Filed Pursuant to Rule 424(b)(3)

Registration No. 333-262277

PROSPECTUS

a Florida corporation

96,487,250 Shares of Common Stock

This Prospectus relates to the offer and sale

of up to 96,487,250 shares of our Common Stock (“Common Stock”) by Selling Stockholders listed on page 23 of this Prospectus

(the “Selling Stockholders”), (the “Offering”). See “SELLING STOCKHOLDERS.”

The Selling Stockholders, or their respective

transferees, pledgees, donees or other successors-in-interest, may sell their shares of our Common Stock (the “Shares”) from

time to time at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling

Stockholders may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what amount the Selling

Stockholders may sell their Shares hereunder following the effective date of this registration statement.

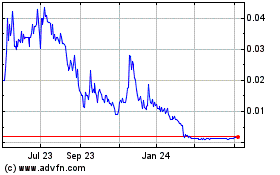

Our Common Stock is currently traded on the OTCQB

Marketplace operated by the OTC Markets Group, Inc. (the “OTCQB”) under the symbol “KITL.” On August 25, 2022,

the last reported sale price for our common stock was $0.0281 per share. Each Selling Stockholder is or may be an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act. See “DETERMINATION OF OFFERING PRICE,” “SELLING

STOCKHOLDERS” and “PLAN OF DISTRIBUTION.”

We will pay the expenses of registering these

Shares. We will not receive any proceeds from the sale of Shares of Common Stock in this Offering. All of the net proceeds from the sale

of the Shares will go to the Selling Stockholders. However, to the extent that the warrants held by the Selling Stockholders are exercised

for cash, we will receive the payment of the exercise price in connection with such exercise.

We are an “emerging growth company”

as defined under the federal securities laws and are subject to reduced public company reporting requirements.

Investing in our Common Stock involves a high

degree of risk. You should invest in our Common Stock only if you can afford to lose your entire investment.

SEE “RISK FACTORS” BEGINNING

ON PAGE 5.

The information in this Prospectus is not complete

and may be changed. This Prospectus is included in the registration statement that was filed by Kisses From Italy Inc. with the Securities

and Exchange Commission. The Selling Stockholders may not sell these Shares until the registration statement becomes effective. This Prospectus

is not an offer to sell these Shares and is not soliciting an offer to buy these Shares in any State where the offer or sale is not permitted.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is September 9,

2022

TABLE OF CONTENTS

PROSPECTUS SUMMARY

This summary provides an overview of certain

information contained elsewhere in this Prospectus and does not contain all of the information that you should consider or that may be

important to you. Before making an investment decision, you should read the entire Prospectus carefully, including the “RISK FACTORS”

section and the financial statements and the notes to the financial statements. In this Prospectus, the terms “the “Company,”

“we,” “us” and “our” refer to Kisses From Italy Inc., unless otherwise specified herein.

We were incorporated

in the State of Florida on March 7, 2013, with a focus on developing a fast, casual food dining chain restaurant business.

The Company

operates through its wholly-owned subsidiaries, Kisses From Italy 9th LLC, Kisses From Italy-Franchising LLC, Kisses

From Italy, Inc. (Canada) (a company incorporated under the laws of Canada and registered in Quebec on December 23, 2020), and Kisses

From Italy Italia SRLS (a limited liability company incorporated in Italy), and its 70% owned subsidiary, Kisses-Palm Sea Royal LLC.

We commenced

operations by opening our initial corporate-owned restaurant in Fort Lauderdale, Florida in May 2015. By April 2016, we opened three

additional restaurants located in various Wyndham Hotel properties in the Pompano Beach, Florida area. In September 2017, Hurricane Irma

caused significant damage to the area, which resulted in Wyndham halting operations at its hotel properties for repairs and renovations

and the closure of our Wyndham hotel locations. In December 2017, we vacated one of our restaurants in the Wyndham Hotel properties due

to damage from the hurricane and have not re-opened such restaurant. During the first half of 2021, we consolidated the remaining two

Wyndham stores into one location.

While our

Fort Lauderdale location was reopened in early November 2017, we were only able to reopen two of the hotel locations in Pompano Beach

in late January 2018. We also elected not to reopen our fourth location, as the damages were too excessive. If we can raise additional

capital, of which there is no assurance, we intend to own and operate up to 10 restaurants and utilize them as a showcase in the marketing

of our proposed franchise operations.

In May 2017, we completed our National Franchise

License which permits us to sell franchises in all of the states in the United States except for New York, Virginia, and Maryland, which

licenses we may obtain if sufficient demand exists in the future.

We opened

our first European location in Ceglie del Campo, Bari, Italy, in October 2019. The Bari location closed in April 2020 due to the Covid-19

pandemic, briefly re-opened and has not re-opened as of the date of this Report. Such location was intended to serve as the distribution

center for products for European locations, as well as to be used as a training facility for European franchises. However, this initiative

has been severely curtailed due to the onset and lingering impact of Covid -19 in Europe.

Our two corporate-owned

restaurants, one located in Fort Lauderdale, Florida, and one within the Wyndham location in Pompano Beach, Florida, have fully re-opened

without limitation or any social distancing requirement.

In September

2019, the Company's common stock was approved for trading by FINRA and in October 2019 was approved for uplisting by the OTC Markets

Group to the OTCQB under the symbol “KITL”.

In June of 2020, the Company entered into a multi-unit

development agreement (the “Development Agreement”) pursuant to which it granted development rights to Demasar Management,

Inc. to open and operate up to 100 restaurants in Canada. Under this Development Agreement, the developer is obligated to open a

minimum of 20 restaurants by June 17, 2025. On November 20, 2021, we opened a franchise location under the Development Agreement in Montreal,

Quebec, Canada.

In September

of 2020, we entered retail food and grocery stores with Kisses From Italy branded products in Canada. The product launch began in November

of 2020 and Kisses From Italy branded products were in nine retail stores by the end of 2020. Currently, Kisses From Italy branded products

are in 40 stores across Ontario and Quebec, Canada.

In April of 2021, we entered into a Consulting

Agreement (the “Consulting Agreement”) with Fransmart, LLC, a Delaware limited liability company (“Fransmart”),

pursuant to which we engaged Fransmart as our exclusive global franchise developer and representative for a period of ten years.

In June of

2021, the Company’s first franchise location opened in Chino, California. In November of 2021, the Company opened its second franchise

location in Montreal, Canada.

On March 9, 2022,

Articles of Amendment to the Company’s Articles of Incorporation to increase the number of its authorized common stock from 200,000,000

shares to 300,000,000 shares became effective. Such action was approved by the Board of Directors on January 25, 2022 and a majority

of the Company’s shareholders on January 27, 2022. The purpose of share increase is to make available additional shares of

common stock for issuance of all the current obligations of the Company to issue common stock, including under outstanding convertible

securities.

COVID-19

On March

11, 2020, the World Health Organization declared the COVID-19 outbreak to be a global pandemic. In addition to the devastating effects

on human life, the pandemic is having a negative ripple effect on the global economy, leading to disruptions and volatility in the global

financial markets. Most U.S. states and many countries have issued policies intended to stop or slow the further spread of the disease.

COVID-19

and the U.S.’s response to the pandemic are significantly affecting the economy. There are no comparable events that provide guidance

as to the effect the COVID-19 pandemic may have, and, as a result, the ultimate effect of the pandemic is highly uncertain and subject

to change. We do not yet know the full extent of the effects on the economy, the markets we serve, our business, or our operations.

The Company’s

two US based locations are fully opened without any Covid-19 limitation. Our location in Bari, Italy remains closed due to COVID-19 restrictions.

Our principal offices are located at 80 SW 8th

St. Suite 2000, Miami, Florida, 33130, and our phone number is (305) 423-7024. Our website is www.kissesfromitaly.com

About

The Offering

| Common Stock to be Offered by Selling Stockholders |

|

96,487,250 shares, consisting of (i) 75,000,000 shares of our Common

Stock issuable pursuant to that certain Standby Equity Commitment Agreement dated November 22, 2021, by and between MacRab LLC, a Florida

limited liability company (“MacRab”) and us; (ii) up to 14,112,000 shares of our Common Stock issuable upon conversion of

the principal and accrued interest at maturity of three convertible promissory notes in the aggregate principal amount of $480,000 issued

by the Company to Talos Victory Fund, LLC, a Delaware limited liability company (“Talos”), and Blue Lake Partners, LLC, a

Delaware limited liability company (“Blue Lake”), at a conversion price of $0.05 per share, and to Fourth Man, LLC, a Nevada

limited liability company (“Fourth Man”) at a conversion price of $0.025 per share; (iii) 5,550,000 shares of our Common Stock

issuable upon exercise of outstanding warrants held by MacRab, Talos, Blue Lake, and Fourth Man at an exercise price of $0.10 per share;

(iv) 1,607,000 shares of our Common Stock issued to Talos, Blue Lake, and Fourth Man in connection with the issuance of the convertible

promissory notes as commitment shares; and (v) up to 218,250 shares of our Common Stock issuable upon exercise of outstanding warrants

held by J.H. Darbie & Co., Inc. |

| |

|

|

| Common Stock outstanding before the Offering |

|

185,520,582 shares of Common Stock |

| |

|

|

| Common Stock outstanding after the Offering (assuming all of the shares offered in the Offering have been issued and sold) |

|

282,007,832 shares of Common Stock |

| |

|

|

| OTCQB symbol |

|

KITL |

| |

|

|

| Use of Proceeds |

|

We

will not receive any proceeds from the sale of the Common Stock. However, to the extent that the warrants held by the Selling Stockholders

are exercised for cash, we will receive the payment of the exercise price in connection with such exercise. |

| |

|

|

| Risk Factors |

|

See the discussion under the caption “RISK FACTORS” and other information in this Prospectus for a discussion of factors you should carefully consider before deciding to invest in our Common Stock. |

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

We have made some statements in this Prospectus,

including some under “RISK FACTORS,” “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS,” “DESCRIPTION OF BUSINESS” and elsewhere, which constitute forward-looking statements. These statements

may discuss our future expectations or contain projections of our results of operations or financial condition or expected benefits to

us resulting from acquisitions or transactions and involve known and unknown risks, uncertainties and other factors that may cause our

actual results, levels of activity, performance or achievements to be materially different from any results, levels of activity, performance

or achievements expressed or implied by any forward-looking statements. These factors include, among other things, those listed under

“RISK FACTORS” and elsewhere in this Prospectus. In some cases, forward-looking statements can be identified by terminology

such as “may,” “should,” “could,” “expects,” “intends,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue”

or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in forward-looking

statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

RISK FACTORS

Investing in our Common Stock involves a high

degree of risk. Before investing in our Common Stock, you should carefully consider the risks described below, as well as the other information

in this prospectus, including our consolidated financial statements and the related notes. In addition, we may face additional risks and

uncertainties not currently known to us, or which as of the date of this registration statement we might not consider significant, which

may adversely affect our business. If any of the following risks occur, our business, financial condition and results of operations could

be materially adversely affected. In such case, the trading price of our Common Stock could decline due to any of these risks or uncertainties,

and you may lose part or all of your investment.

Risks Related to Our Business

Our independent accountants have expressed a "going concern"

opinion.

Our financial statements accompanying this prospectus

have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and liquidation of

liabilities in the normal course of business. The financial statements do not include any adjustment that might result from the outcome

of this uncertainty. We have a minimal operating history and minimal revenues or earnings from operations. We have no significant assets

or financial resources. We will, in all likelihood, sustain operating expenses without corresponding revenues for the immediate future.

See “DESCRIPTION OF BUSINESS” and “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Liquidity and Capital Resources.” There are no assurances that

we will generate profits from operations.

We have not generated profits from our operations.

We incurred net losses of $540,314 in the

six months ended June 30, 2022 and net losses of $4,942,113 and $3,709,402 in the years ended December 31, 2021 and 2020, respectively.

There can be no assurances that we will ever establish profitable operations. As we pursue our business plan, we are incurring significant

expenses without corresponding revenues. In the event that we remain unable to generate significant revenues to pay our operating expenses,

we will not be able to achieve profitability or continue operations.

Our financial condition and

results of operations have been and may continue to be adversely affected by the COVID-19 pandemic or future pandemics or

disease outbreaks.

During March 2020,

a global pandemic was declared by the World Health Organization related to the rapidly spreading outbreak of a novel strain of

coronavirus (“COVID-19”). The COVID-19 pandemic has caused businesses, including our business, as well as

federal, state and local governments to implement significant actions to attempt to mitigate this public health crisis in the United

States. Our operations have been impacted by the COVID-19 pandemic. Future pandemics (or epidemics on a local basis) could

have a similar impact on our business.

During 2020 and

2021, individuals in areas where we operate our restaurants were required to practice social distancing, restricted from gathering

in groups and/or mandated to “stay home” except for “essential” purposes. In response to the

COVID-19 pandemic and government restrictions, we were required to close or restrict our locations. The mobility restrictions,

fear of contracting COVID-19 and the sharp increase in unemployment caused by the closure of businesses in response to

the COVID-19 pandemic, have adversely affected and may continue to adversely affect our guest traffic, which in turn

adversely impacts our business, financial condition or results of operations. Even as the mobility restrictions were loosened or

lifted, we believe that some guests remained reluctant to return and the impact of lost wages due to COVID-19 related

unemployment has dampened consumer spending. Our restaurant operations have been and could continue to be adversely affected by

employees who are unable or unwilling to work, whether because of illness, quarantine, fear of contracting COVID-19 or

caring for family members due to COVID-19 disruptions or illness. Restaurant closures, limited service options or modified

hours of operation due to staffing shortages could materially adversely affect our business, liquidity, financial condition or

results of operations.

The extent of the impact

of the COVID-19 pandemic on our operations and financial results depends on future developments and is highly uncertain due to the unknown

duration and severity of the outbreak, including the potential impact of the COVID-19 delta and omicron variants. The situation is changing

rapidly and future impacts may materialize that are not yet known. We intend to continue to actively monitor the evolving situation and

may take further actions that alter our business operations as may be required by federal, state or local authorities or that we determine

are in the best interests of our team members, customers, suppliers and shareholders. The further spread of COVID-19 or other

infectious diseases, and the requirements or measures imposed or taken by federal, state and local governments and businesses to mitigate

the spread of such diseases, could disrupt our business or impact our ability to carry out our business as usual. Depending on the duration

and severity of any such business interruption, we may need to seek additional sources of liquidity. There can be no guarantee that additional

liquidity, whether through the credit markets or government programs, will be readily available or available on favorable terms to us.

The ultimate impact of adverse events in the future on our operations is unknown and will depend on future developments, which are highly

uncertain and cannot be predicted with confidence, including the duration, and any additional preventative and protective actions that

governments, or we, may direct, which may result in an extended period of continued business disruption, reduced guest traffic, damage

to our reputation and reduced operations, any of which could have a material adverse effect on our business, financial condition and results

of operations. The COVID-19 pandemic or other infectious diseases may also have the effect of heightening other risks disclosed

in this prospectus, including, but not limited to, those related to our growth strategy, access capital markets and other funding sources,

changes in consumer spending behaviors, supply chain interruptions and/or commodity price increases.

We are vulnerable

to changes in economic conditions and consumer preferences that could have a material adverse effect on our business, financial condition

and results of operations.

The restaurant industry

depends on consumer discretionary spending and is often affected by changes in consumer tastes, national, regional and local economic

conditions and demographic trends, including changes in behavior caused by the COVID-19 pandemic. In addition, factors such

as traffic patterns, weather, fuel prices, local demographics, local regulations and the type, number and locations of competing restaurants

may adversely affect the performances of individual locations. In addition, economic downturns, inflation or increased food or energy

costs could harm the restaurant industry in general and our restaurants in particular. Adverse changes in any of these factors could

reduce consumer traffic or impose practical limits on pricing that could have a material adverse effect on our business, financial condition

and results of operations. There can also be no assurance that consumers will continue to regard our menu offerings favorably, that we

will be able to develop new menu items that appeal to consumer preferences or that there will not be a drop in consumer demand. Restaurant

traffic and our resulting sales depend in part on our ability to anticipate, identify and respond to changing consumer preferences and

economic conditions. In addition, the restaurant industry is subject to scrutiny due to the perception that restaurant company practices

have contributed to poor nutrition, high caloric intake, obesity or other health concerns of their customers. If we are unable to adapt

to changes in consumer preferences and trends, we may lose customers, which could have a material adverse effect on our business, financial

condition and results of operations.

Changes in customer preferences,

general economic conditions, discretionary spending priorities, demographic trends, traffic patterns and the type, number and location

of competing restaurants affect the restaurant industry. Our success depends to a significant extent on consumer confidence, which is

influenced by general economic conditions, local and regional economic conditions in the markets in which we operate, and discretionary

income levels. Our sales may decline during economic downturns, which can be caused by various economic factors such as high gasoline

prices, or during periods of uncertainty, such as those during the Covid-19 pandemic. Any material decline in consumer confidence or a

decline in spending could cause our sales, operating results, business or financial condition to decline. If we fail to adapt to changes

in customer preferences and trends, we may lose customers, fail to gain customers, and our sales may deteriorate.

Customer preference on

how and where they purchase food may change because of advances in technology or alternative service channels. If we are not able to respond

to these changes, or our competitors respond to these changes more effectively, our business, financial condition and results of operations

could be adversely affected.

Changes in the cost of food could have

a material adverse effect on our business, financial condition and results of operations.

Our profitability depends

in part on our ability to anticipate and react to changes in the cost of sales of food items. We are susceptible to increases in the cost

of food due to factors beyond our control, such as freight and delivery charges, general economic conditions, seasonal economic fluctuations,

weather conditions, global demand, food safety concerns, infectious diseases, fluctuations in the U.S. dollar, tariffs and import taxes,

product recalls and government regulations. Dependence on frequent deliveries of food products subjects our business to the risk that

shortages or interruptions in supply could adversely affect the availability, quality or cost of ingredients or require us to incur additional

costs to obtain adequate supplies. Deliveries of supplies may be affected by adverse short-term weather conditions or long-term changes

in weather patterns, including those related to climate change, natural disasters, labor shortages, or financial or solvency issues of

our distributors or suppliers, product recalls or other issues. Further, increases in fuel prices could result in increased distribution

costs. In addition, a material adverse effect on our business, financial condition and results of operations could occur if any of our

distributors, suppliers, vendors, or other contractors fail to meet our quality or safety standards or otherwise do not perform adequately,

or if any one or more of them seeks to terminate its agreement or fails to perform as anticipated, or if there is any disruption in any

of our distribution or supply relationships or operations for any reason. Changes in the price or availability of certain food products,

including as a result of the COVID-19 pandemic, could affect our profitability and reputation.

Changes in the cost of

ingredients can result from a number of factors, including seasonality, short-term weather conditions or long-term changes in weather

patterns, natural disasters, currency exchange rates, increases in the cost of grain, consumer demand, disease and viruses and other factors

that affect availability and greater international demand for domestic products. In the event of cost increases with respect to one or

more of our raw ingredients, we may choose to temporarily suspend or permanently discontinue serving menu items rather than paying the

increased cost for the ingredients. Any such changes to our available menu could negatively impact our restaurant traffic, business and

results of operations during the shortage and thereafter. While future cost increases can be partially offset by increasing menu prices,

there can be no assurance that we will be able to offset future cost increases by such menu price increases. If we implement menu price

increases, there can be no assurance that increased menu prices will be fully absorbed by our guests without any resulting change to their

visit frequencies or purchasing patterns. Competitive conditions may limit our menu pricing flexibility and if we implement menu price

increases to protect our margins, restaurant traffic could be materially adversely affected.

An important aspect

of our growth strategy involves opening new restaurants in existing and new markets. We may be unsuccessful in opening new restaurants

or establishing new markets and our new restaurants may not perform as well as anticipated, which could have a material adverse effect

on our business, financial condition and results of operations.

A key part of our growth

strategy includes opening new restaurants in existing and new markets and operating those restaurants on a profitable basis. We must

identify target markets where we can enter or expand, and we may not be able to open our planned new restaurants within budget or on

a timely basis, and our new restaurants may not perform as well as anticipated. Our ability to successfully open new restaurants is affected

by several factors, many of which are beyond our control, including our ability to:

| |

· |

|

identify available, appropriate and attractive restaurant sites; |

| |

· |

|

compete for restaurant sites; |

| |

· |

|

reach acceptable agreements regarding the lease or purchase of restaurant sites; |

| |

· |

|

obtain or have available the financing required to develop and operate new restaurants, including construction and opening costs, which includes access to leases and equipment leases at favorable interest and capitalization rates; |

| |

· |

|

respond to unforeseen engineering or environmental problems with our selected restaurant sites; |

| |

· |

|

respond to landlord delays and the failure of landlords to timely deliver real estate to us; |

| |

· |

|

mitigate the impact of inclement weather, natural disasters and other calamities on the development of restaurant sites; |

| |

· |

|

hire, train and retain the skilled management and other team members necessary to meet staffing needs of new restaurants; |

| |

· |

|

obtain, in a timely manner and for an acceptable cost, required licenses, permits and regulatory approvals and respond effectively to any changes in local, state or federal law and regulations that adversely affect our costs or ability to open new restaurants; and |

| |

· |

|

respond to construction and equipment cost increases for new restaurants. |

There is no guarantee

that a sufficient number of available, appropriate and attractive restaurant sites will be available in desirable areas or on terms that

are acceptable to us in order to achieve our growth plan. If we are unable to open new restaurants, or if planned restaurant openings

are significantly delayed, it could have a material adverse effect on our business, financial condition and results of operations.

As part of our long-term

growth strategy, we may open restaurants in geographic markets in which we have little or no prior operating experience. The challenges

of entering new markets include: difficulties in hiring experienced personnel; unfamiliarity with local real estate markets and demographics;

consumer unfamiliarity with our brand; and different competitive and economic conditions, consumer tastes and discretionary spending patterns

that are more difficult to predict or satisfy than in our existing markets. Consumer recognition of our brand has been important in the

success of our restaurants in our existing markets, and we may find that our concept has limited appeal in new markets. Restaurants we

open in new markets may take longer to reach expected sales and profit levels on a consistent basis and may have higher construction,

occupancy and operating costs than existing restaurants. Any failure on our part to recognize or respond to these challenges may adversely

affect the success of any new restaurants and could have a material adverse effect on our business, financial condition and results of

operations.

We intend to continue

to make investments to support our business growth and may require additional funds to respond to business challenges or opportunities,

including the need to open additional restaurants. Accordingly, we may need to engage in equity or debt financings to secure additional

funds. In addition, we may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain

adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth

and to respond to business challenges could be significantly limited, which could have a material adverse effect on our business, financial

condition and results of operations.

New restaurants may not be profitable

or may close, and the performance of our restaurants that we have experienced in the past may not be indicative of future results.

In new markets, the length

of time before average sales for new restaurants stabilize is less predictable as a result of our limited knowledge of these markets and

consumers’ limited awareness of our brand. Our ability to operate our restaurants profitably will depend on many factors, some of

which are beyond our control, including:

| |

· |

|

consumer awareness and understanding of our brand; |

| |

· |

|

general economic conditions, which can affect restaurant traffic, local labor costs and prices we pay for the food products and other supplies we use; |

| |

· |

|

consumption patterns and food preferences that may differ from region to region; |

| |

· |

|

changes in consumer preferences and discretionary spending; |

| |

· |

|

difficulties obtaining or maintaining adequate relationships with distributors or suppliers in new markets; |

| |

· |

|

increases in prices for commodities; |

| |

· |

|

inefficiency in our labor costs as the staff gains experience; |

| |

· |

|

competition, either from our competitors in the restaurant industry or our own restaurants; |

| |

· |

|

temporary and permanent site characteristics of new restaurants; |

| |

· |

|

changes in government regulation; and |

| |

· |

|

other unanticipated increases in costs, any of which could give rise to delays or cost overruns. |

If our new restaurants

do not perform as planned or close, it could have a material adverse effect on our business, financial condition and results of operations.

Our growth strategy also includes continued development

of our business through franchising. The opening and successful operation of our restaurants by franchisees depends on a number of factors,

including those identified above, as well as the availability of suitable franchise candidates and the financial and other resources of

our franchisees such as our franchisees’ ability to receive financing from banks and other financial institutions, which may become

more challenging in the current economic environment. As noted above, identifying and securing an adequate supply of suitable new restaurant

sites presents significant challenges because of the intense competition for those sites in our target markets, and increasing development

and leasing costs. This may be especially true as we continue to expand. Further, any restrictions or limitations of credit markets may

require developers to delay or be unable to finance new projects. Delays or failures in opening new restaurants due to any of the reasons

set forth above could materially and adversely affect our growth strategy and our expected results.

Our success in part depends on the success

of our franchisees’ business.

To achieve our expansion goals within our desired

timeframe, we have adopted a franchising and area developer model into our business strategy. We hope to continue to open new company-owned

restaurants, while also moving forward to developing our franchised operation where we will solicit others to become our franchisees.

We have not used a franchising or area developer model in the past and may not be successful in attracting franchisees and developers

to our business concept or identifying franchisees and developers that have the business abilities or access to financial resources necessary

to open our restaurants or to develop or operate successfully our restaurants in a manner consistent with our standards. Incorporating

a franchising and area developer model into our strategy will required us to devote significant management and financial resources to

prepare for and support the eventual sale of franchises. If we are not successful in incorporating a franchising or area developer

model into our strategy, we may experience delays in our growth or may not be able to expand and grow our business.

Our success also depends in part on the operations

of our franchisees. While we provide training and support to, and monitor the operations of, our franchisees, the product quality and

service they deliver may be diminished by any number of factors beyond our control, including financial pressures and their own business

operations, such as employment related matters. We strive to provide our customers with the same experience at company-owned restaurants

and franchise-operated restaurants. Our customers may attribute to us problems which originate with one of our franchisees, particularly

those affecting the quality of the service experience, food safety, litigation or compliance with laws and regulations, thus damaging

our reputation and brand value and potentially adversely affecting our results of operations. Our growth expectations and revenues could

be negatively impacted by a material downturn in sales at and to franchise-operated locations or if one or more key franchisees become

insolvent.

Our franchisees could take actions that

could harm our business.

Franchisees are independently owned and operated,

and they are not our employees. Although we provide certain training and support to franchisees, our franchisees operate their shops as

independent businesses. Consequently, the quality of franchised shop operations may be diminished by any number of factors beyond our

control. Moreover, franchisees may not operate shops in a manner consistent with applicable laws and regulations or in accordance with

our standards and requirements. Also, franchisees may not successfully hire and train qualified managers and other shop personnel. Although

we believe we currently generally enjoy a positive relationship with our franchisees, there is no assurance that future developments,

some of which may be outside our control, may significantly harm our future relationships with existing and new franchisees. In addition,

our image and reputation, and the image and reputation of other franchisees, may suffer materially if our franchisees do not operate successfully,

or in accordance with our standards and requirements, which could result in a significant decline in our sales, our revenues and our profitability.

Our failure to

manage our growth effectively could harm our business and results of operations.

Our growth plan includes

opening new restaurants. Our existing restaurant management systems, financial and management controls and information systems may be

inadequate to support our planned expansion. Managing our growth effectively will require us to continue to enhance these systems, procedures

and controls and to hire, train and retain managers and team members. We may not respond quickly enough to the changing demands that our

expansion will impose on our management, restaurant teams and existing infrastructure, which could have a material adverse effect on our

business, financial condition and results of operations. These demands could cause us to operate our existing business less effectively,

which in turn could cause a deterioration in the financial performance of our existing restaurants. If we experience a decline in the

financial performance, we may decrease the number of or discontinue restaurant openings, or we may decide to close restaurants that we

are unable to operate in a profitable manner.

Opening new restaurants

in existing markets may negatively impact sales at our existing restaurants.

The consumer target area

of our restaurants varies by location, depending on a number of factors, including population density, other local retail and business

attractions, area demographics and geography. As a result, if we open new restaurants in or near markets in which we already have restaurants,

it could have a material adverse effect on sales at these existing restaurants. Existing restaurants could also make it more difficult

to build our consumer base for a new restaurant in the same market. Our core business strategy does not entail opening new restaurants

that we believe will materially affect sales at our existing restaurants over the long term. However, due to brand recognition and logistical

synergies, as part of our growth strategy, we also intend to open new restaurants in areas where we have existing restaurants. This plan

could have a material adverse effect on the results of operations and same-restaurant sales for our restaurants in such markets due to

the close proximity with our other restaurants and market saturation. Unintentional sales cannibalization or sales cannibalization in

excess of what was intended may become significant in the future as we continue to open new restaurants, and could affect our sales growth,

which could, in turn, have a material adverse effect on our business, financial condition and results of operations.

Our plans to open

new restaurants, and the ongoing need for capital expenditures at our existing restaurants, require us to spend capital.

Our growth strategy depends

on opening new restaurants, which will require us to use cash flows from operations and proceeds from equity or debt offerings. We cannot

assure you that cash flows from operations and the net proceeds of any offering will be sufficient to allow us to implement our growth

strategy. If this cash is not allocated efficiently among our various projects, or if any of these initiatives prove to be unsuccessful,

we may experience reduced financial results and we could be required to delay, significantly curtail or eliminate planned restaurant openings,

which could have a material adverse effect on our business, financial condition, results of operations and the price of our stock.

In addition, as our restaurants

mature, our business will require capital expenditures for the maintenance, renovation and improvement of existing restaurants to remain

competitive and maintain the value of our brand standard. This creates an ongoing need for cash, and, to the extent we cannot fund capital

expenditures from cash flows from operations, funds will need to be borrowed or otherwise obtained.

If the costs of funding

new restaurants or renovations or enhancements at existing restaurants exceed budgeted amounts, and/or the time for building or renovation

is longer than anticipated, our profits could be reduced. If we cannot access the capital we need, we may not be able to execute on our

growth strategy, take advantage of future opportunities or respond to competitive pressures.

Incidents involving food-borne illness

and food safety, including food tampering or contamination could adversely affect our brand perception, business, financial condition

and results of operations.

Food safety is a top

priority, and we dedicate substantial resources to help ensure that our guests enjoy safe, quality food products. However, food-borne

illnesses and other food safety issues have occurred in the food industry in the past, and could occur in the future. Incidents or reports

of food-borne or water-borne illness or other food safety issues, food contamination or tampering, team member hygiene and cleanliness

failures or improper team member conduct, guests entering our restaurants while ill and contaminating food ingredients or surfaces at

our restaurants could lead to product liability or other claims. Such incidents or reports could negatively affect our brand and reputation

and could have a material adverse effect on our business, financial condition and results of operations.

We cannot guarantee to

consumers that our food safety controls, procedures and training will be fully effective in preventing all food safety and public health

issues at our restaurants, including any occurrences of pathogens (i.e., Ebola, “mad cow disease,” “SARS,” “swine

flu,” Zika virus, avian influenza, hepatitis A, porcine epidemic diarrhea virus, norovirus or other virus), bacteria (i.e., salmonella,

listeria or E. coli), parasites or other toxins infecting our food supply. These public health issues, in addition to food tampering,

could adversely affect food prices and availability of certain food products, could generate negative publicity and litigation, and could

lead to closure of restaurants, resulting in a decline in our sales or profitability. In addition, there is no guarantee that our restaurant

locations will maintain the high levels of internal controls and training we require at our restaurants. Furthermore, some food-borne

illness incidents could be caused by third-party food suppliers and transporters outside of our control, and may affect multiple restaurant

locations as a result. We cannot assure you that all food items will be properly maintained during transport throughout the supply chain

and that our team members will identify all products that may be spoiled and should not be used in our restaurants. The risk of food-borne

illness may also increase whenever our menu items are served outside of our control, such as by third-party food delivery services, guest

take out or at catered events. We do not have direct control over our third-party suppliers, transporters or delivery services, including

in their adherence to additional sanitation protocols and guidelines as a result of the COVID-19 pandemic or other infectious

diseases, and may not have visibility into their practices. New illnesses resistant to our current precautions may develop in the future,

or diseases with long incubation periods could arise, that could give rise to claims or allegations on a retroactive basis. One or more

instances of food-borne illness in one of our restaurants could negatively affect sales at all our restaurants if highly publicized, such

as on national media outlets or through social media. This risk exists even if it were later determined that the illness was wrongly attributed

to one of our restaurants. Food safety incidents, whether at our restaurants or involving our business partners, could lead to wide public

exposure and negative publicity, which could materially harm our business. Additionally, even if food-borne illnesses were not identified

at our restaurants, our restaurant sales could be adversely affected if instances of food-borne illnesses at other restaurants were highly

publicized.

Damage to our reputation

and negative publicity could have a material adverse effect on our business, financial condition and results of operations.

Any incident that

erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by

negative publicity relating to food quality, the safety, sanitation and welfare of our restaurant facilities, guest complaints or

litigation alleging illness or injury, health inspection scores, integrity of our or our suppliers’ food processing and other

policies, practices and procedures, team member relationships and welfare or other matters at one or more of our restaurants. Any

publicity relating to health concerns, perceived or specific outbreaks of a food-borne illness attributed to one or more of our

restaurants, or non-compliance with food handling and sanitation requirements imposed by federal, state and local

governments could result in a significant decrease in guest traffic in all of our restaurants and could have a material adverse

effect on our results of operations. Furthermore, similar negative publicity or occurrences with respect to other restaurants or

other restaurant chains could also decrease our guest traffic and have a similar material adverse effect on our business. In

addition, incidents of restaurant commentary have increased dramatically with the proliferation of social media platforms. Negative

publicity may adversely affect us, regardless of whether the allegations are valid or whether we are held responsible. In addition,

the negative impact of adverse publicity may extend far beyond the restaurant involved, and affect some or all our other

restaurants.

The digital and

delivery business, and expansion thereof, is uncertain and subject to risk.

As the digital space

around us continues to evolve, our technology needs to evolve concurrently to stay competitive with the industry. If we do not maintain

and innovate our digital systems that are competitive with the industry, our digital business may be adversely affected and could damage

our sales. We rely on third-parties for our ordering and payment platforms. Such services performed by these third-parties could be damaged

or interrupted by technological issues, which could then result in a loss of sales for a period of time. Information processed by these

third-parties could also be impacted by cyber-attacks, which could not only negatively impact our sales, but also harm our brand image.

Recognizing the rise

in delivery services offered throughout the restaurant industry, we understand the importance of providing such services to meet our guests

wherever and whenever they want. We rely on third-parties to fulfill delivery orders timely and in a fashion that will satisfy our guests.

Errors in providing adequate delivery services may result in guest dissatisfaction, which could also result in loss of guest retention,

loss in sales and damage to our brand image. Additionally, as with any third-party handling food, such delivery services increase the

risk of food tampering while in transit. We are also subject to risk if there is a shortage of delivery drivers, which could result in

a failure to meet our guests’ expectations.

Third-party delivery

services within the restaurant industry is a competitive environment and includes a number of players competing for market share. If our

third-party delivery partners fail to effectively compete with other third-party delivery providers in the sector, our delivery business

may suffer resulting in a loss of sales. If any third-party delivery provider we partner with experiences damage to their brand image,

we may also see ramifications due to our partnership with them.

Natural disasters,

unusual weather conditions, pandemic outbreaks, political events, war and terrorism could disrupt our business and result in lower sales,

increased operating costs and capital expenditures.

Our home office, restaurant

locations, suppliers and distributors, and their respective facilities, as well as certain of our vendors and customers, are located in

areas, south as southern Florida, that have been and could be subject to natural disasters such as floods, drought, hurricanes, tornadoes,

fires or earthquakes. Adverse weather conditions or other extreme changes in short-term weather conditions or long-term changes in weather

patterns related to climate change, including those that may result in electrical and technological failures, may disrupt our business

and may adversely affect our ability to obtain food and supplies and sell menu items. Our business may be harmed if our ability to obtain

food and supplies and sell menu items is impacted by any such events, any of which could influence customer trends and purchases and may

negatively impact our revenues, properties or operations. Such events could result in physical damage to one or more of our properties,

the temporary closure of some or all of our restaurants and our suppliers and distributors, the temporary lack of an adequate work force

in a market, temporary or long-term disruption in the transport of goods, delay in the delivery of goods and supplies to our restaurants

and our suppliers and distributors, disruption of our technology support or information systems, or fuel shortages or dramatic increases

in fuel prices, all of which would increase the cost of doing business. These events also could have indirect consequences such as increases

in the costs of insurance if they result in significant loss of property or other insurable damage. Any of these factors, or any combination

thereof, could have a material adverse effect on our business, financial condition and results of operations.

Our financial results may fluctuate from

period to period as a result of several factors which could adversely affect our stock price.

Our operating results may fluctuate significantly

in the future as a result of a variety of factors, many of which are outside our control. Factors that will affect our financial results

include:

| |

· |

acceptance of our restaurant concept and market penetration; |

| |

· |

the amount and timing of capital expenditures and other costs relating to the implementation of our business plan; |

| |

· |

the introduction of new products by our competitors; |

| |

· |

seasonality applicable to our geographic location; and |

| |

· |

general economic conditions and economic conditions specific to our industry. |

As a strategic response to changes in the competitive

environment, we may from time to time make certain pricing, service, or marketing decisions or acquisitions that could have a material

adverse effect on our business, prospects, financial condition, and results of operations.

The fast-food segment of the restaurant industry is highly competitive.

We operate in the fast food segment of the restaurant

industry, which is highly competitive with respect to, among other things, taste, consumer trends, price, food quality and presentation,

service, location and the ambiance and condition of the restaurant. Our competition includes a variety of locally owned restaurants, as

well as national and regional chains. Our competitors offer dine-in, carry-out, delivery and drive-through services. Most of our competitors

have existed longer and often have a more established brand and market presence with substantially greater financial, marketing, personnel

and other resources than us. Among our main competitors include Jimmy John’s, Chipotle Mexican Grill, Miami Subs Grill, Subway and

Starbucks, most of whom have expanded nationally. As we expand, our existing restaurants may face competition from existing and new restaurants

that operate in these markets.

Several of our competitors compete by offering

menu items that are specifically identified as low in fat, carbohydrates and calories, allegedly better for customers, or otherwise targeted

at healthier consumer preferences. Many of our competitors in the fast food segment of the restaurant industry also emphasize lower cost,

“value meal” menu options, which is a strategy we also pursue.

Moreover, new companies will likely enter our

markets and target our customers. For example, additional competitive pressures have come recently from the deli sections and in-store

cafés of several major grocery chains, including those targeted at customers who want higher quality and healthier food, as well

as from convenience stores and casual dining outlets. These competitors may have, among other things, lower operating costs,

better locations, better brand awareness, better facilities, better management, more effective marketing and more efficient operations

than we do.

In the restaurant industry, labor is a primary

operating cost component. Competition for qualified employees could also require us to pay higher wages to attract a sufficient number

of employees. We also expect to compete for restaurant locations with other fast food restaurants. Until our name is better recognized,

landlords may prefer well-known fast food restaurants over us and we may experience difficulties in securing desirable restaurant locations.

All of these competitive factors may adversely affect us and reduce our sales and profits.

Our expansion into new markets may present

increased risks due to our unfamiliarity with those areas and our target customers’ unfamiliarity with our brand.

Our initial restaurants are located, and future

restaurants will be located, in markets where we have no operating experience and our restaurants may be less successful than restaurants

where established restaurants are more familiar. Consumers in our new markets will not be familiar with our brand, and we will need to

build brand awareness in those markets through investments in advertising and promotional activity. We may find it more difficult in our

markets to secure desirable restaurant locations and to hire, motivate and keep qualified employees.

We expect to incur losses in the near future, which may impact

our ability to implement our business strategy and adversely affect our financial condition.

We expect to significantly increase our operating

expenses by expanding our marketing activities and increasing our level of capital expenditures in order to grow our business. Such increases

in operating expense levels and capital expenditures may adversely affect our operating results if we are unable to immediately realize

benefits from such expenditures. In addition, if we are unable to manage a significant increase in operating expenses, our

liquidity will likely decrease and negatively impact our cash flow and ability to sustain operations. In turn, this would have a negative

impact on our financial condition and share price.

We also cannot assure you that we will be profitable

or generate sufficient profits from operations in the future. If our revenues do not grow, we may experience a loss in one or more future

periods. We may not be able to reduce or maintain our expenses in response to any decrease in our revenue, which may impact our ability

to implement our business strategy and adversely affect our financial condition. This would also have a negative impact on our share price.

Failure to receive frequent deliveries of

higher quality food ingredients and other supplies could harm our operations.

Our ability to maintain our menu depends in part

on our ability to acquire ingredients that meet our specifications from reliable suppliers. Interruptions or shortages in the supply of

ingredients caused by unanticipated demand, problems in production or distribution, food contamination, inclement weather or other conditions

could adversely affect the availability, quality and cost of our ingredients, which could harm our operations If any of our distributors

or suppliers fails to perform adequately, or our distribution or supply relationships are disrupted for any reason, our business, financial

condition, results of operations or cash flows could be adversely affected. Our inability to replace or engage distributors or suppliers

who meet our specifications in a short period of time could increase our expenses and cause shortages of food and other items at our restaurant,

which could cause a restaurant to remove items from its menu. If that were to happen to our restaurants that affected our key ingredients

such as beef, chicken, cheese and produce, it could adversely affect our operating results. We are susceptible to increases in food costs

as a result of factors beyond our control, such as general economic conditions, seasonal fluctuations, weather conditions, demand, food

safety concerns, product recalls, labor disputes and government regulations. In addition to food, we purchase electricity, oil and natural

gas needed to operate our restaurants, and suppliers purchase gasoline needed to transport food and supplies to us. Any significant increase

in energy costs could adversely affect our business through higher rates and the imposition of fuel surcharges by our suppliers. Because

we provide moderately priced food, we may choose not to, or be unable to, pass along commodity price increases to our customers. Additionally,

significant increases in gasoline prices could result in a decrease of customer traffic at our restaurants. We rely on third-party distribution

companies to deliver food and supplies to our restaurant. Interruption of distribution services due to financial distress or other issues

could impact our operations.

Our operating costs also include premiums that

we pay for our insurance (including workers’ compensation, general liability, property and health). The cost of insurance has risen

significantly in the past few years and we expect could experience significant reductions in sales during the shortage or thereafter,

if our customers change their dining habits as a result.

In addition, we intend to use a substantial amount

of naturally raised and organically grown ingredients, and try to make our food as fresh as we can, in light of pricing considerations.

As we increase our use of these ingredients, the ability of our suppliers to expand output or otherwise increase their supplies to meet

our needs may be constrained. Our inability to obtain a sufficient and consistent supply of these ingredients on a cost-effective basis,

or at all, could cause us difficulties in aligning our brand with the principle of “fresh and healthy,” which could in turn

make us less popular among our customers and cause sales to decline.

If we fail to retain our key personnel or

if we fail to attract additional qualified personnel, we may not be able to achieve our anticipated level of growth and our business could

suffer.

Our future success and ability to implement our

business strategy depends, in part, on our ability to attract and retain key personnel, and on the continued contributions of members

of our senior management team and key technical personnel, each of whom would be difficult to replace. All of our employees, including

our senior management, are free to terminate their employment relationships with us at any time. Competition for highly skilled technical

people is extremely intense, and we face challenges identifying, hiring and retaining qualified personnel in many areas of our business.

If we fail to retain our senior management and other key personnel or if we fail to attract additional qualified personnel, we may not

be able to achieve our strategic objectives and our business could suffer.

Changes in accounting standards and subjective

assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

Generally accepted accounting principles and related

pronouncements, implementation guidelines and interpretations with regard to a wide variety of matters that are relevant to our business,

such as, but not limited to, revenue recognition, stock-based compensation, trade promotions, and income taxes are highly complex and

involve many subjective assumptions, estimates and judgments by our management. Changes to these rules or their interpretation or changes

in underlying assumptions, estimates or judgments by our management could significantly change our reported results.

If we are unable to build and sustain proper

information technology infrastructure, our business could suffer.

We depend on information technology as an enabler

to improve the effectiveness of our operations and to interface with our customers, as well as to maintain financial accuracy and efficiency.

If we do not allocate and effectively manage the resources necessary to build and sustain the proper technology infrastructure, we could

be subject to transaction errors, processing inefficiencies, the loss of customers, business disruptions, or the loss of or damage to

intellectual property through security breach. Our information systems could also be penetrated by outside parties’ intent on extracting

information, corrupting information or disrupting business processes. Such unauthorized access could disrupt our business and could result

in the loss of assets.

We are dependent upon third party suppliers of our raw materials.

We are dependent on outside vendors for our supplies

of raw materials. While we believe that there are numerous sources of supply available, if the third-party suppliers were to cease production

or otherwise fail to supply us with quality raw materials in sufficient quantities on a timely basis and we were unable to contract on

acceptable terms for these services with alternative suppliers, our ability to produce our products would be materially adversely affected.

Our inability to protect our trademarks,

patents and trade secrets may prevent us from successfully marketing our products and competing effectively.

Failure to protect our intellectual property could

harm our brand and our reputation, and adversely affect our ability to compete effectively. Further, enforcing or defending our intellectual

property rights, including our trademarks, patents, copyrights and trade secrets, could result in the expenditure of significant financial

and managerial resources. We regard our intellectual property, particularly our trademarks, patents and trade secrets to be of considerable

value and importance to our business and our success. We rely on a combination of trademark, patent, and trade secrecy laws, confidentiality

procedures and contractual provisions to protect our intellectual property rights. There can be no assurance that the steps taken by us

to protect these proprietary rights will be adequate or that third parties will not infringe or misappropriate our trademarks, patented

processes, trade secrets or similar proprietary rights. In addition, there can be no assurance that other parties will not assert infringement

claims against us, and we may have to pursue litigation against other parties to assert our rights. Any such claim or litigation could

be costly. In addition, any event that would jeopardize our proprietary rights or any claims of infringement by third parties could have

a material adverse effect on our ability to market or sell our brands, profitably exploit our products or recoup our associated research

and development costs.

We may be subject to legal claims against

us or claims by us which could have a significant impact on our resulting financial performance.

At any given time, we may be subject to litigation,

the disposition of which may have an adverse effect upon our business, financial condition, or results of operation. Such claims include

but are not limited to and may arise from product liability and related claims in the event that any of the products that we sell is faulty

or contains defects in materials or design. We may be subject to infringement claims from our products. In addition, we may be subject

to claims by our lenders, claims for rent, and claims from our vendors on our accounts payable; and although we have been able to obtain

understandings with the foregoing and have informal forbearance agreements from those parties, one or more of them may elect to commence

collection proceedings which could result in judgments against us and have a significant negative impact on our operations.

The requirements of being a public company

may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified

board members.

As a public company, we are subject to the reporting

requirements of the Securities Exchange Act of 1934, as amended, and the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act, and

other applicable securities rules and regulations. Compliance with these rules and regulations increases our legal and financial compliance

costs, make some activities more difficult, time-consuming or costly, and increase demand on our systems and resources, particularly after

we are no longer an “emerging growth company,” as defined in the Jumpstart our Business Startups Act, or the JOBS Act. The

Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and operating

results. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal

control over financial reporting. In order to maintain and, if required, improve our disclosure controls and procedures and internal control

over financial reporting to meet this standard, significant resources and management oversight may be required. As a result, management’s

attention may be diverted from other business concerns which could adversely affect our business and operating results. We may need to

hire more employees in the future or engage outside consultants who will increase our costs and expenses.

In addition, changing laws, regulations and standards

relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance

costs and making some activities more time consuming. These laws, regulations and standards are subject to varying interpretations, in

many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided

by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated

by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and

standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time

and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards

differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory

authorities may initiate legal proceedings against us and our business may be adversely affected.

However, for as long as we remain an “emerging

growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to public companies

that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation

requirements of Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements,

and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden

parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an “emerging

growth company.”

We would cease to be an “emerging growth

company” upon the earliest of: (i) the first fiscal year following the fifth anniversary of our becoming a reporting company, (ii)

the first fiscal year after our annual gross revenues are $1.0 billion or more, (iii) the date on which we have, during the previous three-year

period, issued more than $1.0 billion in non-convertible debt securities, or (iv) as of the end of any fiscal year in which the market

value of our Common Stock held by non-affiliates exceeded $75 million as of the end of the second quarter of that fiscal year.

We also expect that being a public company and

these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required

to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for

us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee,

and qualified executive officers.

As a result of disclosure of information in this

Prospectus and in future filings required of a public company, our business and financial condition will become more visible, which we

believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful,

our business and operating results could be adversely affected, and even if the claims do not result in litigation or are resolved in

our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely

affect our business and operating results.

We are an “emerging growth company”

and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Stock less

attractive to investors.

As a reporting company under the Exchange Act,

we are classified as an "emerging growth company," as defined in the JOBS Act. We may take advantage of certain exemptions from

various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply

with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive

compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote

on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors

will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive

as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

Section 107 of the JOBS Act provides that an “emerging

growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933

(the “Securities Act” or “33 Act”) for complying with new or revised accounting standards. In other words, an

“emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply

to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards

pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company”

for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1

billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would

occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most

recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during

the preceding three-year period.

Notwithstanding the above, we are a “smaller

reporting company.” In the event that we are still considered a “smaller reporting company,” at such time are we cease

being an “emerging growth company,” the disclosure we will be required to provide in our SEC filings will increase, but will

still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting

company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to

provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley

Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control

over financial reporting; and have certain other decreased disclosure obligations in their SEC filings. Decreased disclosures in our SEC

filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for

investors to analyze our results of operations and financial prospects. Should we cease to be an “emerging growth company”

but remain a “smaller reporting company”, we would be required to: (1) comply with new or revised US GAAP accounting standards

applicable to public companies, (2) comply with new Public Company Accounting Oversight Board requirements applicable to the audits of

public companies, and (3) to make additional disclosures with respect to related party transactions, namely Item 404(d).

Our management and principal shareholders

have the ability to significantly influence or control matters requiring a shareholder vote and other shareholders may not have the ability

to influence corporate transactions.

Currently,

our principal shareholders own approximately 59.2% of our outstanding Common Stock. As a result, they have the ability to determine the

outcome on all matters requiring approval of our shareholders, including the election of directors and approval of significant corporate

transactions.

Risks Relating to our Common

Stock

The sale of a large number of shares of

Common Stock by our principal shareholders could depress the market price of our common stock.

As of

June 28, 2022, our principal shareholders beneficially owned approximately 58.9% of our common stock outstanding. The shares may

become available for resale, subject to the requirements of the U.S. securities laws. The sale or prospect of a sale of a