Filed Pursuant to Rule 424(b)(3)

Registration No. 333-265598

Prospectuses Supplement

(to Prospectuses dated June 24, 2022)

Jones Soda Co.

24,324,384 Shares of Common Stock

This prospectus supplement supplements the prospectus, dated June 24, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (Registration No. 333-265598). This prospectus supplement is being filed to update, amend and supplement the information included or incorporated by reference in the Prospectus with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”) on March 29, 2023 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relates to the sale of up to 24,324,384 shares of our common stock which may be resold from time to time by the selling shareholders identified in the Prospectus. The shares of common stock covered by the Prospectus include 18,302,192 shares issuable upon exercise of outstanding warrants. All of the shares of common stock included in the Prospectus were purchased from the Company in either a private placement transaction or a court-approved share exchange transaction under Section 3(a)(10) under the Securities Act of 1933, as amended, that involved a shell company and are being offered for resale by the selling shareholders only. We are not selling any common stock under the Prospectus and this prospectus supplement and will not receive any of the proceeds from the sale or other disposition of shares by the selling shareholders.

This prospectus supplement should be read in conjunction with the Prospectus. This prospectus supplement updates, amends and supplements the information included or incorporated by reference in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is listed for quotation on the OTCQB quotation system under the symbol “JSDA.” The last bid price of our common stock on March 31, 2023 was $0.25 per share.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” of the Prospectus, and under similar headings in any amendment or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 3, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 28, 2023

Jones Soda Co.

(Exact Name of Registrant as Specified in Its Charter)

Washington

(State or Other Jurisdiction of Incorporation)

| |

|

|

0-28820

|

52-2336602

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

4786 1st Avenue South, Suite 103, Seattle, Washington

|

98134

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(206) 624-3357

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

None

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On March 28, 2023, the Audit Committee of the Board of Directors (the “Audit Committee”) of Jones Soda Co. (the “Company”) in consultation with the management of the Company and the Company’s independent registered public accounting firm, Armanino LLP, reached a determination that the Company’s consolidated financial statements and related disclosures for the year ended December 31, 2021, included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2022, and for each of the quarterly and year-to-date periods ended March 31, 2022 and June 30, 2022, should no longer be relied upon because of a certain misstatement contained in those condensed consolidated financial statements.

As part of preparing the Company’s consolidated financial statements as at and for the year ended December 31, 2022, an error was identified in the accounting for a short-term financing agreement that had an impact on the consolidated financial statements for the year ended December 31, 2021, which had been previously filed. Effective November 15, 2021, the Company entered into a one year financing agreement with IPFS Corporation (“IPFS”) to fund a portion of its insurance premiums in the amount of $903,000. Repayments were made quarterly on January 15, 2022, April 15, 2022, and July 15, 2022 under the terms of this financing agreement with IPFS, and the entirety of the financing was paid off in full on July 15, 2022. Since under the terms of the financing agreement with IPFS, IPFS funded a portion of the Company’s insurance premiums a prepaid asset was required to be recognized on our balance sheet for the year ended December 31, 2021, along with an associated liability or obligation to pay down this financing per the quarterly payment schedule noted above. The Company did not record this beforementioned asset or liability on the Company’s balance sheet as of December 31, 2021, which was previously filed with the SEC.

As a result of the identification of this error, the Company’s Audit Committee concluded that the previously issued consolidated financial statements as at and for the year ended December 31, 2021, were misstated. Accordingly, the Company has restated its consolidated financial statements as at and for the year ended December 31, 2021, to increase current assets and current liabilities by $903,000 on the balance sheet. Additionally, the Company has recorded the $903,000 change in prepaid asset in the operating activity portion on the statement of cash flows and the $903,000 liability in the financing activity portion of the statement of cash flows. Further, the Company has restated its consolidated financial statements as at and for the three months ended March 31, 2022, to increase current assets and current liabilities by $597,000 on the balance sheet, while recording $306,000 in additional cash provided in the operating activity portion on the statement of cash flows and $306,000 of cash used in the financing activity portion of the statement of cash flows. Finally, the Company has restated its consolidated financial statements as at and for the nine months ended June 30, 2022, to increase current assets and current liabilities by $289,000 on the balance sheet, while recording $614,000 in additional cash provided in the operating activity portion on the statement of cash flows and $614,000 of cash used in the financing activity portion of the statement of cash flows.

This error did not have any impact on the Company’s consolidated statement of operations, consolidated statements of comprehensive loss, or consolidated statement of shareholders' equity.

The impacts of this correction to fiscal year 2021 is as follows:

| |

|

As of

|

| |

|

December 31, 2021

|

| |

|

(In thousands)

|

| |

|

(Unaudited) |

|

Consolidated Balance Sheet:

|

|

As Reported

|

|

Restatement

Adjustments

|

|

As Restated

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

4,667

|

|

$

|

-

|

|

$

|

4,667

|

|

Accounts receivable, net of allowance of $114

|

|

|

2,662

|

|

|

-

|

|

|

2,662

|

|

Inventory

|

|

|

1,923

|

|

|

-

|

|

|

1,923

|

|

Prefunded insurance premiums from financing

|

|

|

-

|

|

|

903

|

|

|

903

|

|

Prepaid expenses and other current assets

|

|

|

358

|

|

|

-

|

|

|

358

|

|

Total current assets

|

|

$

|

9,610

|

|

$

|

903

|

|

$

|

10,513

|

| |

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

1,239

|

|

|

-

|

|

|

1,239

|

|

Accrued expenses

|

|

|

1,544

|

|

|

-

|

|

|

1,544

|

|

Insurance Premium Financing

|

|

|

-

|

|

|

903

|

|

|

903

|

|

Lease liability, current portion

|

|

|

109

|

|

|

-

|

|

|

109

|

|

Taxes payable

|

|

|

8

|

|

|

-

|

|

|

8

|

|

Current portion of convertible subordinated notes payable, net

|

|

|

92

|

|

|

-

|

|

|

92

|

|

Current portion of accrued interest expense

|

|

|

55

|

|

|

-

|

|

|

55

|

|

2022 Financing Proceeds Received, Net of Closing Costs

|

|

|

538

|

|

|

-

|

|

|

538

|

|

Total current liabilities

|

|

$

|

3,585

|

|

$

|

903

|

|

$

|

4,488

|

| |

|

Year Ended

|

| |

|

December 31, 2021

|

| |

|

(In thousands)

|

| |

|

(Unaudited) |

|

Consolidated Statement of Cash flows:

|

|

As Reported

|

|

Restatement

Adjustments

|

|

As Restated

|

|

OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,811)

|

|

$

|

-

|

|

$

|

(1,811)

|

|

Adjustments to reconcile net loss to net cash flows from

|

|

|

|

|

|

|

|

|

|

|

operating activities:

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

166

|

|

|

-

|

|

|

166

|

|

Stock-based compensation

|

|

|

144

|

|

|

-

|

|

|

144

|

|

Change in allowance for doubtful accounts

|

|

|

21

|

|

|

-

|

|

|

21

|

|

Forgiveness of PPP SBA loan

|

|

|

(335)

|

|

|

-

|

|

|

(335)

|

|

Loss (gain) on sale of fixed asset

|

|

|

5

|

|

|

-

|

|

|

5

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(1,129)

|

|

|

-

|

|

|

(1,129)

|

|

Inventory

|

|

|

(66)

|

|

|

-

|

|

|

(66)

|

|

Prefunded insurance premiums from financing

|

|

|

-

|

|

|

(903)

|

|

|

(903)

|

|

Prepaid expenses and other current assets

|

|

|

(164)

|

|

|

-

|

|

|

(164)

|

|

Accounts payable

|

|

|

(147)

|

|

|

-

|

|

|

(147)

|

|

Accrued expenses

|

|

|

783

|

|

|

-

|

|

|

783

|

|

Taxes payable

|

|

|

1

|

|

|

-

|

|

|

1

|

|

Other liabilities

|

|

|

4

|

|

|

-

|

|

|

4

|

|

Net cash used in operating activities

|

|

$ |

(2,528)

|

|

$ |

(903)

|

|

$ |

(3,431)

|

| |

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options

|

|

$

|

296

|

|

$

|

-

|

|

$

|

296

|

|

Proceeds from issuance of convertible notes, net

|

|

|

1,778

|

|

|

-

|

|

|

1,778

|

|

Proceeds from 2022 convertible notes prior to close, net

|

|

|

538

|

|

|

-

|

|

|

538

|

|

Additional financing for insurance premiums, net of repayments

|

|

|

-

|

|

|

903

|

|

|

903

|

|

Net cash provided by financing activities

|

|

$

|

2,612

|

|

$

|

903

|

|

$

|

3,515

|

The impacts of this correction as at and for the three months ended March 31, 2022 (unaudited) is as follows:

| |

|

As of

|

| |

|

March 31, 2022

|

| |

|

(In thousands)

|

| |

|

(Unaudited) |

|

Condensed Consolidated Balance Sheet:

|

|

As Reported

|

|

Restatement

Adjustments

|

|

As Restated

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

11,856

|

|

$

|

-

|

|

$

|

11,856

|

|

Accounts receivable, net of allowance of $111

|

|

|

3,216

|

|

|

-

|

|

|

3,216

|

|

Inventory

|

|

|

2,907

|

|

|

-

|

|

|

2,907

|

|

Prefunded insurance premiums from financing

|

|

|

-

|

|

|

597

|

|

|

597

|

|

Prepaid expenses and other current assets

|

|

|

477

|

|

|

-

|

|

|

477

|

|

Total current assets

|

|

$

|

18,456

|

|

$

|

597

|

|

$

|

19,053

|

| |

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

1,735

|

|

|

-

|

|

|

1,735

|

|

Accrued expenses

|

|

|

1,526

|

|

|

-

|

|

|

1,526

|

|

Insurance Premium Financing

|

|

|

-

|

|

|

597

|

|

|

597

|

|

Lease liability, current portion

|

|

|

111

|

|

|

-

|

|

|

111

|

|

Taxes payable

|

|

|

9

|

|

|

-

|

|

|

9

|

|

Current portion of convertible subordinated notes payable, net

|

|

|

2,893

|

|

|

-

|

|

|

2,893

|

|

Total current liabilities

|

|

$

|

6,274

|

|

$

|

597

|

|

$

|

6,871

|

| |

|

Quarter Ended

|

| |

|

March 31, 2022

|

| |

|

(In thousands)

|

| |

|

(Unaudited) |

|

Condensed Consolidated Statement of Cash flows:

|

|

As Reported

|

|

Restatement

Adjustments

|

|

As Restated

|

|

OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,664)

|

|

$

|

-

|

|

$

|

(1,664)

|

|

Adjustments to reconcile net loss to net cash flows from

|

|

|

|

|

|

|

|

|

|

|

operating activities:

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

247

|

|

|

-

|

|

|

247

|

|

Stock-based compensation

|

|

|

268

|

|

|

-

|

|

|

268

|

|

Change in allowance for doubtful accounts

|

|

|

(3)

|

|

|

-

|

|

|

(3)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(545)

|

|

|

-

|

|

|

(545)

|

|

Inventory

|

|

|

(982)

|

|

|

-

|

|

|

(982)

|

|

Prefunded insurance premiums from financing

|

|

|

-

|

|

|

306

|

|

|

306

|

|

Prepaid expenses and other current assets

|

|

|

(119)

|

|

|

-

|

|

|

(119)

|

|

Other assets

|

|

|

25

|

|

|

-

|

|

|

25

|

|

Accounts payable

|

|

|

496

|

|

|

-

|

|

|

496

|

|

Accrued expenses

|

|

|

(66)

|

|

|

-

|

|

|

(66)

|

|

Taxes payable

|

|

|

1

|

|

|

-

|

|

|

1

|

|

Other liabilities

|

|

|

1

|

|

|

-

|

|

|

1

|

|

Net cash used in operating activities

|

|

$

|

(2,341)

|

|

$

|

306

|

|

$

|

(2,035)

|

| |

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible notes, net

|

|

$

|

2,354

|

|

$

|

-

|

|

$

|

2,354

|

|

Repayments on Insurance financing, net of additional financing

|

|

|

-

|

|

|

(306)

|

|

|

(306)

|

|

Proceeds from issuance of common stock and warrants, net

|

|

|

7,152

|

|

|

-

|

|

|

7,152

|

|

Net cash provided by financing activities

|

|

$

|

9,506

|

|

$

|

(306)

|

|

$

|

9,200

|

The impacts of this correction as at and for the six months ended June 30, 2022 (unaudited) is as follows:

| |

|

As of

|

| |

|

June 30, 2022

|

| |

|

(In thousands)

|

| |

|

(Unaudited) |

|

Condensed Consolidated Balance Sheet:

|

|

As Reported

|

|

|

Restatement

Adjustments

|

|

As Restated

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

9,285

|

|

|

$

|

-

|

|

$

|

9,285

|

|

Accounts receivable, net of allowance of $119

|

|

|

4,071

|

|

|

|

-

|

|

|

4,071

|

|

Inventory

|

|

|

2,833

|

|

|

|

-

|

|

|

2,833

|

|

Prefunded insurance premiums from financing

|

|

|

-

|

|

|

|

289

|

|

|

289

|

|

Prepaid expenses and other current assets

|

|

|

944

|

|

|

|

-

|

|

|

944

|

|

Total current assets

|

|

$

|

17,133

|

|

|

$

|

289

|

|

$

|

17,422

|

| |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

1,619

|

|

|

|

-

|

|

|

1,619

|

|

Accrued expenses

|

|

|

1,529

|

|

|

|

-

|

|

|

1,529

|

|

Insurance Premium Financing

|

|

|

-

|

|

|

|

289

|

|

|

289

|

|

Lease liability, current portion

|

|

|

114

|

|

|

|

-

|

|

|

114

|

|

Taxes payable

|

|

|

14

|

|

|

|

-

|

|

|

14

|

|

Total current liabilities

|

|

$

|

3,276

|

|

|

$

|

289

|

|

$

|

3,565

|

| |

|

Six months Ended

|

| |

|

June 30, 2022

|

| |

|

(In thousands)

|

| |

|

(Unaudited) |

|

Condensed Consolidated Statement of Cash flows:

|

|

As Reported

|

|

|

Restatement

Adjustments

|

|

As Restated

|

|

OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(3,099)

|

|

|

$

|

-

|

|

$

|

(3,099)

|

|

Adjustments to reconcile net loss to net cash flows from

|

|

|

|

|

|

|

|

|

|

|

|

operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

382

|

|

|

|

-

|

|

|

382

|

|

Stock-based compensation

|

|

|

386

|

|

|

|

-

|

|

|

386

|

|

Change in allowance for doubtful accounts

|

|

|

5

|

|

|

|

-

|

|

|

5

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(1,428)

|

|

|

|

-

|

|

|

(1,428)

|

|

Inventory

|

|

|

(916)

|

|

|

|

-

|

|

|

(916)

|

|

Prefunded insurance premiums from financing

|

|

|

-

|

|

|

|

614

|

|

|

614

|

|

Prepaid expenses and other current assets

|

|

|

(585)

|

|

|

|

-

|

|

|

(585)

|

|

Other assets

|

|

|

25

|

|

|

|

-

|

|

|

25

|

|

Accounts payable

|

|

|

383

|

|

|

|

-

|

|

|

383

|

|

Accrued expenses

|

|

|

(43)

|

|

|

|

-

|

|

|

(43)

|

|

Taxes payable

|

|

|

6

|

|

|

|

-

|

|

|

6

|

|

Other liabilities

|

|

|

1

|

|

|

|

-

|

|

|

1

|

|

Net cash used in operating activities

|

|

$

|

(4,883)

|

|

|

$

|

614

|

|

$

|

(4,269)

|

| |

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible notes, net

|

|

$

|

2,354

|

|

|

$

|

-

|

|

$

|

2,354

|

|

Repayments on Insurance financing, net of additional financing

|

|

|

-

|

|

|

|

(614)

|

|

|

(614)

|

|

Proceeds from issuance of common stock and warrants, net

|

|

|

7,152

|

|

|

|

-

|

|

|

7,152

|

|

Net cash provided by financing activities

|

|

$

|

9,506

|

|

|

$

|

(614)

|

|

$

|

8,892

|

The Company intends to include restated consolidated financial statements as of and for the year ended December 31, 2021 in its Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Annual Report”), which it expects to file on March 29, 2023. In conjunction with restating its annual financial statements, the Company will include corrected unaudited interim financial information for the quarterly and year-to-date periods ended March 31, 2022 and June 30, 2022, in the 2022 Annual Report and will revise the applicable unaudited 2022 interim financial statements in connection with the filing of its Quarterly Reports on Form 10-Q for the quarters ending March 31, 2023 and June 30, 2023.

The Company’s management and Audit Committee have discussed the matters disclosed in this Item 4.02 with the Company’s independent registered public accounting firm, Armanino LLP.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

| |

|

JONES SODA CO.

(Registrant)

|

| |

|

|

|

|

March 29, 2023

|

|

By:

|

/s/ Mark Murray

|

| |

|

|

|

Mark Murray

Chief Executive Officer and President

|

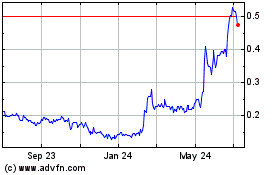

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2024 to May 2024

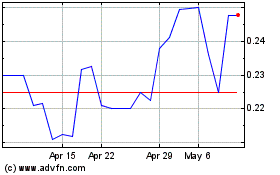

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From May 2023 to May 2024