213 |

| CUPRUM 41 |

|

Adams |

|

|

| CUPRUM 42 |

|

Adams |

|

|

| CUPRUM 43 |

|

Adams |

|

|

| CUPRUM 44 |

|

Adams |

|

|

| CUPRUM 45 |

|

Adams |

|

|

| CUPRUM 46 |

|

Adams |

|

|

| CUPRUM 47 |

|

Adams |

|

|

| CUPRUM 48 |

|

Adams |

|

|

| CUPRUM 49 |

|

Adams |

|

|

| CUPRUM 50 |

|

Adams |

|

|

| CUPRUM 51 |

|

Adams |

|

|

| CUPRUM 52 |

|

Adams |

|

|

| CUPRUM 53 |

|

Adams |

|

|

| CUPRUM 54 |

|

Adams |

|

|

| CUPRUM 55 |

|

Adams |

|

|

| CUPRUM 56 |

|

Adams |

|

|

| CUPRUM 57 |

|

Adams |

|

|

| CUPRUM 58 |

|

Adams |

|

|

| CUPRUM 59 |

|

Adams |

|

|

| CUPRUM 60 |

|

Adams |

|

|

| CUPRUM 61 |

|

Adams |

|

|

| CUPRUM 62 |

|

Adams |

|

|

| CUPRUM 63 |

|

Adams |

|

|

| CUPRUM 64 |

|

Adams |

|

|

| CUPRUM 65 |

|

Adams |

|

|

| CUPRUM 66 |

|

Adams |

|

|

| CUPRUM 67 |

|

Adams |

|

|

| CUPRUM 68 |

|

Adams |

|

|

| CUPRUM 69 |

|

Adams |

|

|

| CUPRUM 70 |

|

Adams |

|

|

| CUPRUM 71 |

|

Adams |

|

|

NCB 1-65 (66 CLAIMS FOR COPPER BUTTE PROJECT

- NOTE THERE ARE TWO CLAIMS NAMED NCB 1)

| CLAIM NAME |

LOCATION DATE |

COUNTY |

COUNTY # |

BLM # |

| NCB 1 |

4/23/23 |

Pinal |

2023-053123 |

AZ106306984 |

| NCB 1 |

11/29/22 |

Pinal |

2023-009047 |

AZ105820355 |

| NCB 2 |

12/14/22 |

Pinal |

2023-009048 |

AZ105820356 |

| NCB 3 |

12/14/22 |

Pinal |

2023-009049 |

AZ105820357 |

| NCB 4 |

4/23/23 |

Pinal |

2023-053124 |

AZ106306985 |

| NCB 4 |

11/22/22 |

Pinal |

2023-009050 |

AZ105820358 |

| NCB 5 |

12/14/22 |

Pinal |

2023-009051 |

AZ105820359 |

| NCB 6 |

12/13/22 |

Pinal |

2023-009052 |

AZ105820360 |

| NCB 7 |

4/2/23 |

Pinal |

2023-053125 |

AZ106306986 |

| NCB 7 |

11/22/22 |

Pinal |

2023-009053 |

AZ105820361 |

| NCB 8 |

12/14/22 |

Pinal |

2023-009054 |

AZ105820362 |

| NCB 9 |

12/13/22 |

Pinal |

2023-009055 |

AZ105820363 |

| NCB 10 |

4/23/23 |

Pinal |

2023-053126 |

AZ106306987 |

| NCB 10 |

11/29/22 |

Pinal |

2023-009056 |

AZ105820364 |

| NCB 11 |

12/14/22 |

Pinal |

2023-009057 |

AZ105820365 |

| NCB 12 |

12/13/22 |

Pinal |

2023-009058 |

AZ105820366 |

| NCB 13 |

12/13/22 |

Pinal |

2023-009059 |

AZ105820367 |

| NCB 14 |

4/23/23 |

Pinal |

2023-053122 |

AZ106306988 |

| NCB 14 |

11/29/22 |

Pinal |

2023-009060 |

AZ105820368 |

| NCB 15 |

12/14/22 |

Pinal |

2023-009061 |

AZ105820369 |

| NCB 16 |

12/14/22 |

Pinal |

2023-009062 |

AZ105820370 |

| NCB 17 |

12/10/22 |

Pinal |

2023-009063 |

AZ105820371 |

| NCB 18 |

12/12/22 |

Pinal |

2023-009064 |

AZ105820372 |

| NCB 19 |

12/15/22 |

Pinal |

2023-009065 |

AZ105820373 |

| NCB 20 |

12/15/22 |

Pinal |

2023-009066 |

AZ105820374 |

| NCB 21 |

12/10/22 |

Pinal |

2023-009067 |

AZ105820375 |

| NCB 22 |

12/12/22 |

Pinal |

2023-009068 |

AZ105820376 |

| NCB 23 |

12/15/22 |

Pinal |

2023-009069 |

AZ105820377 |

| NCB 24 |

12/15/22 |

Pinal |

2023-009070 |

AZ105820378 |

| NCB 25 |

12/10/22 |

Pinal |

2023-009071 |

AZ105820379 |

| NCB 26 |

11/30/22 |

Pinal |

2023-009072 |

AZ105820380 |

| NCB 27 |

12/12/22 |

Pinal |

2023-009073 |

AZ105820381 |

| NCB 28 |

12/15/22 |

Pinal |

2023-009111 |

AZ105820382 |

| NCB 29 |

12/15/22 |

Pinal |

2023-009082 |

AZ105820383 |

| NCB 30 |

12/10/22 |

Pinal |

2023-009083 |

AZ105820384 |

| NCB 31 |

11/30/22 |

Pinal |

2023-009084 |

AZ105820385 |

| NCB 32 |

12/12/22 |

Pinal |

2023-009085 |

AZ105820386 |

| NCB 33 |

12/15/22 |

Pinal |

2023-009086 |

AZ105820387 |

| NCB 34 |

12/10/22 |

Pinal |

2023-009087 |

AZ105820388 |

| NCB 35 |

11/30/22 |

Pinal |

2023-009088 |

AZ105820389 |

| NCB 36 |

12/9/22 |

Pinal |

2023-009089 |

AZ105820390 |

| NCB 37 |

12/8/22 |

Pinal |

2023-009090 |

AZ105820391 |

| NCB 38 |

12/9/22 |

Pinal |

2023-009091 |

AZ105820392 |

| NCB 39 |

12/8/22 |

Pinal |

2023-009092 |

AZ105820393 |

| NCB 40 |

12/9/22 |

Pinal |

2023-009093 |

AZ105820394 |

| NCB 41 |

12/8/22 |

Pinal |

2023-009094 |

AZ105820395 |

| NCB 42 |

12/9/22 |

Pinal |

2023-009095 |

AZ105820396 |

| NCB 43 |

12/8/22 |

Pinal |

2023-009096 |

AZ105820397 |

| NCB 44 |

12/9/22 |

Pinal |

2023-009097 |

AZ105820398 |

| NCB 45 |

12/8/22 |

Pinal |

2023-009098 |

AZ105820399 |

| NCB 46 |

12/2/22 |

Pinal |

2023-009099 |

AZ105820400 |

| NCB 47 |

12/9/22 |

Pinal |

2023-009100 |

AZ105820401 |

| NCB 48 |

12/8/22 |

Pinal |

2023-009101 |

AZ105820402 |

| NCB 49 |

12/6/22 |

Pinal |

2023-009102 |

AZ105820403 |

| NCB 50 |

12/9/22 |

Pinal |

2023-009103 |

AZ105820404 |

| NCB 51 |

12/8/22 |

Pinal |

2023-009104 |

AZ105820405 |

| NCB 52 |

12/6/22 |

Pinal |

2023-009105 |

AZ105820406 |

| NCB 53 |

12/13/22 |

Pinal |

2023-009106 |

AZ105820407 |

| NCB 54 |

12/8/22 |

Pinal |

2023-009107 |

AZ105820408 |

| NCB 55 |

12/13/22 |

Pinal |

2023-009108 |

AZ105820409 |

| NCB 56 |

12/8/22 |

Pinal |

2023-009109 |

AZ105820410 |

| NCB 65 |

12/13/22 |

Pinal |

2023-009110 |

AZ105820411 |

APPENDIX B

COPPER

CLIFF LEASE AGREEMEMT

PARCEL

# RPMM20N3W1500

APPENDIX C

FORM OF ASSIGNMENT

AGREEMENT

This ASSIGNMENT

AGREEMENT made this ___________, by and between Magellan Gold Corp. , hereinafter referred to as 'Assignee', and Gold Express Mines,

Inc. , hereinafter referred to as 'Assignor', in consideration of the mutual covenants herein contained and other good and valuable consideration,

the sufficiency of which is hereby acknowledged;

WHEREAS,

Assignor entered into a Lease, included as an attachment to this Agreement, namely a Lease Agreement hereinafter referred to as the "Lease"

and entered into with Stanley Quimby and Travis Quimby, hereinafter collectively the 'Obligor';

WHEREAS,

Assignor wishes to assign all of its rights and obligations under the Lease to Assignee; and

NOW THEREFORE,

Assignor and Assignee agree as follows:

1.

Assignor and Assignee hereby agree that the Assignor shall assign all

its right, title, and interest, and delegate all its obligations, responsibilities, and duties, in and to the Lease, to Assignee.

2.

Assignee hereby accepts the assignment of all of Assignors obligations,

responsibilities, and duties under the Lease and all of Assignors right, title and interest in and to the Lease.

3.

Assignor has obtained the permission of the Obligor to assign the Lease

to the Assignee.

4.

Notwithstanding the foregoing, Assignor agrees to defend and indemnify

the Obligor from any and all claims, actions, judgments, liabilities, proceedings and costs, including reasonable attorney’s fees

and other costs of defense and damages, resulting from Assignors performance prior to the assignment of the contract and resulting from

Assignees performance after the assignment of the Lease, provided however, that after the assignment of the Lease the State shall first

look to Assignee to satisfy all claims, actions, judgments, liabilities, proceedings and costs, including reasonable attorney’s

fees and other costs of defense and damages resulting from Assignees performance.

5.

Assignee agrees to indemnify the Obligor from any and all claims, actions,

judgments, liabilities, proceedings and costs, including reasonable attorney’s fees and other costs of defense and damages, resulting

from Assignees performance after the assignment of the Lease.

6.

This Agreement is governed by the laws of the State of Idaho, without

regard to Idaho's conflict or choice of law provisions, and both parties expressly consent to jurisdiction in such courts.

IN WITNESS

WHEREOF, the parties set their hands and seals as of the date first above written.

ASSIGNEE

____________________________

Mike Lavigne,

President and CEO

Magellan

Gold Corp.

Date:

ASSIGNOR

____________________________

John Ryan,

President and CEO Gold Express Mines, Inc.

Date:

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

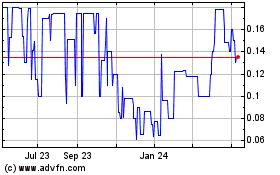

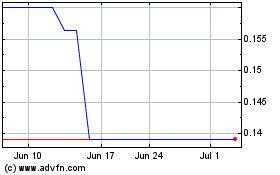

Magellan Gold (PK) (USOTC:MAGE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Magellan Gold (PK) (USOTC:MAGE)

Historical Stock Chart

From Dec 2023 to Dec 2024